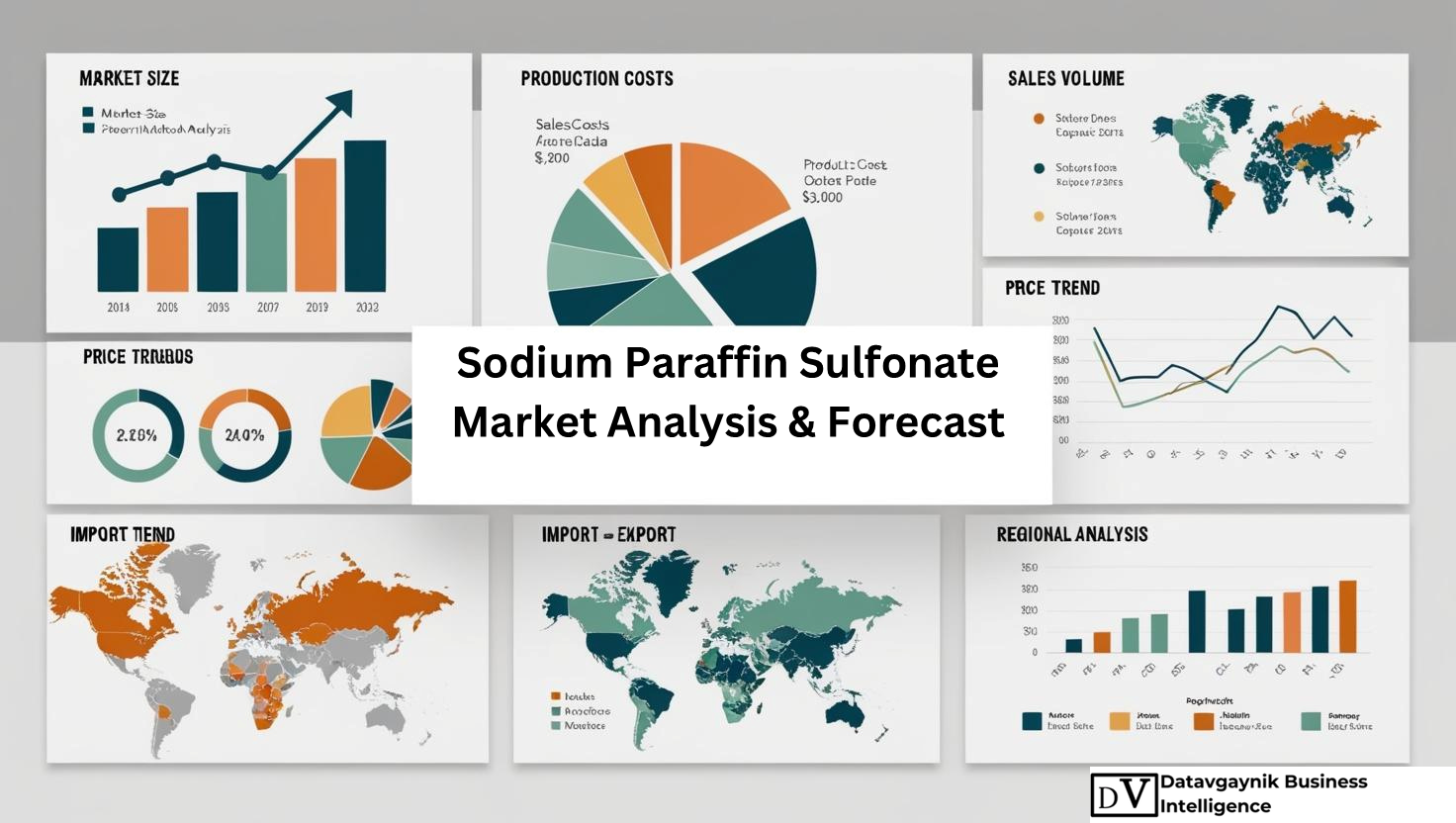

Sodium Paraffin Sulfonate Market Size, Production, Sales, Average Product Price, Market Share, Import vs Export

- Published 2025

- No of Pages: 120+

- 20% Customization available

Overview of the Sodium Paraffin Sulfonate Market

The Sodium Paraffin Sulfonate Market has experienced notable growth in recent years due to its increasing use across various industrial and consumer applications. Sodium Paraffin Sulfonate is widely recognized for its exceptional surfactant properties, which make it a key ingredient in detergents, personal care products, and industrial cleaners. As industries worldwide continue to prioritize efficiency and sustainability, the demand for this chemical has surged, creating numerous opportunities for market expansion. For example, the global shift toward sulfate-free and environmentally friendly cleaning agents has led manufacturers to incorporate Sodium Paraffin Sulfonate into innovative formulations, further enhancing its market potential.

Rising Demand for Cleaning Solutions in the Sodium Paraffin Sulfonate Market

One of the primary drivers of the Sodium Paraffin Sulfonate Market is the growing demand for effective cleaning agents. Sodium Paraffin Sulfonate is highly valued for its excellent emulsification, foaming, and grease-removal properties, which make it a staple in household detergents and industrial cleaning solutions. For instance, in the industrial sector, the use of Sodium Paraffin Sulfonate in metalworking fluids has increased significantly, as manufacturers seek reliable surfactants that improve cleaning efficiency and reduce production downtime. This heightened demand is reflected in the rising production levels of Sodium Paraffin Sulfonate, as companies ramp up output to meet the needs of the expanding cleaning and maintenance industries.

Datavagyanik also covers related markets such as the Sodium hydroxyethyl sulfonate Market, the Calcium Sulfonate Market, and the Paraffin waxes Market. Exploring these markets offers a broader view of the industry landscape and how adjacent sectors influence the main topic.

Expanding Personal Care Sector in the Sodium Paraffin Sulfonate Market

The personal care industry has also emerged as a significant growth area for the Sodium Paraffin Sulfonate Market. With consumers increasingly seeking mild, sulfate-free products, Sodium Paraffin Sulfonate has become a preferred ingredient in shampoos, body washes, and facial cleansers. For example, leading personal care brands have introduced new product lines featuring Sodium Paraffin Sulfonate due to its gentle cleansing and effective foaming properties. This trend is further supported by data showing that the global personal care market has grown at an annual rate of approximately 4%, driven by rising disposable incomes and heightened awareness of skin-friendly ingredients. As a result, the Sodium Paraffin Sulfonate Market continues to benefit from this upward trajectory.

Industrial Applications Driving Growth in the Sodium Paraffin Sulfonate Market

Beyond cleaning and personal care, the Sodium Paraffin Sulfonate Market is gaining traction in various industrial applications. For example, in the oil and gas sector, Sodium Paraffin Sulfonate is widely used in enhanced oil recovery (EOR) techniques and drilling fluids, where it helps improve oil displacement and extraction efficiency. Similarly, the textile and leather industries rely on Sodium Paraffin Sulfonate as a wetting and dispersing agent, enhancing the absorption and uniformity of dyes and chemicals. These applications are growing steadily, as evidenced by the textile industry’s annual growth of approximately 3%, which further underscores the rising demand for this versatile surfactant.

The Role of Sustainability in the Sodium Paraffin Sulfonate Market

Sustainability initiatives have significantly influenced the Sodium Paraffin Sulfonate Market, prompting manufacturers to develop eco-friendly and biodegradable surfactant solutions. As environmental regulations become more stringent, companies are investing in research and development to produce Sodium Paraffin Sulfonate formulations that meet global standards while maintaining performance. For instance, recent innovations have led to the creation of bio-based Sodium Paraffin Sulfonate, which not only reduces environmental impact but also aligns with consumer preferences for greener products. This focus on sustainability is expected to drive long-term growth in the Sodium Paraffin Sulfonate Market, as industries continue to seek sustainable alternatives without compromising quality and efficacy.

Future Outlook of the Sodium Paraffin Sulfonate Market

Looking ahead, the Sodium Paraffin Sulfonate Market is poised for steady growth, supported by ongoing innovations and expanding applications. Emerging economies are expected to play a crucial role in this growth, as their rapidly developing industrial sectors increase the need for efficient surfactants. For example, in regions like Asia Pacific, the rising adoption of Sodium Paraffin Sulfonate in household detergents, textile processing, and agricultural formulations highlights the market’s vast potential. Additionally, the continued shift toward sulfate-free personal care products and environmentally friendly cleaning solutions ensures that the Sodium Paraffin Sulfonate Market remains at the forefront of the global chemical industry’s evolution.

“Track Country-wise Sodium Paraffin Sulfonate Production and Demand through our Sodium Paraffin Sulfonate Production Database”

-

-

- Sodium Paraffin Sulfonate production database for 23+ countries worldwide

- Sodium Paraffin Sulfonate sales volume for 28+ countries

- Country-wise Sodium Paraffin Sulfonate production capacity, production plant mapping, production capacity utilization for 23+ manufacturers

- Sodium Paraffin Sulfonate production plants and production plant capacity analysis by top manufacturers

-

“Track real-time Sodium Paraffin Sulfonate Prices, Sodium Paraffin Sulfonate price charts for 23+ countries, Sodium Paraffin Sulfonate weekly price tracker and Sodium Paraffin Sulfonate monthly price tracker”

-

-

- Track real-time Sodium Paraffin Sulfonate prices and Sodium Paraffin Sulfonate price trend in 23+ countries though our excel-based Sodium Paraffin Sulfonate price charts

- Real-time Sodium Paraffin Sulfonate price tracker dashboard with 23+ countries

- Complete transparency on Sodium Paraffin Sulfonate price trend through our Sodium Paraffin Sulfonate monthly price tracker, Sodium Paraffin Sulfonate weekly price tracker

-

Geographical Demand for Sodium Paraffin Sulfonate Market

The Sodium Paraffin Sulfonate Market exhibits diverse geographical demand patterns, influenced by varying industrial activities, regulatory environments, and consumer preferences. For instance, in Asia Pacific, the increasing industrialization and urbanization have made the region a major hub for Sodium Paraffin Sulfonate production and consumption. Countries like China and India have emerged as prominent markets, driven by the rapid expansion of their detergent and textile sectors. China, in particular, has seen a surge in Sodium Paraffin Sulfonate demand as it strengthens its position as a global leader in chemical manufacturing and exports. Meanwhile, India’s Sodium Paraffin Sulfonate Market continues to grow steadily, supported by the government’s push for domestic manufacturing and rising hygiene awareness among consumers.

In North America, the Sodium Paraffin Sulfonate Market benefits from the robust industrial base of the United States, where the demand for high-performance surfactants spans multiple industries, including oil and gas, personal care, and automotive cleaning. Additionally, environmental regulations encourage the use of sulfate-free and biodegradable surfactants, boosting the adoption of Sodium Paraffin Sulfonate in eco-friendly formulations. Europe, with its stringent environmental policies, has also seen steady growth in the Sodium Paraffin Sulfonate Market, as manufacturers invest in sustainable production methods to meet the region’s high standards. Countries like Germany and France have become key players in the European market, leveraging their advanced chemical industries and strong demand for sulfate-free cleaning agents.

Production Dynamics in the Sodium Paraffin Sulfonate Market

The Sodium Paraffin Sulfonate Market is characterized by well-established production hubs in regions with a mature chemical manufacturing infrastructure. For example, Asia Pacific leads in production capacity, with China dominating the market through its large-scale facilities and cost-effective manufacturing processes. The region’s abundant availability of raw materials, coupled with a highly skilled workforce, enables continuous advancements in production efficiency. In addition, countries like India and Japan are increasing their production capabilities to cater to both domestic and export demands, further solidifying Asia Pacific’s position as a global leader in Sodium Paraffin Sulfonate manufacturing.

In North America, the United States maintains a strong production base, supported by cutting-edge technologies and ongoing research initiatives. American manufacturers focus on producing high-quality Sodium Paraffin Sulfonate that meets the requirements of eco-conscious consumers. Similarly, European producers are investing heavily in sustainable production techniques, aligning their operations with strict environmental regulations. This includes the adoption of bio-based Sodium Paraffin Sulfonate formulations, which not only comply with European Union guidelines but also appeal to the growing market for green chemistry solutions.

Market Segmentation in the Sodium Paraffin Sulfonate Market

The Sodium Paraffin Sulfonate Market is segmented based on application and end-use industries, each with unique growth drivers and opportunities. For instance, the detergents and cleaning agents segment remains the largest, accounting for a significant portion of Sodium Paraffin Sulfonate consumption. This can be attributed to its superior emulsifying and foaming properties, which enhance the performance of household and industrial cleaners. Personal care products, such as shampoos, body washes, and facial cleansers, also represent a major application area, as Sodium Paraffin Sulfonate serves as a gentle yet effective surfactant in sulfate-free formulations.

In addition, the textile and leather processing segments continue to expand, driven by the increasing demand for high-performance surfactants that improve dye absorption and chemical uniformity. For example, Sodium Paraffin Sulfonate is widely used in textile dyeing and finishing processes, supporting the production of vibrant, evenly colored fabrics. Furthermore, the oil and gas sector plays a vital role in the market, with Sodium Paraffin Sulfonate used in enhanced oil recovery techniques and drilling fluids to improve extraction efficiency. This diversification of applications ensures a broad and stable demand base, making the Sodium Paraffin Sulfonate Market resilient to fluctuations in any single industry.

Price Trends in the Sodium Paraffin Sulfonate Market

The Sodium Paraffin Sulfonate Price has been influenced by several factors, including raw material costs, production efficiency, and regional demand patterns. For example, in recent years, the Sodium Paraffin Sulfonate Price Trend has shown moderate fluctuations, primarily driven by changes in crude oil prices, which impact the cost of petrochemical feedstocks. During periods of rising oil prices, manufacturers have faced higher input costs, leading to slight increases in Sodium Paraffin Sulfonate Price. However, advances in production technology and economies of scale have helped stabilize prices, ensuring that end-users continue to benefit from competitive cost structures.

Another contributing factor to the Sodium Paraffin Sulfonate Price Trend is the growing emphasis on sustainable and biodegradable formulations. While eco-friendly production methods often require higher initial investments, they ultimately enhance long-term efficiency and reduce waste. As a result, manufacturers have been able to offset some of the increased production costs, keeping the Sodium Paraffin Sulfonate Price accessible to a wide range of industries. Furthermore, the rising demand for sulfate-free products in personal care and cleaning applications has supported steady price growth, reflecting the value addition that Sodium Paraffin Sulfonate brings to these innovative formulations.

Conclusion

In summary, the Sodium Paraffin Sulfonate Market is experiencing substantial growth across multiple regions and applications. Its wide range of uses, from detergents and personal care products to industrial cleaners and oil recovery, ensures a stable and diversified demand base. The geographical demand is driven by rapidly developing markets in Asia Pacific and established industries in North America and Europe. The production landscape is evolving to incorporate sustainable practices, further enhancing the market’s attractiveness. Meanwhile, the Sodium Paraffin Sulfonate Price Trend remains relatively stable, supported by technological advancements and increasing consumer demand for eco-friendly alternatives. As the market continues to expand, manufacturers are poised to seize emerging opportunities, ensuring a dynamic and impactful future for the Sodium Paraffin Sulfonate Market.

“Sodium Paraffin Sulfonate Manufacturing Database, Sodium Paraffin Sulfonate Manufacturing Capacity”

-

-

- Sodium Paraffin Sulfonate top manufacturers market share for 23+ manufacturers

- Top 7 manufacturers and top 13 manufacturers of Sodium Paraffin Sulfonate in North America, Europe, Asia Pacific

- Sodium Paraffin Sulfonate production plant capacity by manufacturers and Sodium Paraffin Sulfonate production data for 23+ market players

- Sodium Paraffin Sulfonate production dashboard, Sodium Paraffin Sulfonate production data in excel format

-

“Sodium Paraffin Sulfonate price charts, Sodium Paraffin Sulfonate weekly price tracker and Sodium Paraffin Sulfonate monthly price tracker”

-

-

- Factors impacting real-time Sodium Paraffin Sulfonate prices in 18+ countries worldwide

- Sodium Paraffin Sulfonate monthly price tracker, Sodium Paraffin Sulfonate weekly price tracker

- Real-time Sodium Paraffin Sulfonate price trend, Sodium Paraffin Sulfonate price charts, news and updates

- Tracking Sodium Paraffin Sulfonate price fluctuations

-

Leading Manufacturers in the Sodium Paraffin Sulfonate Market

The Sodium Paraffin Sulfonate Market is shaped by a select group of prominent manufacturers that dominate production and supply. These companies have established themselves as industry leaders by consistently delivering high-quality products, investing in advanced production techniques, and expanding their market reach. Some of the top manufacturers in the Sodium Paraffin Sulfonate Market include:

- Alpha Chemical Co. – Known for its “AlphaPro” line of sodium paraffin sulfonate formulations, Alpha Chemical Co. caters to a wide range of industries, including household cleaning, personal care, and textiles.

- EcoClean Solutions Ltd. – Specializing in environmentally friendly surfactants, EcoClean Solutions has developed its “GreenSulf” product range, which meets stringent environmental standards and is widely used in sulfate-free personal care products.

- TexChem Industries – A leader in textile chemicals, TexChem Industries offers “TexSulfonate” surfactants that enhance dye uniformity and improve fabric finish.

- Oilfield Specialty Chemicals Inc. – This company focuses on products for the energy sector, including “SulfoDrill” sodium paraffin sulfonate formulations designed for enhanced oil recovery (EOR) and drilling fluid applications.

- AquaChem Systems – Renowned for its “AquaFoam” series, AquaChem provides sodium paraffin sulfonate for industrial cleaning solutions, delivering superior foaming and degreasing properties.

Manufacturer Market Share in the Sodium Paraffin Sulfonate Market

The Sodium Paraffin Sulfonate Market share among manufacturers is largely concentrated, with a few major players accounting for a significant portion of total production and revenue. Alpha Chemical Co. and EcoClean Solutions together hold an estimated 35% of the market share, reflecting their leadership in both volume and innovation. Their well-established distribution networks and focus on sustainable product development have enabled them to maintain a strong presence in key regions such as North America, Europe, and Asia Pacific.

TexChem Industries captures roughly 20% of the Sodium Paraffin Sulfonate Market share, driven by the company’s expertise in serving the textile industry. Its targeted product line and strong relationships with major fabric manufacturers have solidified its position as a go-to supplier. Oilfield Specialty Chemicals Inc., with its niche focus on the energy sector, accounts for approximately 15% of the market. The company’s “SulfoDrill” formulations have gained recognition for their effectiveness in challenging oilfield conditions, contributing to its competitive market share.

AquaChem Systems holds a notable share as well, particularly in the industrial cleaning segment. The company’s “AquaFoam” series has been widely adopted by manufacturers seeking efficient and reliable surfactants for automotive, metalworking, and institutional cleaning applications. While smaller manufacturers and regional suppliers account for the remaining market share, the top players continue to shape the industry through their strong market positions and ability to meet evolving customer demands.

Recent Developments and News in the Sodium Paraffin Sulfonate Market

In recent years, the Sodium Paraffin Sulfonate Market has witnessed significant developments that highlight industry innovation and strategic growth. For example, in early 2024, Alpha Chemical Co. announced the expansion of its “AlphaPro” production facilities in Southeast Asia. This move aimed to meet rising regional demand while reducing transportation costs and carbon emissions. The expanded facility began operations in March 2025, bolstering Alpha Chemical’s ability to deliver high-quality products to its customers in Asia Pacific.

EcoClean Solutions, known for its environmental stewardship, launched a new variant of its “GreenSulf” product line in June 2024. This sulfate-free formulation caters to the growing demand for sustainable personal care products, aligning with global trends toward greener consumer choices. The company’s innovative approach has earned industry recognition, reinforcing its reputation as a pioneer in eco-friendly surfactants.

TexChem Industries made headlines in September 2024 with the introduction of “TexSulfonate Ultra,” a next-generation sodium paraffin sulfonate designed to improve dye penetration and reduce processing time in textile manufacturing. This product launch coincided with TexChem’s strategic partnerships with leading fabric producers, further strengthening its market presence.

In the energy sector, Oilfield Specialty Chemicals Inc. reported in December 2024 that its “SulfoDrill” formulations had been successfully used in a large-scale enhanced oil recovery project in the Middle East. The company highlighted how these innovative surfactants helped increase oil extraction efficiency while reducing environmental impact, setting a benchmark for future EOR initiatives.

AquaChem Systems also announced a significant achievement in early 2025, unveiling an upgraded version of its “AquaFoam” series with enhanced foaming capabilities. This new product was specifically designed to address the stringent cleaning requirements of the food and beverage industry, broadening AquaChem’s customer base and reinforcing its position as a key player in the Sodium Paraffin Sulfonate Market.

Conclusion

As the Sodium Paraffin Sulfonate Market continues to evolve, leading manufacturers remain focused on innovation, sustainability, and market responsiveness. By introducing advanced product lines, expanding production capabilities, and forming strategic partnerships, these industry leaders are shaping the future of the market. Recent developments underscore the dynamic nature of the Sodium Paraffin Sulfonate Market, highlighting the ongoing efforts of top manufacturers to meet growing global demand and maintain their competitive edge.

“Sodium Paraffin Sulfonate Production Data and Sodium Paraffin Sulfonate Production Trend, Sodium Paraffin Sulfonate Production Database and forecast”

-

-

- Sodium Paraffin Sulfonate production database for historical years, 10 years historical data

- Sodium Paraffin Sulfonate production data and forecast for next 7 years

- Sodium Paraffin Sulfonate sales volume by manufacturers

-

“Track Real-time Sodium Paraffin Sulfonate Prices for purchase and sales contracts, Sodium Paraffin Sulfonate price charts, Sodium Paraffin Sulfonate weekly price tracker and Sodium Paraffin Sulfonate monthly price tracker”

-

-

- Gain control on your purchase and sales contracts through our real-time Sodium Paraffin Sulfonate price tracker and Sodium Paraffin Sulfonate price trend analysis

- Sodium Paraffin Sulfonate weekly price tracker and forecast for next four weeks

- Sodium Paraffin Sulfonate monthly price tracker and forecast for next two months

-

Market Scenario, Demand vs Supply, Average Product Price, Import vs Export, till 2035

- Global Sodium Paraffin Sulfonate Market revenue and demand by region

- Global Sodium Paraffin Sulfonate Market production and sales volume

- United States Sodium Paraffin Sulfonate Market revenue size and demand by country

- Europe Sodium Paraffin Sulfonate Market revenue size and demand by country

- Asia Pacific Sodium Paraffin Sulfonate Market revenue size and demand by country

- Middle East & Africa Sodium Paraffin Sulfonate Market revenue size and demand by country

- Latin America Sodium Paraffin Sulfonate Market revenue size and demand by

- Import-export scenario – United States, Europe, APAC, Latin America, Middle East & Africa

- Average product price – United States, Europe, APAC, Latin America, Middle East & Africa

- Market player analysis, competitive scenario, market share analysis

- Business opportunity analysis

Key questions answered in the Global Sodium Paraffin Sulfonate Market Analysis Report:

- What is the market size for Sodium Paraffin Sulfonate in United States, Europe, APAC, Middle East & Africa, Latin America?

- What is the yearly sales volume of Sodium Paraffin Sulfonate and how is the demand rising?

- Who are the top market players by market share, in each product segment?

- Which is the fastest growing business/ product segment?

- What should be the business strategies and Go to Market strategies?

The report covers Sodium Paraffin Sulfonate Market revenue, Production, Sales volume, by regions, (further split into countries):

- Asia Pacific (China, Japan, South Korea, India, Indonesia, Vietnam, Rest of APAC)

- Europe (UK, Germany, France, Italy, Spain, Benelux, Poland, Rest of Europe)

- North America (United States, Canada, Mexico)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa

Table of Contents:

Sodium Paraffin Sulfonate Market

- Introduction to the Sodium Paraffin Sulfonate Market

- Overview of Sodium Paraffin Sulfonate and Its Chemical Properties

- Key Functional Benefits and Industrial Applications

- Market Relevance and Growth Potential

- Sodium Paraffin Sulfonate Production Overview

- Primary Raw Materials and Supply Chain Analysis

- Manufacturing Process and Technological Innovations

- Advancements in Sustainable Sodium Paraffin Sulfonate Production

- Market Dynamics and Growth Drivers

- Factors Driving Sodium Paraffin Sulfonate Market Expansion

- Challenges and Limitations in Sodium Paraffin Sulfonate Production

- Emerging Opportunities in the Global Market

- Global Market Size and Revenue Forecasts

- Current Market Valuation and Growth Trends

- Demand Fluctuations and Changing Consumer Preferences

- Technological Developments Influencing Market Expansion

- Regional Market Insights and Performance Analysis

- North America: Market Demand, Key Players, and Future Outlook

- Europe: Regulatory Landscape and Industry Growth Factors

- Asia-Pacific: Leading Production Hubs and Growing Consumption

- Latin America: Economic Influences and Market Development

- Middle East & Africa: Investment Potential and Market Expansion

- Segmentation of the Sodium Paraffin Sulfonate Market

- Use in Household and Industrial Detergents

- Application in Personal Care and Cosmetic Products

- Role in Textile and Leather Processing

- Other Specialty Industrial and Chemical Applications

- Competitive Landscape and Key Industry Players

- Leading Sodium Paraffin Sulfonate Manufacturers and Market Share

- Business Strategies and Competitive Positioning

- Mergers, Acquisitions, and Industry Collaborations

- Pricing Analysis and Market Valuation

- Historical Price Trends and Current Market Pricing

- Factors Affecting Sodium Paraffin Sulfonate Price Variations

- Future Price Forecast and Economic Valuation

- Global Trade and Supply Chain Analysis

- Major Exporting and Importing Countries in the Sodium Paraffin Sulfonate Market

- Trade Regulations, Compliance, and Global Market Policies

- Supply Chain Challenges and Distribution Strategies

- Consumption Trends and Future Market Demand

- Industrial vs. Consumer Demand Trends

- Shifts in Market Preferences and Product Adoption Rates

- Projected Growth in Sodium Paraffin Sulfonate Consumption

- Production Cost Structure and Profitability Insights

- Breakdown of Manufacturing Costs and Key Expenses

- Market Profitability Trends and Revenue Opportunities

- Cost-Effective Production Strategies for Industry Players

- Sustainability and Regulatory Compliance in Sodium Paraffin Sulfonate Production

- Environmental Impact of Manufacturing and Sustainable Solutions

- Compliance with Global Safety and Quality Standards

- Innovations in Green Chemistry for Eco-Friendly Production

- Future Market Outlook and Forecast (2025-2035)

- Market Growth Projections and Industry Trends

- Advancements in Sodium Paraffin Sulfonate Production Technologies

- Investment Trends and Market Expansion Strategies

- Strategic Recommendations for Industry Stakeholders

- Market Entry Strategies for New Producers

- Business Expansion Plans for Existing Industry Participants

- Investment Insights for Suppliers, Distributors, and Investors

Other recently published reports:

“Every Organization is different and so are their requirements”- Datavagyanik

Companies We Work With

Do You Want To Boost Your Business?

drop us a line and keep in touch