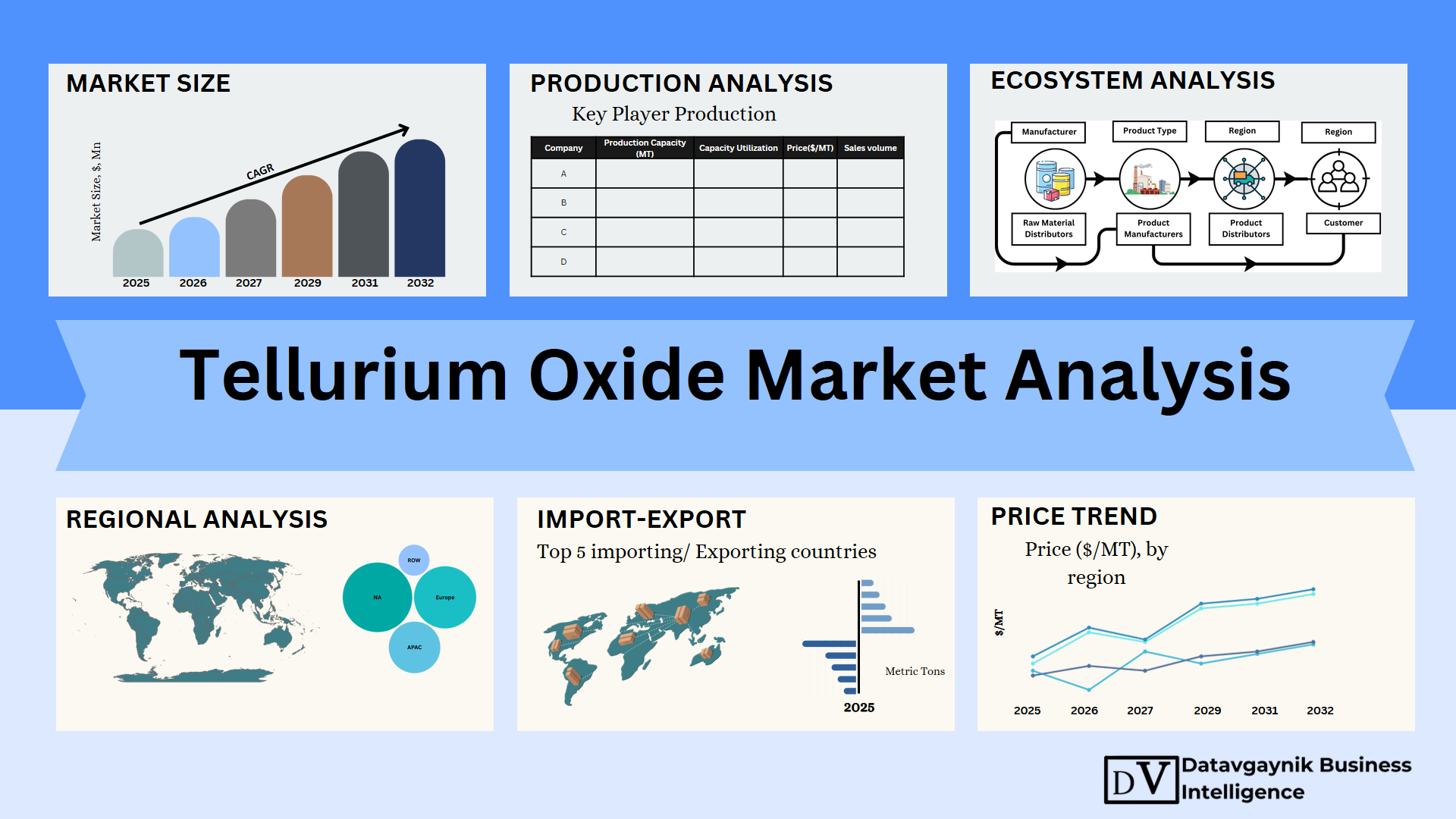

Global Tellurium Oxide Market Size, Production, Sales, Average Product Price, Market Share, Import vs Export – United States, Europe, APAC, Latin America, Middle East & Africa

- Published 2025

- No of Pages: 120+

- 20% Customization available

Accelerating Electronics Sector Fuels Tellurium Oxide Market Growth

The Tellurium Oxide Market is experiencing significant traction, primarily driven by rising demand in advanced electronics. As the global electronics industry continues its rapid evolution, the use of semiconductors, infrared sensors, and photodetectors is increasing. Tellurium oxide plays a critical role in producing these components due to its unique optical and electronic properties. For instance, demand for high-purity materials in semiconductor fabrication has surged in regions like East Asia, where annual output of optoelectronic devices is expanding by over 6%. This growth directly impacts the Tellurium Oxide Market as manufacturers seek materials with higher conductivity, thermal stability, and precision.

Expanding Role in Solar Energy Bolsters Tellurium Oxide Market

Another crucial growth vector for the Tellurium Oxide Market is its rising application in solar photovoltaics. Tellurium oxide is an essential material in cadmium telluride (CdTe) thin-film solar cells, known for their cost-efficiency and strong performance under low-light conditions. The increasing global emphasis on renewable energy has led to a surge in solar installations, particularly in emerging markets. With the global solar PV capacity expected to more than double over the next decade, the demand for tellurium-based compounds is anticipated to grow proportionally. This trend places tellurium oxide as a critical enabler in achieving future energy transition goals.

Datavagyanik also covers related markets such as the Tellurium Sulfate Market. These compounds are commonly used in oxidation systems and industrial chemical processing, supporting shifts in formulation standards and regulatory compliance.

Optical and Thermal Properties Driving High-Tech Applications

Tellurium oxide is favored for its exceptional optical transparency in the infrared spectrum and superior thermal characteristics, making it indispensable in the manufacturing of specialized lenses, infrared windows, and fiber optic devices. As industrial automation and surveillance systems become more advanced, the demand for high-performance optics has grown steadily. This shift directly feeds into the Tellurium Oxide Market, as producers of thermal imaging and night vision equipment require consistent supply of reliable IR materials. Moreover, tellurium oxide’s compatibility with doped glass formulations adds value in creating enhanced photonic components for defense and aerospace.

Tellurium Oxide Market Size Influenced by Rising Ceramics Demand

The Tellurium Oxide Market size is being further influenced by growth in the ceramics industry. Tellurium oxide is used as a coloring and clarifying agent in advanced ceramics and specialty glass. This segment is experiencing increased adoption in automotive displays, architectural glass, and high-performance cookware. The ceramics market, projected to expand at 5–6% annually, is amplifying the uptake of tellurium oxide in both aesthetic and functional applications. As production technologies evolve, the demand for chemical additives like tellurium oxide that can enhance heat resistance, optical properties, and material durability continues to expand.

Critical Role in Thermoelectric Materials Accelerates Demand

Thermoelectric devices represent a growing frontier for the Tellurium Oxide Market. With rising interest in energy harvesting technologies, tellurium oxide is gaining attention as a base material for thermoelectric modules that convert waste heat into electricity. These systems are now being applied in automotive, aerospace, and industrial manufacturing sectors to enhance energy efficiency. For example, the use of tellurium-based thermoelectrics in electric vehicles has doubled over the past three years, driven by regulatory emphasis on fuel efficiency and carbon neutrality. As more OEMs integrate these modules, demand for tellurium oxide will likely see accelerated growth.

Strategic Supply Chain Developments Shaping Tellurium Oxide Market

Geopolitical shifts and increased focus on critical mineral security have brought renewed attention to tellurium’s global supply chain. Tellurium oxide production is primarily concentrated in regions with copper refining operations, as tellurium is extracted as a by-product. With copper smelting hubs modernizing and expanding in Asia and Latin America, the production pipeline for tellurium oxide is stabilizing. However, regional disparities in refining capacity and environmental restrictions in developed economies have also prompted companies to explore recycling and synthetic production pathways. These structural adjustments are shaping the long-term dynamics of the Tellurium Oxide Market.

Tellurium Oxide Market Size Reinforced by Growth in Data Centers and AI

The growing footprint of data centers and artificial intelligence infrastructure is reinforcing the Tellurium Oxide Market size. High-performance computing environments require advanced cooling systems and power-efficient components, many of which benefit from tellurium oxide-based materials. From IR sensors in data center monitoring systems to thermoelectric devices that manage heat load, tellurium oxide contributes to improved efficiency and durability. As hyperscale data centers proliferate globally and AI workloads increase, the need for specialized electronic materials will continue to fuel tellurium oxide demand.

Advancements in Chemical Vapor Deposition (CVD) to Boost Market

The adoption of advanced deposition techniques, particularly chemical vapor deposition (CVD), is enhancing the use of tellurium oxide in nanotechnology and electronics fabrication. CVD allows for thin-film layering of tellurium oxide on substrates with precision, a requirement in next-gen electronics and MEMS (Micro-Electro-Mechanical Systems). These innovations support a broader application base, including high-frequency filters, pressure sensors, and medical diagnostics. The Tellurium Oxide Market is expected to benefit as fabrication methods grow more sophisticated, pushing demand for high-purity and finely processed tellurium oxide.

Strategic Investments and R&D Stimulate Tellurium Oxide Market

Companies and governments alike are increasing investments in R&D focused on tellurium oxide materials. From improving purity levels to exploring new composite formulations, innovation is a defining factor in sustaining competitiveness in the Tellurium Oxide Market. For instance, research into tellurium oxide’s use in flexible electronics and quantum computing has opened potential new revenue streams. As funding expands in nanomaterials and electronic polymers, tellurium oxide’s versatility positions it as a valuable candidate for integration across emerging technological platforms.

Regional Trends and Policy Incentives Accelerate Market Expansion

Regional dynamics play a significant role in shaping the Tellurium Oxide Market. Asia-Pacific remains the dominant region due to its advanced electronics manufacturing infrastructure and growing renewable energy installations. Meanwhile, North America and Europe are witnessing renewed interest due to sustainability-focused regulations and local sourcing initiatives. Government incentives targeting solar cell production, semiconductor localization, and clean energy innovation are creating a fertile environment for tellurium oxide applications. These regional policies, combined with private sector expansion, are collectively strengthening market fundamentals.

Track Country-wise Tellurium Oxide Production and Demand through our Tellurium Oxide Production Database

-

-

- Tellurium Oxide production database for 30+ countries worldwide

- Tellurium Oxide sales volume for 31+ countries

- Country-wise Tellurium Oxide production capacity, production plant mapping, production capacity utilization for 30+ manufacturers

- Tellurium Oxide production plants and production plant capacity analysis by top manufacturers

-

Track real-time Tellurium Oxide Prices, Tellurium Oxide price charts for 30+ countries, Tellurium Oxide weekly price tracker and Tellurium Oxide monthly price tracker

-

-

- Track real-time Tellurium Oxide prices and Tellurium Oxide price trend in 30+ countries though our excel-based Tellurium Oxide price charts

- Real-time Tellurium Oxide price tracker dashboard with 30+ countries

- Complete transparency on Tellurium Oxide price trend through our Tellurium Oxide monthly price tracker, Tellurium Oxide weekly price tracker

-

Asia-Pacific Leads Global Tellurium Oxide Market Demand

The Tellurium Oxide Market in the Asia-Pacific region is expanding at an accelerated pace, primarily due to the region’s dominance in semiconductor manufacturing and photovoltaic solar cell production. Countries like China, Japan, South Korea, and Taiwan are investing heavily in electronics, which continues to propel demand for tellurium-based compounds. For instance, China’s growing production of cadmium telluride solar cells and infrared sensors has led to a steady year-on-year increase in tellurium oxide consumption.

South Korea’s burgeoning optoelectronics sector also relies on high-purity tellurium oxide for use in advanced chipsets and display technologies. Collectively, the region accounts for more than one-third of the global Tellurium Oxide Market demand, and this share is expected to rise further due to increasing infrastructure spending in renewable energy and AI-driven hardware.

North America Emerging as a Key Consumer in Tellurium Oxide Market

North America’s Tellurium Oxide Market is primarily driven by the United States, which has witnessed significant growth in the demand for semiconductor wafers, thermoelectric materials, and high-resolution IR optics. The region’s emphasis on reshoring critical semiconductor manufacturing has resulted in several billion-dollar investments into fabrication plants and advanced materials R&D. For example, as defense and aerospace industries expand their use of tellurium-based thermal imaging devices, tellurium oxide consumption is set to rise in tandem. Additionally, investments in clean energy storage and smart grid technologies further enhance market demand. Canada is also contributing to the region’s growth through its mining operations and refining capabilities, particularly for rare and strategic elements like tellurium.

European Demand Driven by Sustainability and Advanced Optics

In Europe, the Tellurium Oxide Market is experiencing consistent growth, supported by environmental regulations, technological innovation, and a strong push toward sustainable energy solutions. Germany, France, and the United Kingdom are leading contributors, particularly in the renewable energy and optoelectronics sectors. European automotive manufacturers are increasingly incorporating thermoelectric modules to improve energy efficiency and reduce emissions. As a result, demand for tellurium oxide as a thermoelectric material is growing steadily. Additionally, advancements in fiber optics and high-performance coatings are expanding the material’s use in medical imaging, scientific instrumentation, and aerospace. These trends reinforce the region’s importance as a stable and diversified market for tellurium oxide.

Strategic Growth in Middle East, Africa, and Latin America

Although still in nascent stages compared to other regions, the Tellurium Oxide Market in the Middle East, Africa, and Latin America is showing signs of rapid growth. Countries such as Brazil, Saudi Arabia, and South Africa are increasingly investing in renewable energy infrastructure, creating a ripple effect in demand for thin-film solar cells where tellurium oxide is a key ingredient. For instance, several large-scale solar projects underway in Brazil and the UAE are expected to significantly boost tellurium oxide imports in the coming years. Additionally, the mining potential in these regions remains underexplored, presenting future opportunities for localized production and downstream processing.

Tellurium Oxide Market Production: Global Refining Capacity Expands

Tellurium oxide is primarily derived as a by-product during copper and lead refining, making production highly dependent on global mining output and smelter efficiency. China currently holds the largest refining capacity, contributing more than half of global tellurium oxide production. The country’s vertically integrated supply chain, which spans mining to high-purity refining, provides it with a strong competitive advantage in controlling both cost and volume. Russia, Japan, and Canada follow with significant capacities, each playing a key role in maintaining global supply stability.

Production is now seeing a shift with new investments aimed at increasing refining throughput and improving purity standards. For instance, newer facilities are deploying hydrometallurgical and vapor-phase refining methods to yield ultrapure tellurium oxide suitable for semiconductor and optoelectronic use. As global demand continues to rise, these production upgrades are crucial in balancing the Tellurium Oxide Market supply chain.

Emerging Trends in Secondary Production and Recycling

As demand intensifies, the Tellurium Oxide Market is gradually moving toward more sustainable sources, including recycling of tellurium-bearing waste and electronic scrap. High-purity tellurium oxide can be recovered from solar panel decommissioning, thermoelectric devices, and metallurgical slags. Emerging recycling technologies are expected to play a critical role in reducing dependency on primary mining, especially in regions lacking domestic tellurium reserves.

In developed economies such as the United States and Germany, policies supporting circular economy practices are leading to pilot-scale facilities capable of recovering tellurium oxide from spent modules and electronics. Over time, the growth in secondary production will help offset volatility in primary supply and offer a more balanced approach to meeting market needs.

Market Segmentation: Application Landscape Expands Rapidly

The Tellurium Oxide Market is segmented based on application into five key categories: solar cells, thermoelectric devices, semiconductors, specialty glass and ceramics, and others including catalysts and optical coatings.

The solar cell segment accounts for the largest share, driven by cadmium telluride (CdTe) thin-film technologies. With solar energy adoption growing by over 20% annually in many regions, this segment alone ensures a stable and rising consumption of tellurium oxide.

Thermoelectric devices form the second-largest segment, with increasing integration into consumer electronics, electric vehicles, and industrial waste heat recovery systems. For instance, as EV adoption rises, so does the demand for energy-efficient heat management systems, fueling tellurium oxide utilization.

Specialty glass and ceramics account for a notable share as well, particularly in advanced cookware, architectural panels, and industrial glass. In these applications, tellurium oxide is valued for its coloration properties, heat resistance, and structural enhancement.

Semiconductors and optoelectronic applications are also expanding, particularly in MEMS, sensors, and imaging systems. Innovations in chip design and nanofabrication are expected to further increase this segment’s importance in the Tellurium Oxide Market.

Tellurium Oxide Price Trends Driven by Supply Constraints and Tech Demand

The Tellurium Oxide Price has experienced fluctuations over the past five years, largely influenced by supply-side constraints and shifts in downstream demand. Prices have ranged between $80 to $130 per kilogram depending on purity and regional supply availability.

During periods of high photovoltaic panel production or semiconductor shortages, Tellurium Oxide Price Trend shows notable spikes due to intensified competition for available stock. For example, prices surged during global chip shortages as suppliers rushed to secure high-purity materials.

Conversely, when copper refining slows due to falling base metal prices, tellurium production also declines, tightening supply and pushing prices upward. This cyclical nature makes Tellurium Oxide Price a sensitive indicator of broader industrial activity.

Outlook on Tellurium Oxide Price and Future Stability

The Tellurium Oxide Price Trend is expected to stabilize over the medium term as recycling efforts scale and new production capacities come online. However, rapid expansion in electric vehicles, solar installations, and AI-driven electronics could introduce new waves of demand-side pressure. Technological advancements requiring ultrapure tellurium oxide may also influence pricing due to cost-intensive purification processes.

Datavagyanik anticipates that global price equilibrium will depend heavily on strategic resource planning, diversification of supply sources, and integration of secondary recovery into mainstream production. Stakeholders in the Tellurium Oxide Market should be prepared for short-term volatility but long-term resilience, especially as the material becomes more deeply embedded in future-facing industries.

Tellurium Oxide Manufacturing Database, Tellurium Oxide Manufacturing Capacity

-

-

- Tellurium Oxide top manufacturers market share for 30+ manufacturers

- Top 11 manufacturers and top 18 manufacturers of Tellurium Oxide in North America, Europe, Asia Pacific

- Tellurium Oxide production plant capacity by manufacturers and Tellurium Oxide production data for 30+ market players

- Tellurium Oxide production dashboard, Tellurium Oxide production data in excel format

-

Tellurium Oxide price charts, Tellurium Oxide weekly price tracker and Tellurium Oxide monthly price tracker

-

-

- Factors impacting real-time Tellurium Oxide prices in 30+ countries worldwide

- Tellurium Oxide monthly price tracker, Tellurium Oxide weekly price tracker

- Real-time Tellurium Oxide price trend, Tellurium Oxide price charts, news and updates

- Tracking Tellurium Oxide price fluctuations

-

Leading Manufacturers in the Tellurium Oxide Market

The Tellurium Oxide Market is highly consolidated, with a small group of established players dominating global supply. These manufacturers operate across mining, refining, and specialty chemical processing, giving them full control over the tellurium value chain. As demand continues to rise in sectors such as semiconductors, solar energy, and thermoelectric systems, these companies are expanding capacity and diversifying their product portfolios to meet specific end-user requirements.

Key players in the Tellurium Oxide Market include 5N Plus Inc., Vital Materials Co., Ltd., Umicore N.V., Maruti Chemicals Company, Aurubis AG, and XI’AN Function Material Group Co., Ltd. Together, these companies command more than 65% of global production and distribution of high-purity tellurium oxide.

5N Plus Inc. – High Purity Leadership in the Tellurium Oxide Market

5N Plus Inc., headquartered in Canada, is recognized for its advanced purification technologies and vertically integrated operations. The company supplies tellurium oxide to several global clients in the semiconductor and solar industries. Under its “Eco-Friendly Materials” portfolio, 5N Plus offers high-purity tellurium oxide tailored for cadmium telluride solar cell production. The company has invested in next-generation refining techniques to produce oxide powders with purity exceeding 99.999%.

5N Plus holds approximately 18% of the global Tellurium Oxide Market share, making it one of the most dominant suppliers in the western hemisphere. It has continued to expand its footprint in North America and Europe, leveraging its strong logistics and refining infrastructure.

Vital Materials – Asia’s Dominant Force in Tellurium Oxide Production

Vital Materials, based in China, plays a central role in global tellurium supply, controlling nearly 25% of the total Tellurium Oxide Market. The company operates across multiple stages of the supply chain, from tellurium extraction to refining and chemical synthesis. Vital Materials offers a range of tellurium compounds, including ultrafine tellurium oxide used in IR optics and thermoelectric cooling modules.

Its product line includes high-purity tellurium oxide powder for laser optics, solar materials, and advanced semiconductors. The company is also a leading supplier to CdTe solar panel manufacturers in China and Southeast Asia. Vital Materials has expanded rapidly through technology licensing and strategic partnerships with renewable energy developers.

Umicore – A Pioneer in Specialty Materials and Recycling

Belgium-based Umicore is a prominent name in the Tellurium Oxide Market, particularly for its focus on sustainable sourcing and material recycling. The company’s refining division recovers tellurium from industrial residues and electronics scrap, supplying purified tellurium oxide for applications in optics and electronics.

Umicore controls roughly 10% of the global market and is known for its environmentally conscious product lines. Its tellurium oxide grades meet stringent requirements for use in infrared detectors and specialized glass formulations. The company is expanding its presence in Asia and North America by leveraging its well-developed recycling and circular economy capabilities.

XI’AN Function Material Group – Innovation-Led Growth in China

XI’AN Function Material Group Co., Ltd. is a high-tech Chinese enterprise specializing in rare metal materials, including tellurium oxide. The company offers semiconductor-grade and nano-sized tellurium oxide particles, serving clients in photonics, optoelectronics, and thermoelectrics.

The company’s product line includes tellurium oxide with particle sizes under 50 nanometers, catering to cutting-edge research and development labs. It holds around 7% of the Tellurium Oxide Market and is one of the fastest-growing players in Asia. Focused on R&D, XI’AN has introduced new formulations compatible with MEMS devices and microchip fabrication, which are seeing rapid adoption across global tech hubs.

Aurubis AG – Strategic Refiner with Multimetal Focus

Aurubis AG, headquartered in Germany, is primarily known for its large-scale copper refining, but it also plays a crucial role in the production of tellurium and its oxides as a by-product. The company maintains a stable share of the Tellurium Oxide Market, estimated at 5–6%, and supplies to customers in Europe and North America.

Aurubis has integrated tellurium oxide into its specialty metals division, with products used in technical glass, solar modules, and IR optics. The company’s operational model emphasizes sustainability, with tellurium extraction integrated into its core smelting processes. It has recently upgraded its refining plants to support higher throughput and traceability for critical elements, including tellurium.

Maruti Chemicals – Consistent Contributor from India

India-based Maruti Chemicals Company is a niche yet consistent player in the Tellurium Oxide Market, supplying to local and regional clients in the glass and ceramics industries. While its market share remains modest at around 2–3%, the company has established itself as a reliable supplier of lab-grade and industrial-grade tellurium oxide.

Maruti Chemicals is expanding its reach into Southeast Asia, supported by increasing demand for infrared glass and pigments. Its production capability includes low to mid-purity grades used in industrial coatings and catalysts, an area that is gaining traction in process industries across developing markets.

Tellurium Oxide Market Share by Manufacturers

In terms of global market share distribution, Vital Materials and 5N Plus Inc. are the most prominent, together accounting for over 40% of the Tellurium Oxide Market. Umicore and XI’AN Function Material Group follow closely, with combined share of around 17%. The remaining share is distributed among mid-sized producers like Aurubis, Maruti Chemicals, and several other region-specific firms.

This concentrated structure gives major players considerable pricing influence, particularly during supply constraints. It also enables them to direct industry innovation through strategic collaborations with end-use sectors such as renewable energy, defense, and high-tech electronics.

Recent Developments and Industry News in the Tellurium Oxide Market

Several recent developments are shaping the Tellurium Oxide Market outlook:

- In January 2024, 5N Plus announced the expansion of its facility in Saint-Laurent, Quebec, to increase high-purity tellurium oxide production capacity by 30% to support growing demand in solar and semiconductor markets.

- In March 2024, Vital Materials launched a new product line of nano-grade tellurium oxide for use in photonic integrated circuits. This marks a strategic move into advanced photonics for telecommunications and AI hardware.

- In June 2024, Umicore completed a €40 million upgrade of its refining plant in Belgium to boost tellurium oxide production from recycled sources, reinforcing its sustainability-first approach.

- XI’AN Function Material Group entered into a partnership with a South Korean semiconductor firm in April 2024 to co-develop low-defect-density tellurium oxide for nano-fabrication.

- Aurubis reported in May 2025 the commissioning of its next-generation metallurgical plant in Hamburg, designed to extract higher yields of tellurium from copper concentrates, which is expected to raise its market share.

These developments underscore the competitive intensity and innovation pace within the Tellurium Oxide Market. As major players expand capacity, refine products, and secure downstream partnerships, the market is set for both consolidation and accelerated growth.

Tellurium Oxide Production Data and Tellurium Oxide Production Trend, Tellurium Oxide Production Database and forecast

-

-

- Tellurium Oxide production database for historical years, 11 years historical data

- Tellurium Oxide production data and forecast for next 11 years

- Tellurium Oxide sales volume by manufacturers

-

Track Real-time Tellurium Oxide Prices for purchase and sales contracts, Tellurium Oxide price charts, Tellurium Oxide weekly price tracker and Tellurium Oxide monthly price tracker

-

-

- Gain control on your purchase and sales contracts through our real-time Tellurium Oxide price tracker and Tellurium Oxide price trend analysis

- Tellurium Oxide weekly price tracker and forecast for next four weeks

- Tellurium Oxide monthly price tracker and forecast for next two months

-

Market Scenario, Demand vs Supply, Average Product Price, Import vs Export, till 2032

- Global Tellurium Oxide Market revenue and demand by region

- Global Tellurium Oxide Market production and sales volume

- United States Tellurium Oxide Market revenue size and demand by country

- Europe Tellurium Oxide Market revenue size and demand by country

- Asia Pacific Tellurium Oxide Market revenue size and demand by country

- Middle East & Africa Tellurium Oxide Market revenue size and demand by country

- Latin America Tellurium Oxide Market revenue size and demand by

- Import-export scenario – United States, Europe, APAC, Latin America, Middle East & Africa

- Average product price – United States, Europe, APAC, Latin America, Middle East & Africa

- Market player analysis, competitive scenario, market share analysis

- Business opportunity analysis

Key questions answered in the Global Tellurium Oxide Market Analysis Report:

- What is the market size for Tellurium Oxide in United States, Europe, APAC, Middle East & Africa, Latin America?

- What is the yearly sales volume of Tellurium Oxide and how is the demand rising?

- Who are the top market players by market share, in each product segment?

- Which is the fastest growing business/ product segment?

- What should be the business strategies and Go to Market strategies?

The report covers Tellurium Oxide Market revenue, Production, Sales volume, by regions, (further split into countries):

- Asia Pacific (China, Japan, South Korea, India, Indonesia, Vietnam, Rest of APAC)

- Europe (UK, Germany, France, Italy, Spain, Benelux, Poland, Rest of Europe)

- North America (United States, Canada, Mexico)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa

Table of Contents:

1. Introduction to the Tellurium Oxide Market

- Definition and Market Scope

- Key Characteristics and Industrial Importance

- Emerging Trends in the Tellurium Oxide Market

2. Market Segmentation in the Tellurium Oxide Industry

- Categorization by Purity and Composition

- Application-Based Market Breakdown

- Industry-Specific Demand Segments

3. Global Tellurium Oxide Market Size and Forecast (2019-2032)

- Market Expansion and Growth Projections

- Revenue Analysis and Market Share Distribution

- Key Growth Factors and Restraining Challenges

4. Regional Analysis of the Tellurium Oxide Market

4.1 North America

- Tellurium Oxide Market Trends and Demand Drivers

- Tellurium Oxide Production vs Import-Export Analysis

- Regulatory Framework and Safety Standards

4.2 Europe

- Market Performance in Major European Economies

- Production Capacity and Industrial Utilization

- Regional Pricing and Trade Policies

4.3 Asia-Pacific

- Growing Applications and Market Potential

- Key Players in Tellurium Oxide Production

- Trade and Distribution Landscape

4.4 Latin America

- Market Expansion and Business Opportunities

- Production vs Consumption Analysis

- Emerging Industrial Applications

4.5 Middle East & Africa

- Market Growth Potential and Strategic Developments

- Tellurium Oxide Production and Regional Supply Chain

- Investment and Trade Policies

5. Global Tellurium Oxide Production Trends (2019-2032)

- Tellurium Oxide Production Processes and Methods

- Manufacturing Innovations and Technological Advancements

- Industry Challenges and Future Production Trends

6. Competitive Landscape in the Tellurium Oxide Market

- Leading Manufacturers and Market Share Analysis

- Competitive Strategies and Business Expansion Trends

- Research, Innovation, and Market Positioning

7. Revenue and Pricing Analysis (2019-2024)

- Revenue Growth Trends and Market Performance

- Price Dynamics and Cost Fluctuations

- Global Economic Impact on Pricing Strategies

8. Tellurium Oxide Trade, Supply Chain, and Logistics

- Tellurium Oxide Production vs Global Export Trends

- Market Consumption vs Import Dependence

- Distribution Challenges and Market Entry Strategies

9. Demand and Consumption Analysis

- Industry-Wise Consumption Trends

- Regional Demand for Tellurium Oxide

- Emerging Application Sectors Driving Demand

10. Cost Analysis and Manufacturing Structure

- Tellurium Oxide Production Cost Breakdown

- Raw Material Sourcing and Market Availability

- Price Sensitivity and Cost Optimization Strategies

11. Industrial Supply Chain and Market Dynamics

- Supply Chain Efficiency and Market Ecosystem

- Procurement Strategies for Raw Materials

- Industrial Applications and Market Innovations

12. Distribution and Marketing Strategies

- Tellurium Oxide Sales Channels and Key Distributors

- Customer Base and End-User Market Analysis

- Market Accessibility and Expansion Strategies

13. Future Prospects and Investment Opportunities

-

- Tellurium Oxide Market Growth Forecasts

- Technological Innovations in Tellurium Oxide Production

- Strategic Business Investments and Expansion Plans

Other recently published reports:

“Every Organization is different and so are their requirements”- Datavagyanik

Companies We Work With

Do You Want To Boost Your Business?

drop us a line and keep in touch