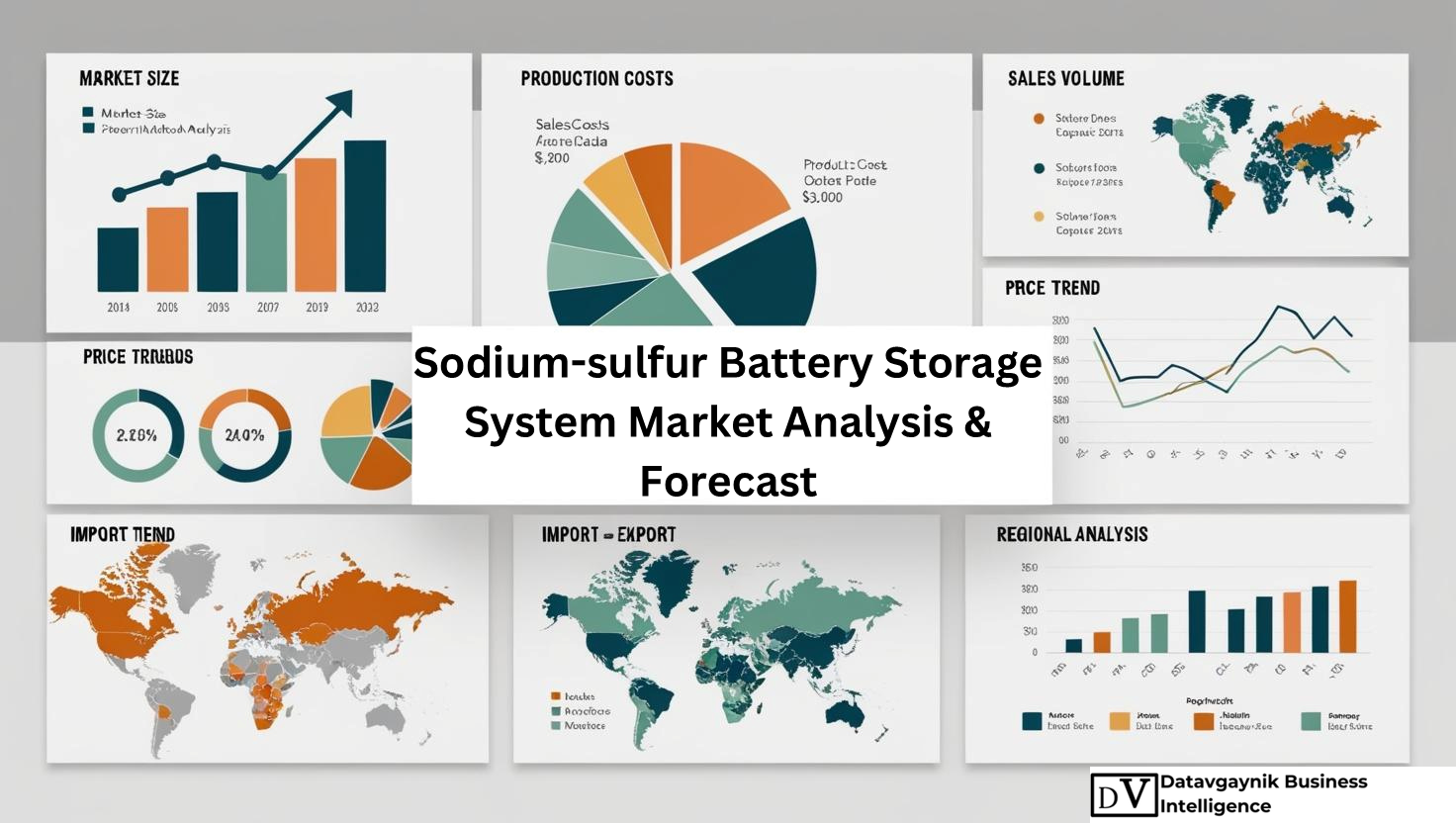

Sodium-Sulfur Battery Storage System Market Size, Production, Sales, Average Product Price, Market Share, Import vs Export

- Published 2025

- No of Pages: 120+

- 20% Customization available

Global Demand Shift and Market Transformation in the Sodium-sulfur Battery Storage System Market

The Sodium-sulfur battery storage system Market is undergoing a pivotal transformation driven by the global acceleration toward renewable energy integration, long-duration energy storage needs, and the increasing pressure to decarbonize power infrastructure. Countries across continents are investing heavily in energy transition strategies, creating an ideal growth environment for sodium-sulfur batteries, particularly due to their high energy density, long discharge duration, and suitability for grid-scale applications. The global energy storage market crossed 191 GWh in 2023 and is projected to exceed 500 GWh by 2030—significantly influenced by technologies such as sodium-sulfur storage systems, which are rapidly emerging as critical enablers of grid flexibility and reliability.

The Sodium-sulfur battery storage system Market is undergoing a pivotal transformation driven by the global acceleration toward renewable energy integration, long-duration energy storage needs, and the increasing pressure to decarbonize power infrastructure. Countries across continents are investing heavily in energy transition strategies, creating an ideal growth environment for sodium-sulfur batteries, particularly due to their high energy density, long discharge duration, and suitability for grid-scale applications. The global energy storage market crossed 191 GWh in 2023 and is projected to exceed 500 GWh by 2030—significantly influenced by technologies such as sodium-sulfur storage systems, which are rapidly emerging as critical enablers of grid flexibility and reliability.

Sodium-sulfur Battery Storage System Market Driven by Renewable Energy Integration

The Sodium-sulfur battery storage system Market is directly benefiting from the growing deployment of intermittent renewable energy sources, especially solar and wind. For instance, solar photovoltaic capacity globally increased by over 266 GW in 2023 alone. As these sources continue to scale, the challenge of intermittency becomes more pronounced. Sodium-sulfur batteries, with the ability to deliver energy for 6–10 hours continuously, are ideally positioned to manage these fluctuations. Grid operators are increasingly choosing sodium-sulfur systems to store surplus daytime solar output and release it during peak evening demand, thereby maintaining grid stability.

Datavagyanik also covers related markets such as the Sulfur Donors (sulfur bearing chemicals) Market. These markets provide auxiliary insights into surrounding supply chains, application clusters, and evolving demand patterns affecting the primary topic.

Rising Grid Modernization Initiatives Fueling the Sodium-sulfur Battery Storage System Market

In response to outdated infrastructure and growing power reliability concerns, governments and utilities are implementing large-scale grid modernization initiatives. For example, the U.S. committed over $13 billion in 2023 toward power grid upgrades, including large-scale energy storage investments. The Sodium-sulfur battery storage system Market is seeing rapid uptake in this scenario, especially because these systems provide high-temperature operation capability and superior thermal stability. Countries such as the United States, Germany, and China are prioritizing sodium-sulfur battery installations to support grid stabilization, load shifting, and frequency regulation, directly impacting their adoption rate in utility-scale storage projects.

Long-Duration Energy Storage Demand Accelerating Growth in the Sodium-sulfur Battery Storage System Market

One of the primary drivers behind the growth of the Sodium-sulfur battery storage system Market is the global surge in demand for long-duration energy storage (LDES). Technologies that can store and discharge energy for over six hours are increasingly essential to bridge the gap between energy generation and consumption. Sodium-sulfur batteries, with discharge durations reaching up to 10 hours, are among the top candidates for these applications. As of 2024, more than 45 countries have introduced LDES deployment targets, and sodium-sulfur technology is among the front-running solutions due to its scalability and cost-effectiveness over extended storage durations.

Sodium-sulfur Battery Storage System Market Boosted by Favorable Economics and Material Abundance

The Sodium-sulfur battery storage system Market is gaining traction because of its favorable raw material economics. Unlike lithium-ion batteries, which rely on critical minerals such as lithium and cobalt—subject to geopolitical supply risks and price volatility—sodium and sulfur are abundant and inexpensive. For instance, sodium is nearly 1,200 times more abundant in the Earth’s crust than lithium, while sulfur is often available as a byproduct of industrial processes like petroleum refining. This cost advantage significantly reduces the levelized cost of storage (LCOS), making sodium-sulfur batteries an attractive choice for grid operators seeking sustainable, economically viable storage solutions.

High Energy Density and Compact Design Driving Sodium-sulfur Battery Storage System Market Expansion

In high-demand regions where land use and space optimization are critical, the Sodium-sulfur battery storage system Market is witnessing accelerated adoption due to the technology’s superior energy density. Sodium-sulfur batteries typically provide energy densities of around 150–240 Wh/kg, significantly higher than several other large-scale storage technologies. This compact form factor allows installations even in space-constrained urban environments. For example, Japan has deployed over 190 MW of sodium-sulfur storage, particularly in urban grid-support applications, where space efficiency and long-duration discharge are essential.

Environmental Regulations and Emission Targets Supporting Sodium-sulfur Battery Storage System Market

Global policy shifts favoring clean energy and emissions reduction have created strong tailwinds for the Sodium-sulfur battery storage system Market. For instance, the European Union aims to achieve a 55% reduction in greenhouse gas emissions by 2030 and net-zero by 2050. These ambitious goals require energy storage solutions that are not only efficient but environmentally benign. Sodium-sulfur batteries contain no toxic heavy metals and are fully recyclable, making them compliant with increasingly stringent environmental regulations. Their deployment also contributes toward ESG goals, positioning them favorably for large corporations and public infrastructure projects seeking to meet sustainability benchmarks.

Industrial and Utility Sector Demand Accelerating the Sodium-sulfur Battery Storage System Market

The utility and industrial sectors remain the largest end users in the Sodium-sulfur battery storage system Market, driven by their need for resilient, long-duration power backup and cost optimization. For example, industrial zones in Germany and South Korea are adopting sodium-sulfur battery systems to ensure uninterrupted power during peak loads or grid failures. In these environments, sodium-sulfur batteries not only reduce energy costs through load shifting but also provide enhanced grid reliability and operational stability, especially in manufacturing-intensive regions where energy downtime translates directly to economic losses.

Technology Advancement and R&D Investments Enhancing Sodium-sulfur Battery Storage System Market Prospects

Continuous advancements in materials science and battery engineering are playing a crucial role in the evolution of the Sodium-sulfur battery storage system Market. Research institutions and private companies are investing in improving electrolyte performance, thermal management systems, and battery life cycles. For example, newer innovations in solid-state separators have increased the safety profile and operational efficiency of sodium-sulfur systems, enabling them to compete directly with lithium-ion solutions in markets previously considered inaccessible. R&D efforts in countries like Japan and South Korea are expected to bring next-gen sodium-sulfur batteries to commercial readiness within the next 2–3 years, further catalyzing market growth.

“Track Country-wise Sodium-sulfur battery storage system Production and Demand through our Sodium-sulfur battery storage system Production Database”

-

-

-

- Sodium-sulfur battery storage system production database for 20+ countries worldwide

- Country-wise Sodium-sulfur battery storage system production capacity and production plant mapping

- Sodium-sulfur battery storage system production plants and production plant capacity analysis for key manufacturers

-

-

Resilience Against Extreme Weather Conditions Favoring the Sodium-sulfur Battery Storage System Market

Another compelling advantage driving the Sodium-sulfur battery storage system Market is its resilience under extreme weather conditions. Unlike lithium-ion batteries that suffer from performance degradation in cold or high-temperature environments, sodium-sulfur systems operate efficiently at elevated temperatures (typically around 300°C). This makes them particularly suitable for deployment in regions with extreme climates, such as the Middle East, North Africa, and northern Canada. For example, a 34 MW sodium-sulfur installation in Abu Dhabi has demonstrated consistent performance in harsh desert conditions, validating the technology’s robustness for global grid storage use cases.

Global Energy Storage Investment Surges Powering Sodium-sulfur Battery Storage System Market

With global investment in energy storage projected to exceed $620 billion by 2040, the Sodium-sulfur battery storage system Market stands to capture a significant share of this momentum. Countries are now allocating substantial budgets for long-term storage technologies as they move away from fossil-based grid backup systems. For example, India’s National Energy Storage Mission outlines the development of 100 GWh of battery storage capacity by 2030, where sodium-sulfur is being actively considered due to its ability to support grid decentralization and rural electrification.

North America Emerging as a Key Player in the Sodium-sulfur Battery Storage System Market

The Sodium-sulfur battery storage system Market in North America is evolving rapidly, driven by the region’s focus on energy independence, renewable integration, and infrastructure resilience. In the United States, sodium-sulfur battery deployment is gaining momentum as utilities invest in grid stabilization to combat the effects of climate-induced power disruptions. For example, California’s wildfire-induced blackouts have compelled energy providers to adopt long-duration storage technologies. Sodium-sulfur batteries, with their high-temperature operation and 6+ hour discharge capacity, are being selected for pilot projects targeting energy reliability in both urban and rural areas.

Across Canada, demand for sodium-sulfur systems is rising in remote communities that depend on diesel generators. These batteries offer a cost-effective and environmentally responsible alternative, allowing off-grid communities to store renewable energy generated through solar or wind installations. With government funding expanding through national clean energy programs, North America’s position in the Sodium-sulfur battery storage system Market is set to strengthen further.

Europe’s Grid Modernization and Carbon Reduction Targets Fueling the Sodium-sulfur Battery Storage System Market

Europe is at the forefront of grid decarbonization, and the Sodium-sulfur battery storage system Market is directly benefiting from this commitment. Countries such as Germany, the United Kingdom, and France are actively investing in energy storage technologies that support the integration of intermittent renewable power. For instance, Germany’s “Energiewende” program is expected to achieve over 80% renewable electricity by 2030, creating a massive need for long-duration energy storage.

Sodium-sulfur batteries are being integrated into Germany’s renewable hubs to mitigate frequency deviation and ensure power consistency. Similarly, in the United Kingdom, the National Grid is deploying sodium-sulfur systems to address storage gaps caused by variable offshore wind output. France is leveraging its dual power mix—nuclear and renewables—by implementing sodium-sulfur batteries for load leveling in regions with aging grid infrastructure.

Additionally, Spain and Italy are seeing rapid adoption of sodium-sulfur batteries due to their booming solar energy sectors. These countries are experiencing renewable penetration rates exceeding 45%, necessitating large-scale storage systems capable of managing day-to-night energy transfers. The result is a robust expansion of the Sodium-sulfur battery storage system Market across the continent.

Asia Pacific Leading Production and Deployment in the Sodium-sulfur Battery Storage System Market

Asia Pacific is both the largest producer and one of the fastest adopters in the Sodium-sulfur battery storage system Market. Japan remains the global pioneer, with over 300 MW of installed sodium-sulfur storage capacity. Major players such as NGK Insulators have deployed large-scale systems across the country, particularly in remote islands and industrial parks where uninterrupted power is critical. For instance, NGK’s 50 MW sodium-sulfur project in Hokkaido is designed to balance wind energy variability and maintain stable grid output.

South Korea is emerging as a competitive hub, leveraging its R&D capabilities and export-oriented manufacturing to drive innovation in sodium-sulfur battery technology. Korean firms are targeting markets across Southeast Asia and the Middle East, where climate conditions demand robust and heat-tolerant storage solutions.

In China, sodium-sulfur battery installations are increasing in regions with high wind and solar penetration. For example, Inner Mongolia and Xinjiang provinces are incorporating sodium-sulfur systems in their renewable zones to stabilize voltage and frequency. China’s broader goal of installing over 100 GW of energy storage capacity by 2030 directly aligns with the scalability advantages of sodium-sulfur batteries.

India is also emerging as a growth hotspot in the Sodium-sulfur battery storage system Market. With its aggressive renewable energy expansion—targeting 500 GW by 2030—the country faces significant grid balancing challenges. Sodium-sulfur batteries are being considered in rural microgrids, urban peak load management, and industrial power backup, especially due to their cost advantage and extended lifespan over traditional storage solutions.

Middle East and Africa Creating Niche Demand in the Sodium-sulfur Battery Storage System Market

The Sodium-sulfur battery storage system Market in the Middle East and Africa is being driven by increasing investments in solar megaprojects. For instance, Saudi Arabia’s NEOM city project and the UAE’s Al Dhafra Solar Park are implementing utility-scale energy storage to complement solar generation. Sodium-sulfur batteries are ideal for these high-irradiance regions due to their operational resilience in extreme temperatures.

In Africa, grid instability and electrification efforts are accelerating sodium-sulfur deployment. Countries like South Africa, Kenya, and Morocco are investing in energy storage for both rural and urban applications. For example, Morocco’s solar-rich south is exploring sodium-sulfur batteries for overnight power availability in desert-based solar installations.

Latin America Catching Up in the Sodium-sulfur Battery Storage System Market

Though still in early stages, Latin America’s Sodium-sulfur battery storage system Market is beginning to grow. Brazil, Chile, and Mexico are actively exploring long-duration storage for solar and wind integration. Chile’s Atacama Desert, a hotspot for solar energy, is evaluating sodium-sulfur technology to store power during peak production hours and release it through the night. Given the region’s growing solar investments—over $25 billion between 2020 and 2024—the deployment of sodium-sulfur systems is set to rise significantly over the next decade.

Production Hubs and Technology Centers Driving the Sodium-sulfur Battery Storage System Market

Production in the Sodium-sulfur battery storage system Market is dominated by Japan, China, and South Korea. Japan’s NGK Insulators remains the global leader, supplying more than 90% of installed sodium-sulfur battery capacity globally. These batteries are manufactured under stringent conditions, involving high-temperature operation and ceramic-based solid electrolytes. Japan’s innovation ecosystem allows companies to scale high-precision, durable battery units capable of operating for 15+ years.

China is scaling up its manufacturing base, particularly in provinces with clean energy industrial zones. Local firms are entering into licensing agreements to expand sodium-sulfur battery production, aided by supportive policies such as tax credits and land grants. South Korea’s stronghold in electronics and battery manufacturing is enabling rapid advancements in safety systems and energy density optimization.

Europe is building domestic capacity through industrial alliances focused on diversifying away from lithium-based supply chains. Germany and France are home to emerging sodium-sulfur battery startups focused on solid-state designs and automation-driven manufacturing. These developments aim to reduce production costs by 20–30% over the next five years.

“Sodium-sulfur battery storage system Manufacturing Database, Sodium-sulfur battery storage system Manufacturing Capacity”

-

-

- Sodium-sulfur battery storage system top manufacturers market share

- Top five manufacturers and top 10 manufacturers of Sodium-sulfur battery storage system in North America, Europe, Asia Pacific

- Production plant capacity by manufacturers and Sodium-sulfur battery storage system production data for market players

- Sodium-sulfur battery storage system production dashboard, Sodium-sulfur battery storage system production data in excel format

-

Grid Storage Leading in the Application-Based Segmentation of the Sodium-sulfur Battery Storage System Market

Within the application spectrum of the Sodium-sulfur battery storage system Market, grid storage dominates with over 60% of the global share. Sodium-sulfur batteries are highly effective in utility-scale applications such as frequency regulation, voltage support, and load balancing. For instance, Texas and California have implemented grid projects using sodium-sulfur batteries to handle solar curtailment and evening ramp-up periods.

These systems are also gaining prominence in transmission and distribution deferral strategies, where they reduce the need for expensive grid infrastructure expansion. Given that global power consumption is expected to grow by 50% by 2040, grid storage demand will continue to be a primary driver of sodium-sulfur battery adoption.

Industrial and Commercial Applications Growing in the Sodium-sulfur Battery Storage System Market

Industrial use cases in the Sodium-sulfur battery storage system Market are expanding across manufacturing, data centers, and energy-intensive operations. These batteries are used for power continuity, energy cost management, and emissions compliance. For example, automotive manufacturers in Germany are deploying sodium-sulfur systems to offset high peak tariffs and ensure production continuity during blackouts.

Commercial buildings, such as hospitals, universities, and malls, are turning to sodium-sulfur batteries to shift energy usage from peak to off-peak hours. As commercial electricity prices continue to rise—especially in regions like Western Europe and East Asia—adoption of sodium-sulfur storage solutions in this segment is expected to rise significantly.

Capacity-Based Segmentation Shaping the Sodium-sulfur Battery Storage System Market

In the Sodium-sulfur battery storage system Market, large-scale systems dominate due to the inherent design and operation profile of NaS technology. These systems, typically ranging from 1 MWh to over 100 MWh, are suited for national grid applications, renewable energy parks, and industrial clusters. Small and medium-scale systems are emerging in applications like remote power support, smart campuses, and microgrids.

As sodium-sulfur battery modularity improves, medium-scale systems are being tailored for mid-sized commercial and municipal use, especially in areas with space constraints and high energy volatility.

Solid-State and High Voltage Technologies Influencing the Sodium-sulfur Battery Storage System Market

Technological innovation is segmenting the Sodium-sulfur battery storage system Market based on voltage and electrolyte type. High voltage systems are preferred for grid and industrial-scale deployments, providing fast response and high-capacity output. Low voltage systems, while niche, are becoming viable for community microgrids and smart building infrastructure.

Solid-state sodium-sulfur batteries, utilizing advanced ceramic electrolytes, are being designed for higher energy retention and improved cycle life. These batteries promise enhanced safety, eliminating the risks of fire or leakage, and are now entering early commercialization in Japan and South Korea.

Major Manufacturers Leading the Sodium-sulfur Battery Storage System Market

The Sodium-sulfur battery storage system Market is shaped by a select group of technologically advanced manufacturers who dominate both production and deployment. These companies not only possess proprietary technology but also actively contribute to shaping market dynamics through innovation, strategic partnerships, and global project implementation.

NGK Insulators (Japan): Pioneer and Global Leader in the Sodium-sulfur Battery Storage System Market

NGK Insulators remains the undisputed leader in the Sodium-sulfur battery storage system Market, responsible for over 90% of the world’s operational NaS battery installations. The company’s flagship product line, NAS® Batteries, is designed for grid-scale applications with discharge durations ranging from 6 to 8 hours and life cycles exceeding 4,500 cycles. These systems are deployed across more than 190 projects in countries including Japan, the U.S., Germany, and the UAE. NGK’s technology has been validated through installations such as the 50 MW/300 MWh system in Abu Dhabi, which supports renewable energy stabilization in desert climates.

NGK has continually improved its battery architecture, including advanced ceramic electrolyte separators and thermally insulated enclosures that maintain system stability at high temperatures. The company is now focused on enhancing energy density and developing compact containerized solutions to cater to emerging markets in Asia and Africa.

Sieyuan Electric (China): A Strategic Challenger in the Sodium-sulfur Battery Storage System Market

Sieyuan Electric is emerging as a key Chinese contender in the Sodium-sulfur battery storage system Market. The company is actively developing its sodium-sulfur battery portfolio under its SYEnergy Storage division. These systems are being deployed in industrial parks and renewable energy integration projects in northern China. Sieyuan is positioning its systems as grid-scale, modular, and cost-competitive, targeting large renewable installations where lithium-ion storage becomes less economically viable.

The company is also focused on domestic manufacturing of sodium and sulfur-based components, reducing reliance on imported materials. This is in line with China’s national strategy to become energy self-sufficient and reduce its exposure to critical material imports.

Korea Electric Power Corporation (KEPCO): Innovation Driver in the Sodium-sulfur Battery Storage System Market

KEPCO, South Korea’s largest electric utility, is investing significantly in long-duration storage through its R&D subsidiary. KEPCO’s sodium-sulfur battery prototype systems are undergoing field trials in energy-dense urban centers, supporting smart grid pilot programs. These batteries are part of KEPCO’s broader plan to transition from fossil-fuel-dependent infrastructure to a decentralized, renewable-based power grid.

KEPCO has collaborated with Korean universities to enhance the thermal management and durability of sodium-sulfur cells. The company is expected to release its first commercialized NaS system under the Smart ESS Project Line in late 2025, specifically targeting microgrids and secondary power backup applications.

POSCO Holdings (South Korea): Materials-Backed Expansion in the Sodium-sulfur Battery Storage System Market

POSCO, a global steel and materials giant, is entering the Sodium-sulfur battery storage system Market through its chemical and materials division. By leveraging its vertical integration in sulfur and sodium refining, POSCO is developing next-generation solid-state sodium-sulfur batteries. These systems are under pilot testing and are expected to deliver 250 Wh/kg energy density with extended thermal range operation, specifically for deployment in industrial logistics hubs and ports.

POSCO’s move aligns with its broader transition into green materials and battery components, with sodium-sulfur being a logical progression due to its material cost advantages and application scalability.

Sumitomo Electric Industries (Japan): Specialist in Advanced Power Grids within the Sodium-sulfur Battery Storage System Market

Sumitomo Electric has invested in alternative sodium-sulfur designs that integrate directly with smart power grids. The company’s solution, branded as SUMI-GridStorage, emphasizes ultra-reliable operation and minimal degradation over time. These systems are being tested for disaster recovery grids in Japan’s coastal zones, where grid resilience is a top national priority.

Sumitomo’s innovation includes hybrid sodium-sulfur systems that can operate in tandem with supercapacitors for fast-response energy dispatch, targeting critical infrastructure such as data centers and hospitals.

Fiamm Energy Technology (Italy): Growing Presence in the European Sodium-sulfur Battery Storage System Market

Fiamm, traditionally known for its telecom and industrial energy solutions, has expanded into the Sodium-sulfur battery storage system Market by developing medium-scale battery modules designed for commercial and grid-side applications. These systems are tailored to European grid conditions and carbon reduction goals.

Fiamm’s NaS technology emphasizes safe, sealed modules with plug-and-play integration for smart buildings and municipal energy systems. The company is currently piloting systems in southern Italy and Spain in conjunction with solar cooperatives.

GE Vernova (United States): Integrating Sodium-sulfur Storage into Global Renewable Projects

GE Vernova, the clean energy arm of General Electric, is exploring sodium-sulfur technology as part of its multi-chemistry energy storage strategy. The company is conducting joint trials with third-party sodium-sulfur developers in the United States and Southeast Asia. These projects are focused on hybrid wind-storage farms, where GE’s turbine systems integrate with long-duration storage batteries.

Although not yet a direct manufacturer, GE’s systems integration capabilities give it strategic influence over large-scale deployments and commercial validation of sodium-sulfur storage in multi-MW capacities.

Recent Developments and Market Movements in the Sodium-sulfur Battery Storage System Market

– February 2024: NGK Insulators announced a new 300 MWh sodium-sulfur battery installation in Saudi Arabia to support the Red Sea Project, marking one of the largest standalone NaS deployments globally. The system will supply consistent energy for desalination and solar hybrid plants.

– December 2023: South Korea’s KEPCO initiated pilot testing for modular sodium-sulfur energy storage in smart cities like Busan, where grid load balancing and decentralized energy supply are being prioritized.

– October 2023: Fiamm and the Italian Ministry of Ecological Transition launched a joint R&D program to commercialize sodium-sulfur batteries for municipal renewable storage, with initial rollout expected in Q1 2026.

– August 2023: China’s National Energy Administration approved the first industrial sodium-sulfur battery storage standardization project in Hebei province, targeting 10 GWh of deployed capacity by 2027.

– July 2023: NGK unveiled its next-gen NAS-X system with improved energy density and a 20-year projected lifespan, developed for emerging markets in Southeast Asia and Latin America.

These developments underscore how rapidly the Sodium-sulfur battery storage system Market is advancing through innovation, public-private partnerships, and global project rollouts. With manufacturers expanding capacity and new players entering the space, the market is transitioning from niche to mainstream—poised to play a central role in the global energy transformation.

“Sodium-sulfur battery storage system Production Data and Sodium-sulfur battery storage system Production Trend, Sodium-sulfur battery storage system Production Database and forecast”

-

-

- Sodium-sulfur battery storage system production database for historical years, 10 years historical data

- Sodium-sulfur battery storage system production data and forecast for next 7 years

-

Market Scenario, Demand vs Supply, Average Product Price, Import vs Export, till 2035

- Global Sodium-sulfur battery storage system Market revenue and demand by region

- Global Sodium-sulfur battery storage system Market production and sales volume

- United States Sodium-sulfur battery storage system Market revenue size and demand by country

- Europe Sodium-sulfur battery storage system Market revenue size and demand by country

- Asia Pacific Sodium-sulfur battery storage system Market revenue size and demand by country

- Middle East & Africa Sodium-sulfur battery storage system Market revenue size and demand by country

- Latin America Sodium-sulfur battery storage system Market revenue size and demand by

- Import-export scenario – United States, Europe, APAC, Latin America, Middle East & Africa

- Average product price – United States, Europe, APAC, Latin America, Middle East & Africa

- Market player analysis, competitive scenario, market share analysis

- Business opportunity analysis

Key questions answered in the Global Sodium-sulfur battery storage system Market Analysis Report:

- What is the market size for Sodium-sulfur battery storage system in United States, Europe, APAC, Middle East & Africa, Latin America?

- What is the yearly sales volume of Sodium-sulfur battery storage system and how is the demand rising?

- Who are the top market players by market share, in each product segment?

- Which is the fastest growing business/ product segment?

- What should be the business strategies and Go to Market strategies?

The report covers Sodium-sulfur battery storage system Market revenue, Production, Sales volume, by regions, (further split into countries):

- Asia Pacific (China, Japan, South Korea, India, Indonesia, Vietnam, Rest of APAC)

- Europe (UK, Germany, France, Italy, Spain, Benelux, Poland, Rest of Europe)

- North America (United States, Canada, Mexico)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa

Table of Contents:

Sodium-Sulfur Battery Storage System Market

- Introduction to Sodium-Sulfur Battery Storage Systems

- Overview of Sodium-Sulfur (NaS) Batteries

- Working Principle and Components of NaS Batteries

- Evolution and Development of Sodium-Sulfur Technology

- Advantages of Sodium-Sulfur Batteries Over Other Energy Storage Systems

- Market Overview and Dynamics

- Global Market Landscape for Sodium-Sulfur Battery Storage Systems

- Growth Drivers and Market Trends

- Environmental and Technological Factors Influencing Market Expansion

- Market Challenges and Barriers to Adoption

- Sodium-Sulfur Battery Storage System Applications

- Use in Renewable Energy Storage (Solar, Wind)

- Applications in Grid Stabilization and Frequency Regulation

- Industrial Applications: Uninterruptible Power Supply (UPS) and Backup Power

- Role in Electric Vehicles and Transportation Sector

- Use in Military, Aerospace, and Defense

- Market Segmentation

- By End-User Industry (Energy, Utilities, Transportation, Industrial, etc.)

- By Product Type (Small-Scale Systems, Large-Scale Systems)

- By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa)

- By Capacity (Low-Capacity, Medium-Capacity, High-Capacity Systems)

- Regional Market Analysis

- North America: Market Size, Key Players, and Growth Trends

- Europe: Government Policies and Investment in Energy Storage Systems

- Asia Pacific: Leading Producers and Expanding Applications in Emerging Economies

- Latin America: Potential Market Growth and Energy Transition Efforts

- Middle East & Africa: Regional Developments in Renewable Energy and Storage

- Technological Advancements and Innovations

- Advancements in Sodium-Sulfur Battery Efficiency and Performance

- Innovations in Electrolyte Materials and Battery Design

- Safety Improvements and Thermal Management Solutions

- Integration of NaS Batteries with Smart Grids and Energy Management Systems

- Supply Chain and Manufacturing Dynamics

- Raw Materials Required for Sodium-Sulfur Batteries: Sodium, Sulfur, etc.

- Overview of Key Manufacturers and Production Facilities

- Challenges in Scaling Production and Supply Chain Management

- Cost Structure and Economic Feasibility of NaS Batteries

- Market Competition and Key Players

- Overview of Leading Manufacturers in the Sodium-Sulfur Battery Market

- Competitive Landscape and Market Share Analysis

- Key Partnerships, Acquisitions, and Collaborations in the Industry

- Strategies for Market Differentiation and Expansion

- Economic Feasibility and Cost Analysis

- Pricing Trends for Sodium-Sulfur Batteries: Production vs Market Prices

- Total Cost of Ownership (TCO) and Return on Investment (ROI) for End-Users

- Financial Incentives and Subsidies for Energy Storage Projects

- Cost Reduction Strategies in NaS Battery Production

- Regulatory Environment and Government Policies

- Global and Regional Regulations Impacting Sodium-Sulfur Battery Adoption

- Policies Supporting Energy Storage Systems and Clean Energy Transition

- Standards for Battery Safety, Recycling, and Disposal

- Impact of Carbon Footprint Reduction Regulations on Market Growth

- Environmental Impact and Sustainability

- Sodium-Sulfur Batteries and Their Environmental Benefits

- Lifecycle Analysis of NaS Batteries: Manufacturing to Disposal

- Recycling and Reusability of Sodium and Sulfur Components

- Sustainability Challenges and Opportunities in NaS Battery Technology

- Key Trends and Emerging Opportunities

- Growing Demand for Long-Duration Energy Storage Solutions

- Role of Sodium-Sulfur Batteries in Smart Grid Development

- Integration of NaS Batteries with Renewable Energy Projects

- Innovations in Hybrid Energy Storage Systems (Combining NaS with Other Technologies)

- Risk Analysis and Market Barriers

- Risks Associated with High Operating Temperatures and Safety Concerns

- Limitations in Energy Density and Cycle Life of Sodium-Sulfur Batteries

- Potential Substitution by Alternative Energy Storage Technologies

- Regulatory and Economic Barriers to Widespread Adoption

- Future Outlook and Market Forecast (2025-2040)

- Projected Market Growth and Adoption Rates Globally

- Technological Developments Expected to Influence Market Trends

- Emerging Markets and Future Investment Opportunities

- Strategic Directions for Companies Operating in the NaS Battery Market

- Investment Landscape and Strategic Recommendations

- Investment Opportunities in Sodium-Sulfur Battery Startups and Established Players

- Recommendations for Manufacturers Looking to Enter the Market

- Strategic Focus Areas for Innovation, Cost Reduction, and Market Penetration

- Case Studies and Successful Implementations

- Case Study 1: Large-Scale NaS Battery Integration in Power Grids

- Case Study 2: Use of Sodium-Sulfur Batteries in Remote or Off-Grid Applications

- Case Study 3: Industry-Specific Applications in Telecom and Data Centers

- Conclusion and Key Takeaways

- Summary of Key Insights and Market Opportunities

- Strategic Insights for Stakeholders in the Sodium-Sulfur Battery Ecosystem

- Future Prospects and Technological Roadmap for Sodium-Sulfur Battery Storage

“Every Organization is different and so are their requirements”- Datavagyanik

Companies We Work With

Do You Want To Boost Your Business?

drop us a line and keep in touch