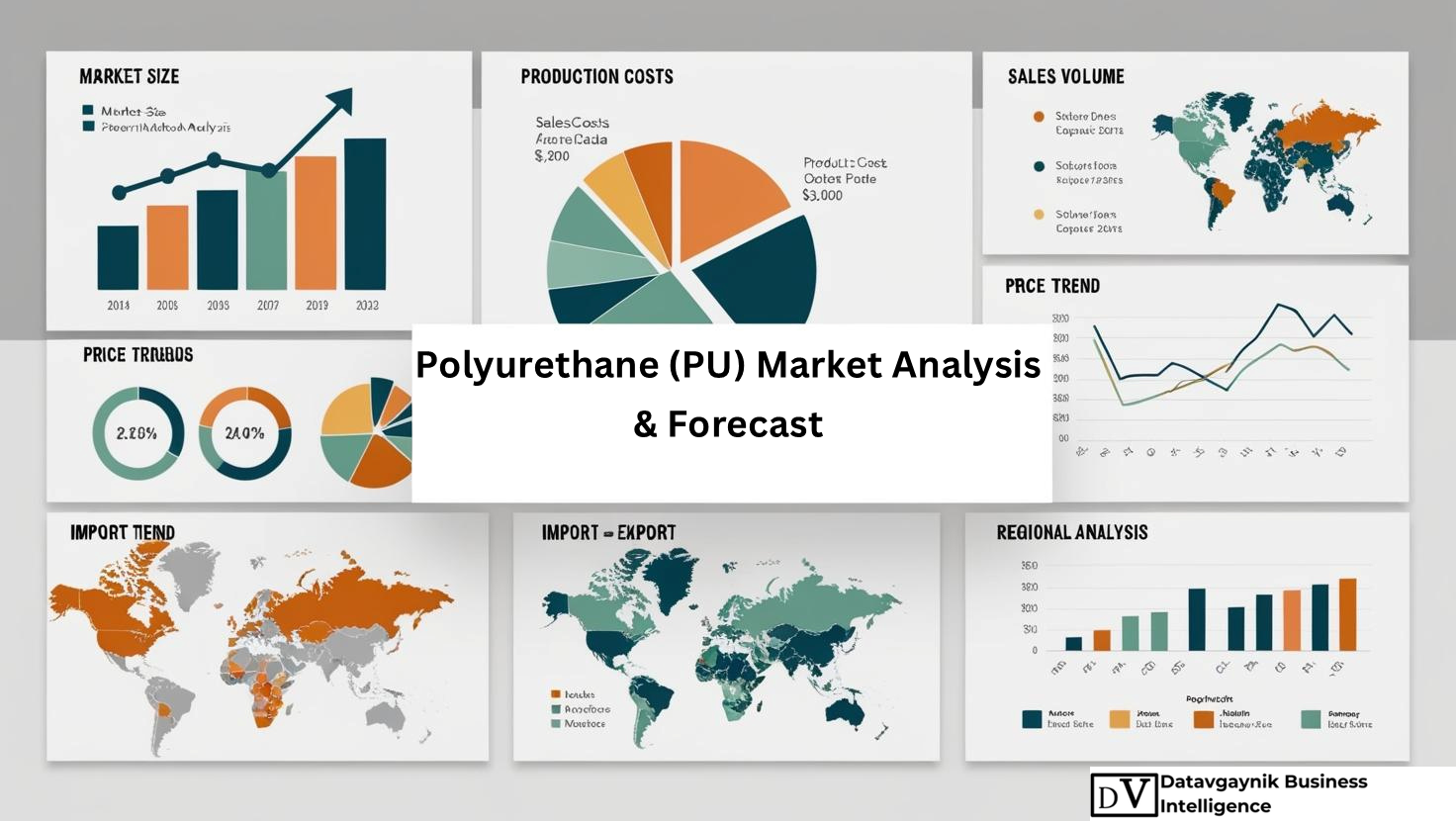

Polyurethane (PU) Market Size, Production, Sales, Average Product Price, Market Share, Import vs Export

- Published 2025

- No of Pages: 120+

- 20% Customization available

Global Expansion of Construction Sector Driving Polyurethane (PU) Market Growth

The Polyurethane (PU) Market is witnessing robust expansion due to the accelerating global construction industry. Polyurethane’s exceptional thermal insulation, weather resistance, and structural strength have positioned it as a key material in energy-efficient construction. For instance, the increasing enforcement of energy codes across major economies has led to widespread adoption of PU insulation panels and sealants. Datavagyanik estimates that global demand for rigid polyurethane foam used in insulation has grown by over 6% CAGR in the past five years, particularly in residential and commercial real estate developments.

In Europe, stringent building efficiency regulations, such as those implemented in Germany and France, are reinforcing the use of PU in retrofitting old buildings with insulation solutions. Similarly, the United States has shown a consistent rise in demand for PU spray foam in both roofing and wall applications. This growth in construction activities is projected to remain a fundamental driver for the Polyurethane (PU) Market over the next decade.

Automotive Industry Innovations Accelerating Polyurethane (PU) Market Demand

The Polyurethane (PU) Market is also being strongly driven by the automotive industry’s push toward lightweight and fuel-efficient vehicles. Polyurethane materials are being increasingly utilized in seating, interior components, dashboards, door panels, and noise-damping insulation. For example, vehicle manufacturers are integrating PU foam in car seats for its superior cushioning, weight reduction, and durability.

According to Datavagyanik, the use of polyurethane in vehicle interiors has grown at an annual rate of 7% globally over the past three years. In electric vehicles, where weight optimization is crucial for maximizing battery efficiency, PU components offer a perfect balance between mechanical performance and light weight. This shift is significantly contributing to the overall expansion of the Polyurethane (PU) Market.

Datavagyanik also covers related markets such as the Biodegradable Polyurethane (PU) Market, the Catalysts for PU Flexible Foam Market, and the Polyurethane Foam Market. Tracking these sectors reveals parallel dynamics and helps anticipate shifts likely to affect the primary market.

Growing Preference for Comfort Driving Polyurethane (PU) Market in Furniture and Bedding

The Polyurethane (PU) Market is also experiencing strong demand from the global furniture and bedding industry. Flexible polyurethane foam is a core material used in mattresses, pillows, sofas, and upholstered furniture. With rising consumer spending on home furnishings and increasing awareness of sleep quality, the demand for high-performance comfort materials has surged.

For instance, Datavagyanik notes a consistent 5–6% annual growth in PU foam demand within the global bedding segment. Companies are innovating in memory foam and hybrid mattress designs, both of which heavily rely on polyurethane. This growing demand for comfort-based furniture products is expected to keep the Polyurethane (PU) Market on a strong upward trajectory.

Booming Electronics Sector Enhancing Polyurethane (PU) Market Opportunities

Another major force behind the growth of the Polyurethane (PU) Market is the consumer electronics and appliances sector. Polyurethane coatings, adhesives, and potting compounds provide essential protection for circuit boards, components, and device casings against moisture, vibration, and heat. As the global electronics industry expands—especially in countries like China, South Korea, and Japan—the need for advanced PU formulations continues to grow.

Datavagyanik highlights that PU-based protective coatings for electronics have seen a demand rise of over 8% annually, particularly in the production of smartphones, LED lighting, and wearable devices. This growing application breadth within electronics is reshaping the future scope of the Polyurethane (PU) Market.

Sustainability Trends Transforming the Polyurethane (PU) Market

Environmental considerations and sustainability initiatives are significantly reshaping the Polyurethane (PU) Market. With mounting pressure to reduce carbon emissions and waste, industries are shifting toward bio-based and recyclable PU alternatives. Leading manufacturers have begun investing in green chemistry solutions to reduce the environmental footprint of PU production.

For example, bio-based polyols derived from soy, castor oil, and palm oil are increasingly being adopted in the formulation of both flexible and rigid PU foams. Datavagyanik identifies that the share of bio-based polyurethane materials has grown from under 3% to nearly 7% globally between 2018 and 2023. As this shift accelerates, driven by circular economy policies and end-user preferences, the Polyurethane (PU) Market is entering a phase of sustainable innovation.

Consumer Goods Applications Broadening Polyurethane (PU) Market Reach

In addition to traditional sectors, the Polyurethane (PU) Market is expanding rapidly in various consumer goods applications, including footwear, luggage, sports equipment, and fashion. Thermoplastic polyurethane (TPU), in particular, is gaining popularity due to its abrasion resistance, flexibility, and resilience. Brands are utilizing TPU for shoe soles, backpacks, and even wearable electronics.

For instance, major global footwear manufacturers have adopted lightweight PU soles to enhance performance and user comfort. Datavagyanik projects a 6.5% CAGR in TPU usage for lifestyle and performance shoes through 2030. This rising demand in consumer-driven sectors reinforces the versatility and market penetration of polyurethane materials.

Medical Applications Contributing to Polyurethane (PU) Market Diversification

Medical-grade polyurethane is gaining traction for its biocompatibility, flexibility, and durability. The Polyurethane (PU) Market is experiencing increased utilization in wound dressings, catheter tubing, surgical drapes, and implantable devices. With the expansion of global healthcare infrastructure, demand for safe, high-performance materials is increasing.

Datavagyanik data reveals that the PU medical segment has grown at 7–8% CAGR, especially in North America and Asia Pacific. Innovations in antimicrobial and breathable PU films are further advancing its role in modern medical technology. The integration of polyurethane in next-generation wearable healthcare devices is also opening new avenues in this segment.

Evolving Industrial Applications Expanding Polyurethane (PU) Market Use Cases

Beyond consumer and healthcare sectors, the Polyurethane (PU) Market is seeing expanding adoption in industrial applications such as mining equipment, oil and gas insulation, agricultural machinery, and packaging. PU elastomers, sealants, and coatings offer superior mechanical strength, corrosion resistance, and longevity in harsh environments.

For instance, polyurethane coatings are increasingly replacing traditional metal-based protection in offshore rigs and wind turbines, owing to their anti-corrosive and UV-resistant properties. Datavagyanik highlights a steady 5% annual growth in industrial-grade PU applications worldwide. As industries modernize and seek long-lasting materials, polyurethane is emerging as a top solution across sectors.

Rapid Urbanization in Developing Regions Fueling Polyurethane (PU) Market Size Expansion

Urbanization trends in Asia Pacific, the Middle East, and parts of Africa are significantly expanding the Polyurethane (PU) Market Size. As cities grow and infrastructure investments accelerate, the demand for energy-efficient construction materials, automotive parts, and consumer goods is rapidly rising. Polyurethane fits well into this landscape due to its versatility and cost-effectiveness.

For example, India and Southeast Asian countries are investing heavily in mass housing, smart cities, and transport systems—all of which demand polyurethane products for insulation, seating, and structural applications. Datavagyanik emphasizes that the Polyurethane (PU) Market Size in emerging economies is growing at nearly twice the global average, indicating strong future potential.

Technological Advancements Reinforcing Polyurethane (PU) Market Expansion

Advancements in manufacturing processes and material science are playing a key role in shaping the Polyurethane (PU) Market. From high-pressure PU injection molding to reactive PU adhesives and 3D printable TPU, technology is unlocking new efficiency levels and use cases.

For instance, PU composites are being used in aerospace and railway applications for their lightweight and flame-retardant properties. Furthermore, digital simulation tools are allowing manufacturers to optimize PU formulations for specific performance metrics. Datavagyanik notes that innovation-led expansion is becoming a strategic focus for major PU producers, ensuring that the Polyurethane (PU) Market remains future-ready.

“Track Country-wise Polyurethane (PU) Production and Demand through our Polyurethane (PU) Production Database”

-

-

- Polyurethane (PU) production database for 27+ countries worldwide

- Polyurethane (PU) Powder sales volume for 31+ countries

- Country-wise Polyurethane (PU) production capacity and production plant mapping, production capacity utilization for 27+ manufacturers

- Polyurethane (PU) production plants and production plant capacity analysis for top manufacturers

-

North America Driving Consistent Growth in Polyurethane (PU) Market

The Polyurethane (PU) Market in North America continues to demonstrate steady expansion, underpinned by strong demand across construction, automotive, and consumer goods sectors. The United States, in particular, holds a leading position due to robust infrastructure spending and residential development projects. Datavagyanik confirms that over 40% of rigid polyurethane foam used in North America is directed toward building insulation, with demand rising by approximately 6% annually due to stricter energy efficiency norms.

The automotive sector in the U.S. is also heavily influencing the Polyurethane (PU) Market through lightweight interior components and energy-absorbing foam applications. Additionally, the domestic furniture industry has witnessed an uptick in PU foam usage, driven by increased consumer spending on home improvement. These combined factors are propelling overall consumption and production, positioning North America as a critical contributor to global Polyurethane (PU) Market growth.

Europe’s Focus on Sustainability Strengthening Polyurethane (PU) Market Base

In Europe, the Polyurethane (PU) Market is being shaped by stringent sustainability directives and a matured industrial landscape. Germany, France, Italy, and the United Kingdom are leading production and consumption, particularly in construction and automotive applications. The European Green Deal and similar policies have led to heightened demand for thermally efficient PU insulation and recyclable PU materials.

Germany’s automotive sector is integrating PU in seat cushioning, lightweight body parts, and acoustic insulation. Meanwhile, the construction industry across the European Union is experiencing a shift toward PU spray foam and panel insulation as builders adopt energy-conscious designs. Datavagyanik indicates that European consumption of polyurethane for insulation purposes has grown by more than 8% in the past five years, reinforcing the continent’s strategic position in the global Polyurethane (PU) Market.

Asia Pacific Emerging as Powerhouse in Polyurethane (PU) Market

The Asia Pacific region stands out as the fastest-growing contributor to the Polyurethane (PU) Market, both in terms of production and demand. China dominates the region, driven by massive infrastructure investments, automotive expansion, and its status as a global manufacturing hub. Datavagyanik data suggests that China alone accounts for nearly 30% of global polyurethane production.

India is also emerging as a significant player, with PU demand accelerating across real estate, transportation, and consumer durables. The Indian automotive sector’s rapid transformation and the country’s construction boom are major drivers. For instance, PU insulation is now a key component in high-rise buildings due to its space-saving efficiency and superior thermal properties. Japan and South Korea contribute via advanced PU technologies for electronics and medical equipment, making Asia Pacific the most dynamic zone in the Polyurethane (PU) Market.

Latin America Showing Positive Momentum in Polyurethane (PU) Market

Latin America is witnessing moderate yet consistent growth in the Polyurethane (PU) Market. Countries like Brazil and Mexico are expanding PU production to support their domestic industries in automotive, construction, and footwear. For example, Brazil’s footwear manufacturing relies heavily on PU soles and midsoles due to their comfort and wear resistance. Additionally, the ongoing expansion of affordable housing projects is contributing to higher demand for PU insulation panels and foams.

Datavagyanik reveals that Latin America’s PU consumption is growing at a compound rate of over 4.5%, with import substitution policies in place to encourage local production. Regional manufacturers are also beginning to explore bio-based PU alternatives, gradually aligning with sustainability trends seen in North America and Europe.

Middle East and Africa Expanding Use of Polyurethane (PU) in Construction

The Polyurethane (PU) Market in the Middle East and Africa is expanding on the back of urbanization, infrastructure development, and an increasing focus on energy efficiency in arid climates. For example, the Gulf countries are investing in polyurethane-based insulation systems for buildings to combat extreme temperatures and reduce energy consumption.

Saudi Arabia, UAE, and South Africa are leading regional demand, with PU applications spanning from construction to oil and gas insulation. Datavagyanik confirms an upward shift in PU foam imports and local manufacturing capacity across these nations. The introduction of green building codes is also helping drive the adoption of sustainable PU materials in this region.

Geographical Production Hubs Shaping Global Polyurethane (PU) Market Supply

Global Polyurethane (PU) Market production is centered around key manufacturing clusters in China, the United States, Germany, South Korea, and India. These countries not only meet domestic consumption but also serve as major exporters of PU raw materials, foams, coatings, and elastomers. China, for example, has scaled up capacity to produce over 6 million metric tons of polyurethane annually.

India’s PU output has increased by over 10% year-on-year due to favorable government policies and a booming construction sector. Germany, meanwhile, maintains its leadership in high-performance and sustainable PU technologies, including recyclable thermoplastics and low-emission foams. These production hubs are pivotal in balancing global demand across sectors such as automotive, construction, consumer goods, and healthcare.

Polyurethane (PU) Market Segmentation Reflects Broad Application Base

The Polyurethane (PU) Market is segmented across several categories that reflect its versatile applications. By product type, flexible PU foam continues to hold a dominant position due to its use in mattresses, seating, and cushioning. Rigid PU foam is growing rapidly in construction and refrigeration due to its unmatched thermal insulation.

CASE (Coatings, Adhesives, Sealants, Elastomers) applications are also showing robust growth, driven by demand for weather-resistant coatings in infrastructure and high-performance adhesives in electronics. Thermoplastic polyurethane is increasingly adopted in footwear, mobile accessories, and automotive interiors due to its elasticity and abrasion resistance. This diverse segmentation underscores the material’s widespread integration across industrial and consumer applications, reinforcing the strength of the Polyurethane (PU) Market.

Polyurethane (PU) Price Trend Driven by Feedstock Volatility and Regional Dynamics

The Polyurethane (PU) Price is highly sensitive to fluctuations in the cost of key feedstocks such as isocyanates and polyols, which are derived from crude oil. Datavagyanik notes that over the past two years, sharp volatility in global crude prices has directly impacted the Polyurethane (PU) Price Trend. During peak crude periods, PU prices surged by nearly 20%, especially for flexible foams used in bedding and furniture.

Regionally, Asia Pacific offers the most competitive pricing due to economies of scale in China and India, where production costs are lower. In contrast, North America and Europe experience relatively higher PU prices due to stricter environmental regulations and costlier labor. For instance, the average Polyurethane (PU) Price in Europe is 15–20% higher than in China for comparable grades.

However, increased adoption of bio-based feedstocks is stabilizing the Polyurethane (PU) Price Trend over time. These materials reduce dependency on oil markets, allowing for greater pricing predictability in the long term. Furthermore, advancements in recycling and circular economy practices are expected to reduce production costs in the coming years.

Demand-Supply Imbalance Influencing Polyurethane (PU) Price Fluctuations

The Polyurethane (PU) Price is also influenced by regional supply-demand imbalances. For example, during COVID-19-related lockdowns, temporary closures of PU production facilities led to severe supply shortages in North America and Europe, causing price hikes of up to 25%. Post-pandemic recovery efforts, along with restocking activities across industries, resulted in demand surges that further stressed pricing dynamics.

Datavagyanik suggests that despite ongoing capacity additions in Asia and North America, localized bottlenecks still exist in raw material logistics and downstream formulation, leading to temporary spikes in the Polyurethane (PU) Price. These trends highlight the importance of integrated supply chains and localized production for price stability.

Outlook for Polyurethane (PU) Price Trend Indicates Gradual Normalization

Looking ahead, the global Polyurethane (PU) Price Trend is expected to gradually stabilize due to better alignment of supply chains, increased use of bio-based feedstocks, and regional capacity expansion. Datavagyanik projects that average global PU prices will stabilize at a compound growth rate of around 3–4% annually over the next five years.

This normalization will be supported by consistent demand in housing, automotive, and electronics, along with reduced dependency on volatile petrochemical markets. Innovations in PU recycling and improved energy efficiency in production are further contributing to cost optimization, positively influencing the long-term Polyurethane (PU) Price Trend.

“Polyurethane (PU) Manufacturing Database, Polyurethane (PU) Manufacturing Capacity”

-

-

- Polyurethane (PU) top manufacturers market share for 27+ manufacturers

- Top 7 manufacturers and top 17 manufacturers of Polyurethane (PU) in North America, Europe, Asia Pacific

- Production plant capacity by manufacturers and Polyurethane (PU) production data for 27+ market players

- Polyurethane (PU) production dashboard, Polyurethane (PU) production data in excel format

-

Top Manufacturers Dominating the Global Polyurethane (PU) Market

The Polyurethane (PU) Market is consolidated among a few dominant global players, with a mix of multinational corporations and regionally influential manufacturers. These companies play a crucial role in the value chain—from the production of isocyanates and polyols to the development of customized PU systems for construction, automotive, furniture, and other sectors. Datavagyanik analysis indicates that the top ten companies account for nearly 60% of the global Polyurethane (PU) Market share, highlighting a high level of concentration in key regions.

BASF SE: Leading Innovator in Polyurethane (PU) Market

BASF SE holds a prominent position in the Polyurethane (PU) Market with a diversified product portfolio across both flexible and rigid foams, coatings, adhesives, and thermoplastic polyurethane (TPU). Its product line includes Elastollan (TPU), Elastopor (rigid foam), and Elastoflex (flexible foam systems). BASF operates PU production and R&D centers across North America, Europe, and Asia, with a focus on sustainability through bio-based feedstock and circular economy initiatives.

The company’s market share in the global Polyurethane (PU) Market is estimated to be around 12–13%, backed by its strong presence in automotive, insulation, and consumer goods sectors. BASF’s continued investment in low-emission PU systems and high-performance applications reinforces its leadership in both innovation and volume.

Covestro AG: Pioneering Sustainable Polyurethane (PU) Production

Covestro AG is another major player in the Polyurethane (PU) Market, known for its commitment to sustainability and circular materials. Its Bayflex and Baydur product lines are widely used in automotive interiors, building insulation, and industrial foams. Covestro is a global supplier of polyols, isocyanates, and TPU, serving a vast network of downstream processors.

Datavagyanik estimates Covestro’s share in the global Polyurethane (PU) Market at approximately 10%, with strong footprints in Europe, China, and North America. The company has been instrumental in developing CO₂-based polyols and expanding its TPU offerings in consumer electronics and medical applications.

Huntsman Corporation: Integrated Polyurethane (PU) Solutions Provider

Huntsman Corporation ranks among the leading Polyurethane (PU) Market manufacturers, offering tailored solutions for automotive, footwear, construction, and electronics industries. Its product lines include VITROX (rigid foams), DALTOFOAM (flexible systems), and AVALON (TPU). Huntsman has integrated operations, from raw materials to PU formulation, across its global facilities.

The company commands around 8–9% of the Polyurethane (PU) Market share, supported by its strong North American base and strategic expansion in emerging markets such as India and Southeast Asia. Huntsman continues to develop low-emission, energy-efficient systems aimed at construction and refrigeration applications.

The Dow Chemical Company: Key Supplier of PU Feedstocks

Dow remains a core player in the Polyurethane (PU) Market primarily as a supplier of essential feedstocks such as polyether polyols and isocyanates. Its Voracor and VORANOL product lines are integral to PU foam production across automotive, bedding, appliance, and construction applications. Dow has maintained strong strategic collaborations with foam processors to develop customized PU systems for insulation and comfort.

Its market share is estimated at around 7%, driven by its large-scale manufacturing capacity and innovation in recyclable PU solutions. Dow’s efforts in developing carbon footprint-reduced PU systems and thermoset formulations further cement its role in driving market evolution.

Wanhua Chemical Group: Asia’s Largest Polyurethane (PU) Producer

China-based Wanhua Chemical has emerged as the largest PU producer in Asia and a global leader in MDI (Methylene diphenyl diisocyanate) production. The company’s Wanthane product line includes PU coatings, adhesives, and elastomers targeted toward automotive, electronics, and consumer goods applications.

Wanhua holds a market share of approximately 6–7% globally, but its dominance in the Asia Pacific region, especially China, makes it a pivotal force in regional supply chains. Datavagyanik notes that Wanhua’s recent investments in low-emission PU technologies and circular production systems are aimed at boosting its international market share.

Mitsui Chemicals: Expanding in High-Performance PU Applications

Mitsui Chemicals is a key Japanese manufacturer in the Polyurethane (PU) Market, with a focus on thermoplastic polyurethane for footwear, electronics, and industrial components. Its STABiO series represents its commitment to sustainable TPU development, targeting bio-based content and enhanced recyclability.

The company’s market share stands at approximately 3–4% globally, with a growing presence in Southeast Asia and North America. Mitsui is increasing its production capacity to cater to the rising demand for high-performance PU in electronic gadgets, smart devices, and wearable technologies.

Other Prominent Players in the Polyurethane (PU) Market

Additional influential players include Recticel, Sheela Foam, Foamex Innovations, Sekisui Chemical, and Rogers Corporation. These companies specialize in niche applications such as medical-grade PU foams, acoustics insulation, and high-density rigid foam boards. Regional leaders like Sheela Foam hold significant domestic market share in India, while companies such as Recticel focus on PU insulation panels across the European Union.

Polyurethane (PU) Market Share by Manufacturers Indicates High Consolidation

The Polyurethane (PU) Market share distribution highlights a highly consolidated landscape. The top five manufacturers together account for nearly 50% of total global PU production. Their dominance is reinforced by their integrated value chains, robust R&D capabilities, and wide application portfolios. Mid-tier companies, while agile and application-specific, face challenges in scaling up production and competing on price with global giants.

Datavagyanik emphasizes that consolidation is expected to continue as market leaders acquire regional players to strengthen their supply chains and expand their application reach. At the same time, the emergence of specialized sustainable PU start-ups is injecting innovation into the market.

Recent Developments Reshaping the Polyurethane (PU) Market

March 2024 – Covestro announced the commercial launch of a partially bio-based TPU range designed for the electronics and sportswear sectors. This move is expected to strengthen its presence in circular economy materials.

January 2024 – BASF inaugurated a new R&D center in India focusing on polyurethane formulations for tropical and emerging markets. This is aimed at capturing regional demand in construction and footwear industries.

November 2023 – Huntsman completed the expansion of its polyurethane systems house in Vietnam, enhancing its capacity to serve Southeast Asia’s construction and refrigeration markets.

September 2023 – Dow introduced a series of high-efficiency PU foam systems targeting cold chain logistics and sustainable packaging applications. These systems offer lower thermal conductivity and reduced emissions.

August 2023 – Wanhua Chemical signed a strategic agreement to export its low-emission MDI-based PU systems to Europe, targeting applications in automotive and building insulation.

These developments reflect a clear industry pivot toward sustainability, regional expansion, and application-specific innovation. As companies invest in new product lines, research hubs, and strategic partnerships, the Polyurethane (PU) Market is set for a transformative growth phase shaped by both technological and environmental imperatives.

“Polyurethane (PU) Production Data and Polyurethane (PU) Production Trend, Polyurethane (PU) Production Database and forecast”

-

-

- Polyurethane (PU) production database for historical years, 10 years historical data

- Polyurethane (PU) production data and forecast for next 7 years

-

Market Scenario, Demand vs Supply, Average Product Price, Import vs Export, till 2035

- Global Polyurethane (PU) Market revenue and demand by region

- Global Polyurethane (PU) Market production and sales volume

- United States Polyurethane (PU) Market revenue size and demand by country

- Europe Polyurethane (PU) Market revenue size and demand by country

- Asia Pacific Polyurethane (PU) Market revenue size and demand by country

- Middle East & Africa Polyurethane (PU) Market revenue size and demand by country

- Latin America Polyurethane (PU) Market revenue size and demand by

- Import-export scenario – United States, Europe, APAC, Latin America, Middle East & Africa

- Average product price – United States, Europe, APAC, Latin America, Middle East & Africa

- Market player analysis, competitive scenario, market share analysis

- Business opportunity analysis

Key questions answered in the Global Polyurethane (PU) Market Analysis Report:

- What is the market size for Polyurethane (PU) in United States, Europe, APAC, Middle East & Africa, Latin America?

- What is the yearly sales volume of Polyurethane (PU) and how is the demand rising?

- Who are the top market players by market share, in each product segment?

- Which is the fastest growing business/ product segment?

- What should be the business strategies and Go to Market strategies?

The report covers Polyurethane (PU) Market revenue, Production, Sales volume, by regions, (further split into countries):

- Asia Pacific (China, Japan, South Korea, India, Indonesia, Vietnam, Rest of APAC)

- Europe (UK, Germany, France, Italy, Spain, Benelux, Poland, Rest of Europe)

- North America (United States, Canada, Mexico)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa

Table of Contents:

Table of Contents: Polyurethane (PU) Market

Introduction to the Polyurethane (PU) Market

- Overview of Polyurethane (PU) and Its Industrial Importance

- Evolution and Growth of the Global Polyurethane (PU) Industry

- Key Market Drivers Boosting Polyurethane (PU) Demand

Polyurethane (PU) Production Processes and Manufacturing Technologies

- Industrial Techniques for Polyurethane (PU) Production

- Advances in Polyurethane (PU) Polymerization and Processing

- Innovations in Sustainable Polyurethane (PU) Manufacturing

Raw Materials and Supply Chain in Polyurethane (PU) Production

- Essential Raw Materials for Polyurethane (PU) Manufacturing

- Global Sourcing and Logistics for Polyurethane (PU) Supply Chain

- Cost Structures and Economic Challenges in Polyurethane (PU) Production

Applications of Polyurethane (PU) Across Industries

- Expanding Use of Polyurethane (PU) in Construction and Insulation

- Polyurethane (PU) in Automotive, Aerospace, and Transportation

- Growth of Polyurethane (PU) in Furniture, Footwear, and Consumer Goods

Market Segmentation of Polyurethane (PU) Products

- Flexible vs. Rigid Polyurethane (PU) Foam: Applications and Market Trends

- Regional Demand Variations in the Polyurethane (PU) Market

- Specialty Polyurethane (PU) Grades and Emerging Industrial Applications

Sustainability and Environmental Impact of Polyurethane (PU)

- Recycling and Waste Management Strategies for Polyurethane (PU)

- Development of Bio-Based and Low-Emission Polyurethane (PU) Materials

- Regulatory Challenges and Sustainable Practices in Polyurethane (PU) Production

Global Market Demand and Growth Trends for Polyurethane (PU)

- Rising Adoption of Polyurethane (PU) in Energy-Efficient Insulation

- Key Growth Regions: North America, Europe, and Asia-Pacific

- Market Forecast and Demand Projections for Polyurethane (PU) Products

Competitive Landscape in the Polyurethane (PU) Market

- Leading Companies in Polyurethane (PU) Production and Supply

- Strategies of Key Players in the Polyurethane (PU) Industry

- Mergers, Acquisitions, and Market Consolidation in Polyurethane (PU) Sector

Technological Advancements in the Polyurethane (PU) Market

- Innovations in High-Performance Polyurethane (PU) Formulations

- Next-Generation Polyurethane (PU) Composites and Smart Materials

- Digitalization and Automation in Polyurethane (PU) Manufacturing

Pricing Trends and Economic Factors Affecting the Polyurethane (PU) Market

- Impact of Raw Material Prices on Polyurethane (PU) Cost Structures

- Government Policies and Trade Regulations Influencing Polyurethane (PU) Pricing

- Future Projections for Polyurethane (PU) Market Price Trends

Supply Chain and Logistics for Polyurethane (PU) Distribution

- Global Trade and Distribution Networks for Polyurethane (PU) Products

- Challenges in Transportation and Storage of Polyurethane (PU) Materials

- Strategies for Supply Chain Optimization in Polyurethane (PU) Industry

Regulatory and Policy Landscape in the Polyurethane (PU) Market

- Environmental Regulations Affecting Polyurethane (PU) Manufacturing

- Compliance Standards for Polyurethane (PU) in Consumer and Industrial Applications

- Future Policy Trends Shaping the Growth of Polyurethane (PU) Market

Future Outlook and Investment Opportunities in the Polyurethane (PU) Market

- Long-Term Market Growth Potential for Polyurethane (PU) Applications

- Investment and R&D Opportunities in Sustainable Polyurethane (PU) Technologies

- Expansion Prospects in High-Performance Polyurethane (PU) Sectors

Challenges and Risks in the Polyurethane (PU) Market

- Supply Chain Disruptions and Raw Material Shortages in Polyurethane (PU) Production

- Regulatory and Environmental Constraints Impacting Polyurethane (PU) Industry

- Competitive Pressures and Market Volatility in the Polyurethane (PU) Sector

Conclusion: Strategic Recommendations for Polyurethane (PU) Market Stakeholders

- Key Takeaways for Polyurethane (PU) Manufacturers, Suppliers, and Investors

- Enhancing Efficiency and Sustainability in Polyurethane (PU) Production

- Business Strategies for Competitive Advantage in Polyurethane (PU) Market

Other recently published reports:

“Every Organization is different and so are their requirements”- Datavagyanik

Companies We Work With

Do You Want To Boost Your Business?

drop us a line and keep in touch