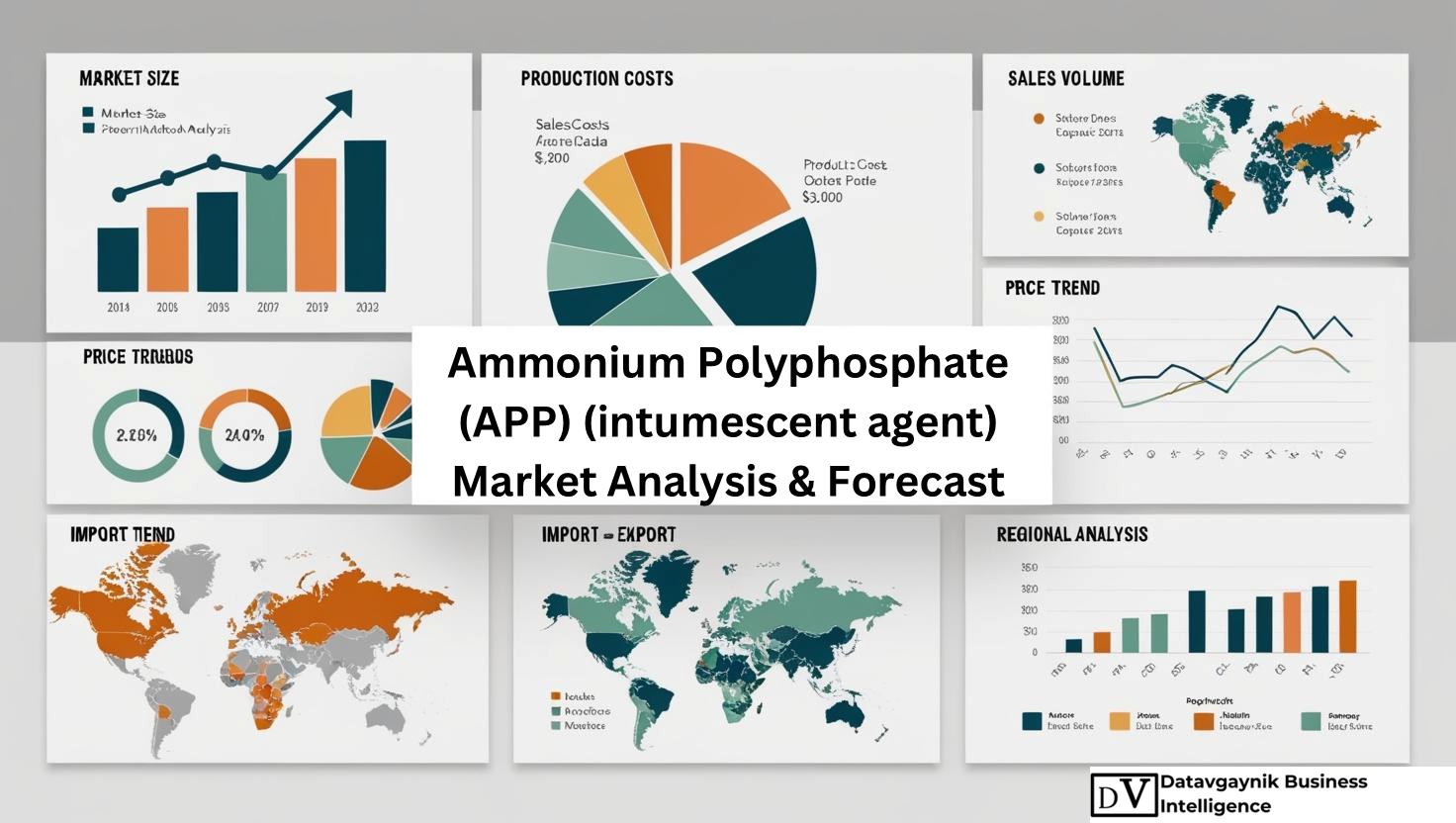

Ammonium Polyphosphate (APP) (intumescent agent) Market Size, Production, Sales, Average Product Price, Market Share, Import vs Export

- Published 2025

- No of Pages: 120+

- 20% Customization available

Surge in Fire Safety Compliance Fueling the Ammonium Polyphosphate (APP) (intumescent agent) Market

The Ammonium Polyphosphate (APP) (intumescent agent) Market is witnessing accelerated growth as global fire safety standards become increasingly stringent. For instance, with the rise in construction of high-rise buildings and smart infrastructure, regulatory bodies are demanding more effective flame-retardant solutions. Ammonium polyphosphate, a crucial component in intumescent coatings, has emerged as a preferred choice for enhancing fire resistance in structural materials. According to Datavagyanik, countries such as the United States, Germany, and China are leading this transition by embedding fire safety compliance into every layer of construction and public infrastructure development. This shift is translating directly into a consistent surge in demand for APP-based solutions across industrial coatings, insulation, and polymer additives.

Expanding Construction Activities Bolstering Ammonium Polyphosphate (APP) (intumescent agent) Market Growth

The construction sector remains the largest consumer of Ammonium Polyphosphate, accounting for over 40% of the total demand globally, as per Datavagyanik. The increasing urbanization in Asia Pacific, especially in India and Southeast Asia, is projected to push residential and commercial construction spending by over 6% annually through 2028. In these fast-expanding urban environments, fire-resistant coatings that utilize APP are critical for ensuring building code compliance. Additionally, developed economies such as the United Kingdom and Canada have increased funding for renovation of older infrastructure, incorporating modern flame-retardant systems. This trend further boosts the Ammonium Polyphosphate (APP) (intumescent agent) Market as new builds and retrofits alike require long-lasting, eco-safe fire protection materials.

Datavagyanik also covers related markets such as the Melamine Polyphosphate Market. Each of these markets adds unique insights into end-user applications, regulatory influences, and competitive developments.

Ammonium Polyphosphate (APP) (intumescent agent) Market Driven by Automotive Electrification Trends

The automotive industry has emerged as a key driver of the Ammonium Polyphosphate (APP) (intumescent agent) Market. With global electric vehicle (EV) sales exceeding 10 million units in 2023 and forecasted to reach 17 million units by 2025, there is a rising need for non-toxic, lightweight, flame-retardant materials. For example, APP is now commonly used in the insulation of EV battery casings, wire harnesses, and interior components, replacing traditional halogenated retardants. As manufacturers aim to meet both safety and sustainability goals, APP’s compatibility with polyamide and polypropylene composites makes it ideal for integration into EV platforms. Datavagyanik highlights that the shift toward e-mobility is expected to increase APP demand in automotive applications by 9.2% CAGR over the next five years.

Rising Demand for Halogen-Free Flame Retardants Accelerating Ammonium Polyphosphate (APP) (intumescent agent) Market Expansion

Sustainability has become a critical benchmark across all industrial sectors. One of the major transformations underway is the global phase-out of halogenated flame retardants due to their toxic emission during combustion. This regulatory shift has created strong tailwinds for the Ammonium Polyphosphate (APP) (intumescent agent) Market. For instance, the European REACH regulation and the U.S. Environmental Protection Agency’s evolving standards have classified many halogen-based retardants as substances of very high concern (SVHC). In response, major manufacturers are switching to APP as an environmentally friendly alternative. This trend has contributed to a significant rise in the use of APP-based formulations in paints, coatings, and polymer applications, particularly in sectors like electronics, automotive, and aerospace, where regulatory compliance is non-negotiable.

Electronics and Consumer Appliances Strengthening the Ammonium Polyphosphate (APP) (intumescent agent) Market Base

The electronics industry has emerged as another robust contributor to the growth of the Ammonium Polyphosphate (APP) (intumescent agent) Market. With the global electronics market projected to surpass $4.5 trillion by 2027, demand for fire-retardant polymers used in circuit boards, wiring, and enclosures is on the rise. APP is especially suited to high-temperature applications and is increasingly replacing older, hazardous flame retardants in consumer appliances such as washing machines, microwaves, and televisions. For example, in Japan and South Korea, where electronics manufacturing is highly advanced and regulated, APP is being integrated into circuit insulation and cable sheathing to reduce fire risk in confined environments.

Innovation in Intumescent Coatings Catalyzing Ammonium Polyphosphate (APP) (intumescent agent) Market Development

R&D investment in new formulations of intumescent coatings has opened new growth avenues for the Ammonium Polyphosphate (APP) (intumescent agent) Market. These coatings, when exposed to heat, expand to form a char layer, protecting the underlying material from fire. APP, being a core ingredient in such systems, is being improved to deliver higher thermal stability and faster expansion under flame exposure. For instance, coatings using APP have been tailored to meet the unique demands of steel structures, bridges, and oil rigs. Innovations in microencapsulation and particle dispersion have also allowed APP to be used more efficiently, improving its compatibility with resin systems and reducing costs.

Rising Industrial Applications Broadening Ammonium Polyphosphate (APP) (intumescent agent) Market Horizons

Beyond construction and automotive, the Ammonium Polyphosphate (APP) (intumescent agent) Market is expanding rapidly into industrial applications such as power generation, shipbuilding, railways, and mining. For instance, mining operations are now adopting APP-based insulation for electrical panels and control systems exposed to high-temperature environments. In the power sector, APP is used in flame-resistant cable sheaths and switchgear insulation. According to Datavagyanik, industrial consumption of APP is expected to grow at over 7.5% annually, driven by stringent equipment safety norms and the need to reduce downtime caused by fire incidents.

Ammonium Polyphosphate (APP) (intumescent agent) Market Size: Demand Forecast and Projections

The Ammonium Polyphosphate (APP) (intumescent agent) Market Size reached an estimated valuation of over $1.2 billion in 2023, with projected growth pushing the market beyond $1.9 billion by 2028. This represents a CAGR of approximately 9.7%, supported by rapid adoption across construction, automotive, and electronics. The Asia Pacific region currently holds the largest market share, accounting for over 40% of global consumption, followed by Europe and North America. This momentum reflects APP’s dual advantage of high fire resistance and environmental safety, making it the material of choice in modern industrial formulations.

Ammonium Polyphosphate (APP) (intumescent agent) Market Trends in Emerging Economies

Emerging markets such as India, Brazil, and parts of Southeast Asia are increasingly contributing to the global Ammonium Polyphosphate (APP) (intumescent agent) Market. For instance, India’s Smart Cities Mission and urban housing schemes have created a fertile ground for fire-resistant construction materials. Government mandates now require public buildings and urban infrastructure to adhere to modern fire safety norms, directly boosting the demand for APP-based coatings. Similarly, Brazil’s construction industry is recovering from a slowdown, with a renewed focus on safety standards creating new opportunities for flame-retardant technologies. In these markets, APP is also gaining traction in local manufacturing of electric vehicles and home appliances, thus expanding its footprint further.

Government Regulations and Incentives Shaping the Ammonium Polyphosphate (APP) (intumescent agent) Market

Public policy and regulation continue to play a transformative role in the Ammonium Polyphosphate (APP) (intumescent agent) Market. For example, fire safety initiatives such as California’s Wildfire Prevention Code or the European Union’s Construction Products Regulation (CPR) have increased the legal burden on developers and manufacturers to deploy fire-retardant materials. Moreover, several governments now offer tax incentives or green building certifications to projects that adopt halogen-free, low-toxicity materials such as APP. This has led to a surge in demand for sustainable flame retardants, and APP’s compatibility with modern compliance requirements has made it the go-to solution for industry leaders across sectors.

“Ammonium Polyphosphate (APP) (intumescent agent) Manufacturing Database, Ammonium Polyphosphate (APP) (intumescent agent) Manufacturing Capacity”

-

-

- Ammonium Polyphosphate (APP) (intumescent agent) top manufacturers market share for 23+ manufacturers

- Top 7 manufacturers and top 13 manufacturers of Ammonium Polyphosphate (APP) (intumescent agent) in North America, Europe, Asia Pacific

- Ammonium Polyphosphate (APP) (intumescent agent) production plant capacity by manufacturers and Ammonium Polyphosphate (APP) (intumescent agent) production data for 23+ market players

- Ammonium Polyphosphate (APP) (intumescent agent) production dashboard, Ammonium Polyphosphate (APP) (intumescent agent) production data in excel format

-

“Ammonium Polyphosphate (APP) (intumescent agent) price charts, Ammonium Polyphosphate (APP) (intumescent agent) weekly price tracker and Ammonium Polyphosphate (APP) (intumescent agent) monthly price tracker”

-

-

- Factors impacting real-time Ammonium Polyphosphate (APP) (intumescent agent) prices in 18+ countries worldwide

- Ammonium Polyphosphate (APP) (intumescent agent) monthly price tracker, Ammonium Polyphosphate (APP) (intumescent agent) weekly price tracker

- Real-time Ammonium Polyphosphate (APP) (intumescent agent) price trend, Ammonium Polyphosphate (APP) (intumescent agent) price charts, news and updates

- Tracking Ammonium Polyphosphate (APP) (intumescent agent) price fluctuations

-

Asia Pacific Dominates Global Ammonium Polyphosphate (APP) (intumescent agent) Market Demand

The Asia Pacific region continues to lead the Ammonium Polyphosphate (APP) (intumescent agent) Market in both volume and growth trajectory. As of 2024, the region accounts for over 42% of global APP consumption. This dominance is largely attributed to massive infrastructure development and industrialization in China, India, and Southeast Asia. For example, China’s urban construction spending crossed $2.8 trillion in 2023, with fire safety standards becoming more rigorous. As a result, demand for intumescent coatings utilizing APP has increased across commercial buildings, rail infrastructure, and industrial zones.

India follows closely, driven by rapid urban expansion under government-led smart city and affordable housing programs. APP consumption in India is rising at a CAGR of 10.1%, primarily in fire-retardant coatings for cementitious structures and in energy-efficient building insulation. Additionally, countries like Vietnam and Indonesia are investing in modern public infrastructure where APP plays a central role in fire prevention strategies.

Europe’s Regulatory Framework Fueling Ammonium Polyphosphate (APP) (intumescent agent) Market Growth

Europe represents a mature but highly dynamic region within the Ammonium Polyphosphate (APP) (intumescent agent) Market, where strict environmental and fire safety regulations fuel sustained demand. For instance, countries like Germany, France, and the Netherlands have mandated halogen-free, low-VOC flame retardants across public and commercial construction projects. The European Ammonium Polyphosphate (APP) (intumescent agent) Market is growing steadily at 6.8% annually, driven by sectors such as automotive, aerospace, and electrical equipment manufacturing.

Germany, with its robust automotive ecosystem, extensively incorporates APP in wire harness protection, battery insulation, and vehicle interior safety features. Meanwhile, in the UK, following the enactment of the Building Safety Act, there has been a 25% increase in demand for flame-retardant building materials over the past two years. These trends illustrate how regional policy is accelerating the penetration of APP across diverse application areas in Europe.

North America Emphasizing Innovation in the Ammonium Polyphosphate (APP) (intumescent agent) Market

North America holds a strategic position in the Ammonium Polyphosphate (APP) (intumescent agent) Market due to its focus on product innovation and sustainable flame retardant technologies. The U.S. market alone accounted for nearly 18% of global APP sales in 2023. For example, California’s wildfire prevention regulations have significantly increased the demand for intumescent coatings in both residential and industrial applications. Additionally, the growth of the electric vehicle market in North America—where over 1.4 million EVs were sold in 2023—is driving APP adoption in battery packs and wire insulation.

Canada, too, has observed a consistent rise in the use of APP-based materials in green building initiatives, where compliance with LEED and BREEAM standards requires fire-safe and environmentally friendly formulations. Datavagyanik projects the North American Ammonium Polyphosphate (APP) (intumescent agent) Market to grow at a CAGR of 7.4% over the next five years, with a significant push from sustainable building and automotive materials.

Emerging Markets Creating New Frontiers in the Ammonium Polyphosphate (APP) (intumescent agent) Market

Latin America, the Middle East, and Africa are gradually becoming focal points in the global Ammonium Polyphosphate (APP) (intumescent agent) Market. Brazil and Mexico are seeing increased investments in commercial construction and public infrastructure, where APP-based coatings are used to meet updated fire safety codes. In the Middle East, mega-projects such as NEOM in Saudi Arabia are adopting advanced building materials that prioritize sustainability and fire resistance, further boosting the need for APP.

South Africa and the UAE have also adopted new fire codes that necessitate the use of intumescent agents like APP in large-scale buildings and public facilities. These regions are currently dependent on imports, but increasing local demand presents a significant opportunity for regional production and distribution networks to scale.

Ammonium Polyphosphate (APP) (intumescent agent) Market Segmentation by Type and Form

The Ammonium Polyphosphate (APP) (intumescent agent) Market is segmented by product type into crystalline Phase I and polymeric Phase II forms. Phase II APP holds the dominant share at over 65% due to its superior thermal stability and water resistance, making it ideal for long-term structural applications such as steel coatings and electric cables. For instance, in tunnel construction and high-rise towers, Phase II APP is extensively used to meet enhanced fire protection standards.

In terms of form, solid APP continues to dominate the market, primarily because of its integration into powder coatings and thermoplastics. However, liquid APP is gaining momentum in the sprayable coatings segment, especially in prefabricated construction and modular housing. These trends suggest a shift toward more versatile application formats, with manufacturers increasingly investing in refining particle sizes and dispersion technologies for improved compatibility.

Industry-Wise Application Landscape of the Ammonium Polyphosphate (APP) (intumescent agent) Market

From an application standpoint, the construction industry remains the largest consumer, absorbing nearly 48% of the global Ammonium Polyphosphate (APP) (intumescent agent) Market. This is followed by the automotive sector at 22%, where lightweight, flame-resistant polymers are critical in EV and hybrid vehicles. Electronics account for 15% of market share, driven by the growing need for fire-safe circuit boards, enclosures, and wiring systems. For example, data centers and server farms now routinely incorporate APP-based materials to meet strict operational safety norms.

Smaller but high-value segments such as aerospace and defense are also adopting APP, particularly in applications like composite fuselage coatings, interior panels, and heat shields. The textile sector is another emerging user of APP, especially in protective clothing for firemen, industrial workers, and military personnel.

Regional Production Landscape in the Ammonium Polyphosphate (APP) (intumescent agent) Market

The production of Ammonium Polyphosphate is geographically diversified, with China leading as the global manufacturing hub. In 2023, China alone accounted for over 45% of global APP output. The country’s cost-effective production, coupled with high domestic consumption in construction and automotive sectors, has made it a key exporter to Southeast Asia, Africa, and parts of Europe.

Germany and the United States also maintain strong production capabilities. German manufacturers focus on high-purity APP formulations tailored for industrial and automotive use. U.S. producers, on the other hand, are investing in low-VOC, halogen-free variants to meet evolving EPA regulations and sustainability goals. Meanwhile, India and South Korea are expanding their production footprints to cater to both regional demand and export opportunities.

Ammonium Polyphosphate (APP) (intumescent agent) Price Trend and Factors Driving Pricing Volatility

The Ammonium Polyphosphate (APP) (intumescent agent) Price has seen moderate fluctuations over the last 24 months. The average global Ammonium Polyphosphate (APP) (intumescent agent) Price ranged between $2,100 to $2,600 per metric ton in 2023, depending on purity level, formulation type, and region of supply. One of the main drivers of price volatility has been raw material costs—particularly phosphoric acid and ammonia—which are closely tied to global fertilizer and chemical demand.

Another key influence on the Ammonium Polyphosphate (APP) (intumescent agent) Price Trend is logistics. In regions heavily dependent on imports, such as Latin America and Africa, freight charges have significantly impacted final product pricing. For instance, ocean freight costs rose by 18% in mid-2023, directly influencing landed prices in South American ports.

However, as local production capacity expands and more sustainable manufacturing technologies are introduced, the Ammonium Polyphosphate (APP) (intumescent agent) Price Trend is expected to stabilize. Datavagyanik forecasts a 3–5% price correction by 2026, supported by improved supply chains and optimized energy use in production facilities.

Impact of Sustainability on Ammonium Polyphosphate (APP) (intumescent agent) Price and Market Preference

The growing focus on green chemistry is altering both demand dynamics and pricing in the Ammonium Polyphosphate (APP) (intumescent agent) Market. For instance, formulations that are certified as halogen-free or compliant with EU REACH and U.S. TSCA standards are commanding a price premium of 8–12%. This reflects a broader trend where buyers—particularly in Europe and North America—are prioritizing APP products that align with their environmental, social, and governance (ESG) commitments.

Manufacturers that invest in cleaner production technologies are benefiting from higher margins despite rising input costs. As eco-labeled construction and automotive products gain popularity, APP producers are repositioning their offerings to reflect environmental credentials—leading to segmentation within the market based on performance and sustainability profiles.

“Ammonium Polyphosphate (APP) (intumescent agent) Production Data and Ammonium Polyphosphate (APP) (intumescent agent) Production Trend, Ammonium Polyphosphate (APP) (intumescent agent) Production Database and forecast”

-

-

- Ammonium Polyphosphate (APP) (intumescent agent) production database for historical years, 10 years historical data

- Ammonium Polyphosphate (APP) (intumescent agent) production data and forecast for next 7 years

- Ammonium Polyphosphate (APP) (intumescent agent) sales volume by manufacturers

-

“Track Real-time Ammonium Polyphosphate (APP) (intumescent agent) Prices for purchase and sales contracts, Ammonium Polyphosphate (APP) (intumescent agent) price charts, Ammonium Polyphosphate (APP) (intumescent agent) weekly price tracker and Ammonium Polyphosphate (APP) (intumescent agent) monthly price tracker”

-

-

- Gain control on your purchase and sales contracts through our real-time Ammonium Polyphosphate (APP) (intumescent agent) price tracker and Ammonium Polyphosphate (APP) (intumescent agent) price trend analysis

- Ammonium Polyphosphate (APP) (intumescent agent) weekly price tracker and forecast for next four weeks

- Ammonium Polyphosphate (APP) (intumescent agent) monthly price tracker and forecast for next two months

-

Leading Manufacturers in the Ammonium Polyphosphate (APP) (intumescent agent) Market

The Ammonium Polyphosphate (APP) (intumescent agent) Market is moderately consolidated, with a group of prominent manufacturers dominating global supply. These players are differentiated by product quality, technology integration, regional presence, and environmental certifications. As demand for flame-retardant solutions grows across industries, these companies are enhancing their capacity and expanding their portfolio to maintain market leadership.

Notable names in the global Ammonium Polyphosphate (APP) (intumescent agent) Market include Clariant AG, Budenheim (part of Chemische Fabrik Budenheim KG), JLS Flame Retardants, Nutrien Ltd., Lanxess AG, Shian Chem, and ICL Group Ltd. Together, these players contribute over 65% of the total global APP supply, as estimated by Datavagyanik.

Clariant AG: A Pioneer in High-Performance APP Solutions

Clariant AG holds a significant market share in the Ammonium Polyphosphate (APP) (intumescent agent) Market through its Exolit AP product line. Exolit AP series includes grades such as AP 422 and AP 750, which are widely used in thermoplastics, intumescent coatings, and PU foams. These products are characterized by their excellent thermal stability, low water solubility, and high efficiency in fire protection.

Clariant’s innovative APP technologies are also integrated into environmentally friendly building materials that comply with stringent EU fire and chemical regulations. The company maintains a strong footprint in Europe and North America, with manufacturing sites focused on sustainable production practices. Clariant accounts for approximately 15% of the global Ammonium Polyphosphate (APP) (intumescent agent) Market share.

Budenheim: Stronghold in Halogen-Free Flame Retardants

Germany-based Budenheim is a key player in the APP space, offering products under the BUDIT brand. The BUDIT AP range includes APP formulations tailored for industrial coatings, insulation systems, and construction materials. Known for its specialty grades with controlled particle size and high char-yielding capability, Budenheim is the preferred supplier for many European construction material manufacturers.

Budenheim has also focused on regulatory compliance and offers REACH-registered, halogen-free APP products. The company is estimated to command around 11–12% of the global Ammonium Polyphosphate (APP) (intumescent agent) Market.

JLS Flame Retardants: Dominant Force in Asia Pacific

JLS Flame Retardants, based in China, is among the largest producers of APP globally. The company offers a broad portfolio, including JLS-APP I and JLS-APP II, which cater to both domestic and export markets. JLS products are widely used in plastics, wire & cable insulation, and intumescent paints. With a production capacity exceeding 60,000 metric tons per year, JLS has built a strong supply chain across Asia Pacific and emerging markets.

JLS’s strategic advantage lies in its cost competitiveness and the ability to produce both standard and customized grades. The company holds roughly 13–14% of the global Ammonium Polyphosphate (APP) (intumescent agent) Market share and continues to expand its export footprint into Southeast Asia and Africa.

Nutrien Ltd.: Raw Material Integration for Cost Leadership

Nutrien, primarily known for fertilizers and phosphate products, plays a critical upstream role in the Ammonium Polyphosphate (APP) (intumescent agent) Market by supplying key feedstock like phosphoric acid. Although not a direct producer of APP flame retardants, Nutrien’s integration in the raw material supply chain provides cost advantages to partnered APP manufacturers, particularly in North America.

Nutrien’s impact is most visible in the pricing dynamics of high-purity APP used in coatings and thermoplastic applications. Through strategic partnerships, Nutrien indirectly influences nearly 8–9% of the APP market value chain.

Lanxess AG: High-End Specialty Applications

Lanxess offers ammonium polyphosphate solutions as part of its Emerald Innovation portfolio, focused on high-performance flame retardants. These are primarily targeted toward specialty applications in electronics, aviation, and high-end polymers. Lanxess prioritizes low-toxicity and low-smoke APP formulations, with R&D centers actively developing next-gen additives for electric vehicle batteries and power electronics.

Lanxess serves clients in Europe and North America and maintains a market share of approximately 6–7% in the global Ammonium Polyphosphate (APP) (intumescent agent) Market. The company’s focus on premium segments gives it a distinct position among manufacturers.

ICL Group: Diversification in Specialty Chemicals

ICL Group, headquartered in Israel, has expanded its flame retardants business through APP grades under the Fyrolflex and Phos-Chek series. While traditionally focused on fire suppression chemicals, ICL now supplies APP for use in industrial coatings, rigid polyurethane foams, and thermoplastics.

ICL has strong distribution channels across Europe and Asia Pacific, with plans to increase capacity in response to the rising demand for non-halogenated flame retardants. The company holds about 5–6% market share and is steadily increasing its product footprint in the electronics and construction sectors.

Market Share Breakdown in the Ammonium Polyphosphate (APP) (intumescent agent) Market

The Ammonium Polyphosphate (APP) (intumescent agent) Market is shared among top-tier global producers and a growing pool of regional manufacturers. Market share distribution, based on production volume and global trade estimates from Datavagyanik, is as follows:

-

Clariant AG – 15%

-

JLS Flame Retardants – 13–14%

-

Budenheim – 11–12%

-

Lanxess AG – 6–7%

-

ICL Group – 5–6%

-

Other regional and mid-tier producers – 35–40%

The remaining market is held by smaller players in China, India, and Southeast Asia that cater to regional demands, often offering cost-effective but less specialized APP variants. These regional producers are gaining traction in price-sensitive markets but face challenges in matching the performance standards required by advanced economies.

Recent Industry Developments and Strategic Announcements

Several notable developments have shaped the recent trajectory of the Ammonium Polyphosphate (APP) (intumescent agent) Market:

-

July 2023 – Clariant announced the expansion of its APP production line in Knapsack, Germany, with a 15% increase in capacity to meet rising demand from the automotive and electronics sectors.

-

October 2023 – Budenheim launched BUDIT AP 770, a new grade designed specifically for intumescent coatings in offshore structures and marine applications. This product targets enhanced water resistance and long-term thermal stability.

-

January 2024 – JLS Flame Retardants completed a new manufacturing unit in Jiangsu province, adding 20,000 metric tons to its annual APP production capacity. The move aims to reduce supply constraints and enhance export capabilities.

-

March 2024 – Lanxess unveiled a partnership with a major European EV manufacturer to co-develop APP-integrated materials for battery housing systems, signaling deeper penetration into automotive safety applications.

-

April 2024 – ICL Group entered into a joint venture with an Indian specialty chemicals firm to locally produce APP for the South Asian market, with an initial focus on construction-grade flame retardants.

These developments reflect the strategic direction of key manufacturers—focused on capacity expansion, geographic diversification, and new product innovations that cater to high-growth industries like EVs, infrastructure, and sustainable housing.

“Track Country-wise Ammonium Polyphosphate (APP) (intumescent agent) Production and Demand through our Ammonium Polyphosphate (APP) (intumescent agent) Production Database”

-

-

- Ammonium Polyphosphate (APP) (intumescent agent) production database for 23+ countries worldwide

- Ammonium Polyphosphate (APP) (intumescent agent) sales volume for 28+ countries

- Country-wise Ammonium Polyphosphate (APP) (intumescent agent) production capacity, production plant mapping, production capacity utilization for 23+ manufacturers

- Ammonium Polyphosphate (APP) (intumescent agent) production plants and production plant capacity analysis by top manufacturers

-

“Track real-time Ammonium Polyphosphate (APP) (intumescent agent) Prices, Ammonium Polyphosphate (APP) (intumescent agent) price charts for 23+ countries, Ammonium Polyphosphate (APP) (intumescent agent) weekly price tracker and Ammonium Polyphosphate (APP) (intumescent agent) monthly price tracker”

-

-

- Track real-time Ammonium Polyphosphate (APP) (intumescent agent) prices and Ammonium Polyphosphate (APP) (intumescent agent) price trend in 23+ countries though our excel-based Ammonium Polyphosphate (APP) (intumescent agent) price charts

- Real-time Ammonium Polyphosphate (APP) (intumescent agent) price tracker dashboard with 23+ countries

- Complete transparency on Ammonium Polyphosphate (APP) (intumescent agent) price trend through our Ammonium Polyphosphate (APP) (intumescent agent) monthly price tracker, Ammonium Polyphosphate (APP) (intumescent agent) weekly price tracker

-

Market Scenario, Demand vs Supply, Average Product Price, Import vs Export, till 2035

- Global Ammonium Polyphosphate (APP) (intumescent agent) Market revenue and demand by region

- Global Ammonium Polyphosphate (APP) (intumescent agent) Market production and sales volume

- United States Ammonium Polyphosphate (APP) (intumescent agent) Market revenue size and demand by country

- Europe Ammonium Polyphosphate (APP) (intumescent agent) Market revenue size and demand by country

- Asia Pacific Ammonium Polyphosphate (APP) (intumescent agent) Market revenue size and demand by country

- Middle East & Africa Ammonium Polyphosphate (APP) (intumescent agent) Market revenue size and demand by country

- Latin America Ammonium Polyphosphate (APP) (intumescent agent) Market revenue size and demand by

- Import-export scenario – United States, Europe, APAC, Latin America, Middle East & Africa

- Average product price – United States, Europe, APAC, Latin America, Middle East & Africa

- Market player analysis, competitive scenario, market share analysis

- Business opportunity analysis

Key questions answered in the Global Ammonium Polyphosphate (APP) (intumescent agent) Market Analysis Report:

- What is the market size for Ammonium Polyphosphate (APP) (intumescent agent) in United States, Europe, APAC, Middle East & Africa, Latin America?

- What is the yearly sales volume of Ammonium Polyphosphate (APP) (intumescent agent) and how is the demand rising?

- Who are the top market players by market share, in each product segment?

- Which is the fastest growing business/ product segment?

- What should be the business strategies and Go to Market strategies?

The report covers Ammonium Polyphosphate (APP) (intumescent agent) Market revenue, Production, Sales volume, by regions, (further split into countries):

- Asia Pacific (China, Japan, South Korea, India, Indonesia, Vietnam, Rest of APAC)

- Europe (UK, Germany, France, Italy, Spain, Benelux, Poland, Rest of Europe)

- North America (United States, Canada, Mexico)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa

Table of Contents:

Introduction to Ammonium Polyphosphate (APP) as an Intumescent Agent

1.1 Definition and Overview of Ammonium Polyphosphate (APP)

1.2 Role of APP in Intumescent Systems: Fire Safety and Protection

1.3 Historical Development and Market Evolution of APP as an Intumescent Agent

Chemical Composition and Characteristics

2.1 Molecular Structure of Ammonium Polyphosphate (APP)

2.2 Physical Properties: Thermal Stability, Water Absorption, and Fire Resistance

2.3 Chemical Reactivity and Performance in Fire Protection Systems

Synthesis and Production of Ammonium Polyphosphate (APP)

3.1 Common Methods of Producing Ammonium Polyphosphate

3.2 Advances in Production Technologies for APP (Intumescent Agent)

3.3 Environmental Impact and Sustainability Considerations in APP Production

Market Overview and Dynamics

4.1 Global Market Size and Historical Growth Trends

4.2 Key Drivers for the Demand of APP in Fire Retardant Applications

4.3 Future Market Projections and Emerging Opportunities

Drivers of Market Growth

5.1 Increasing Demand for Fire-Resistant Materials in Construction and Manufacturing

5.2 Stringent Fire Safety Regulations in Various Industries

5.3 Expanding Use in Coatings, Textiles, and Polymers

Challenges in the Ammonium Polyphosphate (APP) Market

6.1 Regulatory Compliance and Safety Standards

6.2 Raw Material Sourcing and Price Fluctuations

6.3 Competition from Alternative Fire Retardant Chemicals

Applications of Ammonium Polyphosphate (APP) as an Intumescent Agent

7.1 Use in Building Materials: Fireproof Coatings and Insulation

7.2 Application in Textiles: Fire Retardant Fabrics

7.3 Use in Plastics and Polymers: Enhancing Fire Resistance

7.4 Other Applications: Electrical Cables, Coatings for Metals, and More

Market Segmentation by Application

8.1 By Application Type: Coatings, Textiles, Polymers, and Others

8.2 By End-Use Industry: Construction, Electronics, Automotive, and More

8.3 Geographic Segmentation: Market Demand Insights by Region

End-User Industry Insights

9.1 Construction Industry: Role of APP in Building Safety and Fire Protection

9.2 Textile Industry: Use of APP in Fire Retardant Fabrics

9.3 Plastics and Polymers: Fire Protection in Manufacturing and Packaging

9.4 Electronics and Automotive: Application in Wiring, Cables, and Components

Geographic Market Dynamics

10.1 North America: Regulatory Landscape and Market Trends

10.2 Europe: Advancements in Fire Safety Standards and Market Growth

10.3 Asia-Pacific: Manufacturing Hub and Expanding Demand for APP

10.4 Latin America: Emerging Market and Growth Opportunities

10.5 Middle East & Africa: Increasing Infrastructure Development and Fire Safety Focus

Competitive Landscape

11.1 Key Market Players and Market Share Distribution

11.2 Recent Market Developments: Strategic Initiatives, Mergers, and Acquisitions

11.3 Focus on R&D and Innovations in APP (Intumescent Agent) Production

Production and Supply Chain Insights

12.1 Global Production Capacities and Key Manufacturing Regions

12.2 Sourcing of Raw Materials and Supply Chain Challenges

12.3 Strategies for Optimizing Production Efficiency and Cost Control

Pricing Trends and Market Economics

13.1 Pricing Trends for Ammonium Polyphosphate (APP)

13.2 Factors Impacting the Cost Structure of APP Production

13.3 Future Price Trends and Market Economic Factors

Demand Forecast and Consumption Patterns

14.1 Consumption by Application Type and Region

14.2 Projected Growth in Demand for APP (Intumescent Agent)

14.3 Key Drivers of Consumption Across Key Markets

Technological Innovations in APP Production

15.1 Advances in Production Processes for Enhanced Performance

15.2 Technological Developments in APP-based Fire Retardant Coatings

15.3 Innovations in Sustainable Production and Green Chemistry

Environmental Impact and Sustainability

16.1 Eco-friendly Practices in APP Production

16.2 Regulatory Compliance with Environmental and Safety Standards

16.3 Sustainability Challenges and Solutions in Fire Retardant Production

Market Outlook and Future Trends (2025-2035)

17.1 Long-Term Market Growth Projections

17.2 Risks and Barriers to Market Expansion

17.3 Opportunities for Innovation and New Applications of APP

Strategic Recommendations for Industry Stakeholders

18.1 Market Entry Strategies for New Entrants and Emerging Players

18.2 Risk Mitigation and Competitive Positioning in the APP Market

18.3 Collaborative Strategies for Market Leadership and Growth

Other recently published reports:

Fatty Acids and Their Salts Market

“Every Organization is different and so are their requirements”- Datavagyanik

Companies We Work With

Do You Want To Boost Your Business?

drop us a line and keep in touch