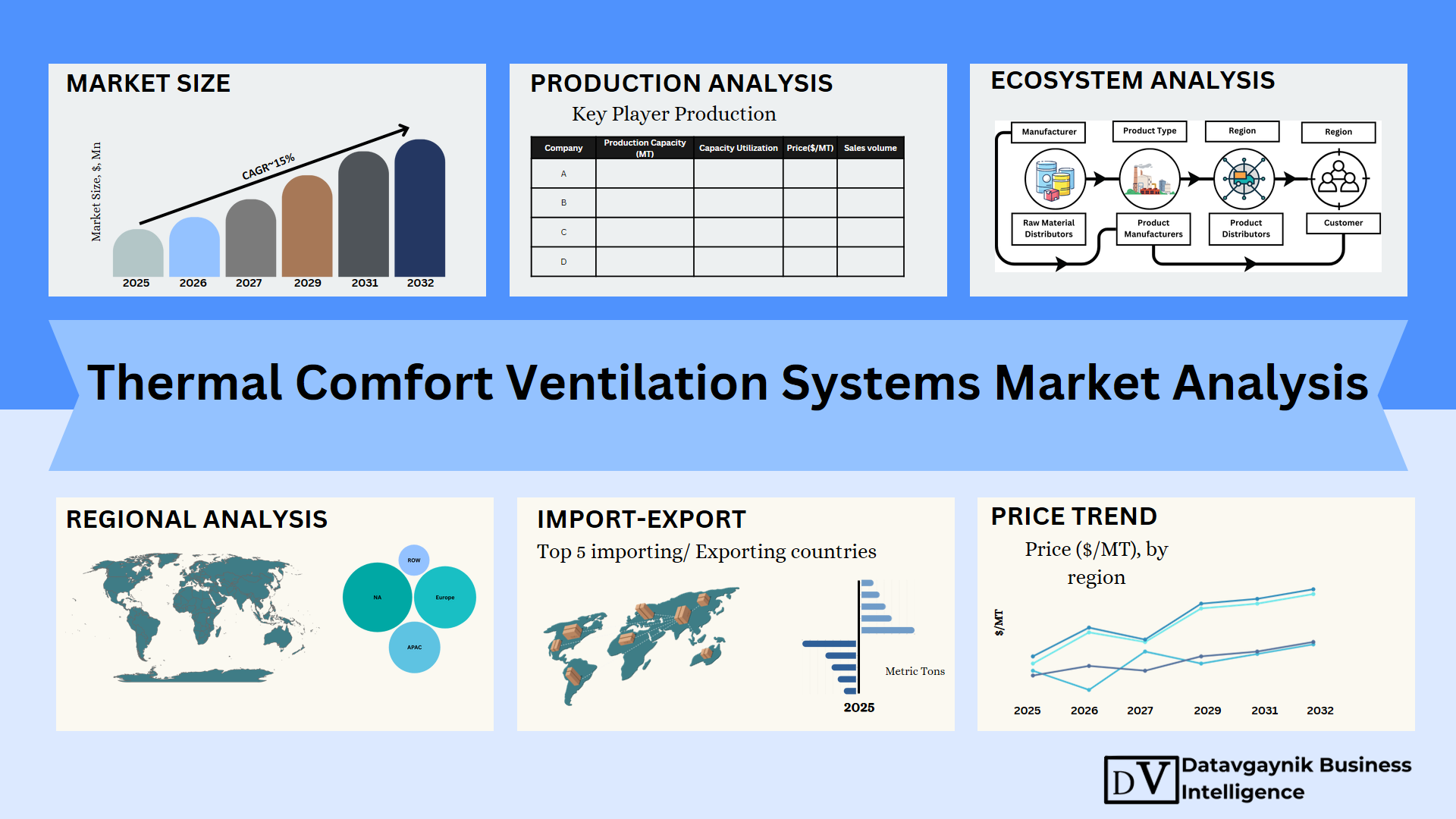

Thermal Comfort Ventilation Systems Market Size, Production, Sales, Average Product Price, Market Share, Import vs Export

- Published 2025

- No of Pages: 120+

- 20% Customization available

Rising Urbanization Fueling Growth in the Thermal Comfort Ventilation Systems Market

The rapid pace of urbanization globally has become a fundamental growth driver for the Thermal Comfort Ventilation Systems Market. As cities expand and populations concentrate in dense urban areas, the need for efficient indoor environmental control becomes critical. For instance, over 56% of the world’s population now lives in urban centers, and this figure is expected to climb past 68% by 2050. Such a shift creates immense pressure on urban infrastructure, particularly in maintaining healthy, thermally balanced indoor environments.

Urban high-rise buildings, commercial complexes, and smart housing projects require advanced ventilation systems that can deliver consistent thermal comfort. The market is responding to this need with intelligent, adaptable systems that optimize airflow and temperature based on real-time data. This has led to a measurable increase in demand, particularly in newly built structures that integrate energy efficiency from the design phase.

Climate Extremes and Changing Weather Patterns Intensify Demand

The Thermal Comfort Ventilation Systems Market is being profoundly shaped by climate change. As weather conditions become more unpredictable, with heatwaves and cold spells occurring more frequently, buildings must be equipped to offer stable indoor temperatures. For example, in regions experiencing longer, hotter summers, traditional HVAC systems are no longer sufficient. Building operators are seeking smarter, more energy-conscious ventilation solutions that respond dynamically to temperature fluctuations.

This trend is not confined to any single geography. Whether it’s extreme cold in northern Europe or soaring summer temperatures in South Asia, the demand for systems capable of maintaining thermal balance is universal. The market is thus expanding both in volume and in the range of applications, as manufacturers develop products tailored to diverse climate zones.

Smart Technologies Reshaping the Thermal Comfort Ventilation Systems Market

Technology continues to be a major disruptor across the Thermal Comfort Ventilation Systems Market. Smart sensors, AI algorithms, and IoT connectivity are enabling a new generation of ventilation systems that automatically adjust based on occupancy, air quality, and external temperature. These systems not only improve thermal comfort but also deliver significant energy savings.

For instance, smart systems can detect high carbon dioxide levels and respond by increasing airflow only when needed, avoiding unnecessary energy use. This adaptive capability is especially valued in commercial settings such as office buildings and healthcare facilities, where consistent air quality and comfort are essential. The adoption of smart systems has increased dramatically, and this segment of the market is projected to maintain double-digit growth well into the next decade.

Stricter Energy Efficiency Regulations Driving Market Expansion

One of the strongest tailwinds for the Thermal Comfort Ventilation Systems Market comes from evolving regulatory frameworks focused on sustainability and energy conservation. Governments worldwide are implementing building energy codes that mandate higher standards for indoor air quality and energy efficiency.

For example, several regions now require the use of energy recovery ventilation systems that minimize heat loss while providing fresh air. This has spurred a sharp rise in the production and installation of advanced thermal comfort systems that are compliant with these newer regulations. Manufacturers that innovate within these constraints—offering systems that exceed baseline energy requirements—are gaining significant competitive advantages in the market.

Residential Adoption Accelerates with Lifestyle Shifts

The residential segment within the Thermal Comfort Ventilation Systems Market is undergoing rapid transformation. As more people adopt remote and hybrid work models, there’s a heightened emphasis on home comfort and indoor environment quality. Homeowners are increasingly investing in systems that offer not just heating or cooling, but intelligent thermal comfort management.

Ventilation systems designed specifically for residential use now come with features such as ultra-quiet operation, compact form factors, and seamless integration with smart home ecosystems. Demand for such systems has been surging, particularly in urban and suburban areas where air quality concerns are also a consideration. This marks a shift from viewing ventilation systems as luxuries to recognizing them as essential components of a modern, healthy living space.

Expanding Application in Healthcare, Education, and Retail Sectors

The Thermal Comfort Ventilation Systems Market is seeing accelerated adoption in sectors beyond residential and traditional commercial spaces. In healthcare, for instance, maintaining stable indoor temperatures and clean air is vital for infection control and patient recovery. Hospitals and clinics are increasingly retrofitting existing infrastructure with high-performance ventilation systems.

Similarly, educational institutions are investing in ventilation systems to improve classroom air quality, which has been linked to better student performance and reduced absenteeism. In the retail sector, comfort translates directly to customer dwell time and satisfaction. Shopping malls, stores, and restaurants are upgrading to systems that can deliver precise climate control with minimal noise and energy expenditure.

This multi-sectoral expansion reflects the growing recognition of thermal comfort as a foundational element of human productivity, health, and well-being.

Green Building Projects Amplify Demand for Sustainable Solutions

Sustainability initiatives and the global shift toward green construction have significantly boosted the Thermal Comfort Ventilation Systems Market. Developers and architects are prioritizing systems that align with certifications such as LEED, WELL, and BREEAM, which emphasize energy efficiency, low environmental impact, and occupant well-being.

Energy recovery systems, hybrid ventilation units, and systems made from recyclable materials are gaining traction, particularly in high-end commercial and institutional projects. These systems are not only eco-friendly but also offer long-term operational savings. As green building projects gain momentum worldwide, demand for compatible thermal comfort systems is expected to grow proportionally.

Thermal Comfort Ventilation Systems Market Size Reflects Upward Momentum

The Thermal Comfort Ventilation Systems Market Size continues to show healthy growth trends, underscoring the expanding scope of application and adoption. As of the latest industry estimates, the market is expected to surpass significant revenue milestones in the coming years, propelled by advancements in production technology, smarter system integration, and increased construction activity across residential and non-residential segments.

Manufacturers that align their product development strategies with these growth levers—particularly smart functionality, sustainability, and regional climate responsiveness—are expected to outperform in this increasingly competitive landscape.

Retrofit Installations Provide Substantial Market Opportunities

While new construction fuels a significant portion of the market, retrofit installations are becoming a powerful growth channel in the Thermal Comfort Ventilation Systems Market. Aging infrastructure, especially in developed regions, is prompting a wave of modernization efforts. Existing buildings are being retrofitted with updated ventilation systems to meet current energy and air quality standards.

Retrofit solutions must be adaptable to older architectural formats and offer plug-and-play integration to reduce installation time and cost. This demand has sparked innovation in modular and scalable systems that can be customized without extensive structural modifications. The retrofit segment is particularly promising in mature markets such as North America and Europe, where existing building stock far exceeds new construction.

“Track Country-wise Thermal Comfort Ventilation Systems Production and Demand through our Thermal Comfort Ventilation Systems Production Database”

-

-

- Thermal Comfort Ventilation Systems production database for 27+ countries worldwide

- Thermal Comfort Ventilation Systems Powder sales volume for 31+ countries

- Country-wise Thermal Comfort Ventilation Systems production capacity and production plant mapping, production capacity utilization for 27+ manufacturers

- Thermal Comfort Ventilation Systems production plants and production plant capacity analysis for top manufacturers

-

Regional Dynamics Driving the Thermal Comfort Ventilation Systems Market

The Thermal Comfort Ventilation Systems Market displays distinctive growth patterns across various global regions, each shaped by climate conditions, economic development, regulatory focus, and construction trends. For instance, North America and Europe remain mature markets with high per capita investment in energy-efficient infrastructure, while Asia Pacific is leading in terms of volume growth due to urban expansion and rapid industrialization.

In North America, demand is primarily driven by stringent building codes and a strong focus on indoor air quality. Residential and commercial retrofitting projects form a major share of installations. In the United States, for example, over 60% of commercial buildings are over 20 years old, presenting a ripe opportunity for system upgrades. These installations prioritize smart, low-energy ventilation units capable of maintaining consistent thermal comfort across variable climate zones.

Europe, meanwhile, continues to lead in the adoption of green building practices. Countries like Germany, France, and the Nordic region are aggressively implementing sustainable ventilation solutions across residential and institutional infrastructure. Public subsidies and incentives for energy-efficient systems have played a crucial role in expanding the Thermal Comfort Ventilation Systems Market across the continent.

Asia Pacific represents the fastest-growing regional market. Countries such as China and India are seeing exponential growth in urban housing, commercial real estate, and industrial facilities. For instance, China adds over 2 billion square meters of new building floor space annually, much of which now integrates modern ventilation technologies. Southeast Asia is also becoming an active contributor due to rising tourism, commercial expansion, and the development of smart cities. These trends are collectively fueling increased demand for thermal comfort solutions.

Strategic Production Hubs Reshaping the Thermal Comfort Ventilation Systems Market

Production dynamics in the Thermal Comfort Ventilation Systems Market are closely aligned with regional manufacturing strengths and raw material access. Asia Pacific, particularly China and India, holds the largest share of global production, benefiting from economies of scale, low labor costs, and rapid technological advancement. Manufacturers in this region are capable of delivering both high-volume, cost-efficient systems and premium models that cater to export markets.

For instance, China alone contributes a substantial share to global thermal ventilation system exports, supplying both developed and emerging markets with products ranging from standard exhaust systems to intelligent, IoT-enabled ventilation networks. Indian manufacturers are gaining traction in South Asia, the Middle East, and Africa by offering competitively priced, customized systems tailored to local building styles and climate requirements.

Europe focuses on high-performance systems designed with precision engineering and environmental sustainability. Germany and Italy, in particular, are known for producing advanced ventilation technologies that meet strict European Union energy efficiency standards. These countries have developed strong export capabilities, targeting premium buyers in North America, the Middle East, and Oceania.

The United States emphasizes innovation-driven production. Domestic manufacturers are investing in R&D to deliver next-generation systems featuring wireless connectivity, sensor-based controls, and integrated air purification. These innovations are gradually transforming the production landscape and creating new benchmarks in the Thermal Comfort Ventilation Systems Market.

Segmentation by Product Type in the Thermal Comfort Ventilation Systems Market

The Thermal Comfort Ventilation Systems Market is segmented by product type into ducted systems, non-ducted systems, exhaust ventilation systems, supply ventilation systems, and balanced ventilation systems. Each category serves a specific set of applications and is growing at a different pace.

Ducted ventilation systems remain dominant in commercial and institutional settings. These centralized systems are capable of maintaining consistent thermal environments in multi-zone buildings such as malls, airports, and hospitals. Their efficiency in large-scale airflow management continues to drive their adoption, especially in urban developments.

Non-ducted systems, often wall- or window-mounted, are rapidly gaining market share in residential settings. With the rise of compact urban living spaces and do-it-yourself home upgrades, consumers are gravitating toward easy-to-install ventilation units that offer targeted thermal comfort without the need for structural modifications.

Exhaust and supply ventilation systems are increasingly being paired in modern buildings to create balanced airflow. Balanced ventilation systems, which combine the features of exhaust and supply units, are particularly suited to energy-efficient buildings. Their ability to control humidity, temperature, and pollutant levels simultaneously makes them ideal for green-certified buildings and energy-conscious buyers.

Technological Segmentation Driving Innovation in the Thermal Comfort Ventilation Systems Market

Technological advancements have introduced new system types in the Thermal Comfort Ventilation Systems Market, namely mechanical systems, natural ventilation systems, hybrid systems, and smart systems. Among these, smart ventilation systems are the fastest growing, as they align with broader trends in smart buildings and home automation.

Smart systems equipped with sensors and remote control capabilities are gaining traction in commercial and premium residential projects. These systems offer precise climate control, monitor CO2 levels, and adjust airflow automatically, enhancing both thermal comfort and energy savings. Their adoption is strongest in technologically advanced regions such as North America, Japan, and Western Europe.

Hybrid systems that combine natural and mechanical ventilation are witnessing increased demand in green building projects. These systems offer a flexible, environmentally responsible solution, particularly in temperate climates. Natural systems still find relevance in low-cost housing segments in developing countries, though their limitations in extreme climates restrict broader adoption.

Sector-Wise Application Fuels Diversification in the Thermal Comfort Ventilation Systems Market

The Thermal Comfort Ventilation Systems Market serves a wide range of end-use sectors. Residential, commercial, industrial, educational, healthcare, and transportation segments all present unique demand profiles.

The residential segment continues to expand with the rise in remote work culture and consumer investment in indoor comfort. Modern housing developments now view advanced ventilation systems as essential infrastructure rather than optional upgrades.

Commercial spaces such as offices, hotels, and retail stores are also key growth contributors. These environments require dynamic systems that adapt to changing occupancy levels throughout the day, maintaining comfort without excessive energy usage.

Industrial facilities prioritize rugged, high-capacity systems capable of operating under demanding conditions. Thermal comfort in factories and warehouses directly affects worker productivity and equipment longevity, making it a critical operational concern.

Educational and healthcare institutions are increasingly investing in high-efficiency systems to ensure healthy learning and recovery environments. Ventilation systems that reduce airborne contaminants while delivering thermal stability are a top priority in post-pandemic infrastructure planning.

Thermal Comfort Ventilation Systems Price Trends Across Global Markets

The Thermal Comfort Ventilation Systems Price varies significantly by product type, technology level, and regional manufacturing dynamics. For example, standard non-ducted residential units are available in the range of $150 to $600, while advanced smart ventilation systems for commercial buildings can cost upwards of $5,000 per unit depending on size and feature set.

The Thermal Comfort Ventilation Systems Price Trend over the past three years shows a gradual increase due to rising raw material costs, semiconductor shortages, and higher freight charges. For instance, prices for core components such as aluminum heat exchangers and digital sensors have risen by 12–18% since 2021, impacting overall system pricing.

However, this upward price pressure is being partially offset by increased automation in manufacturing and the use of modular designs that reduce labor costs. In Asia Pacific, where large-scale production facilities operate at high efficiency, prices remain more competitive. On the other hand, in regions like North America and Europe, prices tend to be higher due to stricter quality and environmental standards.

The Thermal Comfort Ventilation Systems Price Trend is expected to stabilize as global supply chains normalize and more manufacturers localize production. The long-term trend also indicates a gradual price segmentation, where entry-level systems remain affordable while high-tech models command premium pricing.

Future Outlook: Evolving Price Strategies in the Thermal Comfort Ventilation Systems Market

Manufacturers are increasingly adopting flexible pricing strategies to remain competitive. Tiered pricing, value bundling with air purification or dehumidification features, and extended service warranties are common tactics. These strategies help justify higher prices in the premium segment while preserving volume in the price-sensitive markets.

Additionally, the rising share of retrofitting projects is shifting pricing strategies toward lifecycle cost analysis rather than upfront cost alone. Buyers are increasingly evaluating Total Cost of Ownership (TCO), which includes energy consumption, maintenance, and system lifespan. This shift favors high-efficiency, durable systems and allows for moderate price increases if accompanied by demonstrable operational savings.

The Thermal Comfort Ventilation Systems Price Trend is thus not only a function of production economics but also of evolving buyer expectations and regulatory environments. Manufacturers that align their pricing models with regional demand nuances and emphasize long-term value will maintain stronger market positions.

“Thermal Comfort Ventilation Systems Manufacturing Database, Thermal Comfort Ventilation Systems Manufacturing Capacity”

-

-

- Thermal Comfort Ventilation Systems top manufacturers market share for 27+ manufacturers

- Top 7 manufacturers and top 16 manufacturers of Thermal Comfort Ventilation Systems in North America, Europe, Asia Pacific

- Production plant capacity by manufacturers and Thermal Comfort Ventilation Systems production data for 27+ market players

- Thermal Comfort Ventilation Systems production dashboard, Thermal Comfort Ventilation Systems production data in excel format

-

Leading Manufacturers in the Thermal Comfort Ventilation Systems Market

The Thermal Comfort Ventilation Systems Market is shaped by a diverse set of global players that dominate both volume and innovation. These manufacturers are leveraging advanced technologies, regional manufacturing bases, and comprehensive distribution networks to maintain competitive advantage.

Daikin Industries is one of the most recognized names in the thermal comfort segment, particularly known for its energy-efficient, ductless ventilation solutions. The company’s product line includes the Daikin VAM series of ventilation systems, which are designed for both residential and commercial buildings. These systems offer energy recovery capabilities and intelligent control features that cater to energy-conscious consumers. Daikin’s dominance is most pronounced in Asia and parts of Europe, where its systems are often integrated into green building projects.

Carrier Global Corporation holds a significant share of the North American market, with a strong presence in both commercial and institutional sectors. Its product portfolio includes the OptiClean and WeatherExpert lines, which are tailored to large buildings, educational campuses, and hospitals. Carrier is known for incorporating advanced filtration, humidity control, and smart diagnostics into its ventilation solutions. The company’s focus on performance reliability and regulatory compliance has solidified its role as a preferred supplier in energy retrofit projects.

Johnson Controls is another top-tier player in the Thermal Comfort Ventilation Systems Market. The company offers a wide range of thermal ventilation systems under its YORK brand, targeting industrial facilities, offices, and healthcare infrastructure. With integrated Building Management Systems (BMS), Johnson Controls enhances control and monitoring capabilities across large-scale installations. The company’s emphasis on scalable and modular systems positions it strongly in the retrofit and expansion markets, particularly in developed economies.

Zehnder Group, a Switzerland-based manufacturer, is a leader in the European residential segment, known for its ComfoAir and ComfoSpot lines. These systems are compact, ultra-quiet, and optimized for single-family homes and small commercial units. Zehnder’s specialization in balanced ventilation systems with energy recovery has made it a go-to brand for energy-efficient housing developers. The company has built a loyal customer base across Germany, the UK, and the Nordic countries.

Mitsubishi Electric plays a dominant role in the high-performance smart ventilation segment, offering solutions like the Lossnay series, which combines advanced heat exchange with automated airflow control. With a strong presence in Japan, South Korea, and Southeast Asia, Mitsubishi’s systems are favored in both high-rise residential towers and tech-driven commercial buildings. Their ability to integrate with smart home ecosystems adds significant appeal for developers of modern infrastructure.

Systemair, a Swedish manufacturer, is a prominent supplier across Europe, Asia, and the Middle East. The company provides a broad range of ventilation products, including axial fans, air handling units, and energy-efficient rooftop systems. Its Geniox series is widely used in industrial and commercial environments that require consistent airflow and strict air quality compliance. Systemair’s diversified product base and large production footprint enable it to compete across multiple price tiers.

LG Electronics has also made strong inroads into the Thermal Comfort Ventilation Systems Market, particularly with its ERV and HRV systems that are designed for integration with VRF air conditioning platforms. LG’s expertise in consumer electronics and smart systems gives it a unique position in the residential and small-commercial segments, where buyers are increasingly seeking connected solutions.

Panasonic and Swegon are notable names in regional markets. Panasonic, with its WhisperGreen and Intelli-Balance lines, has gained attention in North America and Asia for energy-efficient residential ventilation units. Swegon, based in Sweden, specializes in commercial and institutional projects across Europe, with its GOLD RX air handling units frequently used in educational and hospital projects due to their low noise and energy recovery capabilities.

Thermal Comfort Ventilation Systems Market Share by Manufacturer

In terms of market share, Daikin and Carrier collectively command approximately 30 to 35 percent of the global Thermal Comfort Ventilation Systems Market. These companies have a balanced portfolio across residential, commercial, and industrial segments and maintain a strong presence in both mature and emerging markets.

Johnson Controls holds an estimated 10 to 12 percent market share, with particular strength in commercial and institutional applications in North America and the Middle East. Zehnder Group, while smaller in scale, dominates specific residential markets in Western Europe and holds close to 5 percent of the overall market, but as much as 15 to 20 percent in select segments like energy recovery ventilation for single-family homes.

Systemair and Mitsubishi Electric both operate in the mid- to upper-tier range, with 5 to 8 percent market share each. Their ability to serve both standard and premium customer segments, as well as their global distribution networks, keeps them in strong competitive positions.

Other manufacturers, including LG Electronics, Panasonic, and Lennox International, collectively occupy the remaining 30 to 35 percent of the market. Their regional specialization and targeted innovations help them capture niche segments or geographic footholds where localized customization is key.

Strategic Developments and Product Innovations in the Market

Recent developments in the Thermal Comfort Ventilation Systems Market illustrate a shift toward smart, sustainable, and user-centric solutions. Manufacturers are expanding their R&D investments and launching new products that address both climate impact and user control.

In late 2023, Carrier introduced a new range of smart ventilation systems featuring integrated CO2 sensors and adaptive airflow, targeting educational facilities and offices. The launch coincided with several U.S. states updating their indoor air quality mandates, giving Carrier a first-mover advantage in regulatory compliance.

Zehnder Group, in the first quarter of 2024, announced the rollout of a new version of its ComfoAir Q series, featuring upgraded heat recovery performance and quieter operation. This aligns with the growing trend of passive house construction, particularly in Scandinavia and Germany.

Daikin, in mid-2023, invested in an expansion of its production facility in India, aimed at serving the fast-growing residential construction sector in South Asia. The move supports the company’s efforts to localize production and reduce logistics costs in one of the world’s highest-growth markets.

Mitsubishi Electric, in early 2024, released an upgraded model of its Lossnay ventilation system, adding AI-powered self-learning features. This advancement improves energy usage forecasting and predictive maintenance, placing Mitsubishi ahead of competitors in the smart ventilation niche.

Systemair completed its acquisition of a regional Middle Eastern HVAC distributor in March 2024. This strategic move allows the company to strengthen its foothold in arid-climate markets where thermal comfort solutions are essential throughout the year.

“Thermal Comfort Ventilation Systems Production Data and Thermal Comfort Ventilation Systems Production Trend, Thermal Comfort Ventilation Systems Production Database and forecast”

-

- Thermal Comfort Ventilation Systems production database for historical years, 10 years historical data

- Thermal Comfort Ventilation Systems production data and forecast for next 7 years

Market Scenario, Demand vs Supply, Average Product Price, Import vs Export, till 2035

- Global Thermal Comfort Ventilation Systems Market revenue and demand by region

- Global Thermal Comfort Ventilation Systems Market production and sales volume

- United States Thermal Comfort Ventilation Systems Market revenue size and demand by country

- Europe Thermal Comfort Ventilation Systems Market revenue size and demand by country

- Asia Pacific Thermal Comfort Ventilation Systems Market revenue size and demand by country

- Middle East & Africa Thermal Comfort Ventilation Systems Market revenue size and demand by country

- Latin America Thermal Comfort Ventilation Systems Market revenue size and demand by

- Import-export scenario – United States, Europe, APAC, Latin America, Middle East & Africa

- Average product price – United States, Europe, APAC, Latin America, Middle East & Africa

- Market player analysis, competitive scenario, market share analysis

- Business opportunity analysis

Key questions answered in the Global Thermal Comfort Ventilation Systems Market Analysis Report:

- What is the market size for Thermal Comfort Ventilation Systems in United States, Europe, APAC, Middle East & Africa, Latin America?

- What is the yearly sales volume of Thermal Comfort Ventilation Systems and how is the demand rising?

- Who are the top market players by market share, in each product segment?

- Which is the fastest growing business/ product segment?

- What should be the business strategies and Go to Market strategies?

The report covers Thermal Comfort Ventilation Systems Market revenue, Production, Sales volume, by regions, (further split into countries):

- Asia Pacific (China, Japan, South Korea, India, Indonesia, Vietnam, Rest of APAC)

- Europe (UK, Germany, France, Italy, Spain, Benelux, Poland, Rest of Europe)

- North America (United States, Canada, Mexico)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa

Table of Contents:

Thermal Comfort Ventilation Systems Market:

- Introduction to Thermal Comfort Ventilation Systems

1.1 Concept of Thermal Comfort and Its Importance

1.2 Applications Across Residential, Commercial, and Industrial Sectors - Scope and Objectives of the Market Study

2.1 Definition and Functionality of Thermal Comfort Ventilation Systems

2.2 Research Goals and Methodology - Evolution of Thermal Comfort Technology

3.1 Historical Developments in Ventilation for Comfort

3.2 Innovations in Thermal Regulation Systems - Market Segmentation of Thermal Comfort Ventilation Systems

4.1 By System Type (Mechanical, Natural, Hybrid)

4.2 By End-Use Sector (Residential, Commercial, Industrial, Healthcare)

4.3 By Climate Zone Application - Thermal Comfort and Human Productivity

5.1 Impact on Workplace Efficiency and Well-Being

5.2 Role in Enhancing Indoor Environmental Quality - Global Market Overview and Growth Projections (2025–2040)

6.1 Historical Performance of the Market

6.2 Revenue and Demand Forecasts - Regional Market Insights

7.1 North America: Innovations in Climate-Adaptive Ventilation

7.2 Europe: Emphasis on Energy-Efficient Comfort Solutions

7.3 Asia-Pacific: Market Trends in Urban Expansion

7.4 Latin America: Adoption in Hot and Humid Climates

7.5 Middle East & Africa: Solutions for Extreme Thermal Conditions - Drivers and Restraints of the Thermal Comfort Ventilation Market

8.1 Market Drivers: Climate Adaptability and Urbanization

8.2 Challenges: High Costs and Installation Complexities - Energy Efficiency and Sustainability in Thermal Comfort Ventilation

9.1 Role in Reducing Carbon Footprint

9.2 Contribution to Sustainable Construction Practices - Competitive Landscape and Industry Participants

10.1 Overview of Leading Market Players

10.2 Strategies for Gaining Competitive Advantage - Pricing Analysis and Cost Trends

11.1 Analysis of System and Installation Costs

11.2 Impact of Raw Material Prices on System Affordability - Thermal Comfort Systems in Residential Applications

12.1 Role in Enhancing Home Living Standards

12.2 Smart Home Integration with Thermal Comfort Systems - Industrial Applications of Thermal Comfort Ventilation Systems

13.1 Ensuring Worker Safety and Efficiency

13.2 Applications in Temperature-Sensitive Manufacturing - Advancements in Thermal Comfort Technologies

14.1 Innovations in Zonal Temperature Regulation

14.2 Use of Advanced Sensors for Real-Time Monitoring - Thermal Comfort Ventilation in Educational and Healthcare Facilities

15.1 Creating Healthy Learning Environments

15.2 Importance in Patient Recovery and Comfort - Role of Building Design in Thermal Comfort Optimization

16.1 Architectural Innovations for Enhanced Ventilation

16.2 Passive Design Strategies for Energy Savings - Impact of Climate Change on Thermal Comfort Systems

17.1 Increasing Demand in Extreme Weather Regions

17.2 Adapting Systems for Greater Resilience - Material Trends in Thermal Comfort System Manufacturing

18.1 Lightweight and Insulating Materials

18.2 Innovations in Sustainable Material Use - Supply Chain and Manufacturing Analysis

19.1 Overview of the Supply Chain Ecosystem

19.2 Trends in Production and Distribution - Export and Import Dynamics in the Market

20.1 Trade Patterns in Thermal Comfort Systems

20.2 Regional Contributions to Global Exports and Imports - Case Studies on Thermal Comfort Solutions

21.1 Success Stories in Smart Residential Projects

21.2 Lessons Learned from Commercial Applications - Consumer Preferences in Thermal Comfort Ventilation

22.1 Insights from Residential and Commercial Users

22.2 Growing Demand for Customizable Solutions - Future Opportunities in Thermal Comfort Ventilation Systems

23.1 Emerging Markets and Untapped Potential

23.2 Innovations Driving the Next Decade - Role of Regulations in Shaping Market Trends

24.1 Compliance with Thermal Comfort Standards

24.2 Government Incentives for Energy-Efficient Systems - Thermal Comfort Systems for Smart Cities

25.1 Integration with Urban Infrastructure

25.2 Enhancing Livability Through Advanced Ventilation - Investment Trends in Thermal Comfort Ventilation Systems

26.1 Funding for R&D and Market Expansion

26.2 Role of Green Financing in Market Growth - Conclusion and Strategic Recommendations

27.1 Summary of Key Findings and Market Insights

27.2 Actionable Recommendations for Stakeholders

“Every Organization is different and so are their requirements”- Datavagyanik

Companies We Work With

Do You Want To Boost Your Business?

drop us a line and keep in touch