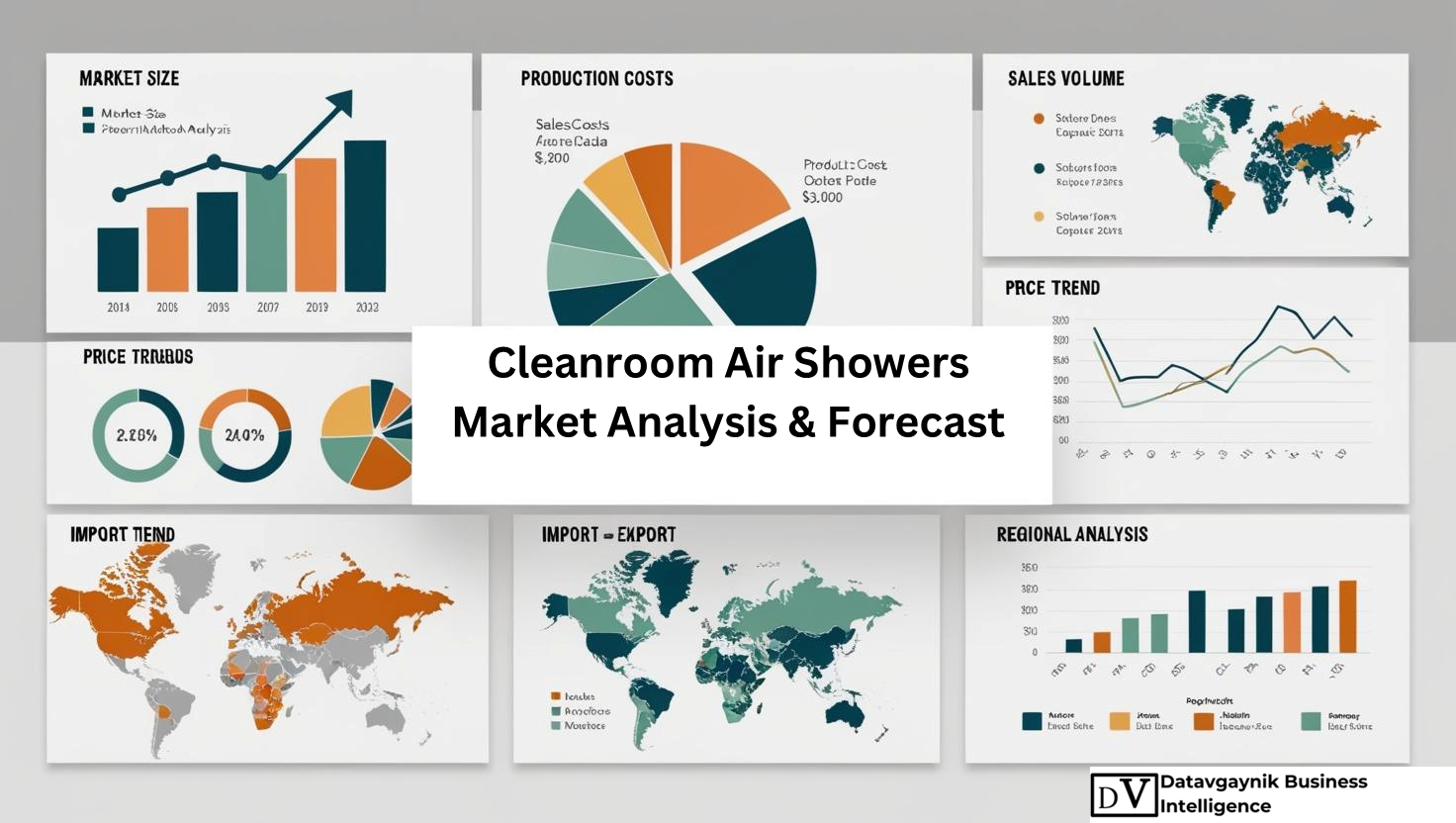

Cleanroom Air Showers Market Size, Production, Sales, Average Product Price, Market Share, Import vs Export

- Published 2025

- No of Pages: 120+

- 20% Customization available

Cleanroom Air Showers Market Driven by Pharmaceutical Manufacturing Expansion

The Cleanroom Air Showers Market is undergoing a phase of rapid expansion, driven by unprecedented growth in pharmaceutical manufacturing. As global pharmaceutical output continues to increase, maintaining contamination-free environments has become a non-negotiable requirement. For instance, the biopharmaceutical industry alone is projected to grow at a CAGR of over 9% between 2023 and 2030. This directly fuels the demand for cleanroom technologies, especially air showers, which play a critical role in removing particulate matter from personnel and equipment before entering sterile zones. From vaccine production to biologics and injectable therapeutics, contamination control is now central to operational compliance. The Cleanroom Air Showers Market is scaling up to meet this demand, offering customizable solutions for various production scales.

Rising Regulatory Scrutiny Accelerates Cleanroom Air Showers Market Growth

The tightening of regulatory frameworks across industries has had a profound effect on the Cleanroom Air Showers Market. Regulatory bodies such as the U.S. FDA, EMA in Europe, and international guidelines like ISO 14644-1 demand rigorous adherence to air cleanliness classes. Facilities falling short of these expectations face operational shutdowns and costly compliance risks. For example, over 75% of pharmaceutical product recalls in the U.S. over the past five years were contamination-related. As a result, companies are proactively investing in cleanroom air showers to prevent personnel from introducing particulates into critical environments. The Cleanroom Air Showers Market has thus become an indispensable part of regulatory compliance infrastructure for pharmaceutical and biotech firms.

Datavagyanik also covers related markets such as the Cleanroom Ventilation Systems Market. These markets provide auxiliary insights into surrounding supply chains, application clusters, and evolving demand patterns affecting the primary topic.

Semiconductor Industry Expansion Pushes Cleanroom Air Showers Market Upward

The exponential rise in semiconductor demand—spurred by developments in 5G, electric vehicles, and AI—has significantly bolstered the Cleanroom Air Showers Market. Semiconductor manufacturing requires ultra-clean environments, as a single microscopic particle can ruin an entire wafer. Global semiconductor sales surpassed $600 billion in 2023, with foundries expanding cleanroom floor space aggressively. For instance, new chip fabrication plants in the U.S. and Asia have led to over 30% growth in the installation of cleanroom air showers in the last two years alone. The Cleanroom Air Showers Market is benefiting directly from this momentum, as manufacturers incorporate air showers to minimize human-borne contaminants in chip fabrication processes.

Cleanroom Air Showers Market Benefits from Biotechnology Sector Surge

The biotechnology industry has become a key consumer segment within the Cleanroom Air Showers Market, particularly in areas like gene therapy, vaccine R&D, and personalized medicine. For example, the global cell and gene therapy market is expected to surpass $55 billion by 2030. These therapies require not only high sterility but also zero tolerance for contamination during manipulation of sensitive biological materials. Cleanroom air showers, especially customized units with HEPA/ULPA filtration and ionization features, have found broad adoption in biotech cleanrooms. The Cleanroom Air Showers Market is responding with innovations tailored for small-batch, high-value bioproduction, further expanding its footprint in this sector.

Increased Focus on Health Infrastructure Driving Cleanroom Air Showers Market

Global focus on building resilient health infrastructure—especially post-COVID—has contributed significantly to the rise of the Cleanroom Air Showers Market. Governments across the globe are expanding investments in domestic drug production, diagnostic laboratories, and vaccine storage facilities. For example, India’s Production Linked Incentive (PLI) scheme for pharmaceutical manufacturing has catalyzed the setup of over 250 new cleanroom facilities in the past three years. This infrastructure boom translates directly into rising demand for cleanroom air showers, which are critical in creating airlock zones that prevent contamination transfer. The Cleanroom Air Showers Market is increasingly being integrated into healthcare facility design as a standard hygiene protocol.

Food Processing Sector Opens New Avenues for Cleanroom Air Showers Market

While traditionally associated with pharmaceutical and semiconductor industries, the Cleanroom Air Showers Market is now finding significant opportunities in the food and beverage sector. With rising consumer preference for high-quality, hygienically processed packaged foods, manufacturers are upgrading their facilities with cleanroom environments. For example, in high-risk categories such as dairy, bakery, and ready-to-eat meals, even minimal contamination can result in mass recalls. The global packaged food industry, growing at a CAGR of over 6%, is adopting air showers to improve hygiene levels and comply with food safety regulations like FSMA and ISO 22000. This trend is expanding the addressable market for cleanroom air showers.

Cleanroom Air Showers Market Empowered by Technological Advancements

Advancements in filtration and automation technology are reshaping the Cleanroom Air Showers Market. Modern air showers are now equipped with real-time sensors, touchless entry, programmable air velocities, and antimicrobial interiors. These features not only enhance decontamination efficiency but also ensure operational consistency in high-throughput environments. For example, dual-side high-velocity air showers now reduce personnel entry time by 40%, increasing productivity in cleanroom operations. Additionally, energy-efficient models that consume 25–30% less power are gaining traction in sustainability-focused facilities. These innovations are driving adoption across multiple industries and are pivotal in expanding the scope of the Cleanroom Air Showers Market.

Emergence of Modular Cleanroom Designs Enhancing Cleanroom Air Showers Market Penetration

The rise of modular cleanroom construction is creating favorable conditions for the Cleanroom Air Showers Market. Industries are increasingly shifting to prefabricated cleanroom units for speed, cost-efficiency, and adaptability. For instance, modular cleanrooms can be installed 40% faster than traditional cleanrooms, and they often come with pre-integrated air showers. This shift is particularly beneficial for medium-scale enterprises and start-ups in pharmaceuticals and electronics, which require flexible and scalable cleanroom solutions. As modular cleanrooms become more popular, the demand for compact, plug-and-play air shower units is driving further growth in the Cleanroom Air Showers Market.

Aerospace and Automotive Cleanrooms Adding Momentum to Cleanroom Air Showers Market

Precision industries such as aerospace and automotive are fueling the evolution of the Cleanroom Air Showers Market by incorporating clean manufacturing practices. Aircraft component manufacturing, EV battery assembly, and autonomous vehicle technology development all require high-precision, contaminant-free environments. For example, the aerospace components sector in Europe grew by 12% in 2023, and much of this growth involved production within controlled cleanroom spaces. Cleanroom air showers are used extensively in these sectors to control particulate ingress at critical points. As aerospace and automotive industries continue their shift toward high-tech, cleanroom-integrated facilities, the Cleanroom Air Showers Market will see broader applications and higher customization demands.

COVID-19 Legacy Strengthens Long-Term Outlook for Cleanroom Air Showers Market

The aftermath of COVID-19 has left a lasting impact on hygiene standards across industries, propelling the Cleanroom Air Showers Market into a strategic necessity. Whether in hospital labs, diagnostic centers, or vaccine manufacturing units, the need for personnel decontamination has become part of operational SOPs. For example, global healthcare infrastructure investment rose by over $500 billion between 2020 and 2023, with a significant portion allocated toward contamination control. Air showers became essential components in facility designs aiming to prevent cross-contamination and airborne transmission. This post-pandemic shift in risk management ensures that the Cleanroom Air Showers Market remains relevant and essential for years to come.

Cleanroom Air Showers Market Fuelled by Cleanroom Certification Requirements

Industries aiming to obtain or maintain cleanroom certifications such as ISO Class 5 or EU GMP Grade A must meet strict standards on particulate contamination. Cleanroom air showers are instrumental in these certification processes, as they serve as a critical line of defense against contaminants introduced by personnel. For instance, a large number of pharmaceutical and biotech companies preparing for regulatory audits invest in air showers as a last-mile safeguard. These installations can reduce up to 90% of surface particles on garments within seconds, a metric often required for ISO compliance. This need directly supports the consistent expansion of the Cleanroom Air Showers Market among quality-driven manufacturers.

North America Leading Cleanroom Air Showers Market with High-Tech Manufacturing Surge

The Cleanroom Air Showers Market in North America is showing strong and sustained growth, driven primarily by the dominance of pharmaceutical and semiconductor industries. The United States accounts for a major share of this regional demand. For example, the U.S. pharmaceutical industry alone was valued at over $550 billion in 2023, with continuous investments in biologics, vaccines, and injectable therapies. These production facilities rely heavily on Class 100 to Class 1000 cleanrooms, where air showers are not just regulatory requirements but a critical component of contamination control strategy.

Semiconductor fabs in states like Arizona, Texas, and Oregon are also expanding rapidly. With the CHIPS Act pouring over $50 billion into domestic chip production, the need for controlled environments is accelerating. For instance, every new fabrication unit integrates high-efficiency cleanroom air showers for personnel decontamination at multiple entry points. These trends are cementing North America’s leadership position in the Cleanroom Air Showers Market.

Europe Cleanroom Air Showers Market Bolstered by Strict Hygiene Regulations

The Cleanroom Air Showers Market in Europe is marked by strict regulatory standards and industrial diversity. Germany, France, and the UK are the key contributors to market demand. Germany’s strength lies in its massive pharmaceutical and medical device sector, which exceeded €50 billion in exports in 2023. These industries depend on stringent hygiene protocols, and cleanroom air showers play a critical role in minimizing human-borne contamination in sterile environments.

In France, the aerospace industry adds another dimension to demand. Air showers are used in precision assembly units to prevent particle ingress during the fabrication of aircraft parts. Meanwhile, the UK’s biotechnology ecosystem, including a growing number of start-ups focused on personalized medicine, is integrating modular cleanrooms equipped with compact air showers. With rising investment in cleanroom upgrades and a push toward automation, the Cleanroom Air Showers Market across Europe is seeing consistent growth supported by well-defined quality standards.

Asia Pacific Dominates Cleanroom Air Showers Market in Volume and Capacity

The Asia Pacific region leads the Cleanroom Air Showers Market in terms of production capacity and unit installations, due to its extensive high-tech manufacturing infrastructure. China, Japan, South Korea, and India are the powerhouses driving this regional expansion. In China, the electronics and semiconductor industries represent more than 35% of cleanroom infrastructure investments. With major players like SMIC and TSMC expanding fabs, air showers have become an integral part of facility design.

India, on the other hand, is witnessing a pharmaceutical boom, having become the world’s third-largest producer of generic medicines. With drug exports surpassing $25 billion annually, India’s pharmaceutical companies are investing in GMP-compliant cleanrooms, incorporating automated air showers to meet U.S. FDA and EMA standards. Japan’s demand is also significant, particularly in the medical device and electronics sectors, where cleanroom air showers are built into every clean zone. As Asia Pacific continues to scale up high-precision and contamination-sensitive industries, the Cleanroom Air Showers Market remains central to facility planning and operational design.

Middle East and Africa Cleanroom Air Showers Market Accelerating through Healthcare and R&D Investments

While traditionally a nascent market, the Cleanroom Air Showers Market in the Middle East and Africa is gaining traction as governments invest heavily in pharmaceutical production, diagnostics, and medical R&D. The UAE and Saudi Arabia, for instance, are developing health-tech and vaccine production hubs under their Vision 2030 programs. These include cleanroom facilities designed to meet international hygiene benchmarks.

For example, new pharmaceutical production zones in Riyadh and Abu Dhabi are outfitted with modular cleanrooms where air showers are mandatory at gowning and de-gowning areas. In Africa, countries like South Africa and Egypt are also investing in local vaccine manufacturing units. These developments are opening up new frontiers for the Cleanroom Air Showers Market, especially as international health bodies partner with local firms to improve manufacturing capabilities and quality assurance.

Latin America Cleanroom Air Showers Market Grows with Domestic Drug Manufacturing

The Cleanroom Air Showers Market in Latin America is expanding steadily, driven by domestic pharmaceutical production and growing exports. Brazil and Mexico are leading this growth. Brazil’s pharmaceutical market exceeded $22 billion in 2023, with over 70% of production facilities now adopting cleanroom protocols. Air showers are playing a key role in these facilities to comply with ANVISA and global regulatory standards.

Mexico’s cleanroom investments are also driven by its position as a nearshore manufacturing hub for U.S.-based life sciences and electronics companies. New plants being developed in Guadalajara and Monterrey include cleanroom facilities that require state-of-the-art air shower systems. As Latin American manufacturers aim for higher export certifications and better compliance, the Cleanroom Air Showers Market is poised for robust growth across the region.

OEM-Led Production Structure Enhances Cleanroom Air Showers Market Efficiency

The Cleanroom Air Showers Market is largely structured around Original Equipment Manufacturers (OEMs) who handle everything from design to installation. These companies are now prioritizing customization, modularity, and energy efficiency. For example, OEMs are producing units with dual-stage filtration and smart monitoring systems that integrate into facility management dashboards.

Many leading OEMs operate across multiple regions, with manufacturing bases in Asia and assembly or service centers in North America and Europe. This global footprint allows for both cost efficiency and localized product configuration. The Cleanroom Air Showers Market is increasingly dependent on agile OEM networks that can rapidly deliver customized units aligned with client industry specifications and regional compliance requirements.

Distributors and System Integrators Add Value to Cleanroom Air Showers Market

Beyond manufacturing, the Cleanroom Air Showers Market includes a dense network of distributors and system integrators who provide end-to-end solutions. These players assist in layout planning, retrofitting, filtration system upgrades, and lifecycle support. For instance, pharmaceutical clients often work with integrators to add HEPA filters or antimicrobial coatings tailored to their batch processes.

In the semiconductor industry, distributors offer air showers with built-in ionizers for static neutralization, customized for cleanroom entry zones. This ecosystem not only supports market reach but also adds recurring value through maintenance and system updates. As industries increasingly outsource cleanroom design and validation, the role of integrators in the Cleanroom Air Showers Market continues to grow.

Segmentation by Type Expands Flexibility in Cleanroom Air Showers Market

The Cleanroom Air Showers Market is segmented into single-side, double-side, pass-through, and customized systems—each tailored to different operational needs. Single-side air showers are commonly deployed in compact cleanrooms with low foot traffic, such as diagnostic labs or small-scale biotech firms. Double-side models are favored in high-volume production areas, such as vaccine plants, where decontamination time must be minimized without compromising quality.

Pass-through air showers are popular in logistics-intensive cleanrooms where materials and equipment require decontamination alongside personnel. Customized air showers, often requested by aerospace and research facilities, are built to accommodate large equipment or unique gowning protocols. This segmentation enables end-users across industries to select systems that optimize space, cost, and compliance, reinforcing growth in the Cleanroom Air Showers Market.

End-Use Industry Segmentation Enhances Strategic Targeting in Cleanroom Air Showers Market

The Cleanroom Air Showers Market serves a wide array of industries, each with distinct requirements. Pharmaceutical manufacturing remains the largest segment, with consistent demand for automated and HEPA-filtered units. Semiconductor plants, with their zero-defect tolerance policies, represent the most technically demanding segment, requiring high-velocity air showers with built-in monitoring systems.

Biotechnology firms often seek flexible air shower configurations that can support diverse workflows such as cell therapy, tissue culture, and genetic editing. Food and beverage companies, particularly those dealing in ready-to-eat or dairy products, are integrating air showers to meet food safety certification standards. Aerospace and automotive cleanrooms need durable systems that can handle heavy-duty equipment and particulate-sensitive assembly tasks. This segmentation underscores how diverse applications continue to drive robust expansion of the Cleanroom Air Showers Market.

Technology Segmentation Reshaping Innovation in Cleanroom Air Showers Market

The Cleanroom Air Showers Market is experiencing rapid innovation, especially across automated, energy-efficient, and high-performance air shower systems. Automated systems are now equipped with motion sensors and programmable cycles that reduce human error and improve throughput. For example, these units can complete a full decontamination cycle in less than 15 seconds, reducing cleanroom entry bottlenecks in high-traffic zones.

Energy-efficient air showers utilize advanced air circulation algorithms, reducing power consumption by up to 30%. These models are gaining popularity in regions with high energy costs or sustainability mandates. High-performance units feature ULPA filters and ionization modules to meet the most stringent air quality standards, such as ISO Class 5 or better. This diversification is transforming the Cleanroom Air Showers Market, attracting clients with different budgets and performance requirements.

Material and Construction Preferences Diversify Cleanroom Air Showers Market Offering

Material segmentation within the Cleanroom Air Showers Market also plays a vital role in influencing buyer decisions. Stainless steel is widely preferred due to its corrosion resistance and ease of sanitization. It dominates pharmaceutical and semiconductor applications where sterility and durability are key. Aluminum variants offer lightweight options at a lower cost, commonly used in less critical environments or temporary cleanroom setups.

Plastic-based units, such as those made from polycarbonate or PVC, are gaining traction in budget-sensitive industries like academic research or food processing. As more end-users demand customization, manufacturers are offering hybrid material models with composite panels, modular casings, and antimicrobial coatings. This versatility enhances the Cleanroom Air Showers Market by meeting a broad spectrum of client needs across industrial verticals.

Key Manufacturers Shaping the Cleanroom Air Showers Market

The Cleanroom Air Showers Market is characterized by a mix of global giants and regional specialists, each offering a range of solutions tailored to various industry needs. These manufacturers are not only supplying standard air showers but also developing advanced product lines integrated with automation, energy efficiency, and customization features. The growing demand across pharmaceutical, semiconductor, biotechnology, and food sectors has pushed these companies to innovate in performance, footprint, and compliance.

Terra Universal – Modular Cleanroom Air Showers Leading U.S. Manufacturing

Terra Universal is one of the most prominent players in the Cleanroom Air Showers Market, particularly in the United States. Known for its modular cleanroom systems, Terra offers air showers designed for ISO Class 4 to Class 8 environments. The company’s product line includes the Smart Pass-Through Air Shower, featuring touchscreen interfaces and programmable airflow cycles. These units are commonly deployed in pharmaceutical labs and semiconductor fabs where contamination control is vital.

Terra also emphasizes antimicrobial surface coatings and seamless stainless-steel construction, making their air showers suitable for biologics and vaccine production zones. Their CleanMount and BioSafe air shower models are among the most recognized in the industry for sterile applications.

Clean Air Products – High-Velocity, Custom-Built Solutions for Critical Environments

Based in the U.S., Clean Air Products manufactures high-performance air showers that cater to cleanroom standards ranging from ISO Class 5 to Class 7. Their key offering, the Model CAP701, is built with HEPA filtration and variable speed blowers capable of reaching air velocities above 8,000 feet per minute.

The company also offers dual-person air showers and multi-entry configurations, enabling large teams to pass through clean zones efficiently. Clean Air Products is known for working closely with clients on custom builds, making them a preferred choice in biotech and aerospace cleanroom installations.

Esco Group – Energy-Efficient Designs with International Reach

Esco Group, headquartered in Singapore, has established a strong presence in the Cleanroom Air Showers Market globally. Their Esco Airstream® Air Shower series is used widely across Asia, Europe, and North America, particularly in pharmaceutical and microelectronics applications.

Esco’s systems are designed with pre-installed ULPA filters, infrared sensors, and ergonomic airflow designs. The company focuses on energy-saving technologies, with many units running on low-power motors without compromising decontamination effectiveness. The integration of digital displays and fault diagnostics adds to the operational efficiency of Esco’s air showers.

Hepa Filter Technology – Precision Manufacturing in German Engineering

Germany’s Hepa Filter Technology (HFT) is a dominant European player in the Cleanroom Air Showers Market, offering systems that meet stringent EU GMP and ISO standards. The company specializes in air showers for pharmaceutical, aerospace, and nanotechnology cleanrooms. HFT’s flagship product, the Stericlean-AS series, comes with modular side-panel configurations, UV lighting for added disinfection, and customizable nozzle layouts.

HFT is particularly favored in the EU region due to its emphasis on green manufacturing and use of recyclable materials in production. Their systems are widely deployed in R&D labs and high-precision engineering units where zero particulate tolerance is essential.

Mecart Cleanrooms – High-Capacity Modular Air Showers for Large-Scale Operations

Mecart, based in Canada, is a full-service cleanroom manufacturer offering air showers integrated into custom cleanroom environments. Mecart’s Heavy-Duty Industrial Air Shower systems are used in pharmaceutical warehouses, semiconductor factories, and aerospace assembly lines.

These units are designed for high-throughput decontamination, often built with dual-entry and exit lanes. Mecart emphasizes low-noise operation and robust construction using corrosion-resistant panels and advanced airflow diffusers. Their systems are frequently implemented in multi-line cleanroom setups, reflecting their strong presence in industrial-scale operations in North America.

Nicotra Gebhardt – Advanced Air Shower Systems with Italian Engineering Excellence

Nicotra Gebhardt, an Italian-based cleanroom technology firm, plays a notable role in the Cleanroom Air Showers Market across Europe and Asia. Their NanoClean Pro and FlexiAir AS series are engineered for ultra-low noise, high velocity, and minimal maintenance. These units are designed with airflow optimization systems that adapt to real-time personnel traffic, using motion sensors and programmable logic controllers.

Nicotra’s focus on integrating their air showers with HVAC systems and cleanroom monitoring platforms makes their offerings ideal for advanced pharmaceutical and biosafety labs. Their reputation for reliability and system compatibility places them among the most trusted brands in cleanroom engineering.

Suzhou Antai Airtech – Mass Production Expertise in Asia Pacific

China-based Suzhou Antai Airtech is one of the largest producers of cleanroom air showers in the Asia Pacific region. Their product range includes the AT-AS series, which is widely used in semiconductor fabrication plants and electronic assembly cleanrooms across China, India, and Southeast Asia.

Suzhou Antai focuses on cost-effective, scalable production with rapid delivery timelines. Their systems often feature dual-door interlocking systems, high-grade stainless steel, and digital PLC control panels. The brand’s strength lies in supplying large quantities of modular air showers for expansive manufacturing sites with high personnel turnover.

Phoenix Controls – Smart Integration with Building Management Systems

Phoenix Controls, a part of Honeywell, has developed a unique position in the Cleanroom Air Showers Market through its expertise in smart controls and automation. Though primarily known for airflow control valves and environmental sensors, Phoenix offers integrated air shower systems that communicate with cleanroom HVAC and building management systems.

Their air showers are equipped with real-time contamination tracking, entry-logging features, and alert mechanisms that notify facility managers of anomalies in air quality or usage. This smart integration is gaining popularity in mission-critical applications such as biologics production and military-grade electronics manufacturing.

Recent Developments in the Cleanroom Air Showers Market

The Cleanroom Air Showers Market is evolving not just through products but also through strategic partnerships, facility expansions, and compliance-driven upgrades.

– In June 2023, Terra Universal expanded its production facility in California to meet rising demand from pharmaceutical clients, particularly for modular cleanrooms with integrated air showers.

– In March 2024, Esco Group launched the Airstream EcoPlus air shower series, featuring 25% lower energy consumption and a built-in compliance tracking module, aimed at the European biopharmaceutical segment.

– In October 2023, Mecart signed a multi-million-dollar contract to supply air shower-equipped cleanrooms for a new mRNA vaccine manufacturing plant in Quebec, reinforcing its position in North America’s biopharma sector.

– In January 2024, Suzhou Antai Airtech announced the opening of a new export-focused production line targeting Southeast Asia and the Middle East, aimed at providing affordable, ISO-certified cleanroom air showers.

– In February 2024, HFT introduced a next-generation version of its Stericlean-AS 2.0, adding smart airflow analytics and antimicrobial interior finishes, tailored for Germany’s expanding gene therapy R&D sector.

These industry developments underscore how manufacturers in the Cleanroom Air Showers Market are responding to shifts in demand, energy efficiency regulations, and the growing emphasis on smart and sustainable cleanroom operations.

Market Scenario, Demand vs Supply, Average Product Price, Import vs Export, till 2035

- Global Cleanroom Air Showers Market revenue and demand by region

- Global Cleanroom Air Showers Market production and sales volume

- United States Cleanroom Air Showers Market revenue size and demand by country

- Europe Cleanroom Air Showers Market revenue size and demand by country

- Asia Pacific Cleanroom Air Showers Market revenue size and demand by country

- Middle East & Africa Cleanroom Air Showers Market revenue size and demand by country

- Latin America Cleanroom Air Showers Market revenue size and demand by

- Import-export scenario – United States, Europe, APAC, Latin America, Middle East & Africa

- Average product price – United States, Europe, APAC, Latin America, Middle East & Africa

- Market player analysis, competitive scenario, market share analysis

- Business opportunity analysis

Key questions answered in the Global Cleanroom Air Showers Market Analysis Report:

- What is the market size for Cleanroom Air Showers in United States, Europe, APAC, Middle East & Africa, Latin America?

- What is the yearly sales volume of Cleanroom Air Showers and how is the demand rising?

- Who are the top market players by market share, in each product segment?

- Which is the fastest growing business/ product segment?

- What should be the business strategies and Go to Market strategies?

The report covers Cleanroom Air Showers Market revenue, Production, Sales volume, by regions, (further split into countries):

- Asia Pacific (China, Japan, South Korea, India, Indonesia, Vietnam, Rest of APAC)

- Europe (UK, Germany, France, Italy, Spain, Benelux, Poland, Rest of Europe)

- North America (United States, Canada, Mexico)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa

Table of Contents:

Cleanroom Air Showers Market

- Introduction to Cleanroom Air Showers

- Definition and Functionality of Cleanroom Air Showers

- Importance in Contamination Control and Cleanroom Standards

- Types of Cleanroom Air Showers and Their Applications

- Market Overview and Growth Dynamics (2020-2035)

- Current Market Landscape and Key Growth Drivers

- Technological Developments and Innovations

- Growing Demand in Pharmaceutical, Semiconductor, and Biotech Industries

- Global Market Analysis

- Market Size, Share, and Future Projections

- Key Factors Influencing Market Expansion

- Regional Market Distribution and Adoption Rates

- Regional Market Insights

- North America: Demand for Cleanroom Air Showers in High-Tech Industries

- Europe: Strict Regulatory Requirements and Market Trends

- Asia-Pacific: Rapid Growth in Semiconductor and Pharmaceutical Sectors

- Latin America and Middle East: Emerging Markets and Growth Potential

- Key Applications of Cleanroom Air Showers

- Pharmaceutical Manufacturing and Biotechnology Labs

- Semiconductor Fabrication Facilities

- Food Processing and Healthcare Cleanrooms

- Aerospace and Automotive Industries

- Types of Cleanroom Air Showers

- Manual vs. Automated Cleanroom Air Showers

- Single and Double-Entry Air Showers

- High-Efficiency and HEPA/ULPA Filtered Systems

- Custom Cleanroom Air Shower Solutions

- Market Segmentation by Product Type

- Air Showers with Recirculated Air Systems

- High-Performance Air Showers for Class 100 to Class 1000 Environments

- Mobile and Modular Air Showers for Flexibility

- Smart and Automated Air Showers with IoT Integration

- Technological Innovations in Cleanroom Air Showers

- Advancements in Filtration and Airflow Control Technologies

- Integration of IoT for Real-Time Monitoring and Efficiency

- Sustainable and Eco-Friendly Designs in Air Shower Systems

- Competitive Landscape and Market Players

- Leading Manufacturers and Key Service Providers

- Market Share and Strategic Positioning of Top Players

- Analysis of Mergers, Acquisitions, and Strategic Alliances

- Cost Analysis and Financial Outlook

- Initial Investment vs. Long-Term Operational Costs

- Price Variability Based on Features and Customization

- Economic Impact on Industries Adopting Air Showers

- Environmental Impact and Sustainability Considerations

- Energy Efficiency and Reduced Environmental Footprint

- Regulatory Compliance with Environmental Standards

- Use of Recyclable Materials and Eco-Friendly Components

- Challenges and Barriers in the Cleanroom Air Showers Market

- High Capital Expenditure for Installation

- Maintenance and Operational Challenges

- Technological Integration Issues in Existing Cleanroom Systems

- Regulatory and Industry Standards

- Cleanroom Classifications and Compliance Requirements

- Health and Safety Regulations for Cleanroom Air Showers

- Standards for Air Shower Testing and Performance

- Future Trends and Market Predictions (2025-2040)

- Technological Evolution in Air Shower Systems

- Growing Focus on Smart, Automated, and Energy-Efficient Solutions

- The Role of Cleanroom Air Showers in Sustainable Manufacturing

- Investment Opportunities and Market Forecast

- Potential Areas for Investment in Emerging Markets

- Growth Potential in Biotechnology and Pharmaceutical Sectors

- Strategic Recommendations for Market Entry and Expansion

- Supply Chain and Distribution Insights

- Key Manufacturers and Suppliers of Air Shower Systems

- Challenges and Opportunities in Global Supply Chains

- Distribution Channels and Efficient Logistics for Cleanroom Solutions

- Market Forecast and Key Developments

- Projections for Market Growth and Trends (2025-2040)

- Emerging Applications and Opportunities for Cleanroom Air Showers

- Impact of Technological Advancements on Market Evolution

- Strategic Recommendations for Industry Stakeholders

- Best Practices for Manufacturers and Suppliers

- Solutions to Overcome Market Barriers and Drive Adoption

- Recommendations for Improving Market Reach and Customer Satisfaction

“Every Organization is different and so are their requirements”- Datavagyanik

Companies We Work With

Do You Want To Boost Your Business?

drop us a line and keep in touch