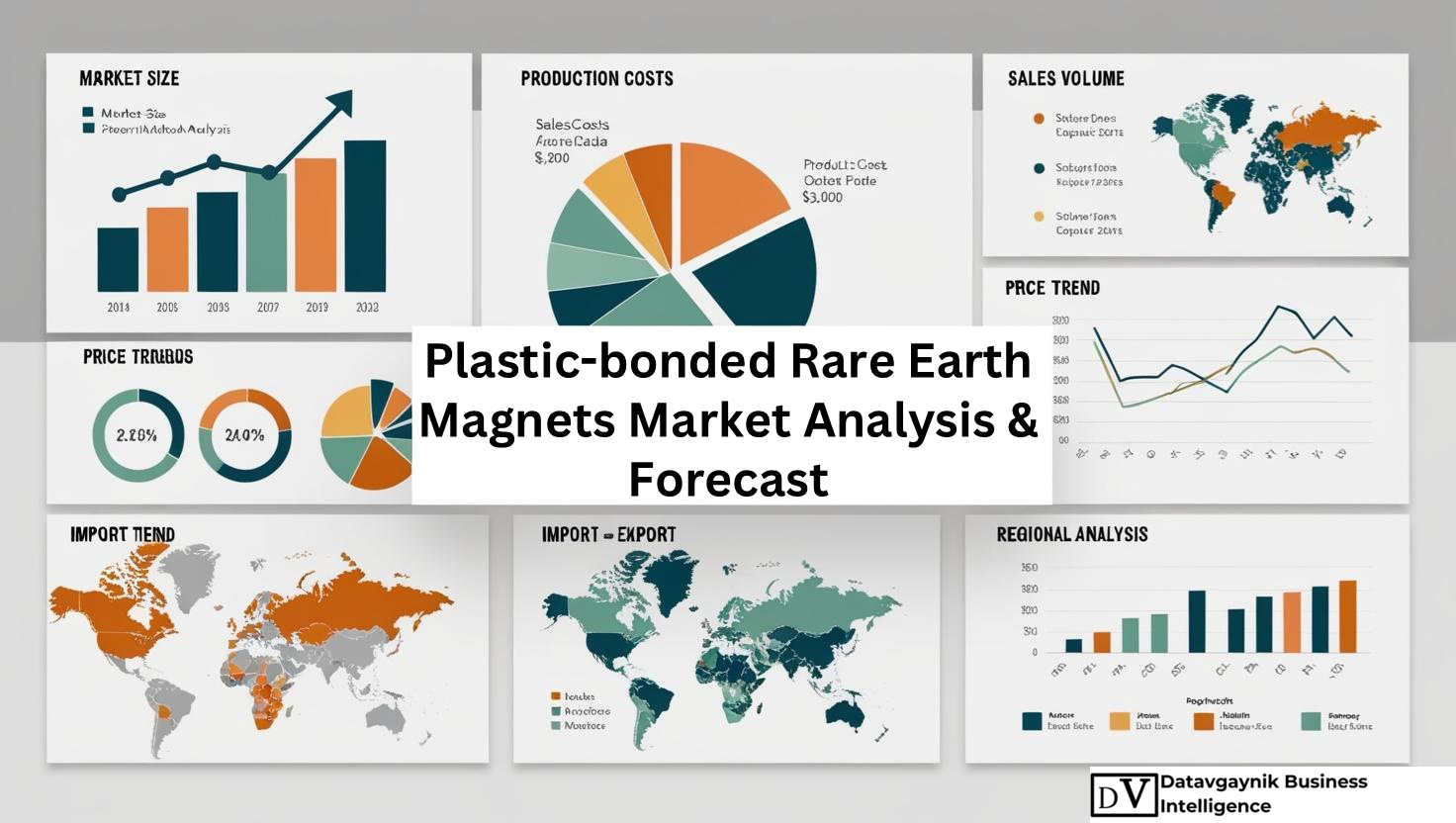

Plastic-bonded rare earth magnets Market Size, Production, Sales, Average Product Price, Market Share, Import vs Export

- Published 2025

- No of Pages: 120+

- 20% Customization available

Global Growth Trends in the Plastic-bonded Rare Earth Magnets Market

The Plastic-bonded rare earth magnets Market is undergoing a transformative expansion, driven by the evolution of high-performance applications across automotive, electronics, renewable energy, and industrial automation. The demand for compact, energy-efficient, and cost-effective magnet solutions has surged due to the proliferation of electric vehicles (EVs), smart electronics, and green energy systems. For instance, global EV sales reached over 14 million units in 2023—a 35% year-on-year increase—directly elevating the demand for rare earth magnets used in traction motors, sensors, and actuators. These industry shifts are cementing the role of the Plastic-bonded rare earth magnets Market as a critical enabler of next-generation technologies.

Electric Vehicles Fueling the Plastic-bonded Rare Earth Magnets Market

The most prominent growth driver in the Plastic-bonded rare earth magnets Market is the electrification of the global automotive industry. Lightweight magnet components are essential in EV powertrains where efficiency and range are paramount. For example, each electric vehicle requires up to 2–3 kilograms of rare earth magnets for electric drive motors. With EV penetration expected to exceed 50% of new car sales globally by 2030, the demand for plastic-bonded variants is scaling rapidly. These magnets offer advantages such as reduced weight, corrosion resistance, and design flexibility, making them ideal for in-wheel motors, power steering systems, and battery cooling pumps. This shift is not regional—countries like the U.S., Germany, China, and India are all investing in EV infrastructure, further strengthening the Plastic-bonded rare earth magnets Market outlook.

Miniaturization and Innovation in Consumer Electronics

Another robust contributor to the Plastic-bonded rare earth magnets Market is the relentless miniaturization of consumer electronics. As devices like smartphones, wireless earbuds, wearable health monitors, and ultra-slim laptops evolve, they demand smaller, lighter, and thermally stable magnetic components. For instance, over 1.4 billion smartphones were shipped globally in 2023, each using miniature plastic-bonded magnets in their speakers, vibration motors, and haptic systems. This demand is complemented by the growing wearables market, which recorded over 500 million unit sales in 2023. As a result, manufacturers in the Plastic-bonded rare earth magnets Market are enhancing injection molding and compression bonding processes to produce finer, more efficient magnet structures tailored for such high-volume applications.

Renewable Energy Expansion Strengthening the Plastic-bonded Rare Earth Magnets Market

The renewable energy sector is a pillar of growth for the Plastic-bonded rare earth magnets Market, particularly in wind energy applications. Direct-drive wind turbines employ rare earth magnets in their generators, improving reliability and reducing maintenance. Countries such as China, the United States, and Germany are aggressively scaling up wind power capacities. For example, global wind power installations added 117 GW in 2023, up from 94 GW in 2022. Plastic-bonded magnets are increasingly being used in control systems and auxiliary motors for wind turbines due to their resistance to environmental degradation. Their corrosion-resistant properties make them ideal for offshore wind farms, where harsh marine conditions demand high durability. As governments continue to fund renewable energy deployment, the Plastic-bonded rare earth magnets Market is set to benefit substantially.

Industrial Automation Driving Magnet Innovation

The push toward Industry 4.0 has fueled investments in factory automation, robotics, and precision control systems—sectors that rely heavily on magnetic sensors and actuators. The Plastic-bonded rare earth magnets Market plays a pivotal role in enabling these technologies. For example, robotic arms and conveyor systems require lightweight, high-strength magnets for efficient movement and sensor feedback. In 2023, global spending on industrial automation crossed $200 billion, and it is forecasted to grow at over 8% CAGR through 2030. Plastic-bonded magnets are preferred in such applications due to their dimensional stability, customizable shapes, and ability to withstand operational stress. These attributes are enhancing their adoption in automated manufacturing environments, quality inspection tools, and material handling systems.

Supply Chain Diversification Enhancing Plastic-bonded Rare Earth Magnets Market Stability

Global geopolitical developments and trade restrictions have pushed manufacturers to reconfigure their rare earth supply chains. Traditionally dependent on China for over 80% of rare earth elements, countries such as the United States, Canada, and Australia are now investing in domestic mining and magnet production. This strategic shift is stabilizing the Plastic-bonded rare earth magnets Market by improving supply security and fostering regional manufacturing hubs. For instance, new production facilities in North America and Europe are integrating plastic-bonded magnet technologies to reduce reliance on sintered alternatives. Additionally, increased recycling of rare earth materials from end-of-life electronics is providing an alternative raw material stream, further reinforcing market resilience.

Advanced Manufacturing Techniques Accelerating Market Competitiveness

Technological advancements in magnet production processes are sharpening the competitive edge of the Plastic-bonded rare earth magnets Market. Injection molding and compression bonding techniques now enable complex shapes, high fill ratios, and enhanced isotropic properties. For example, recent innovations have allowed manufacturers to achieve over 75% magnetic powder loading in polymer matrices without compromising mechanical strength. These improvements reduce energy consumption during production and allow for cost-effective scaling in mass-market applications. Furthermore, the development of hybrid bonded magnets—combining plastic-bonded and sintered properties—is opening new avenues in high-torque applications, such as robotics and aerospace propulsion systems.

Growth in Medical Technology Applications Expanding Market Horizons

The Plastic-bonded rare earth magnets Market is also gaining momentum in the medical devices sector. These magnets are utilized in diagnostic equipment such as MRI machines, hearing aids, and portable scanning devices. For instance, the global MRI device market is expected to surpass $9 billion by 2026, with each machine incorporating several kilograms of high-precision magnets. The light weight, biocompatibility, and customization potential of plastic-bonded variants make them ideal for patient-centric technologies. Moreover, with an aging global population and the proliferation of home-based diagnostics, demand for compact medical devices is rising—further anchoring growth for the Plastic-bonded rare earth magnets Market.

Sustainability and Regulatory Push Supporting Eco-friendly Magnet Solutions

Environmental regulations across regions are reshaping industrial design principles, prompting a shift toward sustainable components. The Plastic-bonded rare earth magnets Market aligns well with these requirements, offering reduced environmental impact during production compared to sintered alternatives. For instance, compression bonding eliminates high-temperature sintering and reduces CO₂ emissions. Moreover, polymers used in plastic-bonded magnets can now be sourced from bio-based or recycled materials, making the entire value chain more sustainable. As industries seek to comply with carbon-neutral policies, particularly in Europe and North America, the demand for eco-friendly magnet solutions is intensifying, giving further momentum to the Plastic-bonded rare earth magnets Market.

Integration in Aerospace and Defense Strengthens Strategic Importance

The aerospace and defense sectors are increasingly utilizing high-performance magnet systems in avionics, UAV propulsion, radar modules, and guidance systems. The Plastic-bonded rare earth magnets Market caters to these needs by delivering components with low weight, high dimensional accuracy, and excellent resistance to vibration and thermal shock. For instance, plastic-bonded magnets are employed in drone propulsion systems where both power density and lightweight structures are crucial. As global defense budgets rise—exceeding $2.2 trillion in 2023—the investment in advanced aerospace technologies is creating new opportunities for magnet manufacturers. This integration into strategic sectors reinforces the importance of a secure and innovative Plastic-bonded rare earth magnets Market ecosystem.

Conclusion: A Market Driven by Innovation, Electrification, and Sustainability

In summary, the Plastic-bonded rare earth magnets Market is positioned at the crossroads of electrification, digitalization, and environmental transformation. Its growth trajectory is fueled by tangible demand from electric vehicles, miniaturized electronics, renewable power systems, and smart automation. With enhanced manufacturing techniques, diversified supply chains, and rising global investments in sustainable technologies, the next decade will likely witness the Plastic-bonded rare earth magnets Market becoming an indispensable component of modern industrial ecosystems.

“Track Country-wise Plastic-bonded rare earth magnets Production and Demand through our Plastic-bonded rare earth magnets Production Database”

-

-

- Plastic-bonded rare earth magnets production database for 20+ countries worldwide

- Country-wise Plastic-bonded rare earth magnets production capacity and production plant mapping

- Plastic-bonded rare earth magnets production plants and production plant capacity analysis for key manufacturers

-

Geographic Expansion Accelerating the Plastic-bonded Rare Earth Magnets Market in Asia Pacific

The Asia Pacific region leads the global Plastic-bonded rare earth magnets Market, backed by large-scale manufacturing, a robust electronics sector, and high electric vehicle penetration. China, for instance, produces over 70% of the world’s rare earth materials, giving it unmatched control over magnet production. China’s domestic demand has also surged as the country delivered over 9 million electric vehicles in 2023 alone, each requiring significant volumes of rare earth magnets. With initiatives like “Made in China 2025,” the government continues to invest heavily in EVs, robotics, and renewable energy—all of which drive magnet consumption.

Japan and South Korea are critical players within this region. Japan, home to companies such as Hitachi Metals and Shin-Etsu Chemical, specializes in high-performance magnets used in precision electronics and automotive components. In 2023, over 25% of Japan’s new car registrations were hybrids or electric vehicles, reinforcing the demand for plastic-bonded magnets in motors and inverters. Meanwhile, South Korea’s electronics giants—Samsung and LG—produce billions of units of consumer electronics annually, further expanding the Plastic-bonded rare earth magnets Market as demand for speakers, sensors, and compact motors rises.

North American Electrification Trends Fueling the Plastic-bonded Rare Earth Magnets Market

North America represents a fast-evolving demand center within the Plastic-bonded rare earth magnets Market, driven by the rapid shift to electric mobility and regional efforts to reduce dependence on imports. The United States sold over 1.4 million EVs in 2023, marking a 50% increase from the previous year. Each vehicle requires several types of plastic-bonded rare earth magnets across its systems—from traction motors to automated control sensors. Furthermore, the rise of offshore wind energy projects across the eastern seaboard is creating parallel demand in turbine generators and auxiliary systems that rely on these magnets.

The U.S. has also initiated strategic projects to strengthen domestic production. For instance, public-private partnerships are advancing rare earth mining and processing in states like California and Texas, with a focus on producing neodymium and samarium for downstream magnet manufacturing. This initiative is creating a localized, resilient supply chain to support the growing Plastic-bonded rare earth magnets Market across automotive, defense, and energy sectors. Canada, meanwhile, is investing in similar electrification and sustainability initiatives, adding further momentum to regional demand.

European Green Transition Catalyzing the Plastic-bonded Rare Earth Magnets Market

The European Plastic-bonded rare earth magnets Market is gaining traction due to the continent’s ambitious decarbonization goals and aggressive adoption of electric vehicles. Germany alone is targeting 15 million EVs on the road by 2030, and with automotive giants like Volkswagen and BMW converting factories to EV production, demand for rare earth magnets is skyrocketing. Plastic-bonded magnets are playing a pivotal role in lightweight drivetrain systems and sensor-rich autonomous platforms.

France and the UK are also scaling up renewable energy production. For example, France aims to install 40 GW of offshore wind capacity by 2050, while the UK already operates the largest offshore wind farms globally. These infrastructures depend on high-durability plastic-bonded magnets for turbine components, pitch control systems, and backup power devices. Moreover, the European Union’s Green Deal and Critical Raw Materials Act are fostering domestic rare earth processing facilities to ensure a secure magnet supply chain. All these developments solidify Europe’s growing share in the Plastic-bonded rare earth magnets Market.

Emerging Markets Expanding the Global Plastic-bonded Rare Earth Magnets Market Footprint

Emerging economies such as India, Brazil, and Southeast Asian countries are adding new layers of opportunity to the Plastic-bonded rare earth magnets Market. India, for instance, is targeting 30% EV adoption by 2030. With over 2.3 million electric two-wheelers sold in 2023, the need for compact, lightweight magnets in battery management systems and drive motors is evident. The government’s Production Linked Incentive (PLI) scheme for electronics and automobile components is catalyzing investment in magnet manufacturing facilities.

Similarly, in Southeast Asia, growing consumer electronics production in nations like Vietnam and Thailand is spurring magnet demand. These countries are becoming manufacturing hubs for global brands, pushing the need for high-volume, cost-effective plastic-bonded magnets. Meanwhile, Brazil is investing in smart grid technologies and wind energy, both of which require high-performance magnet systems. As industrialization spreads and localized magnet production ramps up, emerging markets will contribute increasingly to the global Plastic-bonded rare earth magnets Market growth trajectory.

Production Dynamics Transforming the Plastic-bonded Rare Earth Magnets Market

The structure of the Plastic-bonded rare earth magnets Market is shifting from traditional sintered magnet dependence to innovative bonding methods. Injection molding, the dominant technique, enables the mass production of highly intricate shapes used in electronics and automotive systems. For instance, injection-molded magnets account for over 60% of global plastic-bonded magnet output, largely due to their versatility in low-volume, high-performance parts.

Compression bonding is growing in relevance, especially for applications demanding higher magnetic strength. These magnets are finding increased use in renewable energy motors and high-torque industrial actuators. Companies are now combining bonded and sintered technologies to develop hybrid magnets with tailored performance characteristics, a trend that is setting new benchmarks in the Plastic-bonded rare earth magnets Market.

Segmentation by Magnet Type Repositioning Market Dynamics

The Plastic-bonded rare earth magnets Market is segmented into key magnet types such as Neodymium-Iron-Boron (NdFeB) and Samarium-Cobalt (SmCo), each with unique demand patterns. NdFeB magnets dominate due to their exceptional magnetic strength and are widely used in EVs, robotics, and personal electronics. For instance, over 90% of all electric motors in EVs use NdFeB-based magnets, often enhanced with plastic bonding for better resistance to corrosion and mechanical stress.

Samarium-Cobalt magnets, while more expensive, are preferred in high-temperature environments such as aerospace and military systems. They maintain magnetic stability even at 350°C, making them ideal for propulsion units and satellite applications. As defense and aerospace investments increase globally, especially in the U.S., Europe, and East Asia, the demand for SmCo magnets is expected to rise, bolstering this niche within the Plastic-bonded rare earth magnets Market.

Application-based Demand Diversifying the Plastic-bonded Rare Earth Magnets Market

The Plastic-bonded rare earth magnets Market serves multiple sectors with varying growth trajectories. Automotive remains the largest segment, with EVs, hybrid vehicles, and autonomous platforms all requiring complex magnet arrays. For example, a single EV may use over 20 individual magnets across traction motors, ABS sensors, steering systems, and HVAC pumps.

Consumer electronics follow closely behind, with over 1 billion smartphones and 500 million wearable devices sold globally each year. These devices depend on micro-magnets for audio functions, haptic feedback, and internal motors. The renewable energy sector also contributes significantly. Offshore wind installations, in particular, are expected to grow by 13% CAGR through 2030, fueling magnet demand in turbine systems.

Other high-growth segments include medical devices and industrial automation. In healthcare, magnets are used in imaging machines and motorized implants, while automation relies on them in robotic joints, conveyor systems, and smart sensors. Each sector brings specific requirements—thermal resistance, miniaturization, or magnetic stability—driving innovation across the Plastic-bonded rare earth magnets Market.

End-user Industry Trends Strengthening Market Foundations

Different industries are redefining magnet requirements, contributing to the nuanced expansion of the Plastic-bonded rare earth magnets Market. In automotive, lightweight materials and high energy density are non-negotiable, driving demand for plastic-bonded variants over sintered magnets. Consumer electronics, on the other hand, prioritize ultra-compact and heat-resistant solutions, pushing manufacturers toward high-precision molding technologies.

In the energy and utility sector, smart grid transformers and wind generators are pushing the boundaries of magnet longevity and efficiency. The healthcare industry is demanding biocompatible, corrosion-resistant magnets for long-term use in medical implants and diagnostic tools. This diversity in end-user demands is promoting product line differentiation and is a key reason why the Plastic-bonded rare earth magnets Market is developing application-specific innovations at an unprecedented pace.

Regional Production Clusters Strengthening Global Supply Chains

The Plastic-bonded rare earth magnets Market is increasingly defined by the rise of regional production hubs. China remains the global center of rare earth mining and magnet manufacturing, with vertically integrated operations covering raw material extraction to final product assembly. Japan and South Korea serve as innovation hubs, developing premium-grade magnets for electronics and EVs.

In the West, the U.S. and Canada are working to localize production and reduce import dependency. Europe is investing in both primary rare earth sourcing and magnet assembly, with initiatives in Germany, Sweden, and France focusing on recycling and circular magnet economies. These regional production clusters are helping balance the global supply chain and are expected to improve resilience within the Plastic-bonded rare earth magnets Market.

Conclusion: Geographic Synergies and Segmentation Strategy Shaping the Future

The future of the Plastic-bonded rare earth magnets Market lies in how well geographies align with segmentation strategies. Countries are no longer just consuming magnets—they are producing, innovating, and setting new standards. From Asia Pacific’s manufacturing dominance to Europe’s sustainability-driven transformation and North America’s reshoring initiatives, each region contributes uniquely to the market’s trajectory. Combined with detailed segmentation by type, application, and end-user needs, the global Plastic-bonded rare earth magnets Market is entering an era of strategic diversification, advanced customization, and demand-driven evolution.

“Plastic-bonded rare earth magnets Production Database, Plastic-bonded rare earth magnets Production Capacity”

-

-

- Plastic-bonded rare earth magnets production data for key manufacturers

- Plastic-bonded rare earth magnets production plant capacity by manufacturers and Plastic-bonded rare earth magnets production data for market players

- Plastic-bonded rare earth magnets production dashboard, Plastic-bonded rare earth magnets production data in excel format

-

Major Manufacturers Leading the Plastic-bonded Rare Earth Magnets Market

The Plastic-bonded rare earth magnets Market is shaped by a select group of global manufacturers that combine rare earth expertise, advanced polymer bonding technologies, and high-precision magnet fabrication. These companies play a pivotal role in supplying critical components for electric vehicles, industrial automation, renewable energy systems, and miniaturized electronics.

Hitachi Metals Ltd. – Premium Grade Bonded Magnet Solutions

Hitachi Metals is among the most dominant players in the Plastic-bonded rare earth magnets Market, known for its pioneering work in Neodymium-based bonded magnets. The company’s product line includes the NEOMAX series, which is widely used in motors for electric power steering and compact electronic devices. Hitachi Metals focuses on injection-molded and hybrid magnet types, enabling better dimensional accuracy and corrosion resistance for automotive and industrial use. The company has also invested in magnet recycling technologies to create sustainable production pipelines and reduce raw material dependence.

Shin-Etsu Chemical Co., Ltd. – Technologically Advanced Polymer-bonded Magnets

Shin-Etsu Chemical has established a strong presence in the Plastic-bonded rare earth magnets Market with its series of high-performance NdFeB magnets. These magnets are tailored for applications in printers, HDDs, automotive actuators, and energy-efficient motors. The company’s polymer bonding innovations have resulted in thermally stable and lightweight magnets ideal for compact assemblies. Shin-Etsu also maintains strong R&D investment in extrusion and compression molding techniques to support next-generation EV technologies and smart manufacturing devices.

Arnold Magnetic Technologies – North American Leader in Bonded Magnet Production

Arnold Magnetic Technologies is a key U.S.-based manufacturer with a growing role in the Plastic-bonded rare earth magnets Market, especially within North America’s defense, aerospace, and EV sectors. Its RECOMA® and Flexmag® product lines include both rare earth and flexible polymer-bonded magnets. These are used in torque sensors, ABS systems, and high-speed motor applications. Arnold focuses heavily on customization, offering application-specific design solutions for medical devices, robotic assemblies, and military-grade equipment.

VACUUMSCHMELZE GmbH – European Excellence in Samarium-Cobalt Magnet Manufacturing

Germany’s VACUUMSCHMELZE (VAC) is known for its specialization in Samarium-Cobalt (SmCo) bonded magnets. These magnets are deployed in aerospace propulsion, high-temperature sensors, and mission-critical defense systems. VAC’s product series such as VACODYM and VACOMAX are highly sought after for their thermal and magnetic stability. The company’s vertically integrated operations ensure control from alloy production to final magnet fabrication, making it a strategic supplier for many European EV and turbine manufacturers within the Plastic-bonded rare earth magnets Market.

TDK Corporation – Diversified Product Portfolio for Electronics and Automotive

TDK Corporation is another major player in the Plastic-bonded rare earth magnets Market, particularly strong in consumer electronics and vehicle electronics. The company offers a wide array of miniature bonded magnets under the NeoREC brand, tailored for high-speed motors in cooling fans, hard drives, and hybrid vehicle inverters. TDK’s global manufacturing footprint spans across Japan, China, and Germany, allowing it to serve diversified end-user industries with agility and scale.

Galaxy Magnets Co., Ltd. – China’s High-Volume Bonded Magnet Supplier

As one of the largest rare earth magnet manufacturers in China, Galaxy Magnets plays a central role in the global Plastic-bonded rare earth magnets Market. The company offers both NdFeB and SmCo bonded magnets under the GalaxyMag series. These products are exported worldwide and widely integrated into electric motors, wind turbines, and automation systems. Galaxy Magnets benefits from direct access to raw rare earth materials, making its supply chain cost-effective and reliable. It continues to expand its production capacity, focusing on high-density compression-bonded magnets for EV and industrial drives.

Bunting Magnetics Co. – U.S. Based Specialist in Injection Molding Magnets

Bunting Magnetics has carved out a niche in the Plastic-bonded rare earth magnets Market with its focus on highly engineered magnet assemblies. The company offers molded magnet products for OEMs in medical, automotive, and automation industries. Its injection molding capabilities are used to produce magnets with complex geometries and tight tolerances. Bunting’s custom bonded magnet solutions are especially valuable in applications requiring embedded sensing and compact magnetic configurations.

Daido Electronics Co., Ltd. – Japan’s Innovation Driver in Compact Magnet Technologies

Daido Electronics, a division of Daido Steel, has made strategic advances in the Plastic-bonded rare earth magnets Market through its development of hybrid bonded magnets with enhanced magnetic energy. These magnets are integral in low-power motors for electric power tools and HVAC systems. The company is collaborating with Japanese auto OEMs to optimize magnet performance in battery cooling fans and sensor modules, contributing to the efficiency of electric drivetrains and control electronics.

Yunsheng Company Limited – Large-scale Production for Consumer Electronics

Yunsheng, another top-tier Chinese magnet manufacturer, has increased its dominance in the Plastic-bonded rare earth magnets Market by offering injection-molded NdFeB magnets in extremely high volumes. These magnets are widely used in audio devices, printers, and small motors. Yunsheng’s advantage lies in its ability to scale production quickly while maintaining product consistency, making it a preferred supplier for multinational electronics and appliance brands.

Dexter Magnetic Technologies – Custom Magnetic Assemblies for Industrial Applications

Dexter, headquartered in the United States, serves niche markets within the Plastic-bonded rare earth magnets Market with its custom bonded magnet assemblies. The company focuses on low-volume, high-complexity solutions for aerospace, defense, and oilfield technologies. Dexter’s strength lies in integrating plastic-bonded rare earth magnets into multifunctional assemblies such as rotary encoders, position sensors, and motor shaft coupling systems.

Recent Industry Developments in the Plastic-bonded Rare Earth Magnets Market

The Plastic-bonded rare earth magnets Market has seen several strategic developments and milestones in the past year, aimed at strengthening supply chains, expanding capacity, and accelerating innovation:

- January 2024: Hitachi Metals initiated a $200 million expansion of its magnet production facility in Japan to double output of bonded NdFeB magnets by 2026, with a focus on EV applications.

- March 2024: Arnold Magnetic Technologies announced a joint venture with a U.S.-based mining firm to secure domestic sources of rare earth oxides, ensuring vertically integrated production for high-spec plastic-bonded magnets.

- April 2024: Shin-Etsu Chemical introduced a new high-heat-resistant polymer matrix for bonded magnets that can withstand continuous operation at 180°C, specifically targeting hybrid and electric vehicle applications.

- May 2024: TDK Corporation launched a new line of compact plastic-bonded magnets for mini drone propulsion systems under the NeoREC-SmartFly series, enhancing the company’s footprint in lightweight aerospace tech.

- June 2024: VAC announced the successful completion of a pilot recycling plant in Germany to recover samarium and cobalt from end-of-life magnets, aimed at reducing environmental impact and raw material dependency.

- August 2024: Galaxy Magnets completed the installation of three new compression bonding lines in Inner Mongolia, increasing their annual production capacity by 15% to meet international EV motor demand.

These developments signify an accelerated shift in the Plastic-bonded rare earth magnets Market toward supply chain resilience, sustainability, and advanced material science. As leading players continue to invest in innovation and expand global footprints, the market is set to maintain its upward trajectory across automotive, renewable energy, and electronics applications.

“Plastic-bonded rare earth magnets Production Data and Plastic-bonded rare earth magnets Production Trend, Plastic-bonded rare earth magnets Production Database and forecast”

-

-

- Plastic-bonded rare earth magnets production database for historical years, 10 years historical data

- Plastic-bonded rare earth magnets production data and forecast for next 7 years

-

Market Scenario, Demand vs Supply, Average Product Price, Import vs Export, till 2035

- Global Plastic-bonded rare earth magnets Market revenue and demand by region

- Global Plastic-bonded rare earth magnets Market production and sales volume

- United States Plastic-bonded rare earth magnets Market revenue size and demand by country

- Europe Plastic-bonded rare earth magnets Market revenue size and demand by country

- Asia Pacific Plastic-bonded rare earth magnets Market revenue size and demand by country

- Middle East & Africa Plastic-bonded rare earth magnets Market revenue size and demand by country

- Latin America Plastic-bonded rare earth magnets Market revenue size and demand by

- Import-export scenario – United States, Europe, APAC, Latin America, Middle East & Africa

- Average product price – United States, Europe, APAC, Latin America, Middle East & Africa

- Market player analysis, competitive scenario, market share analysis

- Business opportunity analysis

Key questions answered in the Global Plastic-bonded rare earth magnets Market Analysis Report:

- What is the market size for Plastic-bonded rare earth magnets in United States, Europe, APAC, Middle East & Africa, Latin America?

- What is the yearly sales volume of Plastic-bonded rare earth magnets and how is the demand rising?

- Who are the top market players by market share, in each product segment?

- Which is the fastest growing business/ product segment?

- What should be the business strategies and Go to Market strategies?

The report covers Plastic-bonded rare earth magnets Market revenue, Production, Sales volume, by regions, (further split into countries):

- Asia Pacific (China, Japan, South Korea, India, Indonesia, Vietnam, Rest of APAC)

- Europe (UK, Germany, France, Italy, Spain, Benelux, Poland, Rest of Europe)

- North America (United States, Canada, Mexico)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa

Table of Contents:

Plastic-Bonded Rare Earth Magnets Market

- Introduction to the Plastic-Bonded Rare Earth Magnets Market

- Definition and Overview of Plastic-Bonded Rare Earth Magnets

- Applications and Importance in Modern Technologies

- Market Evolution and Key Drivers Behind Plastic-Bonded Magnet Growth

- Types of Plastic-Bonded Rare Earth Magnets

- NdFeB (Neodymium-Iron-Boron) Plastic-Bonded Magnets

- SmCo (Samarium-Cobalt) Plastic-Bonded Magnets

- Hybrid and Custom Plastic-Bonded Magnets

- Market Dynamics and Growth Drivers

- Increasing Demand for Lightweight and High-Performance Magnets

- Rising Applications in Electric Vehicles, Consumer Electronics, and Renewable Energy

- Technological Advancements in Plastic-Bonded Magnet Production

- Plastic-Bonded Rare Earth Magnets Market Segmentation

- By Material Type (Neodymium, Samarium-Cobalt, Ferrite)

- By Application (Automotive, Consumer Electronics, Wind Energy, Industrial)

- By End-User Industry (Electronics, Automotive, Aerospace, Renewable Energy)

- By Form Factor (Powder, Ribbon, Custom Shapes)

- Global Plastic-Bonded Rare Earth Magnets Market Size and Forecast (2025-2035)

- Market Valuation and Projected Growth Rates

- Revenue and Demand Analysis by Region

- Market Share Distribution by Product and Application

- Regional Market Analysis and Opportunities

- North America: Market Growth in Electric Vehicles and Renewable Energy

- Europe: Technological Leadership in Aerospace and Automotive Applications

- Asia-Pacific: Market Expansion and Manufacturing Hubs

- Latin America & Middle East/Africa: Emerging Demand in Industrial and Consumer Applications

- Plastic-Bonded Rare Earth Magnets Production Process

- Overview of Manufacturing Techniques for Plastic-Bonded Magnets

- Key Materials and Manufacturing Technologies

- Challenges and Innovations in Production Efficiency

- Competitive Landscape and Market Share Analysis

- Leading Manufacturers and Key Market Players

- Competitive Strategies and Technological Innovations

- Mergers, Acquisitions, and Strategic Partnerships in the Plastic-Bonded Magnet Industry

- Raw Material Sourcing and Cost Structure Analysis

- Sourcing Rare Earth Elements and Other Key Materials

- Impact of Supply Chain Disruptions on Plastic-Bonded Magnet Production

- Cost Breakdown and Factors Affecting Pricing of Rare Earth Magnets

- Sustainability and Environmental Impact of Plastic-Bonded Magnets

- Environmental Concerns in Rare Earth Mining and Recycling

- Innovations in Sustainable Production Processes

- Regulations and Standards for Eco-Friendly Manufacturing

- Market Challenges and Risk Factors

- Volatility in Rare Earth Material Prices

- Competition from Alternative Magnet Technologies

- Regulatory Barriers and Trade Restrictions on Rare Earth Elements

- Investment and Business Opportunities in the Plastic-Bonded Rare Earth Magnets Market

- High-Growth Applications Driving Investment Opportunities

- Strategic Business Models for New Entrants

- Growth Opportunities in Emerging Markets

- Technological Advancements in Plastic-Bonded Rare Earth Magnets

- Innovations in Magnetization Processes

- Advancements in Composite Materials for Enhanced Performance

- Integration of Plastic-Bonded Magnets in Smart and IoT Devices

- Pricing Trends and Market Structure

- Price Fluctuations in Rare Earth Magnets and Production Costs

- Pricing Strategies Adopted by Leading Manufacturers

- Future Pricing Trends and Impact on Market Growth

- Distribution Channels and Sales Strategies

- Key Distribution Networks for Plastic-Bonded Rare Earth Magnets

- Direct Sales vs. Third-Party Distributors

- Strategic Marketing and Sales Models for Niche Applications

- Regulatory and Compliance Landscape

- Standards and Regulations Governing the Production and Use of Rare Earth Magnets

- Environmental Compliance in Manufacturing Processes

- International Trade Policies and Restrictions on Rare Earth Materials

- Future Outlook and Trends in Plastic-Bonded Rare Earth Magnets Market (2025-2035)

- Long-Term Growth Projections and Demand Forecasts

- Emerging Trends in Applications for Electric Motors and Generators

- The Role of Plastic-Bonded Magnets in Sustainable Energy Solutions

- Conclusion and Strategic Recommendations

- Summary of Key Market Insights and Opportunities

- Strategic Business and Investment Recommendations

- Long-Term Vision for Growth in the Plastic-Bonded Rare Earth Magnets Market

Other recently published reports:

“Every Organization is different and so are their requirements”- Datavagyanik

Companies We Work With

Do You Want To Boost Your Business?

drop us a line and keep in touch