- Published 2024

- No of Pages: 200

- 20% Customization available

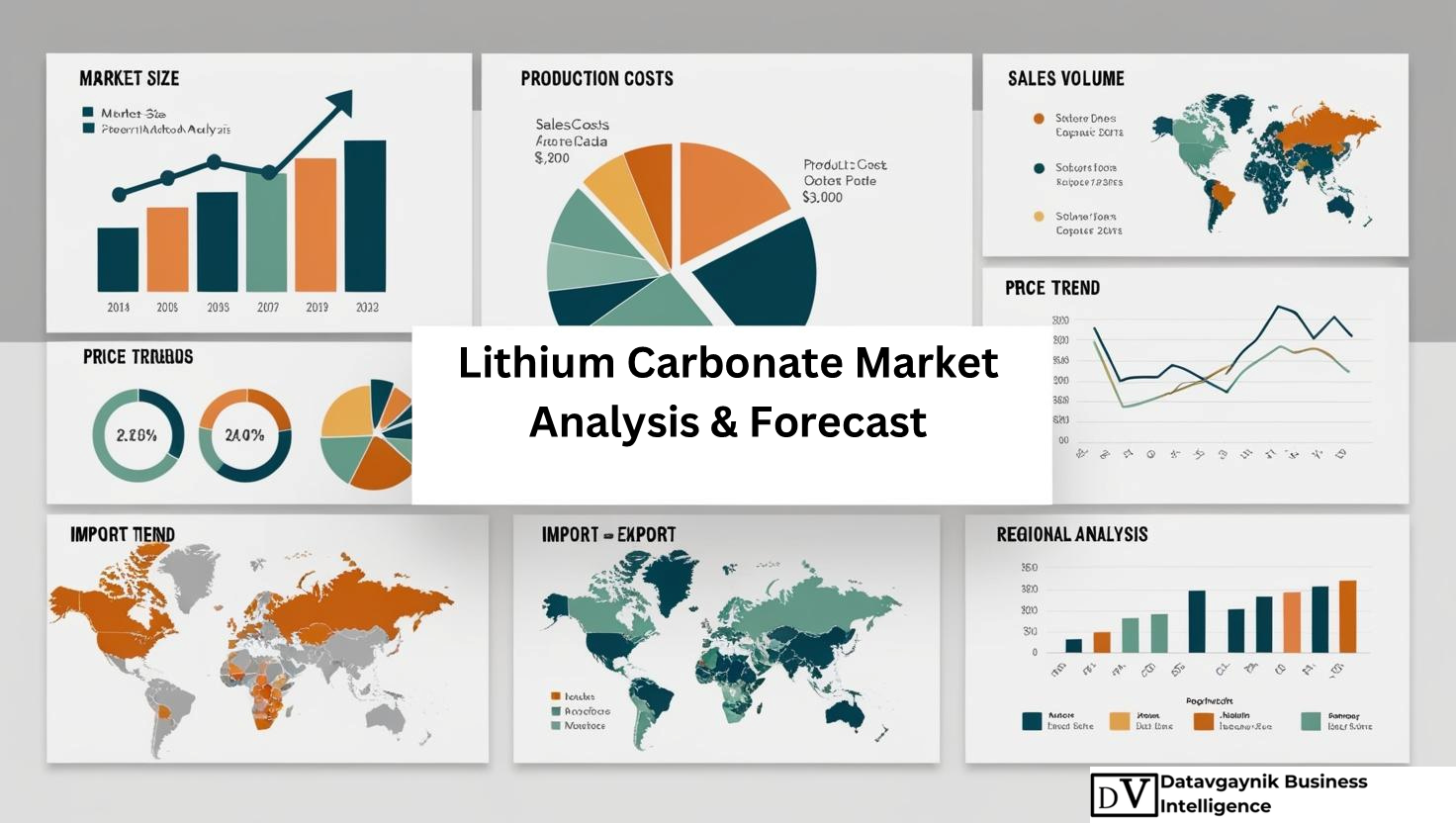

Lithium Carbonate Market Size, Production, Sales, Average Product Price, Market Share, Import vs Export

Global Lithium Carbonate Market: Strategic Insights and Growth Prospects

Global Lithium Carbonate Market Size is expected to grow at a notable pace in the coming years. Lithium Carbonate demand is growing due to

- Electric Vehicle (EV) Market Growth: One of the most significant drivers of increasing Lithium Carbonate demand is the rapid expansion of the electric vehicle market. Lithium-ion batteries, which are essential for EVs, require Lithium Carbonate as a key component. As more consumers and businesses adopt electric vehicles in response to climate change concerns and government incentives, the demand for Lithium Carbonate, which powers these batteries, is surging.

- Renewable Energy Storage: The growing focus on renewable energy sources such as solar and wind has spurred demand for energy storage solutions. Lithium-ion batteries, which are efficient and have a long lifespan, are widely used for storing energy generated from renewable sources. This has directly led to an increase in the demand for Lithium Carbonate, as it is a primary material in the production of these batteries.

- Rising Demand in Consumer Electronics: The widespread use of portable electronics, including smartphones, laptops, tablets, and wearables, continues to fuel the demand for Lithium-ion batteries. These devices require smaller, more powerful batteries, which are primarily produced using Lithium Carbonate. As the global consumption of consumer electronics rises, so does the need for Lithium Carbonate.

- Sustainability and Energy Transition: Governments and industries worldwide are increasingly prioritizing sustainability and the transition to clean energy. Lithium Carbonate is crucial in the development of technologies that support this shift, particularly in the form of lithium-ion batteries for EVs, renewable energy storage, and other clean energy applications. The push towards reducing carbon emissions is expected to sustain and increase Lithium Carbonate demand.

- Technological Advancements in Lithium-ion Batteries: Ongoing advancements in battery technology, such as higher energy densities, longer lifespans, and faster charging capabilities, are driving up the need for Lithium Carbonate. As battery manufacturers continue to innovate and optimize their products, the demand for high-quality Lithium Carbonate will increase to meet the standards of these new technologies.

- Geopolitical and Economic Factors: The growing demand for Lithium Carbonate is also influenced by geopolitical factors. Countries rich in lithium reserves, such as Chile, Argentina, and Australia, are ramping up production to meet the global demand. Additionally, strategic trade agreements and the race for lithium resources are impacting supply chains and prices, making Lithium Carbonate increasingly sought after.

United States and Europe Lithium Carbonate Market Recent Developments and Business Opportunities by Country

- The United States and Europe have become pivotal players in the global Lithium Carbonate market, driven by the increasing demand for electric vehicles (EVs), energy storage solutions, and consumer electronics. Over the past few years, several factors have contributed to the growth of the market in these regions, including advancements in battery technologies, government incentives for green energy projects, and strategic efforts to secure a stable supply of lithium. This article explores the recent developments in the Lithium Carbonate market within the United States and Europe, highlighting production trends and business opportunities in key countries.

United States Lithium Carbonate Market

- In the United States, the Lithium Carbonate market has witnessed significant growth, primarily driven by the expanding electric vehicle (EV) market and the transition towards renewable energy. The U.S. government has been actively promoting the adoption of electric vehicles through various policies and incentives, such as the federal EV tax credit and state-specific rebates, which have boosted the demand for lithium-ion batteries. Since Lithium Carbonate is a primary component in these batteries, the surge in EV production directly translates into a higher demand for lithium.

- A major development in the U.S. is the growing focus on domestic lithium production. In the past, the U.S. was heavily reliant on imports for its lithium supply, particularly from countries like Chile, Argentina, and Australia. However, in recent years, there has been a concerted effort to reduce reliance on foreign suppliers by investing in domestic lithium extraction projects. Companies like Albemarle, Livent Corporation, and Tesla are driving these efforts, with the latter also planning to extract lithium from geothermal brine sources. As of now, the U.S. is still in the early stages of ramping up domestic lithium production, but the potential is significant, especially with the U.S. government emphasizing energy independence and supporting initiatives such as the Inflation Reduction Act, which promotes clean energy and electric vehicle development.

- In terms of production, the U.S. has a rich supply of lithium-bearing minerals such as spodumene and clay, which are being increasingly targeted for extraction. Nevada, in particular, is home to the largest lithium reserves in the country, with projects like the Thacker Pass Lithium Mine by Lithium Americas, which is expected to be a significant contributor to U.S. lithium production once operational. As the U.S. moves toward securing a stable lithium supply and scaling up production, there are numerous business opportunities for local manufacturers of lithium-ion batteries, electric vehicles, and energy storage systems.

- Additionally, the U.S. has seen substantial investments in recycling lithium batteries. Companies are increasingly focusing on battery recycling as a sustainable solution to meet lithium demand. Battery recycling facilities are being developed to recover valuable materials from used batteries, including Lithium Carbonate. This sector presents considerable business opportunities as companies seek to reduce environmental impact and ensure a circular supply chain for lithium.

Europe Lithium Carbonate Market

- In Europe, the demand for Lithium Carbonate is experiencing rapid growth, driven primarily by the European Union’s ambitious targets for carbon neutrality and its emphasis on the green transition. The EU has set strict regulations aimed at reducing greenhouse gas emissions, which has led to an increase in electric vehicle adoption and the development of renewable energy solutions, both of which require significant amounts of lithium. Several European countries are positioning themselves as key players in the Lithium Carbonate market by ramping up their production capacities and securing lithium supplies from both domestic and international sources.

Germany

- Germany, a leader in the European automotive industry, is at the forefront of the lithium demand in Europe. The country’s strong automotive sector, represented by giants such as Volkswagen, BMW, and Mercedes-Benz, is rapidly transitioning to electric mobility, which is increasing the demand for Lithium Carbonate. Germany is also focusing on the development of battery cell production and assembly facilities as part of the European Battery Alliance. The government has pledged substantial investments in these initiatives, aiming to create a competitive and sustainable battery manufacturing ecosystem within Europe.

- To meet this rising demand, Germany is exploring ways to secure a stable supply of lithium. The country is investing in lithium extraction projects and developing collaborations with lithium-rich countries. Additionally, companies like BASF are working to optimize the supply chain by establishing direct links with lithium producers in South America and Australia. Germany’s push to establish domestic production of lithium-ion batteries is opening up various business opportunities, particularly for local manufacturers and suppliers of lithium materials and components.

France

- France is another European country actively seeking to develop its domestic lithium production capabilities. As part of its commitment to achieving carbon neutrality by 2050, France is looking to accelerate the adoption of electric vehicles, thereby increasing demand for Lithium Carbonate. France has several initiatives underway to strengthen its battery production infrastructure, including the development of gigafactories for lithium-ion batteries. Companies like the French multinational automotive company PSA (now part of Stellantis) are working alongside partners to invest in lithium-ion battery production in the country.

- In addition to the rise in demand from the automotive sector, France is focusing on renewable energy storage. The growing need for efficient energy storage systems for solar and wind power is another key driver of Lithium Carbonate demand. France is heavily investing in energy storage technologies, and lithium-ion batteries play a crucial role in this effort. This trend is creating numerous opportunities for business growth in battery manufacturing, lithium extraction, and battery recycling within the French market.

Spain

- Spain is emerging as a significant player in the European lithium market, with a growing focus on both lithium extraction and the development of battery manufacturing. The country is home to some of Europe’s largest lithium reserves, and companies such as Excellon Resources and Infinity Lithium are working on lithium mining projects. These initiatives are crucial to securing a steady supply of Lithium Carbonate for Spain’s burgeoning battery production sector.

- In addition to extraction, Spain is seeing a rise in battery recycling projects. Companies in Spain are focusing on developing infrastructure to recycle lithium-ion batteries, a process that not only addresses environmental concerns but also helps reduce dependency on primary lithium sources. This recycling trend is expected to create significant business opportunities in the Spanish market, especially as the European Union pushes for more sustainable and circular supply chains.

Italy

- Italy, while not as dominant as Germany or France in the lithium sector, has still shown considerable interest in developing its role in the European Lithium Carbonate market. The country has been investing in research and development to support the production of lithium-ion batteries and energy storage solutions. Italy is also home to several manufacturers focused on electric vehicles, which has led to an increasing demand for lithium-based batteries. Furthermore, Italian companies are involved in both the upstream and downstream sectors of the lithium market, including mining and battery production.

Conclusion

- In both the United States and Europe, the Lithium Carbonate market is poised for substantial growth. In the U.S., the market is being driven by the expansion of the electric vehicle industry, renewable energy storage, and the push for domestic lithium production. Meanwhile, Europe is undergoing a significant transformation as countries such as Germany, France, Spain, and Italy ramp up production capacities to meet the demand for lithium-based products. With government incentives, advancements in battery technologies, and an increasing focus on sustainability, there are numerous business opportunities emerging in these regions, particularly in areas such as battery manufacturing, recycling, and lithium extraction. As the global transition to electric vehicles and renewable energy continues, both the United States and Europe are expected to remain key players in the Lithium Carbonate market.

Asia Pacific Lithium Carbonate Market Recent Developments and Business Opportunities by Country

The Asia Pacific region has emerged as a crucial player in the global Lithium Carbonate market, with several countries in the region actively pursuing growth in lithium production, consumption, and related industries. Driven by the rising demand for electric vehicles (EVs), renewable energy storage, and consumer electronics, the Asia Pacific market has experienced rapid growth in recent years. This article explores the recent developments and business opportunities in the Lithium Carbonate market across key countries in the region, including China, Japan, South Korea, India, and Australia.

China

China has long been the dominant force in the global Lithium Carbonate market, with the country playing a significant role both as a producer and consumer. The demand for Lithium Carbonate in China has surged, primarily due to the country’s massive electric vehicle market, which is the largest in the world. The Chinese government has heavily invested in the EV sector through subsidies and incentives, making electric cars more affordable and encouraging consumers to transition away from traditional internal combustion engine vehicles. As a result, China’s demand for lithium-ion batteries—and, by extension, Lithium Carbonate—has skyrocketed.

In terms of production, China has not only ramped up its lithium extraction efforts but has also become a global hub for lithium-ion battery manufacturing. The country has significant lithium reserves, primarily in regions such as Qinghai and Sichuan, and continues to expand its domestic production capacity. Companies like Ganfeng Lithium, Tianqi Lithium, and CATL are among the key players in the Chinese market, contributing to both domestic production and international supply chains. Furthermore, China has strategically invested in securing lithium resources abroad, with Chinese companies acquiring mining assets in countries like Australia, Argentina, and Zimbabwe to ensure a stable supply of lithium.

China’s growing lithium production capacity presents significant business opportunities for stakeholders involved in mining, battery manufacturing, and recycling. Additionally, as the country leads the way in electric mobility, there is an increasing need for research and innovation in Lithium Carbonate production to enhance battery performance, which opens up avenues for companies in R&D and technological development.

Japan

Japan, while not as large a producer of Lithium Carbonate as China or Australia, is a significant consumer and innovator in the market. The country’s demand for Lithium Carbonate is driven primarily by the automotive sector, which has been focusing on the development and production of electric vehicles. Major automakers like Toyota, Honda, and Nissan have been accelerating their efforts to produce EVs, and this has led to a rise in demand for lithium-ion batteries, thus increasing the need for Lithium Carbonate.

In addition to the automotive sector, Japan is heavily investing in renewable energy solutions, particularly in energy storage systems, which rely on lithium-ion batteries. Japan’s commitment to reducing carbon emissions has fueled the demand for sustainable energy storage technologies, which further drives the need for lithium-based solutions.

Japan is also investing in lithium extraction and production technologies, although the country does not have significant lithium reserves of its own. Instead, Japan has entered into partnerships with international suppliers and mining companies to secure the lithium required for its battery and EV industries. Companies like Sumitomo Metal Mining and Mitsubishi Corporation RtM Japan are involved in these international partnerships, ensuring that Japan maintains a steady supply of Lithium Carbonate for its industries.

The business opportunities in Japan’s Lithium Carbonate market lie in the growing demand for EVs and renewable energy storage, as well as the potential for technological innovations in battery production. Furthermore, Japan’s focus on energy efficiency and sustainability provides ample opportunities for companies involved in the research and development of new lithium-based technologies.

South Korea

South Korea is another key player in the Lithium Carbonate market, with its demand driven by its robust electronics and automotive sectors. The country’s major electronics manufacturers, such as Samsung and LG, are significant consumers of lithium for the production of smartphones, laptops, and other portable devices. As lithium-ion batteries are essential for powering these devices, the demand for Lithium Carbonate in South Korea has been steadily increasing.

In the automotive sector, South Korea’s leading automaker Hyundai is expanding its electric vehicle portfolio, further driving demand for Lithium Carbonate. The country has also made significant strides in developing lithium-ion battery production technologies. Companies like LG Chem, Samsung SDI, and SK Innovation are key players in the South Korean lithium-ion battery market, contributing to the increased demand for Lithium Carbonate.

South Korea has also focused on establishing strategic partnerships with lithium producers in other parts of the world, including Australia and South America, to secure a stable supply of Lithium Carbonate. As a result, there are growing business opportunities for stakeholders involved in mining, battery manufacturing, and lithium recycling. South Korea’s commitment to sustainability and its push for a green energy transition also present opportunities in energy storage systems, which heavily rely on Lithium Carbonate.

India

India’s Lithium Carbonate market is still in the early stages of development, but the demand for lithium is expected to grow rapidly in the coming years. The country’s rising population, expanding middle class, and growing demand for consumer electronics are all contributing factors to the increasing need for lithium-based products. Additionally, India’s government has set ambitious targets for the adoption of electric vehicles, with the goal of having a significant portion of its vehicle fleet converted to electric by 2030. This shift to electric mobility will significantly boost the demand for Lithium Carbonate.

India has limited lithium reserves, which has led to an increased focus on securing lithium imports from countries with abundant reserves, such as Australia and Bolivia. However, the country has been exploring lithium extraction from other sources, such as lithium-rich clay deposits, as well as recycling lithium from used batteries. These efforts to diversify supply sources present business opportunities for both domestic and international companies involved in lithium mining, battery manufacturing, and recycling.

India is also making strides in developing its battery manufacturing capabilities. The government’s focus on the “Make in India” initiative and the National Electric Mobility Mission Plan (NEMMP) is expected to drive investments in local production and help reduce the country’s reliance on imports. With the Indian electric vehicle market growing rapidly, there will be ample opportunities for companies to engage in lithium production, battery manufacturing, and related industries.

Australia

Australia is a major global supplier of lithium and plays a critical role in the production of Lithium Carbonate. The country has vast lithium deposits, particularly in Western Australia, which is home to the Greenbushes Lithium Mine—the world’s largest active lithium mine. Australia is a key supplier of spodumene, a mineral that is processed into lithium hydroxide and Lithium Carbonate. With global lithium demand increasing, Australia has ramped up its lithium production to meet the needs of the global market, particularly for the rapidly expanding electric vehicle and energy storage sectors.

The Australian government has supported the lithium industry through favorable policies and incentives, and the country is witnessing a rise in investment in both mining and battery manufacturing. Several new lithium extraction projects are underway, and Australia is also focusing on developing processing capabilities to produce high-purity Lithium Carbonate locally. As the country continues to expand its production capacity, there are significant business opportunities in mining, refining, and the establishment of battery manufacturing plants.

Global Lithium Carbonate Analysis by Market Segmentation

- By Application:

- Batteries: Lithium Carbonate is widely used in the production of lithium-ion batteries, which are crucial for electric vehicles (EVs), consumer electronics, and energy storage systems. This is the largest segment in the market, driven by the increasing demand for EVs and renewable energy solutions.

- Ceramics and Glass: Lithium Carbonate is used in the ceramics and glass industry to improve the durability and performance of glass products. It is particularly useful in the production of flat glass, which is used in architectural applications and automotive windows.

- Pharmaceuticals: Lithium Carbonate is used in the pharmaceutical industry for the production of drugs, especially in the treatment of psychiatric disorders such as bipolar disorder. The pharmaceutical application is growing as mental health awareness increases.

- Polymers: In the polymer industry, Lithium Carbonate is used in the production of certain types of plastics and rubber materials. This segment is growing as new applications for lithium-based products in manufacturing evolve.

- Other Applications: Lithium Carbonate is also used in various other industries, such as lubricants, aluminum production, and as a fluxing agent in steel production. These niche applications contribute to the overall demand but are comparatively smaller in scale.

- By End-Use Industry:

- Automotive: The automotive industry, especially with the rise of electric vehicles, is the largest consumer of Lithium Carbonate. Batteries used in electric vehicles require high-quality Lithium Carbonate for energy storage.

- Energy Storage: Lithium Carbonate is used in energy storage systems, which are essential for renewable energy applications. These systems help store energy generated by wind and solar power for later use, making them crucial for the global transition to green energy.

- Consumer Electronics: Lithium-ion batteries in consumer electronics such as smartphones, laptops, and tablets are a significant driver for the Lithium Carbonate market. The increasing demand for portable electronic devices continues to fuel market growth in this segment.

- Industrial Applications: The industrial use of Lithium Carbonate is spread across several sectors, including manufacturing and construction. Its applications in ceramics, glass, and polymers contribute significantly to the overall market.

- By Geography:

- North America: The demand for Lithium Carbonate in North America is driven by the growing adoption of electric vehicles, renewable energy storage projects, and the electronics industry. The U.S. has seen a significant increase in lithium mining projects, and demand is expected to rise steadily.

- Europe: Europe is also witnessing strong demand for Lithium Carbonate, primarily due to its focus on clean energy and electric mobility. Countries such as Germany, France, and Norway are heavily investing in electric vehicle infrastructure, which is expected to boost lithium demand.

- Asia Pacific: The Asia Pacific region, led by China, Japan, and South Korea, remains the largest market for Lithium Carbonate. China is the dominant consumer due to its extensive electric vehicle and electronics industries, while countries like Japan and South Korea contribute significantly to the battery production segment.

- Latin America: Latin America, particularly countries like Argentina, Bolivia, and Chile, holds some of the largest lithium reserves in the world. This region is an important player in the production and export of Lithium Carbonate, with increasing global demand bolstering local economies.

- Middle East and Africa: The market in the Middle East and Africa is growing, albeit at a slower pace compared to other regions. However, as the region diversifies its energy sources and increases investment in green technologies, the demand for Lithium Carbonate may rise in the future.

- By Production Technology:

- Mineral Extraction: Lithium Carbonate is mainly obtained through the extraction of lithium-containing minerals such as spodumene. This method is most common in countries with large mineral reserves, such as Australia and China. It requires significant capital investment in mining infrastructure but offers a reliable supply of lithium.

- Brine Extraction: Another key method of producing Lithium Carbonate is by extracting lithium from brine pools, often found in salt flats. This method is common in regions such as South America, particularly in the “Lithium Triangle” consisting of Argentina, Chile, and Bolivia. Brine extraction can be more cost-effective than mineral extraction but requires a long production time and specific geographic conditions.

- Recycling: Lithium-ion battery recycling is an emerging technology that helps recover Lithium Carbonate from used batteries. The recycling segment is gaining traction due to increasing environmental concerns, regulations around waste management, and the need to reduce reliance on raw materials. This segment is expected to grow significantly in the coming years.

- By Grade:

- Technical Grade: This grade of Lithium Carbonate is used primarily in industries such as ceramics and glass manufacturing. It has lower purity and is suitable for industrial applications where ultra-high purity is not required.

- Battery Grade: The demand for battery-grade Lithium Carbonate has been increasing due to the growing adoption of electric vehicles and consumer electronics. Battery-grade Lithium Carbonate is of higher purity, ensuring optimal performance in lithium-ion batteries. This segment is expected to see continued growth as the market for electric mobility expands.

- By Supply Chain:

- Integrated Supply Chain: Some of the leading players in the Lithium Carbonate market have vertically integrated supply chains, controlling the entire process from mining to final product delivery. These companies typically have an advantage in securing stable production and mitigating risks related to supply chain disruptions.

- Non-integrated Supply Chain: Other companies operate in non-integrated supply chains, focusing on specific stages of the production process, such as mining, processing, or battery manufacturing. These players often rely on strategic partnerships to meet supply demands.

Lithium Carbonate Production and Import-Export Scenario

The production and import-export scenario for Lithium Carbonate is heavily influenced by global demand, particularly due to its essential role in the electric vehicle (EV) industry, renewable energy storage systems, and consumer electronics. As a critical raw material for lithium-ion batteries, Lithium Carbonate’s production has expanded rapidly in response to the increasing adoption of electric vehicles and the growing need for energy storage solutions.

The primary sources of Lithium Carbonate production are mineral extraction and brine extraction. Mineral extraction typically involves the mining of spodumene, a lithium-bearing mineral, and is most commonly done in countries like Australia. Australia is the largest global producer of lithium from spodumene. The extraction process involves crushing the minerals, concentrating them, and then converting them into lithium hydroxide, which can then be converted into Lithium Carbonate. This production method is energy-intensive but remains a key contributor to global supply.

Brine extraction, on the other hand, involves extracting lithium from salt flats and is most common in South American countries, particularly Argentina, Chile, and Bolivia. Known as the “Lithium Triangle,” these countries possess some of the world’s largest lithium brine reserves. The extraction process typically involves pumping brine from underground reservoirs into large evaporation ponds, where the water is evaporated, and the lithium salts are concentrated. The process is slower and requires specific climatic conditions, but it can be less expensive and more environmentally sustainable compared to mineral extraction.

Another emerging trend in Lithium Carbonate production is recycling. The recycling of used lithium-ion batteries is gaining traction as a sustainable way to meet growing demand. The process of lithium-ion battery recycling helps recover valuable materials, including Lithium Carbonate, reducing the reliance on primary production sources and mitigating the environmental impact of mining. Several countries, particularly in Europe and North America, are exploring and investing in lithium recycling technologies to close the loop on lithium supply chains.

In terms of global production volume, China is both a major producer and consumer of Lithium Carbonate. The country has invested heavily in the lithium sector, both in terms of domestic production and securing global supply chains through investments in lithium-rich countries. China’s dominance in the battery manufacturing industry has also led to its significant consumption of Lithium Carbonate. China has made substantial investments in lithium mining projects, as well as in brine extraction operations in South America, making it one of the world’s largest importers of lithium from countries like Argentina and Chile.

The United States and Europe, while not significant producers of Lithium Carbonate, are important players in the global market. The U.S. has a growing lithium industry, with several new mining and extraction projects coming online in states like Nevada. However, the country still imports a large portion of its Lithium Carbonate needs, primarily from South America and Australia. Europe, on the other hand, has limited domestic production capacity, relying heavily on imports from regions like Latin America and Australia. The EU has been focused on securing long-term lithium supply agreements and investing in local mining projects to reduce dependence on external sources.

In terms of global trade, the export and import scenario for Lithium Carbonate is largely shaped by the balance of supply and demand between producing and consuming countries. Major exporters of Lithium Carbonate include Australia, Chile, Argentina, and China. These countries export significant volumes of lithium to regions with high demand, such as Europe, the U.S., and Japan. However, the market has been facing challenges related to supply chain disruptions, fluctuating production costs, and geopolitical tensions. For example, in recent years, trade tensions between China and the U.S. have had an impact on the flow of raw materials, including lithium, between these two countries.

The rapid growth of the electric vehicle market has driven increased imports of Lithium Carbonate, particularly in countries with ambitious green energy and automotive transition plans. In the U.S., lithium imports have surged as domestic production has not been able to keep pace with demand. Europe, which is making a concerted effort to reduce its dependence on fossil fuels, is also a significant importer of lithium. The EU is heavily focused on the transition to electric mobility and has set ambitious targets for reducing carbon emissions, leading to increased demand for lithium-based batteries.

As demand for lithium increases, so does the competition for access to the raw material. The market is seeing a shift toward strategic partnerships and agreements between lithium producers and major battery manufacturers, which ensures the steady supply of Lithium Carbonate to meet growing battery production needs. For instance, global automakers such as Tesla, Volkswagen, and BYD have entered into agreements with lithium producers to secure long-term lithium supplies for their electric vehicle production lines.

While the growth in Lithium Carbonate production and trade presents significant business opportunities, it also raises concerns about supply chain sustainability. The environmental impact of lithium extraction, especially from brine pools, has been under scrutiny due to concerns about water use and land degradation. As the global market for Lithium Carbonate grows, there is increasing pressure to adopt more sustainable and eco-friendly production methods.

Overall, the Lithium Carbonate production and import-export landscape is evolving rapidly, with increasing focus on securing supply chains, improving production technologies, and expanding recycling efforts. The demand for lithium is expected to continue its upward trajectory due to the growth of the electric vehicle market and the global push for renewable energy solutions, making it an essential component of the green energy transition. The import-export dynamics of Lithium Carbonate will play a key role in shaping global supply chains and ensuring the continued availability of this critical resource for future industries.

Market Scenario, Demand vs Supply, Average Product Price, Import vs Export, till 2035

- Global Lithium Carbonate Market revenue and demand by region

- Global Lithium Carbonate Market production and sales volume

- United States Lithium Carbonate Market revenue size and demand by country

- Europe Lithium Carbonate Market revenue size and demand by country

- Asia Pacific Lithium Carbonate Market revenue size and demand by country

- Middle East & Africa Lithium Carbonate Market revenue size and demand by country

- Latin America Lithium Carbonate Market revenue size and demand by

- Import-export scenario – United States, Europe, APAC, Latin America, Middle East & Africa

- Average product price – United States, Europe, APAC, Latin America, Middle East & Africa

- Market player analysis, competitive scenario, market share analysis

- Business opportunity analysis

Key questions answered in the Global Lithium Carbonate Market Analysis Report:

- What is the market size for Lithium Carbonate in United States, Europe, APAC, Middle East & Africa, Latin America?

- What is the yearly sales volume of Lithium Carbonate and how is the demand rising?

- Who are the top market players by market share, in each product segment?

- Which is the fastest growing business/ product segment?

- What should be the business strategies and Go to Market strategies?

The report covers Lithium Carbonate Market revenue, Production, Sales volume, by regions, (further split into countries):

- Asia Pacific (China, Japan, South Korea, India, Indonesia, Vietnam, Rest of APAC)

- Europe (UK, Germany, France, Italy, Spain, Benelux, Poland, Rest of Europe)

- North America (United States, Canada, Mexico)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa

Table of Contents:

Introduction to the Lithium Carbonate Market

- Overview of Lithium Carbonate and Its Importance in Modern Industries

- Historical Development and Evolution of the Lithium Carbonate Market

- Key Market Drivers and Trends in Lithium Carbonate Demand

Production of Lithium Carbonate: Methods and Technologies

- Extraction of Lithium Carbonate: Mining vs. Brine Processing

- The Role of Lithium Carbonate Production in Electric Vehicle Batteries

- Advanced Technologies in Lithium Carbonate Production: Efficiency and Cost-effectiveness

- Environmental Impacts of Lithium Carbonate Production and Sustainable Solutions

Applications of Lithium Carbonate Across Various Industries

- Lithium Carbonate in Battery Manufacturing: Focus on Electric Vehicles (EVs) and Energy Storage

- The Role of Lithium Carbonate in the Pharmaceutical Industry: Medical and Therapeutic Uses

- Lithium Carbonate as a Raw Material in Glass and Ceramics Manufacturing

- Lithium Carbonate in the Production of Lubricants and Greases

- Emerging Uses of Lithium Carbonate in Renewable Energy and Clean Technologies

Market Segmentation and Regional Analysis of the Lithium Carbonate Market

- Forms of Lithium Carbonate: Technical Grade vs. Battery Grade

- Analysis of Lithium Carbonate Demand by End-use Industries

- Regional Demand Analysis: Lithium Carbonate Market Trends in North America, Europe, Asia-Pacific, and Other Regions

- Growth Opportunities in Developing Economies: Key Markets and Emerging Applications

Supply Chain Dynamics in the Lithium Carbonate Market

- Key Suppliers and Manufacturers of Lithium Carbonate

- Raw Materials for Lithium Carbonate Production: Lithium Brines, Spodumene, and Clay

- Supply Chain Challenges and Opportunities in the Lithium Carbonate Market

- Global Trade of Lithium Carbonate: Export-Import Trends and Trade Agreements

Pricing Trends and Economic Influences on the Lithium Carbonate Market

- Key Factors Driving Lithium Carbonate Prices: Supply, Demand, and Raw Material Costs

- Price Volatility and Forecasting in the Lithium Carbonate Market

- The Impact of Market Fluctuations on Lithium Carbonate Producers and Consumers

- Economic Factors Shaping the Future of Lithium Carbonate Production and Pricing

Environmental and Sustainability Considerations in Lithium Carbonate Production

- Environmental Challenges in Lithium Carbonate Extraction and Processing

- Sustainability in Lithium Carbonate Manufacturing: Recycling and Waste Management

- Innovations for Reducing Environmental Footprint in Lithium Carbonate Production

- Regulatory Frameworks and Compliance for Sustainable Lithium Carbonate Production

Technological Advancements in Lithium Carbonate Production

- Innovations in Lithium Extraction Techniques: Direct Lithium Extraction (DLE)

- Technological Developments in Lithium Carbonate Purification and Quality Control

- Impact of Automation and Digitalization on Lithium Carbonate Manufacturing

- Future Trends in Lithium Carbonate Production Technologies

Regulatory Landscape and Policies Affecting the Lithium Carbonate Market

- Government Regulations and Policies Impacting Lithium Carbonate Extraction and Trade

- International Standards for Lithium Carbonate Production and Quality Assurance

- The Role of Sustainability Certifications and Environmental Guidelines

- Regulatory Challenges Faced by Lithium Carbonate Manufacturers

Competitive Landscape of the Lithium Carbonate Market

- Leading Players in the Lithium Carbonate Market: Key Companies and Their Market Shares

- Competitive Strategies: Mergers, Acquisitions, and Strategic Partnerships in the Lithium Sector

- Analysis of Competitive Advantage in Lithium Carbonate Production and Market Presence

- Research and Development Focus of Major Lithium Carbonate Manufacturers

Challenges and Risks in the Lithium Carbonate Market

- Supply Chain Bottlenecks and Raw Material Scarcity in Lithium Carbonate Production

- Geopolitical Risks and Trade Barriers Impacting the Lithium Market

- Environmental and Ethical Issues Surrounding Lithium Mining and Processing

- Technological Challenges in Scaling Up Lithium Carbonate Production

Future Outlook and Growth Opportunities in the Lithium Carbonate Market

- Projected Growth in Lithium Carbonate Demand and Production Over the Next Decade

- The Role of Lithium Carbonate in the Transition to a Green Economy

- Investment Opportunities in the Lithium Carbonate Industry

- Strategic Recommendations for Market Players to Capitalize on Emerging Opportunities

Conclusion: Key Takeaways for Stakeholders in the Lithium Carbonate Market

- Insights for Manufacturers, Producers, and Distributors in the Lithium Carbonate Market

- Strategic Recommendations for Navigating the Evolving Lithium Carbonate Market

- Final Thoughts on the Future of Lithium Carbonate in Global Markets

Other recently published reports:

“Every Organization is different and so are their requirements”- Datavagyanik

Companies We Work With

Do You Want To Boost Your Business?

drop us a line and keep in touch