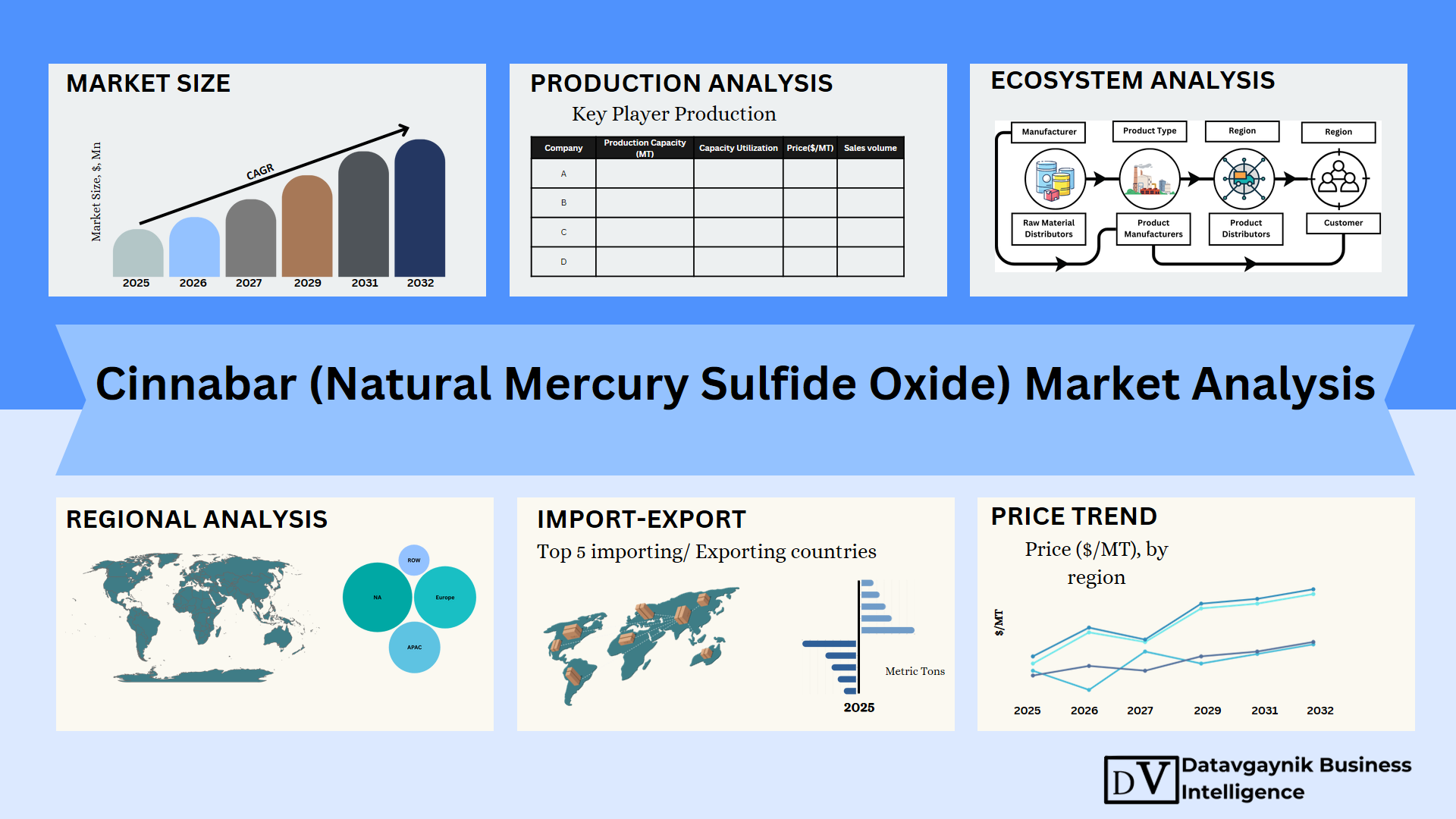

Global Cinnabar (Natural Mercury Sulfide Oxide) Market Size, Production, Sales, Average Product Price, Market Share, Import vs Export – United States, Europe, APAC, Latin America, Middle East & Africa

- Published 2025

- No of Pages: 120+

- 20% Customization available

Market Trends Driving the Cinnabar (Natural Mercury Sulfide Oxide) Market Growth

The global Cinnabar (Natural Mercury Sulfide Oxide) Market has witnessed remarkable growth in recent years, driven by an increasing demand for industrial applications, as well as cultural and historical uses. This upward trend is fueled by both traditional and emerging industries, all of which continue to expand their reliance on cinnabar in diverse ways. As we look ahead to the future, the Cinnabar (Natural Mercury Sulfide Oxide) Market is poised for further growth, especially in sectors such as electronics, energy, and chemical manufacturing, which all require mercury-based compounds. With these growing applications, the Cinnabar (Natural Mercury Sulfide Oxide) Market Size is expected to experience significant expansion in the forecast period from 2024 to 2032.

Industrial Applications and Increased Demand for Cinnabar (Natural Mercury Sulfide Oxide)

One of the most significant factors propelling the demand for cinnabar is its indispensable role in various industrial applications. Cinnabar is the primary ore for mercury extraction, which is widely used in thermometers, barometers, fluorescent lights, and electrical switches. As industrialization progresses globally, particularly in emerging economies, the need for these mercury-based products is expected to rise, subsequently driving the demand for cinnabar.

For instance, the demand for fluorescent lighting, which remains prevalent in both commercial and residential applications, is expected to grow at a compound annual growth rate (CAGR) of 5.5% between 2024 and 2032. As the market expands, the Cinnabar (Natural Mercury Sulfide Oxide) Market is likely to experience a parallel increase in demand, reinforcing its essential role in industrial sectors.

Datavagyanik also covers related markets such as the Cinnabar (Mercury Sulfide) Market and the Mercury Chloride Market. Tracking these sectors reveals parallel dynamics and helps anticipate shifts likely to affect the primary market.

Growth in Gold Mining and Impact on Cinnabar (Natural Mercury Sulfide Oxide) Market

In addition to its widespread use in industrial applications, cinnabar continues to play an important role in the mining industry, particularly in gold extraction. Cinnabar is utilized in some gold mining processes to separate gold from ores, especially in artisanal and small-scale mining operations. The continued rise in gold prices, which have surged by over 20% since 2020, has significantly impacted the demand for cinnabar in gold mining.

This growth is expected to continue as global demand for gold remains strong, driven by its use in electronics and jewelry. The increasing reliance on cinnabar in gold mining is expected to further fuel the Cinnabar (Natural Mercury Sulfide Oxide) Market, especially in regions like Latin America and parts of Asia where artisanal mining is prevalent.

Technological Advancements in Electronics Boosting the Cinnabar (Natural Mercury Sulfide Oxide) Market

Technological developments in the energy and electronics sectors have provided a new impetus for the cinnabar market. The adoption of advanced technologies such as semiconductors, LCDs, and batteries is driving the demand for mercury compounds, including those derived from cinnabar. For example, the global semiconductor market is projected to grow at a CAGR of 7.5%, reaching an estimated $1.3 trillion by 2030.

As the demand for high-tech electronics increases, cinnabar’s role in the manufacturing of components such as switches, relays, and batteries remains essential. The growing use of mercury in advanced electronic products ensures continued growth for the Cinnabar (Natural Mercury Sulfide Oxide) Market. Furthermore, as the production of electronic devices intensifies, the use of cinnabar is likely to rise in parallel.

Environmental and Regulatory Factors Shaping the Cinnabar (Natural Mercury Sulfide Oxide) Market

Environmental and regulatory factors have had a profound influence on the Cinnabar (Natural Mercury Sulfide Oxide) Market, particularly in regions such as North America and Europe. Mercury is a toxic substance, and its usage has been increasingly regulated worldwide. For example, the Minamata Convention on Mercury, an international treaty aimed at curbing mercury pollution, has led to the gradual phase-out of mercury in many industries.

This regulatory push has, in some cases, reduced the demand for cinnabar, as alternatives to mercury-based products become more readily available. However, in certain applications, cinnabar remains irreplaceable due to its unique properties. The evolving regulatory landscape is likely to shape the future growth trajectory of the Cinnabar (Natural Mercury Sulfide Oxide) Market, as businesses adapt to stricter environmental standards while continuing to meet demand for mercury-based products in specific industries.

Cinnabar (Natural Mercury Sulfide Oxide) in Chemical Manufacturing

The chemical manufacturing sector is another key driver of the Cinnabar (Natural Mercury Sulfide Oxide) Market. Mercury extracted from cinnabar is essential for the production of various chemicals, including chlorine and caustic soda. While the overall mercury usage has been on the decline in several industrial applications, there is still substantial demand for cinnabar in chemical manufacturing. The global chemical industry is projected to grow at a CAGR of 4.2% from 2024 to 2032, with an increasing reliance on mercury-based chemicals in processes such as chlor-alkali production. This continued demand for cinnabar in chemical manufacturing is expected to maintain a steady demand for cinnabar, even as other applications face regulatory challenges.

Mercury-Based Medicinal and Historical Uses of Cinnabar (Natural Mercury Sulfide Oxide)

Though modern medicine has moved away from the use of mercury-based compounds due to health concerns, cinnabar still holds historical and cultural significance in some regions. In traditional medicine, cinnabar has been used in various remedies, particularly in parts of Asia, where it is valued for its perceived health benefits. Despite the decline in its use for medicinal purposes, the continued cultural and historical importance of cinnabar ensures a niche demand. In fact, traditional practices in Chinese medicine, where cinnabar is considered a substance of significance, continue to contribute to the Cinnabar (Natural Mercury Sulfide Oxide) Market. This demand, although limited, remains steady, and businesses targeting niche markets in traditional medicine are poised to capitalize on this segment.

The Role of Cinnabar (Natural Mercury Sulfide Oxide) in Art and Cultural Significance

Cinnabar’s use as a pigment in art and decoration remains a significant aspect of its market demand. Historically, cinnabar was highly prized for its rich red hue, making it an essential ingredient in Chinese lacquerware and other decorative crafts. Even today, cinnabar continues to be used in high-end decorative items, including jewelry, sculptures, and luxury products. In regions with strong cultural ties to traditional crafts, such as China and parts of Southeast Asia, the demand for cinnabar-based products remains robust. This cultural significance not only sustains demand but also drives a steady market for cinnabar in artistic applications, contributing to the overall Cinnabar (Natural Mercury Sulfide Oxide) Market Size.

The Influence of Growing Demand for Sustainable and Eco-Friendly Alternatives

Sustainability concerns are influencing various industries, including those that traditionally rely on mercury. In response to growing environmental awareness, there is a significant push toward the development of mercury-free alternatives in sectors such as lighting and electronics. While this has led to a decline in mercury-based applications, it also opens the door for innovation. The development of non-toxic and sustainable alternatives to cinnabar-based products is gaining traction, and businesses are exploring ways to offer safer, eco-friendly substitutes. These innovations may reshape the Cinnabar (Natural Mercury Sulfide Oxide) Market, as industries seek to balance demand for traditional mercury-based products with growing sustainability pressures.

“Track Country-wise Cinnabar (Natural Mercury Sulfide Oxide) Production and Demand through our Cinnabar (Natural Mercury Sulfide Oxide) Production Database”

-

-

- Cinnabar (Natural Mercury Sulfide Oxide) production database for 23+ countries worldwide

- Cinnabar (Natural Mercury Sulfide Oxide) sales volume for 28+ countries

- Country-wise Cinnabar (Natural Mercury Sulfide Oxide) production capacity, production plant mapping, production capacity utilization for 23+ manufacturers

- Cinnabar (Natural Mercury Sulfide Oxide) production plants and production plant capacity analysis by top manufacturers

-

“Track real-time Cinnabar (Natural Mercury Sulfide Oxide) Prices, Cinnabar (Natural Mercury Sulfide Oxide) price charts for 23+ countries, Cinnabar (Natural Mercury Sulfide Oxide) weekly price tracker and Cinnabar (Natural Mercury Sulfide Oxide) monthly price tracker”

-

-

- Track real-time Cinnabar (Natural Mercury Sulfide Oxide) prices and Cinnabar (Natural Mercury Sulfide Oxide) price trend in 23+ countries though our excel-based Cinnabar (Natural Mercury Sulfide Oxide) price charts

- Real-time Cinnabar (Natural Mercury Sulfide Oxide) price tracker dashboard with 23+ countries

- Complete transparency on Cinnabar (Natural Mercury Sulfide Oxide) price trend through our Cinnabar (Natural Mercury Sulfide Oxide) monthly price tracker, Cinnabar (Natural Mercury Sulfide Oxide) weekly price tracker

-

Geographical Demand and Regional Dynamics of the Cinnabar (Natural Mercury Sulfide Oxide) Market

The Cinnabar (Natural Mercury Sulfide Oxide) Market exhibits diverse demand patterns across regions, influenced by industrial, cultural, and regulatory factors. Geographical differences in cinnabar’s demand are shaped by various factors, including the local adoption of mercury-based products, environmental regulations, and cultural traditions. These regional variations have substantial implications for the overall market dynamics, influencing production strategies, pricing, and the segmentation of cinnabar-based products.

In the Asia Pacific region, cinnabar has long been a staple in both traditional medicine and art. Countries like China, India, and Japan continue to drive the bulk of the demand for cinnabar, primarily in the form of pigments used in traditional crafts, including lacquerware and other decorative items. For example, China, as a key player in the cinnabar market, accounts for a significant share due to its historical association with the pigment, used extensively in its cultural heritage. The Cinnabar (Natural Mercury Sulfide Oxide) Market in this region is expected to see steady growth, particularly as the demand for luxury decorative items in the art and craft sector continues to rise.

Production and Key Manufacturing Regions in the Cinnabar (Natural Mercury Sulfide Oxide) Market

The global production of cinnabar is concentrated in regions with rich mercury sulfide (HgS) deposits, with China being the largest producer by a substantial margin. China dominates the cinnabar production landscape due to its vast natural mercury deposits and long history of cinnabar mining. This has positioned the country as a central supplier to both domestic and international markets. Other countries contributing to cinnabar production include Spain, Mexico, Peru, and Kyrgyzstan, although their production volumes are significantly lower than that of China.

In recent years, cinnabar mining has been subject to stricter environmental regulations, particularly due to mercury’s toxic properties. For example, the Minamata Convention on Mercury, a global treaty aimed at reducing mercury pollution, has had a direct impact on the cinnabar production industry. While these regulations have led to a decline in cinnabar production, especially in developed markets, countries like China and Peru continue to see steady production levels, driven by their existing mining infrastructure. These regions are expected to maintain their positions as leading producers of cinnabar throughout the forecast period, despite growing environmental concerns.

Cinnabar (Natural Mercury Sulfide Oxide) Market Segmentation by Application

The Cinnabar (Natural Mercury Sulfide Oxide) Market is segmented based on various applications, which influence both demand and pricing. One of the most significant applications of cinnabar is in the production of mercury, which is used in various industries, including electronics, lighting, and chemical manufacturing. The demand for cinnabar in these sectors is influenced by global industrialization trends and technological advancements.

In the lighting industry, cinnabar-derived mercury is widely used in fluorescent lights. The global fluorescent lighting market is projected to grow at a CAGR of 4.2% between 2024 and 2032, which will contribute to increased demand for cinnabar as a mercury source. Similarly, cinnabar is used in thermometers, barometers, and electrical switches, where mercury’s unique properties make it irreplaceable in certain applications. Despite the global push towards mercury-free alternatives, cinnabar will continue to play an essential role in these applications in the foreseeable future.

Another key application for cinnabar is in the art and decorative sector. The rich red pigment derived from cinnabar is used in high-end decorative items such as lacquerware, jewelry, and other luxury goods. This segment remains strong, particularly in regions like China and Japan, where cinnabar-based products are highly valued. The demand for these products continues to grow as the global middle class expands, particularly in Asia, where traditional art and cultural items are in high demand.

Cinnabar (Natural Mercury Sulfide Oxide) Price Trends and Market Dynamics

The price of cinnabar has been subject to fluctuations due to multiple factors, including the global regulatory landscape, the supply-demand equilibrium, and environmental concerns surrounding mercury. In recent years, the Cinnabar (Natural Mercury Sulfide Oxide) Price has experienced a downward trend, largely due to tightening environmental regulations and reduced industrial applications of mercury-based products. The price of cinnabar, for example, saw a notable decrease from 2019 to 2023, in response to the global transition towards mercury-free alternatives and the implementation of stricter environmental guidelines such as those set by the Minamata Convention.

However, despite these challenges, the Cinnabar (Natural Mercury Sulfide Oxide) Price Trend is expected to stabilize in the coming years. This is due to the continued demand in niche markets such as art, traditional medicine, and luxury decorative products, which support a steady demand for cinnabar. The growing use of cinnabar-derived mercury in electronics, energy applications, and mining will also contribute to the stabilization of the price.

A key factor that will influence Cinnabar (Natural Mercury Sulfide Oxide) Price trends moving forward is the global shift towards sustainable practices. As industries adopt more eco-friendly alternatives to mercury, the price of cinnabar may become more volatile. The development of mercury-free lighting, electronics, and other industrial applications may dampen demand for cinnabar in the long run, which could result in downward pressure on prices. Conversely, a growing appreciation for traditional materials and the use of cinnabar in cultural practices will likely support stable demand in niche sectors, which could provide price stability for cinnabar.

Impact of Regulatory Measures on Cinnabar (Natural Mercury Sulfide Oxide) Pricing

Regulatory measures play a crucial role in shaping the price and demand for cinnabar in the global market. The rising global awareness of mercury’s toxicity has led to a series of regulations aimed at reducing its use in various applications. In Europe and North America, the regulatory push for mercury-free products has had a significant impact on cinnabar pricing. The Minamata Convention on Mercury, which aims to reduce mercury emissions globally, has made it increasingly difficult to mine cinnabar in a way that complies with environmental standards. This has led to a reduction in cinnabar production, which, in turn, has affected supply and pricing in the market.

However, regions such as Asia Pacific, particularly China, have seen continued production and demand for cinnabar, driven by both industrial applications and cultural significance. In these regions, cinnabar prices have remained relatively stable, with a growing focus on niche applications. This discrepancy between regions highlights the importance of local regulatory environments in determining the overall market dynamics for cinnabar.

Future Outlook for the Cinnabar (Natural Mercury Sulfide Oxide) Market: Price and Production Considerations

Looking ahead, the Cinnabar (Natural Mercury Sulfide Oxide) Market is likely to continue evolving as new applications emerge and environmental regulations become more stringent. The growing trend toward sustainability and the adoption of eco-friendly alternatives may affect cinnabar’s role in various industrial sectors. However, the increasing demand for luxury decorative items, cultural applications, and small-scale gold mining operations will continue to drive the demand for cinnabar, supporting its presence in niche markets.

The price trend for cinnabar will be shaped by these regional and sectoral shifts, with growing demand for cinnabar-derived mercury in electronics and energy applications balancing the decline in demand from traditional mercury-based industries. The Cinnabar (Natural Mercury Sulfide Oxide) Price is expected to remain relatively stable in the coming years, driven by sustained demand in high-value sectors, even as the industry faces challenges from sustainability and regulatory pressures.

As a result, businesses operating in the cinnabar market will need to navigate a complex landscape of regulatory compliance, environmental considerations, and evolving market demands. By leveraging niche opportunities in traditional crafts, luxury goods, and artisanal mining, companies can continue to thrive despite the broader market challenges. The future of the Cinnabar (Natural Mercury Sulfide Oxide) Market will depend on the ability of industry players to adapt to these dynamics while maintaining a focus on sustainability and regulatory compliance.

“Cinnabar (Natural Mercury Sulfide Oxide) Manufacturing Database, Cinnabar (Natural Mercury Sulfide Oxide) Manufacturing Capacity”

-

-

- Cinnabar (Natural Mercury Sulfide Oxide) top manufacturers market share for 23+ manufacturers

- Top 6 manufacturers and top 13 manufacturers of Cinnabar (Natural Mercury Sulfide Oxide) in North America, Europe, Asia Pacific

- Cinnabar (Natural Mercury Sulfide Oxide) production plant capacity by manufacturers and Cinnabar (Natural Mercury Sulfide Oxide) production data for 23+ market players

- Cinnabar (Natural Mercury Sulfide Oxide) production dashboard, Cinnabar (Natural Mercury Sulfide Oxide) production data in excel format

-

“Cinnabar (Natural Mercury Sulfide Oxide) price charts, Cinnabar (Natural Mercury Sulfide Oxide) weekly price tracker and Cinnabar (Natural Mercury Sulfide Oxide) monthly price tracker”

-

-

- Factors impacting real-time Cinnabar (Natural Mercury Sulfide Oxide) prices in 18+ countries worldwide

- Cinnabar (Natural Mercury Sulfide Oxide) monthly price tracker, Cinnabar (Natural Mercury Sulfide Oxide) weekly price tracker

- Real-time Cinnabar (Natural Mercury Sulfide Oxide) price trend, Cinnabar (Natural Mercury Sulfide Oxide) price charts, news and updates

- Tracking Cinnabar (Natural Mercury Sulfide Oxide) price fluctuations

-

Leading Manufacturers in the Cinnabar (Natural Mercury Sulfide Oxide) Market

The Cinnabar (Natural Mercury Sulfide Oxide) Market is dominated by a few key players who specialize in the extraction, processing, and distribution of cinnabar. These manufacturers play a crucial role in the global supply chain, providing cinnabar products to various industries, from chemical manufacturing to decorative arts. The following are some of the prominent manufacturers in the cinnabar market:

- Macsen Laboratories

Macsen Laboratories is a recognized name in the cinnabar market, producing high-purity mercuric sulfide (HgS) for use in industrial applications. Their cinnabar products are widely used in pigment manufacturing, mercury extraction, and electrochemical processes. The company’s focus on maintaining stringent quality standards and its commitment to sustainable practices make it a significant player in the market.

- Baskochem

Baskochem is a leading producer of cinnabar minerals based in Russia. The company supplies mercury sulfide to various markets, particularly in the chemical and pharmaceutical sectors. Baskochem’s cinnabar products are known for their high quality, sourced directly from Russia’s rich cinnabar deposits. Their products serve as a key source of mercury, which is used in various industrial applications.

- Yujiang Chemical (Shandong) Co., Ltd.

Yujiang Chemical, based in Shandong, China, is a major manufacturer of cinnabar, offering a variety of mercury sulfide products for industrial use. The company has established a strong presence in the global market, providing cinnabar products to regions across Asia, Europe, and North America. Their cinnabar products are used in applications ranging from chemical manufacturing to traditional medicine.

Cinnabar (Natural Mercury Sulfide Oxide) Market Share by Manufacturers

The Cinnabar (Natural Mercury Sulfide Oxide) Market is characterized by a few dominant players who have established significant market shares due to their expertise in cinnabar extraction and processing. While specific market share percentages are not publicly available, these manufacturers hold a major portion of the market, particularly in regions with large cinnabar deposits such as China, Russia, and Mexico. Their strategic position is further reinforced by factors such as:

- Geographical Advantage: Proximity to cinnabar-rich regions ensures efficient extraction and cost-effective transportation, giving these manufacturers a competitive edge.

- Product Quality and Consistency: Adherence to rigorous quality control measures allows these companies to deliver reliable and high-quality cinnabar products to industries with specific requirements.

- Regulatory Compliance: Compliance with international standards, including environmental and safety regulations, strengthens their position in the global market.

Recent Developments in the Cinnabar (Natural Mercury Sulfide Oxide) Market

The cinnabar market has witnessed several key developments in recent years, driven by factors such as environmental regulations, demand fluctuations in mercury-based applications, and technological advancements. Some notable developments include:

- Environmental Regulations Impact

In response to the growing awareness of mercury’s toxic properties, global regulations have increasingly targeted the use of mercury, directly influencing the cinnabar market. The implementation of international treaties like the Minamata Convention on Mercury has led to a gradual reduction in cinnabar mining, particularly in countries with stringent environmental laws. Despite this, cinnabar remains a valuable resource for certain niche applications, particularly in traditional industries such as art and luxury goods.

- Technological Advancements in Mercury Use

Advancements in technology have led to the development of mercury-free alternatives in industries such as lighting and electronics, which has decreased the demand for cinnabar in some traditional applications. However, the demand for cinnabar in other sectors, such as chemical manufacturing and pigment production, continues to rise due to its unique properties. These technological shifts have led to a diversification of cinnabar applications, ensuring its continued relevance in modern industries.

- Shift in Demand Patterns

The demand for cinnabar has shifted in recent years as industries move towards sustainability and environmental consciousness. The demand for mercury-free products in the lighting and electronics industries has resulted in a decline in the use of cinnabar in these sectors. However, the growth in niche markets such as high-end decorative items, traditional medicine, and luxury goods has counterbalanced this decline, sustaining a steady demand for cinnabar in certain regions.

- New Market Entrants and Expanding Production

Several new market players have emerged in response to the growing demand for cinnabar in niche markets. These companies are leveraging emerging markets with abundant cinnabar deposits to produce and supply high-quality cinnabar products. With a focus on sustainable practices and innovative applications, these new entrants are positioning themselves to take advantage of growing demand in the decorative arts and chemical industries.

- Ongoing Research and Innovation

The cinnabar market is also seeing innovation in terms of product development and new applications. Research into cinnabar’s properties has led to the discovery of new uses in fields such as energy storage and advanced electronics. As the market evolves, companies are increasingly investing in research to expand cinnabar’s scope of use, particularly in industries that require high-performance materials with specific chemical properties.

“Cinnabar (Natural Mercury Sulfide Oxide) Production Data and Cinnabar (Natural Mercury Sulfide Oxide) Production Trend, Cinnabar (Natural Mercury Sulfide Oxide) Production Database and forecast”

-

-

- Cinnabar (Natural Mercury Sulfide Oxide) production database for historical years, 10 years historical data

- Cinnabar (Natural Mercury Sulfide Oxide) production data and forecast for next 7 years

- Cinnabar (Natural Mercury Sulfide Oxide) sales volume by manufacturers

-

“Track Real-time Cinnabar (Natural Mercury Sulfide Oxide) Prices for purchase and sales contracts, Cinnabar (Natural Mercury Sulfide Oxide) price charts, Cinnabar (Natural Mercury Sulfide Oxide) weekly price tracker and Cinnabar (Natural Mercury Sulfide Oxide) monthly price tracker”

-

-

- Gain control on your purchase and sales contracts through our real-time Cinnabar (Natural Mercury Sulfide Oxide) price tracker and Cinnabar (Natural Mercury Sulfide Oxide) price trend analysis

- Cinnabar (Natural Mercury Sulfide Oxide) weekly price tracker and forecast for next four weeks

- Cinnabar (Natural Mercury Sulfide Oxide) monthly price tracker and forecast for next two months

-

Market Scenario, Demand vs Supply, Average Product Price, Import vs Export, till 2032

- Global Cinnabar (Natural Mercury Sulfide Oxide) Market revenue and demand by region

- Global Cinnabar (Natural Mercury Sulfide Oxide) Market production and sales volume

- United States Cinnabar (Natural Mercury Sulfide Oxide) Market revenue size and demand by country

- Europe Cinnabar (Natural Mercury Sulfide Oxide) Market revenue size and demand by country

- Asia Pacific Cinnabar (Natural Mercury Sulfide Oxide) Market revenue size and demand by country

- Middle East & Africa Cinnabar (Natural Mercury Sulfide Oxide) Market revenue size and demand by country

- Latin America Cinnabar (Natural Mercury Sulfide Oxide) Market revenue size and demand by

- Import-export scenario – United States, Europe, APAC, Latin America, Middle East & Africa

- Average product price – United States, Europe, APAC, Latin America, Middle East & Africa

- Market player analysis, competitive scenario, market share analysis

- Business opportunity analysis

Key questions answered in the Global Cinnabar (Natural Mercury Sulfide Oxide) Market Analysis Report:

- What is the market size for Cinnabar (Natural Mercury Sulfide Oxide) in United States, Europe, APAC, Middle East & Africa, Latin America?

- What is the yearly sales volume of Cinnabar (Natural Mercury Sulfide Oxide) and how is the demand rising?

- Who are the top market players by market share, in each product segment?

- Which is the fastest growing business/ product segment?

- What should be the business strategies and Go to Market strategies?

The report covers Cinnabar (Natural Mercury Sulfide Oxide) Market revenue, Production, Sales volume, by regions, (further split into countries):

- Asia Pacific (China, Japan, South Korea, India, Indonesia, Vietnam, Rest of APAC)

- Europe (UK, Germany, France, Italy, Spain, Benelux, Poland, Rest of Europe)

- North America (United States, Canada, Mexico)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa

Table of Contents:

- Introduction to the Cinnabar (Natural Mercury Sulfide Oxide) Market

- Overview and Chemical Properties of Cinnabar (Natural Mercury Sulfide Oxide)

- Industrial Applications and Economic Significance

- Market Trends and Growth Potential

- Cinnabar (Natural Mercury Sulfide Oxide) Market Segmentation and Classification

- Categorization by Purity Level and Mineral Composition

- Market Breakdown by Industrial and Commercial Applications

- End-Use Sector Demand and Market Distribution

- Global Cinnabar (Natural Mercury Sulfide Oxide) Market Size and Forecast (2019-2032)

- Market Valuation and Revenue Trends

- Demand-Supply Analysis in the Cinnabar (Natural Mercury Sulfide Oxide) Market

- Investment and Expansion Opportunities

- Regional Analysis of the Cinnabar (Natural Mercury Sulfide Oxide) Market

4.1 North America

- Cinnabar (Natural Mercury Sulfide Oxide) Market Demand and Key Industrial Uses

- Cinnabar (Natural Mercury Sulfide Oxide) Production vs Imports

- Regulatory Policies and Environmental Considerations

4.2 Europe

- Key Market Players and Competitive Landscape

- Trade Regulations and Economic Influence on Market Growth

- Technological Developments in Cinnabar (Natural Mercury Sulfide Oxide) Processing

4.3 Asia-Pacific

- Leading Cinnabar (Natural Mercury Sulfide Oxide) Production Regions

- Export Market Trends and Industrial Applications

- Trade and Supply Chain Developments

4.4 Latin America

- Cinnabar (Natural Mercury Sulfide Oxide) Production Trends and Domestic Consumption

- Market Expansion Strategies and Business Development Opportunities

- Trade and Market Penetration Analysis

4.5 Middle East & Africa

- Market Growth Potential and Strategic Developments

- Cinnabar (Natural Mercury Sulfide Oxide) Trade Flow and Policy Regulations

- Future Market Outlook and Industrial Forecast

- Cinnabar (Natural Mercury Sulfide Oxide) Production Trends and Technological Innovations (2019-2032)

- Advances in Cinnabar (Natural Mercury Sulfide Oxide) Extraction and Processing

- Industrial Applications and Refining Techniques

- Sustainability and Cost-Efficient Production Strategies

- Competitive Landscape in the Cinnabar (Natural Mercury Sulfide Oxide) Market

- Leading Cinnabar (Natural Mercury Sulfide Oxide) Producers and Market Share Analysis

- Competitive Strategies and Industry Positioning

- Research & Development in Cinnabar (Natural Mercury Sulfide Oxide) Production

- Market Revenue, Pricing Trends, and Economic Analysis (2019-2024)

- Cinnabar (Natural Mercury Sulfide Oxide) Market Revenue by Region and Industry Sector

- Pricing Volatility and Cost-Impacting Factors

- Future Pricing Forecast and Market Stability

- Global Trade, Logistics, and Supply Chain Analysis

- Cinnabar (Natural Mercury Sulfide Oxide) Production vs Export Market Trends

- Import-Export Market Analysis and Trade Challenges

- Supply Chain Optimization and Logistics Efficiency

- Demand and Consumption Analysis in the Cinnabar (Natural Mercury Sulfide Oxide) Market

- Market Demand by Industry and Application

- Regional Consumption Trends and Growth Forecasts

- Future Market Expansion and Emerging Opportunities

- Cinnabar (Natural Mercury Sulfide Oxide) Production Costs and Raw Material Sourcing

- Cost Breakdown in Cinnabar (Natural Mercury Sulfide Oxide) Manufacturing

- Raw Material Availability and Market Constraints

- Cost Optimization and Efficiency in Production

- Industrial Supply Chain and Market Ecosystem

- Procurement, Processing, and Distribution Networks

- Downstream Industry Influence and Key Application Sectors

- Innovations Driving Market Growth and Industrial Advancements

- Sales, Distribution, and Marketing Strategies in the Cinnabar (Natural Mercury Sulfide Oxide) Market

- Global Market Distribution Channels and Expansion Plans

- Key Distributors and Industry Sales Approaches

- End-User Engagement and Market Penetration Strategies

- Future Market Trends and Investment Opportunities

- Cinnabar (Natural Mercury Sulfide Oxide) Market Growth Forecast and Emerging Technologies

- Business Expansion and Strategic Market Developments

- Investment Potential and Industry Development Forecast

“Every Organization is different and so are their requirements”- Datavagyanik

Companies We Work With

Do You Want To Boost Your Business?

drop us a line and keep in touch