© 2021 All rights reserved

Datavagyanik- Your Research Partner

Food safety is an extremely critical issue not only for processed, frozen, or canned products but also for farm-fresh products to ascertain the fact that these products are risk-free for consumption.

Contaminants and chemicals which can enter at any stage of the food value chain from manufacture till it reaches the consumers are the primary food poisoning causes, which has increased the need to test such toxins. The ever-growing number of food safety scandals, health scares, and outbreaks of food-borne diseases emphasizes the importance of constant vigilance for manufacturers and retailers of food products. Meanwhile, the scale and complexity of food supply chains pose great challenges to traceability, making quality control paramount at every step. Food security testing helps in ensuring safety and checking the compliance of manufacturing processes. It helps to have an accurate picture of the state of products, both prior to shipment and upon arrival.

An increment in the number of outbreaks of diseases caused by food contamination, and increasing emphasis to meet food safety compliance is a driving agent for the food safety testing market. These factors have led to the adoption of pathogen testing methods for various food types such as meat & poultry, dairy, processed foods, fruits & vegetables, and cereals & grains. Globalization of food trade is also a major factor driving the market growth.

Global food safety testing market size has been witnessing steady growth due to stringent food safety regulations, increasing number of food poisoning outbreaks, and increasing consumer awareness on food safety and its implications. The trend of globalization in the food supply trade is expected to further create a huge opportunity for the food safety testing market. The market is expected to grow due to increasing food safety concerns, the intensity of food safety scandals & frauds, and the increasing level of ill effects on consumer health and safety. Positive indicators from processed food industry expansion resulting in to increase in consumer affordability should positively influence industry growth. Growing import and export activities lead to food supply trade globalization which increases contaminant levels due to inadequate control and monitoring. Increasing adulteration levels to improve product shelf life are major factors causing testing demand during imports.

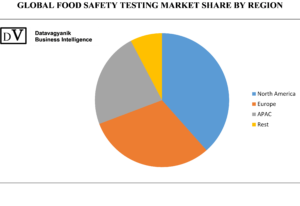

The segmentation of the market is done on the basis of Contaminant testing, technology, food tested, and geography. On the basis of contaminants tested for, the market is segmented as Pathogens GMOs, Pesticides, Toxins, and other residue and (allergens). On the basis of technology, the market is segmented as Conventional and Rapid. On the basis of Food tested, the market is categorized as Meat & Poultry, Dairy Products, processed food, Fruits and Vegetables, and others (grains). On the basis of geography, the market is segmented as North America, Europe, Asia-Pacific, and the Rest of the world.

With the diversity of food culture, various kinds of food articles are consumed in various parts of the world. With the awareness among people, food testing is also gaining pace. Food items like Grains, fruits, vegetables, meat and poultry, dairy, and other processed foods are majorly tested by food safety testing methods.

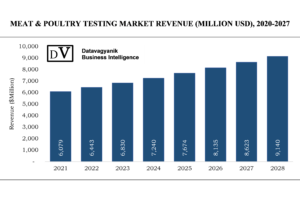

Meat and poultry products consist of Mutton, Chicken, beef, pork, veal, lamb, eggs, turkey, and duck meat. When it comes to food safety, raw meat and poultry are among the highest-risk categories, as evidenced by frequent recalls and safety scandals that impact even major brands. To comply with the stricter safety requirements, protect consumer health, and uphold their brand reputation, meat and poultry manufacturers try their best to guarantee the safety of their products at every stage. For meat and poultry, the food safety measures are seriously taken: from farms and processing facilities to distribution centers and stores. Quality control and compliance services help brands and retailers ensure that the meat and poultry products in their supply chain are manufactured to their standards, stored and shipped under proper conditions, and comply with the regulations of their destination market.

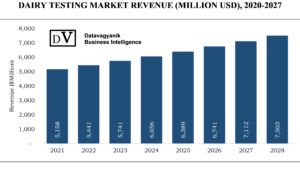

Dairy products or milk products are a type of food that is produced from or contains the milk of mammals, primarily cows, water buffaloes, goats, sheep, and camels. Dairy products include food items such as yogurt, cheese, and butter, clarified butter, concentrated milk, milk solids, milk powder, and others. A facility that produces dairy products is known as a dairy or dairy factory. Dairy products are consumed worldwide with an increasing demand day by day. Dairy products are usually found in European, Middle Eastern, South Asian, and Central Asian cuisines, but are largely absent from East Asian and Southeast Asian cuisines. Dairy products are quite healthy to be consumed, but, they may equally create health issues for people because of the presence of allergens and bacteria present in them. Hence a proper safety testing is required of dairy products right from the farm to the production unit.

Processed food basically refers to food products, (in the most consumable/edible stage) that can be availed by the consumers packaged in boxes, cans, or bags. These foods need to be processed extensively to be edible and are not found as is in nature. In addition to going through many complex processing steps, processed foods often contain additives, artificial flavorings, and other chemical ingredients. Canned beans, frozen fruits, pickles, ready-to-eat meals, bread, cream, canned milk, packaged chips, cheese, jams & jellies, and others, all fall in the category of processed food.

Fruit and vegetable are raw food products that cover a huge section of the food product market. The fruits and vegetable processors need to continuously evaluate their testing practices to ensure that their program is in line with regulatory measures and that their chosen test methods are fast, accurate, and cost-effective. Quality indicators, microbial tests, and residual tests supported by sample collection products will provide ease in testing the products.

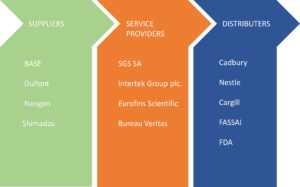

The value chain of the Food safety testing market includes various stakeholders such as Suppliers, Service Providers, and Clients. These stakeholders perform different roles in their specific areas and add value to the global food safety testing market processes flow. Advancements in the food safety testing market model would provide a competitive edge due to initiatives from each stakeholder in the value chain.

Value chain analysis of the global food safety testing Market starts with Suppliers. There are different types of suppliers for food safety testing. The companies which supply these commodities are BASF, DuPont, Neogen, Nuaire, Labtop India, Shimadzu Corporation, and others. In some cases, these roles are played by the same company which is involved in selling its services and manufacturing these commodities on its own such as, Eurofins Scientific. Food safety testing Market Suppliers develop and manage the commodity foundation. Some major food safety testing supply components such as Chemicals, Lab equipment, Agar plates, and Analyzers.

After successful completion of the Supplier stage, the product reaches food safety testing service, providers. The supplied commodities are then used in a required manner as per the client’s requirements only after going through various quality check stages. Food safety testing service providers provide various services like Pathogen testing, GMO Testing, Allergen Testing, Toxin tests, and Heavy metal residue testing. Companies like SGS SA., Intertek Group plc, Eurofins Scientific, and Bureau Veritas are some major food safety testing service, providers.

There is a number of categories for clients which use Food safety testing Services directly or indirectly. In the food manufacturing and packaged food industry, Government authorities conducting food safety inspections use food safety testing services. Processed food industries like dairy product manufacturing units, wine production, drinking water manufacturers, bread manufacturers, and others use various kinds of food testing services in order to comply with the government standards and to serve the best products to their clients. Companies like Britannia, Parle, Cadbury, Nestle, and others are some major clients of food safety testing service providers.

The major market players of the food safety testing market are well established and have gained brand value, hence having almost equal market shares. Topmost companies such as Intertek, Bureau Veritas, and SGS SA., have nearly equal market share and size as well. Similarly, a set of other companies which are relatively small, have almost equal market share. Moreover, the fixed cost or the initial investment required to set up new technology or extend a new unit is very high. This as a result also acts as an exit barrier to the existing companies to back out from the market. Therefore, it can be easily inferred that the pressure pumping market has a high intensity of rivalry

Contaminants like pathogens, allergens, toxins, and heavy metal residues can be quite hazardous to human health if consumed. Each contaminant has a varied technology for its detection. Various kinds of testing methods are applied to detect the presence of contaminants like E.coli, salmonella, uranium, chromium, zing, allergens, and processing stage residues.

The microorganisms which cause diseases such as bacteria, fungi, and viruses are called Pathogens. Most pathogens are parasites (live off the host) and the diseases they cause are an indirect result of their obtaining food from, or shelter in, the host. Larger parasites such as worms are not categorized as pathogens. Pathogens like bacterium is a group of microscopic organisms that are well capable of reproducing on their own, causing human disease by the act of direct invasion of body tissues. Bacteria often produce toxins that can poison the cells they have invaded. Moreover, Virus is a term used for a group of microbes that are incapable of reproducing on their own and must invade a host cell so that could use its genetic machinery for reproduction. Viruses are smaller than bacteria, and are responsible for most common human diseases, like cold and flu. Pathogens are present nearly everywhere in the environment such as soil, food, water, and air.

Decomposable products usually get contaminated during lengthy stages of the supply chain, majorly during processing, packaging, and storing. Companies are emphasizing more on preserving and providing quality products along with stringent guidelines by regulatory bodies on consumable products hence driving the food pathogen testing market size. A growing rate of diarrheal diseases and deaths occurring due to the contaminant diet is creating a strict requirement of pathogen testing. Under-cooking, improper storage, and mishandling lead to contamination which can be only checked by implementing quality measures for ready-to-eat meals, dried processed meals, bakery, infant diet, canned products, and preserved meals which eventually can push food pathogen testing market growth demand. Microbial pathogens such as bacteria and viruses and agricultural chemicals pose threat to consumers and may drive test product demand to ensure meal safety. Growing adulteration in various products to improve shelf-life may drive food pathogen testing market demands. Immunoassay, ELISA, biosensors, PCR-based techniques, and rapid culture detection are various food pathogen testing methods. Currently commercialized GM crops in the U.S. include soy (94%), cotton (90%), canola (90%), sugar beets (95%), corn (88%), Hawaiian papaya (more than 50%), zucchini, and yellow squash.

Food safety testing market size may register a considerable growth owing to strict safety regulations along with increasing cases of meal poisoning and consumer awareness, thus, driving industry growth. Increasing contamination risk owing to meal trade has raised various safety concerns. Tracing contamination is difficult in the supply chain. Changing climatic conditions may contribute to increased incidences of toxins & disease which is expected to drive food pathogen testing market size. Pathogens are most prone to culture in milk and its products. The global dairy products industry may witness considerable growth during the forecast period. Bacteria such as listeria survive post pasteurization which may result in re-contamination and encourage food pathogen testing market size. Several advances in modern biotechnology like automated sequencing can play a big role in the future growth of the market.

A GMO also called a genetically modified organism is the result of a laboratory process where genes from the DNA of one species are extracted and artificially forced into the genes of an unrelated plant or animal. The foreign genes may come from bacteria, viruses, insects, animals, or even humans. Because this involves the transfer of genes, GMOs are also known as “transgenic” organisms. First introduced into the food supply in the mid-1990s, GMOs are now present in the vast majority of processed foods in the US. While they are banned as food ingredients in Europe and elsewhere, the FDA does not even require the labeling of GMOs in food ingredient lists. Although there have been attempts to increase nutritional benefits or productivity, the two main traits that have been added to date are herbicide tolerance and the ability of the plant to produce its own pesticide.

GMO testing comprises of testing of crops and processed food for various traits such as stacked, herbicide tolerance, and insect resistance. The production of genetically modified crops is growing at a considerable rate due to an increase in nutritional demand, which has led to the rise in stringent food safety regulations for GMOs. This has fueled the growth of the GMO testing market. The market players are responding to these new opportunities by expanding their global presence. A demand for enhanced production capacity with limited existing resources, with least or no use of pesticide is on a hike. This is the major factor that is projected to push the demand for GMO food in near future. Moreover, spiked demand for nutritious food items with a prolonged shelf life is another reason to help the GMO food market to expand in upcoming years. The expanded investments and growth in the R&D activities are also leading factors responsible for the growth of this market. Among the crops and processed foods tested for GMO, crops have the largest market share dominated by corn and soy. The bakery & confectionery items are largely tested under GMO testing. They mostly include baking flours, bread, cakes, muffins, and other confectionery & baked goods. The market in breakfast cereals & snacks among processed foods is projected to grow at a considerable rate in the upcoming years. Currently, In addition to that, 17 new genetically modified food items have been given a green signal to be imported into Europe. Citing the reforms in the region and demand for GMO foods, Europe is expected to become one of the net imports of GMO foods.

A pesticide is any substance or mixture of substances used to destroy, suppress or alter the life cycle of any pest. A pesticide can be a naturally derived or synthetically produced substance. Pesticides include bactericides, baits, fungicides, herbicides, insecticides, lures, rodenticides, and repellents. They are used in commercial, domestic, urban, and rural environments. Most crops are treated with pesticides at least a few times in a growing season. Pesticides enable farmers to produce some crops in areas that otherwise would not be suitable, increase crop yields, preserve product quality, and extend shelf life.

Pesticides are among the most regulated products. The fast pace of enterprise in the 21st century presents challenges with regard to the regulatory laws pertaining to pesticide residues. For that reason, FDA tests both domestic and incoming foods for pesticide residues as part of its enforcement activities. The technique used to collect a sample for pesticide testing is undeniably the most critical step in the residue testing process. Proper sampling ensures the sample submitted fully represents the crop, shipment, or production lot. Regulatory bodies follow a precautionary approach when approving the use of pesticides. Pesticides are regulated to make sure they don’t present unacceptable risks to the public, to people who apply them, to the environment, or to animals. In the UK pesticides are assessed by Government departments and an independent scientific committee of experts, Rigorous safety assessments are undertaken to make sure that any pesticide residues remaining in the crop will not be harmful to people. Cryo-treating the sample with liquid nitrogen is the most adopted and efficient method for pesticide residue testing. Screening for residues in foods employs an extraction method to isolate the compounds to be analyzed from the sample. FDA’s Pesticide Analytical Manual (PAM) includes multiple extraction variations, the selection of which depends on the sample and residue.

This increased population density is projected to increase demand for food production by 70% notably due to changes in dietary habits in developing countries towards high-quality food, thus, we need to grow food on even less land, with less water, using less energy, fertilizer, and pesticide than we use today. This eventually will incur a considerable rise and growth in the pesticide residue food testing market. Awareness among common masses, changing food trends, and strict regulations implemented by various governments for pesticide residue in food products is also an opportunity for the Food safety testing market in terms of pesticides.

Some of the important players operating in the Food Safety Testing market are – SGS, SA, Intertek Group PLC, Eurofins Scientific, Bureau Veritas SA, Silicar Inc., ALS Limited, Asurequality Limited, Microbac Laboratories, inc., Covance Inc., International Laboratory Services.

Testing food products to evaluate their safety for eating is the major purpose of food safety testing. Physical, Chemical, and Microbiological analysis is used by food safety testing laboratories and food firms to verify that the product they manufacture is edible continuously.

Bacterial and Viral infections are more likely to spread in healthcare institutions, and food poisoning can be very deadly. Therefore, it is crucial to store, handle, prepare, and present food in a safe, hygienic environment to help prevent hazardous bacteria from spreading and developing and avoid food poisoning.

Food Safety Testing is necessary to guarantee food quality and the best eating experience.

What concerns consumers the most is the safety of what they eat. Therefore, testing in the lab or on the field is the first step toward ensuring it in the future. Food testing is essential for ensuring food safety, but it is also helpful for routine quality control. The specifications for doing food safety tests emphasize how crucial food safety is. The following are some of the primary uses for food safety testing:

An immune system reaction caused by a food allergy might impact several body organs. To ensure no known allergens are present, a product that is marketed as allergen-free, for instance, must be tested. This may result in harmful medical issues involving deadly viruses, bacteria, or other infectious agents. The immune system’s reaction to a food allergy can cause anything from minor skin rashes to severe stomach pain to fatal issues.

The most common food allergens include wheat, peanuts, dairy products, eggs, fish, soy, and almonds.

Food chemistry testing is an essential component of food safety testing. This testing detects a variety of additives, allergies, pollutants, minerals, and heavy metals. Limitations vary depending on the product and its intended use, although there are some legal limits on specific chemicals and minerals.

Some consumables include extra metals like iron to ensure no metals are present in food. However, it’s essential to keep a close eye on the presence of heavy metals like Mercury.

Some viruses can spread through the eating of food. These symptoms are familiar sources of foodborne infections, including nausea, severe vomiting, and abdominal pain. For example, the hepatitis A virus can also be transferred through food, resulting in chronic liver disease. It usually spreads through contaminated raw produce or raw seafood.

Food can spread germs that can make people or other animals sick or even kill them. Pathogens primarily include bacteria, viruses, parasites, and fungi. In addition, pathogens can use food as growth and reproduction medium.

Food poisoning is most frequently caused by bacterial contamination worldwide—the most typical signs of Escherichia. Coli and Salmonella infection includes loss of appetite, vomiting, nausea, and diarrhea.

Food poisoning is a disease carried by consuming unsafe food. The most frequent causes of food poisoning are infectious organisms or their toxins, such as bacteria, viruses, and parasites.

Food safety testing of a product ensures prolonged shelf life and helps represent the impact of mold development, lipid oxidation, and changes in color, flavor, or texture.

Yeasts and molds, in particular, are the primary sources of microbial shelf-life issues.

Food Safety Testing decreases the risk of chronic diseases brought on by slow metabolism and improves poor nutrition.

Food safety refers to all procedures followed to keep food safe during every production process, from harvesting to processing to storage to distribution to preparation to consumption.

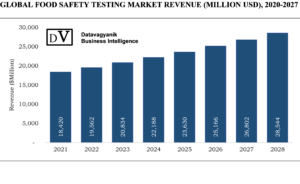

The global market is anticipated to reach USD 31.1 billion by 2027, growing at a CAGR of 8.1% from its estimated USD 21.1 billion in 2022. The increasing prevalence of foodborne illness outbreaks globally, the implementation of strict food safety rules, and the worldwide food supply contribute to expanding the food safety testing market.

Growing consumer awareness of food safety, chemical contamination, and improvements in quick inspection is advancing the business environment. Additionally, rules that have been changed to reduce the number of persons contracting foodborne illnesses like nausea, food poisoning, and diarrhea are improving the quality of goods.

The report analyzes the Food Safety Testing market from the demand as well as the supply side. In supply-side analysis, we reach out to the Food Safety Testing market players to collect information on their portfolio, revenue, target customers, and other insights. During this process, paid interviews and surveys are conducted for obtaining and validating the data pointers. We also deep dive into the available paid industry databases, research studies, white papers, and annual reports.

As a part of our demand-side analysis, we reach out to the end-users of Food Safety Testing, to gauge the application areas, demand trends, and similar insights.

This business analysis report on the Food Safety Testing market presents a regional as well as country-level analysis. The regions covered in the report are – North America, Europe, Asia Pacific, and the Rest of the World. In these four regions, all the countries have been covered in detail with information on Food Safety Testing market size, trends, and forecast.

The report covers Food Safety Testing market revenue and forecast for the period (2021 – 2027), by regions, (further split into countries):

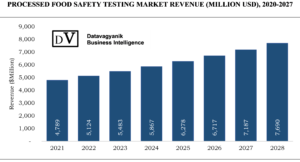

FOOD SAFETY TESTING MARKET REVENUE ($MILLION), AND FORECAST, 2021–2027

| Year | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | CAGR (2021-2027) |

| Food Safety Testing Market Revenue ($Million) | XX | XX | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX | XX | XX |

*Note – Country-level break-down has been covered in the report

Food Safety Testing Market Player Analysis:

Food Safety Testing Market Research Methodology:

There is an entire data collection and validation framework that Datavagyanik follows to provide you with authentic information. We connect to industry experts across various countries to understand market trends and demand patterns. The same is done through paid interviews and surveys.

Our internal team of analysts is experts in studying market patterns, mining data, and extracting useful information from different paid as well as freely available sources. Datavagyanik has an exhaustive internal database with information on markets, market players, and other macro and microeconomic indicators that impact industries.

1. Executive Summary

1.1. Market Attractiveness Analysis

1.2. Global Food Safety Testing Market, By Contaminant Tested

1.3. Global Food Safety Testing Market, By Food Tested

1.4. Global Food Safety Testing Market, By Technology

1.5. Global Food Safety Testing Market, By Geography

2. Research Methodology

2.1. Research Process

2.2. Primary Research

2.3. Secondary Research

2.4. Market Size Estimation

2.5. Forecast Model

2.6. List of Assumptions

3. Market Dynamics

3.1. Introduction

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Challenges

3.6. Covid 19 Impact Analysis

4. Global Food Safety Testing Market Analysis

4.1. Overview

4.2. Global Food Safety Testing Market Size ($Million) and Forecasts (2020 – 2027)

4.1. Global Food Safety Testing Market Size ($Million) and Forecasts (2020 – 2027), By Contaminant Tested

4.1.1. Pathogens

4.1.2. GMOs

4.1.3. Pesticides

4.1.4. Toxins

4.1.5. Others (residue & allergens)

4.2. Global Food Safety Testing Market Size ($Million) and Forecasts (2020 – 2027), By Food Tested

4.2.1. Meat & poultry

4.2.2. Dairy products

4.2.3. Processed food

4.2.4. Fruits & vegetables

4.2.5. Others

4.3. Global Food Safety Testing Market Size ($Million) and Forecasts (2020 – 2027), By Technology

4.3.1. Conventional

4.3.2. Rapid

4.4. Global Food Safety Testing Market Size ($Million) and Forecasts (2020 – 2027), By Geography

4.4.1. North America

4.4.2. Asia Pacific

4.4.3. Europe

4.4.4. Rest of the World

5. North America Food Safety Testing Market analysis

5.1. Overview

5.2. North America Food Safety Testing Market Size ($Million) and Forecasts (2020 – 2027)

5.3. North America Food Safety Testing Market Size ($Million) and Forecasts (2020 – 2027), By Contaminant Tested

5.3.1. Pathogens

5.3.2. GMOs

5.3.3. Pesticides

5.3.4. Toxins

5.3.5. Others (residue & allergens)

5.4. North America Food Safety Testing Market Size ($Million) and Forecasts (2020 – 2027), By Food Tested

5.4.1. Meat & poultry

5.4.2. Dairy products

5.4.3. Processed food

5.4.4. Fruits & vegetables

5.4.5. Others

5.5. North America Food Safety Testing Market Size ($Million) and Forecasts (2020 – 2027), By Technology

5.5.1. Conventional

5.5.2. Rapid

5.6. North America Food Safety Testing Market Size ($Million) and Forecasts (2020 – 2027), By Country

5.6.1. United States

5.6.2. Canada

5.6.3. Mexico

6. Europe Food Safety Testing Market analysis

6.1. Overview

6.2. Europe Food Safety Testing Market Size ($Million) and Forecasts (2020 – 2027)

6.3. Europe Food Safety Testing Market Size ($Million) and Forecasts (2020 – 2027), By Contaminant Tested

6.3.1. Pathogens

6.3.2. GMOs

6.3.3. Pesticides

6.3.4. Toxins

6.3.5. Others (residue & allergens)

6.4. Europe Food Safety Testing Market Size ($Million) and Forecasts (2020 – 2027), By Food Tested

6.4.1. Meat & poultry

6.4.2. Dairy products

6.4.3. Processed food

6.4.4. Fruits & vegetables

6.4.5. Others

6.5. Europe Food Safety Testing Market Size ($Million) and Forecasts (2020 – 2027), By Technology

6.5.1. Conventional

6.5.2. Rapid

6.6. Europe Food Safety Testing Market Size ($Million) and Forecasts (2020 – 2027), By Country

6.6.1. Germany

6.6.2. France

6.6.3. Italy

6.6.4. Spain

6.6.5. U.K.

6.6.6. Rest of Europe

7. Asia Pacific Food Safety Testing Market analysis

7.1. Overview

7.2. Asia Pacific Food Safety Testing Market Size ($Million) and Forecasts (2020 – 2027)

7.3. Asia Pacific Food Safety Testing Market Size ($Million) and Forecasts (2020 – 2027), By Contaminant Tested

7.3.1. Pathogens

7.3.2. GMOs

7.3.3. Pesticides

7.3.4. Toxins

7.3.5. Others (residue & allergens)

7.4. Asia Pacific Food Safety Testing Market Size ($Million) and Forecasts (2020 – 2027), By Food Tested

7.4.1. Meat & poultry

7.4.2. Dairy products

7.4.3. Processed food

7.4.4. Fruits & vegetables

7.4.5. Others

7.5. Asia Pacific Food Safety Testing Market Size ($Million) and Forecasts (2020 – 2027), By Technology

7.5.1. Conventional

7.5.2. Rapid

7.6. Asia Pacific Food Safety Testing Market Size ($Million) and Forecasts (2020 – 2027), By Country

7.6.1. China

7.6.2. Japan

7.6.3. South Korea

7.6.4. India

7.6.5. Australia

7.6.6. Malaysia

7.6.7. Vietnam

7.6.8. Rest of APAC

8. Rest of the World Food Safety Testing Market analysis

8.1. Overview

8.2. Rest of the World Food Safety Testing Market Size ($Million) and Forecasts (2020 – 2027)

8.3. Rest of the World Food Safety Testing Market Size ($Million) and Forecasts (2020 – 2027), By Contaminant Tested

8.3.1. Pathogens

8.3.2. GMOs

8.3.3. Pesticides

8.3.4. Toxins

8.3.5. Others (residue & allergens)

8.4. Global Food Safety Testing Market Size ($Million) and Forecasts (2020 – 2027), By Food Tested

8.4.1. Meat & poultry

8.4.2. Dairy products

8.4.3. Processed food

8.4.4. Fruits & vegetables

8.4.5. Others

8.5. Global Food Safety Testing Market Size ($Million) and Forecasts (2020 – 2027), By Technology

8.5.1. Conventional

8.5.2. Rapid

9. Company Profiles

9.1. Eurofins Scientific

9.1.1. Company Overview

9.1.2. Products Offered

9.1.3. Key Developments

9.1.4. Revenue from Food Safety Testing Business Segment, 2019 & 2020

9.2. SGS SA

9.2.1. Company Overview

9.2.2. Products Offered

9.2.3. Key Developments

9.2.4. Revenue from Food Safety Testing Business Segment, 2019 & 2020

9.3. Intertek Group PLC

9.3.1. Company Overview

9.3.2. Products Offered

9.3.3. Key Developments

9.3.4. Revenue from Food Safety Testing Business Segment, 2019 & 2020

9.4. Bureau Veritas S.A.

9.4.1. Company Overview

9.4.2. Products Offered

9.4.3. Key Developments

9.4.4. Revenue from Food Safety Testing Business Segment, 2019 & 2020

9.5. Merieuz Nutrisciences

9.5.1. Company Overview

9.5.2. Products Offered

9.5.3. Key Developments

9.5.4. Revenue from Food Safety Testing Business Segment, 2019 & 2020

9.6. ALS Limited

9.6.1. Company Overview

9.6.2. Products Offered

9.6.3. Key Developments

9.7. Asurequality Limited

9.7.1. Company Overview

9.7.2. Products Offered

9.7.3. Key Developments

9.7.4. Revenue from Food Safety Testing Business Segment, 2019 & 2020

9.8. Eastman Chemical Company

9.8.1. Company Overview

9.8.2. Products Offered

9.8.3. Key Developments

9.8.4. Revenue from Food Safety Testing Business Segment, 2019 & 2020

9.9. Microbac Laboratories, Inc.

9.10. Covance Inc.

9.11. Other Market Players

“Every Organization is different and so are their requirements”- Datavagyanik

© 2021 All rights reserved

Datavagyanik- Your Research Partner

Add the power of Impeccable research, become a DV client