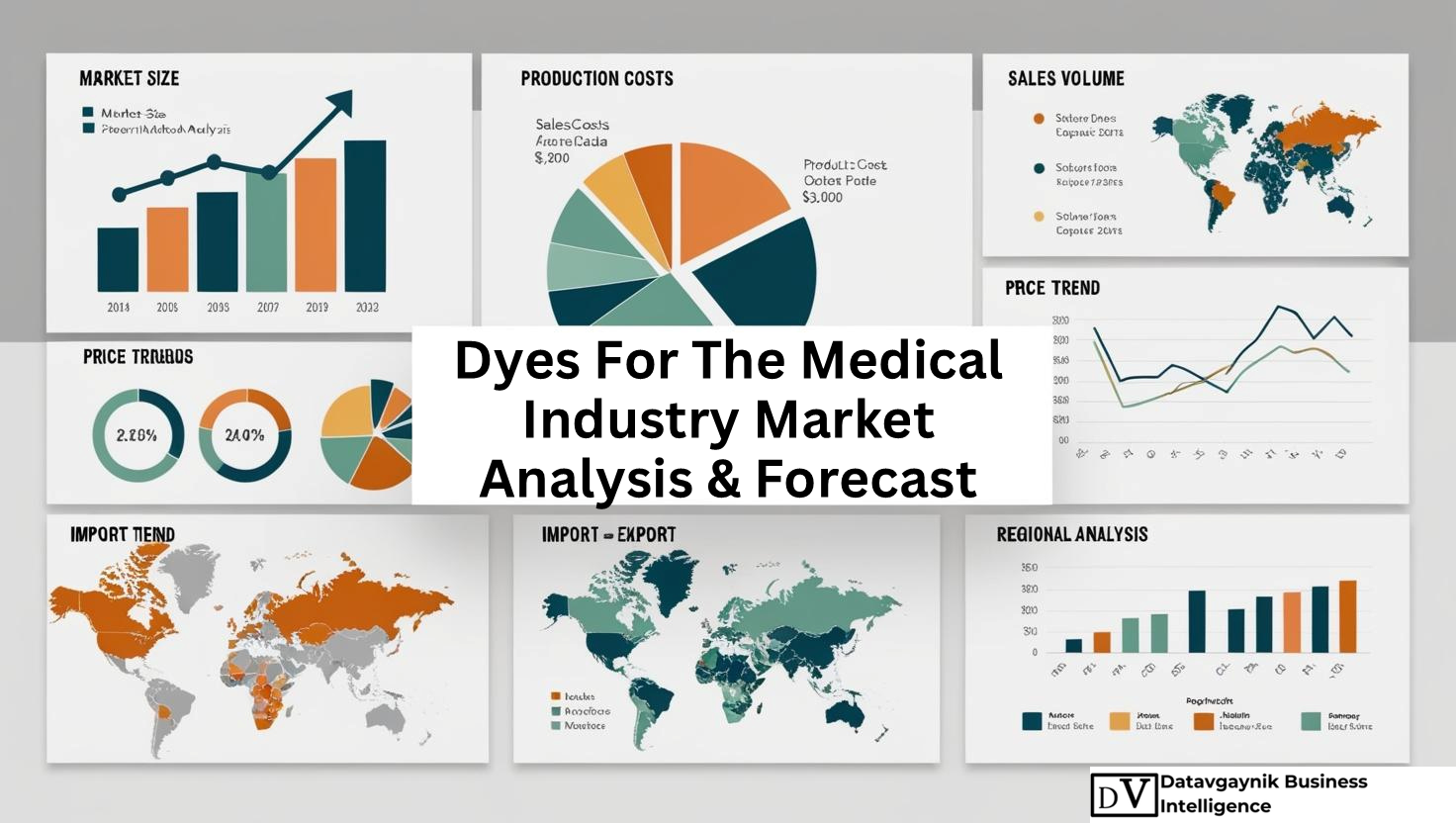

Dyes for the medical industry Market Size, Production, Sales, Average Product Price, Market Share, Import vs Export

- Published 2025

- No of Pages: 120+

- 20% Customization available

Technological Innovation Driving the Dyes for the Medical Industry Market

The Dyes for the medical industry Market is undergoing a transformation led by rapid innovation in diagnostic and imaging technologies. One of the strongest growth drivers is the increasing adoption of advanced contrast agents in MRI, CT scans, and angiography procedures. For instance, the global number of MRI scans exceeded 85 million in 2023, reflecting the rising need for specialized dyes that enhance tissue visibility. These imaging agents are critical in enabling early-stage detection of cancers, cardiovascular diseases, and neurological conditions. As precision diagnostics become the gold standard in modern medicine, the demand for high-purity, biocompatible dyes is accelerating across all regions.

Chronic Disease Burden Fueling the Dyes for the Medical Industry Market

The Dyes for the medical industry Market is being propelled by the global surge in chronic health conditions. For example, cardiovascular diseases account for over 17 million deaths annually, while cancer incidences are projected to reach 28 million new cases per year by 2040. In such scenarios, contrast dyes play a pivotal role in imaging-based diagnostics, ensuring early and accurate disease detection. These dyes are not only essential in identifying tumors, lesions, and arterial blockages but are also critical in planning minimally invasive procedures. As the clinical focus shifts toward proactive health management, the growth in diagnostic imaging procedures directly correlates with rising dye consumption, boosting overall market value.

Minimally Invasive Surgery Trends Expanding the Dyes for the Medical Industry Market

Minimally invasive surgical procedures have increased by over 30% globally in the last five years. In these procedures, medical dyes act as indispensable tools for intraoperative visualization. For instance, indocyanine green (ICG) dyes are commonly used during robotic-assisted surgeries to identify lymph nodes and blood vessels with precision. As hospitals and surgical centers embrace robotics and endoscopy, the Dyes for the medical industry Market sees significant growth from the rising volume of surgeries demanding intraoperative imaging. Furthermore, these dyes improve surgical outcomes and reduce complications, reinforcing their integration into surgical protocols.

Rise of Personalized Medicine Boosting the Dyes for the Medical Industry Market

Tailored therapies and diagnostics are rapidly shaping healthcare strategies, and dyes play a foundational role in this shift. For example, fluorescent probes are widely used in tumor profiling, enabling oncologists to select the most effective treatment based on patient-specific markers. The global personalized medicine market is growing at over 10% CAGR and is expected to surpass $800 billion by 2030. This trend significantly benefits the Dyes for the medical industry Market, especially in areas like molecular diagnostics and companion diagnostics. As precision therapies demand real-time biological visualization, advanced medical dyes are becoming indispensable components in this clinical transformation.

Biotechnology and Research Advancements Strengthening the Dyes for the Medical Industry Market

Biotechnology is fueling consistent demand in the Dyes for the medical industry Market through its reliance on fluorescent markers, biological stains, and molecular dyes. These products are essential in DNA sequencing, immunohistochemistry, and flow cytometry—techniques that are central to drug discovery and disease modeling. For instance, global investments in biotech R&D surpassed $400 billion in 2023, highlighting the sector’s demand for research-grade reagents. Academic institutions, biopharma companies, and contract research organizations are expanding their laboratories, intensifying their usage of high-performance dyes to support genetic, cellular, and microbial studies.

Regulatory Focus on Biocompatibility Accelerating the Dyes for the Medical Industry Market

Global regulatory authorities have intensified their scrutiny over medical products, emphasizing patient safety and eco-friendly formulations. As a result, the Dyes for the medical industry Market is witnessing a shift towards non-toxic, biodegradable, and biocompatible dyes. Manufacturers are now investing in cleaner chemistries that reduce systemic toxicity and improve metabolic clearance. For instance, dyes formulated for pediatric and geriatric applications are undergoing reformulations to meet stricter biocompatibility criteria. This evolution not only enhances patient outcomes but also creates opportunities for producers offering premium-grade dyes that align with emerging compliance frameworks.

North America and Europe Leading the Dyes for the Medical Industry Market in Innovation

The Dyes for the medical industry Market in North America and Europe accounts for a substantial share due to high healthcare spending and a strong foundation in medical R&D. For example, the U.S. dye and pigment manufacturing sector reached $6.9 billion in 2024, with a consistent share allocated to medical applications. Europe’s medical technology sector, valued at €160 billion in 2023, is equally focused on high-performance diagnostic and surgical dyes. Countries such as Germany, the UK, and France are hubs for innovation, manufacturing dyes that meet stringent European Medicines Agency (EMA) and FDA standards. The advanced infrastructure and regulatory stringency in these regions act as quality benchmarks for global markets.

Asia-Pacific Emerges as a Production Powerhouse in the Dyes for the Medical Industry Market

The Dyes for the medical industry Market is experiencing its fastest expansion in Asia-Pacific, with countries like China and India becoming key production hubs. China’s chemical production growth rate of 4.7% and India’s 4.1% in 2025 reflect the capacity surge in dye manufacturing. For instance, Chinese firms are scaling up to meet surging demand in imaging and diagnostics, while Indian companies are capturing global orders with competitively priced, high-purity products. These nations not only serve their domestic healthcare sectors but also act as suppliers to Southeast Asia, the Middle East, and Africa, making Asia-Pacific a strategic export base in the global value chain.

Surge in Diagnostic Imaging Procedures Supporting the Dyes for the Medical Industry Market

Global diagnostic imaging volumes have increased by over 25% since 2020. Techniques such as MRI, PET-CT, and fluoroscopy have become standard for diagnosing cancers, vascular anomalies, and neurological disorders. Each of these procedures relies heavily on contrast dyes to improve visualization. For instance, gadolinium-based contrast agents are widely used in brain and spine MRI scans, while iodine-based dyes dominate CT imaging. This surge in imaging is placing unprecedented demand on the Dyes for the medical industry Market, driving both volume and innovation in product development to improve contrast quality, reduce toxicity, and support faster image acquisition.

Medical Tourism and Emerging Markets Contributing to the Dyes for the Medical Industry Market

Countries like Brazil, Mexico, Thailand, and Malaysia are investing heavily in healthcare infrastructure to attract international patients, creating new avenues for the Dyes for the medical industry Market. For example, Thailand’s medical tourism industry grew by 12% in 2023, with diagnostic and surgical imaging forming core service offerings. As these countries aim to offer world-class healthcare, the demand for high-grade medical dyes—compliant with international standards—is steadily rising. This trend also encourages regional dye manufacturers to elevate their quality and obtain certifications necessary for export to developed markets.

Growing Clinical Diagnostics Segment Enhancing the Dyes for the Medical Industry Market

The global clinical diagnostics market is growing at a CAGR of over 6.5% and is expected to reach $96 billion by 2027. Within this space, dyes serve critical functions in blood testing, cytology, histopathology, and flow cytometry. For example, eosin and hematoxylin stains are used in over 80% of pathology labs worldwide for cell and tissue identification. The increasing demand for early diagnosis of infectious and non-communicable diseases is creating consistent opportunities in the Dyes for the medical industry Market, particularly for biological stains with high staining efficiency and reproducibility.

Surgical Dye Innovation Reinforcing the Dyes for the Medical Industry Market

In the surgical segment, the Dyes for the medical industry Market is advancing with dyes like methylene blue, ICG, and fluorescein sodium enabling higher intraoperative accuracy. For instance, methylene blue is being utilized to trace lymphatic vessels in oncology surgeries, while fluorescein sodium aids in identifying glioma margins during brain surgeries. These dyes reduce surgical errors, optimize outcomes, and are increasingly preferred in procedures involving high-risk organs such as the brain, heart, and liver. Innovation in dye formulation—for extended half-life, clearer visualization, and selective binding—is strengthening the position of dyes as essential surgical aids.

North America’s Strategic Leadership in the Dyes for the Medical Industry Market

The Dyes for the medical industry Market in North America demonstrates sustained leadership driven by world-class healthcare infrastructure, high diagnostic imaging penetration, and consistent investments in biotechnology. For instance, the United States alone performs more than 40 million MRI scans annually, most of which require high-quality contrast agents. This demand has established the region as a core consumption hub for dyes used in radiology, pathology, and surgical imaging. Furthermore, the country’s extensive network of pharmaceutical and biotech firms reinforces the need for advanced research dyes, especially those used in genetic sequencing and cellular analysis.

Canada also contributes significantly, especially through its public healthcare investments. The Canadian market is witnessing an increase in clinical trials, drug development initiatives, and precision diagnostic tools, all of which are heavily reliant on fluorescent and biological stains. This consistent demand pattern supports the region’s position as a high-value market for innovation-driven dye manufacturers.

Europe’s Precision-Focused Demand in the Dyes for the Medical Industry Market

Europe’s focus on precision medicine, combined with stringent regulatory frameworks, drives a robust and quality-centric demand in the Dyes for the medical industry Market. Germany, as Europe’s largest medical technology market, contributes significantly through its emphasis on high-end diagnostic imaging and histopathological research. For example, German hospitals regularly deploy dual-modality imaging (CT+PET), requiring specialty dyes with strong pharmacokinetic profiles.

France and the United Kingdom follow closely. France’s adoption of robotic and laparoscopic surgeries has triggered demand for surgical dyes like ICG and fluorescein. Similarly, the UK’s commitment to healthcare innovation has spurred collaborations between hospitals and research universities, increasing the requirement for research-grade dyes for tissue staining, gene mapping, and neurological studies.

Smaller yet strategic players like Italy and Spain are also contributing through their investments in hospital infrastructure and medical tourism. The growing number of diagnostic procedures across these nations fuels consumption of both contrast and fluorescent dyes, further expanding Europe’s role in the global dye demand landscape.

Asia-Pacific’s Dual Role in Demand and Production in the Dyes for the Medical Industry Market

Asia-Pacific is uniquely positioned as both a fast-growing consumer and a major producer in the Dyes for the medical industry Market. China leads the region with an expansive healthcare network and a dominant chemical manufacturing base. For instance, China’s 4.7% projected growth in chemical production is mirrored by increased demand from its booming diagnostic imaging sector. Hospitals across tier-1 and tier-2 cities are equipping themselves with modern imaging modalities, accelerating consumption of medical dyes.

India’s contribution is also noteworthy. The country’s diagnostics sector is growing at a CAGR of over 10%, driven by the expansion of private pathology labs and imaging centers. As a result, demand for histology dyes, cytological stains, and pH indicators is increasing. Simultaneously, Indian manufacturers are scaling their dye production capacity, supplying both domestic needs and global demand at cost-effective rates.

Japan and South Korea bring high standards and technological sophistication to the market. Japan’s need for ultra-pure dyes in neurological diagnostics and South Korea’s growing biotechnology sector are shaping high-value segments within the region. Both countries are investing in R&D focused on formulating dyes with lower toxicity and higher stability, supporting innovations in dye chemistry.

Emerging Market Growth in Latin America and the Middle East in the Dyes for the Medical Industry Market

Latin America and the Middle East are becoming increasingly relevant in the Dyes for the medical industry Market, primarily due to rising investments in healthcare modernization and diagnostic infrastructure. Brazil, for instance, has emerged as a key player in Latin America. The growing number of private diagnostic chains and government-sponsored health programs have led to greater deployment of imaging tools that depend on contrast agents.

Mexico follows a similar trend. The country’s medical tourism sector has surged over the past five years, particularly in advanced diagnostics and surgeries, creating stable demand for surgical and imaging dyes. Local production is still nascent, but imports from the U.S., Europe, and China help meet internal requirements.

In the Middle East, countries like the UAE and Saudi Arabia are prioritizing healthcare transformation as part of their national development goals. State-of-the-art diagnostic centers and tertiary hospitals now routinely perform imaging and pathology procedures requiring medical dyes. These countries are also actively exploring collaborations with dye producers to localize production and reduce dependence on imports.

Geographic Production Clusters Shaping the Dyes for the Medical Industry Market

The Dyes for the medical industry Market relies heavily on geographically concentrated production clusters. The United States, China, and Germany form the three dominant manufacturing centers, each contributing through specific strengths. The U.S. specializes in high-purity, FDA-compliant dyes used in surgical and diagnostic imaging. China leads in volume production, offering cost-effective solutions, while Germany is known for its technical precision and innovation in dye formulation.

For example, Germany’s exports of dyes and pigments reached nearly $14 billion in 2021, a significant share of which included medical-grade applications. Similarly, China’s $11.5 billion export value in 2022 was driven by its massive chemical synthesis infrastructure. These figures highlight the strategic manufacturing advantage that both countries maintain.

India is rapidly gaining ground, with its exports of medical-grade dyes seeing double-digit growth. Indian producers are meeting strict regulatory expectations for markets like Europe and North America, positioning themselves as alternatives to more expensive Western manufacturers.

Product Segmentation Driving Specialization in the Dyes for the Medical Industry Market

The Dyes for the medical industry Market is segmented into several product types, each serving specialized clinical or research needs. Contrast dyes form the backbone of diagnostic imaging and account for the largest volume of consumption. These dyes, often iodine or gadolinium-based, are indispensable in procedures like angiography, CT scans, and MRIs. With imaging volume growing by over 25% globally since 2020, this segment shows sustained momentum.

Fluorescent dyes represent another fast-growing category, widely used in real-time surgical guidance, especially in neurosurgery, hepatobiliary surgery, and cancer surgeries. For instance, ICG-guided procedures have seen a 30% increase in adoption over the past three years, reinforcing the importance of this segment.

Biological stains are central to pathology and microbiology labs. Products such as hematoxylin, eosin, and crystal violet enable high-contrast cellular imaging, critical for diagnosing cancer, infections, and inflammatory diseases. Rising demand for pathology services—driven by chronic diseases and aging populations—boosts the growth of this segment.

Specialty dyes, including pH indicators and molecular markers, are widely utilized in pharmaceutical R&D and clinical diagnostics. These dyes are critical in monitoring metabolic changes and identifying specific biomolecular interactions, particularly in personalized medicine and genomic testing.

Application-Based Demand Diversifying the Dyes for the Medical Industry Market

Demand in the Dyes for the medical industry Market is distributed across multiple application verticals. Medical imaging remains the largest contributor, driven by hospitals, diagnostic labs, and specialty clinics. Imaging contributes more than 45% of total dye consumption, supported by increasing usage of AI-powered radiology systems that require precise and high-resolution imaging inputs.

Surgical procedures represent the next most significant application. Robotic and laparoscopic procedures are driving demand for dyes that can provide enhanced tissue visualization without systemic side effects. The use of ICG in hepatic resections, sentinel lymph node biopsies, and colorectal surgeries is becoming routine in developed healthcare systems.

Clinical diagnostics—covering pathology, cytology, and hematology—account for nearly 20% of total dye demand. The growing preference for pathology-driven decisions in chronic and infectious diseases has expanded this segment. In addition, with COVID-19 having highlighted the importance of molecular diagnostics, labs globally are enhancing their dye-dependent testing capabilities.

Pharmaceutical and biotechnology research form the final major application area. Fluorescent, biological, and reactive dyes are indispensable in drug screening, genetic research, and bioassays. As the biopharma pipeline continues to grow—especially in oncology and immunotherapy—the need for reliable staining and tracking agents is becoming increasingly critical.

End-User Analysis Reinforcing Target Segments in the Dyes for the Medical Industry Market

The Dyes for the medical industry Market serves a diverse range of end users. Hospitals and diagnostic centers form the primary user base, accounting for nearly 50% of the market share. These institutions use contrast dyes, surgical imaging dyes, and clinical stains on a daily basis. The expansion of hospital networks in Asia and the Middle East directly correlates with growing consumption levels in this segment.

Pharmaceutical and biotechnology companies represent another key segment. These organizations use specialized dyes for drug formulation studies, clinical trial assays, and diagnostic kit development. With over 15,000 clinical trials currently active worldwide, the need for precise dyes in research and patient monitoring continues to expand.

Academic and research institutions are emerging as important end users, particularly in countries investing in scientific education and R&D. Their demand is centered around histological staining, microbial assays, and fluorescence-based cellular studies. The growing footprint of bioscience education in China, India, and Brazil is expected to amplify this segment further.

Major Manufacturers Shaping the Global Dyes for the Medical Industry Market

The Dyes for the medical industry Market is defined by a group of specialized manufacturers that dominate global production, innovation, and supply. These companies lead through a combination of research-backed product lines, robust distribution networks, and stringent quality adherence—meeting the high standards demanded by the medical and diagnostic sectors. Several key players have carved out specific product niches, supporting medical imaging, diagnostics, surgical procedures, and pharmaceutical research applications.

BASF SE – A Global Chemical Leader in the Dyes for the Medical Industry Market

BASF SE is one of the largest contributors to the Dyes for the medical industry Market, with a broad portfolio of medical-grade dyes and intermediates. The company offers a range of contrast and specialty dyes under its pharmaceutical solutions division, with a strong emphasis on safety, biocompatibility, and purity. BASF’s product lines such as “Lutensit” and “Solvaperm” include components widely used in diagnostic agents. The firm also plays a role in developing dyes used for radiology applications, including those required for gadolinium-based contrast agents. BASF’s deep-rooted R&D and its scalable production facilities allow it to serve both developed and emerging markets effectively.

Thermo Fisher Scientific – A Key Innovator in the Dyes for the Medical Industry Market

Thermo Fisher Scientific is a major name in laboratory reagents and dyes used in molecular diagnostics and biomedical research. The company offers an extensive catalog of dyes under brands like “Molecular Probes” and “Invitrogen,” which are widely adopted in cell imaging, flow cytometry, and immunofluorescence. Products such as Alexa Fluor and SYTO dyes are commonly used in tissue labeling, gene expression analysis, and cancer diagnostics. These high-sensitivity dyes are staples in research institutions and pharmaceutical R&D labs, reinforcing Thermo Fisher’s stronghold in the high-precision segment of the Dyes for the medical industry Market.

Merck KGaA – Precision and Purity in the Dyes for the Medical Industry Market

Merck KGaA (operating as MilliporeSigma in North America) is known for delivering ultra-pure dyes for research and diagnostic purposes. Its product range includes biological stains, pH indicators, and histological dyes used in pathology, microscopy, and biochemical testing. The “Certistain” line of dyes, for instance, includes hematoxylin and eosin formulations widely used in histology labs. Merck also offers products suitable for microbial detection and genetic diagnostics. Its consistent focus on regulatory-compliant, research-grade formulations makes it a preferred partner for diagnostic laboratories and biotech innovators across Europe, North America, and Asia.

GE HealthCare – Imaging-Driven Growth in the Dyes for the Medical Industry Market

GE HealthCare remains a dominant force in the medical imaging segment of the Dyes for the medical industry Market. Its contrast media product line, including brands like “Omnipaque” (iohexol) and “Visipaque” (iodixanol), are widely used in CT and X-ray imaging. These agents enhance the clarity of diagnostic images, facilitating accurate visualization of organs, vessels, and tissues. GE’s dyes are formulated for improved safety, low osmolality, and minimal adverse reactions—especially critical for patients with kidney dysfunction or hypersensitivity. The company’s global distribution infrastructure ensures availability across hospitals and imaging centers in more than 100 countries.

Guerbet Group – Specializing in Contrast Agents for the Dyes for the Medical Industry Market

France-based Guerbet Group focuses exclusively on diagnostic imaging and contrast agents. Its key products include “Dotarem” (a macrocyclic gadolinium-based MRI contrast agent) and “Xenetix” (used in CT imaging). Guerbet’s specialization allows it to stay ahead in the high-precision medical dye space, where patient safety and diagnostic efficacy are non-negotiable. Dotarem, for instance, is known for its lower risk of nephrogenic systemic fibrosis and is routinely used in pediatric and geriatric imaging. Guerbet’s strong regulatory record and clinical research support its positioning as a premium player in the Dyes for the medical industry Market.

Bracco Imaging – Excellence in Advanced Medical Imaging Solutions

Bracco Imaging is a top-tier manufacturer of imaging dyes with a portfolio that includes “MultiHance” and “ProHance,” both used in MRI applications. The company also produces “Isovue,” a non-ionic iodine-based dye for X-ray and CT diagnostics. Bracco’s emphasis on product safety, fast renal clearance, and image enhancement makes it a trusted provider for hospitals globally. With a presence in more than 100 countries and multiple production plants in Europe, North America, and Asia, Bracco continues to expand its influence in the Dyes for the medical industry Market, particularly in contrast dye innovations.

Abbott Laboratories – Supporting Diagnostics in the Dyes for the Medical Industry Market

Abbott Laboratories plays a key role in diagnostic staining agents used in pathology and immunoassays. Its diagnostic division integrates biological dyes into its automated platforms, supporting blood analysis, infectious disease screening, and biomarker testing. The company’s focus on automation-friendly dye formulations aligns well with the growing trend of AI-driven diagnostics. Abbott’s ability to integrate dyes with diagnostics devices creates a unique synergy that strengthens its footprint in the Dyes for the medical industry Market, particularly in hospital and lab-based applications.

Agilent Technologies – Molecular-Grade Dyes for the Medical Industry Market

Agilent Technologies contributes to the Dyes for the medical industry Market through its advanced staining kits and molecular labeling products. The company’s dyes are heavily used in genomics, proteomics, and cell-based assays. Its key offerings include dyes used in microarray analysis and high-throughput screening systems. With demand rising for precision biomarkers and DNA sequencing, Agilent continues to develop proprietary formulations that improve signal intensity and reduce background noise—features critical in next-gen sequencing workflows.

Recent News and Developments in the Dyes for the Medical Industry Market

- In January 2024, GE HealthCare launched a new version of its Omnipaque contrast dye with improved low-osmolality formulation, targeting better tolerance in pediatric and renal-impaired patients. This move is expected to expand its reach in hospital imaging centers across Asia and Latin America.

- Thermo Fisher Scientific announced in March 2024 the expansion of its “Invitrogen” dye production facility in Massachusetts to meet growing demand for cell imaging dyes used in oncology diagnostics. The upgrade will increase production capacity by 40%.

- In October 2023, Merck KGaA introduced new eco-friendly biological dyes in its “Certistain Green” product line, aiming to reduce toxic solvents and align with sustainable lab practices. These products are being piloted in research institutions across Germany and the UK.

- Bracco Imaging signed a partnership in November 2023 with a leading diagnostic chain in India to supply ProHance and MultiHance contrast dyes. This strategic move strengthens Bracco’s footprint in emerging markets where diagnostic imaging volumes are increasing rapidly.

- Guerbet Group launched clinical trials for a next-generation gadolinium-based dye in February 2024, designed to offer improved contrast resolution with reduced dosage. If approved, the product could set a new benchmark in MRI diagnostics.

These developments signal a shift towards innovation, sustainability, and patient safety in the Dyes for the medical industry Market. As manufacturers continue to refine formulations and expand geographically, the market is expected to experience sustained, innovation-led growth in the years ahead.

Market Scenario, Demand vs Supply, Average Product Price, Import vs Export, till 2035

- Global Dyes for the medical industry Market revenue and demand by region

- Global Dyes for the medical industry Market production and sales volume

- United States Dyes for the medical industry Market revenue size and demand by country

- Europe Dyes for the medical industry Market revenue size and demand by country

- Asia Pacific Dyes for the medical industry Market revenue size and demand by country

- Middle East & Africa Dyes for the medical industry Market revenue size and demand by country

- Latin America Dyes for the medical industry Market revenue size and demand by

- Import-export scenario – United States, Europe, APAC, Latin America, Middle East & Africa

- Average product price – United States, Europe, APAC, Latin America, Middle East & Africa

- Market player analysis, competitive scenario, market share analysis

- Business opportunity analysis

Key questions answered in the Global Dyes for the medical industry Market Analysis Report:

- What is the market size for Dyes for the medical industry in United States, Europe, APAC, Middle East & Africa, Latin America?

- What is the yearly sales volume of Dyes for the medical industry and how is the demand rising?

- Who are the top market players by market share, in each product segment?

- Which is the fastest growing business/ product segment?

- What should be the business strategies and Go to Market strategies?

The report covers Dyes for the medical industry Market revenue, Production, Sales volume, by regions, (further split into countries):

- Asia Pacific (China, Japan, South Korea, India, Indonesia, Vietnam, Rest of APAC)

- Europe (UK, Germany, France, Italy, Spain, Benelux, Poland, Rest of Europe)

- North America (United States, Canada, Mexico)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa

Table of Contents:

- Introduction to the Dyes for the Medical Industry Market

- Definition and Role of Dyes in Medical Applications

- Market Scope and Industry Significance

- Key Properties and Functional Uses of Medical Dyes

- Market Segmentation of Dyes for the Medical Industry

- By Type:

- Fluorescent Dyes

- Contrast Agents

- Vital Stains

- Biological Stains

- By Application:

- Surgical and Diagnostic Procedures

- Histology and Pathology

- Pharmaceutical Formulations

- Biomedical Imaging

- By Region

- Global Dyes for the Medical Industry Market Trends and Growth Forecast (2019-2035)

- Market Size and Revenue Growth Analysis

- Driving Factors Supporting Market Expansion

- Challenges and Constraints in Medical Dye Production

- Regional Analysis of the Dyes for the Medical Industry Market

- North America: Industry Demand, Regulatory Framework, Market Players

- Europe: Growth Trends, Research Applications, Market Share Distribution

- Asia Pacific: Leading Manufacturers, Market Expansion, Import-Export Statistics

- Latin America: Market Potential, Investment Trends, Supply Chain Insights

- Middle East & Africa: Market Developments, Competitive Landscape

- Dyes for the Medical Industry Production and Manufacturing Analysis

- Global Production Volumes and Forecasts (2019-2035)

- Key Manufacturers and Their Production Capacities

- Technological Advancements in Medical Dye Production

- Competitive Landscape of the Dyes for the Medical Industry Market

- Leading Market Players and Their Market Share

- Company Profiles, Strategic Alliances, and R&D Investments

- Patent Analysis and Innovations in Medical Dyes

- Market Share and Revenue Insights by Key Dyes for the Medical Industry Manufacturers

- Revenue Breakdown by Major Producers (2019-2025)

- Competitive Positioning and Market Strategies

- Pricing and Cost Structure of Dyes for the Medical Industry

- Regional Pricing Trends and Market Volatility

- Cost Breakdown of Medical Dye Production

- Raw Material Costs and Supplier Analysis

- Trade and Supply Chain Analysis for Dyes in the Medical Industry

- Global and Regional Supply Chain Dynamics

- Export-Import Trends and Key Trade Partners

- Supply Chain Logistics and Distribution Challenges

- Consumption and Demand Forecast for Dyes in the Medical Industry

- Global and Regional Consumption Patterns

- Demand Growth by Application and Industry Sector

- Future Demand Projections (2025-2035)

- Industrial and Production Process of Dyes for the Medical Industry

- Chemical Synthesis and Extraction Techniques

- Quality Control Standards and Compliance Regulations

- Sustainable and Biodegradable Dye Alternatives

- Marketing and Distribution Strategies in the Medical Dye Market

- Distribution Networks and Key Suppliers

- End-User Demand Trends and Industry Adoption Rates

- Market Expansion Strategies for Manufacturers

- Innovations and Emerging Technologies in Dyes for the Medical Industry Production

- Breakthroughs in Fluorescent and Biocompatible Dyes

- Sustainable Production Techniques and Green Chemistry Approaches

- Nanotechnology and Smart Dyes in Medical Applications

- Investment and Business Opportunities in the Dyes for the Medical Industry Market

- Market Growth Potential and Emerging Investment Avenues

- Expansion Strategies for Industry Players

- Barriers to Entry and Competitive Challenges

- Future Market Trends and Industry Forecast (2025-2035)

- Expected Market Growth and Adoption of New Technologies

- Changes in Regulatory Frameworks and Compliance Requirements

- Evolution of Medical Dyes in Advanced Healthcare Applications

- Conclusion and Strategic Recommendations

- Summary of Market Insights and Key Findings

- Growth Strategies for Stakeholders and Investors

- Future Roadmap for Dyes for the Medical Industry Market Players

Other recently published reports:

“Every Organization is different and so are their requirements”- Datavagyanik

Companies We Work With

Do You Want To Boost Your Business?

drop us a line and keep in touch