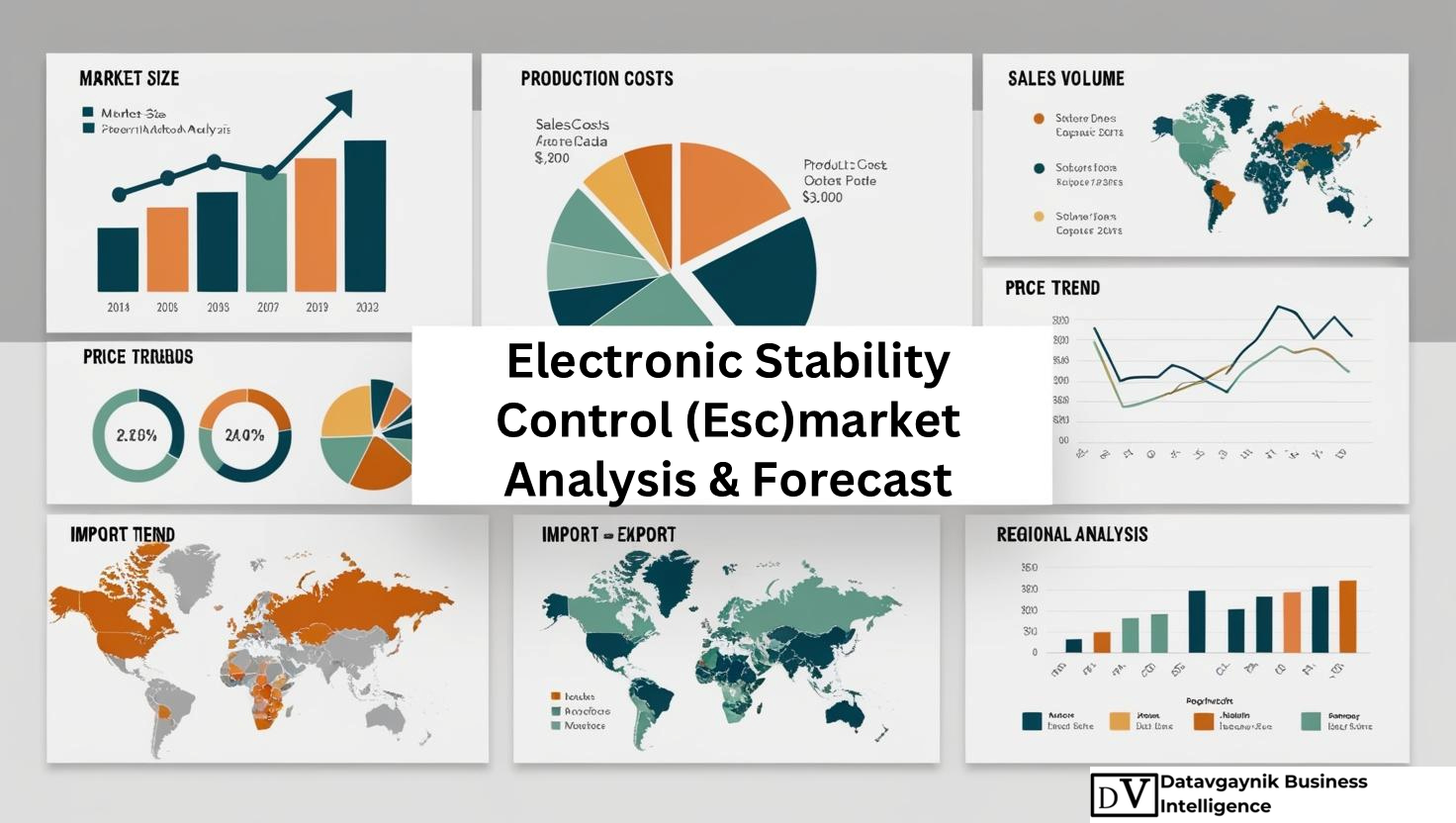

Electronic Stability Control (ESC) Market Size, Production, Sales, Average Product Price, Market Share, Import vs Export

- Published 2025

- No of Pages: 120+

- 20% Customization available

Rising Automotive Safety Mandates Accelerating Electronic Stability Control (ESC) Market Growth

The Electronic Stability Control (ESC) Market is undergoing significant transformation, driven by global regulatory mandates targeting road safety enhancement. For instance, the European Union has made ESC systems mandatory for all new vehicles since 2014, while the United States enforces a similar regulation under the Federal Motor Vehicle Safety Standard (FMVSS) No. 126. Such mandates have resulted in nearly universal ESC integration in new vehicles sold across these regions, contributing to the robust expansion of the Electronic Stability Control (ESC) Market. Countries in the Asia-Pacific region, such as China and India, are also implementing similar policies, pushing OEMs to integrate ESC into even budget vehicle segments, ensuring sustained market demand.

The Electronic Stability Control (ESC) Market is undergoing significant transformation, driven by global regulatory mandates targeting road safety enhancement. For instance, the European Union has made ESC systems mandatory for all new vehicles since 2014, while the United States enforces a similar regulation under the Federal Motor Vehicle Safety Standard (FMVSS) No. 126. Such mandates have resulted in nearly universal ESC integration in new vehicles sold across these regions, contributing to the robust expansion of the Electronic Stability Control (ESC) Market. Countries in the Asia-Pacific region, such as China and India, are also implementing similar policies, pushing OEMs to integrate ESC into even budget vehicle segments, ensuring sustained market demand.

Surge in Global Vehicle Production Supporting Electronic Stability Control (ESC) Market Expansion

Automobile production is rebounding globally, offering a direct boost to the Electronic Stability Control (ESC) Market. For example, global car production crossed 93 million units in 2023, reflecting a steady recovery from the pandemic lows. With rising automotive output, particularly in emerging economies like India, Indonesia, and Mexico, ESC system integration has become a critical focus for manufacturers. As vehicle production scales up, the corresponding rise in ESC installation rates enhances the scale of the Electronic Stability Control (ESC) Market, driving growth in both OEM and aftermarket channels.

Demand for Electric Vehicles (EVs) Fueling Electronic Stability Control (ESC) Market Innovation

The accelerating shift toward electric mobility is reshaping the dynamics of the Electronic Stability Control (ESC) Market. For instance, global EV sales surpassed 14 million units in 2023, with leading countries such as China, Norway, and Germany posting record adoption rates. ESC plays a pivotal role in EV safety by ensuring smooth acceleration and cornering, especially since electric drivetrains deliver instant torque. As EVs continue penetrating mainstream vehicle segments, ESC systems are being redesigned to integrate with regenerative braking, traction management, and battery-specific dynamics, expanding the innovation footprint within the Electronic Stability Control (ESC) Market.

Rising Incidence of Road Accidents Enhancing Electronic Stability Control (ESC) Market Relevance

Road safety has become a critical global concern, reinforcing the relevance of the Electronic Stability Control (ESC) Market. For instance, over 1.3 million people die each year due to road traffic crashes, according to WHO statistics. A large share of these incidents involve loss of control due to skidding or rollover, areas where ESC systems offer measurable risk reduction. Vehicles equipped with ESC have shown a 33% reduction in fatal single-vehicle crashes and up to 67% reduction in rollover accidents. These statistics underline the growing perception of ESC as a non-negotiable safety feature, further fueling the penetration of the Electronic Stability Control (ESC) Market across vehicle categories.

Surging SUV and Pickup Sales Amplifying Electronic Stability Control (ESC) Market Demand

The boom in SUV and light truck sales is a notable catalyst for the Electronic Stability Control (ESC) Market. SUVs accounted for more than 45% of global passenger vehicle sales in 2023, driven by rising consumer preference for higher ground clearance, cargo space, and off-road capability. However, SUVs and pickups are inherently more prone to rollover incidents due to their high center of gravity. ESC systems mitigate this risk through dynamic stability interventions, making their adoption essential in this segment. As SUV sales surge, automakers are standardizing ESC systems across models, contributing to the rapid scaling of the Electronic Stability Control (ESC) Market.

Integration of ESC with ADAS Strengthening Electronic Stability Control (ESC) Market Portfolio

The convergence of ESC with other Advanced Driver Assistance Systems (ADAS) is unlocking new growth opportunities for the Electronic Stability Control (ESC) Market. ESC now functions as a foundational layer for features like lane keeping assist, adaptive cruise control, and autonomous emergency braking. For example, vehicles with Level 2 autonomy require precise control mechanisms that rely on ESC for real-time intervention during potential loss of control scenarios. The ability of ESC to communicate with radar, camera, and LiDAR-based systems enhances vehicle stability under dynamic driving conditions. This integration trend is pushing ESC suppliers to innovate modular and software-driven systems, increasing their share in the expanding Electronic Stability Control (ESC) Market.

Advancements in Sensor Technology Elevating Electronic Stability Control (ESC) Market Efficiency

Sensor evolution is playing a transformative role in the Electronic Stability Control (ESC) Market. Modern ESC systems now rely on a network of gyroscopes, accelerometers, and yaw rate sensors, supported by real-time data analytics. For instance, the latest ESC modules can detect vehicle instability within milliseconds and activate corrective actions through selective braking and throttle adjustments. These precision-driven systems are being adopted by luxury and high-performance vehicles to ensure superior cornering and braking control. The miniaturization of sensors and integration with AI algorithms are further making ESC systems smarter and more adaptable, pushing technological boundaries in the Electronic Stability Control (ESC) Market.

Growth in Autonomous and Connected Vehicles Bolstering Electronic Stability Control (ESC) Market Evolution

The Electronic Stability Control (ESC) Market is evolving in tandem with the global push toward autonomous and connected vehicles. As vehicles move from Level 2 to Level 4 autonomy, the need for real-time vehicle control becomes more critical. ESC systems serve as the backbone for managing dynamic vehicle behavior in these scenarios. For example, in autonomous driving applications, ESC must coordinate with path-planning algorithms and obstacle detection systems to ensure safe maneuvering. As OEMs intensify their focus on connected vehicle platforms, ESC systems are being developed with over-the-air (OTA) update capabilities and real-time diagnostics, signaling a shift from hardware-dependent systems to cloud-integrated ESC ecosystems.

Asia Pacific Dominating Electronic Stability Control (ESC) Market Production and Adoption

Asia Pacific continues to dominate the Electronic Stability Control (ESC) Market, driven by its vast automotive manufacturing base and evolving safety regulations. China, the world’s largest car producer, has made ESC mandatory for key vehicle segments, fueling mass adoption across domestic brands and export models. In India, ESC will be mandated for select vehicle types from 2024 onwards, a move expected to drive annual demand by over 25%. Meanwhile, Japan and South Korea are not only leaders in ESC implementation but also in technological innovation, supplying global markets with advanced and compact ESC systems. As these economies scale up both conventional and electric vehicle production, the Electronic Stability Control (ESC) Market in the region is set for long-term structural growth.

Aftermarket and Retrofitting Creating New Avenues in Electronic Stability Control (ESC) Market

Beyond OEM installations, the Electronic Stability Control (ESC) Market is witnessing increasing traction in the aftermarket and retrofitting space. For instance, commercial fleet operators across Latin America and Southeast Asia are retrofitting older trucks and buses with ESC systems to comply with new safety norms and reduce accident liabilities. Retrofitting solutions are gaining popularity among ride-hailing service providers and logistics companies aiming to improve fleet safety while minimizing operational disruptions. With cost-effective modular ESC kits entering the market, especially in developing regions, the aftermarket segment is emerging as a dynamic sub-sector of the broader Electronic Stability Control (ESC) Market.

“Track Country-wise Electronic Stability Control (ESC) Production and Demand through our Electronic Stability Control (ESC) Production Database”

-

-

- Electronic Stability Control (ESC) production database for 20+ countries worldwide

- Country-wise Electronic Stability Control (ESC) production capacity and production plant mapping

- Electronic Stability Control (ESC) production plants and production plant capacity analysis for key manufacturers

-

North America Leading High-Value Expansion in the Electronic Stability Control (ESC) Market

The Electronic Stability Control (ESC) Market in North America is experiencing strong momentum, particularly in the United States and Canada, where safety regulations are stringent, and vehicle demand is diversifying. For instance, the U.S. mandates ESC installation in all light vehicles under federal law, making it a baseline safety requirement. This regulation, combined with high sales of SUVs and pickup trucks—vehicles more prone to rollover—has created a consistent demand for advanced ESC systems. In 2023 alone, over 11 million light trucks were sold in the U.S., nearly all equipped with ESC technology. Automakers in the region, including Ford, General Motors, and Tesla, are integrating next-generation ESC with adaptive braking and AI-driven control modules. The Canadian market is following a similar trajectory, with a strong focus on vehicle safety in snowy and wet road conditions, pushing the demand for ESC technology in AWD and commercial vehicle segments.

Europe Advancing Technological Integration Across the Electronic Stability Control (ESC) Market

Europe remains a pivotal production and innovation hub in the Electronic Stability Control (ESC) Market. Countries such as Germany, France, Italy, and the UK have not only mandated ESC systems in all new vehicles but also lead in R&D investments. For example, Germany, home to some of the world’s top automakers, is driving ESC innovation through brands like BMW and Mercedes-Benz. These companies are developing software-enhanced ESC that adapts to driver behavior, terrain, and real-time vehicle load. Over 18 million vehicles were produced across the EU in 2023, with nearly all units featuring advanced ESC. France and Italy are focusing on ESC systems tailored for electric and hybrid vehicles, responding to growing EV sales, which now account for over 20% of total passenger car registrations in these countries. The UK is pushing forward with ESC integration into commercial fleets, where stability control is directly linked to insurance incentives and safety compliance.

Asia Pacific Dominating Volume Production in the Electronic Stability Control (ESC) Market

The Asia Pacific region commands the largest production share in the Electronic Stability Control (ESC) Market, driven by China, Japan, India, and South Korea. China’s automotive output surpassed 30 million units in 2023, and the country has mandated ESC in all commercial vehicles and most passenger car segments. Chinese manufacturers such as BYD and Geely are integrating ESC systems optimized for battery-powered platforms, especially for the rapidly expanding EV segment. Japan continues to lead in technology development, with companies like Denso and Hitachi Astemo producing ultra-compact ESC modules for autonomous and hybrid vehicles. In South Korea, Hyundai and Kia are expanding their global ESC footprint by exporting AI-powered systems that adjust to both city and rural road profiles. Meanwhile, India’s recent policy to mandate ESC in all M1 category vehicles by 2024 is expected to trigger a surge in production, especially in cost-sensitive ESC variants suitable for small cars and two-wheelers, which dominate the Indian market.

Latin America Emerging as an Adoption Zone in the Electronic Stability Control (ESC) Market

Latin America, while still in its early stages, is fast becoming a focus area within the Electronic Stability Control (ESC) Market. Brazil and Mexico are leading this transition with increasing adoption of ESC technologies in new vehicles. For example, Brazil has made ESC compulsory in new passenger cars since 2020, creating a clear demand spike. Mexico, which produced over 3 million vehicles in 2023, is increasingly exporting ESC-equipped models to North American and European markets. OEMs operating in Latin America are integrating ESC not just for compliance but also to improve vehicle export value. The regional market is being supported by global ESC suppliers establishing manufacturing and assembly units to meet rising domestic and export demand.

Middle East and Africa Entering the Regulatory Phase of the Electronic Stability Control (ESC) Market

In the Middle East and Africa, the Electronic Stability Control (ESC) Market is entering a regulatory-driven growth phase. Countries like the UAE and Saudi Arabia are adopting UN vehicle safety standards, including ESC, for passenger vehicles. Luxury vehicle demand in the Gulf region remains high, and ESC is a core requirement in most models sold. South Africa, as the continent’s largest vehicle manufacturing hub, is beginning to enforce safety upgrades, with ESC integration becoming standard in exported vehicles. The African ESC market is also receiving support from global development programs focusing on road safety, creating future opportunities for low-cost, durable ESC systems tailored to harsh road conditions.

Passenger Vehicles Segment Dominating Electronic Stability Control (ESC) Market Penetration

The passenger vehicles segment accounts for the highest share in the Electronic Stability Control (ESC) Market. Compact, mid-size, and luxury cars are increasingly being equipped with ESC, especially as consumer awareness about accident prevention grows. For example, the average buyer in North America and Europe now prioritizes stability control among essential safety features. In 2023, over 80% of all new passenger vehicles globally were fitted with ESC systems. Additionally, the rapid growth in electric passenger cars, particularly in Europe and China, is further pushing ESC integration due to its importance in handling and cornering in EV platforms.

Commercial Vehicles Becoming a Growth Catalyst in the Electronic Stability Control (ESC) Market

Commercial vehicles are emerging as a high-growth category within the Electronic Stability Control (ESC) Market. Buses, delivery vans, and long-haul trucks are being equipped with ESC systems to minimize the risk of rollovers and improve control during emergency maneuvers. For example, the logistics boom in India, the U.S., and Germany is creating demand for high-end safety features in fleet vehicles. In 2023, over 1.2 million medium and heavy commercial vehicles were fitted with ESC, with a projected CAGR of over 9% through 2030. Commercial fleet owners are also integrating ESC as part of their compliance with insurance safety benchmarks, which offer lower premiums for ESC-enabled vehicles.

Electric and Hybrid Vehicles Accelerating Future Trends in the Electronic Stability Control (ESC) Market

The rise of electric and hybrid vehicles is significantly reshaping the Electronic Stability Control (ESC) Market. EVs often require recalibrated ESC systems to account for low center of gravity, regenerative braking, and torque vectoring. For instance, electric SUVs and sedans now demand ESC modules that operate seamlessly with battery management systems and AI-driven powertrains. In 2023, nearly 14 million EVs were sold worldwide, nearly all equipped with custom ESC architectures. Companies like Tesla, NIO, and Polestar are leading this wave with proprietary ESC systems that adapt to energy usage patterns and dynamic driver behavior.

Technological Segmentation Driving Competitive Edge in the Electronic Stability Control (ESC) Market

From a technology standpoint, the Electronic Stability Control (ESC) Market is segmented into conventional systems and AI-integrated platforms. Conventional ESC still dominates in emerging markets due to cost-efficiency, especially when paired with ABS and TCS. However, AI-driven ESC systems are growing rapidly, especially in high-end vehicles and autonomous platforms. These systems predict vehicle behavior using machine learning, enabling corrective actions even before a loss of control occurs. For example, a luxury sedan equipped with predictive ESC can respond to rain-slicked roads milliseconds before a driver notices a skid, offering unmatched responsiveness. By 2030, AI-integrated ESC is expected to comprise over 35% of total ESC installations globally.

Electronic Stability Control (ESC) Market Differentiated by Drive Type Applications

Vehicle drivetrain configurations also define demand trends within the Electronic Stability Control (ESC) Market. Front-wheel-drive (FWD) vehicles, which represent the largest global vehicle segment, require ESC to manage understeering and traction on slippery roads. Rear-wheel-drive (RWD) cars, often sports models or performance vehicles, use ESC to counter oversteering at high speeds. For example, sports sedans from brands like BMW and Lexus use dynamic ESC systems that adjust cornering behavior based on drive mode. In contrast, all-wheel-drive (AWD) and 4×4 vehicles demand ESC modules optimized for varied terrain, especially in regions with extreme weather such as Canada, Russia, or the Nordic countries. These tailored ESC applications allow for seamless stability in snow, gravel, and steep inclines, broadening their market share within the overall Electronic Stability Control (ESC) Market.

ESC Component Segmentation Defining Production Trends in the Electronic Stability Control (ESC) Market

The Electronic Stability Control (ESC) Market is also segmented by key components: sensors, ECUs (electronic control units), and hydraulic modulators. Each of these components plays a critical role in overall system performance. The sensor segment is growing rapidly, driven by the integration of gyroscopes, accelerometers, and advanced vehicle dynamics sensors. For instance, vehicles in the mid and premium segments now feature multi-sensor ESC systems capable of capturing wheel slip, yaw rate, and steering input in real time. The ECU segment is evolving through AI-integration, enabling dynamic response under varying road and load conditions. Meanwhile, the hydraulic modulator segment is witnessing demand for smarter braking control, particularly in electric vehicles, where regenerative and friction braking must be harmonized through advanced ESC logic.

“Electronic Stability Control (ESC) Manufacturing Database, Electronic Stability Control (ESC) Manufacturing Capacity”

-

-

- Electronic Stability Control (ESC) top manufacturers market share

- Top five manufacturers and top 10 manufacturers of Electronic Stability Control (ESC) in North America, Europe, Asia Pacific

- Production plant capacity by manufacturers and Electronic Stability Control (ESC) production data for market players

- Electronic Stability Control (ESC) production dashboard, Electronic Stability Control (ESC) production data in excel format

-

Key Global Manufacturers Dominating the Electronic Stability Control (ESC) Market

The Electronic Stability Control (ESC) Market is highly competitive and driven by global manufacturers with specialized expertise in automotive safety systems. These companies not only produce ESC systems but also innovate through integration with ADAS, electric vehicle platforms, and AI-enhanced control systems. Their expansive product portfolios and partnerships with OEMs position them at the forefront of technological advancement.

Robert Bosch GmbH: Leading the Electronic Stability Control (ESC) Market with Integrated Safety Solutions

Robert Bosch GmbH continues to be a dominant force in the Electronic Stability Control (ESC) Market, offering a comprehensive lineup of stability systems tailored to all vehicle classes. Bosch’s flagship ESC system, ESP® hev (hybrid and electric vehicles), is specifically designed for electric mobility platforms. This product integrates seamlessly with regenerative braking and torque management systems in EVs, ensuring maximum vehicle control under various driving conditions. Bosch also offers scalable ESC platforms like ESP® base and ESP® premium, which serve both cost-sensitive markets and high-end OEMs. The company operates ESC production and R&D facilities in Germany, China, India, and the U.S., allowing global supply continuity and regional customization.

Continental AG: Innovating Software-Based ESC for Future Mobility

Continental AG holds a significant share in the Electronic Stability Control (ESC) Market, offering its MK C1 and MK 100 product families. The MK C1 is a fully integrated braking system that merges ESC, brake actuation, and braking force distribution in a single compact unit, reducing weight by 30%. This system is being deployed in premium electric and hybrid vehicles, including several Mercedes-Benz and BMW models. Continental has also introduced ESC control units with over-the-air (OTA) update capabilities, enabling real-time software enhancements. With production facilities across Europe, North America, and Asia, Continental delivers high-volume ESC systems to both established automakers and emerging EV startups.

Denso Corporation: Advancing Electronic Stability Control (ESC) Market through Sensor Precision

Denso Corporation, part of the Toyota Group, is a critical supplier in the Electronic Stability Control (ESC) Market, renowned for its precision sensor technology. Denso’s ESC modules are integrated with high-resolution accelerometers and yaw rate sensors, enabling fine-tuned vehicle dynamics control. The company’s systems are deployed across Toyota, Lexus, Subaru, and Mazda vehicle lines. Its ESC platforms, such as the Denso ES-100 and DS-II, are designed to support both FWD and AWD applications and are adaptable to conventional and hybrid drivetrains. Denso continues to expand its ESC R&D in Japan and Thailand, targeting improvements in energy efficiency and AI-based behavior prediction.

ZF Friedrichshafen AG: Offering Modular ESC Platforms for All Vehicle Segments

ZF Friedrichshafen AG has carved a strong position in the Electronic Stability Control (ESC) Market, offering modular systems suited to both passenger and commercial vehicles. Its ESC solution, TRW ESC Generation 9, offers a wide range of functionalities, including integration with automated emergency braking, roll stability control, and adaptive cruise systems. The Generation 9 platform has already been adopted by key OEMs in Europe and North America, such as Volvo and Ford. ZF is also investing in next-gen ESC platforms for autonomous vehicles, incorporating V2X communication capabilities and AI-driven response modules.

Hitachi Astemo: Pushing Electronic Stability Control (ESC) Market Boundaries in Electrification

Hitachi Astemo, a merger between Hitachi Automotive Systems and three Honda Group suppliers, is aggressively innovating within the Electronic Stability Control (ESC) Market. The company focuses on compact ESC modules optimized for electric and hybrid drivetrains. Their flagship unit, the e-Axle Integrated ESC, works with the motor inverter to manage torque distribution during rapid acceleration or uneven terrain. This system is already deployed in models from Honda and Nissan. Hitachi’s manufacturing presence in Japan, Thailand, and China allows the company to meet rising demand in Asia-Pacific and deliver cost-effective solutions to mass-market EV platforms.

Hyundai Mobis: Accelerating Growth in the Electronic Stability Control (ESC) Market through In-House Development

Hyundai Mobis has emerged as a key ESC supplier in the Asia-Pacific Electronic Stability Control (ESC) Market, particularly to Hyundai and Kia vehicles. Its advanced ESC modules integrate with Forward Collision-Avoidance Assist (FCA) and Lane Keeping Assist (LKA) systems. Hyundai Mobis recently launched a next-gen ESC system that communicates with camera and radar-based safety features in real time, adjusting braking and steering for better trajectory management. With rising exports of Hyundai and Kia EVs globally, Hyundai Mobis is scaling its ESC production to meet higher international safety compliance.

Mando Corporation: Delivering Smart ESC Systems for Autonomous Driving Integration

Mando Corporation, a South Korean Tier-1 supplier, is an important player in the Electronic Stability Control (ESC) Market, with products such as the i-ESC system. Designed for integration into Level 3 and Level 4 autonomous vehicles, i-ESC uses predictive algorithms and sensor fusion to adjust vehicle posture during complex maneuvers. Mando supplies its ESC systems to Mahindra, Hyundai, SsangYong, and several EV-focused startups across Asia. The company’s R&D in AI-based dynamic control is enabling vehicles to adapt stability systems based on environmental feedback such as road surface or driving habits.

WABCO (Now ZF Group): Supporting Commercial Vehicle ESC in the Electronic Stability Control (ESC) Market

WABCO, now operating under the ZF Group umbrella, plays a specialized role in the Electronic Stability Control (ESC) Market with a focus on heavy-duty trucks and buses. ESCsmart™, one of its flagship systems, provides real-time rollover prevention for commercial fleets and adjusts vehicle behavior based on load distribution and terrain. WABCO ESC modules are used in Volvo Trucks, Freightliner, and Iveco vehicles. These systems meet international regulations such as UNECE R13-H and are increasingly in demand for export trucks entering regulated markets such as the EU and North America.

Recent Developments in the Electronic Stability Control (ESC) Market

The Electronic Stability Control (ESC) Market is witnessing a wave of strategic developments as manufacturers align their roadmaps with electrification, autonomy, and safety mandates:

- January 2024: Bosch announced the launch of ESP® hev Gen2, optimized for battery-electric vehicles with enhanced energy regeneration compatibility. This product is expected to support over 15 new EV platforms by 2026.

- March 2024: Continental AG partnered with a European OEM to deploy its latest MK 100 ESC module with software-based real-time adaptation. This system is tailored for icy road conditions and will enter production in Q4 2024.

- December 2023: ZF opened a new ESC assembly facility in Mexico to serve the North and Latin American markets, reducing lead times and cost for regional OEMs.

- February 2024: Hyundai Mobis began mass production of its AI-integrated ESC platform for export EVs, signaling a shift toward more intelligent vehicle dynamics control.

- April 2024: Mando Corporation signed a development agreement with a Japanese automaker to co-develop ESC systems for autonomous urban shuttles and delivery robots.

These developments point to a clear trend: the Electronic Stability Control (ESC) Market is moving beyond conventional braking functions toward intelligent, adaptive, and connected systems. With the automotive industry accelerating toward zero-emission and self-driving futures, ESC systems are becoming not only mandatory but foundational to safe vehicle operation in the modern mobility era.

“Electronic Stability Control (ESC) Production Data and Electronic Stability Control (ESC) Production Trend, Electronic Stability Control (ESC) Production Database and forecast”

-

-

- Electronic Stability Control (ESC) production database for historical years, 10 years historical data

- Electronic Stability Control (ESC) production data and forecast for next 7 years

-

Market Scenario, Demand vs Supply, Average Product Price, Import vs Export, till 2035

- Global Electronic Stability Control (ESC) Market revenue and demand by region

- Global Electronic Stability Control (ESC) Market production and sales volume

- United States Electronic Stability Control (ESC) Market revenue size and demand by country

- Europe Electronic Stability Control (ESC) Market revenue size and demand by country

- Asia Pacific Electronic Stability Control (ESC) Market revenue size and demand by country

- Middle East & Africa Electronic Stability Control (ESC) Market revenue size and demand by country

- Latin America Electronic Stability Control (ESC) Market revenue size and demand by

- Import-export scenario – United States, Europe, APAC, Latin America, Middle East & Africa

- Average product price – United States, Europe, APAC, Latin America, Middle East & Africa

- Market player analysis, competitive scenario, market share analysis

- Business opportunity analysis

Key questions answered in the Global Electronic Stability Control (ESC) Market Analysis Report:

- What is the market size for Electronic Stability Control (ESC) in United States, Europe, APAC, Middle East & Africa, Latin America?

- What is the yearly sales volume of Electronic Stability Control (ESC) and how is the demand rising?

- Who are the top market players by market share, in each product segment?

- Which is the fastest growing business/ product segment?

- What should be the business strategies and Go to Market strategies?

The report covers Electronic Stability Control (ESC) Market revenue, Production, Sales volume, by regions, (further split into countries):

- Asia Pacific (China, Japan, South Korea, India, Indonesia, Vietnam, Rest of APAC)

- Europe (UK, Germany, France, Italy, Spain, Benelux, Poland, Rest of Europe)

- North America (United States, Canada, Mexico)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa

Table of Contents:

Electronic Stability Control (ESC) Market

- Introduction to the Electronic Stability Control (ESC) Market

- Definition and Functionality of Electronic Stability Control Systems

- Importance of ESC in Enhancing Vehicle Safety and Stability

- Market Overview: Key Drivers and Growth Opportunities in the ESC Market

- Components and Technologies of Electronic Stability Control Systems

- Core Components of ESC Systems (Sensors, Actuators, ECU)

- Integration with Other Safety Features (ABS, Traction Control, etc.)

- Innovations in ESC Algorithms and Control Strategies

- Advanced ESC Systems for Autonomous and Electric Vehicles

- Key Applications of Electronic Stability Control

- ESC in Passenger Vehicles for Enhanced Safety

- Use of ESC in Commercial Vehicles and Heavy-Duty Trucks

- ESC Integration in Electric and Hybrid Vehicles

- Adoption of ESC in Performance and Luxury Vehicles

- Electronic Stability Control (ESC) Market Segmentation

- By Vehicle Type (Passenger Cars, Commercial Vehicles, Electric Vehicles, Performance Vehicles)

- By System Type (Active ESC, Passive ESC)

- By End-User Industry (Automotive OEMs, Aftermarket, Vehicle Fleet Operators)

- By Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa)

- Global Market Size and Revenue Forecast (2025-2035)

- Market Size and Growth Projections for ESC Systems in Vehicles

- Revenue Breakdown by Application, Vehicle Type, and Region

- Demand and Supply Forecasts for ESC Systems Worldwide

- Regional Market Insights and Opportunities

- North America: Advanced ESC Adoption Driven by Safety Regulations

- Europe: Strong Emphasis on ESC Systems for Safety and Environmental Compliance

- Asia-Pacific: Rapid Growth in Vehicle Production and Increased Demand for Safety Features

- Latin America & Middle East/Africa: Expanding Automotive Industry and Adoption of ESC Systems

- ESC System Production Process

- Overview of ESC System Manufacturing Techniques

- Key Materials and Technologies Used in ESC System Production

- Innovations in Production for Enhanced System Integration and Cost Efficiency

- Competitive Landscape and Key Market Players

- Leading Manufacturers of ESC Systems and Their Market Share

- Competitive Strategies: Technological Advancements and Cost Leadership

- Mergers, Acquisitions, and Collaborations in the ESC Industry

- Raw Materials and Cost Structure in ESC Production

- Sourcing Key Materials for ESC Systems (Sensors, Electronic Components, Software)

- Cost Breakdown for ESC Manufacturing

- Price Trends and the Impact of Raw Material Costs on ESC System Pricing

- Technological Advancements in Electronic Stability Control Systems

- Innovations in ESC Control Algorithms for Improved Performance

- Developments in Integration with Autonomous Driving Systems

- Real-Time Data Processing and AI in ESC Systems for Enhanced Stability

- Environmental Impact and Sustainability of ESC Systems

- Environmental Benefits of ESC in Reducing Vehicle Accidents and Emissions

- Eco-Friendly Materials and Manufacturing Practices in ESC Production

- Regulatory Compliance for Sustainability in Automotive Safety Technologies

- Market Challenges and Risk Factors

- High Development and Integration Costs of ESC Systems

- Market Barriers in Emerging Markets with Less Strict Safety Regulations

- Competition from Alternative Vehicle Safety Technologies

- Investment and Business Opportunities in the ESC Market

- Investment Areas in ESC System R&D and Technological Advancements

- Opportunities in Emerging Markets for ESC System Adoption

- Business Models for Expanding ESC System Reach in OEMs and Aftermarket Sectors

- Pricing Trends and Profitability in ESC System Production

- Price Dynamics in the ESC System Market

- Factors Affecting Profit Margins in ESC Manufacturing

- Price Forecasts and Market Influence on ESC System Adoption

- Consumption Trends and Demand by Vehicle Type

- Growing Demand for ESC in Passenger and Commercial Vehicles

- Adoption of ESC in Electric and Autonomous Vehicles

- Increasing Use of ESC in Performance and Sports Vehicles

- Future Outlook and Market Projections (2025-2035)

- Long-Term Growth Projections for ESC Systems in the Automotive Industry

- Technological Developments and Their Impact on ESC System Performance

- Emerging Trends in ESC for Autonomous and Electric Vehicles

- Distribution Channels and Sales Strategies

- Key Distribution Channels for ESC Systems (OEMs, Tier-1 Suppliers, Aftermarket)

- Effective Sales and Marketing Strategies for ESC Manufacturers

- Strategic Partnerships for Expanding ESC System Market Reach

- Regulatory Landscape and Compliance in ESC System Manufacturing

- Safety and Performance Regulations for ESC in the Automotive Industry

- Emission and Environmental Standards Affecting ESC System Design

- Compliance with Global Standards for Vehicle Stability and Safety Technologies

- Conclusion and Strategic Recommendations

- Summary of Key Insights and Opportunities in the ESC Market

- Strategic Recommendations for Manufacturers, OEMs, and Stakeholders

- Future Directions for Innovation and Growth in ESC Systems

Other recently published reports:

“Every Organization is different and so are their requirements”- Datavagyanik

Companies We Work With

Do You Want To Boost Your Business?

drop us a line and keep in touch