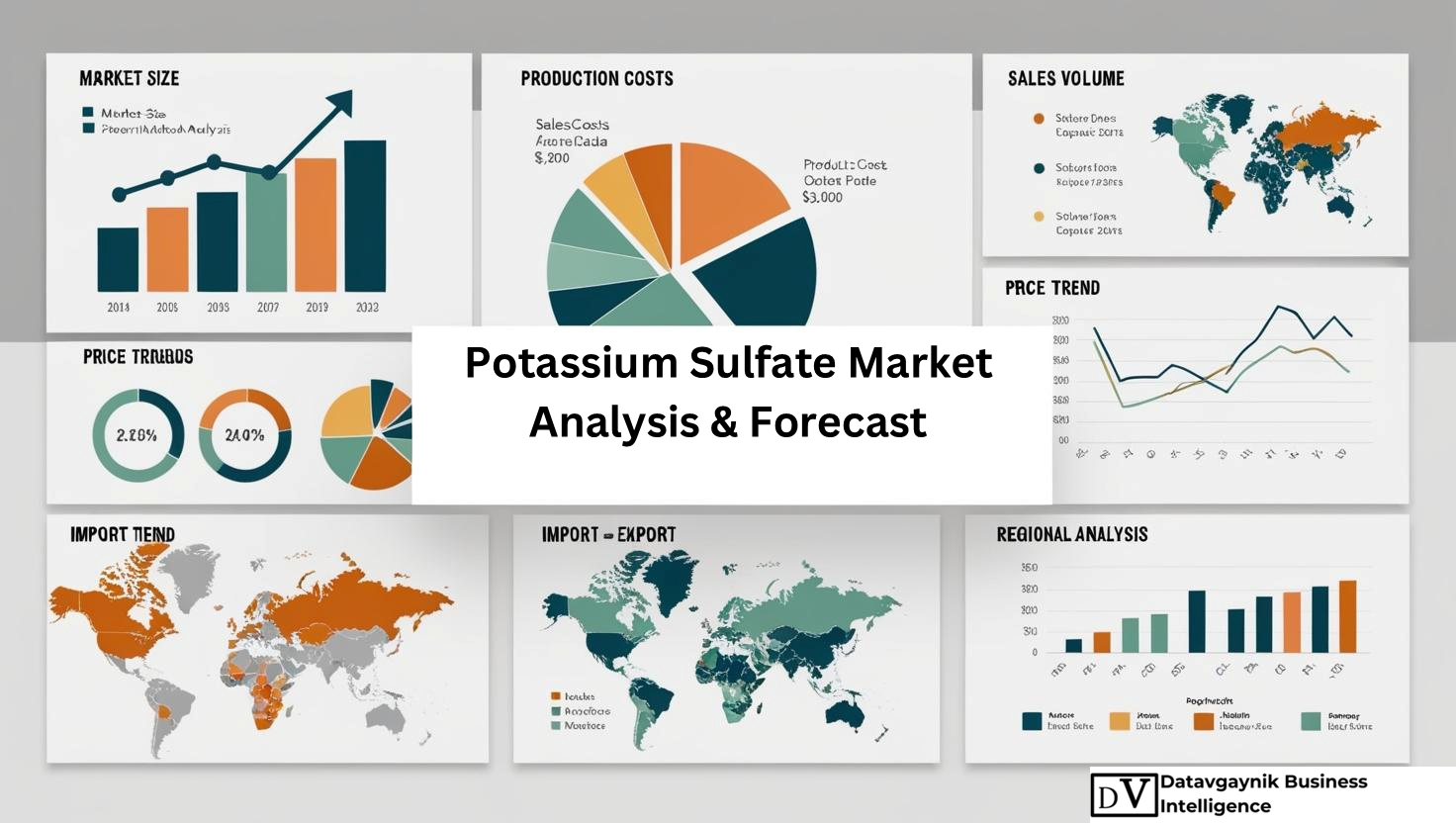

Potassium Sulfate Market Size, Production, Sales, Average Product Price, Market Share, Import vs Export – United States, Europe, APAC, Latin America, Middle East & Africa

- Published 2025

- No of Pages: 120+

- 20% Customization available

Surging Demand for High-Efficiency Fertilizers Drives Potassium Sulfate Market Expansion

The Potassium Sulfate Market is undergoing a transformation, fueled by the growing need for high-performance fertilizers that ensure both yield enhancement and environmental compatibility. As per Datavagyanik, the market is being increasingly shaped by the global shift toward nutrient-specific fertilizers. Potassium sulfate (SOP), with its low chloride content, is witnessing heightened demand in chloride-sensitive crop segments such as tobacco, potatoes, and citrus fruits. The Potassium Sulfate Market is evolving as farmers worldwide prioritize fertilizers that do not compromise soil health or crop quality.

Population Growth and Crop Diversification Propel Potassium Sulfate Market

One of the primary drivers influencing the Potassium Sulfate Market is the exponential rise in global food demand driven by population growth. By 2030, the global population is expected to exceed 8.5 billion, significantly increasing pressure on agricultural systems. Farmers are progressively turning to potassium sulfate to cultivate high-value crops like vegetables, nuts, and fruits, which are not only more profitable but also highly sensitive to chloride-based alternatives. For instance, citrus cultivation in South America and nut farming in California have shown a consistent preference for SOP due to its superior compatibility with chloride-intolerant soil types. This shift continues to widen the Potassium Sulfate Market’s customer base.

Datavagyanik also covers related markets such as the Potassium Phosphate Market, the Potassium Carbonate Market, and the Potassium Nitrate Market. These compounds are commonly used in oxidation systems and industrial chemical processing, supporting shifts in formulation standards and regulatory compliance.

Sustainability and Organic Farming Strengthen Potassium Sulfate Market Outlook

A substantial trend redefining the Potassium Sulfate Market is the alignment with sustainable and organic agricultural practices. For example, in Europe and North America, organic farming is gaining ground, with farmers seeking inputs that conform to environmental regulations. Potassium sulfate, which is permitted under many organic certifications, is increasingly being used as a sustainable alternative to conventional potash fertilizers. The environmental footprint of potassium sulfate is comparatively lower, especially when produced through natural extraction or solar evaporation methods. As more consumers demand traceable and sustainably grown food, the Potassium Sulfate Market is likely to see accelerated adoption across certified organic farms.

Water Efficiency and Climate Resilience Fuel Potassium Sulfate Market Demand

In arid and semi-arid regions such as the Middle East, North Africa, and parts of Central Asia, the demand for potassium sulfate is rising sharply. According to Datavagyanik, SOP improves water use efficiency in crops, an essential trait in water-stressed geographies. Crops grown under water-scarce conditions benefit from potassium’s role in stomatal regulation and drought tolerance. For instance, olive cultivation in North Africa and date farming in Saudi Arabia have registered higher yields and better quality with SOP usage compared to conventional fertilizers. These climate-adaptive properties of potassium sulfate continue to add momentum to the Potassium Sulfate Market trajectory.

Government Policies and Subsidies Catalyze Potassium Sulfate Market Growth

National policies and fertilizer subsidies are playing a crucial role in accelerating the Potassium Sulfate Market. Several governments are incentivizing the adoption of low-chloride fertilizers as part of soil health improvement programs. In India, the government’s push for balanced fertilization under its Nutrient Based Subsidy (NBS) scheme includes support for specialty fertilizers like potassium sulfate. Similarly, countries in Latin America have started promoting SOP for export-oriented horticulture. These supportive regulatory frameworks not only reduce the cost burden for farmers but also create stable demand patterns within the Potassium Sulfate Market.

Industrial Applications Expand the Scope of Potassium Sulfate Market

While agriculture remains the core consumer, the Potassium Sulfate Market is diversifying due to growing usage in industrial sectors. SOP is finding increased application in glass manufacturing, specialty detergents, and pharmaceutical formulations due to its chemical stability and high solubility. For example, potassium sulfate is utilized in intravenous pharmaceutical preparations to treat potassium deficiency. The global pharmaceutical sector, which has been growing at over 6% annually, presents a significant secondary growth engine for the Potassium Sulfate Market. This diversified application base enhances the market’s resilience against fluctuations in agricultural demand.

Potassium Sulfate Market Size Gains Backed by Regional Agricultural Strategies

The Potassium Sulfate Market Size has been steadily increasing, underpinned by regional agricultural modernization strategies. In China, national policies favoring high-efficiency fertilizers have led to SOP gaining considerable traction, particularly in greenhouse vegetable production. Likewise, Brazil’s shift toward export-oriented agriculture, such as fruit and coffee plantations, has made potassium sulfate an essential input. Datavagyanik highlights that as countries work to boost yield per hectare while preserving soil health, the Potassium Sulfate Market Size is expected to register consistent year-on-year growth through 2032.

Technological Advancements Improve Product Efficiency in Potassium Sulfate Market

The advent of precision farming and controlled-release fertilizer technologies is further stimulating the Potassium Sulfate Market. As farm operators adopt GPS-guided fertilization and fertigation systems, SOP’s compatibility with liquid formulations has positioned it as a preferred choice. For instance, fertigation systems in Israel and Spain heavily rely on potassium sulfate due to its solubility and compatibility with drip irrigation setups. This synchronization of fertilizer efficiency with irrigation technology enhances productivity while optimizing input use, reinforcing the relevance of the Potassium Sulfate Market in advanced farming models.

Soil Degradation and Salinity Concerns Reinforce Potassium Sulfate Market Position

Another significant driver contributing to Potassium Sulfate Market growth is the deterioration of soil quality in key agricultural regions. Increasing salinity in irrigated soils, especially in parts of the U.S. Southwest, Northern Africa, and South Asia, has made chloride-free fertilizers a necessity. SOP’s zero-chloride profile positions it as an essential input in reclaiming and maintaining soil health. For example, research in Pakistan’s Indus Valley indicates that shifting to SOP-based fertilization improved crop yields by 12–18% in saline soils over three cropping cycles. This reinforces potassium sulfate’s long-term role in addressing soil degradation challenges, keeping the Potassium Sulfate Market relevant in evolving agronomic scenarios.

Consumer Trends and High-Quality Crop Demand Reshape Potassium Sulfate Market

Global consumption trends are also influencing fertilizer choices. The rise in demand for visually appealing, nutrient-rich produce has prompted farmers to adopt input strategies that optimize crop quality. Potassium sulfate has a proven impact on enhancing fruit firmness, sugar content, and shelf life, making it ideal for commercial vegetable and fruit farming. For instance, vineyards in Southern Europe and berry farms in the Pacific Northwest have increasingly switched to potassium sulfate to improve fruit quality for export markets. This consumer-driven preference directly feeds into the Potassium Sulfate Market’s value chain, supporting price stability and market scalability.

Potassium Sulfate Market Poised for Long-Term Growth Amid Climatic Volatility

Climatic unpredictability, ranging from prolonged droughts to extreme rainfall, is exacerbating nutrient loss in soils, thereby amplifying the need for targeted nutrient replenishment. Potassium, being one of the primary macronutrients required by plants, is essential for stress mitigation and overall plant vigor. SOP’s balanced nutrient profile, providing both potassium and sulfur, ensures quick recovery of crops post-stress. Datavagyanik observes that regions facing climatic volatility, such as parts of Australia, Southern Africa, and Central America, are increasingly adopting potassium sulfate as a buffer against nutrient leaching and abiotic stress, adding long-term resilience to the Potassium Sulfate Market.

“Track Country-wise Potassium Sulfate Production and Demand through our Potassium Sulfate Production Database”

-

-

- Potassium Sulfate production database for 27+ countries worldwide

- Potassium Sulfate sales volume for 31+ countries

- Country-wise Potassium Sulfate production capacity, production plant mapping, production capacity utilization for 27+ manufacturers

- Potassium Sulfate production plants and production plant capacity analysis by top manufacturers

-

“Track real-time Potassium Sulfate Prices, Potassium Sulfate price charts for 27+ countries, Potassium Sulfate weekly price tracker and Potassium Sulfate monthly price tracker”

-

-

- Track real-time Potassium Sulfate prices and Potassium Sulfate price trend in 27+ countries though our excel-based Potassium Sulfate price charts

- Real-time Potassium Sulfate price tracker dashboard with 27+ countries

- Complete transparency on Potassium Sulfate price trend through our Potassium Sulfate monthly price tracker, Potassium Sulfate weekly price tracker

-

Geographical Expansion Reshaping the Potassium Sulfate Market

The Potassium Sulfate Market is undergoing a geographic realignment as countries accelerate the shift toward crop-specific and chloride-free fertilizers. Asia-Pacific leads in absolute volume demand, followed closely by North America and Europe. These regions are not only major consumers but also pivotal influencers in terms of production technologies, pricing frameworks, and application diversification. Datavagyanik emphasizes that the Potassium Sulfate Market is increasingly shaped by climatic, agronomic, and regulatory dynamics unique to each geography, resulting in distinctly regionalized demand patterns.

Asia-Pacific: Largest Growth Driver in the Potassium Sulfate Market

Asia-Pacific is emerging as the central growth engine of the Potassium Sulfate Market, accounting for a significant share of global consumption. Countries like China and India dominate this landscape due to their extensive agricultural footprint and rising demand for high-efficiency fertilizers. In China, potassium sulfate usage has surged in intensive greenhouse cultivation systems where chloride-sensitive vegetables and fruits such as strawberries, cucumbers, and grapes are predominant. For instance, Chinese provinces like Shandong and Fujian have expanded greenhouse coverage by over 20% since 2020, directly influencing regional SOP demand.

India is another critical market, where government subsidies and precision farming campaigns have created new pockets of demand. In southern and western states, horticulture-based exports are driving increased adoption of potassium sulfate. This regional uptake is supporting the Potassium Sulfate Market’s long-term growth momentum across South Asia, especially as India promotes micronutrient-balanced fertilization for soil rejuvenation.

North America Potassium Sulfate Market: Demand Anchored in Specialty Agriculture

North America holds a strategic position in the Potassium Sulfate Market, especially due to its strong base in specialty crops and organic farming. The U.S. market continues to expand steadily, driven by the rising acreage under high-value crops like almonds, berries, and leafy greens in states such as California and Florida. In California, SOP has become integral to orchard management practices, where the crop yield improvement has been as high as 15% with chloride-free fertilization strategies.

Datavagyanik notes that the Potassium Sulfate Market in the U.S. is further reinforced by growing environmental awareness and consumer preference for organically grown produce. Canada, though smaller in scale, shows a parallel trend, particularly in its western provinces where precision agriculture techniques are gaining popularity, aligning well with the efficiency of potassium sulfate.

European Potassium Sulfate Market: Regulated Growth with a Focus on Sustainability

Europe is witnessing steady demand within the Potassium Sulfate Market, primarily driven by strict environmental regulations and a well-established organic farming ecosystem. Countries such as Germany, France, and Italy are investing in reducing their reliance on chloride-based fertilizers, aligning with EU directives aimed at protecting groundwater and soil biodiversity. Potassium sulfate fits seamlessly into this regulatory environment, especially for crops like grapes, lettuce, and potatoes which dominate European agriculture.

France and Germany together represent more than 40% of the continent’s SOP consumption, with vineyards and vegetable farms being the principal application areas. In addition, Eastern European countries like Poland and Romania are slowly emerging as newer markets due to modernization efforts in agriculture, expanding the scope of the Potassium Sulfate Market within Europe.

Middle East and Africa: Sustainability Needs Drive Potassium Sulfate Market Adoption

The Middle East and Africa are increasingly being recognized as high-potential zones within the Potassium Sulfate Market due to their climate-related agricultural challenges. Water scarcity and soil salinity are significant concerns in countries like Egypt, Saudi Arabia, and Morocco. In response, there has been a regional pivot toward fertilizers that improve crop water efficiency without increasing salinity stress. Potassium sulfate meets both these needs.

Egypt has taken a proactive stance, with companies such as EverGrow ramping up domestic SOP production while targeting exports to over 70 countries. Similarly, Saudi Arabia’s Vision 2030 includes agriculture as a key non-oil sector, and potassium sulfate is being widely promoted in drip irrigation-based date and vegetable farming. These developments are solidifying the region’s role in the global Potassium Sulfate Market ecosystem.

South America Potassium Sulfate Market: Export-Oriented Agriculture Fuels Growth

South America is steadily increasing its footprint in the Potassium Sulfate Market. Brazil, the continent’s agricultural powerhouse, is witnessing rising demand for SOP in the production of crops such as coffee, citrus fruits, and sugarcane. Chloride sensitivity in several of these crops has led to a gradual substitution of muriate of potash with potassium sulfate.

Datavagyanik points out that Chile and Argentina are also becoming relevant markets, especially with their focus on fruit exports to Europe and North America. The Potassium Sulfate Market in this region is benefitting from high crop-value returns, which make the cost of premium fertilizers like SOP economically viable.

Potassium Sulfate Production Trends and Regional Specialization

On the production side, the Potassium Sulfate Market is largely supported by established and emerging production hubs. China is the largest global producer, relying on both Mannheim process facilities and natural brine extraction methods. Its domestic SOP capacity is expected to grow steadily as internal demand intensifies.

The United States also remains a key producer, with facilities located strategically close to agricultural belts. Egypt and Jordan, leveraging salt lake and brine resources, are becoming dominant suppliers in the Middle East and North Africa region. Their cost advantage and access to nearby export markets position them as vital players in the Potassium Sulfate Market’s supply chain.

Segmentation by Form and Application Enhancing Potassium Sulfate Market Precision

The Potassium Sulfate Market is segmented across various product forms and end-use sectors. Powdered SOP dominates industrial applications due to its rapid solubility and ease of formulation. In contrast, granular SOP is widely preferred for field applications because of its slow-release capabilities and better soil contact.

Liquid potassium sulfate is gaining attention in hydroponics and fertigation systems, particularly in Asia-Pacific and the Middle East, where efficient water-nutrient integration is crucial. Datavagyanik identifies this segment as a fast-growing niche within the broader Potassium Sulfate Market due to its alignment with modern irrigation technologies.

By application, fruits and vegetables continue to represent the largest share, supported by rising export volumes and consumer preference for high-quality produce. Cereals and turfgrass form the secondary demand base, particularly in countries where SOP’s benefits in aesthetics and shelf life are valued.

Potassium Sulfate Price Dynamics Reflect Regional Supply-Demand Balance

The Potassium Sulfate Price is highly sensitive to supply chain inputs such as potassium chloride and sulfuric acid. Prices tend to be higher in regions that rely heavily on imports, such as Europe and parts of Asia. For instance, in 2024, Potassium Sulfate Price ranged from USD 550 to USD 700 per metric ton in European markets depending on purity and form.

In contrast, the Middle East and North Africa benefit from lower production and transportation costs, leading to more competitive Potassium Sulfate Price structures in domestic and regional markets. Datavagyanik underscores that Potassium Sulfate Price Trend remains stable when production technologies are diversified, such as when both Mannheim and brine-based methods are employed in parallel.

Potassium Sulfate Price Trend Indicates Long-Term Upward Pressure

The Potassium Sulfate Price Trend is expected to witness moderate upward pressure over the next decade. Factors contributing to this include rising raw material costs, stricter environmental compliance costs, and growing demand from premium agricultural segments. However, innovations in production, especially through renewable brine extraction and energy-efficient Mannheim reactors, could help stabilize prices in the long run.

In addition, regional trade agreements and logistic optimizations are expected to influence the Potassium Sulfate Price Trend positively, especially in Asia-Pacific and South America. For example, increased containerized shipping and export incentives in Brazil are helping mitigate input inflation, keeping Potassium Sulfate Price relatively competitive for exporters.

Conclusion: Regional Demand and Pricing Trends Cement Growth in Potassium Sulfate Market

As agriculture continues to evolve with environmental, economic, and consumer-driven forces, the Potassium Sulfate Market stands at the confluence of innovation and necessity. Region-specific factors—from water conservation in the Middle East to export-oriented farming in South America—are reinforcing the global relevance of SOP. Potassium Sulfate Price and Potassium Sulfate Price Trend will remain dynamic variables, but their trajectory will be shaped by advancements in sustainable production and shifting geographic demand centers.

“Potassium Sulfate Manufacturing Database, Potassium Sulfate Manufacturing Capacity”

-

-

- Potassium Sulfate top manufacturers market share for 27+ manufacturers

- Top 9 manufacturers and top 16 manufacturers of Potassium Sulfate in North America, Europe, Asia Pacific

- Potassium Sulfate production plant capacity by manufacturers and Potassium Sulfate production data for 27+ market players

- Potassium Sulfate production dashboard, Potassium Sulfate production data in excel format

-

“Potassium Sulfate price charts, Potassium Sulfate weekly price tracker and Potassium Sulfate monthly price tracker”

-

-

- Factors impacting real-time Potassium Sulfate prices in 21+ countries worldwide

- Potassium Sulfate monthly price tracker, Potassium Sulfate weekly price tracker

- Real-time Potassium Sulfate price trend, Potassium Sulfate price charts, news and updates

- Tracking Potassium Sulfate price fluctuations

-

Top Manufacturers Driving Growth in the Potassium Sulfate Market

The Potassium Sulfate Market is characterized by the presence of several large-scale producers that operate globally and regionally, enabling a competitive and diversified market structure. Key players have developed integrated supply chains, proprietary production technologies, and strong regional distribution networks to maintain their market share. As demand rises across agriculture, pharmaceuticals, and industrial sectors, these manufacturers are expanding capacities, launching product variants, and entering new geographies to solidify their position in the Potassium Sulfate Market.

Compass Minerals – North American Leader in the Potassium Sulfate Market

Compass Minerals is among the most established players in the Potassium Sulfate Market, particularly across North America. The company offers SOP under its Protassium+ brand, which is widely used for specialty crops such as almonds, grapes, and leafy vegetables. Compass Minerals has invested significantly in building agronomic support tools and digital platforms to increase the adoption of Protassium+, especially among large-scale commercial farms.

Its vertically integrated production facility in the United States gives it a pricing and logistics advantage, particularly in western and midwestern states. Compass Minerals holds an estimated 10–12% share of the global Potassium Sulfate Market, with a dominant footprint in U.S. agricultural applications.

K+S Group – Major European Contributor to the Potassium Sulfate Market

K+S Group, based in Germany, has a longstanding presence in the Potassium Sulfate Market through its KALISOP product line. The company primarily serves European agriculture but also exports to Asia, South America, and parts of Africa. KALISOP is particularly favored for use in vineyards, orchards, and greenhouse farming due to its high solubility and purity.

The company leverages natural brine sources and has optimized its production through sustainable mining and evaporation techniques. Datavagyanik identifies K+S Group as holding approximately 8–10% share in the global Potassium Sulfate Market, with a robust position in regulated and sustainability-focused markets such as the European Union.

SQM – A Global Powerhouse in the Potassium Sulfate Market

Sociedad Química y Minera de Chile (SQM) is one of the largest global producers of potassium-based fertilizers, including potassium sulfate. The company benefits from access to rich mineral reserves in Chile’s Salar de Atacama and employs solar evaporation methods for SOP production. Its product line includes a wide range of specialty fertilizers tailored for export crops such as grapes, avocados, and citrus fruits.

SQM’s global distribution strategy has enabled it to capture a considerable share in Asia-Pacific, Latin America, and Europe. It currently holds an estimated 15–18% of the global Potassium Sulfate Market, positioning it among the top three producers globally.

Tessenderlo Group – Integrated Supply Chain Player in the Potassium Sulfate Market

Belgium-based Tessenderlo Group operates under the name ‘Tessenderlo Kerley International’ and has developed an efficient, integrated SOP supply chain. Its production relies largely on the Mannheim process, and the company markets its SOP under the name SoluPotasse. This brand is recognized for its high water solubility, making it ideal for fertigation and hydroponic systems.

Tessenderlo has a significant presence in Europe, the Middle East, and Africa, with targeted expansion in Southeast Asia. The company commands approximately 7–9% of the global Potassium Sulfate Market share and continues to expand through strategic investments in production optimization and agronomic partnerships.

EverGrow Group – Rising Middle Eastern Manufacturer in the Potassium Sulfate Market

EverGrow Group, based in Egypt, is gaining prominence in the Potassium Sulfate Market by rapidly scaling its SOP production and export capabilities. The company’s product portfolio includes standard, granular, and water-soluble potassium sulfate, designed for fruit, vegetable, and ornamental crop cultivation. EverGrow exports to over 70 countries and is strategically located to serve Europe, Africa, and Asia efficiently.

The company has launched an aggressive expansion campaign and aims to double its SOP capacity by 2026. Datavagyanik estimates EverGrow’s current market share to be around 4–6%, with rapid upward mobility based on rising demand from the Middle East and North Africa.

Guotou Xinjiang LuoBuPo Potash Co. – China’s Major SOP Supplier in the Potassium Sulfate Market

Operating under Sinochem Holdings, Guotou Xinjiang LuoBuPo Potash Co. is one of China’s most influential SOP producers. With access to brine lakes in Xinjiang and robust domestic demand, the company plays a pivotal role in China’s self-sufficiency in potassium sulfate. Its SOP products are used across key Chinese provinces and are gaining ground in exports to South and Southeast Asia.

The company has continued to invest in scaling operations and reducing production costs through energy efficiency programs. It is estimated to hold approximately 6–8% share in the global Potassium Sulfate Market, with strong prospects for expansion as China’s agricultural modernization progresses.

Other Notable Participants in the Potassium Sulfate Market

Several other regional and niche players also contribute to the Potassium Sulfate Market landscape. These include:

- Haifa Group (Israel) – Supplies high-grade SOP for fertigation and greenhouse farming across Mediterranean and Gulf markets.

- YARA International (Norway) – Though primarily focused on nitrogen-based fertilizers, YARA markets SOP in certain premium crop segments.

- ICL Group (Israel) – Offers a range of specialty crop nutrition products including potassium sulfate blends, particularly for use in desert farming environments.

These companies maintain smaller but strategically significant market shares, particularly in regions where SOP demand is linked to climate resilience and export agriculture.

Potassium Sulfate Market Share by Manufacturers: Consolidated but Competitive

The Potassium Sulfate Market remains moderately consolidated, with the top five players accounting for nearly 55–60% of global production. However, competitive pressure remains intense, especially as newer manufacturers in the Middle East and Asia scale operations. Datavagyanik highlights that market share dynamics will continue to shift based on factors such as access to raw materials, government incentives, and sustainability benchmarks.

Companies with access to natural resources, such as salt lakes and brine pools, are increasingly favored due to their cost advantages and reduced environmental impact. Conversely, manufacturers relying solely on the Mannheim process face pressure from raw material price fluctuations and tightening environmental compliance requirements.

Recent Developments and Strategic Moves in the Potassium Sulfate Market

- February 2024 – EverGrow Group launched a global marketing campaign to expand its SOP exports beyond 70 countries, targeting Southeast Asia and Latin America.

- January 2024 – SQM announced an expansion of its solar evaporation SOP capacity in Chile by 15%, aiming to support rising demand from Brazil and India.

- December 2023 – Compass Minerals integrated advanced agronomy tools into its Protassium+ distribution network, allowing precision-based SOP recommendations for almond and grape growers in California.

- October 2023 – Tessenderlo Group invested in digital agriculture platforms to better align SoluPotasse application rates with crop-specific nutrient demand in Eastern Europe.

- August 2023 – Guotou Xinjiang LuoBuPo Potash Co. entered into a long-term supply agreement with Indian importers, focusing on high-purity SOP for greenhouse applications.

These strategic developments underscore a shift in the Potassium Sulfate Market where innovation, regional targeting, and supply chain optimization are the key to gaining competitive edge. As demand continues to rise across agriculture and industrial sectors, manufacturers are poised to adapt through operational scale, product innovation, and global reach.

“Potassium Sulfate Production Data and Potassium Sulfate Production Trend, Potassium Sulfate Production Database and forecast”

-

-

- Potassium Sulfate production database for historical years, 10 years historical data

- Potassium Sulfate production data and forecast for next 9 years

- Potassium Sulfate sales volume by manufacturers

-

“Track Real-time Potassium Sulfate Prices for purchase and sales contracts, Potassium Sulfate price charts, Potassium Sulfate weekly price tracker and Potassium Sulfate monthly price tracker”

-

-

- Gain control on your purchase and sales contracts through our real-time Potassium Sulfate price tracker and Potassium Sulfate price trend analysis

- Potassium Sulfate weekly price tracker and forecast for next four weeks

- Potassium Sulfate monthly price tracker and forecast for next two months

-

Market Scenario, Demand vs Supply, Average Product Price, Import vs Export, till 2032

- Global Potassium Sulfate Market revenue and demand by region

- Global Potassium Sulfate Market production and sales volume

- United States Potassium Sulfate Market revenue size and demand by country

- Europe Potassium Sulfate Market revenue size and demand by country

- Asia Pacific Potassium Sulfate Market revenue size and demand by country

- Middle East & Africa Potassium Sulfate Market revenue size and demand by country

- Latin America Potassium Sulfate Market revenue size and demand by

- Import-export scenario – United States, Europe, APAC, Latin America, Middle East & Africa

- Average product price – United States, Europe, APAC, Latin America, Middle East & Africa

- Market player analysis, competitive scenario, market share analysis

- Business opportunity analysis

Key questions answered in the Global Potassium Sulfate Market Analysis Report:

- What is the market size for Potassium Sulfate in United States, Europe, APAC, Middle East & Africa, Latin America?

- What is the yearly sales volume of Potassium Sulfate and how is the demand rising?

- Who are the top market players by market share, in each product segment?

- Which is the fastest growing business/ product segment?

- What should be the business strategies and Go to Market strategies?

The report covers Potassium Sulfate Market revenue, Production, Sales volume, by regions, (further split into countries):

- Asia Pacific (China, Japan, South Korea, India, Indonesia, Vietnam, Rest of APAC)

- Europe (UK, Germany, France, Italy, Spain, Benelux, Poland, Rest of Europe)

- North America (United States, Canada, Mexico)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa

Table of Contents:

Potassium Sulfate Market

1. Introduction to the Potassium Sulfate Market

- Overview of Potassium Sulfate and Its Chemical Properties

- Industrial Significance and Essential Applications

- Research Scope, Market Definitions, and Study Objectives

2. Market Dynamics and Key Growth Factors

- Increasing Demand for Potassium Sulfate in Agriculture and Industrial Sectors

- Challenges in Potassium Sulfate Production and Global Supply Chain Issues

- Opportunities in Sustainable Farming and Water-Soluble Fertilizers

3. Global Potassium Sulfate Market Size and Forecast (2020-2035)

- Revenue and Volume Trends Across Major Regions

- Demand-Supply Balance and Industry Growth Potential

- Long-Term Market Expansion and Future Growth Projections

4. Potassium Sulfate Production and Manufacturing Processes

- Global Potassium Sulfate Production Capacities by Key Manufacturers

- Advancements in Extraction, Purification, and Synthesis Techniques

- Future Outlook for Potassium Sulfate Production (2025-2035)

5. Potassium Sulfate Market Segmentation and Applications

- Classification by Purity, Grade, and Physical Form (Granular, Powder, Liquid)

- End-Use Market Segmentation: Agriculture, Industrial Chemicals, Pharmaceuticals

- Geographic Market Breakdown and Demand Variability

6. Regional Market Insights and Competitive Landscape

- North America: Market Trends, Major Producers, and Trade Regulations

- Europe: Growth Strategies, Sustainability Initiatives, and Import-Export Analysis

- Asia-Pacific: Leading Manufacturers, Expanding Applications, and Demand Surge

- Latin America: Agricultural Market Potential and Industrial Growth Strategies

- Middle East & Africa: Potassium Sulfate Market Expansion and Future Growth

7. Competitive Analysis and Key Market Players

- Leading Potassium Sulfate Producers and Their Market Share

- Business Strategies, Industry Innovations, and Competitive Positioning

- Mergers, Acquisitions, and Strategic Collaborations in the Market

8. Trade Flow, Supply Chain, and Distribution Networks

- Global Trade Flow of Potassium Sulfate and Market Accessibility

- Import-Export Trends and Trade Agreements Impacting Market Growth

- Supply Chain Challenges, Logistics Optimization, and Distribution Strategies

9. Potassium Sulfate Pricing Trends and Cost Structure Analysis

- Historical Price Trends and Market Influences (2019-2025)

- Future Price Forecast and Cost Factors Driving the Market (2025-2035)

- Breakdown of Production Costs and Economic Viability

10. Industrial Applications and Market Demand for Potassium Sulfate

- Agricultural Uses in Fertilizers and Crop Enhancement

- Role in Industrial Applications, Chemical Synthesis, and Specialty Products

- Expanding Uses in Pharmaceuticals, Cosmetics, and Water Treatment

11. Raw Material Sourcing and Supply Chain Risks

- Essential Raw Materials for Potassium Sulfate Production

- Global Supplier Landscape and Market Availability

- Supply Chain Disruptions, Pricing Volatility, and Alternative Sourcing Strategies

12. Innovations and Technological Developments in Potassium Sulfate Processing

- Advancements in Sustainable and Energy-Efficient Production Methods

- Waste Reduction and By-Product Utilization in the Manufacturing Process

- Role of Research & Development in Enhancing Market Applications

13. Investment Trends and Business Expansion Strategies

- Market Entry Strategies for New Players and Emerging Regions

- Investment Trends and Growth Potential in the Potassium Sulfate Market

- Expansion Plans and Business Development Initiatives for Leading Players

14. Regulatory Landscape and Environmental Compliance

- Industry Regulations Impacting Potassium Sulfate Production

- Environmental Sustainability Measures and Regulatory Compliance Requirements

- Future Policy Changes and Their Impact on Market Growth

15. Sales, Distribution Strategies, and Market Access Approaches

- Global and Regional Distribution Networks for Potassium Sulfate

- Sales Strategies for Manufacturers, Wholesalers, and Distributors

- Buyer Preferences, Consumer Trends, and Market Demand Analysis

16. Future Market Outlook and Long-Term Strategic Planning (2025-2035)

- Projected Market Developments and Key Growth Trends

- Risks, Challenges, and Constraints Affecting Future Market Expansion

- Strategic Recommendations for Sustainable Growth and Competitive Advantage

Other recently published reports:

“Every Organization is different and so are their requirements”- Datavagyanik

Companies We Work With

Do You Want To Boost Your Business?

drop us a line and keep in touch