Engine Coolant Temperature Sensor (ECT) Market: Analyzing Growth Trends and Key Drivers

- Published 2025

- No of Pages: 120+

- 20% Customization available

Surging Demand for Engine Coolant Temperature Sensor (ECT) Market Amidst Automotive Industry Expansion

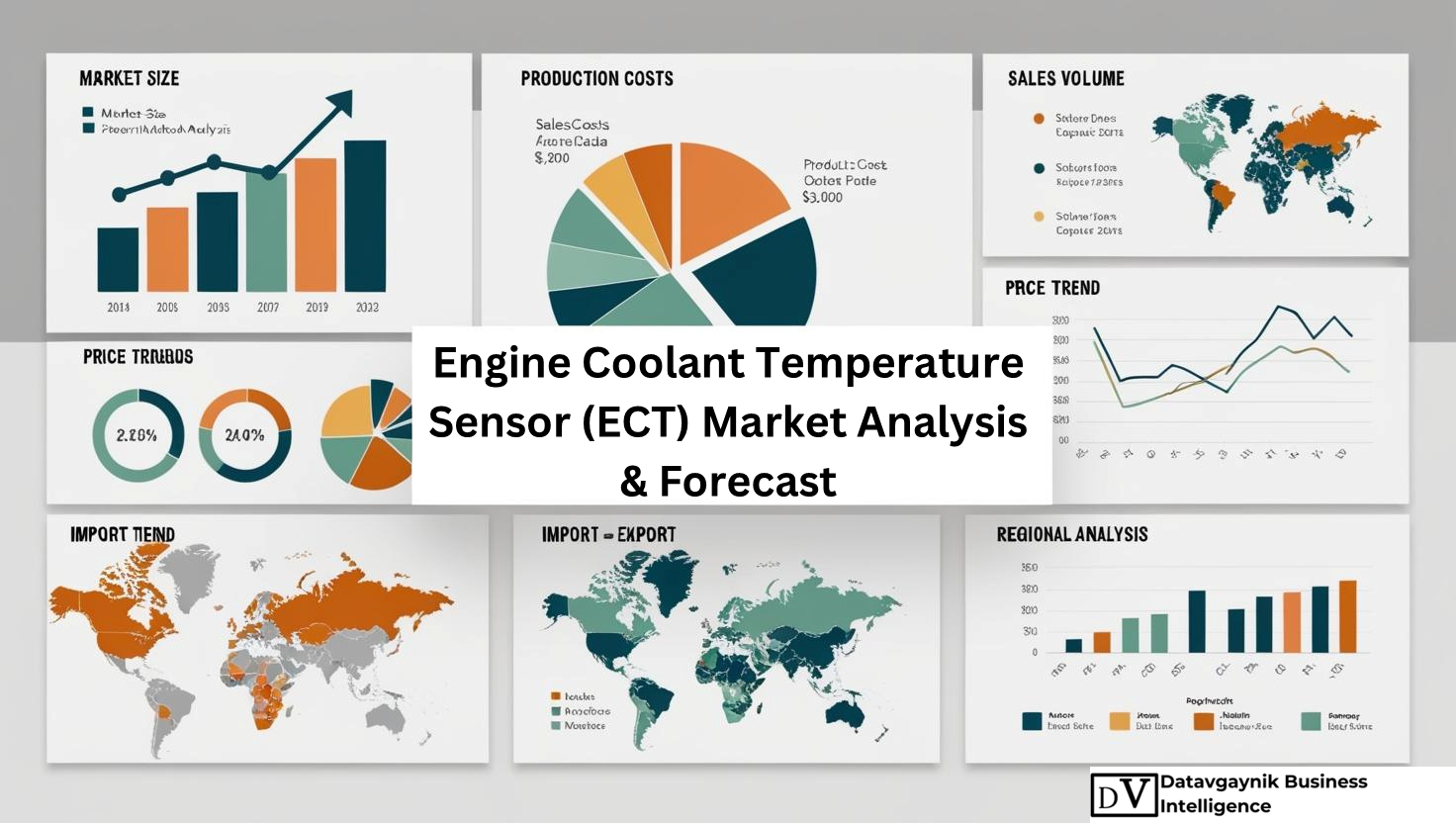

The Engine Coolant Temperature Sensor (ECT) Market is witnessing significant expansion, driven by the growing demand for fuel efficiency, stringent environmental regulations, and rapid advancements in automotive technology. As vehicle manufacturers continue to innovate, ECT sensors play an increasingly critical role in optimizing engine performance, ensuring regulatory compliance, and supporting the shift toward electrification. According to Datavagyanik, the global Engine Coolant Temperature Sensor (ECT) Market is projected to grow at a notable pace, with rising adoption across passenger vehicles, commercial fleets, and electric mobility solutions.

The Engine Coolant Temperature Sensor (ECT) Market is witnessing significant expansion, driven by the growing demand for fuel efficiency, stringent environmental regulations, and rapid advancements in automotive technology. As vehicle manufacturers continue to innovate, ECT sensors play an increasingly critical role in optimizing engine performance, ensuring regulatory compliance, and supporting the shift toward electrification. According to Datavagyanik, the global Engine Coolant Temperature Sensor (ECT) Market is projected to grow at a notable pace, with rising adoption across passenger vehicles, commercial fleets, and electric mobility solutions.

Rising Demand for Fuel-Efficient Vehicles Propelling the Engine Coolant Temperature Sensor (ECT) Market

One of the primary factors driving the Engine Coolant Temperature Sensor (ECT) Market is the growing emphasis on fuel efficiency. Automakers are under continuous pressure to enhance fuel economy due to soaring fuel prices and tightening regulatory norms. For instance, the U.S. Corporate Average Fuel Economy (CAFE) standards mandate an improvement in fuel efficiency by 8% annually for passenger cars and 10% for light trucks. To meet these stringent targets, manufacturers are increasingly integrating ECT sensors into engine control units to optimize fuel combustion and prevent excessive fuel consumption.

Similarly, in Europe, stringent Euro 7 emission standards set to be implemented by 2025 require automakers to enhance vehicle efficiency by reducing emissions, a goal achievable through precise engine thermal management facilitated by Engine Coolant Temperature Sensors (ECTs). This regulatory push is creating sustained demand for ECT sensors, with automakers incorporating them as a standard component in modern powertrains.

Stringent Emission Regulations Driving the Need for Advanced Engine Coolant Temperature Sensors (ECTs)

Governments worldwide are implementing stricter emission norms, propelling the demand for advanced Engine Coolant Temperature Sensors (ECTs). The International Council on Clean Transportation (ICCT) reports that vehicle emissions account for nearly 29% of global CO₂ emissions, necessitating immediate control measures. ECT sensors ensure optimal engine temperatures, minimizing incomplete combustion, which directly reduces NOₓ, CO₂, and hydrocarbon emissions.

In China, where the China VI emission norms are among the strictest globally, automakers must integrate high-precision ECT sensors to achieve 30% lower nitrogen oxide emissions than previous limits. Similarly, India’s BS-VI (Bharat Stage VI) emission standards, which came into effect in 2020, have necessitated widespread adoption of ECT sensors in both passenger and commercial vehicles to comply with the mandate for efficient thermal regulation.

With countries such as Japan and South Korea also enforcing aggressive vehicle emission reduction targets, the Engine Coolant Temperature Sensor (ECT) Market is expected to experience continued expansion as automakers scramble to meet regulatory benchmarks.

Electrification of Vehicles Creating New Growth Avenues for the Engine Coolant Temperature Sensor (ECT) Market

The rising adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs) is transforming the Engine Coolant Temperature Sensor (ECT) Market, as these vehicles rely heavily on thermal management systems. Unlike traditional internal combustion engines (ICEs), EVs require temperature monitoring to prevent overheating of lithium-ion batteries and electric motors.

For example, Tesla’s Battery Thermal Management System (BTMS) employs ECT sensors to maintain optimal operating temperatures, preventing battery degradation and enhancing vehicle performance. Similarly, Toyota’s hybrid lineup, including the Prius and RAV4 Hybrid, incorporates advanced ECT sensor technology to manage both the internal combustion engine and electric motor cooling mechanisms.

Global EV sales surpassed 10 million units in 2022, reflecting a 60% year-over-year growth, as reported by the International Energy Agency (IEA). This surge in EV adoption is amplifying the demand for ECT sensors, as efficient temperature regulation is crucial for enhancing battery lifespan, vehicle safety, and overall energy efficiency.

Advancements in Automotive Electronics Boosting the Engine Coolant Temperature Sensor (ECT) Market

With vehicles becoming increasingly smart and connected, the role of ECT sensors is expanding beyond traditional applications. Modern engine management systems (EMS) integrate ECT sensors to provide real-time diagnostic data, improving vehicle performance and maintenance.

For instance, Bosch and Continental, two of the world’s leading automotive sensor manufacturers, have developed intelligent ECT sensors that transmit continuous temperature data to the vehicle’s ECU (Engine Control Unit). This innovation enables proactive maintenance, preventing potential engine damage due to overheating.

The rising incorporation of Advanced Driver Assistance Systems (ADAS) and autonomous vehicle technology is also fostering demand for ECT sensors, as self-driving systems require continuous engine temperature monitoring to avoid performance failures.

Growing Automotive Aftermarket Sector Accelerating Demand for Engine Coolant Temperature Sensors (ECTs)

The aftermarket demand for Engine Coolant Temperature Sensors (ECTs) is growing steadily due to the increasing number of aging vehicles requiring sensor replacements. According to the European Automobile Manufacturers Association (ACEA), the average age of vehicles in Europe exceeded 11.5 years in 2022, while in the United States, the average vehicle age hit 12.2 years, as reported by IHS Markit.

As vehicles age, coolant temperature sensors degrade, leading to incorrect temperature readings, engine inefficiencies, and increased emissions. This trend is fueling the demand for high-quality aftermarket ECT sensors, particularly in regions with large volumes of aging fleets, such as North America, Europe, and emerging economies in Asia-Pacific.

Increasing Adoption of Smart Sensors in Connected Vehicles

The transition toward connected vehicles and predictive maintenance solutions is further boosting the Engine Coolant Temperature Sensor (ECT) Market. Automakers are integrating IoT-enabled smart sensors into vehicles, allowing real-time monitoring of engine temperature fluctuations.

For example, General Motors’ OnStar Diagnostics System utilizes ECT sensors to notify drivers about potential overheating issues before they escalate into serious engine failures. Similarly, BMW’s predictive maintenance platform employs ECT sensor data analytics to optimize engine cooling strategies, reducing maintenance costs and improving vehicle longevity.

The rise of 5G connectivity and vehicle-to-everything (V2X) communication is expected to further enhance the capabilities of ECT sensors, making them an indispensable component in next-generation vehicles.

Conclusion: The Future of the Engine Coolant Temperature Sensor (ECT) Market

The Engine Coolant Temperature Sensor (ECT) Market is poised for robust growth, fueled by advancements in fuel efficiency, emission control regulations, EV adoption, and smart automotive technologies. As automakers invest in next-generation engine cooling solutions, the demand for high-performance, durable, and intelligent ECT sensors will continue to rise.

With governments mandating lower emissions and improved fuel economy, automakers, suppliers, and aftermarket vendors must innovate to meet evolving market demands. The expanding role of ECT sensors in EV battery thermal management, ADAS, and predictive maintenance solutions presents lucrative opportunities for sensor manufacturers and technology providers in the coming decade.

According to Datavagyanik, the Engine Coolant Temperature Sensor (ECT) Market will remain a pivotal segment in the global automotive industry, shaping the future of vehicle efficiency, sustainability, and performance optimization.

Geographical Demand and Production Trends in the Engine Coolant Temperature Sensor (ECT) Market

The Engine Coolant Temperature Sensor (ECT) Market is expanding across key global regions, driven by rising vehicle production, regulatory mandates, and technological advancements. Regional demand patterns vary based on automotive industry maturity, emission regulations, and the pace of electric vehicle (EV) adoption. While developed markets in North America and Europe emphasize high-precision sensors for emission compliance, Asia-Pacific is witnessing exponential growth due to massive vehicle production volumes. Additionally, emerging economies in South America and the Middle East are gradually increasing their adoption of ECT sensors, reflecting expanding automotive sectors.

North America: Innovation-Driven Growth in the Engine Coolant Temperature Sensor (ECT) Market

North America remains a key contributor to the Engine Coolant Temperature Sensor (ECT) Market, largely due to the region’s strong automotive industry and growing focus on fuel efficiency. The United States and Canada are experiencing heightened demand for ECT sensors, driven by stringent Corporate Average Fuel Economy (CAFE) standards and consumer preference for fuel-efficient vehicles.

For instance, in the United States, where the average vehicle lifespan has crossed 12.2 years, aftermarket demand for ECT sensors is on the rise. IHS Markit reports that over 280 million vehicles are in operation in the U.S., with nearly 15 million vehicles added annually. This expanding fleet creates sustained demand for replacement ECT sensors in the aftermarket segment.

Additionally, North America is a leading producer of advanced ECT sensors, with manufacturers such as Sensata Technologies, Honeywell, and Delphi Technologies investing in next-generation automotive sensors that integrate IoT and predictive analytics. The push towards EV adoption, spearheaded by companies like Tesla, Ford, and General Motors, is further amplifying the need for ECT sensors, particularly for thermal management systems in electric powertrains.

Europe: Regulatory-Driven Expansion of the Engine Coolant Temperature Sensor (ECT) Market

The European Engine Coolant Temperature Sensor (ECT) Market is heavily influenced by emission reduction policies and the region’s leadership in electric vehicle production. The Euro 7 emission standards, set to take effect in 2025, require automakers to integrate precise thermal management systems, where ECT sensors play a critical role.

For example, Germany, the largest automotive producer in Europe, has ramped up investments in advanced sensor technologies. Major manufacturers such as Bosch, Continental, and Hella are leading the way in developing high-precision ECT sensors that cater to the demands of both internal combustion engines (ICEs) and EVs. With over 3.5 million vehicles produced annually in Germany, the integration of ECT sensors remains a key priority for OEMs.

In France and the UK, rising EV sales are driving demand for specialized ECT sensors. Renault and Peugeot are incorporating ECT sensors into their latest hybrid models, ensuring optimal cooling for electric powertrains. Similarly, Jaguar Land Rover’s EV lineup, including the Jaguar I-PACE, employs sophisticated ECT sensors to manage battery thermal conditions, preventing overheating and efficiency losses.

The aftermarket sector in Europe is also witnessing strong demand for ECT sensors, as aging vehicle fleets require sensor replacements to maintain engine performance and emission compliance.

Asia-Pacific: The Largest Growth Market for Engine Coolant Temperature Sensors (ECTs)

Asia-Pacific dominates the Engine Coolant Temperature Sensor (ECT) Market, driven by high vehicle production, rising EV adoption, and government regulations enforcing thermal efficiency standards. China, Japan, South Korea, and India are the key players in the region.

China: A Powerhouse in the Engine Coolant Temperature Sensor (ECT) Market

China is the largest automotive market globally, producing over 27 million vehicles annually. The country’s aggressive push towards electrification, backed by government subsidies and investments, is creating immense demand for ECT sensors.

For example, BYD and NIO, two leading Chinese EV manufacturers, are deploying ECT sensors in their vehicles to regulate battery pack temperatures, enhancing performance and battery lifespan. The Chinese government’s policy to mandate 30% electric vehicle penetration by 2030 is expected to further drive demand for high-performance ECT sensors.

Additionally, China is a major producer and exporter of ECT sensors, with companies such as Denso China, Baolong Sensors, and Shanghai Aerospace supplying both domestic and international markets.

Japan & South Korea: Technology-Driven Growth in the Engine Coolant Temperature Sensor (ECT) Market

Japan and South Korea are at the forefront of automotive sensor innovation. Companies like Toyota, Honda, Hyundai, and Kia are integrating ECT sensors into hybrid and electric vehicles to meet stringent fuel efficiency norms.

For instance, Toyota’s Hybrid Synergy Drive system utilizes advanced ECT sensors to ensure seamless operation between internal combustion engines and electric motors. Similarly, Hyundai’s E-GMP platform for electric vehicles, used in models like the Hyundai Ioniq 5 and Kia EV6, employs ECT sensors to regulate battery temperature, maximizing range and performance.

India: An Emerging Market for Engine Coolant Temperature Sensors (ECTs)

India’s growing automotive industry is fueling demand for ECT sensors, particularly as the country shifts towards BS-VI emission norms. With over 3.7 million passenger vehicles sold annually, automakers such as Tata Motors, Maruti Suzuki, and Mahindra are increasingly adopting ECT sensors to enhance engine efficiency and compliance.

The Indian EV market, which saw a 300% growth in 2022, is another catalyst for ECT sensor adoption, particularly in two-wheelers and commercial electric fleets.

Segmentation Analysis of the Engine Coolant Temperature Sensor (ECT) Market

The Engine Coolant Temperature Sensor (ECT) Market can be segmented by vehicle type, sensor type, end-user, application, and sales channel, each presenting unique growth opportunities.

By Vehicle Type: Passenger Vehicles Leading the Market

The passenger vehicle segment dominates the ECT sensor market, accounting for over 60% of total demand. Rising consumer expectations for fuel efficiency and vehicle longevity are driving manufacturers to integrate ECT sensors as standard components.

In the commercial vehicle segment, demand for ECT sensors is growing, particularly in heavy-duty trucks and buses that require robust thermal management to enhance engine durability and fuel economy.

With the rapid growth of electric vehicles, demand for ECT sensors in EVs and hybrids is surging, as thermal management remains a key factor in battery performance and vehicle efficiency.

By Sensor Type: Thermistors Dominating the Engine Coolant Temperature Sensor (ECT) Market

Among sensor types, thermistors remain the most widely used due to their cost-effectiveness and reliability. These sensors, used in both ICE and electric vehicles, dominate 70% of the market.

However, Resistor Temperature Detectors (RTDs) and thermocouples are gaining traction, particularly in high-performance vehicles that require precision temperature monitoring.

By Application: ECU and Battery Thermal Management Driving Growth

The Engine Control Unit (ECU) segment remains the largest application area for ECT sensors, accounting for over 50% of market demand. As engine performance optimization becomes a priority, demand for ECT sensors in ECUs is rising.

Additionally, the battery thermal management segment is witnessing rapid growth, particularly in electric and hybrid vehicles, where ECT sensors are critical for maintaining battery health.

By Sales Channel: OEMs and Aftermarket Demand Growing Simultaneously

The OEM sector accounts for the largest share of ECT sensor sales, as automakers integrate these sensors into new vehicle models. However, the aftermarket segment is expanding, driven by rising vehicle lifespans and increased maintenance needs.

Conclusion: A Strong Growth Outlook for the Engine Coolant Temperature Sensor (ECT) Market

The Engine Coolant Temperature Sensor (ECT) Market is poised for continued expansion, driven by vehicle electrification, emission regulations, and advancements in sensor technology. While Asia-Pacific dominates production and consumption, North America and Europe remain critical markets due to regulatory compliance needs.

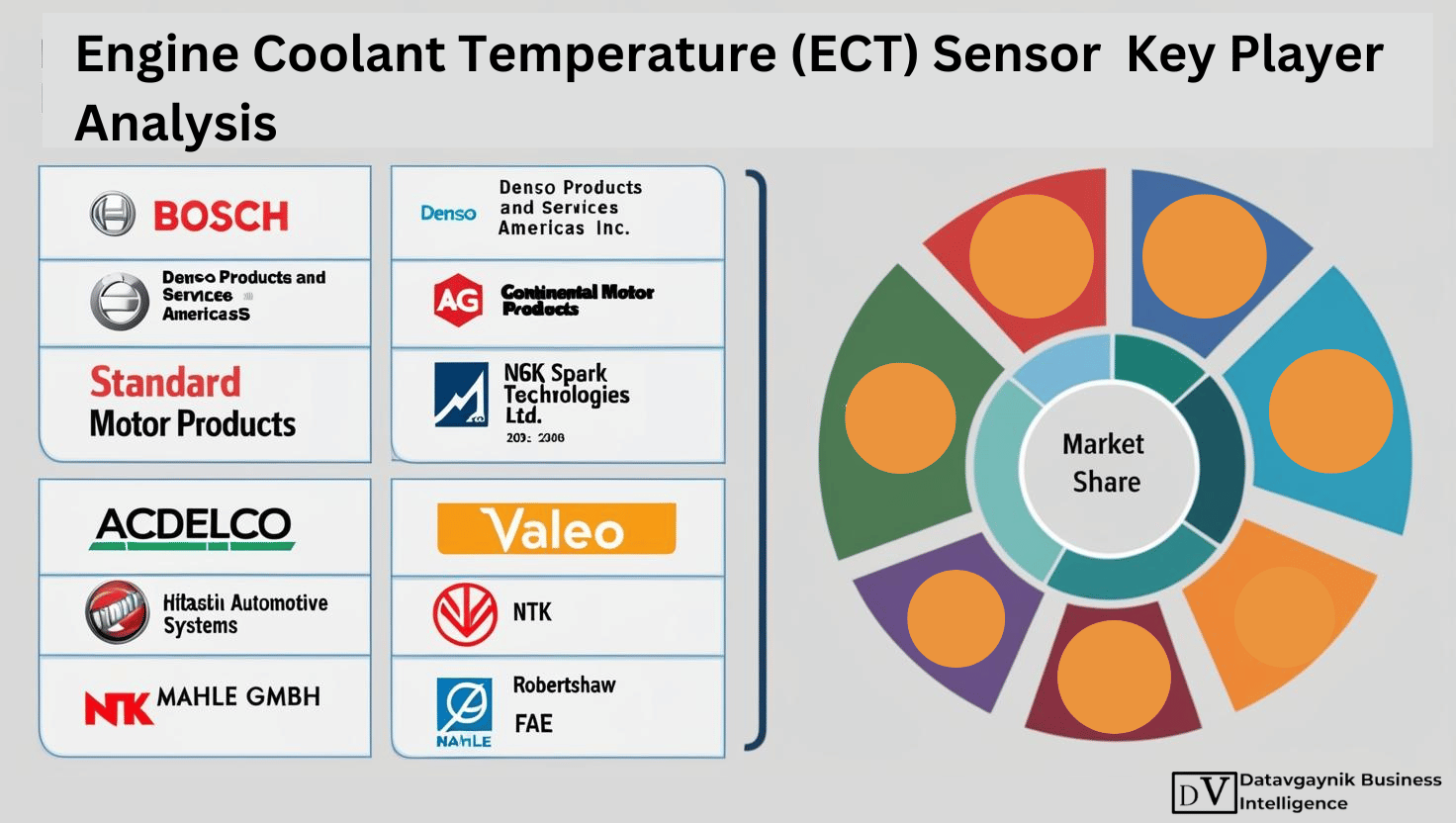

Key Manufacturers in the Engine Coolant Temperature Sensor (ECT) Market

The Engine Coolant Temperature Sensor (ECT) Market is highly competitive, with several established players driving innovation and product advancements. Leading automotive sensor manufacturers are investing in precision engineering, IoT integration, and predictive maintenance solutions, catering to the evolving needs of both internal combustion engine (ICE) and electric vehicles (EVs). Below is a detailed analysis of key ECT sensor manufacturers, their flagship product lines, and their contributions to the market.

- Bosch – Precision and Innovation in Engine Coolant Temperature Sensors (ECTs)

Robert Bosch GmbH, one of the largest automotive component manufacturers, is a leading producer of high-performance ECT sensors. Bosch’s temperature sensors are widely used in passenger vehicles, commercial trucks, and hybrid powertrains, ensuring engine efficiency and regulatory compliance.

Key Product Lines:

Bosch 0280130093 Coolant Temperature Sensor – A widely used OEM-grade sensor designed for engine control unit (ECU) integration, ensuring precise temperature readings. Bosch Wide-Range Temperature Sensors – Used in modern vehicle diagnostics systems, providing real-time data for fuel injection optimization and emission control. Bosch continues to lead in smart automotive sensors, integrating ECT technology into cloud-based predictive maintenance systems, helping OEMs reduce downtime and improve vehicle performance.

- Continental AG – Advanced Thermal Management Solutions

Continental AG, a German automotive technology giant, offers Engine Coolant Temperature Sensors (ECTs) designed for high accuracy and durability. The company specializes in high-precision thermistors that support low-emission and fuel-efficient vehicles.

Key Product Lines:

Continental OE Temperature Sensor Series – Known for its robust construction, these sensors are compatible with leading automakers like Volkswagen, BMW, and Mercedes-Benz. Continental Digital ECT Sensors – These next-generation sensors integrate AI-based analytics, helping automakers enhance ECU performance and prevent overheating in EVs. Continental’s thermal management expertise makes it a preferred supplier for hybrid and electric vehicles, with recent collaborations focusing on ECT sensors for battery cooling applications.

- Denso Corporation – Automotive Sensor Leader in Asia-Pacific

Denso Corporation, a Japan-based Tier 1 supplier, is a global leader in automotive thermal management systems. The company provides ECT sensors that are widely used in Toyota, Honda, and Nissan vehicles.

Key Product Lines:

Denso First Time Fit Coolant Temperature Sensors – Designed for precise engine monitoring, ensuring optimal fuel combustion and emission reduction. Denso Smart Temperature Sensors – Integrated with hybrid and EV platforms, these sensors provide real-time battery cooling optimization. Denso continues to expand its presence in the EV sector, with ECT sensor innovations tailored for electric powertrains.

- Delphi Technologies – Engine Management Experts

Delphi Technologies, now part of BorgWarner, offers high-quality Engine Coolant Temperature Sensors (ECTs) focused on engine efficiency and emission control. Delphi sensors are widely used in passenger cars, commercial trucks, and performance vehicles.

Key Product Lines:

Delphi OE Coolant Temperature Sensors – Designed for accurate thermal monitoring, ensuring ECU efficiency and reduced fuel consumption. Delphi Performance Sensors – Used in high-performance and turbocharged engines, ensuring stable temperature regulation under extreme conditions. With an increasing focus on fuel-efficient technologies, Delphi is integrating smart diagnostics into its ECT sensor portfolio, offering enhanced engine protection.

- Honeywell – High-Precision Automotive Sensors

Honeywell manufactures automotive sensors, including high-precision ECT sensors for passenger and commercial vehicles. The company specializes in rugged, temperature-resistant sensors designed for harsh environments.

Key Product Lines:

Honeywell PX2 Series Temperature Sensors – Featuring rugged construction, ideal for heavy-duty commercial vehicles. Honeywell Thermocouple-Based ECT Sensors – Used in high-performance and racing vehicles, offering ultra-fast temperature detection. Honeywell continues to invest in advanced sensor technologies, integrating ECT sensors into predictive analytics platforms for fleet management applications.

- NGK Spark Plug Co. (NTK) – Specialist in Engine Sensors

NGK/NTK, a leading name in engine sensor technology, offers high-precision ECT sensors for both OEMs and aftermarket applications.

Key Product Lines:

NTK Engine Coolant Temperature Sensors – Engineered for high-temperature stability, used in performance and hybrid vehicles. NTK Smart Thermal Sensors – Designed for real-time diagnostics, improving engine control and fuel efficiency. NTK is investing heavily in sensor miniaturization and smart diagnostics integration, targeting next-generation vehicle platforms.

- Standard Motor Products (SMP) – Leader in Aftermarket ECT Sensors

Standard Motor Products (SMP) specializes in high-quality aftermarket ECT sensors, supplying North America and Europe.

Key Product Lines:

SMP Intermotor Coolant Temperature Sensors – Cost-effective replacements for aging OEM sensors, widely used in older vehicles. SMP Heavy-Duty ECT Sensors – Designed for commercial fleets, ensuring stable thermal regulation under continuous heavy loads.With an extensive distribution network, SMP is a top supplier for auto repair shops and independent service providers.

Recent News and Industry Developments in the Engine Coolant Temperature Sensor (ECT) Market

The Engine Coolant Temperature Sensor (ECT) Market is experiencing rapid technological advancements and market expansions, with key developments shaping its future.

- Bosch Expands Sensor Production for EVs (February 2024)

Bosch announced an investment in new production facilities in Germany and China, focusing on next-generation ECT sensors optimized for EV battery cooling.

- Continental Unveils AI-Driven ECT Sensors (January 2024)

Continental launched intelligent ECT sensors that use machine learning algorithms to predict thermal fluctuations, improving vehicle diagnostics and predictive maintenance.

- Denso Partners with Toyota for Next-Gen Hybrid ECT Sensors (December 2023)

Denso is developing high-efficiency ECT sensors in collaboration with Toyota, ensuring thermal stability in hybrid powertrains for the next generation of Prius models.

- Delphi Technologies Integrates Smart ECT Sensors in Electric Trucks (November 2023)

Delphi Technologies revealed a new line of ECT sensors specifically designed for electric commercial vehicles, enhancing thermal management efficiency.

- Rising Aftermarket Demand for ECT Sensors in Aging Vehicles (October 2023)

Industry reports indicate a surge in aftermarket sales, as vehicle owners seek cost-effective ECT sensor replacements to meet fuel efficiency and emission norms.

Conclusion: The Future of the Engine Coolant Temperature Sensor (ECT) Market

The Engine Coolant Temperature Sensor (ECT) Market is evolving with advancements in smart diagnostics, AI integration, and electric vehicle applications. Leading manufacturers like Bosch, Continental, Denso, and Delphi are investing in next-generation ECT sensors, aligning with stringent fuel efficiency and emission regulations.

With vehicle electrification accelerating and global emission targets tightening, demand for high-precision, smart, and IoT-enabled ECT sensors is set to surge. As OEMs and aftermarket suppliers continue to innovate, ECT sensors will remain a critical component in modern automotive thermal management systems.

Other recently published reports:

“Every Organization is different and so are their requirements”- Datavagyanik

Companies We Work With

Do You Want To Boost Your Business?

drop us a line and keep in touch