© 2021 All rights reserved

Datavagyanik- Your Research Partner

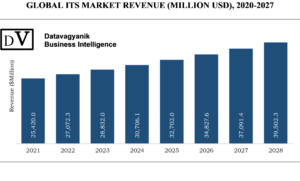

The global intelligent transportation systems (ITS) market was valued at $25,420 million in 2021 and witnessed a growth of 6.5% to reach $39.502 million in 2028. Factors such as the increasing need to reduce congestion in metropolitan areas of the world, improve the efficiency of the existing transportation networks are driving the market growth. In addition, intelligent transportation systems are gaining traction owing to the need to reduce the emission of hazardous pollutants, thereby improving the quality of life.

An intelligent transportation system (ITS) is broadly defined as the integration of information and communication technology with an existing transportation network for higher traffic efficiency. Some European and American countries such as U.S., UK, and Germany have implemented intelligent transportation systems very early. Some of the Asian countries such as Japan and Australia have been witnessing significant growth in the adoption of ITS systems. In 1996, the first ITS system named Electronic Route Guidance System was developed in the U.S. During the same period, Japan introduced the first Comprehensive Automobile Traffic Control System (CATC). These countries observed a massive improvement in the performance of transportation network operations after deploying ITS systems. These countries observed a massive improvement in the performance of transportation network operations after deploying ITS systems. ITS benefits these countries to improve the efficiency of their transportation networks, reduce fuel consumption and traffic congestions. Emerging countries such as India, China, and Brazil are exhibiting increased adoption of ITS systems.

ITS systems are comprised of sensors, wireless communication devices, computers, the application of data analysis tools, and navigation systems. Effective integration of these technologies improves traffic efficiency, environment quality, reduces fuel consumption, reduces traveling delays, and improves safety.

Transportation plays an important role in driving a nation’s economy. Thus, improper transport infrastructure hampers the economic and social development of the nation. Faulty traffic signals and traffic incidents cause the majority of the accidents in the world. This also leads to an increase in pollution levels in the urban and interurban networks. Congestion cost is a big issue for any country in terms of fuel consumption and travel time. As per estimates of various ITS associations such as ITS Canada, ITS Turkey, advanced traffic management systems (ATMs) reduce the waiting time at a signal by 20% to 30% and the travel time by 25%, which in turn helps in saving a huge chunk of notified congestion. These systems are also beneficial to reducing greenhouse gas emissions such as carbon dioxide (CO2), nitrous oxide (N2O), methane (CH4), and others. There is a minimization of 0.7 gallons of fuel by light vehicle for every hour delay time reduction in traffic. Deploying electronic tolling systems and ramp metering systems can reduce the traffic and maintain the flow of traffic on inter-urban road networks. An increasing number of vehicles would cause congestion in major cities of the world due to the increasing number of vehicles limited space for transportation network expansion and budgets. These factors majorly impact the growth of the ITS market and help to boost the demand for overall ITS management systems in the coming years.

Road accidents cost about $520 billion per year globally, which costs individual countries about 1% to 2% of their GDP. In the U.S., road fatalities cost $230 billion per year, and on average that costs $820 per person. In middle and low-income countries road accidents have a high impact on their economic development as it costs $5 billion annually. This exceeds the annual budgets received for their development assistance. Countries across the world are focusing to reduce the number of road accidents by deploying advanced traffic management systems in their country’s road networks. In addition, increasing awareness about road safety among vehicle owners is expected to increase the demand for cooperative systems such as vehicle to vehicle (V2V) and vehicle to infrastructure (V2I) in the coming years. Developed regions are fully committed and implementing stringent regulations and policies to reduce the number of road fatalities. North America and Europe have made electronic stability control (ESC) systems mandatory in both commercial and passenger cars. ESC is a driver assistance system and enables drivers to avoid accidents caused due to skidding. Increased awareness and stated facts have helped the overall ITS market to develop at a rapid pace in recent years and are expected to continue its impact in coming years.

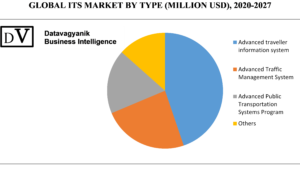

Based on type, intelligent transportation systems are categorized into advanced traveler information systems, transportation management systems, public transport systems, transportation pricing systems, and cooperative vehicle systems. Advanced transportation management systems accounted for the largest share of 37% in the global ITS market in 2021. Growing demand for advanced traffic management and control solutions to maintain the flow of traffic in both urban and inter-urban networks has mainly contributed to the growth of transportation management systems. This helps to reduce the economic burden of the government and minimizes traveling delays and fuel consumption. The public transportation system is expected to grow at a CAGR of 6% during the forecast period owing to the increase in annual expenditure on public transport due to the increasing number of public transport users globally. Globally the public transport authorities are focusing on providing an enhanced traveling experience for passengers by installing advanced technology solutions in transportation vehicles and infrastructure. In addition, cooperative vehicle systems are expected to see significant growth due to increasing demand for the vehicle to vehicle (V2V) and Vehicle to Infrastructure (V2I) communication devices for real-time information sharing to improve driver safety.

Moreover, governments in North America and Europe have designed traffic reduction and safety regulations which increased the demand for ITS systems. Asia-Pacific region is expected to exhibit the fastest growth on account of growing investment in China and India to improve the efficiency of their transportation network with the implementation of traffic management systems.

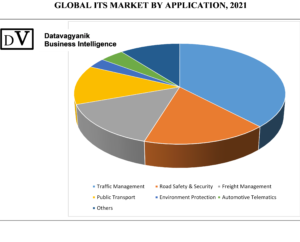

Major applications of ITSs include traffic management, public transport, freight management, parking management, road safety and security, automotive telematics, environment protection, and road user charging. A growing trend among vehicle owners towards automotive telematics systems to access real-time information would foster the growth of automotive telematics systems.

The automotive telematics segment is expected to see strong growth in the after-market as vehicle owners are increasingly installing these systems to access real-time traffic information. Stringent automotive emission regulations in Europe and North America are increasing the demand for automotive emission control systems in these regions. Traffic management ITSs dominated the global market in 2021 and accounted for 34.2% of the total market. This segment is expected to maintain its dominance throughout the period 2021 – 2027.

Each party involved in the value chain of the ITS industry plays a key role in the development of the ITS market. Following are the key parties involved in the development and implementation of ITSs:

Transport authorities: This includes regional and national transportation authorities who install ITSs to control and manage operations of transportation networks. Some transportation authorities also act as regulatory bodies to set standards and regulations for the implementation and development of ITSs. They also collaboratively work with equipment and software suppliers for innovations and improve the functionality of the existing systems.

Transport authorities share the traffic and other transportation-related information with public and private transport operators through wireless or satellite-based communication devices. Public transport normally includes bus, rail, and air transport operating under regional or national transportation authorities. Private transportation operators include car rental companies, freight service providers, travel agencies, and other private transpiration service providers. Automotive telematics, ETC tags, and other communicating devices are installed in these personal and transportation operators’ vehicles. These systems are either integrated in-vehicle by the manufacturers or vehicle owner purchases them from aftermarket OEMs.

System integrators play an important role in the value chain of the ITS industry. They act as a design and procurement advisor for transportation authorities. IBM and Xerox are two leading system integrators in the global ITS industry and provide ITS architecture deployment services globally. Hardware equipment providers manufacture and supply devices and equipment used in ITS including automotive sensors, security devices (CCTVs), computers, display screens, embedded circuits, and communication devices. IT solution providers work closely with hardware equipment providers to improve the functionality of their products. End-use ITS solution providers procure hardware and IT solutions from different vendors to provide final ITS solutions to end-users. Some established end-use solution providers such as Kapsch, Hitachi, and Siemens prefer to develop hardware and software solutions in-house instead of outsourcing the same. They sell ITS solutions either through direct distribution channels or through system integrators to the end-user. Support service providers offer internet, wireless mobile, and satellite-based communication services for effective information sharing between all ITS users. NTT DoCoMo, Version Wireless, and AT&T are some leading communication service providers in the global ITS market.

The threat of new entrants

A large number of established players in the global ITS industry have a stronghold on this market. The high initial investment is a barrier for new entrants. In addition, one needs to have strong technical resources, skilled manpower, and the ability to develop unique products, in order to sustain in this competitive industry. However, government and transportation authorities are providing support in developing advanced transportation solutions for improving the performance of existing networks and road safety. In addition to this, higher profit margins and huge potential in the global market are attracting new entrants to invest in this industry. Owing to these facts, the threat of new entrants is expected to remain medium throughout the estimated period.

Degree of competition

The global ITS industry is categorized as highly competitive with many multinational and domestic players. Organized players have strong manufacturing, financial, and marketing resources along with a broad range of product offerings. Strong national standards set by several countries such as the U.S., Japan, Singapore, and the UK to improve the interoperability of national transportation systems reduce product differentiation of the competitors’ offering. In addition, an increasing partnership between public sector users and manufacturers contributes to a high degree of market competition. Low entry barriers and high incentive to develop advanced solutions attract new players to this industry. Governments in both developed and developing markets are giving high incentives to manufacturers for advanced congestion reduction solutions. This will attract new players to enter this market. This represents a high degree of competition in the global ITS market.

Today, ITS is found useful for a variety of applications such as traffic management, safety and security, public transport, freight management, environment protection, automotive telematics, parking management, and road user charging.

The traffic management application is expected to dominate the market throughout the analysis period. The application garnered a market value of $7.5 billion in 2021. In terms of growth, environment protection application is expected to grow at the fastest CAGR of 13% during the forecast period. The application consolidated a market value of $0.5 billion in 2021.

Some of the important players operating in the Intelligent Transportation Systems (ITS) market are – Siemens, Addco, Thales Group, Xerox Corporation, Recardo, Sensys Networks, Inc., TomTom International BV, TransCore, Telenav, Inc., Iteris, Inc., Kapsch TrafficCom, Lanner, Nuance Communications, Inc., Agero, Inc., DENSO CORPORATION, EFKON GmbH, Hitachi, Ltd., Garmin Ltd., Q-Free ASA, and others

The report analyzes the Intelligent Transportation Systems (ITS) market from the demand as well as the supply side. In supply-side analysis, we reach out to the Intelligent Transportation Systems (ITS) market players to collect information on their portfolio, revenue, target customers, and other insights. During this process, paid interviews and surveys are conducted for obtaining and validating the data pointers. We also deep dive into the available paid industry databases, research studies, white papers, and annual reports.

As a part of our demand-side analysis, we reach out to the end-users of Intelligent Transportation Systems (ITS), to gauge the application areas, demand trends, and similar insights.

This business analysis report on the Intelligent Transportation Systems (ITS) market presents a regional as well as country-level analysis. The regions covered in the report are – North America, Europe, Asia Pacific, and the Rest of the World. In these four regions, all the countries have been covered in detail with information on Intelligent Transportation Systems (ITS) market size, trends, and forecast.

The report covers Intelligent Transportation Systems (ITS) market revenue and forecast for the period (2021 – 2028), by regions, (further split into countries):

INTELLIGENT TRANSPORTATION SYSTEMS (ITS) MARKET REVENUE ($MILLION), AND FORECAST, 2021–2027

| Year | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | CAGR (2021-2027) |

| Intelligent Transportation Systems (ITS) Market Revenue ($Million) | XX | XX | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX | XX | XX |

*Note – Country-level break-down has been covered in the report

There is an entire data collection and validation framework that Datavagyanik follows to provide you with authentic information. We connect to industry experts across various countries to understand market trends and demand pattern. The same is done through paid interviews and surveys.

Our internal team of analysts is experts in studying market patterns, mining data, and extracting useful information from different paid as well as freely available sources. Datavagyanik has an exhaustive internal database with information on markets, market players, and other macro and micro economic indicators that impact industries.

1. Executive Summary

1.1. Market Attractiveness Analysis

1.2. Global Intelligent Transportation Systems (ITS) Market, By Material

1.3. Global Intelligent Transportation Systems (ITS) Market, By Application

1.4. Global Intelligent Transportation Systems (ITS) Market, By Geography

2. Research Methodology

2.1. Research Process

2.2. Primary Research

2.3. Secondary Research

2.4. Market Size Estimation

2.5. Forecast Model

2.6. List of Assumptions

3. Market Dynamics

3.1. Introduction

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Challenges

3.6. Covid 19 Impact Analysis

4. Global Intelligent Transportation Systems (ITS) Market Analysis

4.1. Overview

4.2. Global Intelligent Transportation Systems (ITS) Market Size ($Million) and Forecasts (2020 – 2027)

4.3. Global Intelligent Transportation Systems (ITS) Market Size ($Million) and Forecasts (2020 – 2027), By Type

4.3.1. Traveler Information System

4.3.2. Advanced Traffic Management System

4.3.3. Advanced Public Transportation Systems Program

4.4.4. Others

4.4. Global Intelligent Transportation Systems (ITS) Market Size ($Million) and Forecasts (2020 – 2027), By Application

4.4.1. Traffic Management

4.4.2. Road Safety & Security

4.4.3. Freight Management

4.4.4. Public Transport

4.4.5. Environment Protection

4.4.6. Automotive Telematics

4.4.7. Others

4.3. Global Intelligent Transportation Systems (ITS) Market Size ($Million) and Forecasts (2020 – 2027), By Geography

4.3.1. North America

4.3.2. Asia Pacific

4.3.3. Europe

4.3.4. Rest of the World

5. North America Intelligent Transportation Systems (ITS) Market analysis

5.1. Overview

5.2. North America Intelligent Transportation Systems (ITS) Market Size ($Million) and Forecasts (2020 – 2027)

5.3. North America Intelligent Transportation Systems (ITS) Market Size ($Million) and Forecasts (2020 – 2027), By Type

5.3.1. Traveler Information System

5.3.2. Advanced Traffic Management System

5.3.3. Advanced Public Transportation Systems Program

5.3.4. Others

5.4. North America Intelligent Transportation Systems (ITS) Market Size ($Million) and Forecasts (2020 – 2027), By Application

5.4.1. Traffic Management

5.4.2. Road Safety & Security

5.4.3. Freight Management

5.4.4. Public Transport

5.4.5. Environment Protection

5.4.6. Automotive Telematics

5.4.7. Others

5.5. North America Intelligent Transportation Systems (ITS) Market Size ($Million) and Forecasts (2020 – 2027), By Country

5.5.1. United States

5.5.2. Canada

5.5.3. Mexico

6. Europe Intelligent Transportation Systems (ITS) Market analysis

6.1. Overview

6.2. Europe Intelligent Transportation Systems (ITS) Market Size ($Million) and Forecasts (2020 – 2027)

6.3. Europe Intelligent Transportation Systems (ITS) Market Size ($Million) and Forecasts (2020 – 2027), By Type

6.3.1. Traveler Information System

6.3.2. Advanced Traffic Management System

6.3.3. Advanced Public Transportation Systems Program

6.3.4. Others

6.4. Europe Intelligent Transportation Systems (ITS) Market Size ($Million) and Forecasts (2020 – 2027), By Application

6.4.1. Traffic Management

6.4.2. Road Safety & Security

6.4.3. Freight Management

6.4.4. Public Transport

6.4.5. Environment Protection

6.4.6. Automotive Telematics

6.4.7. Others

6.5. Europe Intelligent Transportation Systems (ITS) Market Size ($Million) and Forecasts (2020 – 2027), By Country

6.5.1. Germany

6.5.2. France

6.5.3. Italy

6.5.4. Spain

6.5.5. U.K.

6.5.6. Rest of Europe

7. Asia Pacific Intelligent Transportation Systems (ITS) Market analysis

7.1. Overview

7.2. Asia Pacific Intelligent Transportation Systems (ITS) Market Size ($Million) and Forecasts (2020 – 2027)

7.3. Asia Pacific Intelligent Transportation Systems (ITS) Market Size ($Million) and Forecasts (2020 – 2027), By Type

7.3.1. Traveler Information System

7.3.2. Advanced Traffic Management System

7.3.3. Advanced Public Transportation Systems Program

7.3.4. Others

7.4. Asia Pacific Intelligent Transportation Systems (ITS) Market Size ($Million) and Forecasts (2020 – 2027), By Application

7.4.1. Traffic Management

7.4.2. Road Safety & Security

7.4.3. Freight Management

7.4.4. Public Transport

7.4.5. Environment Protection

7.4.6. Automotive Telematics

7.4.7. Others

7.5. Asia Pacific Intelligent Transportation Systems (ITS) Market Size ($Million) and Forecasts (2020 – 2027), By Country

7.5.1. China

7.5.2. Japan

7.5.3. South Korea

7.5.4. India

7.5.5. Australia

7.5.6. Malaysia

7.5.7. Vietnam

7.5.8. Rest of APAC

8. Rest of the World Intelligent Transportation Systems (ITS) Market analysis

8.1. Overview

8.2. Rest of the World Intelligent Transportation Systems (ITS) Market Size ($Million) and Forecasts (2020 – 2027)

8.3. Rest of the World Intelligent Transportation Systems (ITS) Market Size ($Million) and Forecasts (2020 – 2027), By Type

8.3.1. Traveler Information System

8.3.2. Advanced Traffic Management System

8.3.3. Advanced Public Transportation Systems Program

8.3.4. Others

8.4. Rest of the World Intelligent Transportation Systems (ITS) Market Size ($Million) and Forecasts (2020 – 2027), By Application

8.4.1. Traffic Management

8.4.2. Road Safety & Security

8.4.3. Freight Management

8.4.4. Public Transport

8.4.5. Environment Protection

8.4.6. Automotive Telematics

8.4.7. Others

9. Company Profiles

9.1. Siemens

9.1.1. Company Overview

9.1.2. Products Offered

9.1.3. Key Developments

9.1.4. Revenue from Intelligent Transportation Systems (ITS) Business Segment, 2019 & 2020

9.2. Addco

9.2.1. Company Overview

9.2.2. Products Offered

9.2.3. Key Developments

9.2.4. Revenue from Intelligent Transportation Systems (ITS) Business Segment, 2019 & 2020

9.3. Thales Group

9.3.1. Company Overview

9.3.2. Products Offered

9.3.3. Key Developments

9.3.4. Revenue from Intelligent Transportation Systems (ITS) Business Segment, 2019 & 2020

9.4. Xerox Corporation

9.4.1. Company Overview

9.4.2. Products Offered

9.4.3. Key Developments

9.4.4. Revenue from Intelligent Transportation Systems (ITS) Business Segment, 2019 & 2020

9.5. Recardo

9.5.1. Company Overview

9.5.2. Products Offered

9.5.3. Key Developments

9.5.4. Revenue from Intelligent Transportation Systems (ITS) Business Segment, 2019 & 2020

9.6. Sensys Networks, Inc.

9.6.1. Company Overview

9.6.2. Products Offered

9.6.3. Key Developments

9.7. TomTom International BV

9.7.1. Company Overview

9.7.2. Products Offered

9.7.3. Key Developments

9.7.4. Revenue from Intelligent Transportation Systems (ITS) Business Segment, 2019 & 2020

9.8. TransCore

9.8.1. Company Overview

9.8.2. Products Offered

9.8.3. Key Developments

9.8.4. Revenue from Intelligent Transportation Systems (ITS) Business Segment, 2019 & 2020

9.9. Telenav, Inc.

9.10. Iteris, Inc.

9.11. Kapsch TrafficCom

9.12. Lanner

9.13. Nuance Communications

9.14. Agero

9.15. DENSO CORPORATION

9.16. EFKON GmbH

9.17. Hitachi, Ltd.

9.18. Garmin Ltd.

9.19. Q-Free ASA

Others

“Every Organization is different and so are their requirements”- Datavagyanik

© 2021 All rights reserved

Datavagyanik- Your Research Partner

Add the power of Impeccable research, become a DV client