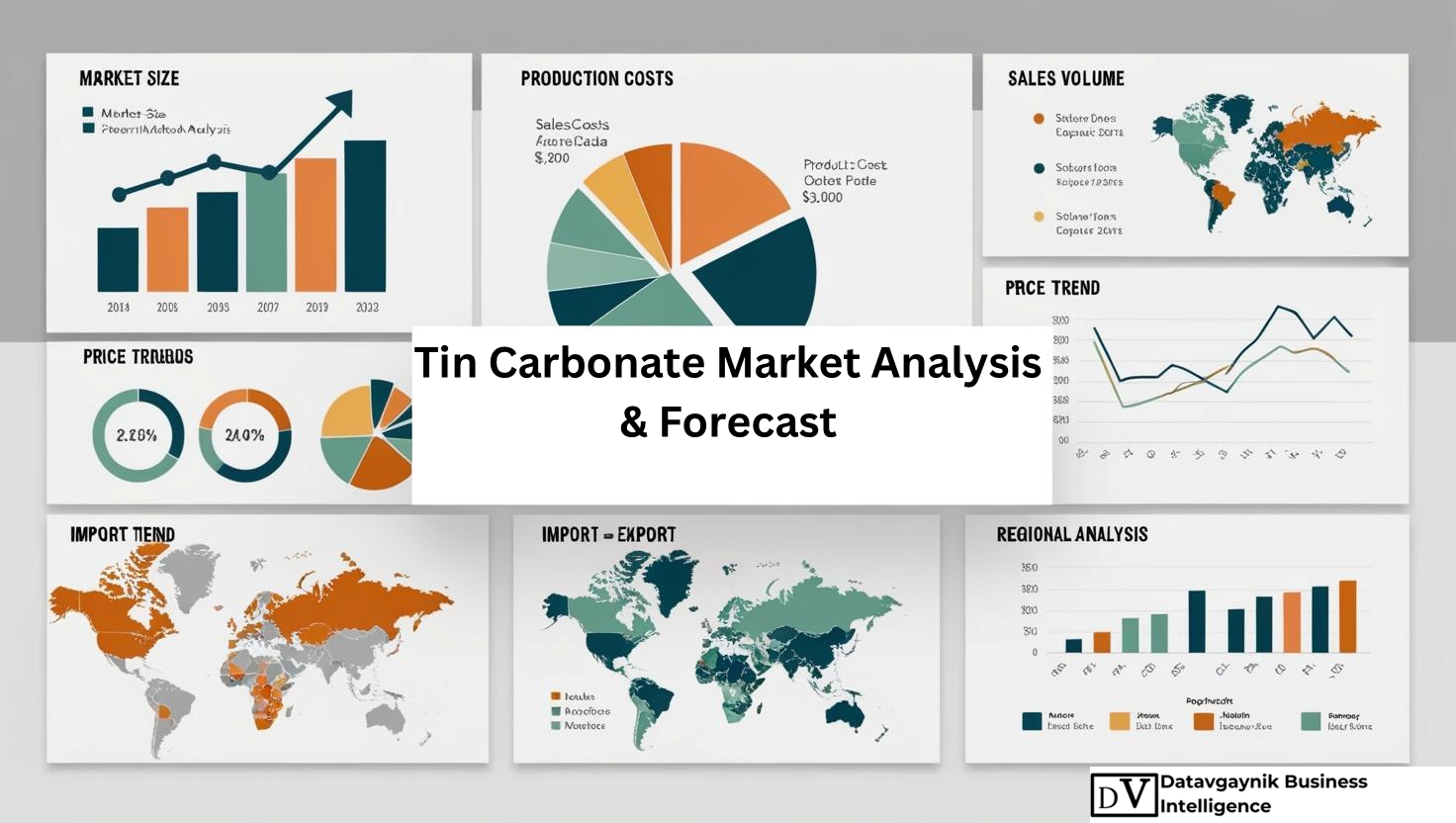

Tin Carbonate Market Size, Production, Sales, Average Product Price, Market Share, Import vs Export

- Published 2025

- No of Pages: 120+

- 20% Customization available

Tin Carbonate Market: Key Market Trends and Drivers

The Tin Carbonate Market is experiencing robust growth driven by a variety of industry factors that are fueling demand across several sectors. This growth is primarily underpinned by the expanding applications of Tin Carbonate in industries such as electronics, ceramics, coatings, and specialty chemicals. As industries evolve and adopt more sustainable and technologically advanced solutions, the Tin Carbonate Market continues to gain traction.

Expanding Electronics Industry and Demand for Tin Carbonate

The rapid growth in the electronics sector is one of the most significant drivers for the Tin Carbonate Market. Tin Carbonate is increasingly utilized in the production of semiconductors, printed circuit boards (PCBs), and electronic coatings. The rising demand for consumer electronics and advancements in technology, such as 5G and miniaturized electronic devices, have significantly boosted the need for high-purity Tin Carbonate.

For instance, the semiconductor industry’s growing importance in global manufacturing is directly contributing to the increase in demand for Tin Carbonate, particularly in the production of electronic components that require high-quality coatings. As industries continue to innovate in electronics, the demand for specialized materials like Tin Carbonate will only increase. The global semiconductor market, which reached a value of $527 billion in 2021, is expected to grow at a compound annual growth rate (CAGR) of 10.4% from 2022 to 2030, which will drive the need for Tin Carbonate in the production of next-generation electronic devices.

Datavagyanik also covers related markets such as the Tin Oxide Market, the Tin Sulfate Market, and the Tin Dioxide Market. These compounds are commonly used in oxidation systems and industrial chemical processing, supporting shifts in formulation standards and regulatory compliance.

Growth in Ceramics and Glass Industry Driving Tin Carbonate Demand

The ceramics and glass industries are also contributing significantly to the growth of the Tin Carbonate Market. Tin Carbonate is an essential component in the production of ceramic glazes and glass coatings, where it enhances both the aesthetic appeal and the durability of the products. The global ceramics market, valued at over $320 billion in 2021, is projected to grow steadily as consumer demand for both decorative and functional ceramic items rises, particularly in developing regions.

The growing focus on high-performance and decorative ceramics in the construction sector is driving the use of Tin Carbonate. In addition, the expanding demand for energy-efficient and durable glass materials is fostering further adoption of Tin Carbonate in the production of glass coatings. As urbanization continues globally, with the construction sector being a major contributor to economic growth, the demand for Tin Carbonate in the ceramics and glass industry is set to expand. For example, the global construction market is projected to grow by 7.8% annually through 2026, which will drive the demand for ceramic and glass products that utilize Tin Carbonate.

Advancements in Eco-Friendly Coatings and Sustainable Solutions

The Tin Carbonate Market is also benefiting from the growing demand for eco-friendly coatings and paints. As environmental concerns become more pronounced, industries are increasingly shifting towards sustainable solutions, including the use of non-toxic materials such as Tin Carbonate. The push for safer chemical alternatives in industries such as automotive, construction, and electronics is driving manufacturers to explore and adopt Tin Carbonate-based formulations that meet stringent environmental regulations.

For example, the global push for lead-free paints and coatings is a significant trend influencing the market. Tin Carbonate, as a non-toxic alternative, has been gaining popularity in the coatings industry, where it is used in industrial and automotive coatings. The global demand for environmentally friendly coatings is expected to grow at a CAGR of 4.5% from 2022 to 2028, with Tin Carbonate playing an important role in meeting these sustainability goals. This shift towards green chemicals is poised to be a major market driver for Tin Carbonate in the coming years.

Pharmaceutical and Cosmetic Industry Adoption of Tin Carbonate

The Tin Carbonate Market is also witnessing increasing adoption in the pharmaceutical and cosmetic industries. Tin Carbonate’s unique chemical properties make it a versatile compound for specialized pharmaceutical formulations and cosmetic products. In the pharmaceutical sector, it is being explored for its potential applications in dermatological treatments, while in cosmetics, it is being used in skincare products due to its safe, non-toxic nature.

As the global cosmetics market continues to expand, projected to reach $758.4 billion by 2027, the demand for safe and effective ingredients is growing. The increasing preference for natural and non-toxic ingredients in cosmetics is providing a significant opportunity for Tin Carbonate producers. Furthermore, the pharmaceutical industry’s ongoing research into new drug formulations is likely to open up additional avenues for Tin Carbonate usage, particularly in the development of specialized treatments for skin conditions and other dermatological applications.

Industrialization in Emerging Markets Driving Market Growth

The industrial expansion in emerging markets, particularly in regions like Asia-Pacific and Latin America, is another key driver for the Tin Carbonate Market. These regions are undergoing rapid industrialization, with sectors such as manufacturing, construction, automotive, and electronics growing at an accelerated pace. As a result, the demand for Tin Carbonate in these markets is increasing, driven by its applications in ceramics, coatings, electronics, and chemicals.

China and India, for instance, are witnessing rapid economic growth, and both countries are major consumers and producers of Tin Carbonate. In India, the booming construction industry is contributing to an increase in demand for high-performance coatings, where Tin Carbonate plays a critical role. The country’s urbanization drive is further accelerating the demand for materials such as Tin Carbonate used in construction and industrial applications. Similarly, in China, the rapid expansion of the electronics industry and the increasing production of consumer goods is driving the need for Tin Carbonate.

Regulatory Pressures and Demand for Safer Alternatives

Stricter environmental regulations and increased awareness about hazardous chemicals are encouraging manufacturers to explore safer alternatives to traditional compounds. As governments around the world impose regulations to limit the use of toxic substances in products such as coatings, paints, and electronics, the demand for safer alternatives like Tin Carbonate is on the rise.

For instance, the European Union’s REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations are prompting industries to adopt safer chemical formulations, thus increasing the adoption of non-toxic materials like Tin Carbonate. Similarly, in the United States, the Environmental Protection Agency (EPA) has increased its focus on reducing the use of harmful substances in manufacturing, further driving the demand for Tin Carbonate in industrial applications. This regulatory push for safer chemical alternatives is set to continue, creating a long-term growth opportunity for the Tin Carbonate Market.

Technological Advancements and Innovation in Tin Carbonate Production

Technological advancements in the production of Tin Carbonate are also playing a crucial role in shaping market trends. As the demand for high-purity Tin Carbonate grows, especially in advanced applications such as electronics and semiconductors, manufacturers are focusing on improving production processes to enhance purity levels and reduce costs. Innovations in production techniques, such as more efficient extraction methods and green chemistry approaches, are making Tin Carbonate more accessible and sustainable.

Research and development in the field of Tin Carbonate are driving the creation of new formulations and applications, further supporting market growth. As industries look for higher-quality materials to meet the demands of high-tech applications, technological improvements in the production of Tin Carbonate are likely to continue playing an important role in market dynamics.

Conclusion: Growth Prospects for the Tin Carbonate Market

The Tin Carbonate Market is set for substantial growth, driven by a combination of factors including expanding industrial applications, increasing demand for eco-friendly solutions, and technological advancements in production processes. Industries such as electronics, ceramics, coatings, and pharmaceuticals are expected to continue to drive demand for Tin Carbonate, making it a crucial component in various sectors. Furthermore, the rise of emerging markets, regulatory shifts, and a focus on sustainable production methods will contribute to the long-term success of the Tin Carbonate Market. As a result, market players should look to capitalize on these trends to position themselves for future growth and profitability.

“Track Country-wise Tin Carbonate Production and Demand through our Tin Carbonate Production Database”

-

-

- Tin Carbonate production database for 27+ countries worldwide

- Tin Carbonate sales volume for 31+ countries

- Country-wise Tin Carbonate production capacity, production plant mapping, production capacity utilization for 27+ manufacturers

- Tin Carbonate production plants and production plant capacity analysis by top manufacturers

-

“Track real-time Tin Carbonate Prices, Tin Carbonate price charts for 27+ countries, Tin Carbonate weekly price tracker and Tin Carbonate monthly price tracker”

-

-

- Track real-time Tin Carbonate prices and Tin Carbonate price trend in 27+ countries though our excel-based Tin Carbonate price charts

- Real-time Tin Carbonate price tracker dashboard with 27+ countries

- Complete transparency on Tin Carbonate price trend through our Tin Carbonate monthly price tracker, Tin Carbonate weekly price tracker

-

Geographical Demand and Production of Tin Carbonate Market

The geographical distribution of Tin Carbonate demand and production is significantly influenced by industrial growth patterns, technological advancements, and regional policies. As global industries diversify, the demand for Tin Carbonate is expanding across various sectors, with certain regions emerging as key production hubs.

Strong Demand in Asia-Pacific

The Asia-Pacific region is the dominant player in the Tin Carbonate Market, driven by its rapidly growing manufacturing, electronics, and construction industries. China, Japan, and India are the primary consumers of Tin Carbonate, with the compound being integral to their electronics, coatings, ceramics, and glass manufacturing sectors.

In China, the rise of high-tech industries and an expanding middle class are major contributors to the demand for Tin Carbonate. The Chinese government’s focus on expanding electronic manufacturing capabilities, especially in semiconductors and circuit boards, has significantly boosted the need for high-purity Tin Carbonate. China’s dominance in electronics, expected to maintain a CAGR of 6.5% from 2022 to 2030, ensures consistent demand for high-quality Tin Carbonate production, particularly for use in advanced technological applications.

India is also experiencing a surge in demand for Tin Carbonate, particularly in its rapidly growing construction and coatings industries. The country’s urbanization rate is increasing, with urban population growth projected to surpass 600 million by 2031, further driving demand for construction materials that use Tin Carbonate in coatings and ceramics. Moreover, India’s growing pharmaceutical industry, which is increasingly exploring Tin Carbonate for medicinal formulations, adds to the overall market expansion.

European Demand for Tin Carbonate

Europe remains a significant market for Tin Carbonate, with demand primarily driven by countries such as Germany, France, and the United Kingdom. These regions have robust industrial sectors focused on electronics, automotive manufacturing, and high-performance coatings, all of which rely on Tin Carbonate for various applications.

Germany’s automotive and semiconductor industries are key consumers of Tin Carbonate. The increasing emphasis on electric vehicles (EVs) and the push for sustainable, non-toxic coatings are further boosting the demand for Tin Carbonate in this region. The country’s extensive research in high-purity materials, particularly in electronics, drives a substantial portion of the European Tin Carbonate demand.

In the United Kingdom, the demand for Tin Carbonate is driven by advancements in the electronics and chemical processing industries. The push for greener and more sustainable manufacturing practices has led to an increased focus on Tin Carbonate-based products in coatings and paints. The growing need for non-toxic, eco-friendly materials is shifting demand toward Tin Carbonate formulations that comply with strict environmental standards.

France also contributes significantly to the market, with its strong chemical and coatings industries. The country’s commitment to green chemistry is resulting in increased demand for Tin Carbonate in low-emission and non-toxic coatings used in various industrial applications, from automotive to construction.

North American Tin Carbonate Market Demand

In North America, the Tin Carbonate Market is largely driven by demand from the United States. The country’s extensive semiconductor and electronics industries contribute heavily to the need for high-purity Tin Carbonate. The demand for Tin Carbonate in coatings and catalysts has grown substantially, especially with increased government incentives for renewable energy and electric vehicles.

The United States’ semiconductor market, valued at over $200 billion in 2022, is expected to grow at a CAGR of 7% through 2030, thus further accelerating the need for Tin Carbonate in electronic applications. Moreover, the emphasis on environmental sustainability in the country has driven demand for non-toxic coatings, with Tin Carbonate being a preferred choice for industries requiring safe and effective formulations.

Middle Eastern and African Market Expansion

In the Middle East and Africa, the demand for Tin Carbonate is emerging, primarily driven by the construction and coatings industries. As urbanization accelerates in regions like the United Arab Emirates (UAE) and Saudi Arabia, demand for protective coatings and specialty ceramics is increasing, leading to higher consumption of Tin Carbonate. The growing infrastructure projects in these regions, supported by investments in sustainable construction methods, are likely to fuel long-term demand for Tin Carbonate.

In Africa, the market for Tin Carbonate is still in its early stages but is set for significant growth as the chemical industry expands. Countries like South Africa are investing in research and production to meet the growing demand for specialty chemicals, including Tin Carbonate, which is required in diverse industrial applications such as catalysis and coatings.

Tin Carbonate Market Segmentation

The Tin Carbonate Market can be broadly segmented based on grade, application, and end-use industry. This segmentation helps in understanding the dynamics of the market and the areas where growth is most significant.

By Grade: Industrial and High-Purity Tin Carbonate

The Tin Carbonate Market is divided into industrial-grade and high-purity Tin Carbonate. Industrial-grade Tin Carbonate is widely used in ceramics, coatings, and pigments, especially in sectors requiring bulk production at a lower cost. As construction activities continue to rise globally, particularly in the Asia-Pacific and Latin American regions, industrial-grade Tin Carbonate is in demand due to its role in protective coatings and decorative ceramics.

On the other hand, high-purity Tin Carbonate is essential in specialized industries like electronics and pharmaceuticals. The increasing demand for miniaturized electronic components, particularly in smartphones, semiconductor devices, and printed circuit boards, is pushing the demand for high-purity Tin Carbonate. In countries like Japan, South Korea, and the United States, which have a strong presence in the electronics sector, the demand for high-purity Tin Carbonate continues to rise.

By Application: Coatings, Ceramics, Electronics

The coatings and ceramics segments are the largest contributors to the Tin Carbonate Market, driven by their use in applications ranging from automotive and construction to industrial coatings. In these sectors, the shift toward non-toxic and eco-friendly solutions is increasing demand for Tin Carbonate-based products. Ceramics, particularly in glazes and specialty glass coatings, also constitute a significant portion of the market. As consumer demand for high-performance ceramics grows, especially in the construction and home décor industries, the adoption of Tin Carbonate in this sector is expected to rise.

Additionally, electronics is a rapidly growing application area for Tin Carbonate, especially in semiconductors and electronic coatings. The global semiconductor market is poised for strong growth, pushing demand for high-purity Tin Carbonate used in components like printed circuit boards, displays, and advanced sensors.

Tin Carbonate Price Trend and Market Dynamics

The price trend for Tin Carbonate has been influenced by several factors, including raw material availability, production costs, and regional demand fluctuations. The prices of Tin Carbonate have seen some volatility over the past few years, mainly due to shifts in the supply chain and changes in global trade policies. For instance, the price of tin, a key raw material for Tin Carbonate, has experienced periodic fluctuations. In 2022, the price of tin reached an all-time high, pushing Tin Carbonate prices upward. However, the market has stabilized in recent months, with prices expected to stabilize in the near term.

Tin Carbonate Price Trends are also being shaped by the increasing demand for high-purity grades used in electronics and pharmaceuticals. As demand from the electronics sector continues to rise, especially in regions like Asia Pacific and North America, the prices of high-purity Tin Carbonate are anticipated to experience upward pressure.

On the other hand, industrial-grade Tin Carbonate is subject to cost pressures from raw material price fluctuations and supply chain disruptions. However, with the increase in industrial production in emerging markets like India, Brazil, and Vietnam, it is expected that the price of industrial-grade Tin Carbonate will see moderate increases in the coming years, while still remaining cost-competitive compared to other materials.

Conclusion: Future of Tin Carbonate Market

The Tin Carbonate Market is witnessing a dynamic shift, driven by increasing demand across various regions and sectors. The geographical demand for Tin Carbonate is primarily concentrated in Asia-Pacific, Europe, and North America, with growing adoption in emerging markets such as Africa and the Middle East. As technological advancements continue and the shift toward eco-friendly and high-performance solutions grows, Tin Carbonate is becoming an essential material in electronics, coatings, ceramics, and specialty chemicals.

The segmentation of the market by grade, application, and end-use industry reveals diverse growth opportunities, particularly in high-purity Tin Carbonate applications in electronics and pharmaceuticals. Tin Carbonate Price Trends are influenced by market dynamics, including raw material availability, technological advancements, and shifting supply and demand patterns, with prices expected to continue rising for high-purity grades, while remaining relatively stable for industrial grades.

As global industries continue to innovate and expand, Tin Carbonate is poised to play a pivotal role in meeting the growing demand for sustainable, high-performance materials across a wide range of applications.

“Tin Carbonate Manufacturing Database, Tin Carbonate Manufacturing Capacity”

-

-

- Tin Carbonate top manufacturers market share for 27+ manufacturers

- Top 9 manufacturers and top 16 manufacturers of Tin Carbonate in North America, Europe, Asia Pacific

- Tin Carbonate production plant capacity by manufacturers and Tin Carbonate production data for 27+ market players

- Tin Carbonate production dashboard, Tin Carbonate production data in excel format

-

“Tin Carbonate price charts, Tin Carbonate weekly price tracker and Tin Carbonate monthly price tracker”

-

-

- Factors impacting real-time Tin Carbonate prices in 21+ countries worldwide

- Tin Carbonate monthly price tracker, Tin Carbonate weekly price tracker

- Real-time Tin Carbonate price trend, Tin Carbonate price charts, news and updates

- Tracking Tin Carbonate price fluctuations

-

Top Manufacturers in the Tin Carbonate Market

The Tin Carbonate Market is highly competitive, with several key players dominating both production and distribution across different regions. These manufacturers vary in scale, from large multinational corporations to specialized regional players, and they offer diverse product lines to cater to the growing demand across various industries. The top manufacturers in the market include both established companies with decades of experience and emerging players focused on innovation and sustainability.

Major Manufacturers

- Yunnan Tin Company Limited (China) Yunnan Tin Company is one of the largest producers of Tin Carbonate in the world, based in China. The company has a long history in the tin industry and is known for its robust production capabilities. Yunnan Tin’s product portfolio includes both industrial-grade and high-purity Tin Carbonate, which is used in electronics, coatings, and ceramics. Their focus on expanding production facilities and adopting sustainable production methods has enabled them to maintain a strong presence in the global market.

- Minsur S.A. (Peru) Minsur is a major player in the Tin Carbonate production market, primarily focusing on industrial-grade Tin Carbonate used in a variety of applications, including coatings and ceramics. The company operates one of the largest tin mining operations globally and has integrated production processes that allow it to supply both raw materials and processed products. Minsur’s strength lies in its efficient supply chain and strong relationships with customers in emerging markets.

- MMC Norilsk Nickel (Russia) Known for its operations in the metal and mining sectors, MMC Norilsk Nickel is also involved in the production of Tin Carbonate. The company’s tin production is integrated with its extensive mining and refining capabilities. It produces high-quality Tin Carbonate for use in electronics, coatings, and catalysts, serving a broad spectrum of industries. Norilsk Nickel’s commitment to sustainable practices and efficient manufacturing processes contributes to its growing market share.

- The Vietnam Tin Corporation (Vietnam) Vietnam Tin Corporation is a key producer of Tin Carbonate in Southeast Asia. As a leading exporter of tin products, the company has positioned itself as a reliable supplier for industries that require both industrial-grade and high-purity Tin Carbonate. Their product lines are used extensively in ceramics, coatings, and the growing electronics sector. The company has focused on expanding its research capabilities to improve production efficiency and meet the evolving demands of the market.

- Thailand Smelting and Refining Co. Ltd. (Thailand) Thailand Smelting and Refining is another significant player in the global Tin Carbonate Market. With a strategic focus on the production of both high-purity and industrial-grade Tin Carbonate, the company has established a strong presence in both domestic and international markets. They cater to various industries, including electronics, automotive coatings, and glass production, with a robust supply chain that enables them to serve clients across multiple regions.

- China Tin Group Holdings Limited (China) China Tin Group Holdings is one of the largest state-owned companies involved in the tin production sector. The company offers a variety of tin products, including Tin Carbonate, which is used extensively in ceramics, coatings, and electronics. Their focus on expanding production capacity and enhancing product quality has made them a leading supplier in the global market. China Tin Group is also making strides in developing eco-friendly Tin Carbonate production methods to cater to the growing demand for sustainable chemical products.

- Teck Resources Limited (Canada) Teck Resources, a leading player in the mining and metals industry, is also involved in the production of Tin Carbonate. The company’s operations are primarily focused on the extraction and processing of base metals, but they also manufacture Tin Carbonate for a range of applications, including catalysis and coatings. Teck Resources’ extensive network and commitment to sustainability are key factors that have allowed them to secure a significant market share in the global Tin Carbonate Market.

Tin Carbonate Market Share by Manufacturers

The Tin Carbonate Market is primarily dominated by a few key manufacturers who control a large portion of the market share. These companies are actively expanding their production capacities and establishing strategic partnerships with industries that rely heavily on Tin Carbonate. In terms of market share:

- Yunnan Tin Company holds a significant portion of the global market, with an estimated market share of around 20-25%. This is due to its large-scale production facilities and its extensive reach in Asia-Pacific and Europe.

- Minsur S.A. is another major player, with a market share of approximately 15-20%. Their strong presence in South America and their ability to produce both industrial and high-purity Tin Carbonate have contributed to their substantial market position.

- MMC Norilsk Nickel commands about 10-15% of the market, especially due to its integration of tin production with its mining operations. The company’s strong foothold in Russia and Europe helps maintain its market share in the Tin Carbonate industry.

- Vietnam Tin Corporation and Thailand Smelting and Refining each hold a share of around 5-10%, serving primarily the Southeast Asian market, though they are steadily expanding into international markets as demand for Tin Carbonate grows globally.

Manufacturer Product Lines and Innovation

Each of these top manufacturers has tailored their product lines to meet the specific needs of various industries.

- Yunnan Tin Company produces a wide range of Tin Carbonate products, including both high-purity grades for electronics and industrial-grade Tin Carbonate for ceramics and coatings. The company is also investing in research and development to produce eco-friendly formulations that cater to the growing demand for sustainable solutions.

- Minsur S.A. offers both Tin Carbonate and refined tin products, focusing on industrial applications. The company has built a reputation for supplying high-quality products at competitive prices, particularly in Latin America and emerging markets.

- MMC Norilsk Nickel produces high-purity Tin Carbonate, which is increasingly in demand due to its application in semiconductors and pharmaceuticals. The company’s investment in state-of-the-art production technologies ensures its products meet the high standards required by electronic manufacturers.

- Teck Resources specializes in industrial-grade Tin Carbonate, catering to the needs of industries such as construction, automotive coatings, and glass manufacturing. Teck is also making efforts to introduce sustainable production methods, improving its competitive edge in the market.

Recent News and Industry Developments

Recent developments in the Tin Carbonate Market highlight the increasing importance of sustainable production and the growth of new applications for Tin Carbonate in advanced industries.

In 2023, Yunnan Tin Company announced a significant investment in a new production facility aimed at increasing the output of high-purity Tin Carbonate. The facility is expected to increase their market share in the electronics sector, particularly for use in semiconductors and display technologies. This move reflects the growing demand for Tin Carbonate in high-tech applications, which is expected to drive market growth in the coming years.

Minsur S.A. has also made headlines in 2024 with the expansion of its operations in Brazil, where they are increasing production capacity to meet the rising demand from the construction and automotive coatings sectors in Latin America. The company’s commitment to maintaining high production standards while expanding its market reach in South America positions it well to capitalize on regional growth.

MMC Norilsk Nickel announced in mid-2024 that it would be investing heavily in research to develop eco-friendly Tin Carbonate production techniques. This initiative comes in response to increasing global demand for environmentally friendly chemicals, particularly in Europe and North America, where regulatory pressure is rising to reduce the use of hazardous substances in industrial processes.

Teck Resources, in partnership with a major electronics manufacturer, launched a new line of high-purity Tin Carbonate in 2023 for advanced battery technologies. This new product line aims to serve the growing demand for electric vehicle (EV) batteries and renewable energy storage, tapping into the burgeoning market for clean energy solutions.

Conclusion

The Tin Carbonate Market is characterized by a few large, influential manufacturers that control a significant portion of the global supply. Companies like Yunnan Tin Company, Minsur S.A., and MMC Norilsk Nickel are leading the charge, with substantial market shares and expanding product lines that cater to the growing demand for Tin Carbonate in industries like electronics, coatings, ceramics, and pharmaceuticals. As the market continues to evolve, manufacturers will likely focus on sustainable production methods and innovation to meet the increasing demand for high-purity products and eco-friendly solutions.

“Tin Carbonate Production Data and Tin Carbonate Production Trend, Tin Carbonate Production Database and forecast”

-

-

- Tin Carbonate production database for historical years, 10 years historical data

- Tin Carbonate production data and forecast for next 9 years

- Tin Carbonate sales volume by manufacturers

-

“Track Real-time Tin Carbonate Prices for purchase and sales contracts, Tin Carbonate price charts, Tin Carbonate weekly price tracker and Tin Carbonate monthly price tracker”

-

-

- Gain control on your purchase and sales contracts through our real-time Tin Carbonate price tracker and Tin Carbonate price trend analysis

- Tin Carbonate weekly price tracker and forecast for next four weeks

- Tin Carbonate monthly price tracker and forecast for next two months

-

Market Scenario, Demand vs Supply, Average Product Price, Import vs Export, till 2035

- Global Tin Carbonate Market revenue and demand by region

- Global Tin Carbonate Market production and sales volume

- United States Tin Carbonate Market revenue size and demand by country

- Europe Tin Carbonate Market revenue size and demand by country

- Asia Pacific Tin Carbonate Market revenue size and demand by country

- Middle East & Africa Tin Carbonate Market revenue size and demand by country

- Latin America Tin Carbonate Market revenue size and demand by

- Import-export scenario – United States, Europe, APAC, Latin America, Middle East & Africa

- Average product price – United States, Europe, APAC, Latin America, Middle East & Africa

- Market player analysis, competitive scenario, market share analysis

- Business opportunity analysis

Key questions answered in the Global Tin Carbonate Market Analysis Report:

- What is the market size for Tin Carbonate in United States, Europe, APAC, Middle East & Africa, Latin America?

- What is the yearly sales volume of Tin Carbonate and how is the demand rising?

- Who are the top market players by market share, in each product segment?

- Which is the fastest growing business/ product segment?

- What should be the business strategies and Go to Market strategies?

The report covers Tin Carbonate Market revenue, Production, Sales volume, by regions, (further split into countries):

- Asia Pacific (China, Japan, South Korea, India, Indonesia, Vietnam, Rest of APAC)

- Europe (UK, Germany, France, Italy, Spain, Benelux, Poland, Rest of Europe)

- North America (United States, Canada, Mexico)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa

Table of Contents:

Introduction to the Tin Carbonate Market

- Overview of Tin Carbonate and Its Chemical Composition

- Industrial Importance and Role of Tin Carbonate in Modern Applications

- Evolution of the Tin Carbonate Market: Past Developments and Current Trends

- Global Market Demand and Economic Relevance of Tin Carbonate

Raw Materials and Tin Carbonate Production Methods

- Essential Raw Materials for Tin Carbonate Production and Sourcing Challenges

- Chemical Processes Involved in Tin Carbonate Production

- Innovations in Tin Carbonate Production for Improved Efficiency

- Environmental Considerations in the Production of Tin Carbonate

Industrial Applications and Utilization of Tin Carbonate

- Tin Carbonate in Coatings, Pigments, and Corrosion Protection

- Role of Tin Carbonate in Electronics and Semiconductor Manufacturing

- Use of Tin Carbonate in Chemical Synthesis and Industrial Formulations

- Emerging Applications of Tin Carbonate in Advanced Material Sciences

Market Dynamics and Growth Trends in the Tin Carbonate Market

- Global Demand and Consumption Trends for Tin Carbonate

- Regional Insights: Tin Carbonate Market in North America, Europe, Asia-Pacific, and Beyond

- Key Growth Factors Influencing the Tin Carbonate Market

- Market Challenges: Supply Chain Limitations and Regulatory Constraints

Pricing Analysis and Economic Influences on the Tin Carbonate Market

- Cost Structure and Production Expenses in the Tin Carbonate Industry

- Impact of Raw Material Price Volatility on Tin Carbonate Market Pricing

- Market Demand Fluctuations and Their Influence on Tin Carbonate Prices

- Competitive Pricing Strategies in the Tin Carbonate Market

Technological Developments in Tin Carbonate Production

- Advancements in Production Techniques for High-Purity Tin Carbonate

- Process Automation and Efficiency Enhancements in Tin Carbonate Manufacturing

- Research Innovations for Sustainable and Eco-friendly Tin Carbonate Production

- Future Technological Trends Impacting the Tin Carbonate Market

Segmentation Analysis of the Tin Carbonate Market

- Classification by Application: Coatings, Electronics, Chemical Industry, and More

- Market Segmentation by Purity Levels and Industrial Requirements

- Regional Market Breakdown and Key Demand Drivers for Tin Carbonate

- Consumer Preferences and Shifts in Industrial Utilization of Tin Carbonate

Competitive Landscape and Major Players in the Tin Carbonate Market

- Leading Manufacturers and Suppliers in the Global Tin Carbonate Market

- Competitive Strategies: Mergers, Acquisitions, and Market Expansions in the Tin Carbonate Industry

- Innovations and Technological Edge of Key Competitors in Tin Carbonate Production

- New Market Entrants and Their Impact on the Competitive Landscape

Supply Chain and Distribution Channels for Tin Carbonate

- Overview of Tin Carbonate Supply Chain: From Production to End-User Industries

- Key Distributors and Logistics Networks in the Tin Carbonate Market

- Trade and Export Regulations Affecting Tin Carbonate Distribution

- Challenges in Global Supply Chain Management for Tin Carbonate

Regulatory and Policy Landscape for the Tin Carbonate Market

- Government Policies Governing the Production and Trade of Tin Carbonate

- Environmental and Safety Regulations in Tin Carbonate Manufacturing

- Compliance Standards and Certification Requirements for Tin Carbonate Producers

- International Trade Policies and Their Impact on Tin Carbonate Export and Import

Sustainability and Environmental Impact of Tin Carbonate Production

- Ecological Footprint of Tin Carbonate Manufacturing Processes

- Adoption of Green Chemistry in Tin Carbonate Production for Environmental Safety

- Recycling and Waste Management Solutions in the Tin Carbonate Industry

- Long-Term Sustainability Strategies for the Tin Carbonate Market

Future Growth Prospects and Market Forecast for Tin Carbonate

- Projections for Market Expansion and Demand Trends in the Tin Carbonate Industry

- Emerging Business Opportunities and Potential Growth Areas for Tin Carbonate

- Influence of Technological Innovations on the Future of Tin Carbonate Production

- Strategic Recommendations for Market Players to Capitalize on Growth Potential

Conclusion: Key Takeaways and Strategic Insights for the Tin Carbonate Market

- Summary of Market Trends, Challenges, and Opportunities in Tin Carbonate Industry

- Actionable Recommendations for Manufacturers, Investors, and Distributors in the Tin Carbonate Market

- Final Perspectives on the Evolution and Future Trajectory of Tin Carbonate Production

Other recently published reports:

“Every Organization is different and so are their requirements”- Datavagyanik

Companies We Work With

Do You Want To Boost Your Business?

drop us a line and keep in touch