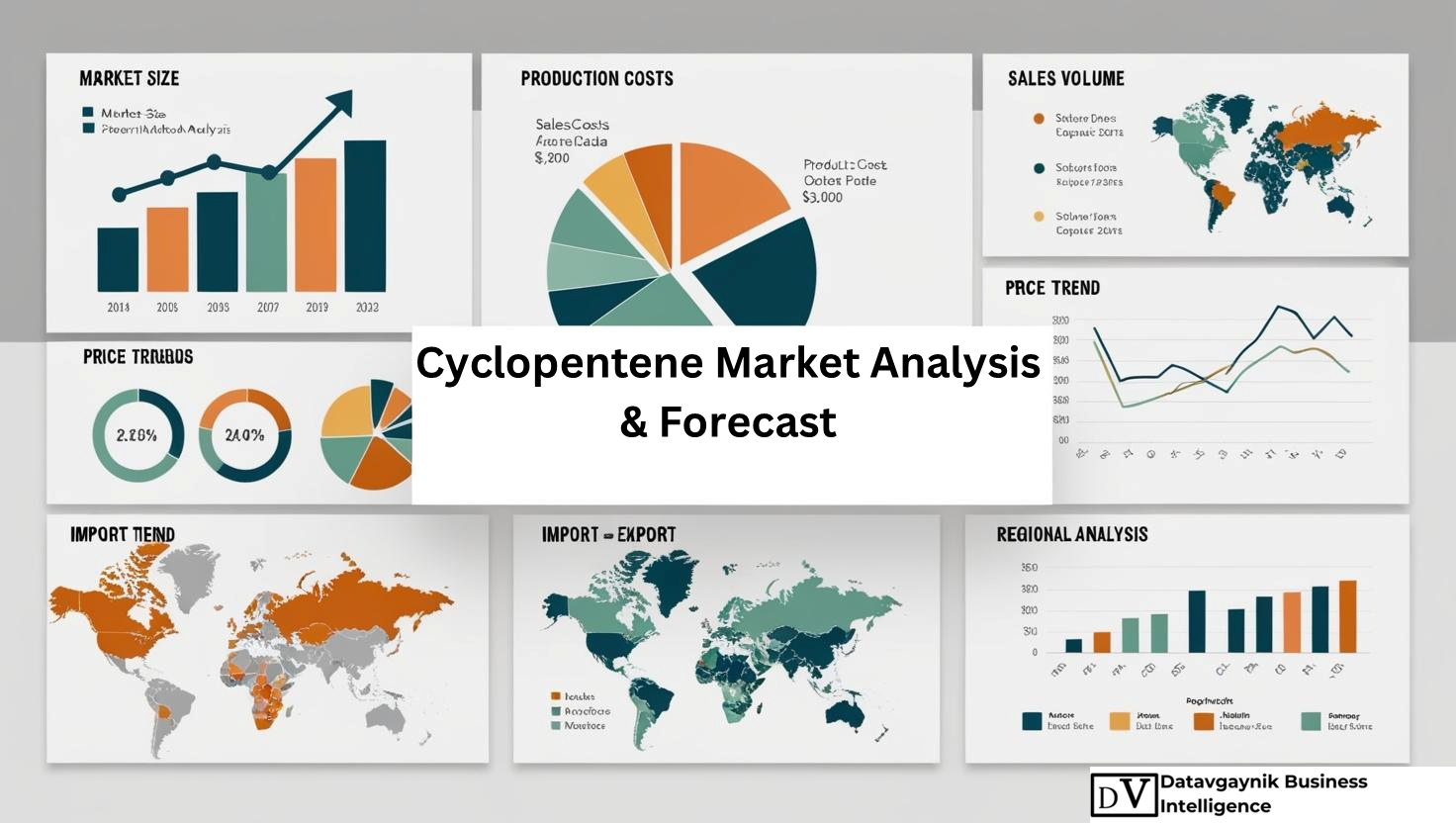

Cyclopentene Market Size, Production, Sales, Average Product Price, Market Share, Import vs Export

- Published 2025

- No of Pages: 120+

- 20% Customization available

Cyclopentene Market Driven by Rising Demand for High-Performance Polymers and Resins

The Cyclopentene Market is experiencing robust growth due to its essential role in producing high-performance polymers and resins. Cyclopentene is a critical intermediate for synthesizing cyclic olefin copolymers (COCs), widely used in automotive, aerospace, electronics, and medical packaging sectors. For instance, the demand for lightweight, heat-resistant, and transparent polymers in the automotive industry has grown at a CAGR of over 7% in the last five years, directly supporting the expansion of the Cyclopentene Market. Automotive manufacturers are increasingly opting for cyclopentene-derived resins to replace heavier traditional materials, enhancing fuel efficiency and reducing emissions.

Expanding Applications in Pharmaceutical Synthesis Boost Cyclopentene Market

One of the most dynamic segments supporting the Cyclopentene Market is pharmaceutical synthesis. Cyclopentene is used as a precursor for various drug intermediates, particularly in the synthesis of complex molecules and active pharmaceutical ingredients (APIs). For instance, as the global pharmaceutical market surpassed $1.6 trillion in 2023, the demand for innovative drug compounds has increased. Cyclopentene’s structural versatility makes it a valuable compound in drug discovery pipelines and custom synthesis operations. This trend is expected to remain strong as personalized medicine and biotech investments expand globally.

Agrochemical Industry Demand Propels Cyclopentene Market Growth

The Cyclopentene Market is further supported by growing applications in the agrochemical sector. Cyclopentene derivatives are widely used in the production of crop protection agents such as herbicides, fungicides, and insecticides. With the global population expected to reach 9.7 billion by 2050, food security remains a top priority. As a result, global agrochemical demand has been rising steadily at 4–5% annually. For example, in 2023, the crop protection chemical market was valued at over $70 billion, with a significant portion involving specialty intermediates like cyclopentene, which improve formulation stability and effectiveness in challenging field conditions.

Surging Construction Sector Drives Demand in Cyclopentene Market

The global construction boom is another key growth engine for the Cyclopentene Market. Cyclopentene is utilized in high-performance adhesives, coatings, and insulation materials, all of which are essential in modern construction. For example, cyclopentene-based coatings offer superior UV resistance and thermal insulation, making them ideal for green building initiatives. The global construction chemicals market crossed $85 billion in 2023, and with urbanization accelerating in Asia Pacific, Middle East, and Latin America, the demand for cyclopentene-based formulations continues to grow. Additionally, strict building codes in Europe and North America mandate energy-efficient construction materials, reinforcing the relevance of cyclopentene-based solutions.

Cyclopentene Market Benefits from Rapid Expansion in Electronics Sector

The electronics industry is another significant contributor to the Cyclopentene Market, particularly in the production of resins for semiconductors and insulating components. Cyclopentene-derived materials are integral in printed circuit boards (PCBs) due to their dielectric stability and thermal endurance. For instance, global PCB production reached over $90 billion in 2023, growing at 5–6% annually, and cyclopentene-based materials are increasingly replacing legacy resins that fail under extreme conditions. Furthermore, with consumer electronics and 5G device proliferation on the rise, the need for compact and heat-resistant components is creating long-term opportunities for cyclopentene producers.

Cyclopentene Market Supported by Shift Towards Lightweight Automotive Components

In the automotive sector, the demand for fuel-efficient and lightweight materials has led to greater adoption of cyclopentene-based elastomers and polymers. These materials are used in components such as seals, gaskets, tubing, and under-the-hood parts. For instance, electric vehicle (EV) production is projected to grow by over 35% annually through 2030, and every EV model requires advanced polymers for battery insulation, thermal protection, and reduced vehicle weight. Cyclopentene’s chemical structure provides the elasticity and heat resistance required for these demanding applications, placing it at the center of next-gen automotive materials development.

Green Chemistry Trends Accelerate Sustainable Production in Cyclopentene Market

The Cyclopentene Market is also evolving in line with green chemistry and sustainability trends. Traditional production of cyclopentene via steam cracking is being augmented by bio-based and catalytic synthesis methods, which reduce carbon footprint and energy consumption. For example, chemical companies are investing in renewable feedstocks and eco-efficient processes to align with ESG mandates. In 2023 alone, over $25 billion was invested globally in green chemical manufacturing technologies. This transformation not only enhances the environmental profile of cyclopentene production but also ensures regulatory compliance in markets like the EU, where carbon penalties are becoming more stringent.

Cyclopentene Market Sees High Momentum in Renewable Energy Applications

The renewable energy sector is emerging as a novel driver for the Cyclopentene Market. Cyclopentene-based resins are used in composite materials for wind turbine blades, solar encapsulants, and energy storage systems. For instance, global wind capacity exceeded 900 GW in 2023 and is projected to double by 2030. These massive installations require lightweight yet durable components, many of which rely on cyclopentene-derived materials. The same applies to advanced battery casings and panel adhesives in the solar energy segment, where thermal endurance and weather resistance are non-negotiable.

Adhesives and Sealants Industry Adds Competitive Edge to Cyclopentene Market

Cyclopentene plays a pivotal role in manufacturing high-performance adhesives and sealants. These products are indispensable in automotive assembly, electronics manufacturing, aerospace, and building construction. As of 2023, the global adhesives market was valued at over $60 billion, with specialty adhesives growing at 6–8% annually. Cyclopentene’s low volatility and reactivity make it suitable for high-strength bonding agents that endure mechanical stress and temperature fluctuations. This unique combination of properties provides cyclopentene-based adhesives a competitive edge, especially in precision applications such as EV battery packs and aircraft components.

“Track Country-wise Cyclopentene Production and Demand through our Cyclopentene Production Database”

-

-

- Cyclopentene production database for 20+ countries worldwide

- Cyclopentene sales volume by country

- Country-wise Cyclopentene production capacity, production plant mapping, production capacity utilization

- Cyclopentene production plants and production plant capacity analysis by key manufacturers

-

“Track real-time Cyclopentene Prices, Cyclopentene price charts for 20+ countries, Cyclopentene weekly price tracker and Cyclopentene monthly price tracker”

-

-

- Track real-time Cyclopentene prices and Cyclopentene price trend in 20+ countries though our excel-based Cyclopentene price charts

- Real-time Cyclopentene price tracker dashboard

- Complete transparency on Cyclopentene price trend through our Cyclopentene monthly price tracker, Cyclopentene weekly price tracker

-

Cyclopentene Market Expansion Backed by Global Chemical Industry Investment

The global Cyclopentene Market is further energized by large-scale investments in chemical production infrastructure. For instance, China alone announced over $120 billion in petrochemical complex investments through 2025, including cyclopentene-related facilities. Meanwhile, the U.S. and Germany continue upgrading their steam-cracking and separation units to enhance output purity and yield. These developments ensure reliable supply and cost competitiveness, making cyclopentene an increasingly preferred intermediate in value-added manufacturing. Such structural investments also support downstream innovation in composite materials, drug development, and industrial coatings.

Strategic Collaborations and Licensing Fuel Innovation in Cyclopentene Market

Collaborations between global chemical giants and academic institutions are giving the Cyclopentene Market an innovative push. For instance, new catalysts developed through joint R&D are enabling low-temperature cyclopentene synthesis with higher selectivity and reduced byproducts. Licensing agreements and technology transfers are also helping regional manufacturers in Asia and Latin America adopt best-in-class processes without massive upfront R&D costs. This democratization of technology has led to a broader base of cyclopentene producers and reduced dependency on traditional Western suppliers, promoting competitive pricing and market resilience.

Outlook Remains Positive for Cyclopentene Market Amid Global Industrial Growth

The overall outlook for the Cyclopentene Market remains bullish, underpinned by strong growth across automotive, construction, electronics, and pharmaceuticals. As industries continue to prioritize performance, durability, and sustainability, the relevance of cyclopentene as a versatile intermediate will only increase. Supported by investment, innovation, and policy alignment, the Cyclopentene Market is poised to maintain a steady growth trajectory well into the next decade.

North America Leads in Advanced Manufacturing Across the Cyclopentene Market

The Cyclopentene Market in North America is marked by high-value demand from sectors like automotive, pharmaceuticals, and electronics. The United States alone accounts for over 35% of the region’s cyclopentene consumption, with robust integration into petrochemical supply chains. For instance, U.S.-based production facilities utilize naphtha and gas oil steam cracking to manufacture cyclopentene at scale, supplying a wide array of specialty intermediates. The pharmaceutical industry, valued at over $600 billion in the U.S., demands high-purity cyclopentene for drug intermediates and specialty compounds. Additionally, North America’s construction sector, supported by infrastructure spending exceeding $1.2 trillion annually, increasingly relies on cyclopentene-based adhesives and coatings for green building materials.

Cyclopentene Market Gains Momentum in Europe with Sustainability-Driven Demand

Europe’s Cyclopentene Market benefits from its focus on circular economy models and environmental sustainability. Germany, France, and the Netherlands lead in cyclopentene adoption across construction and industrial applications. For example, Germany’s chemical industry—Europe’s largest—utilizes cyclopentene in the production of performance polymers and specialty coatings for energy-efficient buildings. In France, government-backed programs targeting energy transition have led to increased demand for cyclopentene-based insulation foams. Meanwhile, the UK has leveraged cyclopentene in replacing fluorocarbon-based refrigerants under its net-zero emission strategy. Collectively, Europe’s construction chemicals market exceeds $25 billion, and cyclopentene-derived formulations are increasingly central to this growth.

Asia Pacific Cyclopentene Market Accelerates with Industrial Expansion

The Asia Pacific Cyclopentene Market is undergoing rapid expansion driven by industrial growth in China, India, Japan, and South Korea. China remains the largest producer and consumer of cyclopentene in the region, with production integrated into its massive petrochemical complexes. For example, the country’s chemical output exceeded $1.7 trillion in 2023, with a growing share allocated to high-performance materials. Cyclopentene plays a vital role in electronics manufacturing hubs such as Shenzhen, where it is used in encapsulants and circuit board coatings. In India, rising urbanization and a $150 billion construction boom have increased demand for cyclopentene-derived insulation and adhesive products. Japan’s technologically advanced pharmaceutical and electronics industries also contribute significantly, using cyclopentene in fine chemical synthesis and semiconductor materials.

Emerging Opportunities in Southeast Asia Fuel Cyclopentene Market Growth

Southeast Asia is rapidly emerging as a growth frontier for the Cyclopentene Market. Countries such as Indonesia, Vietnam, and Thailand are expanding their industrial bases, backed by infrastructure projects and rising foreign investments. For instance, Vietnam’s electronics exports reached over $100 billion in 2023, and cyclopentene-derived resins are increasingly used in the manufacture of mobile devices and consumer electronics. Similarly, Indonesia’s construction market, valued at $260 billion, is leveraging cyclopentene-based adhesives in energy-efficient housing. Government incentives for local manufacturing and lower environmental restrictions further support regional cyclopentene consumption and import substitution.

Cyclopentene Market Gains Footing in Latin America Amid Infrastructure Push

Latin America is building traction in the Cyclopentene Market, led by demand in Brazil and Mexico. These economies are channeling public and private investments into infrastructure and agrochemical development. Brazil, for example, is among the top five global agricultural exporters, creating sustained demand for cyclopentene-based crop protection intermediates. In Mexico, industrial growth around automotive manufacturing hubs has prompted the need for cyclopentene-derived elastomers and thermal-resistant materials. With construction activity projected to grow at 4.5% annually in the region, the market potential for cyclopentene in adhesives, coatings, and polymer composites continues to expand.

Middle East and Africa Witness Cyclopentene Market Growth Through Petrochemical Integration

The Middle East and Africa are gradually strengthening their presence in the Cyclopentene Market through petrochemical investments and downstream diversification. Saudi Arabia and the United Arab Emirates are key players, with new projects in industrial parks and chemical clusters incorporating cyclopentene production capabilities. For example, Saudi Arabia’s industrial strategy aims to develop over 40 new chemical compounds domestically, including cyclic olefins like cyclopentene. In Africa, South Africa and Egypt are building cyclopentene demand through agriculture and construction. As regional economies industrialize, the adoption of cyclopentene in agrochemicals, pharmaceuticals, and advanced polymers is expected to rise steadily.

“Cyclopentene Manufacturing Database, Cyclopentene Manufacturing Capacity”

-

-

- Cyclopentene top manufacturers market share

- Top five manufacturers and top 10 manufacturers of Cyclopentene in North America, Europe, Asia Pacific

- Cyclopentene production plant capacity by manufacturers and Cyclopentene production data for market players

- Cyclopentene production dashboard, Cyclopentene production data in excel format

-

“Cyclopentene price charts, Cyclopentene weekly price tracker and Cyclopentene monthly price tracker”

-

-

- Factors impacting real-time Cyclopentene prices

- Cyclopentene monthly price tracker, Cyclopentene weekly price tracker

- Real-time Cyclopentene price trend, Cyclopentene price charts, news and updates

- Tracking Cyclopentene price fluctuations

-

Cyclopentene Market Segmentation by Application Highlights Industrial Versatility

The Cyclopentene Market is segmented into several high-growth applications, each contributing significantly to overall demand. Polymers and resins represent the largest segment, driven by automotive, electronics, and construction needs. These applications benefit from cyclopentene’s superior thermal resistance, impact strength, and chemical inertness. For instance, the use of cyclopentene in cyclic olefin copolymers is expanding at a CAGR of over 6%, reflecting the shift toward lightweight and transparent materials.

Pharmaceutical intermediates form another key segment, with cyclopentene facilitating ring-closing reactions and complex synthesis. Specialty drugs, anti-viral treatments, and custom synthesis projects increasingly utilize this compound due to its versatility and functional group compatibility.

Agrochemical formulations, including pesticides and herbicides, also represent a fast-growing segment of the Cyclopentene Market. As global food demand rises, cyclopentene-derived intermediates offer efficiency in the formulation of modern crop protection solutions.

Cyclopentene Market Segmentation by End-Use Industry Indicates Broad Applicability

The Cyclopentene Market is widely diversified by end-use industry, reflecting the chemical’s flexibility in formulation. Automotive leads with the highest share, especially in elastomers and resins for sealing systems, engine components, and EV battery casings. For example, the global automotive elastomer market exceeded $50 billion in 2023, and cyclopentene-based compounds are playing a growing role in material innovation.

Construction is another vital end-use, with cyclopentene-derived adhesives and foams used in insulation, joint sealing, and protective coatings. These products enhance energy efficiency and durability in both residential and commercial projects, contributing to sustainable development.

Pharmaceuticals rely on cyclopentene for the production of active ingredients and intermediates. The need for precision synthesis in therapeutic development continues to drive demand in this segment, especially in oncology and infectious disease research.

In agriculture, cyclopentene enables the synthesis of herbicides and fungicides that offer high efficacy and environmental stability. Cyclopentene-based agrochemicals are particularly critical in high-yield farming regions where pest resistance and crop loss are ongoing challenges.

The electronics sector benefits from cyclopentene through its role in high-temperature polymers and dielectric materials. For example, in microelectronics manufacturing, cyclopentene contributes to better thermal conductivity and miniaturization.

Geographical Production Trends Reflect Shifting Dynamics in the Cyclopentene Market

Production of cyclopentene is concentrated in regions with developed petrochemical infrastructure and advanced R&D ecosystems. The United States, China, Germany, and Japan remain global leaders, with facilities integrated into broader chemical value chains. In the U.S., cyclopentene production benefits from shale-based feedstock availability and advanced cracking technologies, ensuring supply consistency and quality.

China, on the other hand, continues to scale production to meet its domestic consumption and growing export demand. Its emphasis on vertical integration in the chemical sector allows for seamless supply of cyclopentene to downstream manufacturers in plastics, coatings, and pharmaceuticals.

Germany’s production is aligned with EU sustainability mandates, and innovations in catalytic cyclopentene synthesis are gaining momentum. Japan maintains a strong foothold through precision chemical synthesis, targeting high-purity grades for electronics and pharmaceutical applications.

Cyclopentene Market Import-Export Dynamics Shaped by Supply Chain Optimization

The global Cyclopentene Market also features intricate trade flows, driven by production hubs, demand centers, and regulatory factors. The United States and Germany often serve as net exporters, supplying cyclopentene to countries in Latin America, Eastern Europe, and parts of Asia with limited local manufacturing capacity.

Conversely, countries like India and Brazil depend partially on imports to supplement domestic production, particularly for high-purity grades used in drug synthesis and specialty polymers. Southeast Asia, despite growing demand, still imports significant volumes due to limited local synthesis capacity.

Emerging economies in Africa and Central Asia are gradually increasing their import volumes as infrastructure and industry expand. Trade agreements, logistics investments, and harmonized regulatory frameworks are expected to improve accessibility and cost efficiency in these markets.

Future Outlook for Cyclopentene Market in Regional and Segmented Applications

Looking ahead, the Cyclopentene Market is projected to expand at a steady CAGR over the next decade, supported by macroeconomic growth, industrial innovation, and regulatory evolution. Regions with established production will continue to lead, while emerging markets will play an increasingly strategic role in consumption. Application-wise, high-performance polymers, pharmaceutical intermediates, and agrochemical innovations will drive demand across multiple geographies.

As the chemical industry prioritizes sustainability, green production of cyclopentene using bio-based feedstocks and energy-efficient technologies will likely gain traction. Meanwhile, cross-border collaborations, capacity expansions, and digital supply chain systems will shape the future landscape of the Cyclopentene Market.

Major Manufacturers Driving Growth in the Cyclopentene Market

The Cyclopentene Market is supported by a well-established network of global manufacturers with strong production capabilities, integrated supply chains, and robust R&D infrastructures. These companies play a pivotal role in meeting the growing demand for cyclopentene across a wide range of industrial applications. Many of them operate specialized product lines catering to polymers, elastomers, adhesives, and pharmaceutical intermediates.

DOW Chemical Company – Integrated Olefin Solutions

Dow is a major player in the Cyclopentene Market, operating large-scale olefin production facilities that serve downstream customers in automotive, construction, and electronics. The company’s cyclopentene output is often used in the development of Dow’s NORDEL™ EPDM rubber and AFFINITY™ polyolefin elastomers, both of which are widely utilized in sealing systems, flexible packaging, and vehicle components. Dow’s focus on sustainable chemical production and circular economy strategies further enhances its position in the cyclopentene supply chain.

Shell Chemicals – Cyclopentene from Naphtha Cracking Units

Shell Chemicals operates integrated steam-cracking units capable of producing high-purity cyclopentene as part of its olefin extraction streams. Shell’s cyclopentene is primarily directed into the production of specialty polymers and automotive resins under the Carilon™ product family. These materials offer superior durability and thermal resistance, particularly in automotive and electronics applications. Shell is also actively investing in low-emission cracking technologies, reinforcing its long-term commitment to sustainable olefin production.

LyondellBasell – Advanced Polymer Feedstocks

LyondellBasell is a global leader in propylene and olefin derivatives, and its cyclopentene production is an important part of its product mix. Cyclopentene produced at LyondellBasell’s European and U.S. facilities is channeled into high-end thermoplastic elastomers and engineered materials used in consumer electronics, appliances, and medical devices. The company’s Hostalen™ and Purell™ product lines rely on consistent feedstock quality, making cyclopentene a critical upstream input.

ExxonMobil Chemical – Specialty Olefins for Performance Materials

ExxonMobil manufactures cyclopentene as part of its broader olefins business, supplying specialty intermediates to customers in pharmaceuticals, coatings, and elastomers. The company’s Vistamaxx™ performance polymers benefit from cyclopentene-derived materials, enabling flexibility, transparency, and toughness in packaging and automotive interiors. ExxonMobil’s research programs have also focused on advanced catalysts that improve cyclopentene yields and reduce energy consumption during steam cracking.

SABIC – Cyclopentene for High-Performance Polymers

SABIC’s cyclopentene production supports a range of specialty polymer applications in automotive, industrial goods, and construction materials. The company’s LNP™ compounds and copolymers incorporate cyclopentene as a precursor for cyclic olefin copolymers, offering enhanced clarity, strength, and temperature resistance. SABIC is also exploring renewable feedstocks and carbon capture integration within its petrochemical complexes to align its cyclopentene output with global sustainability goals.

INEOS Group – Cyclopentene for Industrial and Medical Applications

INEOS, with its extensive European footprint, is a leading cyclopentene producer focused on supplying raw materials for industrial coatings, specialty chemicals, and pharmaceutical intermediates. Cyclopentene is used in INEOS’s derivative formulations for flexible tubing, insulation foams, and medical device enclosures. The company continues to expand its downstream presence in specialty markets, capitalizing on cyclopentene’s chemical reactivity and compatibility with high-value synthesis routes.

Jiangsu Yida Chemical – Rising Asia-Based Cyclopentene Supplier

Jiangsu Yida is a prominent Chinese manufacturer contributing significantly to the Cyclopentene Market. The company produces cyclopentene and its derivatives for use in agrochemicals, elastomers, and fine chemicals. It supports local demand in China while expanding its export footprint across Southeast Asia and Europe. Jiangsu Yida’s investments in catalytic hydrogenation and continuous processing facilities ensure efficient cyclopentene production aligned with international quality standards.

Mitsubishi Chemical Corporation – Japan’s Key Cyclopentene Producer

Mitsubishi Chemical supplies cyclopentene primarily for electronics and high-performance resin applications. The company’s innovative polymer materials, such as DURABIO™ and Hi-SHIELD™, incorporate cyclopentene-derived intermediates to enhance UV resistance and impact strength. Mitsubishi Chemical is also exploring cyclopentene applications in low-VOC coatings and eco-friendly adhesives, aligning with Japan’s national sustainability directives.

Braskem – Cyclopentene Integration in Bio-Based Value Chains

Braskem, a Latin American chemical major, is expanding its Cyclopentene Market share through its green chemistry initiatives. While still developing its cyclopentene infrastructure, Braskem’s focus is on integrating bio-naphtha sources and creating renewable olefins. Cyclopentene produced through these channels supports its I’m green™ product line for sustainable packaging and automotive applications. Braskem’s efforts underscore the growing role of green feedstocks in the future of cyclopentene production.

Toray Industries – Electronics-Focused Cyclopentene Applications

Toray utilizes cyclopentene in the formulation of advanced insulating materials and flexible display films. These materials are essential for OLED screens, flexible PCBs, and semiconductor devices, where cyclopentene-based polymers offer dielectric stability and thermal protection. Toray’s investments in precision polymerization techniques and nanomaterial integration further leverage cyclopentene’s performance advantages.

LG Chem – High-Volume Cyclopentene Consumer in South Korea

LG Chem uses cyclopentene in various applications, particularly in automotive materials and electronics components. Its development of high-performance elastomers and eco-friendly plasticizers includes cyclopentene as a core intermediate. LG Chem’s push into battery materials and electric mobility is expected to raise internal cyclopentene consumption as it introduces more thermally stable and lightweight components.

“Cyclopentene Production Data and Cyclopentene Production Trend, Cyclopentene Production Database and forecast”

-

-

- Cyclopentene production database for historical years, 10 years historical data

- Cyclopentene production data and forecast for next 7 years

- Cyclopentene sales volume by manufacturers

-

“Track Real-time Cyclopentene Prices for purchase and sales contracts, Cyclopentene price charts, Cyclopentene weekly price tracker and Cyclopentene monthly price tracker”

-

-

- Gain control on your purchase and sales contracts through our real-time Cyclopentene price tracker and Cyclopentene price trend analysis

- Cyclopentene weekly price tracker and forecast for next four weeks

- Cyclopentene monthly price tracker and forecast for next two months

-

Recent News and Industry Developments in the Cyclopentene Market

June 2023 – Shell announced the expansion of its chemical plant in Geismar, Louisiana, which includes a focus on higher olefin yields, including cyclopentene, through enhanced cracking technology. This expansion is expected to boost cyclopentene availability for downstream sectors.

September 2023 – Dow introduced a new series of elastomeric materials in its AFFINITY™ line, targeting EV battery encapsulation. These materials use cyclopentene-derived polymers to achieve higher thermal and mechanical performance.

October 2023 – SABIC launched a pilot program to produce cyclopentene through a renewable propane pathway. This innovation aligns with SABIC’s strategy to achieve carbon-neutral production across its core product lines by 2035.

December 2023 – Jiangsu Yida Chemical signed a long-term supply agreement with an Indian agrochemical manufacturer, strengthening its position in the Asia Pacific Cyclopentene Market. The agreement includes plans to co-develop cyclopentene derivatives for next-generation herbicides.

January 2024 – Mitsubishi Chemical announced an R&D initiative focusing on the use of cyclopentene-based polymers in low-emission automotive coatings. The project is part of Japan’s broader clean mobility program and is expected to yield commercial products by 2026.

March 2024 – LG Chem invested $100 million in its Daesan complex to upgrade its cyclopentene processing units. The investment aims to meet surging internal demand for cyclopentene in EV and semiconductor segments.

The Cyclopentene Market continues to be shaped by innovation, sustainability, and expanding applications across high-growth industries. As manufacturers align their operations with evolving global demands, cyclopentene remains a cornerstone for performance-driven and eco-conscious solutions. Let me know if you’d like a summarized conclusion or a visual market overview.

Market Scenario, Demand vs Supply, Average Product Price, Import vs Export, till 2035

- Global Cyclopentene Market revenue and demand by region

- Global Cyclopentene Market production and sales volume

- United States Cyclopentene Market revenue size and demand by country

- Europe Cyclopentene Market revenue size and demand by country

- Asia Pacific Cyclopentene Market revenue size and demand by country

- Middle East & Africa Cyclopentene Market revenue size and demand by country

- Latin America Cyclopentene Market revenue size and demand by

- Import-export scenario – United States, Europe, APAC, Latin America, Middle East & Africa

- Average product price – United States, Europe, APAC, Latin America, Middle East & Africa

- Market player analysis, competitive scenario, market share analysis

- Business opportunity analysis

Key questions answered in the Global Cyclopentene Market Analysis Report:

- What is the market size for Cyclopentene in United States, Europe, APAC, Middle East & Africa, Latin America?

- What is the yearly sales volume of Cyclopentene and how is the demand rising?

- Who are the top market players by market share, in each product segment?

- Which is the fastest growing business/ product segment?

- What should be the business strategies and Go to Market strategies?

The report covers Cyclopentene Market revenue, Production, Sales volume, by regions, (further split into countries):

- Asia Pacific (China, Japan, South Korea, India, Indonesia, Vietnam, Rest of APAC)

- Europe (UK, Germany, France, Italy, Spain, Benelux, Poland, Rest of Europe)

- North America (United States, Canada, Mexico)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa

Table of Contents:

Cyclopentene Market

- Introduction to Cyclopentene Market

- Market Definition & Key Insights

- Industry Relevance & Scope

- Cyclopentene Product Classification & Properties

- Structural Overview & Chemical Composition

- Product Variants and Their Applications

- Market Dynamics & Key Influencing Factors

- Growth Drivers

- Market Restraints

- Emerging Trends

- Global Market Overview and Forecast (2020-2035)

- Market Valuation & Growth Projections

- Demand & Supply Trends

- Regional Market Performance Analysis

- North America: Market Trends & Growth Forecast

- Europe: Demand Trends & Industrial Impact

- Asia-Pacific: Key Growth Areas & Market Potential

- Latin America: Expansion Strategies & Opportunities

- Middle East & Africa: Key Developments & Future Outlook

- Cyclopentene Production Overview

- Manufacturing Processes & Industrial Best Practices

- Production Volume by Key Regions (2019-2035)

- Technology Trends in Cyclopentene Synthesis

- Market Segmentation by Product Type

- High-Purity Cyclopentene

- Industrial-Grade Cyclopentene

- Other Variants & Specialized Forms

- Demand-Supply Analysis & Forecasts

- Global Supply Chain Analysis

- Consumption Trends Across Key Sectors

- Trade Analysis: Import & Export Insights

- Regional Trade Flows & Regulatory Landscape

- Global Import-Export Value Trends

- Competitive Landscape & Key Market Players

- Top Manufacturers & Market Share Distribution

- Competitive Strategies & Innovation Trends

- Cyclopentene Price Trends & Cost Analysis

- Historical & Future Pricing Trends

- Cost Structure & Profitability Metrics

- Application Analysis by End-Use Industries

- Pharmaceuticals & Healthcare Applications

- Chemical Synthesis & Industrial Use

- Polymer Production & Specialty Materials

- Cyclopentene Manufacturing Cost Analysis

- Raw Material Cost Structure

- Key Suppliers & Pricing Trends

- Market Entry Strategies & Investment Opportunities

- Key Market Entry Barriers

- Potential Business Expansion Avenues

- Regulatory Framework & Industry Compliance

- Safety Regulations & Environmental Concerns

- Compliance Requirements for Cyclopentene Production

- Future Outlook & Industry Innovations

- Emerging R&D in Cyclopentene Applications

- Sustainable Production Practices & Market Impact

- Market Challenges & Risk Factors

- Supply Chain Disruptions & Production Constraints

- Economic and Geopolitical Influences on Market Growth

- Forecasting Market Growth & Future Trends (2025-2035)

- Short-Term vs. Long-Term Growth Scenarios

- Future Demand Potential Across Global Regions

- Strategic Recommendations for Stakeholders

- Growth Strategies for Manufacturers

- Investment Insights for Market Players

- Appendices & Data References

- Key Market Statistics & Graphical Data

- Industry Reports & Source Materials

Other recently published reports:

“Every Organization is different and so are their requirements”- Datavagyanik

Companies We Work With

Do You Want To Boost Your Business?

drop us a line and keep in touch