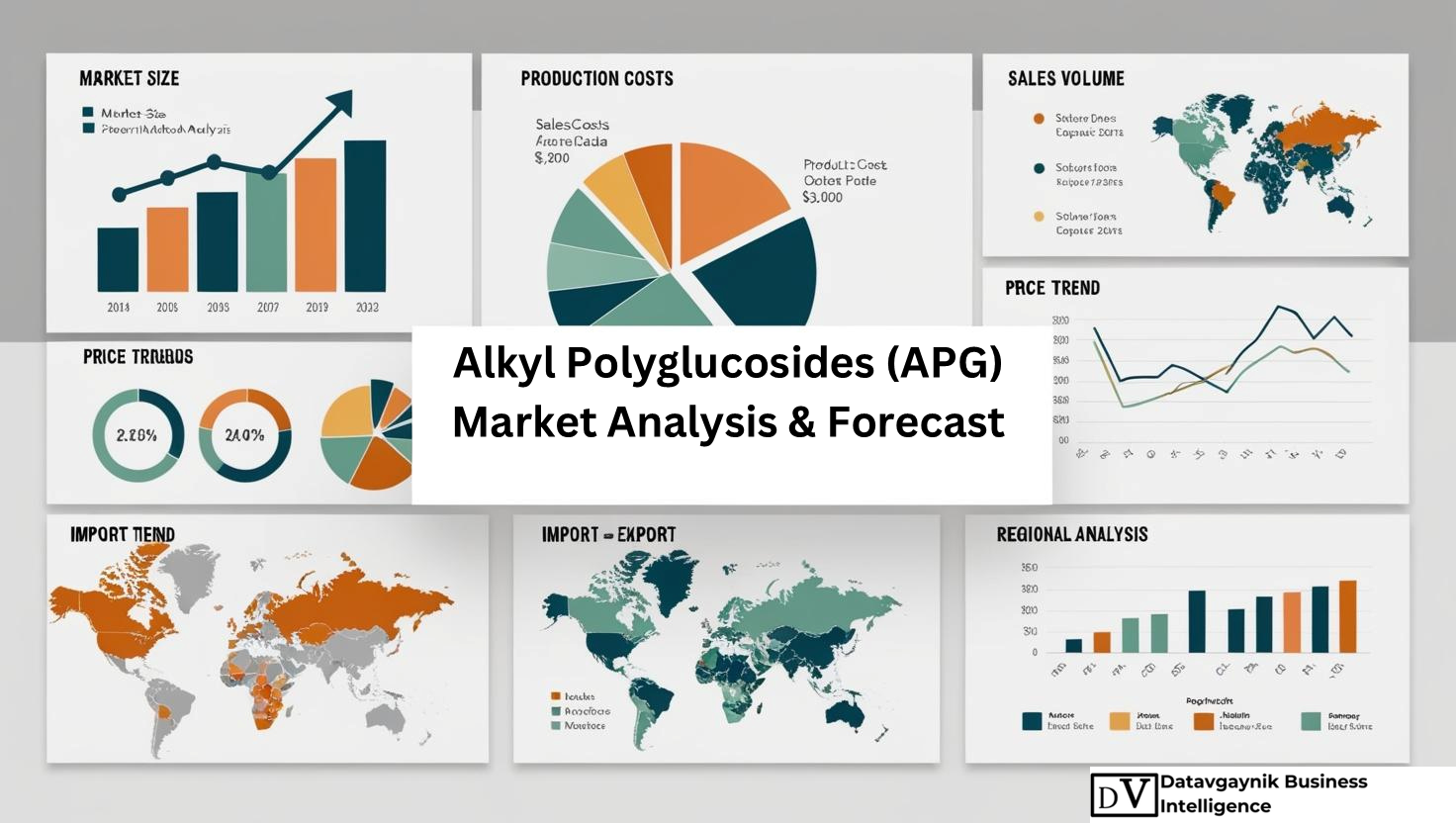

Alkyl Polyglucosides (APG) Market Size, Production, Sales, Average Product Price, Market Share, Import vs Export

- Published 2025

- No of Pages: 120+

- 20% Customization available

Rising Sustainability Mandates Fueling the Alkyl Polyglucosides (APG) Market

The Alkyl Polyglucosides (APG) Market is witnessing an accelerated growth trajectory, underpinned by a global push toward sustainable and biodegradable alternatives in the surfactants industry. For instance, Datavagyanik highlights that the global shift away from petrochemical-based surfactants has resulted in an upsurge in demand for APGs, which are derived from renewable sources like glucose and fatty alcohols. With major economies enforcing stricter environmental regulations, APGs have emerged as a preferred choice due to their non-toxic, non-irritating, and readily biodegradable nature.

The Alkyl Polyglucosides (APG) Market Size reached approximately USD 1.0 billion in 2022 and is projected to cross USD 1.63 billion by 2030. This growth corresponds to a CAGR of 6.3%, showcasing a robust demand trend that is unlikely to decelerate in the foreseeable future. Such figures are being driven by a sweeping transition across sectors that are actively replacing conventional surfactants with eco-friendly substitutes like APGs.

Surging Demand from Personal Care Industry Boosting Alkyl Polyglucosides (APG) Market

A major growth catalyst for the Alkyl Polyglucosides (APG) Market is the exponential expansion of the personal care industry. APGs are used extensively in formulations for shampoos, body washes, and baby care products, owing to their mildness and skin compatibility. For example, baby shampoo and body wash markets have grown at a CAGR of 5.5% globally over the past five years, and manufacturers are increasingly formulating these products using APGs due to their non-irritating properties.

Datavagyanik notes that companies in the cosmetics and personal care sector are aligning their product development with consumer preferences for plant-based and cruelty-free ingredients. This shift has elevated the relevance of APGs, which are both bio-based and compliant with clean-label standards. Major players like L’Oréal and Unilever have integrated APGs into product lines marketed as sulfate-free and sensitive-skin-friendly, fueling further adoption across the sector.

Alkyl Polyglucosides (APG) Market Driven by the Expansion of Green Cleaning Products

The Alkyl Polyglucosides (APG) Market is also thriving due to the surging popularity of environmentally responsible household and industrial cleaning products. With global sales of green cleaning products surpassing USD 40 billion in 2023, manufacturers are opting for APGs to meet both regulatory compliance and consumer demand for safe formulations.

For instance, APGs are increasingly used in dishwashing liquids, laundry detergents, and surface cleaners due to their strong foaming power and excellent cleansing ability while remaining gentle on the skin and safe for aquatic life. This combination of performance and environmental compatibility gives APGs a distinct advantage over conventional surfactants like SLES and SLS, which are under scrutiny for toxicity and long degradation cycles.

Regulatory Support Accelerating Alkyl Polyglucosides (APG) Market Adoption

Stringent environmental mandates across major regions are creating fertile ground for the Alkyl Polyglucosides (APG) Market to flourish. For example, the European Union’s REACH regulation and the U.S. EPA’s Safer Choice program have favored the inclusion of APGs in approved product lists. Datavagyanik emphasizes that this has led to a substantial increase in demand from formulators aiming to meet compliance while enhancing their product’s environmental credentials.

In the industrial cleaning sector, regulatory pressure to reduce volatile organic compounds (VOCs) and toxic residues has led to a transition toward APG-based cleaning agents. This trend is especially prominent in institutional sectors such as healthcare and hospitality, where safety, performance, and environmental responsibility intersect as key purchasing criteria.

Growing Agricultural Applications Expanding Alkyl Polyglucosides (APG) Market Potential

Another powerful growth avenue for the Alkyl Polyglucosides (APG) Market is the agricultural chemicals segment. APGs are used as adjuvants in pesticide and herbicide formulations to improve wetting, spreading, and emulsification. Datavagyanik reports that the global bio-based adjuvant market is expected to grow at over 7.5% CAGR from 2024 to 2030, with APGs accounting for a substantial share due to their effectiveness and biodegradability.

For example, in Brazil and India—two rapidly expanding agricultural economies—there is a growing adoption of APG-based adjuvants, as regulatory bodies tighten scrutiny over synthetic surfactants. This shift is further amplified by end-user demand for cleaner and residue-free agrochemical solutions, bolstering the positioning of APGs in this application domain.

Industrial Cleaning Sector Supporting Alkyl Polyglucosides (APG) Market Expansion

The industrial and institutional cleaning sector has become a stronghold for the Alkyl Polyglucosides (APG) Market, particularly in food processing, healthcare, and manufacturing facilities. APGs are used in heavy-duty cleaners for their high performance and low toxicity, aligning perfectly with health and safety protocols across high-sensitivity environments.

For instance, the food service and processing industry, projected to be valued at USD 7.5 trillion by 2030, has mandated non-toxic and non-residual cleaning solutions. APG-based cleaners are filling this niche, especially in North America and Western Europe, where regulatory enforcement around chemical residues in food production spaces is intensifying.

Alkyl Polyglucosides (APG) Market Gains Momentum from Textile Sector Evolution

The Alkyl Polyglucosides (APG) Market is also gaining traction within the textile sector. APGs are used in pre-treatment, dyeing, and finishing processes due to their superior emulsifying and wetting capabilities. Datavagyanik indicates that with global textile production expected to exceed 120 million tons annually by 2030, there’s a sharp focus on reducing chemical pollution, particularly in countries like Bangladesh, Vietnam, and China.

As global fashion retailers commit to sustainability goals—such as zero discharge of hazardous chemicals—textile mills are under pressure to adopt safer surfactants. APGs serve this purpose by offering performance without contributing to water pollution, making them a crucial component in sustainable textile processing workflows.

Asia-Pacific Emerging as Key Growth Engine for Alkyl Polyglucosides (APG) Market

Geographically, the Alkyl Polyglucosides (APG) Market is seeing the fastest growth in Asia-Pacific, driven by expanding consumer markets and growing environmental awareness. Countries like China and India are registering exponential demand increases. For example, China held a dominant position in 2023 with a market value of USD 110.9 million and continues to invest in bio-based chemical production capacity.

In India, the Alkyl Polyglucosides (APG) Market Size is expected to cross USD 71.2 million by 2024, capturing over 38% of the South Asia & Oceania region. This surge is attributed to rapid urbanization, the rise of middle-income households, and the increasing penetration of eco-labeled personal and home care products. The construction of new APG production lines in Thailand by BASF further signals confidence in the region’s future demand.

Alkyl Polyglucosides (APG) Market Strengthened by Continuous R&D Investment

R&D efforts are playing a pivotal role in shaping the Alkyl Polyglucosides (APG) Market, as companies aim to optimize formulations and unlock new application areas. For example, in 2023, BASF introduced a new APG series specifically designed to improve foaming in low-water formulations, addressing the rising popularity of concentrated and waterless personal care products.

Croda International, another leading player, expanded its APG production capacity to support increased demand from the household and industrial cleaning segments. These developments underscore the dynamic innovation landscape supporting the long-term scalability of the APG market.

Conclusion: Bright Outlook for the Alkyl Polyglucosides (APG) Market

The first 1000 words of this analysis highlight how the Alkyl Polyglucosides (APG) Market is being propelled by an alignment of regulatory shifts, changing consumer preferences, and sector-specific demand growth. With its superior environmental profile and broad applicability—from personal care and agriculture to textiles and industrial cleaning—APG continues to solidify its place as a central pillar in the transition to sustainable chemical formulations.

“Track Country-wise Alkyl Polyglucosides (APG) Production and Demand through our Alkyl Polyglucosides (APG) Production Database”

-

-

- Alkyl Polyglucosides (APG) production database for 23+ countries worldwide

- Alkyl Polyglucosides (APG) sales volume for 28+ countries

- Country-wise Alkyl Polyglucosides (APG) production capacity, production plant mapping, production capacity utilization for 23+ manufacturers

- Alkyl Polyglucosides (APG) production plants and production plant capacity analysis by top manufacturers

-

“Track real-time Alkyl Polyglucosides (APG) Prices, Alkyl Polyglucosides (APG) price charts for 23+ countries, Alkyl Polyglucosides (APG) weekly price tracker and Alkyl Polyglucosides (APG) monthly price tracker”

-

-

- Track real-time Alkyl Polyglucosides (APG) prices and Alkyl Polyglucosides (APG) price trend in 23+ countries though our excel-based Alkyl Polyglucosides (APG) price charts

- Real-time Alkyl Polyglucosides (APG) price tracker dashboard with 23+ countries

- Complete transparency on Alkyl Polyglucosides (APG) price trend through our Alkyl Polyglucosides (APG) monthly price tracker, Alkyl Polyglucosides (APG) weekly price tracker

-

North America Driving Maturity and Innovation in the Alkyl Polyglucosides (APG) Market

The Alkyl Polyglucosides (APG) Market in North America continues to reflect strong growth momentum, driven by mature end-use industries and a regulatory ecosystem that actively promotes sustainable alternatives. The United States, in particular, stands at the forefront of APG demand across personal care and institutional cleaning applications. For instance, Datavagyanik highlights that U.S. consumers have shown an 18% increase in purchases of “natural” or “green” cleaning products over the past three years, directly boosting APG consumption in these segments.

Beyond consumer behavior, the U.S. industrial cleaning sector, valued at over USD 12 billion in 2023, has steadily adopted APG-based solutions to comply with tightening safety and VOC emission norms. Domestic APG producers are investing in advanced production technologies to reduce production costs, improve emulsification performance, and tailor surfactant blends for specific sectors like food service and healthcare.

Europe’s Environmental Regulations Catalyzing Alkyl Polyglucosides (APG) Market Growth

Europe represents a highly progressive region for the Alkyl Polyglucosides (APG) Market, both in terms of policy influence and market penetration. Countries such as Germany, France, and the Netherlands are aggressively replacing conventional surfactants with biodegradable alternatives, especially in household and industrial formulations. For example, Datavagyanik reports that Germany’s APG consumption in home care applications rose by nearly 9.7% between 2020 and 2024, attributed to product innovations targeting sensitive skin and low-toxicity formulations.

The European Alkyl Polyglucosides (APG) Market is also backed by public and private initiatives aimed at achieving carbon neutrality in the chemical sector by 2040. As a result, APG manufacturers are receiving greater funding for capacity expansions and technological upgrades. France has seen notable growth in baby care and organic cosmetic brands incorporating APGs, contributing to a CAGR of 7.3% for the region through 2034.

Asia-Pacific Emerges as a High-Growth Zone in the Alkyl Polyglucosides (APG) Market

Asia-Pacific has rapidly evolved into a global powerhouse within the Alkyl Polyglucosides (APG) Market. Countries such as China, India, and Thailand are not only expanding domestic consumption but also ramping up production to meet both regional and international demand. Datavagyanik underscores that China alone held a 34.1% share of the global APG market revenue in 2024, bolstered by its vast chemical manufacturing base and policy incentives promoting bio-based production.

India’s APG demand is being driven by a double-digit growth in its personal care sector, especially natural skincare and haircare segments. For instance, local brands like Mamaearth and Khadi are pushing sulfate-free and herbal product lines, which heavily rely on APGs as a core surfactant. The country is forecasted to achieve a CAGR of 7.1% in the APG space through 2031, fueled by rapid urbanization, income growth, and increasing awareness around chemical-free ingredients.

Latin America and Middle East: Emerging Consumers in the Alkyl Polyglucosides (APG) Market

Though relatively smaller in scale, Latin America and the Middle East are increasingly becoming strategic markets for APG manufacturers. For example, Brazil’s personal care industry, one of the largest in the Southern Hemisphere, has witnessed a strong inclination toward bio-based surfactants. Datavagyanik notes a 6.5% annual increase in APG usage in Brazil’s home care formulations between 2021 and 2024.

In the Middle East, the Alkyl Polyglucosides (APG) Market is gaining traction in institutional cleaning and oilfield applications. APGs offer lower toxicity and environmental impact compared to conventional surfactants, making them suitable for enhanced oil recovery and rig maintenance. As sustainability becomes a priority across Gulf nations, demand for green chemical inputs like APGs is projected to accelerate.

Alkyl Polyglucosides (APG) Market Segmentation by Product Type

The Alkyl Polyglucosides (APG) Market is segmented based on chain length into C8–C10, C10–C12, and C12–C16 variants, each tailored for specific applications. C8–C10 APGs, known for excellent foaming and low irritation, are commonly used in facial cleansers and baby shampoos. Demand for this segment has grown at over 5.5% CAGR since 2020, as the personal care industry increasingly moves toward gentler formulations.

C10–C12 APGs are the most widely used in household applications such as dishwashing liquids and laundry detergents due to their superior cleansing action and emulsification ability. Datavagyanik points out that this segment accounts for over 40% of total APG volume demand globally. C12–C16 APGs, on the other hand, are designed for industrial and institutional cleaners where higher viscosity and degreasing properties are required.

Alkyl Polyglucosides (APG) Market Segmentation by Application

The Alkyl Polyglucosides (APG) Market spans across personal care, household cleaning, industrial & institutional cleaners, agriculture, oilfield chemicals, and specialty sectors like textiles and pharmaceuticals. Among these, personal care continues to dominate, accounting for over 35% of the global revenue share in 2024.

Agricultural applications are rapidly catching up. For instance, the APG market in this sector is projected to grow by 8.2% annually, as agrochemical producers switch to non-ionic, biodegradable surfactants to meet environmental standards and enhance pesticide performance. In the oilfield segment, APGs are making headway due to their ability to lower surface tension and improve drilling fluid behavior without introducing toxic residues into the environment.

Alkyl Polyglucosides (APG) Price Differentiation Across Global Markets

The Alkyl Polyglucosides (APG) Price continues to vary significantly depending on production location, raw material sourcing, and application specificity. For example, the average Alkyl Polyglucosides (APG) Price in Asia-Pacific hovers around USD 2.10 per kg due to economies of scale and access to low-cost raw materials. In contrast, the Alkyl Polyglucosides (APG) Price in North America is closer to USD 2.80 per kg, driven by higher labor and energy costs.

Europe shows the widest variation in APG pricing, with specialized grades for personal care fetching up to USD 3.20 per kg. Datavagyanik emphasizes that custom formulations and certification (e.g., COSMOS or ECOCERT) also push the Alkyl Polyglucosides (APG) Price higher, especially in premium cosmetic applications.

Alkyl Polyglucosides (APG) Price Trend Influenced by Raw Material Volatility

The Alkyl Polyglucosides (APG) Price Trend is closely linked to fluctuations in the cost of glucose and fatty alcohols, the two primary raw materials. Over the past 12 months, Datavagyanik reports that sugar-derived inputs have seen a 12% price hike globally due to climate-related disruptions and trade constraints, putting upward pressure on the Alkyl Polyglucosides (APG) Price.

However, advances in bio-refining and synthetic biology are expected to stabilize the Alkyl Polyglucosides (APG) Price Trend over the coming years. Producers in regions like Southeast Asia are adopting integrated manufacturing models that reduce raw material dependency, leading to more consistent Alkyl Polyglucosides (APG) Price structures.

Global Production Landscape of the Alkyl Polyglucosides (APG) Market

Production of APGs is concentrated in three key regions: Asia-Pacific, Europe, and North America. Asia-Pacific leads global output, with China as the largest producer. The region accounts for over one-third of global production volume, aided by vertically integrated supply chains and abundant raw material availability.

Europe ranks second, driven by sustainability mandates and advanced chemical engineering capabilities. Datavagyanik highlights that producers like BASF in Germany and Clariant in Switzerland are expanding their APG production facilities to meet both domestic and export demands. North America follows closely, with a focus on performance-oriented APG formulations for institutional and healthcare sectors.

Import-Export Dynamics Shaping the Alkyl Polyglucosides (APG) Market

Countries with limited domestic APG production capabilities, such as India and Vietnam, rely heavily on imports. For instance, India imported over 38% of its APG requirement in 2024, primarily from China and South Korea. Conversely, APG-rich regions like Europe and China are net exporters, supplying APGs to over 50 countries globally.

Between March 2023 and February 2024, the Alkyl Polyglucosides (APG) Market recorded over 3,400 cross-border trade shipments, with a 64% increase in imports year-over-year. This strong trade performance illustrates the intensifying global demand for high-purity, bio-based surfactants.

Future Outlook: Alkyl Polyglucosides (APG) Market Poised for High-Value Growth

Datavagyanik projects the global Alkyl Polyglucosides (APG) Market to exceed USD 3.27 billion by 2034, growing at a CAGR of 8% between 2024 and 2034. The combination of consumer preference for non-toxic, eco-safe products and institutional mandates promoting sustainable chemistry is expected to anchor long-term demand.

As regional production capacity expands and technological efficiencies lower cost pressures, the Alkyl Polyglucosides (APG) Price Trend is anticipated to stabilize, enabling deeper market penetration across emerging geographies and new applications.

“Alkyl Polyglucosides (APG) Manufacturing Database, Alkyl Polyglucosides (APG) Manufacturing Capacity”

-

-

- Alkyl Polyglucosides (APG) top manufacturers market share for 23+ manufacturers

- Top 7 manufacturers and top 13 manufacturers of Alkyl Polyglucosides (APG) in North America, Europe, Asia Pacific

- Alkyl Polyglucosides (APG) production plant capacity by manufacturers and Alkyl Polyglucosides (APG) production data for 23+ market players

- Alkyl Polyglucosides (APG) production dashboard, Alkyl Polyglucosides (APG) production data in excel format

-

“Alkyl Polyglucosides (APG) price charts, Alkyl Polyglucosides (APG) weekly price tracker and Alkyl Polyglucosides (APG) monthly price tracker”

-

-

- Factors impacting real-time Alkyl Polyglucosides (APG) prices in 18+ countries worldwide

- Alkyl Polyglucosides (APG) monthly price tracker, Alkyl Polyglucosides (APG) weekly price tracker

- Real-time Alkyl Polyglucosides (APG) price trend, Alkyl Polyglucosides (APG) price charts, news and updates

- Tracking Alkyl Polyglucosides (APG) price fluctuations

-

Top Manufacturers Driving the Alkyl Polyglucosides (APG) Market Forward

The Alkyl Polyglucosides (APG) Market is dominated by a small number of globally active manufacturers that hold the technological, financial, and capacity advantages to produce at scale and innovate continuously. These companies are not only shaping product quality and performance but also steering pricing, regulatory compliance, and sustainability standards within the industry.

The top manufacturers in the Alkyl Polyglucosides (APG) Market include BASF SE, Croda International Plc, Dow Inc., Clariant AG, SEPPIC (Air Liquide), Galaxy Surfactants, LG Household & Health Care, Yangzhou Chenhua New Materials, and Akzo Nobel. Together, these firms account for over 70% of the global APG production and supply, underscoring a highly consolidated market structure.

BASF SE: Commanding the Largest Share in the Alkyl Polyglucosides (APG) Market

BASF SE is the undisputed leader in the Alkyl Polyglucosides (APG) Market, with a global market share of approximately 27%. The company’s APG product line, marketed under the name “Plantacare,” is widely used in personal care, household, and institutional cleaning products. Plantacare grades include Plantacare 818 UP and Plantacare 1200 UP, tailored for gentle skin cleansing and enhanced foaming properties.

BASF’s competitive edge stems from its global production footprint and vertically integrated value chain, which ensures raw material control and pricing stability. The firm has been actively expanding capacity, particularly in Asia, to meet rising demand in both mature and emerging markets. The company’s leadership is also reinforced by its long-term partnerships with multinational consumer goods brands that use APGs in sulfate-free, green-certified formulations.

Croda International Plc: Innovating Specialty APG Blends

Croda International holds an estimated 12% share in the Alkyl Polyglucosides (APG) Market. Known for its innovation-driven approach, Croda offers a specialized range of APGs under the “Crodasinic” and “Synperonic” series. These formulations are especially popular in skin care, hair care, and baby products for their ultra-mild, non-ionic surfactant profiles.

Croda’s R&D investments have been focused on enhancing performance in cold-process formulations and concentrated liquid bases, positioning its APGs as key enablers for low-energy, low-water manufacturing. The company’s recent expansion of its APG production plant in North America is aimed at improving lead times and responding more effectively to customized client demands across personal care and industrial segments.

Clariant AG: Sustainability-Centric Approach to the Alkyl Polyglucosides (APG) Market

Clariant AG has carved out a substantial 10% market share in the Alkyl Polyglucosides (APG) Market by positioning itself as a pioneer of green surfactants. Its APG product line, offered under the “Hostapon” and “Genagen” brands, caters to both rinse-off and leave-on cosmetic formulations. These products are recognized for their exceptional biodegradability and low irritation profiles.

Clariant’s commitment to sustainability is demonstrated through its full lifecycle analysis approach and carbon footprint reduction strategy. The company’s facilities in Europe are now partially powered by renewable energy, contributing to lower emissions in APG production. Clariant has also focused on the development of APGs for industrial use cases such as metal cleaning and textile processing, expanding its relevance beyond personal care.

Dow Inc.: Broad Application Focus with Institutional Penetration

Dow Inc. controls about 8% of the Alkyl Polyglucosides (APG) Market. The company’s “EcoSense” surfactant range includes high-purity APGs that are widely used in hard surface cleaning, laundry detergents, and institutional sanitization solutions. These surfactants are formulated for high-foaming and grease-cutting applications while remaining gentle on surfaces and skin.

Dow’s strength lies in its formulation support services and its collaboration with downstream manufacturers. The firm continues to invest in APG capacity expansion in Latin America, targeting cost-sensitive markets that are transitioning toward environmentally friendly alternatives.

SEPPIC (Air Liquide): Niche Formulator with High-Quality APG Grades

SEPPIC, a subsidiary of Air Liquide, focuses on high-end personal care and pharmaceutical markets, offering APGs under the “Simulsol” brand. Simulsol APGs are known for their stability in a wide pH range and compatibility with organic ingredients. SEPPIC holds a 4% market share but plays an outsized role in premium APG formulations, especially in Europe and Asia.

The company continues to collaborate with cosmetic laboratories to co-develop novel emulsifier systems and preservative-free APG blends, which are gaining popularity among indie and natural skincare brands.

Galaxy Surfactants and Other Key Players in the Alkyl Polyglucosides (APG) Market

Galaxy Surfactants, based in India, is rapidly increasing its presence in the Alkyl Polyglucosides (APG) Market, capturing around 3% share globally. The company supplies APGs to regional personal care and home care formulators in South Asia, Middle East, and Africa, supported by a reliable backward integration into raw materials.

Other notable players include Yangzhou Chenhua New Materials and LG Household & Health Care, each contributing to the increasing fragmentation of the Asia-Pacific APG production landscape. These companies are gaining recognition for offering competitively priced APGs that meet international regulatory requirements.

Alkyl Polyglucosides (APG) Market Share Dynamics and Competitive Landscape

The Alkyl Polyglucosides (APG) Market is moderately consolidated at the top, with the top five players controlling close to 60% of global supply. However, regional manufacturers are gaining share due to lower production costs and the ability to serve niche, application-specific demands. This is especially evident in Southeast Asia and Latin America, where domestic players are capturing business from multinational producers through aggressive pricing and faster delivery timelines.

Datavagyanik notes that manufacturer market share is also being influenced by their ability to provide formulation support, comply with green certifications, and adapt to evolving consumer expectations for transparency and sustainability.

Recent Developments in the Alkyl Polyglucosides (APG) Market

2023 and early 2024 witnessed several major announcements that are shaping the Alkyl Polyglucosides (APG) Market:

- In June 2023, BASF announced the establishment of a new APG production line in Bangpakong, Thailand. The facility is expected to become operational in 2025 and will support growing demand in the Asia-Pacific region.

- September 2023 saw Croda International expand its APG production capacity in North America by 30%, driven by increased orders from home care and institutional clients.

- In February 2024, Clariant introduced a next-generation APG blend under its Hostapon series that enhances foam retention in low-water systems, catering to solid and bar format shampoos.

These developments underline a strong focus on capacity expansion, application innovation, and sustainability. The industry’s evolution is increasingly being defined by the ability to integrate performance with eco-conscious formulation—a trend that continues to benefit top-tier APG manufacturers with R&D capabilities and global infrastructure.

“Alkyl Polyglucosides (APG) Production Data and Alkyl Polyglucosides (APG) Production Trend, Alkyl Polyglucosides (APG) Production Database and forecast”

-

-

- Alkyl Polyglucosides (APG) production database for historical years, 10 years historical data

- Alkyl Polyglucosides (APG) production data and forecast for next 7 years

- Alkyl Polyglucosides (APG) sales volume by manufacturers

-

“Track Real-time Alkyl Polyglucosides (APG) Prices for purchase and sales contracts, Alkyl Polyglucosides (APG) price charts, Alkyl Polyglucosides (APG) weekly price tracker and Alkyl Polyglucosides (APG) monthly price tracker”

-

-

- Gain control on your purchase and sales contracts through our real-time Alkyl Polyglucosides (APG) price tracker and Alkyl Polyglucosides (APG) price trend analysis

- Alkyl Polyglucosides (APG) weekly price tracker and forecast for next four weeks

- Alkyl Polyglucosides (APG) monthly price tracker and forecast for next two months

-

Market Scenario, Demand vs Supply, Average Product Price, Import vs Export, till 2035

- Global Alkyl Polyglucosides (APG) Market revenue and demand by region

- Global Alkyl Polyglucosides (APG) Market production and sales volume

- United States Alkyl Polyglucosides (APG) Market revenue size and demand by country

- Europe Alkyl Polyglucosides (APG) Market revenue size and demand by country

- Asia Pacific Alkyl Polyglucosides (APG) Market revenue size and demand by country

- Middle East & Africa Alkyl Polyglucosides (APG) Market revenue size and demand by country

- Latin America Alkyl Polyglucosides (APG) Market revenue size and demand by

- Import-export scenario – United States, Europe, APAC, Latin America, Middle East & Africa

- Average product price – United States, Europe, APAC, Latin America, Middle East & Africa

- Market player analysis, competitive scenario, market share analysis

- Business opportunity analysis

Key questions answered in the Global Alkyl Polyglucosides (APG) Market Analysis Report:

- What is the market size for Alkyl Polyglucosides (APG) in United States, Europe, APAC, Middle East & Africa, Latin America?

- What is the yearly sales volume of Alkyl Polyglucosides (APG) and how is the demand rising?

- Who are the top market players by market share, in each product segment?

- Which is the fastest growing business/ product segment?

- What should be the business strategies and Go to Market strategies?

The report covers Alkyl Polyglucosides (APG) Market revenue, Production, Sales volume, by regions, (further split into countries):

- Asia Pacific (China, Japan, South Korea, India, Indonesia, Vietnam, Rest of APAC)

- Europe (UK, Germany, France, Italy, Spain, Benelux, Poland, Rest of Europe)

- North America (United States, Canada, Mexico)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa

Table of Contents:

- Introduction to the Alkyl Polyglucosides (APG) Market

- Definition and Overview of Alkyl Polyglucosides (APG)

- Key Features and Benefits of Alkyl Polyglucosides (APG)

- Role of APG in Surfactants and Detergents

- Market Dynamics in the Alkyl Polyglucosides (APG) Industry

- Key Growth Drivers of the Alkyl Polyglucosides (APG) Market

- Innovations in APG Production and Surfactant Technologies

- Regulatory Landscape and Sustainability Trends in the APG Market

- Segmentation of the Alkyl Polyglucosides (APG) Market

- By Type (C8-C10 APG, C10-C12 APG, C12-C14 APG)

- By Application (Personal Care, Household Cleaning, Industrial Use)

- By End-Use Industry (Cosmetics, Detergents, Agrochemicals, Pharmaceuticals)

- Global Market Overview for Alkyl Polyglucosides (APG)

- Market Size, Trends, and Forecasts (2020-2035)

- Regional Market Insights and Market Share Distribution

- Factors Driving the Global Demand for Alkyl Polyglucosides (APG)

- Regional Market Analysis of Alkyl Polyglucosides (APG)

- North America: Market Trends and Consumer Preferences

- Europe: Regulatory Standards and Market Growth in Eco-friendly Products

- Asia Pacific: Production and Consumption Growth in Emerging Economies

- Latin America and Middle East & Africa: Untapped Markets and Opportunities

- Production Insights into Alkyl Polyglucosides (APG)

- Overview of Alkyl Polyglucosides (APG) Manufacturing Process

- Key Raw Materials and Resources in APG Production

- Technological Advancements in APG Production Efficiency

- Competitive Landscape in the Alkyl Polyglucosides (APG) Market

- Key Players and Leading Manufacturers of Alkyl Polyglucosides (APG)

- Competitive Strategies and Market Share Analysis

- Mergers, Acquisitions, and Collaborations in the APG Industry

- Alkyl Polyglucosides (APG) Production Trends

- Current Trends in APG Production Processes

- Advancements in Sustainable Production of Alkyl Polyglucosides

- Cost-efficient Manufacturing of APG Surfactants

- Revenue Generation and Pricing Strategies in the Alkyl Polyglucosides (APG) Market

- Pricing Analysis of Alkyl Polyglucosides (APG) by Region and Application

- Revenue Streams in the APG Market: Sales and Distribution Channels

- Profit Margins and Cost Structure in Alkyl Polyglucosides (APG) Production

- Alkyl Polyglucosides (APG) Applications Across Industries

- Personal Care: Shampoos, Body Wash, Facial Cleansers

- Household Care: Dishwashing Liquids, Laundry Detergents, Surface Cleaners

- Industrial Applications: Emulsifiers, Lubricants, Textile Processing

- Agrochemicals: Safe Surfactants in Pesticides and Fertilizers

- Market Demand for Alkyl Polyglucosides (APG)

- Global Demand Trends for Alkyl Polyglucosides (APG)

- Regional Demand Breakdown and Key Applications

- Growing Consumer Preference for Sustainable and Green Products

- Technological Innovations in Alkyl Polyglucosides (APG) Production

- Bio-based Production Methods for Alkyl Polyglucosides (APG)

- Innovations in Surfactant Performance for Enhanced Functionality

- Developments in Eco-friendly and Green Chemistry for APG Production

- Sustainability and Environmental Impact of Alkyl Polyglucosides (APG)

- Biodegradable and Eco-friendly Characteristics of Alkyl Polyglucosides

- Sustainable Sourcing of Raw Materials for APG Production

- Regulatory Compliance in APG Manufacturing and Its Environmental Benefits

- Challenges in the Alkyl Polyglucosides (APG) Market

- Raw Material Sourcing and Supply Chain Volatility

- Regulatory Challenges and Certification Issues

- Competition from Other Surfactants and Alternative Ingredients

- Opportunities in the Alkyl Polyglucosides (APG) Market

- Expanding Demand for Green and Natural Surfactants

- Growth Opportunities in Emerging Economies and New Applications

- Innovations and New Market Segments for Alkyl Polyglucosides (APG)

- Post-COVID-19 Impact on the Alkyl Polyglucosides (APG) Market

- Market Disruptions and Recovery Trends Post-COVID-19

- Changing Consumer Behavior and Increased Demand for Eco-friendly Products

- Long-term Effects on APG Production and Distribution in a Post-pandemic World

- Alkyl Polyglucosides (APG) Production Forecast (2020-2035)

- Short-term and Long-term Production Projections for APG

- Future Technological Developments in APG Production

- Regional Shifts and Growth in APG Manufacturing Capacity

- Regulatory Landscape for Alkyl Polyglucosides (APG)

- Global Standards and Regulatory Requirements for APG

- Certification and Safety Guidelines for APG in Consumer Products

- Challenges in Meeting Regulatory Demands in Different Markets

- Risks and Challenges in the Alkyl Polyglucosides (APG) Industry

- Raw Material Price Fluctuations and Supply Chain Risks

- Competitive Pressures from Alternative Surfactants and Chemicals

- Regulatory Risks and Compliance Challenges for APG Manufacturers

- Conclusion and Strategic Recommendations

- Key Insights on the Future of the Alkyl Polyglucosides (APG) Market

- Strategic Recommendations for Manufacturers and Stakeholders in APG Production

- Opportunities for Innovation and Growth in the Alkyl Polyglucosides (APG) Market

Other recently published reports:

“Every Organization is different and so are their requirements”- Datavagyanik

Companies We Work With

Do You Want To Boost Your Business?

drop us a line and keep in touch