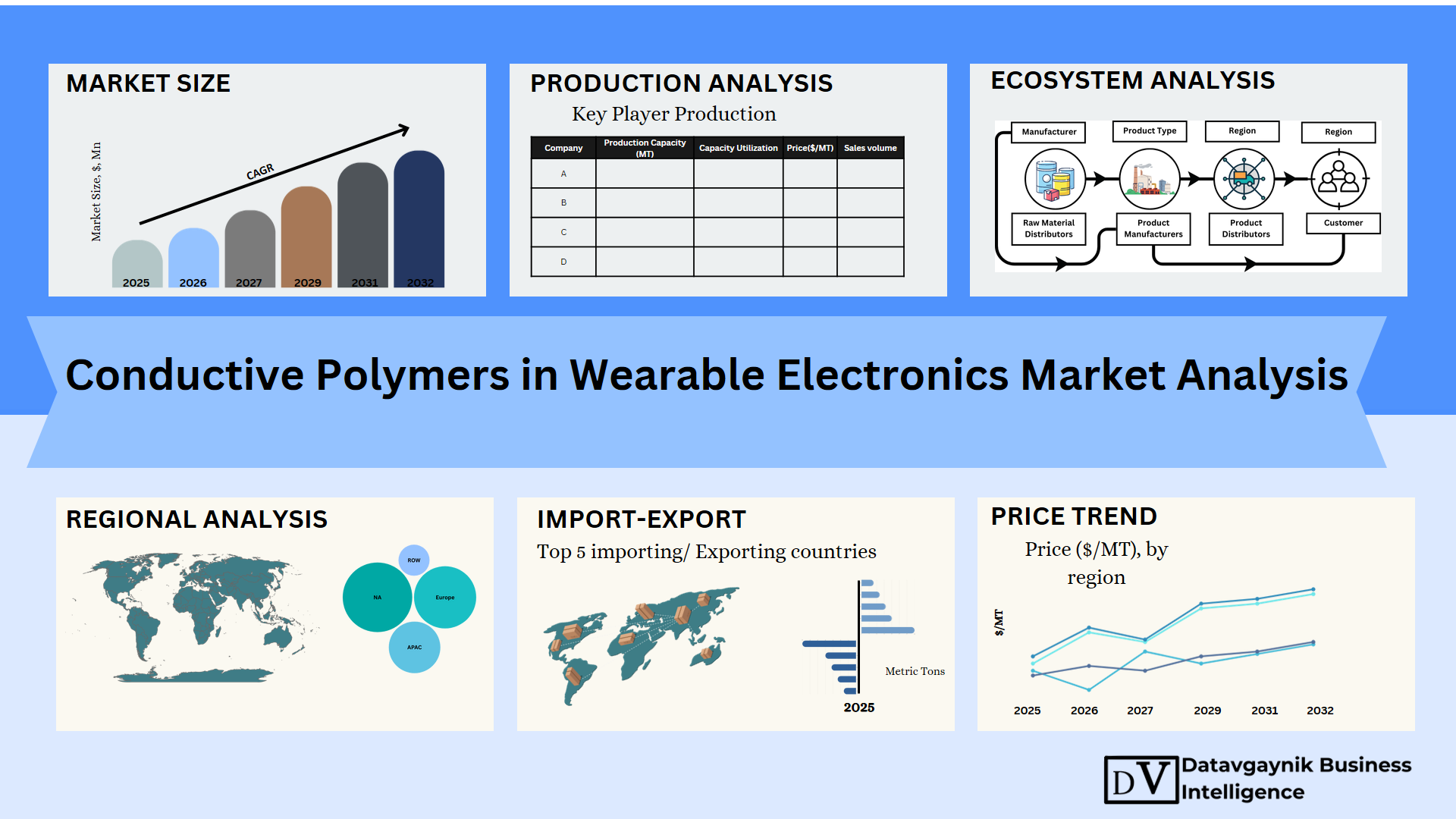

Conductive Polymers in Wearable Electronics Market Size, Production, Sales, Average Product Price, Market Share, Import vs Export

- Published 2025

- No of Pages: 120+

- 20% Customization available

Surging Momentum in the Conductive Polymers in Wearable Electronics Market

The Conductive Polymers in Wearable Electronics Market is entering a high-growth phase, propelled by the rapid evolution of wearable technology and increasing integration of smart systems into daily life. Datavagyanik identifies a strong correlation between the rising consumer demand for health monitoring, fitness tracking, and personalized electronics and the growth of conductive polymer applications. The Conductive Polymers in Wearable Electronics Market Size stood at approximately USD 5.6 billion in 2024 and is projected to double by the end of this decade, marking an inflection point driven by innovation and material performance.

Key enablers include the miniaturization of electronic components, advancements in flexible substrates, and the convergence of electronics with textiles. The need for lightweight, bendable, and skin-compatible materials is no longer optional—it is a foundational requirement. As such, conductive polymers are rapidly replacing traditional rigid conductive materials, particularly in applications where comfort, biocompatibility, and mechanical resilience are essential.

Miniaturization and Device Portability Fueling Conductive Polymers in Wearable Electronics Market

One of the most significant trends catalyzing the Conductive Polymers in Wearable Electronics Market is the relentless push toward smaller, lighter, and more ergonomic devices. Fitness bands, health monitoring patches, augmented reality headsets, and smart glasses are being designed with increasingly compact form factors. In this context, traditional metallic conductors pose limitations due to weight, rigidity, and susceptibility to corrosion.

Conductive polymers, such as polyaniline (PANI), polypyrrole (PPy), and PEDOT:PSS, offer superior flexibility and conductivity in ultra-thin layers, making them ideal for wearable device circuits. For instance, the global market for miniaturized biosensors integrated into wearables is expected to grow at a CAGR of 14.2% through 2028. This expansion directly correlates with higher consumption of conductive polymers, especially in components such as printed electrodes, stretchable circuits, and skin-interfacing sensors.

Datavagyanik also covers related markets such as the Conductive Polymers for Flexible Electronics Market, the Conductive Wax for Electronics Market, and the Liquid Crystal Polymers for Electronics Market. Their relevance lies in how they intersect with the core topic, influencing investment trends and shaping market opportunities.

Healthcare Revolution Accelerating Conductive Polymers in Wearable Electronics Market

The adoption of wearable electronics in the medical sector is one of the most powerful forces shaping the Conductive Polymers in Wearable Electronics Market. Devices such as ECG monitors, glucose monitoring patches, and wearable thermometers are not only in high demand among consumers but are increasingly being integrated into remote patient monitoring systems by healthcare providers. For instance, the remote patient monitoring market reached USD 53 billion in 2023, with wearables accounting for over 45% of the deployed devices.

Conductive polymers are critical in this scenario due to their biocompatibility, softness, and electrical conductivity. Materials like PEDOT:PSS are widely used in electrocardiographic sensors, enabling continuous and real-time signal acquisition without skin irritation. The growing aging population across North America, Europe, and East Asia, coupled with rising incidences of chronic conditions, is projected to triple the demand for skin-adhering medical wearables by 2030. This dynamic is directly translating into increased demand within the Conductive Polymers in Wearable Electronics Market.

Smart Textiles Expanding Application Frontiers in the Conductive Polymers in Wearable Electronics Market

The emergence of smart textiles represents a major frontier in the Conductive Polymers in Wearable Electronics Market. These textiles, embedded with electronic functionality, offer opportunities to create garments that monitor physiological parameters, adjust to environmental changes, or provide communication and location-tracking capabilities. Datavagyanik notes that the global smart textile segment for health and fitness applications grew at 19.3% CAGR from 2020 to 2024, and conductive polymers form the backbone of these textile-integrated circuits.

For instance, poly(3-hexylthiophene) and carbon-filled composites are increasingly used to create electrically conductive threads and inks, enabling washable, durable, and breathable electronic fabrics. Military uniforms with embedded communication systems, sportswear with temperature sensors, and yoga clothing with posture correction modules are just a few examples of market-ready products leveraging conductive polymer technology. As textile-electronics convergence advances, conductive polymers will play an indispensable role in scale-up and mass adoption.

Energy Storage Integration Boosting Conductive Polymers in Wearable Electronics Market

Wearable electronics increasingly require integrated energy storage solutions that are flexible, safe, and lightweight. Traditional lithium-ion battery technologies fall short when used in ultra-thin, flexible, or body-conforming devices due to risks of overheating and mechanical failure. Conductive polymers provide a critical advantage in this space through their application in supercapacitors, solid-state batteries, and energy-harvesting systems.

Conductive polymer composites with carbon nanotubes or graphene are being used to develop flexible energy storage units embedded directly into clothing or wristbands. For example, research from leading institutions in Japan and South Korea has shown that polymer-based wearable batteries can be charged in under 20 minutes and retain 90% capacity after 1000 bending cycles. The integration of energy systems using conductive polymers not only improves safety and flexibility but also eliminates the need for bulky battery compartments, enhancing design versatility across wearables.

Internet of Things (IoT) Synergy Accelerating Conductive Polymers in Wearable Electronics Market

The proliferation of IoT-based wearable devices is creating exponential demand for real-time data acquisition, transmission, and interpretation. In this connected ecosystem, the Conductive Polymers in Wearable Electronics Market is playing a pivotal role. Smartwatches, AR glasses, e-skins, and connected health devices rely heavily on stretchable conductors and antennas fabricated from conductive polymers for uninterrupted communication.

Datavagyanik reports that by 2026, over 1.4 billion wearable IoT devices will be in active use globally, up from 850 million in 2023. Conductive polymers enable seamless integration of wireless connectivity modules, flexible circuitry, and low-power components essential for efficient data exchange. Additionally, their low weight and mechanical compliance enhance user comfort, an increasingly important parameter as wearables move from novelty items to everyday essentials.

Sustainability Imperatives Strengthening Conductive Polymers in Wearable Electronics Market

With sustainability becoming a critical metric in consumer electronics manufacturing, the Conductive Polymers in Wearable Electronics Market is benefiting from its inherently eco-friendlier profile compared to traditional conductive materials like copper and silver. Conductive polymers are synthetically produced using processes that can be optimized for low energy consumption and reduced emissions.

For example, polythiophene and polyaniline can be synthesized using green solvents, and end-of-life recycling processes for conductive polymer-based wearables are easier to implement than for metal-based devices. The push toward biodegradable electronics, particularly in healthcare and fashion applications, is creating strong demand for organic conductive materials. With the European Union and North American markets setting regulatory benchmarks for sustainable electronics, manufacturers are increasingly shifting toward conductive polymers as part of their compliance strategy.

Rising R&D Investments Reshaping the Conductive Polymers in Wearable Electronics Market

Intensive research and development efforts are driving significant enhancements in the electrical, mechanical, and chemical properties of conductive polymers. Over the last three years, over 1400 patents related to wearable conductive polymers have been filed globally, indicating a robust innovation pipeline. Key breakthroughs include improved conductivity via nanostructuring, self-healing polymer matrices, and ultra-thin coatings suitable for stretchable circuits.

Such innovations are enabling the development of multifunctional wearables—devices that not only monitor vitals but also respond with micro-stimulation, haptic feedback, or drug delivery. For instance, projects in the US and Europe are working on epidermal electronics with polymer-based sensors that can release pain relief or insulin based on biosignal triggers. These capabilities would not be feasible without highly adaptable conductive polymer platforms.

Geographic Shifts Influencing the Conductive Polymers in Wearable Electronics Market Size

Regionally, Asia Pacific continues to dominate the Conductive Polymers in Wearable Electronics Market, accounting for over 45% of global production, largely due to cost-effective manufacturing in China, Japan, and South Korea. However, North America is leading in high-performance polymer innovation, particularly for medical-grade wearables. Europe, meanwhile, is emerging as a hub for sustainable polymer development, with Germany, France, and the Netherlands at the forefront.

The Conductive Polymers in Wearable Electronics Market Size in India is expected to grow significantly, supported by government initiatives to expand domestic electronics manufacturing and increased public investment in health-tech startups. Latin America and the Middle East are also witnessing gradual adoption, primarily through imported wearables integrated with conductive polymer technology.

“Track Country-wise Conductive Polymers in Wearable Electronics Production and Demand through our Conductive Polymers in Wearable Electronics Production Database”

-

- Conductive Polymers in Wearable Electronics production database for 28+ countries worldwide

- Conductive Polymers in Wearable Electronics Powder sales volume for 32+ countries

- Country-wise Conductive Polymers in Wearable Electronics production capacity and production plant mapping, production capacity utilization for 28+ manufacturers

- Conductive Polymers in Wearable Electronics production plants and production plant capacity analysis for top manufacturers

Geographical Demand for Conductive Polymers in Wearable Electronics Market

The Conductive Polymers in Wearable Electronics Market has witnessed distinct regional patterns of demand that are shaped by technological infrastructure, consumer adoption rates, and industry-specific applications. North America and Europe are at the forefront of demand, particularly driven by advancements in healthcare and medical devices, while Asia Pacific is swiftly becoming a hub for large-scale production.

In North America, the demand for conductive polymers is primarily fueled by the increasing adoption of medical-grade wearables. Devices like glucose monitors, ECG sensors, and wearable thermometers are growing in popularity, especially within the aging population. The Conductive Polymers in Wearable Electronics Market Size in North America is expected to surpass USD 3 billion by 2027, a testament to the rising demand for continuous health monitoring and personalized healthcare solutions. Additionally, the shift towards sustainable and flexible electronics is gaining significant traction, particularly in smart textiles, fitness trackers, and remote patient monitoring solutions.

Europe, led by countries like Germany, France, and the UK, has been driving demand through its emphasis on sustainable manufacturing and high-performance materials in smart textiles and industrial applications. The demand for conductive polymers in wearables is witnessing robust growth, particularly in healthcare, fitness, and defense applications. European consumers are highly inclined toward eco-friendly materials, making conductive polymers the preferred choice for wearable electronics. In fact, the demand for these materials is set to grow by over 18% annually in the next five years, as more wearable products, from healthcare sensors to energy-harvesting textiles, enter the market.

Asia Pacific’s Growing Role in Conductive Polymers in Wearable Electronics Market

Asia Pacific is quickly emerging as a powerhouse for both the production and consumption of conductive polymers in wearable electronics. Countries such as China, Japan, and South Korea dominate the production landscape due to their massive electronics manufacturing base, high consumer adoption of wearable devices, and ongoing technological advancements. In China, for example, the demand for conductive polymers is largely driven by the booming market for low-cost fitness trackers, smartwatches, and healthcare wearables, alongside the government’s push for innovation in smart textiles.

China alone is expected to account for over 50% of the Conductive Polymers in Wearable Electronics Market in the Asia Pacific by 2028. This surge is propelled by the rapid scale-up of production facilities, low manufacturing costs, and continuous investments in material science. Additionally, Japanese companies are leading in the development of high-precision conductive polymers, which are widely used in advanced wearable devices like medical sensors, industrial tools, and flexible display screens.

In South Korea, the convergence of 5G technologies and wearable electronics has generated substantial demand for conductive polymers in IoT-enabled devices, including health monitors and augmented reality glasses. The South Korean wearable electronics market is projected to see a CAGR of over 16% over the next five years, with conductive polymers integral to the development of next-generation wearable solutions.

Conductive Polymers in Wearable Electronics Market Segmentation

The Conductive Polymers in Wearable Electronics Market can be divided into various segments based on polymer type, application, and end-user industries, each of which shows distinct growth patterns. Understanding these segments allows stakeholders to assess which areas are expanding rapidly and where the biggest opportunities lie.

By Type of Polymer

The primary types of conductive polymers used in wearable electronics are intrinsically conductive polymers (ICPs), conductive polymer composites, and other specialty polymers. ICPs, such as polyaniline (PANI), polypyrrole (PPy), and polythiophene (PTh), are expected to dominate the market due to their inherent conductivity and flexibility. These polymers are crucial in applications requiring lightweight, biocompatible, and flexible materials, including in healthcare and fitness tracking devices.

Conductive polymer composites, which combine non-conductive polymers like PVDF (Polyvinylidene fluoride) with conductive fillers such as carbon nanotubes, graphene, or metal particles, have seen a surge in demand due to their enhanced mechanical properties. This segment is especially favored for flexible circuits and wearable health monitoring systems. Market share in this segment is anticipated to grow by 10% year on year, driven by applications in medical wearables and industrial wearables.

By Application

The applications of conductive polymers in wearable electronics are diverse, including health and medical monitoring, fitness tracking, smart textiles, AR/VR, and energy storage. Among these, healthcare monitoring devices represent the largest market share due to the increasing adoption of biosensors and medical wearables. Conductive polymers are indispensable in the development of devices such as heart rate monitors, glucose sensors, and ECG sensors, as they offer the flexibility, conductivity, and durability required for skin-contact sensors. The demand for medical wearables is expected to rise by 20% annually, further fueling the use of conductive polymers.

Smart textiles are another rapidly growing segment, with conductive polymers used to create garments that can track vitals, regulate temperature, or even harvest energy. The integration of conductive polymers into textiles is opening new doors for wearable technology, particularly in sports, fashion, and defense applications. The smart textile market is forecast to grow at a CAGR of 22%, driving the adoption of conductive polymers.

By End-User Industry

The end-user industries driving the demand for conductive polymers in wearable electronics include healthcare, consumer electronics, sports and fitness, military and defense, and industrial applications. Of these, healthcare continues to be the dominant sector, as wearable medical devices become integral to personalized care. The increasing demand for chronic disease management and remote health monitoring is expected to expand the market for conductive polymers significantly.

The consumer electronics sector is also a significant contributor, particularly with the explosion of fitness bands, smartwatches, and connected devices. The increasing penetration of IoT-based wearables is expected to push the demand for conductive polymers in this segment, especially for components such as stretchable sensors, antennas, and power storage systems.

Conductive Polymers in Wearable Electronics Price Trend

Over the last few years, the Conductive Polymers in Wearable Electronics Price Trend has been on a downward trajectory due to innovations in production technologies and economies of scale. Mass production in Asia Pacific, particularly in China and South Korea, has led to cost reductions, making conductive polymers more affordable for manufacturers. This price reduction is vital in the drive for market expansion, particularly in the consumer electronics and fitness sectors, where price sensitivity is a key factor.

However, for high-performance conductive polymers, such as those used in medical wearables and military applications, prices remain relatively higher. These polymers offer superior properties like increased biocompatibility, durability, and chemical stability. As demand for high-quality, high-value wearables grows, the price trend for these specialized polymers is expected to stabilize, though they will remain premium products.

The fluctuation in the prices of raw materials, particularly graphene and carbon nanotubes used in composites, has also impacted the Conductive Polymers in Wearable Electronics Price. Price volatility in these key ingredients is expected to continue, though advances in recycling technologies and sustainable sourcing are helping to stabilize prices over time.

Market Dynamics Influencing Conductive Polymers in Wearable Electronics Price

Several factors are shaping the Conductive Polymers in Wearable Electronics Price Trend in the market. The expansion of R&D efforts is one of the key drivers, as companies continue to improve the conductivity, durability, and flexibility of conductive polymers. With growing investments in nanotechnology and material science, the efficiency of production processes is expected to improve, further driving down costs and making conductive polymers more accessible for a wider range of applications.

Sustainability efforts are another significant factor influencing prices. Consumers and manufacturers alike are increasingly prioritizing eco-friendly materials, driving demand for biocompatible, recyclable, and biodegradable conductive polymers. As these materials become more widely adopted, economies of scale will reduce their costs, positively impacting the price trend.

Finally, competitive dynamics between manufacturers will continue to play a role in determining prices. As new players enter the market and existing players optimize production capabilities, prices are expected to fluctuate in the short term. However, long-term trends indicate a steady reduction in prices across most polymer types due to technological improvements and larger-scale production.

“Conductive Polymers in Wearable Electronics Manufacturing Database, Conductive Polymers in Wearable Electronics Manufacturing Capacity”

-

-

- Conductive Polymers in Wearable Electronics top manufacturers market share for 28+ manufacturers

- Top 8 manufacturers and top 18 manufacturers of Conductive Polymers in Wearable Electronics in North America, Europe, Asia Pacific

- Production plant capacity by manufacturers and Conductive Polymers in Wearable Electronics production data for 28+ market players

- Conductive Polymers in Wearable Electronics production dashboard, Conductive Polymers in Wearable Electronics production data in excel format

-

Top Manufacturers in the Conductive Polymers in Wearable Electronics Market

The Conductive Polymers in Wearable Electronics Market has a wide array of players contributing to its growth. These manufacturers range from established chemical giants to emerging companies that specialize in advanced material science. These players are driving innovations in conductive polymer technologies, which are crucial for the next generation of wearables. The competitive landscape is shaped by their ability to provide high-quality, flexible, and sustainable conductive polymers, which can be incorporated into a wide range of wearable devices, from healthcare monitors to smart textiles.

- BASF SE

BASF SE, a global leader in the chemical industry, holds a significant share in the Conductive Polymers in Wearable Electronics Market. The company’s focus on innovation and sustainability has positioned it as a key player in this space. BASF’s conductive polymers are widely used in wearable medical devices, smart textiles, and consumer electronics. Their product line includes Elastomix, a polymer solution for flexible, conductive films, and PPSU (polyphenylsulfone) polymers, which are known for their excellent mechanical properties and high conductivity. BASF’s R&D efforts are focused on developing polymers with enhanced biocompatibility, durability, and low environmental impact, which make their offerings highly attractive for use in wearable healthcare devices.

- Heraeus Group

Heraeus, a multinational company specializing in precious metals and advanced materials, is another key player in the Conductive Polymers in Wearable Electronics Market. They manufacture high-performance conductive polymer solutions that are primarily used in wearables such as smart sensors, health-monitoring devices, and flexible electronics. Their Clevios product line, which includes Clevios P conductive polymers, is a prominent offering in the market. These polymers are known for their excellent electrical conductivity and optical transparency, making them ideal for use in touch sensors, electronic inks, and flexible display applications. Heraeus’ focus on research and development of printable conductive polymers is positioning it well to capitalize on the growing demand for wearable devices with flexible, high-performance materials.

- Dow Chemical Company

Dow Chemical is a global leader in advanced materials and specialty chemicals, with a strong presence in the Conductive Polymers in Wearable Electronics Market. Dow’s PRIMENE product line, which includes conductive polymer solutions, is widely used in wearable electronics for its versatility and superior electrical properties. Dow’s conductive polymers are used in a range of applications, from flexible circuits and smart textiles to energy storage systems in wearable devices. The company has been focusing on sustainability and low-energy manufacturing methods to support eco-friendly production, which is becoming increasingly important in the consumer electronics industry.

- Solvay S.A.

Solvay, a multinational chemical company, plays a significant role in the production of conductive polymers for wearable electronics. Their Thixene and Adept product lines are used extensively in the electronics and medical sectors. Thixene, a family of conductive resins, offers high conductivity and flexibility, which makes it suitable for use in wearable medical sensors and other flexible electronics applications. Solvay’s expertise in developing polymers that combine both electrical conductivity and mechanical strength has enabled them to carve a strong niche in the wearable healthcare sector, where durability and flexibility are paramount.

- 3M Company

3M, known for its wide range of innovative products, is also a major player in the Conductive Polymers in Wearable Electronics Market. The company’s 3M™ Conductive Inks and 3M™ Flexible Electronics product lines provide excellent solutions for wearable electronics, offering conductive properties ideal for sensors, touch interfaces, and flexible circuits. 3M’s innovations in ink-based conductive polymers have allowed for large-scale applications in smart textiles and consumer electronics. Their ability to develop inks that are compatible with printing technologies also positions them as a leader in flexible and printed electronics for wearables.

Conductive Polymers in Wearable Electronics Market Share by Manufacturers

The Conductive Polymers in Wearable Electronics Market has a competitive landscape with several key players occupying significant market share. BASF, Heraeus, and Dow Chemical are leading the market, with a combined share of over 45% in 2024, according to Datavagyanik’s analysis. These companies have a stronghold in both the North American and European markets, particularly in the medical and healthcare sectors. Their market share is largely driven by their ongoing innovation in conductive polymers that cater to specific, high-demand applications such as biosensors, wearable sensors, and flexible circuits.

In Asia Pacific, particularly in China, Japan, and South Korea, manufacturers like LG Chem and Samsung Advanced Institute of Technology are also contributing heavily to the market. These companies have been developing specialized conductive polymer composites used in the manufacture of wearables like smartwatches, fitness trackers, and augmented reality glasses. These companies are gaining market share due to their deep integration with consumer electronics giants and their ability to mass-produce flexible, high-performance polymers at competitive prices.

Market Share of Manufacturers in Key Product Categories

- Healthcare Applications: Companies like Heraeus, Solvay, and BASF lead in the healthcare wearables market, with their conductive polymers being used in continuous health monitoring devices, including heart rate monitors and glucose trackers. The increasing demand for health-tech wearables has contributed to these companies holding a dominant share in this sub-segment.

- Smart Textiles: BASF and Dow Chemical lead in the smart textile segment, providing innovative conductive polymers for integration into fabrics. These polymers enable temperature regulation, health monitoring, and other functions, helping these companies dominate a rapidly growing market that is expected to expand by more than 20% in the next five years.

- Consumer Electronics: 3M and LG Chem have captured a substantial share in the consumer electronics sector, thanks to their advanced conductive inks and polymers that enable the production of stretchable, flexible electronics. Their presence in high-volume, low-cost wearables such as smartwatches and fitness trackers solidifies their position in this category.

Recent Developments in the Conductive Polymers in Wearable Electronics Market

- In July 2024, BASF announced the launch of a new line of eco-friendly conductive polymers for wearable electronics. These polymers, developed under their Elastomix line, aim to provide enhanced performance while reducing environmental impact. The new product line has been well-received by the market, particularly in Europe and North America, where there is increasing demand for sustainable wearable technology.

- August 2024 saw Heraeus Group sign a partnership agreement with several leading healthcare providers in Europe to supply their Clevios conductive polymers for next-generation wearable medical devices. This partnership highlights the company’s focus on expanding its presence in the healthcare sector and improving the accuracy and functionality of wearable biosensors.

- November 2023, 3M unveiled its new 3M™ Conductive Film Technology for wearable electronics, offering a breakthrough in the production of lightweight and flexible wearable circuits. This technology promises to reduce manufacturing costs by up to 18%, enabling mass production of low-cost smart textiles and wearables.

- In April 2024, Dow Chemical released a major update to its PRIMENE polymer line, introducing a more flexible, high-conductivity polymer tailored for smart fabrics and health-monitoring wearables. The update is expected to boost their market share in both the medical and sportswear sectors, with a projected growth rate of 15% over the next three years.

- June 2024 marked a significant expansion for Solvay S.A. when they opened a new facility in South Korea dedicated to the production of their advanced conductive polymers for wearables. The new plant is expected to increase Solvay’s market penetration in the Asia Pacific region by 25% within two years, particularly in smart textile applications.

“Conductive Polymers in Wearable Electronics Production Data and Conductive Polymers in Wearable Electronics Production Trend, Conductive Polymers in Wearable Electronics Production Database and forecast”

-

-

- Conductive Polymers in Wearable Electronics production database for historical years, 10 years historical data

- Conductive Polymers in Wearable Electronics production data and forecast for next 7 years

-

Market Scenario, Demand vs Supply, Average Product Price, Import vs Export, till 2035

- Global Conductive Polymers in Wearable Electronics Market revenue and demand by region

- Global Conductive Polymers in Wearable Electronics Market production and sales volume

- United States Conductive Polymers in Wearable Electronics Market revenue size and demand by country

- Europe Conductive Polymers in Wearable Electronics Market revenue size and demand by country

- Asia Pacific Conductive Polymers in Wearable Electronics Market revenue size and demand by country

- Middle East & Africa Conductive Polymers in Wearable Electronics Market revenue size and demand by country

- Latin America Conductive Polymers in Wearable Electronics Market revenue size and demand by

- Import-export scenario – United States, Europe, APAC, Latin America, Middle East & Africa

- Average product price – United States, Europe, APAC, Latin America, Middle East & Africa

- Market player analysis, competitive scenario, market share analysis

- Business opportunity analysis

Key questions answered in the Global Conductive Polymers in Wearable Electronics Market Analysis Report:

- What is the market size for Conductive Polymers in Wearable Electronics in United States, Europe, APAC, Middle East & Africa, Latin America?

- What is the yearly sales volume of Conductive Polymers in Wearable Electronics and how is the demand rising?

- Who are the top market players by market share, in each product segment?

- Which is the fastest growing business/ product segment?

- What should be the business strategies and Go to Market strategies?

The report covers Conductive Polymers in Wearable Electronics Market revenue, Production, Sales volume, by regions, (further split into countries):

- Asia Pacific (China, Japan, South Korea, India, Indonesia, Vietnam, Rest of APAC)

- Europe (UK, Germany, France, Italy, Spain, Benelux, Poland, Rest of Europe)

- North America (United States, Canada, Mexico)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa

Table of Contents:

Conductive Polymers in Wearable Electronics Market

- Introduction to Conductive Polymers

-

- Overview of Conductive Polymers

- Unique Properties and Role in Wearable Electronics

- Advancements in Wearable Electronics

-

- Trends in Wearable Device Technology

- Increasing Demand for Flexible and Lightweight Materials

- Properties of Conductive Polymers for Wearable Applications

-

- Electrical Conductivity and Flexibility

- Biocompatibility and Thermal Stability

- Integration with Smart Textiles

- Types of Conductive Polymers

-

- Polyaniline (PANI)

- Polypyrrole (PPy)

- Poly(3,4-ethylenedioxythiophene) (PEDOT)

- Emerging Conductive Polymer Blends

- Global Market Overview (2020–2035)

-

- Market Dynamics: Drivers, Challenges, and Opportunities

- Impact of Miniaturization and Smart Technologies

- Applications of Conductive Polymers in Wearable Electronics

-

- Fitness Trackers and Health Monitors

- Smart Textiles and E-Textiles

- Flexible Displays and Sensors

- Power Storage and Energy Harvesting Devices

- Regional Market Analysis: North America

-

- Growth of the Wearables Industry in the U.S. and Canada

- Adoption of Conductive Polymers in Consumer Electronics

- Regional Market Analysis: Europe

-

- Trends in Smart Healthcare Wearables

- Impact of Sustainability Goals on Material Choices

- Regional Market Analysis: Asia-Pacific

-

- Dominance of Manufacturing Hubs in Wearable Devices

- Investments in Conductive Polymer Production

- Regional Market Analysis: Latin America

- Opportunities in Emerging Economies

- Growth of Fitness and Health-Conscious Consumer Base

- Regional Market Analysis: Middle East & Africa

- Adoption of Wearable Electronics in Remote Healthcare

- Challenges in Regional Manufacturing and Distribution

- Manufacturing Processes for Conductive Polymers

- Synthesis and Processing Techniques

- Innovations in Polymerization and Coating

- Integration of Conductive Polymers in Wearable Devices

- Challenges in Material Compatibility

- Advances in Flexible Circuitry

- Supply Chain Analysis

- Raw Material Sourcing for Conductive Polymers

- Global Supply and Logistics Trends

- Cost Analysis and Market Feasibility

- Cost Breakdown of Conductive Polymers for Wearables

- Pricing Trends and Economic Viability

- Sustainability and Environmental Impact

- Development of Eco-Friendly Conductive Polymers

- Recycling and End-of-Life Solutions for Wearable Devices

- Competitive Landscape and Key Players

- Profiles of Leading Manufacturers and Suppliers

- Strategies for Market Penetration

- Role of Conductive Polymers in Healthcare Wearables

- Monitoring Vital Signs and Chronic Conditions

- Applications in Remote Patient Care

- Conductive Polymers in Smart Clothing and Textiles

- Innovations in Textile Electronics

- Role in Fashion and Sportswear Industries

- Emerging Technologies in Conductive Polymers

- Nano-Enhanced Conductive Polymers

- Role of Additive Manufacturing in Polymer Integration

- Market Regulations and Standards

- Compliance Requirements for Wearable Electronics

- Regional and International Standards

- Global Trade Dynamics

- Import-Export Analysis of Conductive Polymers

- Key Exporting and Importing Regions

- Price Trends and Market Forecast (2020–2035)

- Historical Price Trends of Conductive Polymers

- Factors Influencing Future Pricing

- Technological Challenges in Conductive Polymers

- Durability and Long-Term Performance in Wearables

- Overcoming Barriers to Mass Production

- Consumer Insights and Market Preferences

- Trends in Wearable Electronics Adoption

- Consumer Expectations for Durability and Comfort

- Opportunities in Emerging Applications

- Energy Harvesting and Storage in Wearables

- Role in Next-Generation Healthcare Devices

- Impact of AI and IoT on Conductive Polymers in Wearables

- Enhancing Connectivity and Data Processing

- Role in Real-Time Monitoring and Feedback Systems

- Investment and R&D in Conductive Polymer Technology

- Funding for Innovations in Wearables

- Public-Private Partnerships in Material Development

- Future Trends in Wearable Electronics

- Growth in Personalized and Adaptive Wearables

- Advances in Self-Healing and Self-Powered Materials

- Global Production and Consumption Forecast (2025–2035)

- Regional Trends in Manufacturing and Consumption

- Projections for Key Applications

- Case Studies in Conductive Polymer Integration

- Success Stories in Fitness Trackers and Smart Textiles

- Insights from Healthcare and Industrial Wearables

- Risk Factors and Mitigation Strategies

- Material Degradation and Environmental Factors

- Addressing Supply Chain Disruptions

- Marketing and Distribution Strategies

- Approaches to Promoting Conductive Polymer-Based Wearables

- Role of Partnerships with Consumer Electronics Brands

- Conclusion and Strategic Recommendations

- Key Insights from the Market Analysis

- Recommendations for Stakeholders and Manufacturers

“Every Organization is different and so are their requirements”- Datavagyanik

Companies We Work With

Do You Want To Boost Your Business?

drop us a line and keep in touch