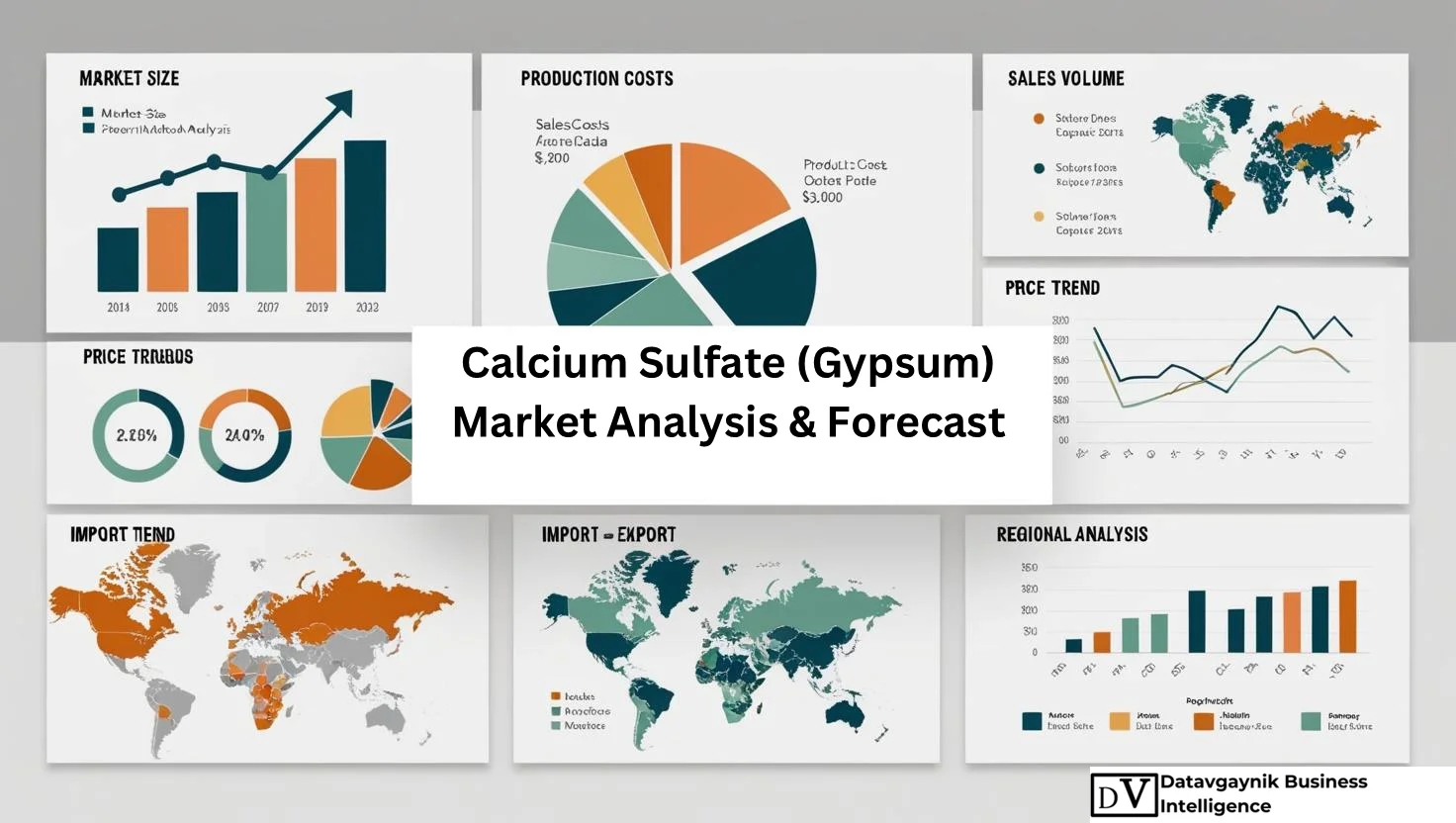

Calcium Sulfate (Gypsum) Market Size, Production, Sales, Average Product Price, Market Share, Import vs Export – United States, Europe, APAC, Latin America, Middle East & Africa

- Published 2025

- No of Pages: 120+

- 20% Customization available

Expanding Urban Infrastructure Propels Calcium Sulfate (Gypsum) Market

The Calcium Sulfate (Gypsum) Market is experiencing accelerated growth on the back of global infrastructure expansion and urban housing development. As per Datavagyanik, the surge in urban construction projects is translating into heightened demand for gypsum-based products such as drywall, plaster, and Portland cement. For instance, in emerging economies like India and Southeast Asia, where urban population growth rates exceed 2% annually, there is a corresponding spike in construction output. This growth is directly linked to increased consumption of gypsum in interior wall applications and cement manufacturing. The integration of gypsum into green construction practices due to its recyclability is further solidifying its role in sustainable infrastructure development.

Cement Manufacturing Drives the Calcium Sulfate (Gypsum) Market

One of the primary drivers of the Calcium Sulfate (Gypsum) Market is its critical application in cement production. Gypsum is added to clinker during cement production to regulate setting time, an essential factor for construction workflows. Datavagyanik notes that the global cement output, which exceeded 4.1 billion tons in 2023, heavily relies on calcium sulfate as a functional additive. The consistent rise in megaprojects—such as roadways, bridges, and commercial buildings—demonstrates how cement demand continues to fuel gypsum consumption. Furthermore, synthetic gypsum sourced from flue gas desulfurization (FGD) in coal-fired power plants is gaining traction as an alternative to natural gypsum, aligning with stricter environmental mandates in developed markets.

Datavagyanik also covers related markets such as the PolyCarboxylate ether for gypsum wallboard manufacturing Market. Each of these markets adds unique insights into end-user applications, regulatory influences, and competitive developments.

Drywall and Plasterboard Application Strengthens Calcium Sulfate (Gypsum) Market

The application of calcium sulfate in drywall and plasterboard remains a pivotal growth segment in the Calcium Sulfate (Gypsum) Market. For example, in North America alone, drywall usage accounts for over 80% of interior wall construction in residential units. The push for lightweight, fire-resistant, and moisture-stable materials in both residential and commercial buildings is directly influencing demand. In particular, the United States gypsum board market, valued at around USD 15.6 billion in 2023, is expected to grow at a CAGR of over 9% through 2030. This illustrates how gypsum-based drywall continues to dominate the interior materials segment, especially in fast-growing housing markets.

Calcium Sulfate (Gypsum) Market Benefits from Agricultural Advancements

Agricultural applications are increasingly shaping the trajectory of the Calcium Sulfate (Gypsum) Market. Calcium sulfate is recognized as a potent soil conditioner, particularly effective in improving water infiltration, reducing soil compaction, and reclaiming sodic or saline soils. Datavagyanik highlights that demand for gypsum-based fertilizers is growing rapidly in countries with large-scale farming sectors such as China, Brazil, and the United States. For instance, in India, government-led initiatives to enhance soil fertility have led to wider adoption of gypsum in arid regions. The dual role of calcium and sulfur in promoting plant health and yield is reinforcing gypsum’s position as a key agricultural input.

Food and Pharma Sector Elevates Calcium Sulfate (Gypsum) Market Prospects

The Calcium Sulfate (Gypsum) Market is witnessing rising demand from the food and pharmaceutical sectors due to its role as a firming agent, stabilizer, and dietary supplement. In the food industry, calcium sulfate (known as additive E516) is used in bakery goods and tofu production. For example, the tofu manufacturing segment in East Asia—valued at over USD 500 million—is a significant end-user of food-grade calcium sulfate. Moreover, in the pharmaceutical industry, calcium sulfate is utilized as a diluent in tablets and as an implant material in orthopedics. These applications not only broaden the market base but also enhance product diversification for gypsum producers globally.

Synthetic Gypsum Expands Opportunities in the Calcium Sulfate (Gypsum) Market

The growing focus on environmental compliance has spurred investments in synthetic gypsum production, thereby reshaping the Calcium Sulfate (Gypsum) Market landscape. Synthetic gypsum, especially derived from FGD processes, accounted for over 30% of the total gypsum used in developed markets in 2023. Datavagyanik reports that this trend is particularly strong in regions like North America and Western Europe, where power generation plants are mandated to reduce sulfur emissions. The resulting synthetic gypsum offers comparable purity and performance characteristics to natural gypsum, making it a viable and eco-friendly substitute. Moreover, its increasing use in cement and drywall applications underlines its strategic value in the transition to circular industrial systems.

Calcium Sulfate (Gypsum) Market Growth Anchored in Population Dynamics

Population growth continues to influence the Calcium Sulfate (Gypsum) Market through rising housing needs and food security concerns. Global population expansion—projected to reach 9.7 billion by 2050—is placing significant pressure on both the housing and agriculture sectors. For instance, the demand for new housing units in Africa and South Asia is contributing to the growth of cement and drywall consumption, both of which are dependent on calcium sulfate. Simultaneously, food production must increase by over 60% to meet the nutritional needs of the growing population, further driving the use of gypsum-based fertilizers. These demographic trends collectively create long-term tailwinds for the calcium sulfate industry.

Green Building Trends Strengthen the Calcium Sulfate (Gypsum) Market

Environmental sustainability is increasingly influencing material selection in the construction sector, positioning the Calcium Sulfate (Gypsum) Market for accelerated growth. For example, LEED-certified buildings and other green construction frameworks often prefer gypsum-based materials due to their low toxicity, fire resistance, and recyclability. Datavagyanik underscores that manufacturers are developing gypsum boards with reduced carbon footprints and higher energy efficiency performance. In Europe, regulatory incentives for low-emission building materials are catalyzing demand for recycled and synthetic gypsum. The broader adoption of environmental certifications globally is expected to further solidify the market presence of calcium sulfate in the construction value chain.

Rising Role of Recycled Gypsum in the Calcium Sulfate (Gypsum) Market

Recycling initiatives are increasingly shaping procurement and usage patterns in the Calcium Sulfate (Gypsum) Market. Recycled gypsum sourced from demolished drywall and construction waste is being reintroduced into the supply chain, particularly in mature markets like the United States, Germany, and the UK. Datavagyanik highlights that in the EU, policy targets aim to increase recycled gypsum utilization to at least 10% of total consumption by 2030. The shift toward circular construction practices not only reduces dependency on natural reserves but also cuts down environmental impact, supporting regulatory compliance and ESG goals for gypsum producers.

Industrial Diversification Enhances Calcium Sulfate (Gypsum) Market Resilience

Beyond construction and agriculture, the Calcium Sulfate (Gypsum) Market is expanding due to its increasing use in niche industrial processes. In the ceramics industry, calcium sulfate is used in mold-making due to its ability to form detailed casts. In the oil and gas sector, it plays a role in cementing operations and wellbore stability. Moreover, its desiccant properties make it suitable for use in drying gases and liquids across chemical and petrochemical industries. This industrial diversification insulates the calcium sulfate market from single-sector volatility and provides broader resilience to macroeconomic fluctuations.

Emerging Economies to Drive Future Calcium Sulfate (Gypsum) Market Size

The future trajectory of the Calcium Sulfate (Gypsum) Market Size will be increasingly defined by developments in emerging economies. Regions such as Southeast Asia, Latin America, and Sub-Saharan Africa are witnessing robust demand for affordable housing, improved agricultural productivity, and localized manufacturing. Datavagyanik estimates that these regions will collectively account for over 40% of incremental calcium sulfate consumption by 2032. For example, governments in Africa are investing in low-cost housing schemes and soil health improvement programs, both of which depend on gypsum supply chains. As a result, global calcium sulfate market participants are strategically investing in regional manufacturing and distribution capabilities to tap into this expanding base.

“Track Country-wise Calcium Sulfate (Gypsum) Production and Demand through our Calcium Sulfate (Gypsum) Production Database”

-

-

- Calcium Sulfate (Gypsum) production database for 27+ countries worldwide

- Calcium Sulfate (Gypsum) sales volume for 31+ countries

- Country-wise Calcium Sulfate (Gypsum) production capacity, production plant mapping, production capacity utilization for 27+ manufacturers

- Calcium Sulfate (Gypsum) production plants and production plant capacity analysis by top manufacturers

-

“Track real-time Calcium Sulfate (Gypsum) Prices, Calcium Sulfate (Gypsum) price charts for 27+ countries, Calcium Sulfate (Gypsum) weekly price tracker and Calcium Sulfate (Gypsum) monthly price tracker”

-

-

- Track real-time Calcium Sulfate (Gypsum) prices and Calcium Sulfate (Gypsum) price trend in 27+ countries though our excel-based Calcium Sulfate (Gypsum) price charts

- Real-time Calcium Sulfate (Gypsum) price tracker dashboard with 27+ countries

- Complete transparency on Calcium Sulfate (Gypsum) price trend through our Calcium Sulfate (Gypsum) monthly price tracker, Calcium Sulfate (Gypsum) weekly price tracker

-

Regional Expansion of the Calcium Sulfate (Gypsum) Market in North America

The North America Calcium Sulfate (Gypsum) Market continues to be characterized by robust demand driven by the construction, agriculture, and industrial manufacturing sectors. The United States remains the largest consumer, supported by strong housing starts, infrastructure refurbishments, and sustainable construction initiatives. For example, residential construction alone accounted for over 42% of total gypsum board usage in 2023, indicating the material’s integral role in building frameworks and interior finishing. Canada also contributes steadily, with a growing number of eco-certified buildings using gypsum-based components. Datavagyanik observes that increasing synthetic gypsum production, sourced from flue gas desulfurization (FGD), is reducing dependence on imports, with the U.S. producing over 11 million tons of synthetic gypsum annually.

Europe’s Sustainable Construction Agenda Fuels the Calcium Sulfate (Gypsum) Market

In Europe, the Calcium Sulfate (Gypsum) Market is driven by sustainability-centric construction policies and strong demand from the agriculture and pharmaceutical industries. Countries such as Germany, France, and the United Kingdom are leading the region in gypsum consumption. Germany’s emphasis on drywall systems for energy-efficient buildings and France’s expanding organic agriculture sector have significantly contributed to the demand for both natural and synthetic gypsum. For instance, European Union targets on recycling have pushed recycled gypsum usage to exceed 6% of regional consumption, a figure projected to double by 2030. Datavagyanik highlights that Europe’s regulatory framework is accelerating the shift toward synthetic gypsum and incentivizing circular building materials across construction projects.

Asia-Pacific Emerges as a High-Growth Zone for the Calcium Sulfate (Gypsum) Market

The Asia-Pacific Calcium Sulfate (Gypsum) Market is undergoing rapid transformation, driven by urban expansion, infrastructure investments, and increasing agricultural modernization. China alone represents over 25% of global gypsum demand, led by large-scale housing developments and a government-backed push for affordable housing. For instance, the gypsum board market in China surpassed USD 12 billion in 2023 and continues to grow at a double-digit pace.

In India, rising adoption of gypsum-based fertilizers in water-stressed agricultural zones is fueling demand, especially in the western and southern regions. Additionally, industrial usage in the ceramics and medical sectors in Japan and South Korea contributes to diversified application bases. Datavagyanik projects Asia-Pacific to dominate incremental global gypsum demand over the next decade, owing to its population size and infrastructure ambitions.

Middle East Infrastructure Investments Catalyze the Calcium Sulfate (Gypsum) Market

The Middle East Calcium Sulfate (Gypsum) Market is increasingly shaped by state-led construction mega-projects and demand for thermal-efficient building materials. For instance, Saudi Arabia’s Vision 2030 has sparked multiple housing and commercial infrastructure projects, leading to increased gypsum board and cement usage. Similarly, the UAE’s commercial real estate boom—particularly in Dubai and Abu Dhabi—is propelling the consumption of lightweight and fire-resistant gypsum products. Qatar, on the back of post-World Cup infrastructure realignments, continues to invest in transport and industrial zones, all requiring substantial volumes of gypsum. Datavagyanik confirms that these developments are creating opportunities for both domestic gypsum production and imports from markets like Oman and Iran.

Latin America Calcium Sulfate (Gypsum) Market Gains Momentum in Agriculture and Housing

In Latin America, the Calcium Sulfate (Gypsum) Market is witnessing steady growth, driven by soil conditioning applications and an expanding middle-class housing market. Brazil is at the forefront due to its large-scale agricultural industry, where gypsum is used to improve soil structure and mitigate acidity, particularly in the Cerrado region. Additionally, countries like Mexico and Colombia are witnessing increased use of drywall systems in residential construction, reflecting a shift from traditional building materials. Datavagyanik reports that domestic gypsum reserves in Chile and Peru are being actively exploited, while countries with limited reserves rely heavily on imports from the U.S. and Southeast Asia. Overall, the market is benefiting from both infrastructural needs and agricultural imperatives.

Calcium Sulfate (Gypsum) Production Dynamics and Leading Exporters

Global production of calcium sulfate continues to rise, with China, the United States, Iran, and Thailand ranking among the top producers. China leads the segment with over 145 million metric tons of natural gypsum reserves, coupled with large-scale industrial capabilities for synthetic gypsum output. The United States also maintains a strategic position, especially with its high FGD-based synthetic gypsum production that serves both domestic and export markets. Thailand and Oman, on the other hand, play a crucial role as major exporters of natural gypsum, supplying to India, Japan, and parts of Southeast Asia. Datavagyanik emphasizes that trade flow is highly influenced by transportation costs and regional infrastructure investment cycles.

Market Segmentation Analysis within the Calcium Sulfate (Gypsum) Market

Segmentation by type shows clear dominance of natural gypsum in regions with abundant geological reserves, whereas synthetic gypsum is gaining traction in nations with robust environmental regulations. For instance, FGD gypsum accounts for over 45% of total gypsum usage in parts of North America and Europe. By product, dihydrate gypsum dominates in drywall manufacturing and soil conditioners, while hemihydrate (plaster of Paris) continues to be widely used in medical applications, sculpture, and mold-making. The anhydrite segment is gaining relevance in cement production and desiccant applications.

From an application perspective, construction remains the largest segment, followed by agriculture and industrial usage. In healthcare, the orthopedic segment’s use of calcium sulfate in bone void fillers and cement continues to grow. Datavagyanik underscores that this diversified segmentation helps buffer the industry against cyclical downturns in any one application area.

Calcium Sulfate (Gypsum) Price Variation Across Regions

Calcium Sulfate (Gypsum) Price trends vary based on purity, logistics, and production methods. Natural gypsum sourced from domestic mines typically offers lower prices compared to synthetic or imported variants. For example, in India, natural gypsum prices ranged from USD 25 to USD 40 per ton in 2024, depending on origin and quality. In contrast, synthetic gypsum used in European green-certified construction tends to be priced 15–20% higher due to value-added processing.

Datavagyanik highlights that in North America, the average Calcium Sulfate (Gypsum) Price in the construction sector hovered around USD 34 per ton in 2023, with moderate increases expected due to rising transportation and energy costs. Meanwhile, Southeast Asian countries such as Vietnam and Indonesia saw price stabilization owing to supply agreements with regional producers.

Calcium Sulfate (Gypsum) Price Trend Influenced by Energy and Logistics

The global Calcium Sulfate (Gypsum) Price Trend is increasingly impacted by energy costs, trade logistics, and regulatory frameworks. Rising fuel prices directly affect mining and processing costs, particularly for synthetic gypsum produced via energy-intensive methods. Additionally, international freight rates and port congestion in major exporting countries such as Oman and Thailand have led to cost fluctuations in the Asia-Pacific region.

Environmental regulations also play a role in influencing the Calcium Sulfate (Gypsum) Price Trend. For instance, mandates on reducing sulfur emissions have prompted higher investments in FGD systems, thereby increasing the availability—and in some cases reducing the cost—of synthetic gypsum. Datavagyanik notes that despite regional volatility, the overall trend remains moderately bullish for 2025, particularly in markets where construction activity remains resilient and agriculture continues to expand.

Future Outlook for Regional Balance in the Calcium Sulfate (Gypsum) Market

Looking ahead, the Calcium Sulfate (Gypsum) Market is expected to see a shift in regional dominance, with Asia-Pacific and Africa set to emerge as major growth engines. These regions are projected to account for over 50% of new construction-related gypsum consumption by 2032, largely due to urbanization and government-led housing programs. At the same time, Europe and North America will continue to lead innovations in recycled and synthetic gypsum utilization, influenced by environmental policy and advanced building codes.

Datavagyanik projects that the Calcium Sulfate (Gypsum) Price Trend will remain firm through the medium term, supported by consistent demand growth, limited raw material substitutes, and regulatory pressures promoting sustainability. This positions the global calcium sulfate industry for strong performance across both developed and emerging markets.

“Calcium Sulfate (Gypsum) Manufacturing Database, Calcium Sulfate (Gypsum) Manufacturing Capacity”

-

-

- Calcium Sulfate (Gypsum) top manufacturers market share for 27+ manufacturers

- Top 9 manufacturers and top 16 manufacturers of Calcium Sulfate (Gypsum) in North America, Europe, Asia Pacific

- Calcium Sulfate (Gypsum) production plant capacity by manufacturers and Calcium Sulfate (Gypsum) production data for 27+ market players

- Calcium Sulfate (Gypsum) production dashboard, Calcium Sulfate (Gypsum) production data in excel format

-

“Calcium Sulfate (Gypsum) price charts, Calcium Sulfate (Gypsum) weekly price tracker and Calcium Sulfate (Gypsum) monthly price tracker”

-

-

- Factors impacting real-time Calcium Sulfate (Gypsum) prices in 21+ countries worldwide

- Calcium Sulfate (Gypsum) monthly price tracker, Calcium Sulfate (Gypsum) weekly price tracker

- Real-time Calcium Sulfate (Gypsum) price trend, Calcium Sulfate (Gypsum) price charts, news and updates

- Tracking Calcium Sulfate (Gypsum) price fluctuations

-

Leading Manufacturers Shaping the Calcium Sulfate (Gypsum) Market

The global Calcium Sulfate (Gypsum) Market is highly consolidated, with a handful of multinational companies holding the majority of production and distribution capacity. These manufacturers are leveraging scale, technological innovation, and strategic acquisitions to meet surging demand across construction, agriculture, and industrial applications. Datavagyanik identifies the following manufacturers as the key players commanding significant market share in the Calcium Sulfate (Gypsum) Market.

Knauf Gips KG – Dominating Global Production

Knauf Gips KG is widely recognized as the global leader in the Calcium Sulfate (Gypsum) Market, with an estimated 25% market share in gypsum wallboard production. Operating across more than 90 countries and supported by over 150 production facilities, Knauf offers an extensive product portfolio ranging from plasterboards to performance-enhanced gypsum products. The company’s Knauf Wallboard and Knauf Safeboard are widely used in fire-resistant and radiation-shielded applications. Knauf’s vertical integration strategy, including its mining operations, ensures consistent raw material supply and cost control, strengthening its position across both developed and emerging markets.

BNBM (Beijing New Building Materials) – Powerhouse in Asia-Pacific

BNBM, a subsidiary of the China National Building Material Group, holds a dominant position in the Asia-Pacific Calcium Sulfate (Gypsum) Market. The company’s gypsum board production capacity has surpassed 2.8 billion square meters annually, with a distribution network that supports both domestic and export markets. Its Taishan Gypsum brand is synonymous with quality and is especially prevalent in large-scale commercial construction across China. BNBM’s market share in the regional wallboard segment exceeds 30%, driven by strong demand from infrastructure development and government housing programs.

Saint-Gobain – Leading Innovation and Sustainability

Saint-Gobain, through its Gyproc brand, plays a significant role in the European Calcium Sulfate (Gypsum) Market and maintains a growing presence in North America and the Middle East. The company focuses on lightweight construction systems, acoustic and thermal insulation, and sustainable building solutions. Its Habito and Glasroc product lines are tailored for impact-resistant and moisture-resilient applications in modern construction. Saint-Gobain commands an estimated 15–18% share of the global gypsum board market and continues to invest in decarbonization and recycling technologies, including net-zero gypsum board production at its upgraded Norway facility.

National Gypsum Company – Focused Growth in North America

National Gypsum Company is a key North American player in the Calcium Sulfate (Gypsum) Market. Its flagship Gold Bond® line of gypsum boards is extensively used in both residential and commercial sectors across the United States. With manufacturing plants spread across the East Coast and the Midwest, the company benefits from proximity to high-demand urban centers. National Gypsum has also developed specialty boards like XP® mold and moisture-resistant products, catering to healthcare and institutional construction. Its estimated market share in the U.S. wallboard segment is close to 10%, and the company is pursuing capacity upgrades to meet future demand.

Georgia-Pacific – Diverse Offerings and Robust Distribution

Georgia-Pacific, a subsidiary of Koch Industries, maintains a strong presence in the U.S. Calcium Sulfate (Gypsum) Market. The company’s ToughRock® and DensArmor Plus® lines are prominent in applications that require durability and resistance to mold and impact. With 14 gypsum board plants and an integrated logistics network, Georgia-Pacific can serve both large-scale and localized construction markets. Its estimated market share in the North American gypsum wallboard market is 12–14%, supported by innovations in moisture defense and high-performance wall systems for commercial structures.

Etex Group – Strengthening Global Reach through Siniat

Etex Group, through its Siniat brand, is expanding its footprint in the global Calcium Sulfate (Gypsum) Market. With a strong presence in Europe and recent expansions in the UK, Siniat provides an array of gypsum-based construction materials, including pre-fabricated wall systems and plaster solutions for modular building. The group’s Bristol plant, inaugurated in 2025, is one of its largest investments and positions Etex to serve growing demand in sustainable building projects. Etex holds approximately 8–10% market share in European gypsum board supply and is gradually scaling in Latin America and Southeast Asia.

Yoshino Gypsum – Japan’s Leading Gypsum Product Manufacturer

Yoshino Gypsum is Japan’s premier manufacturer in the Calcium Sulfate (Gypsum) Market. Its flagship Tiger Board® line dominates the Japanese drywall segment, catering to both seismic-resistant and fireproof construction applications. With a history dating back to 1937, the company has built a reputation for quality and innovation. Yoshino Gypsum’s market share in Japan is estimated at over 60%, and it continues to innovate with lightweight and acoustically engineered board solutions tailored to the needs of dense urban architecture.

Calcium Sulfate (Gypsum) Market Share Distribution by Manufacturer

Based on global analysis, the top five manufacturers—Knauf, BNBM, Saint-Gobain, National Gypsum, and Georgia-Pacific—account for over 70% of the global gypsum board production. Regional specialists like Etex and Yoshino Gypsum add to this consolidation in Europe and Asia, respectively. This concentrated market structure allows these players to set technological trends, control pricing benchmarks, and influence distribution standards globally. The remaining 30% of the market is fragmented among regional players and smaller domestic producers primarily catering to localized construction or agricultural needs.

Recent News and Developments in the Calcium Sulfate (Gypsum) Market

- In April 2023, Knauf announced a major capacity expansion at its Mkuranga plant in Tanzania, increasing its annual wallboard output from 15 million to 43 million square meters. This move is expected to boost gypsum exports across East Africa by over 170%.

- Saint-Gobain completed the decarbonization of its Fredrikstad plant in Norway in mid-2023. This site became the company’s first net-zero CO2 gypsum production facility, reflecting a broader commitment to carbon-neutral manufacturing.

- Etex Group commissioned a new €238 million gypsum board manufacturing facility in Bristol, UK, in March 2025. The plant is designed to support high-efficiency wallboard production and reduce supply chain emissions in the UK construction market.

- BNBM reported a 56% rise in gypsum segment gross profits in 2024, attributed to its strategic realignment toward premium gypsum products and a rise in demand from home renovation markets in China’s Tier 1 and Tier 2 cities.

- Georgia-Pacific launched a new facility in Sweetwater, Texas, in October 2023 to serve residential and commercial builders with faster deliveries and tailored board specifications for large-scale housing projects.

These developments collectively underscore the dynamic nature of the Calcium Sulfate (Gypsum) Market, where top manufacturers are competing not only on capacity and cost but increasingly on sustainability, product customization, and geographic reach. Datavagyanik anticipates further consolidation and strategic expansion in the coming years as the demand for high-performance gypsum-based solutions continues to rise globally

“Calcium Sulfate (Gypsum) Production Data and Calcium Sulfate (Gypsum) Production Trend, Calcium Sulfate (Gypsum) Production Database and forecast”

-

-

- Calcium Sulfate (Gypsum) production database for historical years, 10 years historical data

- Calcium Sulfate (Gypsum) production data and forecast for next 9 years

- Calcium Sulfate (Gypsum) sales volume by manufacturers

-

“Track Real-time Calcium Sulfate (Gypsum) Prices for purchase and sales contracts, Calcium Sulfate (Gypsum) price charts, Calcium Sulfate (Gypsum) weekly price tracker and Calcium Sulfate (Gypsum) monthly price tracker”

-

-

- Gain control on your purchase and sales contracts through our real-time Calcium Sulfate (Gypsum) price tracker and Calcium Sulfate (Gypsum) price trend analysis

- Calcium Sulfate (Gypsum) weekly price tracker and forecast for next four weeks

- Calcium Sulfate (Gypsum) monthly price tracker and forecast for next two months

-

Market Scenario, Demand vs Supply, Average Product Price, Import vs Export, till 2032

- Global Calcium Sulfate (Gypsum) Market revenue and demand by region

- Global Calcium Sulfate (Gypsum) Market production and sales volume

- United States Calcium Sulfate (Gypsum) Market revenue size and demand by country

- Europe Calcium Sulfate (Gypsum) Market revenue size and demand by country

- Asia Pacific Calcium Sulfate (Gypsum) Market revenue size and demand by country

- Middle East & Africa Calcium Sulfate (Gypsum) Market revenue size and demand by country

- Latin America Calcium Sulfate (Gypsum) Market revenue size and demand by

- Import-export scenario – United States, Europe, APAC, Latin America, Middle East & Africa

- Average product price – United States, Europe, APAC, Latin America, Middle East & Africa

- Market player analysis, competitive scenario, market share analysis

- Business opportunity analysis

Key questions answered in the Global Calcium Sulfate (Gypsum) Market Analysis Report:

- What is the market size for Calcium Sulfate (Gypsum) in United States, Europe, APAC, Middle East & Africa, Latin America?

- What is the yearly sales volume of Calcium Sulfate (Gypsum) and how is the demand rising?

- Who are the top market players by market share, in each product segment?

- Which is the fastest growing business/ product segment?

- What should be the business strategies and Go to Market strategies?

The report covers Calcium Sulfate (Gypsum) Market revenue, Production, Sales volume, by regions, (further split into countries):

- Asia Pacific (China, Japan, South Korea, India, Indonesia, Vietnam, Rest of APAC)

- Europe (UK, Germany, France, Italy, Spain, Benelux, Poland, Rest of Europe)

- North America (United States, Canada, Mexico)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa

Table of Contents:

Calcium Sulfate (Gypsum) Market

1. Introduction to the Calcium Sulfate (Gypsum) Market

- Overview of Calcium Sulfate (Gypsum) and Its Chemical Properties

- Industrial Applications and Strategic Importance in Construction and Agriculture

- Research Scope, Market Definitions, and Study Objectives

2. Market Growth Drivers, Challenges, and Opportunities

- Key Factors Driving Demand for Calcium Sulfate (Gypsum)

- Challenges in Calcium Sulfate (Gypsum) Production and Supply Chain Issues

- Emerging Opportunities in Sustainable Construction and Industrial Applications

3. Global Calcium Sulfate (Gypsum) Market Size and Forecast (2020-2035)

- Revenue and Volume Analysis Across Major Regions

- Demand-Supply Trends and Future Growth Projections

- Long-Term Market Expansion Strategies and Industry Forecasts

4. Calcium Sulfate (Gypsum) Production and Manufacturing Processes

- Global Production Capacities and Key Manufacturing Hubs

- Advancements in Calcium Sulfate (Gypsum) Processing Technologies

- Future Outlook for Calcium Sulfate (Gypsum) Production (2025-2035)

5. Calcium Sulfate (Gypsum) Market Segmentation and Applications

- Classification by Purity, Grade, and Form (Anhydrous, Dihydrate, Hemihydrate)

- End-Use Market Segmentation (Construction, Agriculture, Industrial, Medical)

- Geographic Market Distribution and Regional Demand Analysis

6. Regional Market Insights and Industry Performance

- North America: Market Growth, Key Producers, and Regulatory Policies

- Europe: Industry Trends, Trade Regulations, and Sustainability Initiatives

- Asia-Pacific: Dominant Producers, Market Growth Drivers, and Trade Flows

- Latin America: Emerging Investment Opportunities and Market Expansion

- Middle East & Africa: Construction Boom, Market Potential, and Growth Strategies

7. Competitive Landscape and Market Positioning

- Global Calcium Sulfate (Gypsum) Manufacturers and Market Share Analysis

- Competitive Strategies, Mergers, Acquisitions, and Industry Collaborations

- Key Innovations and Business Developments Among Leading Players

8. Trade Flow, Supply Chain, and Distribution Networks

- Global Trade Flow and Market Accessibility

- Import-Export Analysis and Regional Trade Agreements

- Supply Chain Challenges, Logistics Optimization, and Distribution Strategies

9. Calcium Sulfate (Gypsum) Pricing Trends and Cost Structure Analysis

- Historical Pricing Trends and Market Influences (2019-2025)

- Future Pricing Forecasts and Cost-Driving Factors (2025-2035)

- Breakdown of Production Costs and Profitability Assessment

10. Industrial Applications and Market Demand for Calcium Sulfate (Gypsum)

- Role in Cement, Drywall, and Plaster Manufacturing

- Utilization in Agriculture for Soil Conditioning and Fertilization

- Expanding Applications in Pharmaceuticals, Food, and Medical Industries

11. Raw Material Sourcing and Supply Chain Risks

- Key Raw Materials for Calcium Sulfate (Gypsum) Production

- Global Supplier Landscape and Market Availability

- Supply Chain Bottlenecks, Pricing Volatility, and Alternative Sourcing Strategies

12. Innovations and Technological Advancements in Calcium Sulfate (Gypsum) Processing

- Breakthroughs in Sustainable and Energy-Efficient Processing Techniques

- Enhancements in Recycling and By-Product Utilization

- Research & Development Efforts in Expanding Market Applications

13. Investment Trends and Business Growth Strategies

- Market Entry Strategies for New Participants and Industry Players

- Investment Trends and Funding Opportunities in the Calcium Sulfate (Gypsum) Industry

- Expansion Plans, Joint Ventures, and Business Development Initiatives

14. Regulatory Landscape and Environmental Sustainability

- Global and Regional Regulations Impacting Calcium Sulfate (Gypsum) Production

- Sustainability Practices and Environmental Impact Considerations

- Compliance Challenges and Policy Changes Affecting the Industry

15. Sales, Marketing, and Distribution Strategies

- Global and Regional Distribution Channels for Calcium Sulfate (Gypsum)

- Sales Strategies for Manufacturers, Distributors, and Suppliers

- Consumer Preferences, Market Demand, and Industry Trends

16. Future Market Outlook and Long-Term Strategic Planning (2025-2035)

- Predicted Market Developments and Key Growth Sectors

- Risks, Challenges, and Constraints Impacting Future Market Expansion

- Strategic Recommendations for Sustainable Market Growth and Industry Innovation

Other recently published reports:

“Every Organization is different and so are their requirements”- Datavagyanik

Companies We Work With

Do You Want To Boost Your Business?

drop us a line and keep in touch