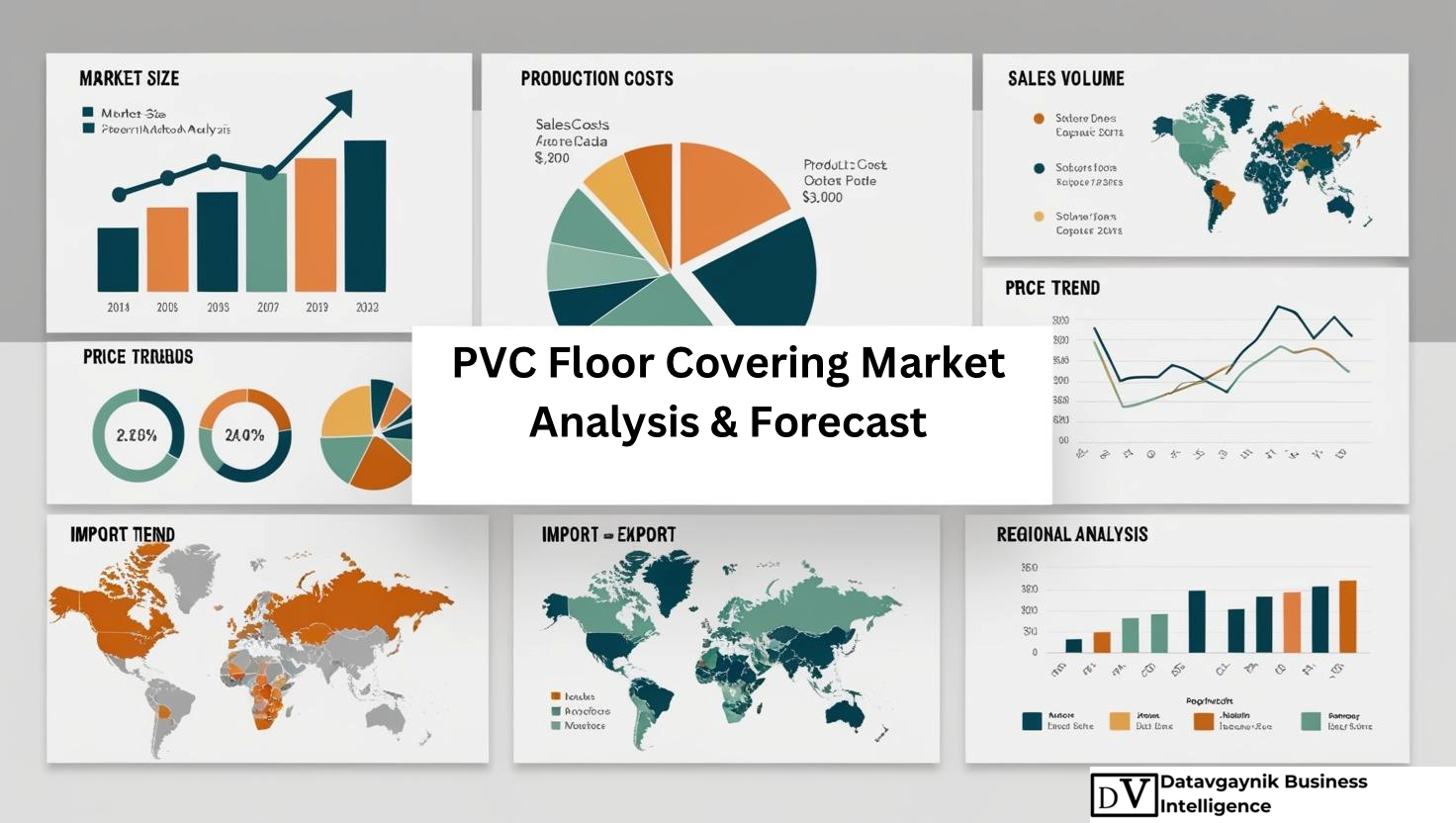

Global PVC FLOOR COVERING Market Size, Production, Sales, Average Product Price, Market Share

- Published 2025

- No of Pages: 120+

- 20% Customization available

Surging Demand in Residential and Commercial Construction Driving PVC Floor Covering Market Expansion

The PVC Floor Covering Market is witnessing significant momentum, primarily due to the rapid expansion of residential and commercial construction projects worldwide. For instance, the global construction industry reached a value of over USD 10 trillion in 2023, and a large share of this spending was directed toward flooring systems that are durable, cost-effective, and visually appealing. In this context, PVC flooring stands out due to its resilience, affordability, and ease of installation. Especially in high-traffic environments like apartment complexes, commercial offices, and retail outlets, PVC flooring offers a long lifecycle with minimal maintenance, making it a preferred solution.

The PVC Floor Covering Market is further propelled by urban population growth, with more than 56% of the world’s population now living in cities. As this number is expected to rise to nearly 70% by 2050, demand for flooring that is easy to install in dense, fast-paced construction environments is growing proportionally. The versatility of PVC flooring in adapting to different architectural aesthetics and construction needs adds to its widespread adoption.

PVC Floor Covering Market Benefits from Cost Efficiency and Maintenance Advantages

A critical driver of the PVC Floor Covering Market is its significant cost advantage over traditional alternatives such as ceramic tiles, hardwood, and marble. For example, installing PVC flooring can cost up to 40% less than hardwood flooring, while also eliminating the need for frequent polishing or sealing. These savings are crucial for large-scale projects like hospitals, educational institutions, and housing developments where cost control is vital.

Furthermore, PVC flooring offers excellent wear resistance, with many products rated for 20 years of heavy usage, depending on the wear layer thickness. Its resistance to moisture, chemicals, and stains makes it ideal for kitchens, bathrooms, laboratories, and even healthcare environments. Such functional benefits have led to increased penetration in both emerging and developed markets, positioning the PVC Floor Covering Market as a cornerstone in modern flooring strategies.

Luxury Vinyl Tiles (LVT) Fueling Premium Segment Growth in PVC Floor Covering Market

Luxury Vinyl Tiles (LVT), a premium segment within the PVC Floor Covering Market, have emerged as a standout performer, growing at a CAGR of 5.9% and capturing a revenue share of over 64.7% in 2024. The popularity of LVT stems from its superior aesthetics that replicate natural materials like wood and stone with remarkable realism. This makes LVT a compelling option for hospitality spaces, luxury homes, and office interiors where visual impact is critical.

In addition to appearance, LVT provides superior dimensional stability, enhanced comfort underfoot, and better sound insulation—characteristics that are increasingly valued in high-end real estate and commercial applications. For example, a growing trend in coworking spaces and boutique hotels is driving demand for high-performance flooring that balances design, durability, and comfort, further boosting the PVC Floor Covering Market.

Renovation and Refurbishment Trends Bolstering PVC Floor Covering Market Growth

Globally, renovation activities are gaining traction, especially in mature markets like North America and Europe. The post-pandemic shift toward home improvement and remote working environments has led to a surge in residential remodeling. For instance, U.S. homeowners spent nearly USD 567 billion on home renovations in 2023, with flooring upgrades being among the top improvements.

This trend has translated into increased demand for PVC floor coverings due to their ease of replacement and minimal disruption during installation. Peel-and-stick options and click-lock mechanisms have made PVC products especially attractive for do-it-yourself (DIY) renovations. As a result, the PVC Floor Covering Market is benefitting from rising consumer interest in quick, low-mess solutions that align with modern lifestyles.

Sustainability and Eco-Friendly Materials Gaining Ground in PVC Floor Covering Market

Sustainability is becoming a decisive factor in flooring material selection, significantly shaping the trajectory of the PVC Floor Covering Market. In response to rising consumer awareness and stricter building codes, manufacturers are now introducing phthalate-free, low-VOC, and recyclable PVC products. For instance, several European countries have implemented regulations requiring low-emission building materials, prompting a wave of product innovation.

Furthermore, recycled content is increasingly being incorporated into PVC flooring, contributing to circular economy goals. In Germany alone, over 80% of PVC floorings now include post-consumer recycled materials. This shift not only enhances environmental compliance but also positions companies as responsible, future-ready suppliers, giving them a competitive edge in the global PVC Floor Covering Market.

Healthcare and Educational Facilities Boosting Institutional Demand in PVC Floor Covering Market

The PVC Floor Covering Market is experiencing strong traction from institutional sectors such as healthcare and education. In environments where hygiene, safety, and durability are paramount, PVC flooring offers non-porous surfaces, anti-slip properties, and easy sterilization. These features are particularly relevant in hospitals, laboratories, and schools, where infection control and accident prevention are priorities.

For example, vinyl sheets are widely used in operating rooms and ICUs due to their seamless installation, which prevents microbial growth in joints and crevices. The global increase in hospital construction—estimated to reach USD 3.6 trillion by 2027—is expected to significantly raise demand for PVC flooring in these sensitive environments, reinforcing the growth trajectory of the PVC Floor Covering Market.

Technological Advancements Enhancing Design and Performance in PVC Floor Covering Market

Technological innovations are redefining the landscape of the PVC Floor Covering Market, especially through advancements in digital printing, embossing, and wear layer technologies. These developments have enabled manufacturers to produce flooring that closely mimics natural surfaces with high-definition clarity and textural depth, expanding the appeal of PVC to high-design segments.

Furthermore, smart flooring solutions are gaining popularity. PVC products embedded with antibacterial coatings, scratch resistance, and even IoT-enabled sensors are being explored for next-generation smart buildings. For instance, smart flooring solutions integrated with occupancy sensors are already being piloted in healthcare and assisted living facilities. Such innovations ensure the PVC Floor Covering Market stays aligned with future architectural and technological demands.

Retail and E-Commerce Channels Transforming PVC Floor Covering Market Distribution

A major transformation in the PVC Floor Covering Market is the evolution of distribution channels. Traditional retail stores continue to play a role, especially for customized solutions where buyers prefer to assess texture and color physically. However, the shift toward e-commerce has accelerated, with platforms offering virtual room visualizers, sample delivery, and direct-to-door installation kits.

Post-2020 consumer habits have fueled online growth. In markets like the U.S. and China, more than 40% of PVC flooring sales are now initiated or completed online. This shift not only reduces sales overhead for manufacturers but also enhances customer outreach, especially in rural and suburban markets. As a result, digital infrastructure is becoming integral to the strategy of companies operating within the PVC Floor Covering Market.

Commercial Sector Expansion Accelerating Demand in PVC Floor Covering Market

The rapid expansion of the commercial real estate sector is a strong catalyst for the PVC Floor Covering Market. New developments in shopping malls, coworking spaces, hotels, and public transport terminals are prioritizing materials that deliver both aesthetics and longevity. PVC flooring’s resistance to foot traffic, spillage, and environmental factors makes it an ideal solution in these settings.

For example, the global hospitality industry is projected to invest over USD 150 billion in construction and renovation by 2026. Much of this investment will go toward flooring systems that are cost-effective and quick to install. The surge in commercial projects across Asia-Pacific, Middle East, and Eastern Europe provides ample growth opportunities for PVC floor covering manufacturers.

Asia-Pacific Leading PVC Floor Covering Market with Aggressive Urbanization

The Asia-Pacific region remains the fastest-growing contributor to the PVC Floor Covering Market, accounting for over 50.9% of global revenue in 2024. Nations such as China, India, and Indonesia are witnessing unprecedented urban development. China’s construction output alone reached USD 4.27 trillion in 2021, with substantial investment directed toward affordable housing and smart city infrastructure—sectors where PVC flooring is a go-to solution.

India’s “Housing for All” initiative, targeting the construction of millions of residential units by 2027, exemplifies the volume-driven demand for economical yet robust flooring materials. Additionally, the rise in retail infrastructure and logistics hubs is boosting commercial demand, keeping the PVC Floor Covering Market on a solid upward trajectory in the region.

Europe’s Regulatory Framework Encouraging Eco-Innovation in PVC Floor Covering Market

Europe is contributing to the PVC Floor Covering Market not just through demand but also via regulatory innovation. The region is at the forefront of enforcing sustainability in construction, with countries like Germany and France promoting recyclable and low-emission building materials. As a result, companies are investing in R&D to develop next-gen PVC flooring solutions that comply with these standards.

Germany’s focus on energy-efficient buildings and the UK’s renovation boom are fostering steady demand for environmentally aligned PVC products. Additionally, design-forward markets like Sweden and Denmark are pushing the boundaries in terms of aesthetic innovation, further diversifying the demand profiles within the PVC Floor Covering Market.

North America’s Evolving Construction Sector Strengthening PVC Floor Covering Market Presence

The PVC Floor Covering Market in North America continues to gain momentum as residential and commercial construction activity surges across the region. In the United States alone, construction spending crossed USD 1.9 trillion in 2024, with a considerable share directed toward new home builds, office renovations, and public infrastructure. For example, the multifamily housing boom in urban areas such as Dallas, Atlanta, and Phoenix is driving significant demand for durable, cost-effective flooring solutions like vinyl planks and luxury vinyl tiles. These product types dominate the PVC Floor Covering Market due to their resistance to moisture, ease of maintenance, and aesthetic adaptability.

Additionally, the increased renovation of public schools and hospitals across the U.S. is another major contributor. These projects often require seamless, hygienic, and slip-resistant flooring, making sheet vinyl and homogeneous PVC flooring ideal solutions. This expanding institutional application base further amplifies the growth trajectory of the PVC Floor Covering Market in North America.

Europe’s Environmental Mandates Accelerating Innovation in PVC Floor Covering Market

Europe plays a crucial role in shaping the global PVC Floor Covering Market through regulatory leadership and design innovation. Countries like Germany, the UK, and France are not only large consumers but also trendsetters in sustainable building materials. For instance, Germany’s emphasis on recyclable and low-emission flooring materials has pushed manufacturers to introduce phthalate-free and eco-certified vinyl flooring options. This has expanded the share of environmentally friendly products in the region’s overall PVC Floor Covering Market.

In France, the residential remodeling sector is expanding rapidly, with over 50% of housing units aged more than 30 years. This aging infrastructure is driving homeowners to opt for resilient and easy-to-install flooring solutions, such as luxury vinyl tiles. Meanwhile, the United Kingdom’s commercial real estate sector is being reshaped by the surge in co-living and co-working spaces, where aesthetically pleasing and hardwearing PVC floors are becoming the default choice.

Asia-Pacific Dominates PVC Floor Covering Market through Production and Consumption Leadership

Asia-Pacific leads the global PVC Floor Covering Market not just in terms of consumption but also in production capacity. China alone contributes over 47% of the global production volume, benefiting from robust manufacturing infrastructure, low labor costs, and proximity to raw material suppliers. For instance, provinces like Jiangsu and Zhejiang house some of the world’s largest vinyl flooring production facilities, which cater to both domestic and export markets.

On the consumption side, rapid urbanization in India, Indonesia, and Vietnam has been a game-changer. India’s Housing for All initiative, targeting the construction of over 20 million affordable homes, directly supports large-scale deployment of low-cost PVC flooring. In Indonesia and Vietnam, rising disposable incomes and new retail developments have created new pockets of demand. These nations are actively expanding their role in the regional PVC Floor Covering Market, with growth rates exceeding 6% annually.

Middle East and Africa Emerging as High-Growth Zones in PVC Floor Covering Market

The PVC Floor Covering Market in the Middle East and Africa is transitioning from a low-penetration to a high-potential phase. Urbanization in cities such as Riyadh, Doha, and Lagos is triggering massive investment in housing, hospitality, and healthcare infrastructure. For instance, Saudi Arabia’s Vision 2030 is driving smart city developments like NEOM, which incorporates sustainable building materials, including eco-friendly vinyl flooring.

In Africa, countries like Nigeria and Kenya are witnessing rising construction activities, particularly in commercial buildings and educational institutions. With PVC flooring offering advantages like affordability, easy cleaning, and moisture resistance, it is rapidly replacing traditional surfaces such as concrete or ceramic tiles in budget-sensitive projects. This makes the region a strategic frontier for expansion in the PVC Floor Covering Market.

Latin America Capitalizing on Retail Growth and Renovation to Propel PVC Floor Covering Market

Latin America, while smaller in market size compared to Asia or Europe, is rapidly becoming a lucrative contributor to the global PVC Floor Covering Market. Brazil and Mexico, in particular, are experiencing growing demand from retail chains, hospitality groups, and home renovation segments. For instance, the renovation wave sweeping through São Paulo’s urban apartments has made vinyl plank flooring highly popular due to its wood-like appearance and durability in humid climates.

Additionally, retail construction is gaining pace across Tier 2 cities in Latin America, with developers increasingly choosing PVC flooring to minimize maintenance costs and downtime. As the region stabilizes economically and consumer preferences shift toward modern interiors, the PVC Floor Covering Market is poised for accelerated growth.

Product Type Segmentation Reshaping Competitive Dynamics in PVC Floor Covering Market

The PVC Floor Covering Market is segmented by product types, each addressing distinct application needs. Luxury Vinyl Tiles (LVT) dominate the premium segment, favored for their high-end design aesthetics and outstanding durability. This category is growing at over 5.9% CAGR, led by adoption in hospitality and retail sectors seeking materials that replicate wood and stone while remaining budget-friendly.

Vinyl planks are gaining popularity in the residential sector, particularly among DIY renovators who appreciate the ease of installation and water-resistant properties. Meanwhile, vinyl sheets hold significant demand in hospitals, laboratories, and schools due to their seamless application and resistance to bacteria and chemicals. This segmentation ensures that the PVC Floor Covering Market remains adaptable across varied usage environments.

Residential Segment Anchoring PVC Floor Covering Market with Rising Urban Households

The residential sector continues to serve as the backbone of the PVC Floor Covering Market. With global urban housing demand projected to reach 300 million new units by 2035, the requirement for fast, affordable, and attractive flooring solutions is growing proportionally. For example, in Southeast Asia, rapid construction of mid-rise apartments is being matched by soaring sales of luxury vinyl tiles and vinyl planks.

In North America and Europe, home renovation is a primary growth driver. A growing base of homeowners are choosing peel-and-stick vinyl solutions for kitchen and basement upgrades, attracted by minimal installation effort and long-term resilience. This rising trend in home improvement is translating directly into higher sales volumes for residential PVC flooring products.

Commercial Infrastructure Development Expanding Scope of PVC Floor Covering Market

The commercial segment of the PVC Floor Covering Market is seeing a surge in demand driven by the development of offices, malls, airports, and hospitality chains. In markets like China and the UAE, premium retail spaces now routinely specify LVT or enhanced wear layer PVC products to handle high footfall and ensure visual consistency.

Moreover, the global data center boom is influencing flooring selection as well. Raised flooring systems often use antistatic PVC finishes due to their safety, durability, and ease of maintenance. As commercial real estate developers prioritize lifecycle cost savings and quick project turnaround, PVC flooring continues to outperform alternatives in project specifications.

Healthcare and Education Applications Reinforcing Institutional Role in PVC Floor Covering Market

Hospitals, clinics, schools, and universities form a distinct end-use segment in the PVC Floor Covering Market, requiring hygienic and safe flooring systems. In the healthcare industry alone, more than USD 3.6 trillion is expected to be spent on new facilities by 2027, with a substantial portion of these buildings adopting seamless PVC flooring to meet sanitation protocols.

For example, vinyl sheet flooring is extensively used in operating rooms and pharmaceutical manufacturing spaces due to its ability to provide sterile, monolithic surfaces. In education, classrooms and corridors benefit from scratch-resistant and anti-slip vinyl flooring that can endure daily wear while maintaining visual appeal. This sector’s demand is stable and resilient, making it a reliable pillar for market stability.

Online Sales and Digital Visualization Tools Reshaping PVC Floor Covering Market Access

Distribution channels in the PVC Floor Covering Market are evolving rapidly. E-commerce platforms are becoming prominent, especially in urban and suburban markets where digital-first buyers dominate. For instance, leading flooring brands now offer sample deliveries and augmented reality room visualizers that allow customers to view how a product will look before purchasing.

Online sales grew by more than 30% year-over-year between 2022 and 2024 in key markets like the U.S. and South Korea. This shift not only reduces dependency on traditional showrooms but also enables small-scale manufacturers to reach broader audiences. As a result, digital transformation is emerging as a critical growth enabler in the global PVC Floor Covering Market.

Global Production Hubs Strengthening Supply Chain Efficiency in PVC Floor Covering Market

The PVC Floor Covering Market benefits from a geographically diverse production landscape. China, Vietnam, and South Korea lead the way, supported by advanced manufacturing facilities, vertical integration, and streamlined logistics. China alone accounts for nearly 46% of global exports, making it a vital player in global supply chains.

Vietnam and South Korea contribute 9.9% and 8.3% respectively, with a focus on quality control and sustainable production. Their trade relationships with the EU and North America offer a competitive edge in tariff management and shipping timelines. This manufacturing base not only satisfies global demand but also ensures resilience against supply chain disruptions, reinforcing the PVC Floor Covering Market’s global scalability.

Key Manufacturers Shaping the Global PVC Floor Covering Market

The PVC Floor Covering Market is dominated by a diverse group of global and regional players, each leveraging product innovation, distribution strength, and sustainability strategies to expand their market presence. These companies cater to a wide range of applications, from luxury residential flooring to industrial-grade solutions, and their contributions play a crucial role in setting quality benchmarks and influencing consumer preferences.

Mohawk Industries Inc. – Comprehensive Product Portfolio in PVC Floor Covering Market

Mohawk Industries is a leading name in the PVC Floor Covering Market, recognized for its wide-ranging product lines including SolidTech and Pergo Extreme. These vinyl flooring solutions are engineered to offer superior durability, water resistance, and scratch resistance. The Pergo Extreme series, for instance, is designed specifically for high-traffic commercial and residential spaces where aesthetics and performance must go hand in hand.

The company has continued to invest in next-generation printing and texturing technologies to make its LVT lines more realistic in design. Its presence in both the U.S. and international markets ensures extensive brand visibility, and the company’s vertical integration enables competitive pricing and rapid supply chain adaptability.

Shaw Industries Group – Leading LVT Innovator in PVC Floor Covering Market

Shaw Industries, a Berkshire Hathaway company, commands a strong position in the PVC Floor Covering Market with innovative product lines such as Floorté and Paragon. The Floorté waterproof series is especially notable for its rigid core construction, which combines the natural look of hardwood with the resilience of vinyl.

Shaw’s emphasis on sustainability is evident in its Cradle to Cradle Certified™ flooring products and commitment to reducing emissions across its production lines. The company has also expanded its recycling initiatives, turning post-consumer vinyl waste into new flooring products, aligning with growing eco-conscious demand in the global PVC Floor Covering Market.

Armstrong Flooring – Trusted Brand with Healthcare and Commercial Solutions

Armstrong Flooring has long been a trusted supplier in the PVC Floor Covering Market, particularly in the healthcare and institutional segments. Its product lines such as Safety Zone, Striations BBT Bio-Flooring, and Natural Creations with Diamond 10 Technology are tailored for environments requiring slip resistance, low VOC emissions, and high wear resistance.

Diamond 10 Technology, in particular, offers advanced scratch and stain resistance, making it a go-to choice for hospitals, schools, and commercial offices. Armstrong’s focus on high-performance and easy-maintenance flooring has made it a preferred brand among architects and facilities managers in North America and beyond.

Tarkett S.A. – European Giant in Sustainable PVC Floor Covering Market

Tarkett, headquartered in France, is a global heavyweight in the PVC Floor Covering Market with a product lineup that includes iD Inspiration, Starfloor Click Ultimate, and Acczent Excellence. These vinyl flooring lines are designed for both residential and commercial applications, offering a combination of visual appeal, durability, and acoustic insulation.

The company has heavily invested in closed-loop recycling and sustainable product development. Its ReStart® take-back program allows customers to return used flooring, which Tarkett then recycles into new products. The company’s strong presence across Europe, North America, and Asia gives it an edge in addressing diverse consumer preferences and regional standards.

Mannington Mills Inc. – Design-Driven Products for Residential and Commercial Sectors

Mannington Mills, a U.S.-based manufacturer, brings a strong design philosophy to the PVC Floor Covering Market. Its standout lines such as Adura Max, Adura Rigid, and Benchmark® target homeowners, retailers, and office spaces seeking premium aesthetics with robust wear performance.

Adura Max, in particular, offers superior sound absorption and waterproof properties, making it a top pick in multi-family housing and hospitality environments. Mannington’s emphasis on in-house design and pattern development allows it to consistently offer trending looks that cater to dynamic consumer tastes.

Gerflor Group – Specialized Vinyl Flooring for Sports and Healthcare Applications

Gerflor is a leading name in the specialized segment of the PVC Floor Covering Market, especially for sports facilities and healthcare institutions. Its product range includes Taralay Impression, Mipolam Biocontrol, and Creation 70, each designed to meet performance and hygiene standards in demanding environments.

The company’s Mipolam range, for example, is widely used in cleanrooms and laboratories for its anti-bacterial and anti-fungal properties. Gerflor’s robust R&D and adherence to international health and safety standards have strengthened its position across Europe, the Middle East, and Asia-Pacific.

Forbo Flooring Systems – High-Performance Vinyl Solutions in PVC Floor Covering Market

Forbo is another key manufacturer contributing to the innovation and growth of the PVC Floor Covering Market. Although well-known for linoleum, Forbo’s vinyl lines such as Eternal, Sarlon, and Allura offer specialized solutions for commercial offices, transportation, and educational facilities.

The Eternal collection, in particular, is appreciated for its durability and modern designs suited to corporate and public sector interiors. Forbo’s integration of noise-reduction technologies and anti-slip features positions it well for applications requiring both safety and design.

Karndean Designflooring – Luxury Segment Leader in PVC Floor Covering Market

Karndean has carved a niche in the luxury vinyl tile space with its Van Gogh, Knight Tile, and Korlok Select collections. These products emphasize realism, with intricate textures and visuals inspired by natural wood and stone. The rigid core Korlok Select range also features waterproofing and acoustic insulation, making it ideal for upscale residential and boutique commercial settings.

The company focuses heavily on interior design collaboration and trend forecasting, enabling it to maintain a loyal customer base that values aesthetics and uniqueness. Karndean’s focus on visual storytelling through its flooring collections keeps it competitive in the premium PVC Floor Covering Market segment.

NOX Corporation – South Korea’s Export Powerhouse in PVC Floor Covering Market

NOX Corporation is a South Korean manufacturer that has established itself as a major exporter of luxury vinyl tiles, supplying to North America, Europe, and the Middle East. Product lines such as NOXGEN, Supreme Tile, and Essenz are well known for their superior dimensional stability and GreenGuard Gold certification, making them suitable for eco-conscious projects.

NOX’s commitment to innovation is evident in its proprietary manufacturing technologies, such as the multi-layer glass fiber reinforcement that enhances product strength and flexibility. The company’s strong export orientation and investment in automation allow it to scale quickly in response to international demand.

Recent Developments in the PVC Floor Covering Market

– In February 2024, Tarkett announced a strategic expansion of its LVT production capacity in Germany to address the growing demand for eco-labeled flooring solutions across Europe. This move will help reduce lead times and boost regional supply capabilities.

– In January 2024, Mohawk Industries unveiled an upgraded version of its SolidTech line featuring enhanced scratch resistance and deeper embossing to meet evolving residential flooring preferences.

– In November 2023, Shaw Industries launched a sustainability roadmap focused on using 100% recycled content in all of its PVC floor coverings by 2028, signaling a significant industry shift toward greener production.

– In October 2023, Armstrong Flooring re-entered the Southeast Asian market through a strategic distribution partnership, aiming to tap into fast-growing commercial construction segments in Malaysia, Indonesia, and Thailand.

– In September 2023, Karndean Designflooring launched new collections under the Van Gogh and Knight Tile lines, emphasizing biophilic design trends inspired by natural materials and patterns.

These recent advancements highlight the industry’s focus on innovation, sustainability, and regional expansion, reinforcing the long-term potential of the PVC Floor Covering Market across diverse sectors and geographies. As leading manufacturers continue to adapt to regulatory pressures, design trends, and shifting consumer expectations, the market is set for a phase of sustained and strategic evolution.

Market Scenario, Demand vs Supply, Average Product Price, Import vs Export, till 2035

- Global PVC Floor Covering Market revenue and demand by region

- Global PVC Floor Covering Market production and sales volume

- United States PVC Floor Covering Market revenue size and demand by country

- Europe PVC Floor Covering Market revenue size and demand by country

- Asia Pacific PVC Floor Covering Market revenue size and demand by country

- Middle East & Africa PVC Floor Covering Market revenue size and demand by country

- Latin America PVC Floor Covering Market revenue size and demand by

- Import-export scenario – United States, Europe, APAC, Latin America, Middle East & Africa

- Average product price – United States, Europe, APAC, Latin America, Middle East & Africa

- Market player analysis, competitive scenario, market share analysis

- Business opportunity analysis

Key questions answered in the Global PVC Floor Covering Market Analysis Report:

- What is the market size for PVC Floor Covering in United States, Europe, APAC, Middle East & Africa, Latin America?

- What is the yearly sales volume of PVC Floor Covering and how is the demand rising?

- Who are the top market players by market share, in each product segment?

- Which is the fastest growing business/ product segment?

- What should be the business strategies and Go to Market strategies?

The report covers PVC Floor Covering Market revenue, Production, Sales volume, by regions, (further split into countries):

- Asia Pacific (China, Japan, South Korea, India, Indonesia, Vietnam, Rest of APAC)

- Europe (UK, Germany, France, Italy, Spain, Benelux, Poland, Rest of Europe)

- North America (United States, Canada, Mexico)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa

Table of Contents:

PVC Floor Covering Market

- Introduction to PVC Floor Covering Market

- Overview of PVC Floor Coverings and Their Applications

- Key Advantages Over Traditional Flooring Materials

- Industry Growth Trends and Market Potential

- Market Segmentation of PVC Floor Covering

- By Product Type (Vinyl Sheet Flooring, Vinyl Tiles, Luxury Vinyl Planks, Homogeneous & Heterogeneous Flooring)

- By Installation Method (Glue-down, Loose-lay, Click-lock, Self-adhesive)

- By End-use Sector (Residential, Commercial, Healthcare, Industrial, Educational, Sports & Recreation)

- By Design & Texture (Embossed, Matte, Glossy, Wood-look, Stone-look, Custom Patterns)

- Global PVC Floor Covering Market Trends (2025-2035)

- Increasing Demand for Waterproof and Durable Flooring Solutions

- Shift Towards Sustainable and Low-VOC PVC Floor Covering Production

- Challenges in Recycling and Environmental Regulations

- Emerging Opportunities in Smart and Anti-bacterial Flooring Technologies

- Regional Market Performance and Growth Analysis

- North America: Demand for Luxury Vinyl Flooring in Home Renovations

- Europe: Adoption of Eco-friendly PVC Floor Covering Solutions

- Asia Pacific: Expansion of Residential and Commercial Infrastructure Driving Demand

- Latin America: Market Potential in Industrial and Public Infrastructure Projects

- Middle East & Africa: Growth in Hospitality and Retail Sector Flooring Solutions

- Competitive Landscape and Market Share Analysis

- Key PVC Floor Covering Manufacturers and Their Market Share

- Strategies in Innovation, Product Quality, and Branding

- Industry Collaborations, Mergers, and Acquisitions

- PVC Floor Covering Production and Supply Chain Insights

- Global Production Capacities and Manufacturing Hubs

- Raw Materials Used in PVC Floor Covering Production and Procurement Strategies

- Supply Chain Optimization and Logistics Challenges

- Consumer Demand and Market Utilization Trends

- Preferences for Customization and Aesthetic Appeal in Flooring Solutions

- Increasing Adoption of Low-maintenance and Scratch-resistant PVC Flooring

- Market Drivers Influencing PVC Floor Covering Selection

- Pricing Trends and Cost Structure in PVC Floor Covering Production

- Cost Breakdown of PVC Floor Covering Manufacturing

- Price Variations by Material Composition and Quality Standards

- Influence of Raw Material Costs and Production Efficiency on Market Pricing

- Trade and International Market Flow Analysis

- Global Import and Export Trends for PVC Floor Covering

- Leading Exporting and Importing Countries in the Industry

- Impact of Trade Policies, Tariffs, and Regulatory Standards

- Technological Advancements in PVC Floor Covering Production

- Innovations in Wear Layer Protection and Scratch Resistance

- Development of Eco-friendly and Recyclable PVC Flooring Materials

- Smart Flooring Solutions: Integration of Anti-slip, Anti-bacterial, and Self-cleaning Technologies

- Investment and Business Growth Opportunities

- Emerging Markets for PVC Floor Covering Production and Sales

- Strategic Alliances and Market Entry Strategies

- Government Regulations and Incentives for Sustainable Flooring Production

- Market Forecast and Future Outlook (2025-2035)

- Growth Projections for the PVC Floor Covering Industry

- Future Demand Trends in Residential and Commercial Applications

- Challenges and Opportunities for PVC Floor Covering Manufacturers

- Conclusion and Strategic Recommendations

- Summary of Key Market Findings and Insights

- Recommendations for Manufacturers, Suppliers, and Investors

- Future Roadmap for Innovation and Market Expansion

Other recently published reports:

“Every Organization is different and so are their requirements”- Datavagyanik

Companies We Work With

Do You Want To Boost Your Business?

drop us a line and keep in touch