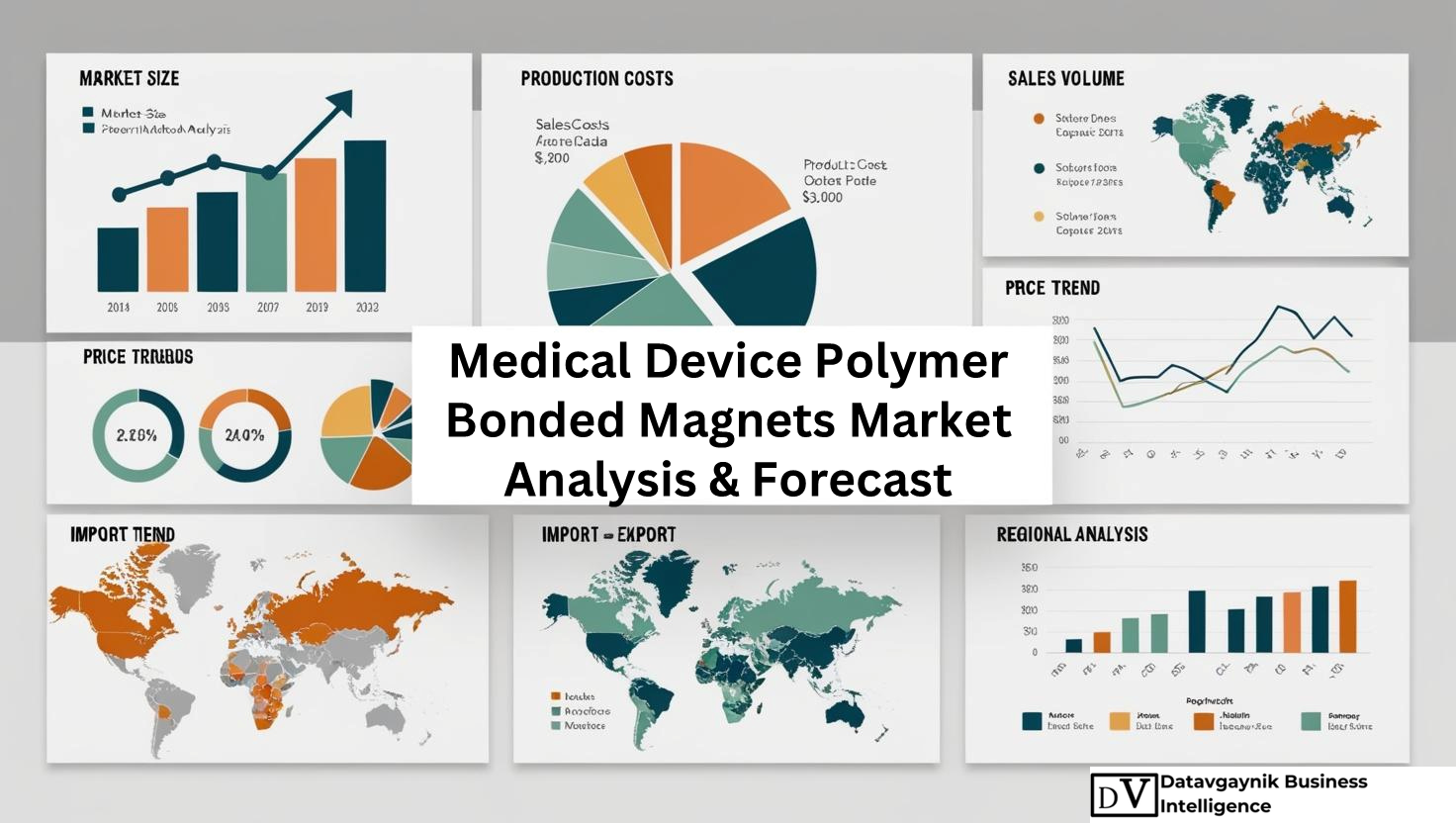

Medical device polymer bonded magnets Market Size, Production, Sales, Average Product Price, Market Share, Import vs Export

- Published 2025

- No of Pages: 120+

- 20% Customization available

Rising Demand in the Medical Device Polymer Bonded Magnets Market Driven by Device Miniaturization

The Medical device polymer bonded magnets Market is experiencing accelerated growth, primarily driven by the global trend of miniaturizing medical devices. Medical equipment manufacturers are shifting toward compact, lightweight, and energy-efficient systems, which has significantly increased the demand for polymer bonded magnets. For instance, hearing aids have become progressively smaller and more sophisticated, with global sales reaching over 125 million units in 2024. Each device utilizes miniaturized motors and actuators that rely on polymer bonded magnets for reliable operation in confined spaces. Similarly, infusion pumps and portable diagnostic tools now feature intricate magnet-based assemblies, highlighting how miniaturization continues to shape product innovation in the Medical device polymer bonded magnets Market.

Medical Device Polymer Bonded Magnets Market Growth Catalyzed by Wearable Health Technologies

The growing demand for wearable medical devices is emerging as a major catalyst for the Medical device polymer bonded magnets Market. Products like glucose monitors, ECG patches, and health tracking wristbands require precise and compact magnetic components for internal mechanisms and sensor functionalities. In 2024 alone, global shipments of wearable medical devices crossed 200 million units, growing at a CAGR of over 19% year-on-year. These devices increasingly use polymer bonded magnets due to their favorable weight-to-strength ratio and design flexibility, which supports continuous health monitoring in real-world environments. As this segment expands, manufacturers in the Medical device polymer bonded magnets Market are scaling up production to meet the demand.

Datavagyanik also covers related markets such as the Medical device magnets Market, the Plastic-bonded-magnets Market, and the Medical device coating additives Market. Such interlinked markets help paint a fuller story of the supply chain, influencing the primary topic’s trajectory.

Enhanced Device Durability Boosts Medical Device Polymer Bonded Magnets Market Expansion

Durability under extreme operating conditions is a vital requirement for modern medical devices, particularly those that come into contact with body fluids or are implanted within the human body. The Medical device polymer bonded magnets Market benefits from the superior corrosion resistance and mechanical stability of polymer bonded magnets, making them ideal for high-reliability applications. For example, pacemakers and cochlear implants must maintain performance over many years within the body. Polymer bonded magnets offer the stability required for such long-term use. Their non-conductive polymer matrix helps reduce the risk of electrical shorting or signal disruption, making them a preferred choice across mission-critical healthcare solutions.

“Track Country-wise Medical device polymer bonded magnets Production and Demand through our Medical device polymer bonded magnets Production Database”

-

-

- Medical device polymer bonded magnets production database for 20+ countries worldwide

- Country-wise Medical device polymer bonded magnets production capacity and production plant mapping

- Medical device polymer bonded magnets production plants and production plant capacity analysis for key manufacturers

-

Medical Device Polymer Bonded Magnets Market Fueled by Growth in Robotic Surgery

Another significant growth avenue for the Medical device polymer bonded magnets Market is the adoption of robotic-assisted surgeries and medical robotics. Global medical robot installations surpassed 8,500 units in 2024, up 13% from the previous year. These systems rely on small yet powerful motors and actuators enabled by polymer bonded magnets for precision-driven tasks. In robotic arms, precise magnetic fields are necessary to control movement at sub-millimeter accuracy. Devices like the da Vinci Surgical System, used in over 1.5 million procedures annually, depend heavily on these magnet-based systems. As the market for minimally invasive surgery continues to grow at double-digit rates, so too does the demand for advanced magnetic materials within the Medical device polymer bonded magnets Market.

Cost-Efficiency and Material Optimization Drive Adoption in Medical Device Polymer Bonded Magnets Market

The Medical device polymer bonded magnets Market also benefits from a cost-efficiency advantage over traditional rare-earth magnets. Polymer bonded alternatives are easier to manufacture at scale due to lower material waste and adaptable molding processes. This cost competitiveness is particularly valuable in mass-produced devices such as wearable monitors and disposable diagnostic equipment. For instance, a mid-sized medical OEM reduced production costs by 18% after switching from sintered magnets to polymer bonded variants. The ability to customize shape, size, and magnetic strength further allows designers to optimize medical device functionality without compromising on performance, boosting the commercial viability of solutions across multiple application segments.

Aging Global Population Stimulates Medical Device Polymer Bonded Magnets Market Growth

The rising elderly population, especially in developed economies, is directly influencing the trajectory of the Medical device polymer bonded magnets Market. By 2030, over 1 in 6 people globally will be aged 60 or above, creating sustained demand for devices that assist with chronic disease management and mobility. Polymer bonded magnets are critical components in hearing aids, orthopedic rehabilitation equipment, and heart monitoring systems—all of which are essential for aging demographics. For example, the market for hearing aids alone is projected to grow at over 7% CAGR through 2030, with embedded magnetic components forming the backbone of performance. This demographic shift continues to push long-term growth for the Medical device polymer bonded magnets Market.

Medical Device Polymer Bonded Magnets Market Thrives on Diagnostic Imaging Advancements

Magnetic resonance imaging (MRI) and other diagnostic imaging technologies are becoming increasingly sophisticated, requiring high-precision components that perform consistently over time. The Medical device polymer bonded magnets Market supports these demands with magnet solutions that offer both shape flexibility and reliable magnetic field generation. MRI machines use polymer bonded magnets in coil assemblies, contrast injectors, and MRI-compatible actuators, contributing to imaging accuracy and operational safety. As global MRI scanner shipments are expected to reach 60,000 units by 2030, growing from 40,000 in 2023, the corresponding demand for polymer bonded magnet components continues to rise. These applications further reinforce the strategic value of polymer bonded magnet manufacturers in the medical imaging sector.

Customization and Design Versatility Strengthen Position of Medical Device Polymer Bonded Magnets Market

Customization remains a key differentiator in the Medical device polymer bonded magnets Market. These magnets can be manufactured into complex geometries, making them suitable for integration into uniquely shaped devices. In comparison to rigid metallic magnets, polymer bonded types offer manufacturers enhanced design freedom without sacrificing magnetic performance. For instance, a European diagnostic device firm recently leveraged over-molded polymer bonded magnets to develop a compact imaging probe for pediatric applications—reducing weight by 22% while maintaining signal strength. This adaptability makes polymer bonded magnets invaluable in next-generation medical equipment, where space constraints and ergonomics are top priorities.

Rising Adoption of Smart Healthcare Accelerates Medical Device Polymer Bonded Magnets Market

The proliferation of smart healthcare systems is yet another powerful driver behind the Medical device polymer bonded magnets Market. From hospital-grade monitoring to home-based diagnostic solutions, smart medical devices increasingly rely on embedded magnets to operate sensors, motors, and actuators. For instance, automated drug delivery systems and AI-powered wearable monitors are gaining traction in remote patient care. These systems demand reliable, miniaturized components that can perform autonomously—an ideal scenario for polymer bonded magnets. As smart healthcare devices grow at a CAGR of 20% globally, the underlying demand for magnet-based components is expected to mirror this trend, cementing their place in future healthcare ecosystems.

Environmental Resistance Fuels Further Expansion of Medical Device Polymer Bonded Magnets Market

In medical environments, devices are often exposed to varying temperatures, moisture, and sterilization processes. The Medical device polymer bonded magnets Market is witnessing rising demand due to the superior environmental resistance of these magnets compared to traditional sintered variants. Polymer bonding materials can be engineered to withstand specific sterilization cycles, making them suitable for reusable surgical tools and hospital equipment. For example, in endoscopic surgical instruments, polymer bonded magnets maintain magnetic integrity even after repeated autoclave cycles. This capability significantly enhances product lifespan and reduces maintenance, offering a compelling value proposition to healthcare providers and OEMs alike.

North America Leads in High-Tech Innovation Driving the Medical Device Polymer Bonded Magnets Market

The United States continues to dominate the Medical device polymer bonded magnets Market due to its robust healthcare infrastructure and strong focus on technological innovation. The U.S. medical device industry, valued at over USD 200 billion in 2024, is one of the largest globally, with significant investments in advanced diagnostics, robotics, and wearable health devices. For example, surgical robotic systems such as those used in orthopedic and cardiac procedures are incorporating polymer bonded magnets into their actuators and control motors to improve motion precision. The growing emphasis on telehealth and home diagnostics has also triggered higher production of compact devices requiring reliable magnetic components, further strengthening the country’s position in the Medical device polymer bonded magnets Market.

European Nations Driving Specialized Demand in the Medical Device Polymer Bonded Magnets Market

In Europe, demand in the Medical device polymer bonded magnets Market is being shaped by advancements in medical imaging, robotic-assisted surgery, and health monitoring systems. Germany leads the regional market due to its strong industrial base and well-established medical equipment manufacturing ecosystem. For example, over 30% of the MRI systems produced in Europe are manufactured in Germany, and many of these rely on polymer bonded magnets for precise imaging controls and component stability. Similarly, the United Kingdom’s thriving wearable health tech sector, which grew by over 15% in 2024, is driving demand for miniaturized, efficient magnet solutions. France, Italy, and Spain are also contributing to regional growth by adopting surgical robotics and diagnostic tools equipped with polymer bonded magnetic assemblies.

Asia Pacific Emerges as the Fastest Growing Region in the Medical Device Polymer Bonded Magnets Market

The Asia Pacific region is witnessing rapid growth in the Medical device polymer bonded magnets Market, driven by expanding healthcare infrastructure and increasing adoption of high-performance medical technologies. China, in particular, has established itself as a leading producer and consumer of polymer bonded magnets. With medical equipment exports exceeding USD 45 billion in 2024, China’s production capacity for compact, precision-driven components is unmatched. Its extensive magnet manufacturing base supports the mass production of hearing aids, pacemakers, and MRI components—each dependent on polymer bonded magnets.

In Japan, medical robotics is a major growth catalyst. The country has over 500 hospitals equipped with robotic surgical systems, and these machines use polymer bonded magnets in their micro-motors and actuators. South Korea, meanwhile, is focusing on wearable diagnostic devices and home-care monitoring systems that integrate polymer bonded magnets for sensor control and mobility functions. As demand for such devices grows, so does the regional contribution to the Medical device polymer bonded magnets Market.

India’s Expanding Healthcare Needs Strengthen the Medical Device Polymer Bonded Magnets Market

India’s healthcare sector is undergoing a significant transformation, opening new frontiers for the Medical device polymer bonded magnets Market. The country’s medical device industry, growing at over 16% annually, is increasingly focused on developing cost-effective solutions for chronic disease management. Devices such as glucose monitors, ECG wearables, and smart inhalers rely heavily on polymer bonded magnets to reduce bulk while enhancing functionality. For instance, low-cost hearing aids designed for rural markets are incorporating molded magnet components that improve sound quality while keeping manufacturing expenses low. This convergence of affordability and functionality is positioning India as a critical market in the global landscape.

Australia’s Innovation-Driven Healthcare Ecosystem Supports the Medical Device Polymer Bonded Magnets Market

Australia, while a smaller market in size, is rapidly advancing in innovation-led healthcare. Hospitals are adopting AI-enabled diagnostic systems and smart surgical instruments that require high-precision components. The Medical device polymer bonded magnets Market in Australia is expanding through the integration of these magnets into robotic arms and diagnostic scanners. Additionally, with an aging population and rising demand for home healthcare, wearable technologies embedded with polymer bonded magnets are witnessing a sharp uptick. This trend is fostering niche opportunities for high-quality magnet producers targeting the Australian medical sector.

Latin America Offers Untapped Potential for the Medical Device Polymer Bonded Magnets Market

Countries such as Brazil and Mexico are emerging as growth pockets in the Medical device polymer bonded magnets Market. Latin America’s healthcare market is shifting toward modern, digitized systems that rely on portable diagnostic devices and surgical innovations. For example, Mexico has seen a 12% year-on-year rise in demand for cardiac monitoring devices, most of which include polymer bonded magnets in their actuation or sensing mechanisms. Brazilian medical equipment manufacturers are adopting locally assembled magnetic components to reduce import costs, creating a domestic production ecosystem that is still in its early stages but shows substantial promise for magnet manufacturers.

Segmentation by Application Defines the Medical Device Polymer Bonded Magnets Market Landscape

Application-based segmentation plays a key role in the structure of the Medical device polymer bonded magnets Market. Hearing aids remain one of the largest segments, with global sales projected to exceed 140 million units by 2025. Polymer bonded magnets are integral to sound transducers and vibration units within these devices. Pacemakers represent another high-value segment, requiring miniature, stable magnets that can operate reliably inside the human body for years without degradation. With cardiovascular disease cases crossing 600 million globally in 2024, demand for pacemakers and implantable defibrillators continues to grow, boosting magnet usage.

Medical robots are an evolving segment within the Medical device polymer bonded magnets Market, driven by high-precision motion systems needed for robotic surgery, rehabilitation tools, and smart prosthetics. These applications demand magnet customization at micron-level tolerances—something polymer bonded magnets can deliver through advanced molding techniques. MRI machines, another application pillar, depend on magnets not only for field generation but also for noise reduction systems and control mechanisms, making polymer bonded magnets essential in both core and peripheral MRI components.

Product Type Diversification Drives Technological Advancements in the Medical Device Polymer Bonded Magnets Market

Product segmentation within the Medical device polymer bonded magnets Market reveals distinct trends across cast, sintered, and extruded magnets. Cast polymer bonded magnets are widely used in diagnostic equipment due to their superior dimensional accuracy and consistent performance. These magnets are preferred in MRI systems, blood analyzers, and infusion devices where performance under high thermal stress is critical.

Sintered polymer bonded magnets dominate in high-performance applications such as robotic arms and implantable devices. Their dense molecular structure provides enhanced magnetic strength and thermal resistance. For instance, sintered magnets are being increasingly integrated into smart catheters and endoscopic tools that require navigation in high-pressure environments.

Extruded polymer bonded magnets, on the other hand, are gaining ground in flexible applications, such as wearable health monitors and curved surface devices. Their ability to be shaped during the extrusion process allows for seamless integration into unconventional device geometries, supporting the trend of ergonomic, patient-friendly medical designs.

End-User Segmentation Reveals Key Stakeholders in the Medical Device Polymer Bonded Magnets Market

Within the Medical device polymer bonded magnets Market, end-user segmentation outlines a clear map of demand origins. Medical equipment manufacturers form the largest consumer base, relying on magnets for a variety of diagnostic, surgical, and monitoring devices. These companies are expanding R&D investments into polymer-based magnetic systems that align with lightweight and battery-efficient product designs.

Healthcare institutions such as hospitals and clinics indirectly influence demand by favoring compact, portable devices that enhance patient care. For example, outpatient clinics increasingly use handheld diagnostic tools for blood analysis and ECG monitoring, all of which require embedded magnets to control internal sensors.

Wearable device manufacturers are another major stakeholder in the Medical device polymer bonded magnets Market. With the wearables market expected to cross USD 120 billion by 2026, the integration of lightweight magnetic systems into watches, straps, and patches is accelerating. Magnet suppliers are developing custom magnetic assemblies tailored to wearable formats, including biocompatible coatings and micro-molding techniques to ensure skin safety and prolonged usage.

Global Production Dynamics Reinforce Strategic Value of Medical Device Polymer Bonded Magnets Market

Global production of polymer bonded magnets is concentrated in strategic locations such as China, the U.S., Japan, and Germany, which collectively account for over 80% of global output. China alone produces more than 60,000 tons of bonded magnets annually, with a significant portion earmarked for medical applications. The Medical device polymer bonded magnets Market benefits from China’s ability to scale production rapidly while maintaining cost advantages through vertical integration and proximity to rare-earth supply chains.

Japan focuses on ultra-precision manufacturing for high-end medical devices. For instance, surgical robots and premium hearing aids developed in Japan integrate magnets with tight tolerances and high magnetic uniformity. South Korea contributes through innovation in medical wearables and point-of-care diagnostics, while Germany’s advanced robotics sector ensures consistent demand for high-performance magnets.

Import-Export Flow Shapes Supply Chains in the Medical Device Polymer Bonded Magnets Market

The Medical device polymer bonded magnets Market is also shaped by complex import-export dynamics. The United States, despite being a major producer, continues to import specialized magnetic materials from Asia to meet the quality and quantity needs of its growing medical device sector. Europe relies heavily on imports for compact magnetic assemblies used in wearables and diagnostics, sourcing mainly from Japan and South Korea.

Meanwhile, countries in Africa and Latin America are emerging as net importers as their healthcare systems modernize. Magnet manufacturers seeking global expansion are targeting these regions with modular, cost-effective magnetic components to support their device assembly ecosystems. Trade agreements and regional partnerships will play a growing role in how the global Medical device polymer bonded magnets Market evolves, particularly in ensuring consistent supply to meet rising international demand.

“Medical device polymer bonded magnets Production Database, Medical device polymer bonded magnets Production Capacity”

-

- Medical device polymer bonded magnets production data for key manufacturers

- Medical device polymer bonded magnets production plant capacity by manufacturers and Medical device polymer bonded magnets production data for market players

- Medical device polymer bonded magnets production dashboard, Medical device polymer bonded magnets production data in excel format

Key Manufacturers Driving Innovation in the Medical Device Polymer Bonded Magnets Market

The Medical device polymer bonded magnets Market is supported by a robust ecosystem of global manufacturers that specialize in high-precision magnet solutions for medical applications. These companies are at the forefront of material science, production efficiency, and product customization, providing polymer bonded magnet systems used in hearing aids, MRI machines, wearable health devices, pacemakers, and robotic surgical instruments. Each major player contributes uniquely to the market, offering differentiated product lines and solutions tailored to the evolving needs of the healthcare industry.

Arnold Magnetic Technologies – Customized Magnetic Assemblies for Medical Robotics

Arnold Magnetic Technologies is a prominent player in the Medical device polymer bonded magnets Market, with a deep portfolio of custom-engineered magnetic solutions for medical devices. The company’s Recoma® and Flexmag® product lines are widely used in miniature motors, sensors, and actuators found in robotic surgery tools and diagnostic equipment. Arnold specializes in manufacturing precision polymer bonded magnets with high magnetic flux density and excellent temperature stability, essential for implantable devices and complex mechatronic systems. Its vertically integrated production facilities enable rapid prototyping and volume manufacturing for global medical OEMs.

Hitachi Metals – High-End Polymer Bonded Magnets for Imaging and Wearables

Hitachi Metals plays a critical role in the Medical device polymer bonded magnets Market by offering premium polymer bonded magnets under its NEOMAX® brand. These magnets are known for superior magnetic properties and low eddy current loss, making them ideal for MRI coil components and high-resolution diagnostic tools. The company also supplies magnets for next-generation wearable health devices that require low-profile, flexible designs with biocompatible coatings. Hitachi’s focus on nanocomposite magnetic materials positions it as a leader in the development of lightweight, high-performance magnets for demanding medical environments.

VACUUMSCHMELZE (VAC) – European Leadership in Magnetics for Medical Applications

Germany-based VACUUMSCHMELZE is a major contributor to the Medical device polymer bonded magnets Market, offering a variety of polymer bonded magnet solutions for surgical robots, diagnostic tools, and advanced imaging systems. Its Vacuumschmelze® VACOFLUX® and VITROPERM® lines are widely recognized for their high magnetic saturation and corrosion resistance. VAC has invested heavily in automated production of injection-molded magnets tailored for wearable and implantable medical devices. Its European footprint supports local supply chains for OEMs in Germany, France, and the UK, where demand for compact, lightweight medical components is accelerating.

TDK Corporation – Broad Product Portfolio for the Medical Device Polymer Bonded Magnets Market

TDK Corporation, a Japan-based global magnetics leader, offers an expansive line of polymer bonded magnets designed for applications in hearing aids, infusion pumps, glucose monitors, and prosthetic devices. Its NEOREC™ product family includes hybrid magnets made from NdFeB and ferrite powders bonded in a polymer matrix. TDK’s polymer bonded solutions are optimized for surface-mounted medical applications, including wearable sensors and implantable motor systems. The company’s emphasis on eco-friendly production and magnet recycling also aligns with the increasing push for sustainability in medical manufacturing.

Alliance LLC – U.S.-Based Supplier of Molded Magnetic Components

Alliance LLC serves the North American Medical device polymer bonded magnets Market with an array of over-molded and injection-molded magnets used in surgical instruments, ventilator motors, and diagnostic scanners. The company provides custom-engineered bonded magnet solutions with precise magnetic field characteristics, working closely with medical device manufacturers to support miniaturization. Alliance’s materials range from nylon- and PPS-based bonded compounds to specialty thermoplastics for high-temperature environments. With growing interest in domestic supply chain reliability, Alliance has become a go-to source for U.S.-based medical magnet needs.

Magnequench – Advanced Injection Molding for High-Volume Medical Components

Magnequench, part of Neo Performance Materials, focuses on the manufacture of high-performance NdFeB-based bonded magnets through rapid solidification technology. The company’s MQ1™ and MQP™ powder grades are widely used in the Medical device polymer bonded magnets Market for producing magnets used in wearable devices, motorized surgical tools, and precision-controlled diagnostic devices. Magnequench’s proprietary magnetic powder technologies allow for consistent magnetic performance in small form factors, supporting mass production of compact medical components.

CMS Magnetics – Asian Specialist in Compact Medical Magnet Solutions

CMS Magnetics is a significant Asian producer of polymer bonded magnets used in medical diagnostics, implantable sensors, and portable scanning systems. The company has a wide product line that includes compression-molded and extruded magnets with customizable magnetic orientation. CMS Magnetics supports OEMs across China, India, and Southeast Asia and has expanded its production footprint to meet growing demand for cost-effective yet high-quality magnets in emerging healthcare markets. Its technical team works closely with device engineers to optimize magnet geometries for energy-efficient operation.

Bunting Magnetics – Integrated Magnet Systems for Healthcare Applications

Bunting Magnetics specializes in polymer bonded magnet assemblies used in infusion systems, smart inhalers, and imaging systems. The company integrates magnets with housings, electronics, and mechanical systems to deliver complete plug-and-play magnetic solutions for OEMs. In the Medical device polymer bonded magnets Market, Bunting is known for delivering durable and repeatable magnet assemblies that meet FDA and ISO 13485 standards. Its custom design services are used extensively by medical startups and established players aiming to accelerate device development cycles.

Daido Electronics – Advanced Polymer Bonded Magnets for Japanese OEMs

Daido Electronics is a Japanese leader in bonded magnet production, offering tailored solutions to medical device companies focused on surgical, diagnostic, and therapeutic technologies. The company’s products serve implantable sensor applications, robotic grippers, and magnetically driven pumps used in drug delivery. Its expertise in fine magnetic powder processing and micro-molding gives Daido a competitive edge in developing ultra-miniature magnets for highly constrained medical assemblies.

Advanced Technology & Materials Co. (AT&M) – China’s Large-Scale Medical Magnet Producer

AT&M is one of China’s largest producers of polymer bonded and rare earth magnets. The company plays a major role in supplying bonded magnets to both domestic and international customers in the Medical device polymer bonded magnets Market. Its production facilities focus on high-volume, low-cost manufacturing of magnet components for hearing aids, glucose monitoring devices, and diagnostic machines. AT&M’s focus on material science and scalability has made it a key supplier to global medical electronics manufacturers.

Recent Developments in the Medical Device Polymer Bonded Magnets Market

The Medical device polymer bonded magnets Market is witnessing strategic advancements aimed at improving product efficiency and localization of production.

- February 2024: TDK announced the development of a new high-temperature polymer bonded magnet compound designed for surgical robotics and high-speed medical motors, enhancing thermal stability by 15%.

- May 2024: Arnold Magnetic Technologies expanded its Rochester, NY facility to boost production of over-molded polymer bonded magnets by 30%, targeting demand from U.S. medical robotics companies.

- July 2024: VAC launched a new product line for MRI-compatible magnets using a unique polymer blend that reduces signal interference by 18%, helping improve MRI imaging resolution.

- September 2024: Bunting Magnetics secured a partnership with a European wearable tech firm to co-develop magnet systems for next-gen ECG wearables, with field trials scheduled for Q2 2025.

- October 2024: Magnequench unveiled an automated injection molding cell in South Korea focused on high-volume production of wearable-grade bonded magnets, capable of outputting over 500,000 units monthly.

These recent developments illustrate how global players in the Medical device polymer bonded magnets Market are enhancing production capabilities, entering strategic collaborations, and launching performance-driven product lines to meet the increasing complexity of medical device requirements.

“Medical device polymer bonded magnets Production Data and Medical device polymer bonded magnets Production Trend, Medical device polymer bonded magnets Production Database and forecast”

-

-

- Medical device polymer bonded magnets production database for historical years, 10 years historical data

- Medical device polymer bonded magnets production data and forecast for next 7 years

-

Market Scenario, Demand vs Supply, Average Product Price, Import vs Export, till 2035

- Global Medical device polymer bonded magnets Market revenue and demand by region

- Global Medical device polymer bonded magnets Market production and sales volume

- United States Medical device polymer bonded magnets Market revenue size and demand by country

- Europe Medical device polymer bonded magnets Market revenue size and demand by country

- Asia Pacific Medical device polymer bonded magnets Market revenue size and demand by country

- Middle East & Africa Medical device polymer bonded magnets Market revenue size and demand by country

- Latin America Medical device polymer bonded magnets Market revenue size and demand by

- Import-export scenario – United States, Europe, APAC, Latin America, Middle East & Africa

- Average product price – United States, Europe, APAC, Latin America, Middle East & Africa

- Market player analysis, competitive scenario, market share analysis

- Business opportunity analysis

Key questions answered in the Global Medical device polymer bonded magnets Market Analysis Report:

- What is the market size for Medical device polymer bonded magnets in United States, Europe, APAC, Middle East & Africa, Latin America?

- What is the yearly sales volume of Medical device polymer bonded magnets and how is the demand rising?

- Who are the top market players by market share, in each product segment?

- Which is the fastest growing business/ product segment?

- What should be the business strategies and Go to Market strategies?

The report covers Medical device polymer bonded magnets Market revenue, Production, Sales volume, by regions, (further split into countries):

- Asia Pacific (China, Japan, South Korea, India, Indonesia, Vietnam, Rest of APAC)

- Europe (UK, Germany, France, Italy, Spain, Benelux, Poland, Rest of Europe)

- North America (United States, Canada, Mexico)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa

Table of Contents:

Medical Device Polymer Bonded Magnets Market

- Introduction to the Medical Device Polymer Bonded Magnets Market

- Definition and Overview of Polymer Bonded Magnets in Medical Devices

- Role of Polymer Bonded Magnets in Medical Applications

- Key Drivers and Market Trends in the Medical Device Polymer Bonded Magnets Industry

- Types of Polymer Bonded Magnets for Medical Devices

- Thermoplastic vs. Thermoset Polymer Bonded Magnets

- Composite vs. Pure Polymer Bonded Magnets

- Custom Polymer Bonded Magnet Solutions for Medical Devices

- Key Applications of Polymer Bonded Magnets in Medical Devices

- Use in MRI (Magnetic Resonance Imaging) Equipment

- Polymer Bonded Magnets in Implantable Medical Devices

- Application in Surgical Instruments and Robotic Systems

- Magnets for Drug Delivery Systems and Magnetic Therapy Devices

- Medical Device Polymer Bonded Magnets Market Segmentation

- By Magnet Type (Ferrite, Rare Earth, Alnico, Samarium Cobalt)

- By Application (Diagnostic, Therapeutic, Surgical, Implantable)

- By End-User Industry (Hospitals, Clinics, Medical Equipment Manufacturers, Research Institutions)

- By Geography (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa)

- Global Market Size and Revenue Forecast (2025-2035)

- Market Size and Growth Projections for Polymer Bonded Magnets in Medical Devices

- Revenue Breakdown by Application, Product Type, and Region

- Demand and Supply Forecasts for Medical Device Polymer Bonded Magnets

- Regional Market Insights and Opportunities

- North America: Advanced Healthcare Infrastructure and Increased Demand for Medical Magnets

- Europe: Growing Regulatory Support and Demand in Medical Device Manufacturing

- Asia-Pacific: Expanding Medical Device Manufacturing and Healthcare Investments

- Latin America & Middle East/Africa: Emerging Opportunities in Medical Device Markets

- Medical Device Polymer Bonded Magnets Production Process

- Overview of Manufacturing Techniques for Polymer Bonded Magnets

- Key Raw Materials and Production Technologies

- Innovations in Polymer Bonding for Enhanced Medical Magnet Performance

- Competitive Landscape and Key Market Players

- Leading Manufacturers of Polymer Bonded Magnets for Medical Devices

- Market Share Analysis and Competitive Strategies

- Mergers, Acquisitions, and Collaborations in the Medical Magnet Industry

- Raw Materials and Cost Structure in Polymer Bonded Magnet Production

- Sourcing and Cost Trends of Raw Materials for Polymer Bonded Magnets

- Impact of Material Prices on the Production of Medical Device Magnets

- Cost Structure Analysis for Polymer Bonded Magnets Used in Medical Devices

- Technological Advancements in Polymer Bonded Magnets for Medical Devices

- Advances in Magnet Composition and Polymer Bonding Techniques

- Improvements in Durability, Strength, and Biocompatibility for Medical Applications

- Integration of Smart Technology and Wireless Capabilities in Polymer Bonded Magnets

- Sustainability and Environmental Impact of Polymer Bonded Magnets

- Environmentally Friendly Manufacturing Practices for Polymer Bonded Magnets

- Recycling Challenges and Opportunities for Magnetic Materials

- Regulations and Standards Promoting Sustainability in Medical Magnet Production

- Market Challenges and Risk Factors

- Technical and Regulatory Challenges in Manufacturing Medical Grade Magnets

- Competition from Alternative Materials and Magnet Technologies

- Cost Pressures and Market Volatility in Medical Device Manufacturing

- Investment and Business Opportunities in the Medical Device Polymer Bonded Magnets Market

- Investment Opportunities in Polymer Bonded Magnet R&D and Production

- Niche Applications and Emerging Markets for Medical Magnets

- Business Strategies for Expanding Market Share in the Medical Device Sector

- Pricing Trends and Profitability in Polymer Bonded Magnet Production

- Price Trends and Cost Variations in Polymer Bonded Magnet Production

- Profit Margins for Manufacturers of Polymer Bonded Magnets

- Price Forecasts and Their Influence on Market Dynamics

- Applications and Consumption of Polymer Bonded Magnets in Medical Devices

- Rising Demand in Diagnostic Equipment (MRI, CT Scanners)

- Use in Implantable Devices: Pacemakers, Defibrillators, and Neurostimulation

- Consumption Trends in Surgical Instruments, Robotic Systems, and Wearables

- Future Outlook and Market Projections (2025-2035)

- Long-Term Growth Projections and Demand for Polymer Bonded Magnets in Healthcare

- Key Technological Advancements Shaping the Future of Medical Magnets

- Projected Market Expansion and Emerging Application Areas

- Distribution Channels and Sales Strategies

- Key Distribution Channels for Polymer Bonded Magnets in the Medical Device Market

- Direct Sales vs. Distribution Partnerships for Medical Magnet Manufacturers

- Marketing and Sales Approaches for Expanding Customer Reach in Healthcare

- Regulatory Landscape and Compliance in Medical Magnet Manufacturing

- Regulatory Standards and Safety Guidelines for Medical Device Magnets

- International Compliance and Certifications for Biocompatible Magnets

- Impact of Medical Device Regulations on Polymer Bonded Magnet Manufacturing

- Conclusion and Strategic Recommendations

- Summary of Key Market Trends, Insights, and Growth Opportunities

- Strategic Recommendations for Stakeholders and Market Players

- Long-Term Vision for the Growth and Development of Polymer Bonded Magnets in Medical Devices

“Every Organization is different and so are their requirements”- Datavagyanik

Companies We Work With

Do You Want To Boost Your Business?

drop us a line and keep in touch