Medical Grade Tubing Market Size, Production, Sales, Average Product Price, Market Share, Import vs Export

- Published 2025

- No of Pages: 120+

- 20% Customization available

Medical Grade Tubing Market Witnessing Structural Transformation

The Medical Grade Tubing Market is undergoing a significant transformation as medical procedures become increasingly sophisticated and reliant on high-performance tubing components. From advanced diagnostic devices to life-sustaining interventions, the demand for precision-engineered tubing has surged. The market is witnessing a steady shift driven by evolving medical practices, demand for minimally invasive treatments, and a sharp focus on patient safety and comfort. With increasing investments in healthcare infrastructure and medtech innovation, the Medical Grade Tubing Market is positioned for long-term growth across key regions.

Rising Preference for Minimally Invasive Procedures in the Medical Grade Tubing Market

A central driver of the Medical Grade Tubing Market is the rising popularity of minimally invasive surgeries. Procedures involving catheters, endoscopes, and laparoscopic instruments require flexible, kink-resistant, and biocompatible tubing. For instance, in cardiovascular surgeries and urological procedures, tubing is essential for navigation, drug delivery, and fluid management. As hospitals seek to reduce inpatient stays and improve recovery outcomes, tubing becomes integral to the shift toward low-risk procedures. This preference has driven the market demand upward, with specialized tubing now embedded across a growing range of surgical devices.

Growth of Home Healthcare Accelerating Medical Grade Tubing Market Expansion

The rapid expansion of home-based medical care is reshaping the Medical Grade Tubing Market. Equipment for respiratory support, dialysis, drug infusion, and nutritional delivery are now increasingly used outside hospital settings. For example, infusion tubing sets for antibiotics, chemotherapy, and pain management are standard in ambulatory and home settings. Similarly, oxygen tubing for COPD patients and peritoneal dialysis systems are experiencing higher deployment rates. This has created a sustained demand for disposable and safe-to-handle tubing solutions designed for layperson use, further reinforcing the market’s momentum in the post-acute care segment.

Innovations in Material Science Driving Differentiation in Medical Grade Tubing Market

Material innovation plays a foundational role in the evolution of the Medical Grade Tubing Market. Manufacturers are shifting from traditional rubber and PVC to advanced polymers such as silicone, polyurethane, thermoplastic elastomers, and fluoropolymers. These materials provide enhanced flexibility, thermal stability, resistance to kinking, and superior biocompatibility. For instance, silicone tubing is now preferred in high-purity applications due to its chemical inertness and ability to withstand repeated sterilization. Meanwhile, fluoropolymer tubing is gaining traction in applications requiring high resistance to solvents, heat, and mechanical stress. This strategic material shift is broadening performance profiles and enabling differentiated applications.

Role of Medical Grade Tubing in Biopharmaceutical and Laboratory Settings

Beyond medical devices, the Medical Grade Tubing Market is gaining traction in pharmaceutical manufacturing and biotechnology applications. Tubing is widely used for sterile fluid transfer, peristaltic pumping, filtration systems, and vaccine production environments. In bioprocessing, the need for contaminant-free and non-reactive materials is critical, pushing demand for tubing that meets tight regulatory thresholds. For example, thermoplastic elastomer tubing that can handle high-pressure flows without leaching chemicals is becoming standard in fluid handling systems. The expansion of the biologics industry, including monoclonal antibodies and cell therapies, is amplifying tubing requirements in controlled environments.

Medical Grade Tubing Market Size Expanding with Healthcare Investments

The overall Medical Grade Tubing Market Size is expanding in line with rising healthcare investments globally. With hospital infrastructure being modernized and surgical capacities expanded, demand for consumables like tubing is increasing steadily. For instance, the integration of tubing into disposable surgical kits, catheterization labs, and diagnostic platforms is becoming widespread. Growth in emerging economies is particularly strong, driven by public health policies, private investment, and medical tourism. These developments are collectively pushing the Medical Grade Tubing Market Size upward with a consistent year-over-year growth trajectory.

Asia-Pacific Emerging as a High-Growth Region in the Medical Grade Tubing Market

Asia-Pacific is emerging as the most dynamic growth zone within the Medical Grade Tubing Market. Countries such as China, India, and South Korea are witnessing surging demand due to expanding hospital networks, increased insurance coverage, and a focus on local manufacturing. Domestic players are entering partnerships with global material suppliers to localize production of high-grade tubing. Additionally, rising incidences of chronic diseases, aging populations, and government investments in medtech parks are supporting the regional acceleration. With cost efficiencies and scale, the region is also becoming a competitive export hub for medical-grade components.

Integration of Smart Features Reinventing the Medical Grade Tubing Market

Technology integration is becoming a defining theme in the Medical Grade Tubing Market. Manufacturers are developing smart tubing solutions that include antimicrobial coatings, embedded sensors, and drug-releasing capabilities. These advanced features are particularly critical in catheter-associated systems and infusion lines, where infection control and monitoring are paramount. For example, pressure-sensing tubing used in intensive care units helps reduce device-related complications by offering real-time feedback. As digital health merges with traditional device functionality, tubing is evolving from a passive component to an active contributor to patient care.

High Burden of Chronic Diseases Supporting Consistent Demand in the Medical Grade Tubing Market

Chronic diseases are significantly influencing the trajectory of the Medical Grade Tubing Market. Conditions such as diabetes, kidney failure, heart disease, and cancer require long-term management involving infusion, dialysis, or nutritional delivery. Tubing systems used in insulin pumps, feeding tubes, and blood filtration devices are essential for continuous care. As patient populations with chronic conditions rise globally, so does the recurring demand for high-performance, reusable, and disposable tubing. This steady consumption cycle ensures the Medical Grade Tubing Market remains resilient to economic fluctuations.

Regulatory Environment Shaping Quality Standards in the Medical Grade Tubing Market

The regulatory landscape is critical in shaping the Medical Grade Tubing Market. Compliance with stringent quality and safety standards is essential for all tubing used in invasive or contact-based applications. Manufacturers must meet medical-grade certifications, such as ISO biocompatibility requirements, for their products to be used in clinical settings. This compliance framework has led to enhanced quality assurance practices and investment in specialized testing facilities. It also serves as a barrier to entry, favoring well-capitalized companies that can meet global regulatory benchmarks and maintain consistent manufacturing standards.

Competitive Strategies Reshaping the Medical Grade Tubing Market

The competitive landscape of the Medical Grade Tubing Market is marked by product innovation, strategic acquisitions, and vertical integration. Leading companies are expanding their capabilities across the tubing value chain—from resin formulation to precision extrusion and finishing. There is a growing emphasis on delivering application-specific tubing that addresses unique needs in neurology, cardiology, oncology, and critical care. Additionally, partnerships between material science firms and medical OEMs are accelerating the co-development of customized solutions. This ecosystem is fostering a more responsive and diversified market structure, allowing for faster innovation cycles.

Long-Term Outlook on the Medical Grade Tubing Market

Looking forward, the Medical Grade Tubing Market is expected to maintain a robust growth outlook. Demand drivers such as increased surgical procedures, decentralized care models, and technological enhancements will continue to create new opportunities. Tubing is evolving beyond a supporting element to a mission-critical component in the design and functionality of next-generation medical systems. As innovation, regulation, and healthcare dynamics converge, the Medical Grade Tubing Market will remain a strategic focus for medtech firms, polymer producers, and healthcare investors alike.

“Track Country-wise Medical Grade Tubing Production and Demand through our Database”

-

-

- Medical Grade Tubing sales volume database for 27+ countries worldwide

-

Regional Demand Patterns Defining the Medical Grade Tubing Market

The Medical Grade Tubing Market is experiencing region-specific demand surges, driven by variations in healthcare infrastructure, regulatory maturity, and medical procedure volumes. North America continues to lead in revenue terms, holding a substantial share due to its advanced hospital infrastructure and wide adoption of invasive procedures. For instance, the United States alone accounts for nearly one-third of global catheter usage, creating sustained demand for specialty tubing used in IVs, cardiovascular devices, and diagnostic systems.

In Europe, demand is evenly spread between western countries such as Germany, France, and the UK, where aging populations and chronic disease prevalence are pushing up usage of infusion and feeding tubing. Regulatory alignment under the Medical Device Regulation (MDR) has increased the preference for certified, traceable tubing systems, further consolidating the market.

Meanwhile, Asia-Pacific is demonstrating the most aggressive growth curve in the Medical Grade Tubing Market. For example, China’s domestic production of tubing used in ventilators and surgical kits has increased nearly twofold over the past five years due to rising healthcare investments. India is showing robust demand for dialysis and neonatal tubing, correlating with increased access to public healthcare services. Regional growth is being driven by rapid expansion in private hospitals and the penetration of mobile medical units, especially in tier-2 and rural areas.

Medical Grade Tubing Manufacturing Landscape Expanding Globally

Medical Grade Tubing Manufacturing has evolved into a globalized yet tightly regulated process. Precision extrusion, cleanroom production, and automated quality assurance systems are now standard across high-capacity facilities. For example, leading manufacturers in the U.S. and Germany have shifted toward multi-layer and co-extrusion techniques to deliver tubing with improved lumen control and fluid dynamics. These methods are essential in interventional cardiology and neurology, where consistency is non-negotiable.

Medical Grade Tubing Manufacturing is also expanding in low-cost regions such as Southeast Asia and Eastern Europe. Countries like Malaysia, Vietnam, and Poland are attracting contract manufacturers with specialized extrusion capabilities. For instance, Malaysian firms are increasing output for U.S. and Japanese OEMs due to favorable trade policies and low labor costs. At the same time, vertical integration is becoming more common. Major manufacturers now control polymer formulation, extrusion, and finishing to ensure uninterrupted supply and tighter regulatory compliance.

With demand rising, companies are also investing in automation and digital monitoring tools to improve throughput. Cleanroom-certified production lines are being upgraded to support a higher volume of multi-durometer tubing, essential in devices that require flexibility and strength across different sections. This trend is transforming Medical Grade Tubing Manufacturing into a data-driven, precision-focused discipline.

Market Segmentation Driving Innovation in the Medical Grade Tubing Market

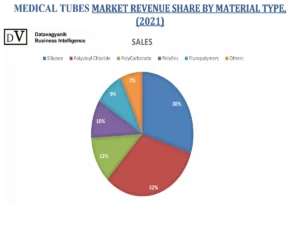

Segmentation within the Medical Grade Tubing Market is becoming increasingly sophisticated. Based on material type, silicone, thermoplastic elastomers (TPE), PVC, and fluoropolymers represent the largest categories. For instance, silicone tubing leads the market in critical care applications due to its high purity and tolerance for repeated sterilization. Meanwhile, PVC remains dominant in general-purpose infusion sets and oxygen lines due to its cost efficiency and flexibility.

By application, the Medical Grade Tubing Market is segmented into bulk disposable tubing, drug delivery systems, catheters, and biopharma processing. Bulk disposables—such as tubing used in IV lines and oxygen masks—represent the largest volume contributor due to their widespread use in hospitals and clinics. For example, large hospitals can consume over 100,000 meters of disposable tubing annually across emergency rooms and intensive care units.

The drug delivery segment is growing rapidly, fueled by innovations in controlled-release systems and smart infusion pumps. Tubing in these devices must maintain consistent internal diameters and low extractables, which has driven a shift to high-end polymers like ethylene tetrafluoroethylene (ETFE) and fluorinated ethylene propylene (FEP).

Biopharma processing is another high-growth vertical. Tubing systems used in vaccine production, fermentation, and downstream purification must withstand chemical exposure while maintaining sterile flow. As biologics become a larger share of pharmaceutical output, this segment is projected to grow at double-digit rates through the next decade.

Impact of End-User Demand Patterns on the Medical Grade Tubing Market

The structure of end-user demand is evolving in the Medical Grade Tubing Market. Hospitals remain the primary consumption point, especially for disposable tubing used in general patient care. However, ambulatory surgical centers and home care providers are now emerging as significant market participants. For instance, home infusion therapy has expanded rapidly in developed markets, necessitating user-friendly, low-memory tubing with tamper-resistant fittings.

Medical device OEMs are also driving demand, particularly in cardiology, nephrology, and diagnostic imaging. These companies require high-specification tubing that can be seamlessly integrated into finished devices. The trend toward device miniaturization has increased the requirement for micro-extruded tubing with ultra-thin walls and precise tolerances.

Additionally, laboratory and life sciences players are influencing the market with demand for chemically inert tubing for fluid transfer in analytical equipment. This has pushed suppliers to develop product lines tailored for high-purity and low-sorption environments.

Price Trends in the Medical Grade Tubing Market

Price behavior in the Medical Grade Tubing Market is influenced by material input costs, regulatory compliance, and production complexity. For instance, tubing made from medical-grade silicone is priced at a premium compared to PVC or polyethylene, due to the higher cost of raw material and more stringent processing standards. Fluoropolymer-based tubing is even more expensive, reflecting its performance under harsh chemical and thermal conditions.

Overall, the market has witnessed modest inflation over the past three years, with average selling prices increasing by 4–6% annually in high-demand segments such as drug delivery and biopharma processing. Price volatility in resin markets, particularly for silicone and TPEs, has also contributed to upward pricing adjustments. However, increased automation in Medical Grade Tubing Manufacturing has helped contain labor costs and improved output efficiencies.

Regional pricing also varies. North America and Europe command higher per-unit pricing due to advanced regulatory compliance and precision manufacturing. In contrast, Asia-Pacific markets benefit from competitive pricing due to local production and lower operational costs. This pricing diversity is fostering a global sourcing strategy among large-scale medical device manufacturers.

Supply Chain and Procurement Strategy in the Medical Grade Tubing Market

Procurement practices in the Medical Grade Tubing Market are becoming more centralized and strategic. Healthcare providers and OEMs are forming long-term partnerships with tubing suppliers to secure stable pricing and ensure supply continuity. For instance, device manufacturers with large tubing requirements for dialysis or drug infusion devices prefer vendors with vertically integrated operations, which provide better cost control and shorter lead times.

Raw material sourcing has also gained prominence. Many large manufacturers are entering backward integration to develop proprietary formulations for silicone, TPE, and fluoropolymer resins. This ensures consistency in tubing performance and reduces supply chain disruptions. Moreover, secondary sourcing strategies are being adopted to reduce dependency on single-region suppliers and build resilience into the Medical Grade Tubing Manufacturing network.

Sustainability and Material Transition in the Medical Grade Tubing Market

Environmental considerations are starting to shape purchasing decisions within the Medical Grade Tubing Market. Regulatory restrictions on certain plasticizers, particularly DEHP in PVC, are prompting a shift toward alternative materials that maintain flexibility without compromising safety. For instance, non-DEHP PVC formulations are now standard in many markets for pediatric and neonatal tubing.

Similarly, recycling initiatives are influencing tubing design, especially in hospital systems targeting carbon footprint reduction. Manufacturers are responding by developing recyclable or lower-impact materials and modifying tubing systems to allow for easier waste segregation. This transition is also pushing innovation in Medical Grade Tubing Manufacturing as producers seek to balance regulatory demands with sustainability objectives.

Future Outlook and Regional Opportunity Mapping in the Medical Grade Tubing Market

As global health systems continue to modernize, the Medical Grade Tubing Market will remain a critical enabler of clinical and pharmaceutical progress. Growth will likely be concentrated in Asia-Pacific, driven by healthcare access expansion and cost-effective Medical Grade Tubing Manufacturing. Meanwhile, North America and Europe will maintain leadership in high-specification and regulatory-intensive segments.

Latin America and the Middle East are emerging as new opportunity zones. These regions are investing in localized healthcare manufacturing and developing new clinical infrastructure, driving demand for tubing in anesthesia, respiratory therapy, and diagnostics. For example, demand for oxygen delivery tubing spiked across urban centers in these regions during public health crises, underscoring their future potential.

“Medical Grade Tubing Manufacturing Database”

-

-

- Medical Grade Tubing top manufacturers market share for 27+ manufacturers

- Top 7 manufacturers and top 17 manufacturers of Medical Grade Tubing in North America, Europe, Asia Pacific

- Medical Grade Tubing sales dashboard, Medical Grade Tubing sales data in excel format

-

Key Manufacturers Driving the Medical Grade Tubing Market

The Medical Grade Tubing Market is defined by a mix of global leaders and specialized manufacturers who offer high-performance tubing solutions for a wide range of medical applications. Market leadership is generally established through manufacturing capacity, extrusion technology, product diversity, and long-term supply relationships with medical device OEMs.

Leading players in the market include Saint-Gobain, Freudenberg Medical, Nordson Corporation, W. L. Gore & Associates, Raumedic AG, Tekni-Plex, The Lubrizol Corporation, and NewAge Industries. These companies are responsible for a significant portion of the global supply, with the top five accounting for more than half of the total market share by revenue.

Saint-Gobain’s Role in the Medical Grade Tubing Market

Saint-Gobain maintains a strong foothold in the Medical Grade Tubing Market through its well-established Tygon product line. This tubing range serves multiple clinical functions including drug delivery, peristaltic pumping, and dialysis. With multiple variants tailored to different flow, sterilization, and chemical compatibility needs, Tygon has become a standard in both hospitals and manufacturing plants. Saint-Gobain has built its dominance through global production facilities, cleanroom environments, and vertically integrated operations.

Freudenberg Medical’s Custom Extrusion Leadership

Freudenberg Medical is recognized for its extensive customization capabilities in medical tubing. The company provides extruded tubing for use in catheter-based devices, drug-delivery systems, and minimally invasive surgical instruments. Freudenberg has established itself in the premium segment of the Medical Grade Tubing Market by delivering multi-lumen, multi-durometer, and antimicrobial tubing solutions. Its tubing is often integrated into devices used in cardiology, endoscopy, and gynecology, supporting both high performance and safety compliance.

Nordson Corporation’s Integrated Manufacturing Strength

Nordson Corporation holds a competitive position in the Medical Grade Tubing Market, especially following its strategic acquisitions in the specialty extrusion space. The company supports both tubing production and the manufacture of precision equipment used in extrusion processes. Nordson’s tubing solutions are typically used in fluid management systems and biopharmaceutical production. The firm has gained prominence by aligning with OEMs seeking end-to-end extrusion and tubing solutions from a single source.

L. Gore & Associates’ Specialty Tubing Expertise

L. Gore & Associates focuses on high-performance medical-grade fluoropolymer tubing used in surgical implants and vascular access devices. Their tubing is engineered for high chemical resistance, bio-inertness, and structural durability under pressure. The company is a niche leader in the Medical Grade Tubing Market, especially where tubing is used in implantable or semi-permanent applications. Gore’s products are commonly used in stent delivery systems, neurovascular catheters, and synthetic graft applications.

Raumedic’s European Presence in Medical Grade Tubing Market

Raumedic AG serves the Medical Grade Tubing Market through its thermoplastic and silicone-based tubing lines. The company is known for its precision extrusion used in neuro-monitoring, infusion therapy, and diagnostic testing. Operating primarily out of Europe, Raumedic caters to both large-volume production and customized project work. Its cleanroom manufacturing facilities are tailored for high-purity applications, supporting the clinical and pharmaceutical sectors alike.

Tekni-Plex and Lubrizol in Niche Product Segments

Tekni-Plex is expanding its footprint in the Medical Grade Tubing Market through acquisitions and expansion in antimicrobial and patient-contact tubing products. It offers a wide range of extrusion formats designed for applications like intravenous fluid transfer and anesthesia circuits. Lubrizol focuses on polymer technologies and offers advanced medical-grade resins used in specialty tubing. These include tubing products for high-pressure drug delivery and long-term wearable medical devices, where flexibility and chemical resistance are critical.

Market Share Analysis of Leading Manufacturers

Based on industry data, Saint-Gobain holds an estimated 20 to 25 percent share of the Medical Grade Tubing Market due to its global manufacturing footprint and product diversity. Freudenberg Medical follows with approximately 10 to 15 percent share, bolstered by its focus on advanced extrusion and antimicrobial features. Nordson Corporation controls around 8 to 12 percent, thanks to its dual role as a tubing manufacturer and equipment provider. W. L. Gore’s market share is more limited, roughly 5 to 8 percent, but it dominates in high-value implantable applications.

Raumedic, Tekni-Plex, and Lubrizol collectively contribute another 10 to 15 percent of the market, serving specialized product categories such as high-purity pharma tubing, smart catheters, and next-generation diagnostic systems. The remaining share is distributed among mid-sized and regional manufacturers offering standard tubing products for low-complexity medical uses.

Product Line Differentiation and OEM Integration

Product line diversity plays a crucial role in defining market share. Manufacturers offering integrated solutions—from raw polymer processing to sterilization-ready finished products—gain preferential access to OEM supply chains. For instance, firms offering tubing pre-fitted with connectors or designed for specific pump systems are more likely to establish long-term contracts. Multi-lumen and multi-durometer configurations have become differentiators in tubing design, especially in cardiology and urology applications.

Additionally, tubing that supports smart integration—such as those that include embedded sensors or RFID markers—is attracting growing interest from OEMs developing next-gen diagnostic tools. This is pushing tubing suppliers to innovate around functionality, not just material.

Recent Industry Developments in the Medical Grade Tubing Market

In the last 18 months, the Medical Grade Tubing Market has seen several notable developments. In Q1 2024, a leading manufacturer expanded its U.S.-based cleanroom capacity to meet increasing demand for micro-extruded tubing used in neurosurgical applications. This expansion was aimed at reducing lead times and meeting regulatory demands for traceability and compliance.

In October 2024, a European player launched a new antimicrobial tubing series for catheter systems, responding to increased demand from infection-prone environments such as ICUs. The product line was received positively by hospitals in Germany and the UK, where infection control is a top priority.

A U.S.-based medical polymer company announced a joint venture in January 2025 with a tubing manufacturer in Southeast Asia to build a high-volume production facility for dialysis and respiratory tubing. This marks a significant shift toward near-shore manufacturing intended to reduce logistics dependency on cross-continental suppliers.

In March 2025, several tubing producers began pilot testing recycled medical-grade materials to reduce hospital waste and align with sustainability goals. While not yet mainstream, the integration of recyclable tubing into basic care settings is likely to expand in the coming years.

“Medical Grade Tubing Production Data and Medical Grade Tubing Production Trend”

-

-

- Medical Grade Tubing sales database for historical years, 10 years historical data

- Medical Grade Tubing sales data and forecast for next 7 years

-

![]()

Key Insights that the Medical Grade Tubing Market analysis report presents are:

- Medical Grade Tubing Market revenue and demand by countries

- Medical Grade Tubing Market production and sales volume by countries

- Break-down of the Medical Grade Tubing Market in terms of application areas, target customers, and other potential market segments

- Areas that are relatively more potential and are faster growing

- Medical Grade Tubing Market competitive scenario, market share analysis

- Medical Grade Tubing Market business opportunity analysis

Global and Country-Wise Medical Grade Tubing Market Statistics

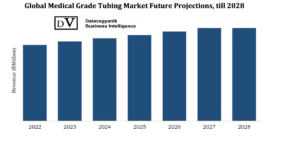

- Global and Country-Wise Medical Grade Tubing Market size ($Million) and Forecast – (2022 – 2028)

- Global and Country-Wise Medical Grade Tubing Market Production Volume and Forecast – (2022 – 2028)

- Global and Country-Wise Medical Grade Tubing Market Sales Volume and Forecast – (2022 – 2028)

- Global and Country-Wise Medical Grade Tubing Market Business Opportunity Assessment

“Every Organization is different and so are their requirements”- Datavagyanik

Companies We Work With

Do You Want To Boost Your Business?

drop us a line and keep in touch