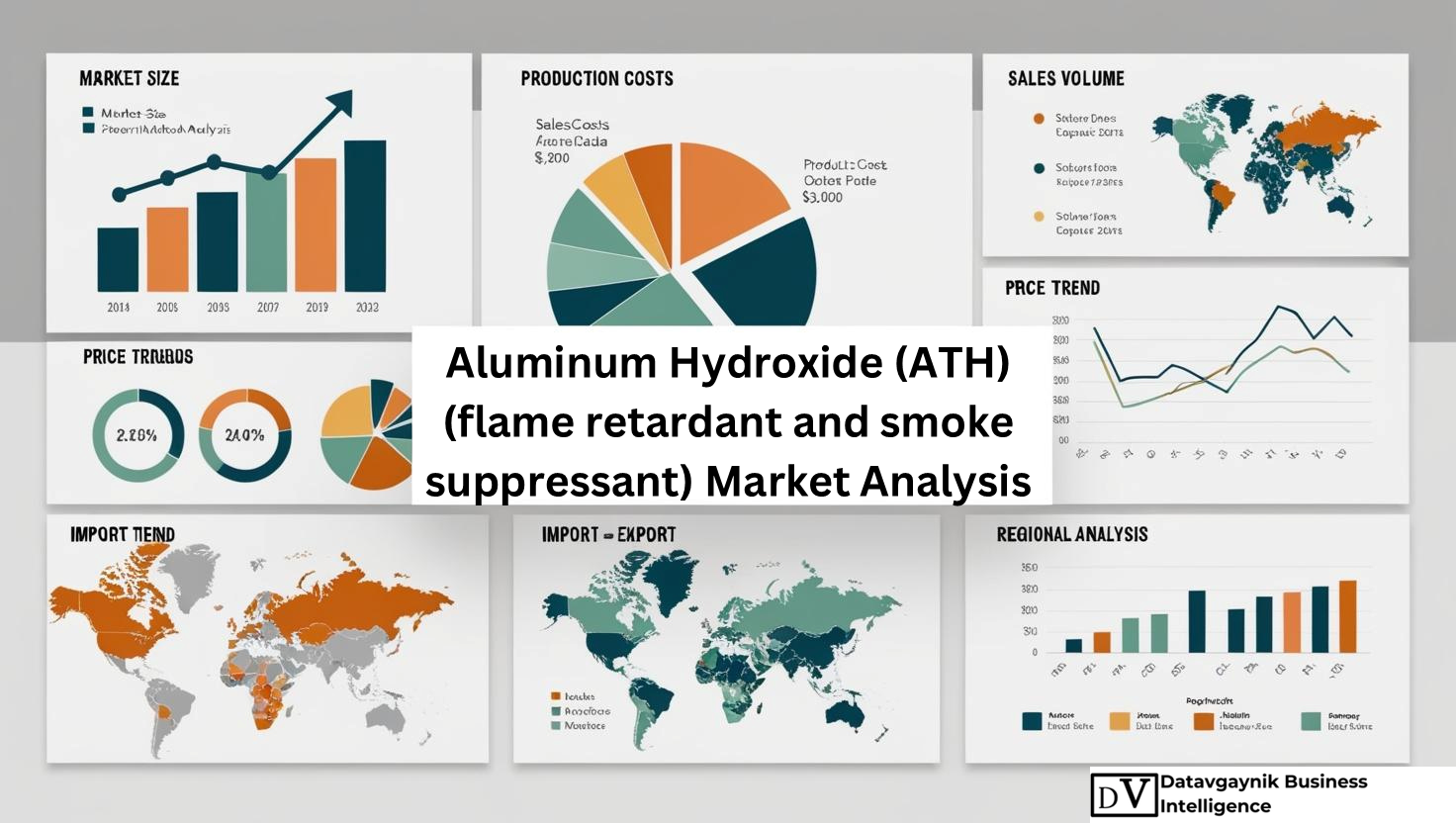

Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market Size, Production, Sales, Average Product Price, Market Share, Import vs Export

- Published 2025

- No of Pages: 120+

- 20% Customization available

Rising Fire Safety Standards Driving the Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market

The Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market is witnessing accelerated growth as fire safety regulations tighten globally. For instance, in the construction industry, stricter building codes across North America, Europe, and parts of Asia have fueled demand for flame-retardant materials. Aluminum hydroxide, due to its water-releasing decomposition and non-toxic nature, is being widely adopted in building insulation, wire coatings, and cable sheathing. Datavagyanik estimates suggest that global fire safety material consumption in construction increased by over 7.2% in 2024 alone, with ATH emerging as a top choice among non-halogenated retardants.

Construction Sector Expansion Amplifying the Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market Demand

The rapid expansion of residential and commercial infrastructure continues to support the Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market. For example, global construction output surpassed USD 12.9 trillion in 2023 and is projected to grow at a CAGR of 6.1% until 2030. Within this context, ATH’s role in green building initiatives is becoming increasingly pivotal. It is incorporated into LEED-compliant insulation, fireproof wallboards, and cable insulation systems. ATH’s ability to act as a flame retardant while also suppressing smoke emissions makes it indispensable in fire-safe architecture. The material’s role is particularly critical in high-rise construction and underground transit systems where smoke suppression is a key concern.

Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market Fueled by Automotive Industry Transformation

The global shift towards electric vehicles (EVs) has opened new avenues for the Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market. Electric vehicles require components capable of withstanding high temperatures without emitting harmful substances in case of thermal events. For instance, battery casings, wiring harnesses, and under-hood plastics are increasingly using ATH-based polymer additives. In 2024, EV production reached over 13 million units globally, a 31% increase from the previous year, driving higher consumption of halogen-free flame retardants. Datavagyanik notes that ATH consumption in EVs alone rose by over 9.5% year-on-year, highlighting its rising strategic value in next-gen vehicle designs.

Regulatory Pressure Boosting the Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market

Stringent environmental and health regulations across developed economies have accelerated the shift away from halogenated flame retardants, propelling the Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market forward. In Europe, directives like RoHS and REACH continue to restrict the use of toxic fire-retardant additives in electronics and automotive components. In response, manufacturers are transitioning to safer alternatives like ATH. For example, Germany and France have seen double-digit growth in ATH imports since 2022, driven by sustainability targets. The material’s non-toxic, low-corrosive nature makes it a regulatory-compliant solution, especially in applications involving close human contact, such as furniture foams and cable insulations.

Electronics Industry Expansion Strengthening the Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market

The continued rise in consumer electronics has significantly influenced the Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market. With global smartphone shipments surpassing 1.3 billion units in 2023 and demand for smart home devices, laptops, and wearable electronics rising, the need for thermally stable, flame-retardant components is more important than ever. ATH is used in printed circuit boards (PCBs), connectors, and charging cables due to its high thermal stability and smoke-suppressing properties. The transition to halogen-free devices across major manufacturers such as Apple, Samsung, and Huawei is expected to increase ATH consumption in this segment by 11% annually through 2027.

Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market Gaining from Green Building Materials Surge

Global interest in sustainable and green building materials continues to fuel the Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market. For example, initiatives such as the U.S. Green Building Council’s LEED and Europe’s BREEAM certification frameworks emphasize the use of non-toxic, sustainable materials. ATH fits squarely into these guidelines as a mineral-based, halogen-free additive. In 2023, green-certified buildings represented nearly 24% of all new construction globally. Datavagyanik projects that this share will exceed 30% by 2026, directly amplifying the demand for ATH in building panels, coatings, and sealants engineered for fire resistance and low smoke generation.

Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market Size Expanding with Polymer Applications

The growing use of flame-retardant additives in polymers and plastics is another key factor expanding the Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market Size. ATH is extensively integrated into thermoplastics like polyethylene, PVC, and polypropylene used in cables, automotive interiors, and electrical enclosures. For example, Datavagyanik research reveals that the flame-retardant polymer segment grew by 8.4% in 2024, with ATH-based compounds accounting for over 40% of halogen-free additives. Its ability to decompose into water and alumina without producing toxic gases makes it ideal for protective enclosures, especially in consumer-facing goods and industrial machinery.

Fire-Retardant Textiles Enhancing the Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market

Fire-retardant textiles represent a growing end-use segment within the Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market. For instance, protective clothing used by firefighters, industrial workers, and military personnel is increasingly manufactured using ATH-treated fabrics. These materials meet NFPA and ISO fire safety standards while maintaining breathability and comfort. Moreover, the use of ATH in upholstery fabrics for aviation, railways, and hospitality has increased. The global flame-retardant textile market, valued at over USD 6 billion in 2024, is projected to grow at 6.8% CAGR, with ATH adoption rising steadily due to its performance and environmental credentials.

Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market Supported by Smoke Suppression Benefits

The smoke-suppressing capabilities of ATH are a key differentiator driving the Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market across sectors. In fire events, smoke—not flames—is the primary cause of fatalities. For example, in tunnel construction and underground public transport systems, cable insulation materials incorporating ATH are preferred due to their low smoke emission profiles. Datavagyanik’s data suggests that flame retardants offering smoke suppression are growing in demand at 7.9% CAGR, with ATH leading among mineral-based alternatives. Its effectiveness in reducing smoke density without releasing corrosive or toxic by-products is influencing material choices in risk-sensitive environments.

Global Transition to Electric Infrastructure Fueling the Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market

The electrification of infrastructure—including renewable energy systems, smart grids, and EV charging networks—is another major growth driver for the Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market. These systems require flame-retardant materials to safeguard against thermal incidents caused by power surges or short circuits. For instance, in solar installations, ATH is being used in panel junction boxes and wire coatings. With global investments in renewable energy exceeding USD 1.8 trillion in 2023, the need for fire-safe, compliant materials such as ATH is expected to grow. Datavagyanik forecasts a 9.3% CAGR for ATH consumption in energy infrastructure applications through 2030.

Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market Size Bolstered by Sustainable Innovation

The Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market Size is also being bolstered by innovations aimed at enhancing the performance and sustainability of flame retardants. For example, nano-engineered ATH particles are now being developed to improve dispersion in polymers, reduce loading levels, and enhance mechanical properties of the final product. These advanced formulations are gaining traction in premium applications such as aerospace interiors, EV battery modules, and electronic packaging. Companies investing in R&D to produce high-efficiency ATH variants with lower environmental impact are well-positioned to capture market share as regulatory and performance expectations continue to rise.

“Track Country-wise Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Production and Demand through our Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Production Database”

-

-

- Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) production database for 23+ countries worldwide

- Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) sales volume for 28+ countries

- Country-wise Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) production capacity, production plant mapping, production capacity utilization for 23+ manufacturers

- Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) production plants and production plant capacity analysis by top manufacturers

-

“Track real-time Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Prices, Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) price charts for 23+ countries, Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) weekly price tracker and Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) monthly price tracker”

-

-

- Track real-time Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) prices and Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) price trend in 23+ countries though our excel-based Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) price charts

- Real-time Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) price tracker dashboard with 23+ countries

- Complete transparency on Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) price trend through our Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) monthly price tracker, Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) weekly price tracker

-

Geographical Demand for Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market

The demand for Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market is geographically diverse, driven by varying industrial applications, regulatory frameworks, and infrastructure development across different regions.

North America

North America remains a significant market for Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market, with the United States leading the charge in both demand and production. The region’s rigorous fire safety standards in sectors such as construction, automotive, and electronics are contributing to the heightened use of ATH. For instance, the U.S. construction industry, valued at over USD 1.5 trillion in 2024, has seen an increasing preference for non-toxic, fire-safe materials, particularly in high-rise buildings and commercial spaces. The growing demand for electric vehicles (EVs) in the U.S. has also spurred ATH consumption, with a 32% increase in EV sales from 2023 to 2024, driving the need for safer, flame-retardant components in vehicle wiring and battery enclosures.

Europe

In Europe, the Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market is influenced by the region’s focus on environmental sustainability and stringent fire safety regulations. Countries like Germany, France, and the United Kingdom are prominent consumers of ATH due to their strong industrial bases in construction, automotive, and electronics. The growing adoption of green building standards, such as LEED and BREEAM, has further fueled ATH demand, particularly in fire-resistant building materials. Additionally, the shift toward electric mobility and halogen-free flame retardants in Europe is driving an increase in ATH use in automotive applications. The European market for ATH has grown by an estimated 8.3% annually in recent years, with further expansion expected as more countries adopt stricter fire safety codes.

Asia-Pacific

The Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market in the Asia-Pacific region is experiencing substantial growth, with China, India, and Japan emerging as major players. In China, rapid urbanization and industrialization have spurred the demand for fire-resistant materials in the construction, automotive, and electronics industries. The country’s construction sector, valued at USD 2.3 trillion in 2024, is particularly focused on using flame-retardant materials to meet stringent fire safety codes. Similarly, India’s automotive and electronics industries are growing, with ATH becoming a key component in automotive wiring, battery systems, and consumer electronics. Japan, known for its technological advancements, is leveraging ATH in high-performance electronics and fire-safe building materials. The demand for Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market in this region is expected to increase by over 9% annually, driven by infrastructure development and regulatory shifts.

Latin America and Middle East

In Latin America and the Middle East, demand for Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market is growing as a result of rapid urbanization, infrastructure development, and increased focus on fire safety. In countries like Brazil, Mexico, and the UAE, construction projects are increasingly integrating flame-retardant materials to comply with new building safety codes. Additionally, the automotive and electronics sectors in these regions are expanding, leading to a rise in the use of ATH in various applications. The Middle East, with its robust construction and real estate development activities, is expected to witness a surge in ATH demand in the coming years.

Production and Supply Chain Dynamics of Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market

The production landscape of the Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market is characterized by a few key manufacturing hubs, notably in Asia-Pacific, North America, and Europe.

Asia-Pacific: Production Hub of Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market

Asia-Pacific, particularly China, dominates the production of Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market, accounting for over 55% of global output. The country’s extensive industrial base, low labor costs, and strong supply chain infrastructure make it the primary producer of ATH globally. Additionally, India and Japan contribute significantly to regional production, with Japan focusing on high-grade ATH for electronics and automotive applications. China’s ATH production is expected to expand by over 7% annually, driven by both domestic consumption and increasing export demand.

North America and Europe: Key Regional Players in ATH Production

North America and Europe, while not as dominant as Asia, are still important players in the Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market production. The U.S. has several manufacturing facilities producing ATH primarily for the construction and automotive sectors, with an annual production growth rate of 6.2%. Europe, with countries like Germany, France, and the United Kingdom, focuses on producing high-quality ATH variants suitable for applications in fire-resistant coatings and electronics. However, these regions are also increasingly reliant on imports from Asia-Pacific due to the lower production costs in the latter. European production of ATH is expected to grow at 5.5% CAGR, with a shift toward sustainable and eco-friendly production methods.

Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market Segmentation

The Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market is segmented across various end-use industries and product types, each catering to specific applications requiring fire-resistant and smoke-suppressing properties.

By Application

- Flame Retardants: ATH is primarily used as a flame retardant, where it acts by releasing water vapor when exposed to heat. This application is prominent in the construction, automotive, and electronics sectors, where flame-resistant materials are critical. For instance, ATH’s usage in building insulation materials has grown by over 10% in recent years, as stricter fire safety regulations push the demand for safer materials.

- Smoke Suppressants: ATH also serves as an effective smoke suppressant, particularly in fire-sensitive environments such as tunnels, public transportation, and aircraft. As industries prioritize reducing smoke hazards, the demand for ATH in smoke suppression applications is growing steadily at a rate of 7.8% annually.

- Polymer and Plastics Additives: The polymer industry, including the production of PVC, polyethylene, and polypropylene, has been a key growth area for ATH, with ATH incorporated to improve fire resistance without compromising the material’s performance. This segment has seen a growth rate of 8.6% in the past year alone.

By End-Use Industry

- Construction: ATH is widely used in construction materials such as insulation, coatings, and fireproof panels, making it a key material in achieving fire safety compliance. The Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market in construction is expected to grow by over 6.7% annually as global infrastructure development continues to rise.

- Automotive: The automotive industry’s adoption of ATH for fire-safe vehicle components, particularly in electric vehicles, is expanding. ATH’s application in electrical components and battery enclosures is set to increase by 9.4% annually due to the rising demand for EVs.

- Electronics: The use of ATH in electronics for PCB production, wiring insulation, and connectors is gaining traction. With the global electronics market valued at over USD 1 trillion, ATH’s role in creating fire-resistant and environmentally safe components has resulted in a steady growth trajectory of around 8.1%.

Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Price Trend

The Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Price Trend has experienced fluctuations, largely influenced by raw material prices, production costs, and regional demand shifts. In recent years, ATH prices have increased by approximately 4.2%, driven by the rising cost of aluminum and stricter environmental standards on manufacturing processes.

Regional Price Differences

Price differences are notable between regions due to variations in production costs and raw material availability. In Asia-Pacific, particularly China, ATH prices are lower due to economies of scale in production. Conversely, North America and Europe experience slightly higher prices due to stricter environmental regulations and higher manufacturing costs.

Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Price Outlook

Looking forward, the Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Price Trend is expected to stabilize with a moderate increase of 2-3% annually, as demand from high-growth sectors such as construction, automotive, and electronics continues to rise. Additionally, the ongoing push for sustainable, non-toxic materials is likely to keep driving innovation and premium pricing in the market.

“Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Manufacturing Database, Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Manufacturing Capacity”

-

-

- Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) top manufacturers market share for 23+ manufacturers

- Top 7 manufacturers and top 13 manufacturers of Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) in North America, Europe, Asia Pacific

- Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) production plant capacity by manufacturers and Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) production data for 23+ market players

- Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) production dashboard, Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) production data in excel format

-

“Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) price charts, Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) weekly price tracker and Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) monthly price tracker”

-

-

- Factors impacting real-time Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) prices in 18+ countries worldwide

- Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) monthly price tracker, Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) weekly price tracker

- Real-time Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) price trend, Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) price charts, news and updates

- Tracking Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) price fluctuations

-

Top Manufacturers in the Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market

The Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market is highly competitive, with several key players dominating production and supplying across multiple industries, including construction, automotive, electronics, and consumer goods. These manufacturers play a crucial role in advancing ATH’s applications by developing products that meet both performance and environmental standards.

1. Hindalco Industries Limited

Hindalco Industries, a part of the Aditya Birla Group, is one of the largest producers of Aluminum Hydroxide (ATH) globally. The company offers a wide range of ATH products tailored for various applications, including flame retardants for the construction and automotive industries. Their Birla Carbon product line is widely used in flame-retardant coatings, cables, and insulation materials. Hindalco’s strong manufacturing presence in India allows them to serve both domestic and international markets effectively. The company holds a significant market share in the Asia-Pacific region, accounting for nearly 14% of the total ATH market in the region.

2. Albemarle Corporation

Albemarle is a well-established leader in the specialty chemicals sector and has a robust footprint in the Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market. Their ATH product line includes Albemarle ATH 82 and Albemarle ATH 72, which are widely used in the construction, automotive, and electronics industries due to their superior performance in fire safety applications. Albemarle’s market share in North America and Europe is considerable, and they continue to expand their operations with the opening of new production facilities in emerging markets. The company’s focus on producing halogen-free flame retardants aligns well with growing environmental regulations, strengthening its position in the market.

3. Nabaltec AG

Nabaltec AG is another prominent manufacturer of Aluminum Hydroxide (ATH), known for its premium-grade ATH products. Their Reomega and Aerosil lines are particularly well-regarded in applications requiring high-performance fire safety properties, such as in construction insulation and electrical cables. Nabaltec’s products are known for their superior dispersion and ease of integration into various polymers, which makes them a preferred choice in the automotive and electronics sectors. With a strong presence in Europe and expanding activities in North America and Asia, Nabaltec holds around 8% of the global market share for ATH.

4. Nippon Light Metal Company

Nippon Light Metal, a Japanese company, is recognized for its advanced ATH products used in fire-resistant building materials and automotive applications. The company’s Nippon ATH is favored for its high thermal stability and minimal smoke emissions, making it ideal for use in electronic components, automotive parts, and construction materials. Nippon Light Metal has a significant share of the ATH market in Japan, and they are increasing their presence in Southeast Asia. Their emphasis on technological innovation and product quality helps them maintain a competitive edge, particularly in the high-performance ATH segment.

5. Sumitomo Chemical Co.

Sumitomo Chemical, a major player in the global chemical industry, produces Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market products under the Sumial brand. Their ATH is known for its excellent flame-retardant properties and is commonly used in the construction, automotive, and electronics industries. With production facilities in Asia and expanding operations in North America, Sumitomo Chemical is positioned as a leading supplier in both the Asia-Pacific and North American markets. The company’s market share in the global ATH sector is estimated to be around 7%, with growth potential in emerging markets.

Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market Share by Manufacturers

The Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market Share is primarily distributed among a few key manufacturers that dominate the market due to their large-scale production capabilities and strong product portfolios. As of recent estimates, the top five players—Hindalco, Albemarle, Nabaltec, Nippon Light Metal, and Sumitomo Chemical—collectively control around 45% of the global market share.

In regions like North America and Europe, Albemarle and Nabaltec hold the largest share, largely due to their robust presence in fire safety applications and their commitment to sustainability, which resonates well with regulatory demands. In the Asia-Pacific region, Hindalco leads, accounting for more than 20% of the market due to its large-scale production capacity and strong foothold in emerging economies like India and China.

While these top manufacturers dominate the market, regional players and local suppliers also hold a significant portion of the market share, especially in developing economies where production costs are a major consideration. These smaller manufacturers often focus on specific market segments or applications, providing a specialized range of ATH products at competitive prices.

Recent News and Developments in the Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market

Expansion of Production Capacity by Hindalco

In April 2024, Hindalco Industries announced an expansion of its ATH production facilities in India. The company plans to increase its capacity by 15% over the next two years, meeting the growing demand for non-halogenated flame retardants in the domestic and international markets. This move is expected to strengthen Hindalco’s position as a market leader, particularly in the Asia-Pacific region, where construction and automotive sectors are experiencing rapid growth.

Albemarle’s Sustainability Commitment

In March 2024, Albemarle Corporation unveiled its new sustainability strategy, which includes increasing the production of halogen-free flame retardants such as Albemarle ATH 82. The company has committed to reducing its carbon footprint and optimizing its manufacturing processes to meet stringent environmental standards. This move is in line with the growing regulatory pressure for sustainable, non-toxic materials in industries like electronics, construction, and automotive. Albemarle aims to increase its market share in Europe, where demand for eco-friendly materials is on the rise.

Nabaltec’s New Product Launch

In January 2024, Nabaltec AG launched a new ATH product under the Reomega brand, specifically designed for high-performance applications in the aerospace industry. The new product boasts improved thermal stability and reduced smoke emission, making it ideal for use in airplane interiors and critical safety equipment. This innovative product line is expected to increase Nabaltec’s market share in the aerospace sector, where stringent fire safety standards are paramount.

Sumitomo Chemical’s Strategic Partnerships

Sumitomo Chemical announced in February 2024 that it had entered into a strategic partnership with a leading European automaker to supply ATH for the manufacturer’s electric vehicle battery enclosures. The collaboration highlights the increasing demand for fire-resistant materials in electric vehicles, especially in the wake of growing concerns regarding battery safety. Sumitomo’s high-quality ATH products are expected to play a critical role in ensuring the safety and sustainability of electric vehicles, bolstering the company’s position in the Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market.

Nippon Light Metal’s Focus on Fire-Safe Construction

In November 2023, Nippon Light Metal launched a new initiative to develop ATH-based fire-resistant coatings for use in the construction industry. The company’s new product line aims to meet the rising demand for fire-resistant paints and coatings in high-rise buildings and public infrastructure projects. This development is set to strengthen Nippon Light Metal’s market share in the construction sector, particularly in fire-sensitive regions like Japan and Southeast Asia.

Conclusion

The Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market continues to grow, driven by increasing demand for fire-safe, non-toxic, and environmentally sustainable materials across multiple industries. Top manufacturers like Hindalco, Albemarle, Nabaltec, Nippon Light Metal, and Sumitomo Chemical are poised to capitalize on this growth, expanding production capabilities and introducing innovative product lines to meet the evolving needs of construction, automotive, and electronics industries. The ongoing industry developments, including new product launches and strategic partnerships, highlight the growing importance of ATH in creating safer, more sustainable products for a wide range of applications.

“Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Production Data and Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Production Trend, Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Production Database and forecast”

-

-

- Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) production database for historical years, 10 years historical data

- Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) production data and forecast for next 7 years

- Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) sales volume by manufacturers

-

“Track Real-time Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Prices for purchase and sales contracts, Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) price charts, Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) weekly price tracker and Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) monthly price tracker”

-

-

- Gain control on your purchase and sales contracts through our real-time Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) price tracker and Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) price trend analysis

- Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) weekly price tracker and forecast for next four weeks

- Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) monthly price tracker and forecast for next two months

-

Market Scenario, Demand vs Supply, Average Product Price, Import vs Export, till 2035

- Global Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market revenue and demand by region

- Global Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market production and sales volume

- United States Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market revenue size and demand by country

- Europe Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market revenue size and demand by country

- Asia Pacific Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market revenue size and demand by country

- Middle East & Africa Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market revenue size and demand by country

- Latin America Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market revenue size and demand by

- Import-export scenario – United States, Europe, APAC, Latin America, Middle East & Africa

- Average product price – United States, Europe, APAC, Latin America, Middle East & Africa

- Market player analysis, competitive scenario, market share analysis

- Business opportunity analysis

Key questions answered in the Global Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market Analysis Report:

- What is the market size for Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) in United States, Europe, APAC, Middle East & Africa, Latin America?

- What is the yearly sales volume of Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) and how is the demand rising?

- Who are the top market players by market share, in each product segment?

- Which is the fastest growing business/ product segment?

- What should be the business strategies and Go to Market strategies?

The report covers Aluminum Hydroxide (ATH) (flame retardant and smoke suppressant) Market revenue, Production, Sales volume, by regions, (further split into countries):

- Asia Pacific (China, Japan, South Korea, India, Indonesia, Vietnam, Rest of APAC)

- Europe (UK, Germany, France, Italy, Spain, Benelux, Poland, Rest of Europe)

- North America (United States, Canada, Mexico)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa

Table of Contents:

Introduction to Aluminum Hydroxide (ATH) as a Flame Retardant and Smoke Suppressant

1.1 Defining Aluminum Hydroxide (ATH) and Its Key Properties

1.2 History and Development of ATH in Fire Safety Applications

1.3 Importance of ATH in Flame Retardancy and Smoke Suppression

Chemical Properties and Behavior of Aluminum Hydroxide (ATH)

2.1 Molecular Structure and Characteristics of Aluminum Hydroxide

2.2 Thermal Decomposition and Flame Retardant Mechanism of ATH

2.3 ATH’s Role in Smoke Suppression and Safety Enhancement

Production and Manufacturing of Aluminum Hydroxide (ATH)

3.1 Conventional Production Methods for Aluminum Hydroxide

3.2 Innovations in ATH Production Processes for Improved Quality

3.3 Environmental Considerations and Sustainability in ATH Manufacturing

Market Overview of Aluminum Hydroxide (ATH)

4.1 Market Size and Growth Trends in the ATH Flame Retardant Sector

4.2 Key Drivers of ATH Demand in Fire Safety and Smoke Suppression

4.3 Future Market Opportunities for ATH in Various Industries

Applications of Aluminum Hydroxide (ATH) as a Flame Retardant

5.1 ATH in Polymer and Plastics Industries for Flame Retardancy

5.2 Use of ATH in Coatings and Paints for Fire Safety

5.3 ATH in Textiles and Fabrics for Smoke Suppression and Safety

5.4 Applications of ATH in Electrical and Electronic Components

Applications of Aluminum Hydroxide (ATH) as a Smoke Suppressant

6.1 ATH in Building Materials: Enhancing Fire Safety in Construction

6.2 Use of ATH in Automotive Applications for Smoke Control

6.3 ATH’s Role in Smoke Suppression in Aircraft and Marine Applications

6.4 ATH in Insulation and Upholstery Materials for Enhanced Fire Resistance

Market Segmentation by Industry and Application

7.1 Segmenting the ATH Market by Industrial Applications

7.2 Regional Analysis of ATH Demand and Usage Patterns

7.3 End-User Industry Requirements and Customization of ATH

Industry Insights and Key End-User Sectors

8.1 Plastics and Polymers: The Role of ATH in Flame Retardancy

8.2 Electronics and Electrical Equipment: ATH for Safety and Protection

8.3 Construction Industry: ATH’s Contribution to Fireproofing Materials

8.4 Textiles and Apparel: ATH’s Role in Flame-Resistant Fabrics

Regional Market Dynamics of ATH

9.1 North America: ATH Market Trends, Regulations, and Key Players

9.2 Europe: Regulatory Frameworks and ATH Market Development

9.3 Asia-Pacific: ATH Production and Increasing Demand in Fire Safety

9.4 Latin America: Market Opportunities and Challenges for ATH

9.5 Middle East & Africa: ATH Market Penetration and Demand Drivers

Competitive Landscape in the ATH Market

10.1 Leading Manufacturers and Market Share Analysis of ATH

10.2 Mergers, Acquisitions, and Partnerships in the ATH Industry

10.3 Research and Development Focus on ATH-Based Fire Safety Products

Production Capacity and Supply Chain Management

11.1 Global Production Capacities for Aluminum Hydroxide (ATH)

11.2 Key Manufacturing Regions and Their Impact on Global Supply

11.3 Optimizing Supply Chain and Distribution for ATH Products

Pricing Dynamics and Market Economics

12.1 Key Pricing Trends and Cost Influencers for Aluminum Hydroxide

12.2 Production Cost Structure and Pricing Strategies for ATH

12.3 Future Price Trends and Their Potential Impact on Market Growth

Demand Forecast and Consumption Patterns of ATH

13.1 Projected Demand Growth for ATH in Various Applications

13.2 Global Consumption Trends and Shifts in Key Industries

13.3 Regional Consumption Patterns and Market Dynamics for ATH

Technological Innovations in ATH Production

14.1 Advances in Manufacturing Techniques for Aluminum Hydroxide

14.2 Enhancements in ATH’s Flame Retardant and Smoke Suppressant Properties

14.3 Future Technological Developments and Their Impact on ATH Market Growth

Sustainability and Environmental Impact of ATH

15.1 Environmental Impact of ATH Production and Mitigation Strategies

15.2 Sustainable Practices in the Manufacturing of ATH Products

15.3 Compliance with Environmental Regulations and Safety Standards

Market Outlook and Forecast (2025-2035)

16.1 Long-Term Growth Projections for Aluminum Hydroxide (ATH) Market

16.2 Emerging Applications and New Markets for ATH

16.3 Key Risks and Challenges Facing the ATH Market in the Coming Decade

Strategic Recommendations for Market Stakeholders

17.1 Market Entry Strategies for New Players in the ATH Industry

17.2 Risk Management and Contingency Planning for ATH Manufacturers

17.3 Strategic Collaborations to Drive Innovation and Market Expansion in ATH

Other recently published reports:

“Every Organization is different and so are their requirements”- Datavagyanik

Companies We Work With

Do You Want To Boost Your Business?

drop us a line and keep in touch