© 2021 All rights reserved

Datavagyanik- Your Research Partner

The Middle East active pharmaceutical ingredients demand market at $410 million in 2021 and is expected to grow at 8% year-on-year during the next six years. As the production of pharmaceutical products will rise in coming years, the demand for active pharmaceutical ingredients will also increase. Presently, most of the API demand in the region is met through imports.

As the manufacturing of drugs in the categories such as cardiovascular, diabetes and heart diseases is picking up in the region, the active pharmaceutical ingredients requirement is bound to rise among the manufacturers. Egypt is the largest manufacturer of drugs in the region and is also a significant exporter to Middle Eastern countries such as Saudi Arabia, Iraq and Yemen. The country is also the largest consumer of active pharmaceutical ingredients.

“We are taking steps to scale our production of diabetes drugs. We are sourcing the required active pharmaceutical ingredients from Europe and India since there is a minimal production of API in Saudi Arabia” – an executive from a pharmaceutical company in Saudi Arabia

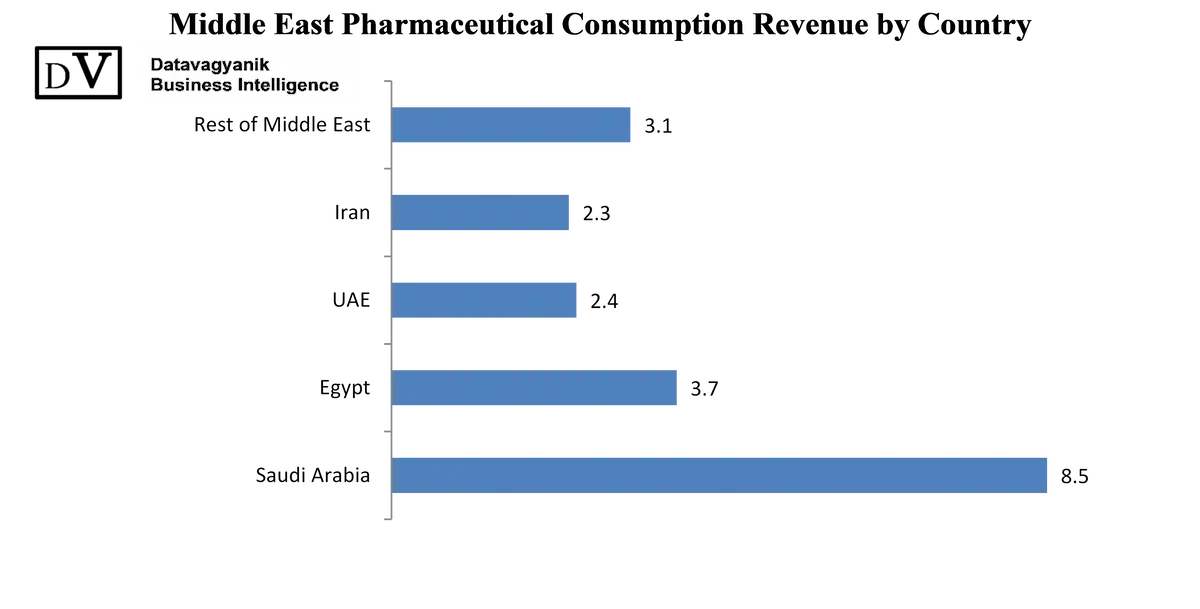

The Middle East pharmaceutical sector is growing notably. With rising healthcare spending and an aging population, the region has emerged to be a potential pharmaceutical market. Non-contagious chronic diseases in the Middle East region are on a rise. Health problems such as obesity, diabetes, and cardiovascular diseases have been some of the major health issues that the region is facing. Pharmaceuticals in the Middle East region is around a $20 billion market with a huge dependence on imports.

Around 65% of the pharmaceutical consumption in the region is met through imports with countries such as Saudi Arabia and UAE being at the top of the importer’s list. The low home market production is mainly attributed to the difference in the regulatory framework across Middle Eastern countries and unstable political conditions in a few markets.

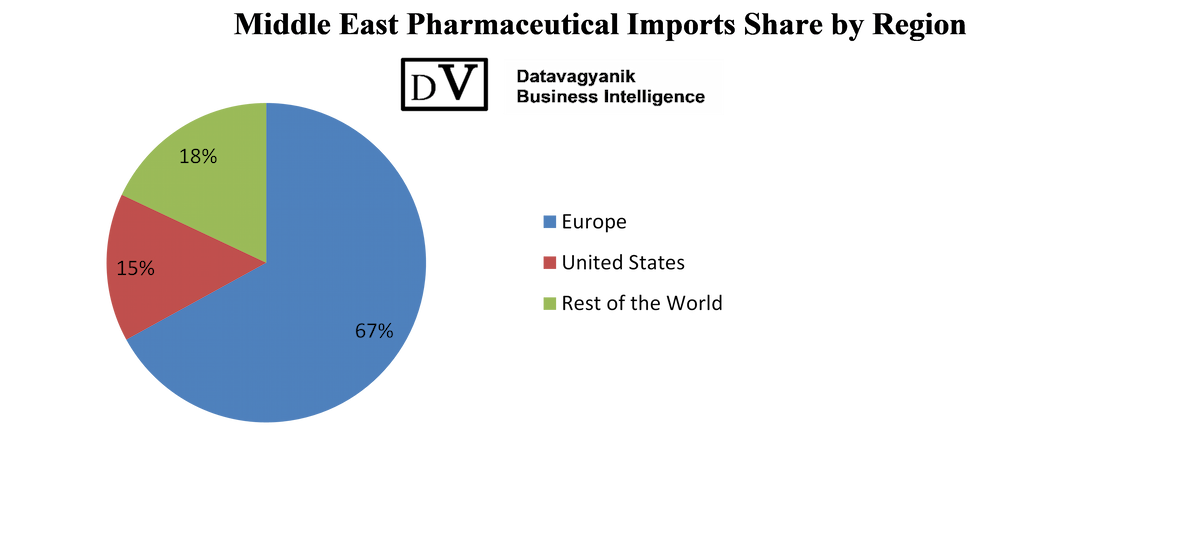

As a general trend, most of the companies active in the pharmaceutical business in the region act as third-party distributors of imported drugs. In 2021, 67% of the drugs consumed in the region were imported from Europe, 15% were imported from the U.S. while the rest was sourced from other foreign markets including China and India. However, countries in the Middle East region have taken efforts to increase generic drugs production and reduce the dependence on imports. Tie-ups with larger pharmaceutical companies in order to contract to manufacture their products is one of the strategies that local players may adopt to meet local production demands. For instance, AJA Pharma Co. Ltd signed an agreement with Novartis for manufacturing drugs in certain categories such as diabetes. As a part of this project, AJA Pharma Co. Ltd announced an investment of SAR 50 million into its production line. Similarly, in 2019, Pharmax Pharmaceuticals opened its generic drug manufacturing plant in Dubai that would mainly produce medicines for chronic diseases.

“Every Organization is different and so are their requirements”- Datavagyanik

© 2021 All rights reserved

Datavagyanik- Your Research Partner

Add the power of Impeccable research, become a DV client