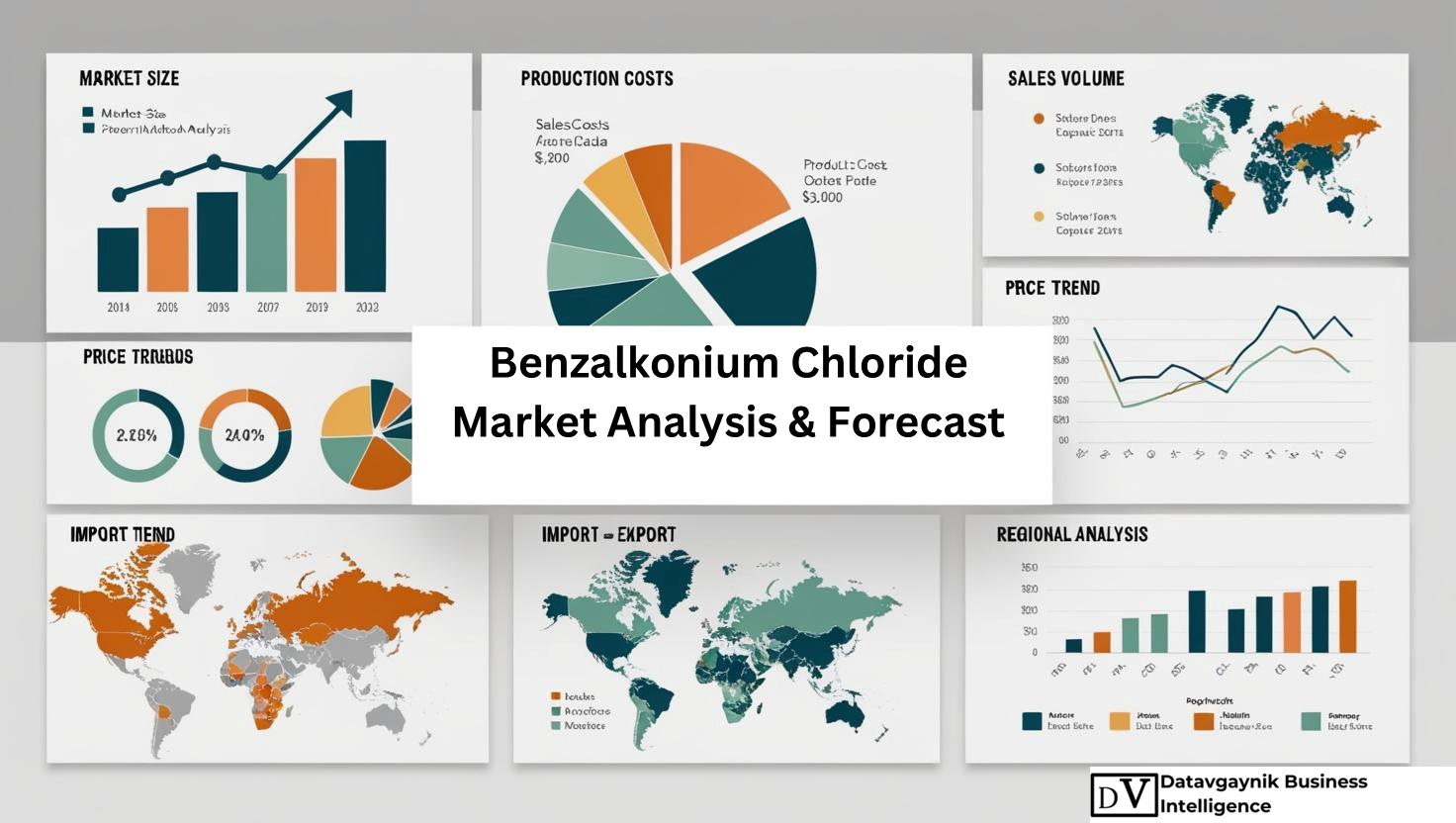

Benzalkonium Chloride Market Size, Production, Sales, Average Product Price, Market Share, Import vs Export

- Published 2025

- No of Pages: 120+

- 20% Customization available

Rising Demand in Hygiene Products Boosting Benzalkonium Chloride Market

The Benzalkonium Chloride Market is experiencing a notable expansion, primarily driven by the sustained rise in demand for hygiene and sanitation products across both consumer and industrial domains. For instance, the global hand sanitizer industry, which stood at approximately USD 2.7 billion in 2020, has witnessed a sharp CAGR of 6.6%, creating an immediate growth ripple across disinfectant supply chains. Benzalkonium chloride, being a key antimicrobial agent, has found increased application in hospital-grade surface disinfectants, household cleaning sprays, and personal sanitization products. As per Datavagyanik, this trend is not a temporary COVID-induced spike but part of a long-term behavioral shift in hygiene awareness.

Pharmaceutical Sector Expansion Fueling Benzalkonium Chloride Market

The Benzalkonium Chloride Market is being significantly driven by pharmaceutical industry growth, especially in the formulation of eye drops, nasal sprays, and antiseptics. Benzalkonium chloride plays a critical role as a preservative in multi-dose ophthalmic solutions, offering stability and extended shelf life. For example, the global ophthalmic drugs market surpassed USD 36 billion in 2022 and is projected to grow at 7.2% annually. The increasing incidence of chronic conditions such as glaucoma, conjunctivitis, and allergic rhinitis is directly expanding the application base of BAC in drug formulations, thereby reinforcing the growth trajectory of the Benzalkonium Chloride Market.

Datavagyanik also covers related markets such as the Sodium Chloride Market. Exploring these markets offers a broader view of the industry landscape and how adjacent sectors influence the main topic.

Benzalkonium Chloride Market Driven by Water Treatment Applications

Another strong demand pillar for the Benzalkonium Chloride Market is water treatment. Municipal bodies, industrial parks, and power plants increasingly rely on quaternary ammonium compounds like BAC to control microbial growth in water systems. The global industrial water treatment market is projected to reach USD 25.3 billion by 2027, growing at 5.7% CAGR. For example, in cooling towers and wastewater facilities, BAC is employed as a non-oxidizing biocide due to its effectiveness in killing bacteria, fungi, and algae. The rising regulatory pressure for clean water compliance, particularly in emerging economies, further strengthens the water-treatment-linked demand for benzalkonium chloride.

Personal Care Industry Growth Enhancing Benzalkonium Chloride Market Size

The personal care industry’s rapid expansion continues to uplift the Benzalkonium Chloride Market Size, especially in segments involving shampoos, lotions, and facial cleansers. Benzalkonium chloride is utilized not only as a preservative but also as an antimicrobial stabilizer in cosmetic formulations. The global cosmetics and personal care products market crossed USD 530 billion in 2023 and is anticipated to expand at a steady 5.5% CAGR. For instance, BAC is used in rinse-off and leave-on products targeting acne treatment and dandruff control. With rising consumer preference for multi-functional ingredients and antimicrobial assurance in skincare, the adoption of BAC in cosmetic applications is scaling, thus fueling the overall Benzalkonium Chloride Market.

Healthcare Infrastructure Development Accelerating Benzalkonium Chloride Market

Emerging economies are rapidly enhancing their healthcare infrastructure, which in turn is expanding the Benzalkonium Chloride Market. Countries such as India, Vietnam, and Indonesia are investing in hospitals, clinics, and diagnostic labs—settings where BAC-based disinfectants and surface cleaners are widely utilized. For example, India’s healthcare infrastructure investments reached USD 372 billion in 2022 and continue to grow at over 22% CAGR. In these environments, BAC is preferred due to its low toxicity and rapid action against gram-positive and gram-negative bacteria. This infrastructural development directly contributes to increasing bulk consumption of BAC in medical-grade hygiene solutions.

Benzalkonium Chloride Market Expansion in Agricultural Sector

Agriculture is another emerging area of influence for the Benzalkonium Chloride Market, driven by the growing need for microbial control in crops. BAC is applied as a bactericide and fungicide in pesticides, seed treatments, and irrigation systems. With global food demand expected to increase by 60% by 2050, the focus on crop yield protection and post-harvest hygiene has intensified. For example, farmers in Brazil and Southeast Asia have adopted BAC-based agrochemicals to combat leaf spot and blight diseases. The versatility of benzalkonium chloride in various agricultural formulations ensures its steady penetration into this high-potential segment.

Surging Industrial Cleaning Requirements Amplifying Benzalkonium Chloride Market

The post-pandemic era has brought an unprecedented focus on industrial sanitation, further propelling the Benzalkonium Chloride Market. From food processing units to semiconductor manufacturing floors, cleanliness standards have become integral to operational certification. BAC is now a standard ingredient in floor disinfectants, machinery cleaners, and high-touch surface sprays used in industrial settings. For example, the global industrial and institutional cleaning chemicals market, which was valued at USD 49.1 billion in 2023, is projected to grow at 5.8% CAGR. The growth of industries in developing regions, especially Southeast Asia and Africa, is leading to rising demand for BAC-based hygiene solutions.

Benzalkonium Chloride Market Growth from Textile and Leather Processing

The Benzalkonium Chloride Market is also witnessing growth due to rising demand from textile and leather processing industries. BAC is applied during dyeing and finishing operations to eliminate microbial growth and enhance durability. The global antimicrobial textiles market exceeded USD 12.5 billion in 2023 and is projected to grow steadily due to demand for functional clothing in healthcare, sportswear, and hospitality. For example, hospitals increasingly use antimicrobial curtains and gowns where BAC-based finishing is essential. The expanding scope of treated textiles contributes directly to the demand in the Benzalkonium Chloride Market.

Food Industry Applications Supporting Benzalkonium Chloride Market

The food and beverage processing industry relies on strict hygiene protocols to prevent contamination, thereby contributing to the Benzalkonium Chloride Market. BAC is used to disinfect equipment surfaces, packaging materials, and processing lines. For instance, the global food safety testing market reached USD 20.1 billion in 2023, underscoring the industry’s priority on microbial control. With stringent global regulations such as HACCP and ISO 22000 requiring chemical-based sanitation, the use of BAC in food-grade cleaning formulations is expanding. This reinforces the compound’s essential role in food industry sanitization frameworks.

Benzalkonium Chloride Market Size Strengthened by Oil and Gas Sector Applications

The Benzalkonium Chloride Market Size is further bolstered by its growing utilization in the oil and gas industry. In this sector, BAC is deployed as a biocide to prevent microbial-induced corrosion in pipelines and drilling fluids. For example, the global market for oilfield biocides alone is estimated to exceed USD 1.2 billion by 2026. With new oil and gas exploration projects emerging in Latin America and the Middle East, the requirement for efficient biocides such as BAC is becoming more pronounced. These applications ensure infrastructure longevity and system performance, making BAC a critical component in the sector’s chemical toolkit.

Technological Advancements in Formulations Driving Benzalkonium Chloride Market

Advances in chemical formulation technologies are unlocking new opportunities for the Benzalkonium Chloride Market. High-purity and pharmaceutical-grade BAC is now being produced through improved quaternization processes, enhancing its efficacy and stability across end-use industries. For example, recent innovations in nanoemulsion technology have allowed BAC to be used in advanced skin care and wound healing products, expanding its footprint beyond traditional formulations. The incorporation of BAC in next-generation disinfectant delivery systems such as foggers and wipes is another testament to the technology-driven evolution of the market.

Future Outlook: Benzalkonium Chloride Market Poised for Consistent Growth

Based on current application trends and industry expansion, the Benzalkonium Chloride Market is expected to witness sustained double-digit growth over the next five years. With a diversified application base—from pharmaceuticals to industrial cleaning—BAC demand is resilient across market cycles. Datavagyanik estimates that the global Benzalkonium Chloride Market Size will exceed USD 1.4 billion by 2027, driven by regulatory support, technological innovation, and end-user industry diversification. As hygiene and microbial control remain top global priorities, BAC’s relevance across sectors will continue to rise, cementing its position as a critical chemical in modern industry.

“Track Country-wise Benzalkonium Chloride Production and Demand through our Benzalkonium Chloride Production Database”

-

-

- Benzalkonium Chloride production database for 23+ countries worldwide

- Benzalkonium Chloride sales volume for 28+ countries

- Country-wise Benzalkonium Chloride production capacity, production plant mapping, production capacity utilization for 23+ manufacturers

- Benzalkonium Chloride production plants and production plant capacity analysis by top manufacturers

-

“Track real-time Benzalkonium Chloride Prices, Benzalkonium Chloride price charts for 23+ countries, Benzalkonium Chloride weekly price tracker and Benzalkonium Chloride monthly price tracker”

-

-

- Track real-time Benzalkonium Chloride prices and Benzalkonium Chloride price trend in 23+ countries though our excel-based Benzalkonium Chloride price charts

- Real-time Benzalkonium Chloride price tracker dashboard with 23+ countries

- Complete transparency on Benzalkonium Chloride price trend through our Benzalkonium Chloride monthly price tracker, Benzalkonium Chloride weekly price tracker

-

Asia-Pacific Leading Benzalkonium Chloride Market in Production and Consumption

The Asia-Pacific region has emerged as the largest contributor to the Benzalkonium Chloride Market, both in terms of production capacity and end-use consumption. Countries such as China and India dominate the regional landscape, backed by low manufacturing costs, abundant raw material access, and growing domestic demand across healthcare, personal care, and industrial applications. For example, China contributes over 35% of the global BAC output, with over 70 operational chemical plants equipped to produce high-purity benzalkonium chloride for pharmaceutical and industrial uses. Datavagyanik reports that India, with its expanding pharmaceutical exports and fast-growing cosmetic industry, has witnessed a 9.5% annual increase in BAC consumption over the last five years.

North America’s Benzalkonium Chloride Market Driven by Healthcare and Institutional Cleaning

In North America, particularly the United States, the Benzalkonium Chloride Market is driven by high demand from institutional cleaning, healthcare sanitation, and pharmaceutical preservation. The U.S. healthcare disinfection market alone exceeded USD 4.2 billion in 2023, with BAC-based disinfectants accounting for a sizable share due to their broad-spectrum antimicrobial activity. For instance, hospital chains across the U.S. have integrated BAC disinfectants into their cleaning protocols as they offer effective and rapid microbial kill rates with lower toxicity compared to other agents. Additionally, the strong regulatory landscape and emphasis on FDA-compliant pharmaceutical preservatives further reinforce BAC’s prominence in the North American market.

Europe’s Mature Benzalkonium Chloride Market Marked by High Quality Standards

Europe represents a highly structured and quality-driven Benzalkonium Chloride Market, with Germany, France, and the United Kingdom leading regional demand. In Germany, the pharmaceutical-grade BAC segment is expanding rapidly due to the country’s specialization in ophthalmic and dermatological formulations. For example, German pharma exports reached USD 126 billion in 2023, with a significant portion involving BAC-preserved products. France’s globally recognized cosmetic industry incorporates BAC as a stable preservative in moisturizers, lotions, and facial cleansers, while the UK’s institutional cleaning sector remains a major driver due to NHS hygiene mandates. As Datavagyanik outlines, Europe’s focus on quality assurance and REACH compliance continues to promote the adoption of high-purity BAC in regulated sectors.

Benzalkonium Chloride Market Growing Steadily in Latin America and MEA

Latin America and the Middle East & Africa (MEA) represent emerging but steadily growing contributors to the Benzalkonium Chloride Market. In Brazil, the combination of rising healthcare infrastructure and robust agricultural exports has created a dual-demand scenario. BAC is now widely used in hospital disinfectants and in crop protection formulations targeting bacterial blight and fungal infections. Similarly, countries in the MEA region, such as Saudi Arabia and the UAE, are utilizing BAC in oilfield biocides and water treatment applications. For example, GCC countries are investing heavily in wastewater reuse projects, many of which rely on BAC-based biocides to ensure microbial safety. These developments are pushing annual BAC consumption in the region by 6.2% CAGR.

Benzalkonium Chloride Market Segmentation by Purity Level

The Benzalkonium Chloride Market is segmented by purity into primarily two concentrations—50% and 80%—with each variant serving specific industrial needs. The 50% BAC solution, typically used in personal care, disinfectants, and pharmaceuticals, is favored for its balance between efficacy and ease of handling. For instance, most commercial disinfectant sprays in consumer markets use BAC at this concentration due to its non-irritating nature and broad-spectrum efficacy. On the other hand, the 80% BAC solution is predominantly utilized in high-strength industrial applications such as oilfield biocides, coatings, and preservatives for heavy-duty equipment. Datavagyanik estimates that while 50% BAC holds a 62% market share by volume, the 80% variant dominates in value terms due to its concentrated formulation and higher price per unit.

Diverse Application Base Driving Benzalkonium Chloride Market Segmentation

The Benzalkonium Chloride Market is characterized by a broad spectrum of applications, including pharmaceuticals, disinfectants, water treatment, personal care, and oil and gas. For example, the pharmaceutical segment alone accounts for over 27% of global BAC consumption. In contrast, the water treatment segment is growing at 7.1% CAGR, driven by stricter water quality regulations and the rise of urban wastewater treatment facilities in Asia and Latin America. In personal care, BAC is used in formulations for acne control, dandruff prevention, and deodorant stabilization. Each application sector continues to drive tailored demand for specific BAC grades and formulations, enhancing the market’s resilience against industry-specific disruptions.

Benzalkonium Chloride Price Trend Influenced by Raw Materials and Regional Supply

The Benzalkonium Chloride Price Trend is largely influenced by fluctuations in raw material prices, particularly alkyl dimethyl benzyl ammonium chloride precursors derived from petrochemicals. In Q4 2023, global BAC prices averaged USD 4.10/kg for 50% solutions and USD 6.25/kg for 80% solutions. Datavagyanik highlights that temporary supply chain disruptions in China and rising freight charges resulted in a 12% price increase year-over-year in North America. Additionally, price differentials across regions reflect variations in production capacity and environmental regulations. For instance, Europe reports consistently higher BAC prices due to REACH compliance and stricter emission controls on chemical synthesis units.

Regional Production Concentration and Export Dynamics in Benzalkonium Chloride Market

Global production in the Benzalkonium Chloride Market is concentrated in Asia-Pacific, particularly China and India, accounting for nearly 60% of total global output. These countries not only meet domestic demand but also serve as key exporters to regions like North America, Europe, and Southeast Asia. India alone made over 6,000 BAC shipments in 2023, with major destinations including Vietnam, Germany, and Peru. China’s dominance stems from vertically integrated manufacturing clusters capable of producing both pharmaceutical and industrial-grade BAC at scale. Meanwhile, the U.S. and Germany maintain limited but high-purity production primarily for domestic pharmaceutical applications. This global supply network ensures availability across price tiers and purity levels but remains sensitive to geopolitical trade dynamics.

Import-Export Imbalance Reflecting Regional Demand Pressures

Import-export trends in the Benzalkonium Chloride Market reveal strong interdependence between producing and consuming nations. For example, Vietnam imported over 11,000 metric tons of hand sanitizer products in 2021 containing BAC, with 40% sourced from India and 22% from China. In the same year, the European Union exported more than USD 520 million worth of BAC-infused sanitizers, largely to North America and Asia. Datavagyanik notes that export values surged by over 15% annually from 2020 to 2023 due to global pandemic-driven demand. However, this trend has stabilized post-pandemic, with a renewed focus on localized sourcing and production diversification.

Benzalkonium Chloride Price Volatility and Its Market Impact

The Benzalkonium Chloride Price has shown moderate volatility, especially during pandemic-induced supply chain shocks. In 2020, BAC prices soared by over 30% due to an unprecedented surge in disinfectant demand and temporary factory shutdowns. However, from 2022 onwards, prices began to normalize, influenced by increased production in Asia and the build-up of inventory buffers across global supply chains. Datavagyanik observes that recent volatility in crude oil prices has again caused minor fluctuations in BAC manufacturing costs, with Q1 2024 witnessing a 5% price bump. These price changes have a cascading effect on downstream products, particularly in price-sensitive markets like agriculture and textile finishing.

Future Benzalkonium Chloride Price Trend Expected to Stabilize

Datavagyanik projects that the Benzalkonium Chloride Price Trend will stabilize over the next five years, provided raw material costs remain under control and no major supply chain disruptions occur. With countries like Vietnam and Indonesia now investing in local production capabilities, import dependency is likely to decrease, easing price pressures. Additionally, new technological developments in BAC synthesis, such as continuous flow reactors and greener catalyst systems, are expected to reduce unit costs and improve output efficiency. This would help maintain average global BAC prices within a range of USD 3.80–4.60/kg for 50% solutions by 2027, assuming consistent demand and regulatory alignment.

Strategic Outlook: Benzalkonium Chloride Market Poised for Supply Chain Recalibration

The future of the Benzalkonium Chloride Market lies in strategic supply chain recalibration, where producers are increasingly looking to establish regional hubs to mitigate logistical risks and respond faster to local demand. Multinational chemical manufacturers are setting up satellite production units in Southeast Asia and Eastern Europe to serve fast-growing markets and reduce export lead times. For example, a leading specialty chemical company recently announced a new BAC manufacturing plant in Vietnam aimed at producing over 15,000 tons annually, catering to both domestic and ASEAN markets. Datavagyanik emphasizes that such initiatives will play a critical role in balancing global supply-demand dynamics and ensuring pricing equilibrium in the Benzalkonium Chloride Market.

Conclusion: Regional Demand and Price Trends Defining Benzalkonium Chloride Market Growth

In conclusion, the Benzalkonium Chloride Market is being reshaped by a mix of regional demand surges, evolving production capacities, and strategic pricing adjustments. With Asia-Pacific leading global production and Europe and North America focusing on high-purity usage, the market’s geography continues to diversify. The Benzalkonium Chloride Price Trend reflects both macroeconomic pressures and sector-specific dynamics, but innovations in manufacturing and logistics are likely to soften future volatility. As demand remains robust across pharmaceuticals, personal care, water treatment, and industrial sanitation, the global Benzalkonium Chloride Market is on a steady growth path reinforced by regional collaboration and resilient trade frameworks.

“Benzalkonium Chloride Manufacturing Database, Benzalkonium Chloride Manufacturing Capacity”

-

-

- Benzalkonium Chloride top manufacturers market share for 23+ manufacturers

- Top 7 manufacturers and top 13 manufacturers of Benzalkonium Chloride in North America, Europe, Asia Pacific

- Benzalkonium Chloride production plant capacity by manufacturers and Benzalkonium Chloride production data for 23+ market players

- Benzalkonium Chloride production dashboard, Benzalkonium Chloride production data in excel format

-

“Benzalkonium Chloride price charts, Benzalkonium Chloride weekly price tracker and Benzalkonium Chloride monthly price tracker”

-

-

- Factors impacting real-time Benzalkonium Chloride prices in 18+ countries worldwide

- Benzalkonium Chloride monthly price tracker, Benzalkonium Chloride weekly price tracker

- Real-time Benzalkonium Chloride price trend, Benzalkonium Chloride price charts, news and updates

- Tracking Benzalkonium Chloride price fluctuations

-

Top Manufacturers Shaping the Global Benzalkonium Chloride Market

The Benzalkonium Chloride Market is dominated by a select group of global chemical manufacturers with extensive production capabilities, well-established distribution networks, and diversified application portfolios. These companies play a pivotal role in driving innovation, pricing trends, and supply security across key end-use industries such as pharmaceuticals, personal care, water treatment, and industrial cleaning. Datavagyanik identifies several leading manufacturers that collectively command a significant share of the global Benzalkonium Chloride Market, each with unique competitive advantages and strategic product lines.

Kao Corporation – Innovator in Cosmetic and Personal Care Applications

Kao Corporation, based in Japan, is a key player in the Benzalkonium Chloride Market, especially in the personal care and cosmetics segment. The company leverages its proprietary formulation expertise to incorporate BAC into its haircare, skincare, and hygiene brands. Under product lines such as Bioré, Kao utilizes benzalkonium chloride for its antimicrobial properties in facial cleansers and acne control formulations. Kao’s focus on high-purity ingredients and regulatory compliance has enabled it to penetrate premium markets in Japan, South Korea, and the United States. The company holds approximately 6% of the global Benzalkonium Chloride Market share, particularly concentrated in cosmetic-grade BAC.

Merck KGaA – High-Purity BAC for Pharmaceutical and Laboratory Use

Germany-based Merck KGaA is a dominant force in the pharmaceutical-grade Benzalkonium Chloride Market, offering highly purified BAC under its Excipients & Biopharma Ingredients division. Merck’s BAC products are widely used in ophthalmic formulations, nasal sprays, and topical drug products due to their superior microbial control. For instance, its Benzalkonium Chloride Solution 50% EP/USP is certified for use in sterile pharmaceutical environments. The company’s strength lies in its ability to meet stringent global pharmacopeia standards (USP, Ph. Eur, JP), which gives it a critical advantage in regulated markets across North America and Europe. Merck commands approximately 7% of the global Benzalkonium Chloride Market share, with a dominant presence in medical and biopharmaceutical applications.

Novo Nordisk Pharmatech – Specialist in GMP-Grade Benzalkonium Chloride

Novo Nordisk Pharmatech, headquartered in Denmark, is known for its specialization in GMP-certified quaternary ammonium compounds. Its Ph.Eur/USP/NF/JP compliant benzalkonium chloride products are marketed specifically for the pharmaceutical and biopharma industries. The company’s strategic partnership with Actylis to distribute high-purity BAC across Europe and North America has significantly boosted its global footprint. Novo Nordisk Pharmatech plays a critical role in the Benzalkonium Chloride Market, particularly for customers requiring full traceability and compliance with stringent manufacturing practices. The company holds close to 5% of the Benzalkonium Chloride Market share, largely focused on injectable-grade and ophthalmic preservatives.

Manav Aktteva Biopharma LLP – Rising Indian Exporter in Global Market

India-based Manav Aktteva Biopharma LLP is a fast-emerging player in the Benzalkonium Chloride Market, focused on supplying pharmaceutical and industrial-grade BAC to over 40 countries. The company has carved a niche by offering competitively priced BAC in various grades, including Benzalkonium Chloride Solution 50% and 80%, aligned with global pharmacopeia specifications. With India’s rapidly growing exports of generic drugs and active pharmaceutical ingredients (APIs), Manav Aktteva benefits from proximity to a thriving domestic customer base and favorable logistics for international shipping. It currently holds approximately 4% of the Benzalkonium Chloride Market share, and its presence is expanding in Southeast Asia, Africa, and Latin America.

Zhengzhou Clean Chemical Co., Ltd. – Leading Chinese Bulk Producer

Zhengzhou Clean Chemical Co., Ltd. is one of the top producers in China, serving both domestic and international Benzalkonium Chloride Market needs. The company offers bulk BAC under the CleanBAC brand, primarily targeting industrial sectors such as water treatment, textile processing, and oilfield biocides. The company’s large-scale production capabilities allow it to maintain a competitive pricing edge, especially in high-volume segments. It exports to over 60 countries and is a key supplier in regions such as Africa and South America. With over 8% of the global Benzalkonium Chloride Market share, Zhengzhou Clean Chemical leads in terms of volume output, particularly for non-pharmaceutical-grade applications.

Spectrum Chemical Manufacturing Corp. – U.S. Supplier with Diverse BAC Portfolio

In the United States, Spectrum Chemical Manufacturing Corp. is a prominent supplier in the Benzalkonium Chloride Market, offering both lab-grade and pharmaceutical-grade BAC solutions. The company’s USP/NF-certified Benzalkonium Chloride 50% Solution is widely used in research, diagnostics, and sterile manufacturing environments. Spectrum’s distribution channels span across pharmaceutical companies, hospitals, academic institutions, and industrial laboratories. The company’s emphasis on quality testing and FDA compliance makes it a trusted BAC source in the regulated North American market. It holds approximately 3% of the Benzalkonium Chloride Market share, with a stronghold in lab and clinical environments.

Jubilant Ingrevia – Expanding Global Presence Through Strategic Investments

Jubilant Ingrevia, another India-based chemical giant, is gaining traction in the Benzalkonium Chloride Market through backward integration and investment in specialty chemicals. The company offers BAC under its Quats Portfolio and targets diverse sectors such as oilfield services, water treatment, and cosmetics. With robust R&D support and integrated production systems, Jubilant is poised to expand its BAC capacity to meet global demand. It currently holds around 4% of the global Benzalkonium Chloride Market share, with increasing market penetration in Europe and North America.

Benzalkonium Chloride Market Share Overview by Manufacturers

As of 2024, Datavagyanik estimates that the top ten manufacturers collectively account for nearly 60% of the global Benzalkonium Chloride Market share, with Merck KGaA, Kao Corporation, and Zhengzhou Clean Chemical Co., Ltd. leading in pharmaceutical, cosmetic, and industrial sectors respectively. The market remains moderately fragmented due to the wide range of purity requirements and application-specific formulations. While large players dominate high-purity segments, smaller regional manufacturers continue to thrive in industrial BAC markets with more relaxed compliance needs.

Recent Developments and Industry News in Benzalkonium Chloride Market

– February 2024: Novo Nordisk Pharmatech expanded its GMP-grade BAC production line in Denmark to meet surging global pharmaceutical demand. The new line increases output capacity by 35%, targeting markets in North America and Europe.

– January 2024: Manav Aktteva Biopharma LLP received EU GMP certification for its benzalkonium chloride production facility, enabling it to supply directly to European pharmaceutical manufacturers under stricter regulatory compliance.

– November 2023: Jubilant Ingrevia announced a USD 20 million investment to double its production of quaternary ammonium compounds, including benzalkonium chloride, by the end of 2025. This move is aimed at capturing a larger share of the specialty chemical market in Europe and Southeast Asia.

– September 2023: Kao Corporation introduced a new antimicrobial personal care line under its Curel brand using benzalkonium chloride, tailored for sensitive skin applications in Japan and South Korea.

– August 2023: Spectrum Chemical launched a rapid-delivery initiative for USP/NF BAC to address growing demand from diagnostic labs in the United States amid the rise of infectious disease testing.

These developments reflect the strategic investments being made by market leaders to strengthen their foothold, improve regulatory alignment, and expand product offerings in the evolving Benzalkonium Chloride Market. As industry players continue to align with high-growth applications and tighten supply chains, the competitive landscape is expected to remain dynamic and innovation-driven.

“Benzalkonium Chloride Production Data and Benzalkonium Chloride Production Trend, Benzalkonium Chloride Production Database and forecast”

-

-

- Benzalkonium Chloride production database for historical years, 10 years historical data

- Benzalkonium Chloride production data and forecast for next 7 years

- Benzalkonium Chloride sales volume by manufacturers

-

“Track Real-time Benzalkonium Chloride Prices for purchase and sales contracts, Benzalkonium Chloride price charts, Benzalkonium Chloride weekly price tracker and Benzalkonium Chloride monthly price tracker”

-

-

- Gain control on your purchase and sales contracts through our real-time Benzalkonium Chloride price tracker and Benzalkonium Chloride price trend analysis

- Benzalkonium Chloride weekly price tracker and forecast for next four weeks

- Benzalkonium Chloride monthly price tracker and forecast for next two months

-

Market Scenario, Demand vs Supply, Average Product Price, Import vs Export, till 2035

- Global Benzalkonium Chloride Market revenue and demand by region

- Global Benzalkonium Chloride Market production and sales volume

- United States Benzalkonium Chloride Market revenue size and demand by country

- Europe Benzalkonium Chloride Market revenue size and demand by country

- Asia Pacific Benzalkonium Chloride Market revenue size and demand by country

- Middle East & Africa Benzalkonium Chloride Market revenue size and demand by country

- Latin America Benzalkonium Chloride Market revenue size and demand by

- Import-export scenario – United States, Europe, APAC, Latin America, Middle East & Africa

- Average product price – United States, Europe, APAC, Latin America, Middle East & Africa

- Market player analysis, competitive scenario, market share analysis

- Business opportunity analysis

Key questions answered in the Global Benzalkonium Chloride Market Analysis Report:

- What is the market size for Benzalkonium Chloride in United States, Europe, APAC, Middle East & Africa, Latin America?

- What is the yearly sales volume of Benzalkonium Chloride and how is the demand rising?

- Who are the top market players by market share, in each product segment?

- Which is the fastest growing business/ product segment?

- What should be the business strategies and Go to Market strategies?

The report covers Benzalkonium Chloride Market revenue, Production, Sales volume, by regions, (further split into countries):

- Asia Pacific (China, Japan, South Korea, India, Indonesia, Vietnam, Rest of APAC)

- Europe (UK, Germany, France, Italy, Spain, Benelux, Poland, Rest of Europe)

- North America (United States, Canada, Mexico)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa

Table of Contents:

Benzalkonium Chloride Market Analysis and Forecast

- Introduction to the Benzalkonium Chloride Market

- Chemical Composition and Key Properties of Benzalkonium Chloride

- Industrial Significance and Market Evolution

- Market Trends and Growth Drivers in Benzalkonium Chloride Production

- Factors Influencing Demand for Benzalkonium Chloride

- Technological Innovations in Benzalkonium Chloride Production

- Segmentation of the Benzalkonium Chloride Market by Product Type and Application

- Industrial and Commercial Grades of Benzalkonium Chloride

- Key Sectors Utilizing Benzalkonium Chloride

- Global Benzalkonium Chloride Market Size and Revenue Forecast (2025-2035)

- Market Valuation Trends and Future Growth Projections

- Contributions of Different Market Segments

- North America Benzalkonium Chloride Market Outlook

- Market Size and Demand Patterns

- Competitive Landscape and Key Players

- Europe Benzalkonium Chloride Market Dynamics

- Regional Market Expansion Strategies

- Regulations Impacting Benzalkonium Chloride Production

- Asia-Pacific Benzalkonium Chloride Market Insights

- Emerging Manufacturing Hubs and Market Opportunities

- Government Regulations Affecting Production and Trade

- Latin America Benzalkonium Chloride Market Analysis

- Industry Growth and Consumer Demand Trends

- Trade Agreements and Regulatory Factors

- Middle East & Africa Benzalkonium Chloride Market Developments

- Market Demand and Potential for Expansion

- Import-Export Trends and Key Market Players

- Benzalkonium Chloride Production Estimates and Market Forecast (2025-2035)

- Future Growth in Production Capacities

- Innovations in Benzalkonium Chloride Manufacturing Processes

- Competitive Landscape: Leading Players in the Benzalkonium Chloride Market

- Market Share Analysis of Key Manufacturers

- Business Expansion Strategies of Major Companies

- Global Benzalkonium Chloride Production by Top Manufacturers

- High-Capacity Producers and Their Market Influence

- Investment Trends in Production Facilities

- Revenue Market Share of Benzalkonium Chloride Producers (2025-2035)

- Financial Performance of Market Leaders

- Pricing Strategies and Profitability Analysis

- International Trade Analysis of Benzalkonium Chloride: Export Trends

- Major Exporting Nations and Market Growth

- Trade Agreements and Their Impact on Global Expansion

- Import Trends and Domestic Consumption of Benzalkonium Chloride

- Key Importing Countries and Their Market Potential

- Industrial Usage of Imported Benzalkonium Chloride

- Market Demand and Application-Specific Consumption of Benzalkonium Chloride

- Sector-Wise Consumption Breakdown

- Emerging Uses in Pharmaceutical and Healthcare Industries

- Regional Consumption Trends in the Benzalkonium Chloride Market

- Country-Specific Demand Analysis

- Economic and Regulatory Factors Driving Consumption

- Product-Based Market Segmentation and Market Share Analysis

- Differences in Demand by Product Type

- Expected Growth in Specialty and High-Purity Variants

- Revenue Contribution by Various Benzalkonium Chloride Product Categories (2025-2035)

- High-Demand Product Variants and Their Market Influence

- Innovations in Specialty Applications

- Benzalkonium Chloride Manufacturing Process and Cost Structure Analysis

- Key Steps in Benzalkonium Chloride Production

- Strategies for Cost Optimization and Efficiency

- Raw Materials Used in Benzalkonium Chloride Production

- Key Ingredients and Their Availability

- Supply Chain Constraints and Market Risks

- Leading Suppliers of Raw Materials for Benzalkonium Chloride Manufacturing

- Major Global and Regional Suppliers

- Pricing Trends and Their Impact on Production Costs

- Cost Breakdown and Profitability in Benzalkonium Chloride Production

- Comparative Analysis of Fixed and Variable Costs

- Profitability Trends and Industry Benchmarks

- Industrial Supply Chain and Logistics in the Benzalkonium Chloride Market

- Role of Distribution Networks and Supply Partners

- Challenges in Storage and Transportation

- Marketing Strategies and Distribution Channels for Benzalkonium Chloride

- Branding and Market Penetration Approaches

- Regional and Global Distribution Trends

- List of Benzalkonium Chloride Distributors and Wholesale Suppliers

- Major Global and Regional Distribution Companies

- Strategic Partnerships in the Market

- End-User Market Analysis for Benzalkonium Chloride

- Key Consumer Segments and Their Usage Patterns

- Market Growth in Healthcare, Cosmetics, and Industrial Cleaning

- Future Market Prospects and Benzalkonium Chloride Production Forecast (2025-2035)

- Industry Innovations and Upcoming Market Disruptors

- Investment Opportunities and Market Expansion Strategies

Other recently published reports:

“Every Organization is different and so are their requirements”- Datavagyanik

Companies We Work With

Do You Want To Boost Your Business?

drop us a line and keep in touch