- Published 2024

- No of Pages: 200

- 20% Customization available

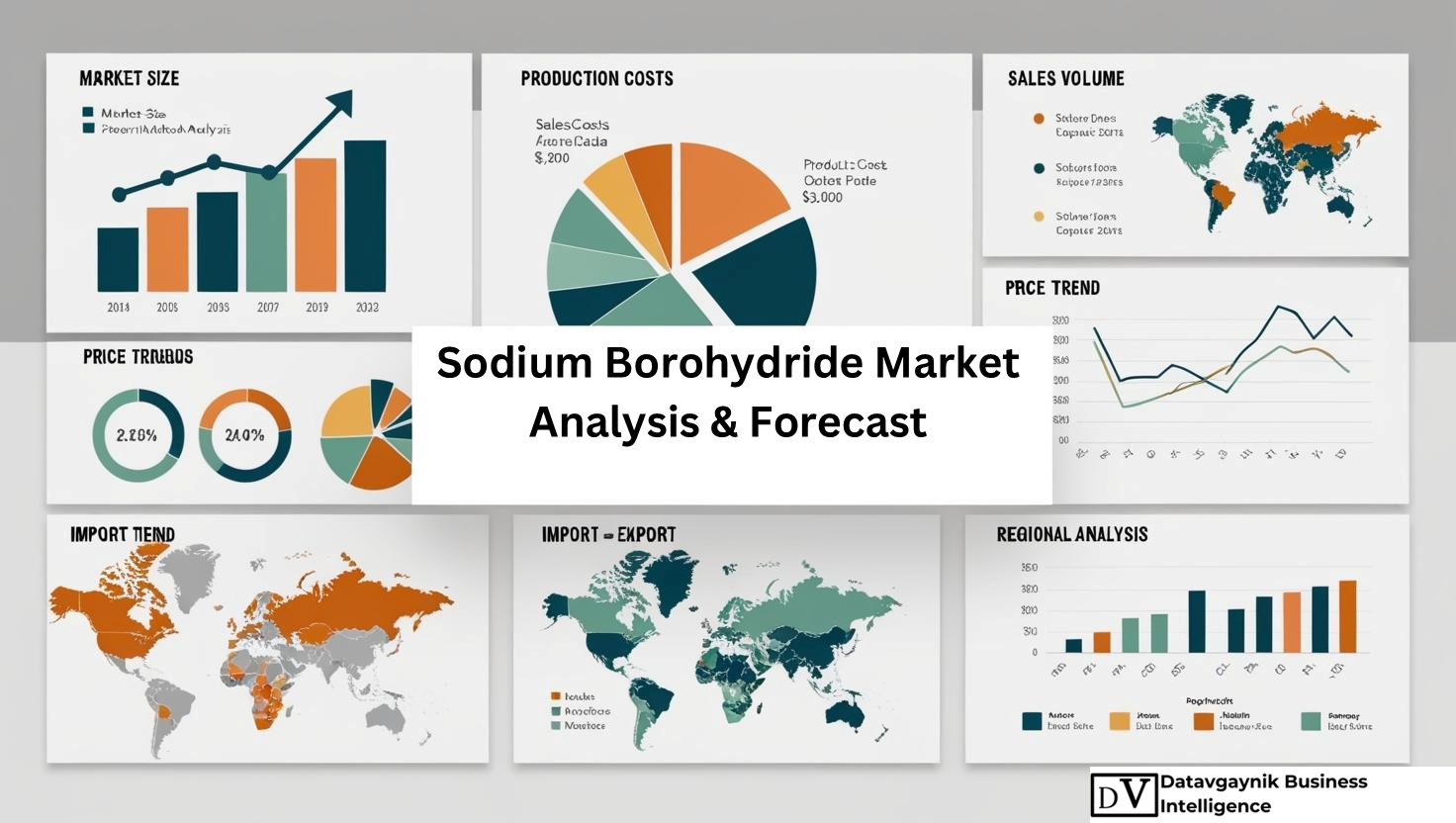

Global Sodium Borohydride Market Size, Production, Sales, Average Product Price, Market Share

Global Sodium Borohydride Market Revenue Size and Production Analysis, till 2032

Global Sodium Borohydride Market Size is expected to grow at an impressive rate during the timeframe (2024-2032). Sodium Borohydride demand is growing due to

- Increasing Use in Pharmaceutical Industry

Sodium borohydride is a key reducing agent in pharmaceutical manufacturing, particularly for producing intermediates like antibiotics, vitamins, and other specialty chemicals. The rising demand for pharmaceuticals globally, driven by population growth and aging demographics, directly contributes to sodium borohydride demand. - Growing Applications in Pulp and Paper Industry

Sodium borohydride is widely used in the pulp and paper industry for bleaching wood pulp, as it helps reduce the consumption of chlorine-based chemicals. The increasing emphasis on eco-friendly and sustainable paper production boosts its adoption. - Expanding Demand for Hydrogen Generation

Sodium borohydride is being explored as a hydrogen storage and generation material, particularly in fuel cell technologies. With a global focus on clean energy solutions, sodium borohydride’s role in providing hydrogen for transportation and energy applications is growing. - Rising Demand in Specialty Chemicals

Sodium borohydride is a crucial component in synthesizing fine and specialty chemicals, including fragrances, agrochemicals, and dyes. The growing need for high-value chemical compounds further drives demand. - Water Treatment Applications

Sodium borohydride is increasingly used in wastewater treatment and desulfurization processes to reduce pollutants like heavy metals. The growing focus on sustainable water management drives its use in this segment. - Growth in Research and Development

Advancements in chemical synthesis and the development of new applications, particularly in the renewable energy and chemical industries, have expanded the scope for sodium borohydride utilization.

Market Trends Driving Growth

- Sustainability Initiatives: Increased adoption in green chemistry practices.

- Technological Innovations: New hydrogen fuel cell systems relying on sodium borohydride.

- Rising Health Standards: Increased production of pharmaceuticals and fine chemicals.

United States Sodium Borohydride Market Trend and Business Opportunities

- Market Overview

The United States Sodium Borohydride market is witnessing steady growth due to its widespread applications in pharmaceuticals, paper and pulp, and specialty chemicals. With a growing emphasis on sustainability and technological advancements in hydrogen storage, the demand for sodium borohydride has increased in various sectors. The U.S. remains a prominent market, driven by innovation, strong industrial infrastructure, and investments in green energy technologies.

- Key Market Trends

- Rising Demand in the Pharmaceutical Sector

- Sodium borohydride plays a critical role in the synthesis of active pharmaceutical ingredients (APIs) and intermediates, particularly for antibiotics, vitamins, and specialized drugs.

- The U.S. pharmaceutical market is expanding rapidly, propelled by a focus on new drug discoveries and rising healthcare spending.

- The adoption of sodium borohydride for efficient and cost-effective reduction reactions is supporting market growth.

- Expansion of Clean Energy Applications

- Sodium borohydride is emerging as a promising material for hydrogen generation and fuel cell technologies.

- The U.S. government’s initiatives to reduce carbon emissions and promote hydrogen-based energy solutions drive its adoption.

- Research and pilot projects are exploring sodium borohydride as a safe and efficient hydrogen storage medium.

- Sustainable Pulp and Paper Processing

- Sodium borohydride is widely used for bleaching wood pulp as a sustainable and chlorine-free alternative.

- The U.S. paper industry’s push towards eco-friendly production processes enhances demand for sodium borohydride.

- Increased recycling of paper products also requires efficient chemical solutions, creating opportunities in the segment.

- Growing Specialty Chemicals Market

- Sodium borohydride is essential in the production of fine and specialty chemicals, such as dyes, fragrances, and agrochemical intermediates.

- The demand for high-performance chemicals in agriculture and consumer goods sectors is rising in the United States.

- Water Treatment and Environmental Solutions

- Sodium borohydride is increasingly used for treating wastewater, removing heavy metals, and reducing industrial pollutants.

- The focus on stringent environmental regulations and sustainable water management fuels the demand for sodium borohydride.

- Business Opportunities

- Innovation in Hydrogen Storage and Fuel Cells

- Companies focusing on renewable energy solutions and hydrogen-powered vehicles can explore sodium borohydride as a hydrogen source.

- Collaborating with research institutions and the U.S. Department of Energy for hydrogen technology development provides a significant business opportunity.

- Pharmaceutical Applications

- Expansion of production facilities to cater to the growing demand for sodium borohydride in drug manufacturing processes presents lucrative opportunities.

- Partnerships with pharmaceutical companies for customized supply solutions can provide long-term growth.

- Strategic Role in Paper and Pulp Industry

- Offering sodium borohydride-based solutions to pulp and paper manufacturers transitioning to sustainable processes opens new avenues.

- Investments in green bleaching technologies will further strengthen the sodium borohydride market’s position.

- Water Treatment Solutions

- Companies can leverage sodium borohydride for industrial and municipal wastewater treatment projects as environmental standards become stricter in the U.S.

- Positioning the chemical as a safe and effective desulfurization and heavy metal removal agent will enhance its market penetration.

- Focus on Specialty Chemical Manufacturers

- Collaboration with specialty chemical manufacturers for the production of dyes, fragrances, and agrochemicals can provide new business opportunities.

- Market Drivers

- Clean Energy Demand: Rising focus on hydrogen-based energy.

- Pharmaceutical Growth: Increased healthcare R&D and drug production.

- Environmental Regulations: Stricter water treatment and industrial emission norms.

- Eco-Friendly Solutions: Demand for sustainable bleaching processes in pulp and paper production.

- Challenges

- High Production Costs: Sodium borohydride manufacturing involves cost-intensive processes.

- Availability of Alternatives: Competition from other reducing agents such as lithium aluminum hydride.

- Storage and Handling Issues: Sodium borohydride is reactive and requires safe handling and transportation infrastructure.

- Recent Developments

- Advancements in hydrogen generation systems using sodium borohydride are being tested across clean energy pilot projects in the U.S.

- Investment in the modernization of pulp and paper plants has increased demand for eco-friendly bleaching chemicals.

- Pharmaceutical manufacturers are adopting sodium borohydride for efficient and cost-effective reduction reactions, driving supply agreements with key producers.

Europe Sodium Borohydride Market Trend and Business Opportunities by Country

- Market Overview

The Europe Sodium Borohydride market is experiencing significant growth, driven by rising demand in pharmaceuticals, pulp and paper, and clean energy applications. The market is propelled by Europe’s commitment to sustainability and green technologies, strict environmental regulations, and the expansion of pharmaceutical production. Countries like Germany, the UK, France, and Italy are leading contributors to demand, while emerging economies in Eastern Europe are showing strong growth potential.

- Key Market Trends

- Rising Pharmaceutical Manufacturing

- Sodium borohydride is critical for synthesizing active pharmaceutical ingredients (APIs) and intermediates.

- Countries like Germany and the UK are major hubs for pharmaceutical production, boosting sodium borohydride demand.

- The pharmaceutical industry’s focus on new drug development aligns with the chemical’s role as an efficient reducing agent.

- Sustainable Pulp and Paper Industry

- Europe is a leader in sustainable practices, and sodium borohydride is increasingly used as a chlorine-free bleaching agent.

- Scandinavian countries like Sweden and Finland, along with Germany, are adopting sodium borohydride to meet sustainability targets.

- Green Hydrogen Production

- Sodium borohydride is emerging as a viable material for hydrogen generation and storage, supporting Europe’s Net-Zero Carbon 2050 goals.

- Countries like Germany and the Netherlands are investing heavily in clean energy solutions, creating opportunities for sodium borohydride in hydrogen fuel cell technologies.

- Increasing Adoption in Water Treatment

- Sodium borohydride is used in industrial wastewater treatment to remove heavy metals and other pollutants.

- Countries like France, Italy, and Spain are adopting advanced water treatment processes to meet stringent EU environmental norms.

- Business Opportunities by Country

- Germany: Leading Pharmaceutical and Paper Industries

- Pharmaceutical Sector: Germany is Europe’s largest pharmaceutical market. Investments in API production and drug synthesis drive sodium borohydride demand.

- Pulp and Paper: Germany’s large paper manufacturing sector is transitioning toward eco-friendly bleaching processes.

- Clean Energy: Hydrogen projects supported by the German government create significant opportunities for sodium borohydride.

Opportunity: Partnerships with pharmaceutical manufacturers and hydrogen technology developers.

- United Kingdom: Growth in Specialty Chemicals

- The UK is witnessing increased demand for sodium borohydride in specialty chemical production, including dyes, fragrances, and agrochemicals.

- Hydrogen-based energy solutions are growing due to the UK’s push for decarbonization by 2035.

Opportunity: Supply agreements with specialty chemical manufacturers and clean energy pilot projects.

- France: Pharmaceutical and Water Treatment Focus

- France is a key player in the pharmaceutical industry, driving sodium borohydride usage in drug production.

- The country’s emphasis on clean water initiatives boosts adoption in industrial wastewater treatment and pollutant removal.

Opportunity: Investments in pharmaceutical supply chains and water treatment solutions.

- Italy: Expansion in Pulp and Paper Sector

- Italy’s paper manufacturing industry is shifting towards sustainable processes using sodium borohydride for bleaching.

- Water treatment facilities in Italy are increasingly adopting sodium borohydride to comply with EU environmental regulations.

Opportunity: Partnerships with pulp and paper manufacturers and industrial water treatment facilities.

- Spain: Emerging Paper Industry and Water Management

- Spain is rapidly developing its pulp and paper industry, supported by sodium borohydride’s sustainable benefits.

- Industrial wastewater treatment projects are creating demand for sodium borohydride solutions in Spain.

Opportunity: Supplying cost-effective sodium borohydride solutions for water treatment and paper production.

- Eastern Europe: Growing Market Potential

- Countries like Poland, Czech Republic, and Hungary are experiencing industrial growth, particularly in pharmaceuticals and paper production.

- Lower production costs and growing investments in clean technologies present strong opportunities for sodium borohydride adoption.

Opportunity: Establishing regional production and distribution hubs to cater to emerging demand.

- Market Drivers in Europe

- Pharmaceutical Demand: Strong drug manufacturing and R&D investments.

- Sustainability Goals: Europe’s focus on chlorine-free bleaching and eco-friendly processes.

- Clean Energy Transition: Hydrogen generation projects and fuel cell applications.

- Water Treatment Regulations: Strict EU environmental standards driving pollutant removal.

- Challenges

- High Production Costs: Sodium borohydride production remains capital-intensive.

- Competition from Alternatives: Competing reducing agents limit its market share.

- Regulatory Compliance: Strict handling and safety protocols increase operational complexity.

- Recent Developments

- Expansion of hydrogen fuel cell projects in Germany and the Netherlands.

- Investments in sustainable paper manufacturing technologies in Sweden and Germany.

- EU-funded initiatives for improving wastewater treatment processes in France and Spain.

Middle East Sodium Borohydride Market Trend and Business Opportunities by Country

- Market Overview

The Middle East Sodium Borohydride market is poised for steady growth, driven by rising demand in pharmaceutical manufacturing, water treatment, and clean energy initiatives. Countries such as Saudi Arabia, UAE, Qatar, and Oman are witnessing increasing adoption of sodium borohydride in industrial sectors, fueled by rapid urbanization, industrialization, and government-led investments in sustainability and water management projects. Additionally, the region’s growing focus on clean hydrogen aligns with sodium borohydride’s application in hydrogen generation.

- Key Market Trends

- Rising Pharmaceutical Production

- Sodium borohydride is essential in pharmaceutical synthesis, particularly for antibiotics and fine chemicals.

- Countries like Saudi Arabia and the UAE are investing heavily in pharmaceutical manufacturing as part of their economic diversification strategies.

- Water Treatment and Desalination Projects

- The Middle East faces critical water scarcity issues, leading to significant investments in water treatment and desalination plants.

- Sodium borohydride’s role in heavy metal removal and water purification processes makes it a valuable chemical for the region.

- Focus on Hydrogen Energy Solutions

- The Middle East is increasingly focusing on clean hydrogen production to diversify its energy mix. Sodium borohydride is emerging as a promising solution for hydrogen storage and fuel cells.

- Governments, particularly in Saudi Arabia and the UAE, are aligning with global Net Zero Carbon goals by investing in hydrogen infrastructure.

- Expansion of Pulp and Paper Industry

- While the pulp and paper industry is relatively smaller in the Middle East compared to other regions, countries like Saudi Arabia and UAE are witnessing steady growth in recycled paper production, which requires sodium borohydride for bleaching processes.

- Business Opportunities by Country

- Saudi Arabia: Leader in Pharmaceuticals and Water Management

- Pharmaceutical Sector: Saudi Arabia is expanding its pharmaceutical production to reduce dependence on imports. Sodium borohydride demand will increase for API and intermediate synthesis.

- Water Treatment: Saudi Arabia is home to some of the world’s largest desalination plants, creating opportunities for sodium borohydride in pollutant removal.

- Clean Energy: The country’s ambitious Neom hydrogen project aligns with sodium borohydride’s role in hydrogen storage.

Opportunity: Collaboration with water treatment facilities and pharmaceutical manufacturers; investment in clean hydrogen pilot projects.

- United Arab Emirates (UAE): Growth in Clean Energy and Pharmaceuticals

- The UAE is rapidly advancing its clean energy agenda with projects such as the Masdar Clean Hydrogen Initiative. Sodium borohydride can play a role in hydrogen generation and storage.

- Pharmaceutical manufacturing in the UAE is growing, driven by government policies encouraging local production.

Opportunity: Supply sodium borohydride for pharmaceutical production and clean energy projects.

- Qatar: Focus on Clean Energy and Water Solutions

- Qatar is prioritizing hydrogen fuel production and clean energy technologies as part of its diversification goals under the Qatar National Vision 2030.

- The country’s investment in wastewater treatment and environmental sustainability creates demand for sodium borohydride.

Opportunity: Partnerships with clean energy developers and water treatment plants.

- Oman: Rising Investments in Water Treatment

- Oman is investing heavily in desalination plants and industrial wastewater treatment to address its water scarcity challenges. Sodium borohydride’s role in water purification is crucial for these projects.

- The government’s push for industrial growth also includes opportunities for sodium borohydride in niche chemical applications.

Opportunity: Supply sodium borohydride for water treatment plants and support emerging industrial sectors.

- Kuwait: Focus on Industrial Applications

- Kuwait’s industrial sector, including specialty chemicals and water treatment, is growing, creating opportunities for sodium borohydride.

- Rising investments in infrastructure and sustainability align with its use in pollutant reduction and hydrogen technologies.

Opportunity: Collaborate with chemical manufacturers and water management companies.

- Market Drivers in the Middle East

- Water Scarcity Solutions: Heavy investments in desalination and wastewater treatment.

- Pharmaceutical Growth: Localized manufacturing of drugs and intermediates to reduce imports.

- Clean Energy Transition: Adoption of hydrogen fuel technology and Net Zero Carbon goals.

- Industrial Diversification: Rising investments in specialty chemicals and sustainable infrastructure.

- Challenges

- High Production Costs: Sodium borohydride’s manufacturing remains cost-intensive.

- Technical Constraints: Limited technological infrastructure for sodium borohydride applications in some countries.

- Competition from Alternatives: Adoption of other reducing agents in industrial processes.

- Recent Developments

- Launch of green hydrogen projects in Saudi Arabia and the UAE to support carbon neutrality.

- Investments in desalination infrastructure across Oman and Qatar, driving demand for water treatment chemicals.

- Pharmaceutical industry expansion in Saudi Arabia and UAE as part of national diversification plans.

- Conclusion: Business Opportunities

The Middle East Sodium Borohydride market presents significant opportunities across water treatment, pharmaceuticals, and clean energy sectors. Key opportunities by country include:

- Saudi Arabia: Water treatment, pharmaceutical synthesis, and hydrogen energy projects.

- UAE: Hydrogen initiatives and expanding pharmaceutical production.

- Qatar: Clean energy infrastructure and wastewater treatment plants.

- Oman: Desalination projects and industrial applications.

- Kuwait: Growth in specialty chemicals and industrial water treatment.

Asia Pacific Sodium Borohydride Market Trend and Business Opportunities by Country

- Market Overview

The Asia Pacific Sodium Borohydride market is growing rapidly due to increasing demand in pharmaceuticals, pulp and paper, water treatment, and hydrogen energy technologies. Countries such as China, India, Japan, South Korea, and Southeast Asian nations are driving demand, supported by industrial expansion, rising pharmaceutical production, and government initiatives for clean energy and sustainable industrial practices.

- Key Market Trends

- Expanding Pharmaceutical Industry

- The Asia Pacific region is a leading hub for pharmaceutical production and generic drug manufacturing. Sodium borohydride is widely used as a reducing agent in the production of antibiotics, vitamins, and active pharmaceutical ingredients (APIs).

- Countries like China and India dominate the global pharmaceutical supply chain.

- Growth in Pulp and Paper Industry

- Sodium borohydride is critical for chlorine-free bleaching in pulp and paper manufacturing.

- Rising demand for sustainable packaging, driven by e-commerce growth, is boosting production in China, Japan, and Southeast Asia.

- Focus on Water Treatment Solutions

- With increasing water scarcity and pollution, sodium borohydride is gaining traction as a solution for industrial wastewater treatment and desalination projects in countries like India and China.

- Advancements in Clean Energy and Hydrogen Technologies

- Sodium borohydride is emerging as a viable solution for hydrogen generation and storage in clean energy projects.

- Governments in countries like Japan and South Korea are investing heavily in hydrogen fuel cell technologies to achieve carbon neutrality.

- Specialty Chemicals Growth

- Rising production of specialty chemicals such as dyes, agrochemicals, and intermediates in countries like China, India, and South Korea is boosting sodium borohydride demand.

- Business Opportunities by Country

- China: Dominating the Industrial and Pharmaceutical Sectors

- Pharmaceutical Industry: China is the largest producer of APIs globally. Sodium borohydride is in high demand for its role in efficient drug manufacturing.

- Pulp and Paper: China leads global paper production, with increasing adoption of chlorine-free bleaching methods.

- Water Treatment: Rising industrial wastewater treatment and pollution control projects are creating opportunities for sodium borohydride suppliers.

Opportunity: Supply chain partnerships with pharmaceutical manufacturers and paper producers; investments in water treatment projects.

- India: Growing Pharmaceutical and Water Treatment Sectors

- Pharmaceutical Industry: India is the world’s largest producer of generic medicines. Sodium borohydride is widely used in drug synthesis and fine chemicals.

- Water Treatment: Rapid industrialization and urbanization have created a need for industrial wastewater management solutions.

- Specialty Chemicals: India is becoming a hub for specialty chemical production, including dyes and agrochemicals.

Opportunity: Strategic partnerships with pharmaceutical and chemical companies; supply solutions for wastewater treatment projects.

- Japan: Focus on Clean Energy and High-Value Chemicals

- Hydrogen Energy: Japan is a leader in hydrogen fuel cell technology and clean energy innovations. Sodium borohydride is gaining importance for hydrogen storage and generation applications.

- Specialty Chemicals: Japan’s demand for high-quality specialty chemicals drives sodium borohydride consumption.

Opportunity: Collaborations with hydrogen energy developers and chemical manufacturers for tailored sodium borohydride solutions.

- South Korea: Advancements in Hydrogen Fuel Cells

- Hydrogen Technology: South Korea is investing heavily in hydrogen-powered vehicles and clean energy infrastructure. Sodium borohydride’s role in hydrogen generation presents a lucrative opportunity.

- Specialty Chemicals: The growing demand for chemicals in electronics and agrochemicals supports sodium borohydride usage.

Opportunity: Supply agreements with clean energy companies and specialty chemical producers.

- Southeast Asia: Emerging Market Potential

- Countries like Indonesia, Vietnam, Malaysia, and Thailand are witnessing rapid industrialization and growing demand for sodium borohydride in:

- Water treatment: Industrial wastewater and pollution control.

- Pulp and paper: Rising production of paper for packaging and exports.

- Pharmaceuticals: Expanding regional pharmaceutical industries.

Opportunity: Establishing regional production hubs and collaborations with local manufacturers to cater to rising demand.

- Market Drivers in Asia Pacific

- Pharmaceutical Growth: Increasing production of APIs, intermediates, and specialty drugs.

- Sustainability Goals: Adoption of sodium borohydride in chlorine-free bleaching processes.

- Water Scarcity: Demand for effective wastewater treatment solutions.

- Clean Energy Transition: Investments in hydrogen technologies and carbon neutrality goals.

- Industrial Growth: Rising specialty chemical production across China, India, and Southeast Asia.

- Challenges

- High Production Costs: Cost-intensive manufacturing processes impact price competitiveness.

- Regulatory Barriers: Stringent environmental regulations in certain countries may require additional compliance efforts.

- Technical Infrastructure: Limited technological adoption in some emerging markets may slow sodium borohydride penetration.

- Recent Developments

- Japan and South Korea have launched large-scale hydrogen energy pilot projects, exploring sodium borohydride as a hydrogen carrier.

- India announced investments in industrial wastewater management, driving demand for water treatment chemicals.

- China continues to dominate the production and export of sodium borohydride for pharmaceuticals and specialty chemicals.

Global Sodium Borohydride Analysis by Market Segmentation

1. Market Overview

The global Sodium Borohydride market is growing due to increasing demand in pharmaceuticals, pulp and paper, water treatment, and clean energy sectors. The chemical’s versatility as a reducing agent, hydrogen carrier, and water treatment component makes it integral to various industries. Market growth is driven by advancements in clean energy, drug manufacturing, and sustainability initiatives across key regions.

2. Market Segmentation

a. By Application

| Application | Market Share (%) | Key Insights |

| Pharmaceuticals | 40% | – Dominant application segment. – Used in API synthesis, antibiotics, and vitamins. – Growth in drug production globally fuels demand. |

| Pulp and Paper | 25% | – Sodium borohydride serves as a chlorine-free bleaching agent. – Rising adoption of eco-friendly paper production methods drives growth. |

| Water Treatment | 15% | – Growing focus on industrial wastewater treatment and desalination projects. – High demand for sodium borohydride in heavy metal removal. |

| Clean Energy | 12% | – Emerging use in hydrogen generation and storage for fuel cell technologies. – Hydrogen projects in developed economies are driving adoption. |

| Others | 8% | – Includes specialty chemicals, dyes, and agrochemical production. – Growth in high-value chemical markets in Asia Pacific. |

b. By Product Form

| Product Form | Market Share (%) | Key Insights |

| Powder/Granular | 60% | – Most commonly used form in pharmaceuticals, pulp and paper, and chemical industries. – High efficiency in industrial applications. |

| Solution | 25% | – Increasing preference for liquid sodium borohydride in water treatment and clean energy. |

| Pellets | 15% | – Used where controlled reactivity and handling are critical. – Growing demand in niche applications. |

c. By End-Use Industry

| Industry | Market Share (%) | Key Insights |

| Pharmaceuticals | 40% | – Leading segment driven by the synthesis of APIs and drug intermediates. – Increasing investments in R&D in the pharmaceutical sector. |

| Pulp and Paper | 20% | – Rising global production of chlorine-free paper to meet sustainability goals. |

| Water Treatment | 15% | – Sodium borohydride’s role in pollutant removal and wastewater treatment boosts growth. |

| Energy | 12% | – Hydrogen generation for clean energy solutions, especially in fuel cell technologies. |

| Specialty Chemicals | 13% | – Growth in high-performance chemicals, dyes, agrochemicals, and fine chemical production. |

d. By Region

| Region | Market Share (%) | Key Insights |

| Asia Pacific | 42% | – Largest market driven by pharmaceutical and chemical production in China and India. – Rising industrial wastewater treatment initiatives. |

| North America | 25% | – Strong demand in pharmaceuticals and growing clean energy projects in the U.S.. – Increasing focus on sustainable industrial practices. |

| Europe | 18% | – Driven by sustainable pulp and paper manufacturing and hydrogen projects. – Strict environmental regulations boost water treatment demand. |

| Middle East & Africa | 8% | – Focus on desalination plants and clean hydrogen technologies in countries like Saudi Arabia and the UAE. |

| Latin America | 7% | – Emerging demand in pharmaceuticals and water treatment industries. |

3. Key Market Drivers

- Rising Pharmaceutical Demand: Growing production of APIs, antibiotics, and vitamins fuels sodium borohydride adoption.

- Sustainability Initiatives: Adoption of sodium borohydride in chlorine-free bleaching in pulp and paper industries.

- Clean Energy Transition: Increasing use of sodium borohydride in hydrogen storage for fuel cell technologies.

- Water Treatment Needs: Rising investments in industrial and municipal wastewater treatment projects.

- Emerging Markets Growth: Asia Pacific and Middle Eastern markets are driving sodium borohydride demand through industrial growth.

4. Challenges

- High Production Costs: Sodium borohydride manufacturing remains capital-intensive.

- Competition from Alternatives: Other reducing agents and technologies can impact market growth.

- Storage and Handling Issues: Sodium borohydride is reactive and requires strict safety measures.

5. Business Opportunities

- Pharmaceuticals: Collaborate with API manufacturers and expand supply chains in Asia and North America.

- Water Treatment: Invest in sustainable wastewater treatment solutions for industrial and municipal applications.

- Clean Energy: Focus on sodium borohydride-based hydrogen generation technologies in developed markets like the U.S., Japan, and South Korea.

- Pulp and Paper: Partner with paper manufacturers transitioning to chlorine-free bleaching processes.

- Regional Expansion: Establish production facilities in emerging markets like India, Southeast Asia, and the Middle East.

Sodium Borohydride Production and Import-Export Scenario

- Production Overview

Sodium borohydride (NaBH₄) is primarily produced through a chemical reaction involving sodium hydride and boron trifluoride in a solvent. The global production process of sodium borohydride varies slightly based on the specific needs of the industry and market, but the fundamental process remains largely similar across the world. The main producers of sodium borohydride are typically located in regions with strong industrial and chemical manufacturing capabilities.

Key Global Producers

- China: China is the largest global producer of sodium borohydride. With its well-established chemical industry and growing demand for sodium borohydride in pharmaceuticals, paper production, and clean energy, China remains the dominant player.

- United States: The U.S. is a significant producer of sodium borohydride, driven by demand in the pharmaceutical industry, water treatment, and clean energy sectors.

- India: India’s growing pharmaceutical industry makes it one of the largest producers of sodium borohydride, particularly for use in the synthesis of active pharmaceutical ingredients (APIs).

- European Union (Germany, France, UK): The EU is a notable producer, particularly due to the demand for sodium borohydride in eco-friendly pulp and paper manufacturing and wastewater treatment.

Production Techniques

- Direct Synthesis: The most common method, involving a direct reaction between sodium hydride and boron trifluoride. This method allows for efficient production of sodium borohydride in large quantities.

- Alternative Routes: Some producers use sodium borohydride in solution phase or alternative reactions based on other chemicals. The choice of method depends on market demand, cost, and application requirements.

- Import and Export Scenario

- Major Exporting Countries

- China: As the largest producer, China is also the largest exporter of sodium borohydride. It exports significant quantities of sodium borohydride to countries in Asia, Europe, and North America. China’s competitive pricing and large-scale production capacity give it a leading edge in the global export market.

- United States: The U.S. exports sodium borohydride to Europe and Latin America, with a particular focus on its high-quality pharmaceutical-grade products.

- India: India exports sodium borohydride to countries in Asia Pacific and Europe, especially for use in pharmaceutical and chemical applications.

- Germany and Other EU Countries: Germany, a major player in both the chemical industry and the sustainable paper manufacturing sector, exports sodium borohydride to Eastern Europe, Middle East, and North America.

- Major Importing Countries

- United States: The U.S. imports sodium borohydride to meet the demand from industries like pharmaceuticals, water treatment, and clean energy. The U.S. imports sodium borohydride primarily from China, Germany, and India.

- Europe (Germany, UK, France): European countries import sodium borohydride to fulfill the requirements of industries like pharmaceuticals, pulp and paper, and water treatment. The EU relies on imports from China, India, and the U.S. to meet its demand.

- Japan and South Korea: Both countries import sodium borohydride for use in their hydrogen fuel cell technologies and specialty chemical production. They primarily import from China and Germany.

- Southeast Asia (Indonesia, Malaysia, Thailand): Growing industrial and pharmaceutical sectors in Southeast Asia lead to increasing imports of sodium borohydride. Countries in this region import sodium borohydride mainly from China and India.

- Trade Routes

- Asia-Pacific to Europe & North America: The primary trade route for sodium borohydride is from Asia (mainly China and India) to Europe and North America due to the high demand in the pharmaceutical and specialty chemicals industries.

- Intra-Asia Trade: There is a growing intra-Asian trade in sodium borohydride, especially with countries like China, India, and Japan playing key roles. Southeast Asian countries are also seeing increased imports from regional producers like China.

- Europe to Middle East & Africa: Europe exports sodium borohydride to the Middle East and Africa, especially for industrial applications like pulp and paper and water treatment.

- Global Trade Flow and Market Dynamics

Key Export and Import Relationships

- China to United States, Europe, and Asia Pacific: China’s position as a low-cost producer makes it a dominant exporter to most regions, particularly in North America and Europe, where the demand for sodium borohydride in pharmaceuticals and clean energy is high.

- United States and Europe to Latin America & the Middle East: These regions rely on imports from both China and India, but there is also a significant trade flow from the U.S. and Germany, especially for high-quality sodium borohydride used in pharmaceuticals and specialized chemicals.

Trade Barriers and Challenges

- Tariffs and Regulatory Challenges: Tariffs and non-tariff barriers, such as regulatory restrictions and safety standards in various countries, may affect the sodium borohydride trade. Import tariffs in Europe and North America can impact pricing and availability.

- Sustainability and Safety Regulations: Stringent safety and environmental regulations in Europe and North America could affect imports. For instance, sodium borohydride needs to meet specific handling standards due to its reactive nature, which may limit the flow of low-quality products.

- Future Outlook

- Expanding Market for Clean Energy

- Hydrogen storage and fuel cell technology are expected to drive the future demand for sodium borohydride in regions like Europe and North America. As countries push towards carbon neutrality, the use of sodium borohydride in clean energy applications could increase, leading to shifts in trade flows and production priorities.

- Growth in Emerging Markets

- Asia Pacific (especially India and Southeast Asia) is expected to be a key driver for sodium borohydride demand in the coming years. As industrialization and urbanization accelerate, these countries will increase their imports of sodium borohydride, especially in sectors like pharmaceuticals, water treatment, and specialty chemicals.

- Increasing Pharmaceutical Production

- The global pharmaceutical industry will continue to be a major driver of sodium borohydride production and trade. Regions such as China, India, and Europe are expected to see sustained demand from drug manufacturing and API synthesis.

Market Scenario, Demand vs Supply, Average Product Price, Import vs Export, till 2032

- Global Sodium Borohydride Market revenue and demand by region

- Global Sodium Borohydride Market production and sales volume

- Import-export scenario

- Average product price

- Market player analysis, competitive scenario, market share analysis

- Business opportunity analysis

Key questions answered in the Global Sodium Borohydride Market Analysis Report:

- What is the market size for Sodium Borohydride?

- What is the yearly sales volume of Sodium Borohydride and how is the demand rising?

- Who are the top market players by market share, in each product segment?

- Which is the fastest growing business/ product segment?

- What should be the business strategies and Go to Market strategies?

The report covers Sodium Borohydride Market revenue, Production, Sales volume, by regions, (further split into countries):

- Asia Pacific (China, Japan, South Korea, India, Indonesia, Vietnam, Rest of APAC)

- Europe (UK, Germany, France, Italy, Spain, Benelux, Poland, Rest of Europe)

- North America (United States, Canada, Mexico)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa

Table of Contents:

- Product Overview and Scope of Sodium Borohydride

- Sodium Borohydride Segment Analysis by Product Category

- Global Sodium Borohydride Revenue Estimates and Forecasts (2019-2032)

- Global Sodium Borohydride Production Estimates and Forecasts (2019-2032)

- Market Competition by Manufacturers

- Global Sodium Borohydride Production by Manufacturers

- Global Sodium Borohydride Revenue Market Share by Manufacturers (2019-2023)

- Production Analysis

- Sodium Borohydride Production, Revenue, Price and Gross Margin (2019-2024)

- Sodium Borohydride Production VS Export

- Sodium Borohydride Consumption VS Import

- Consumption Analysis

- Sodium Borohydride Consumption by Region

- Sodium Borohydride Consumption by Product

- Sodium Borohydride Consumption Market Share by Product

- Segment by Machine Type

- Global Production of Sodium Borohydride by Product (2019-2024)

- Revenue Market Share by Product (2019-2024)

- Production, Revenue, Price and Gross Margin (2019-2024)

- Sodium Borohydride Manufacturing Cost Analysis

- Sodium Borohydride Key Raw Materials Analysis

- Key Raw Materials

- Key Suppliers of Raw Materials

- Proportion of Manufacturing Cost Structure

- Sodium Borohydride Industrial Chain Analysis

- Marketing Channel, Distributors and Customers

- Sodium Borohydride Distributors List

- Sodium Borohydride Sales Partners

- Sodium Borohydride Customers List

- Production and Supply Forecast

“Every Organization is different and so are their requirements”- Datavagyanik

Companies We Work With

Do You Want To Boost Your Business?

drop us a line and keep in touch