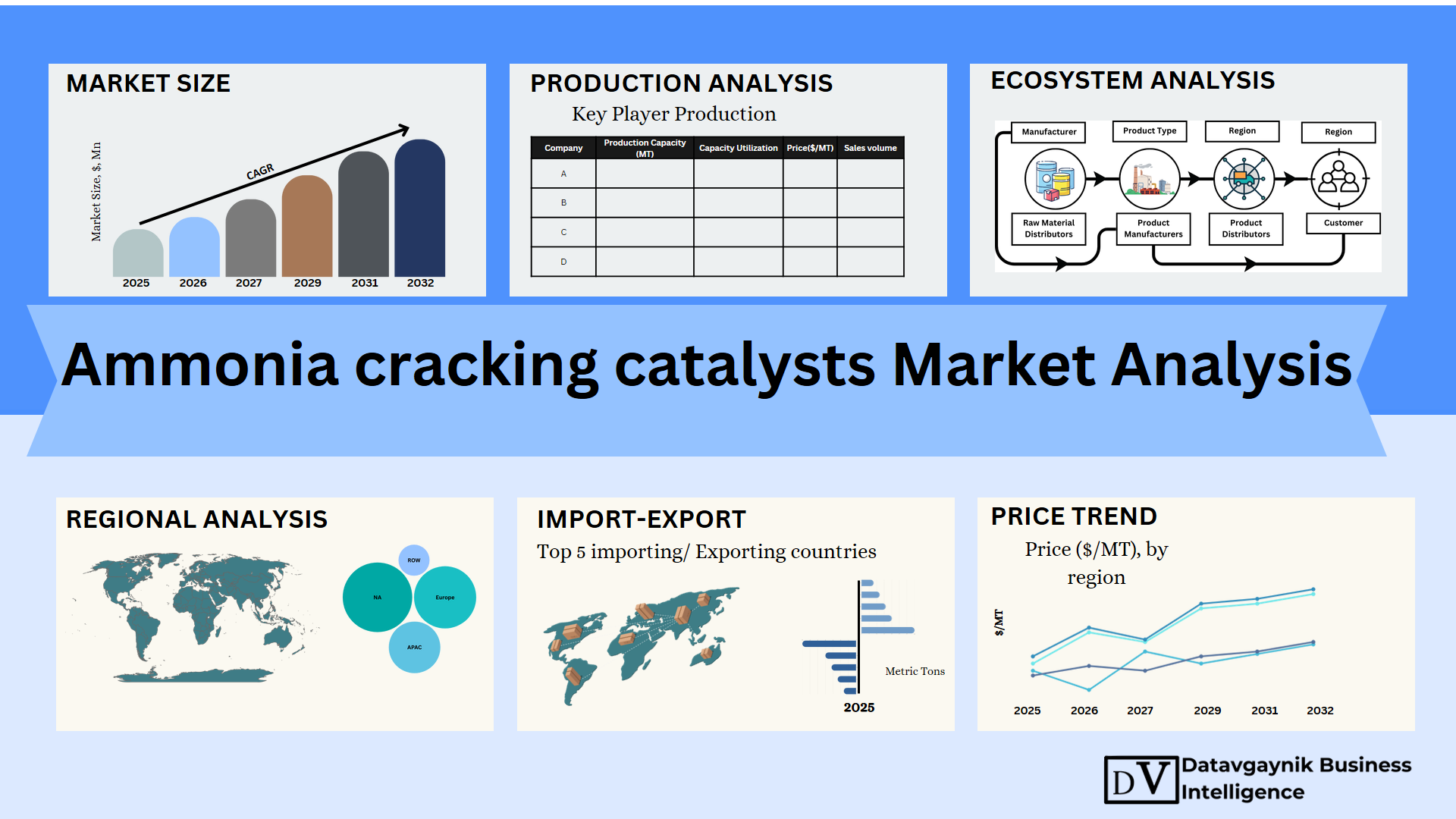

Ammonia cracking catalysts Market Size, Production, Sales, Average Product Price, Market Share, Import vs Export

- Published 2025

- No of Pages: 120+

- 20% Customization available

Surging Demand in the Ammonia Cracking Catalystse Market Driven by Hydrogen Economy Expansion

The Ammonia cracking catalystse Market is undergoing a seismic transformation, driven primarily by the rapid expansion of the global hydrogen economy. Hydrogen, with its high energy density and clean-burning properties, has become a cornerstone of decarbonization strategies across transportation, energy, and industry. However, hydrogen’s storage and transport challenges have propelled ammonia to the forefront as an ideal hydrogen carrier. Ammonia contains 17.6% hydrogen by weight and can be liquefied at moderate pressures, making it suitable for long-distance transport and storage. Consequently, demand for ammonia cracking catalysts—essential for converting ammonia back into usable hydrogen—is witnessing an unprecedented surge.

Green Hydrogen Acceleration Fuels Growth in Ammonia Cracking Catalystse Market

The rise of green hydrogen—produced from renewable energy sources—has amplified the relevance of ammonia as a sustainable hydrogen carrier. As green ammonia production scales up globally, especially in regions rich in renewable energy like Australia and the Middle East, the requirement for efficient and cost-effective cracking catalysts intensifies. For instance, global green ammonia capacity is projected to surpass 70 million tons by 2030, which directly boosts the Ammonia cracking catalystse Market. This shift is not just theoretical; it’s materializing through government-funded mega-projects, bilateral trade agreements, and private-sector innovations that are accelerating green hydrogen adoption and, by extension, catalyst demand.

Ammonia Cracking Catalystse Market Size Expands with Increasing Energy Storage Needs

Energy storage has become a critical component of modern grid systems, especially in regions with high solar and wind penetration. Ammonia serves as a stable, long-term energy storage medium that can be re-converted into hydrogen or electricity. This versatility is positioning ammonia as a key enabler of renewable energy balancing. The Ammonia cracking catalystse Market Size is thus expanding in tandem with utility-scale energy storage projects, particularly those in Europe, Japan, and California. These regions are investing heavily in ammonia-based storage systems that necessitate high-performance cracking catalysts for round-the-clock reliability.

Industrial Decarbonization Catalyzes Ammonia Cracking Catalystse Market Penetration

Heavy industries such as steel, cement, and chemicals are under immense pressure to reduce emissions. Hydrogen is emerging as the fuel of choice for these sectors, and ammonia cracking presents a viable decentralized hydrogen delivery system. For example, hydrogen usage in steel production is projected to grow at a CAGR of over 12% through 2030. This trend directly contributes to the growth of the Ammonia cracking catalystse Market, as cracking catalysts provide a pathway to supply hydrogen exactly where it’s needed—without the complexities of cryogenic or pressurized hydrogen logistics.

Technological Breakthroughs Reshape Ammonia Cracking Catalystse Market Dynamics

The evolving performance metrics of cracking catalysts are transforming market dynamics. Innovations in catalyst materials—such as ruthenium-based and nickel-based formulations—are leading to higher conversion efficiencies, lower operational temperatures, and extended lifespan. These technological improvements are reshaping the Ammonia cracking catalystse Market, as they reduce operating costs and make ammonia cracking feasible at smaller scales. Such breakthroughs are particularly important for distributed hydrogen generation systems, where energy efficiency and system durability are paramount.

Rising Adoption in Fuel Cell Infrastructure Boosts Ammonia Cracking Catalystse Market

The adoption of hydrogen fuel cells across commercial vehicles, marine vessels, and even aviation sectors is fueling demand for on-site hydrogen generation solutions. Ammonia, when cracked on-site using advanced catalysts, eliminates the need for complex hydrogen storage infrastructure. As the global fuel cell vehicle fleet is expected to exceed 3 million units by 2030, the Ammonia cracking catalystse Market is positioning itself as a critical enabler of this shift. From cargo ships to long-haul trucks, industries are turning to ammonia cracking to ensure a reliable hydrogen supply chain.

Ammonia Cracking Catalystse Market Size Rises with Supportive Global Policy Frameworks

Supportive policy frameworks have accelerated the pace of hydrogen infrastructure development worldwide. Governments across the US, EU, and Asia Pacific have launched aggressive strategies promoting ammonia as a hydrogen vector. These include subsidies, carbon pricing mechanisms, and tax incentives for low-emission technologies. As these regulations take effect, the Ammonia cracking catalystse Market Size continues to scale. For instance, the European Hydrogen Strategy aims for 10 million tons of green hydrogen production by 2030—much of it expected to be distributed via ammonia, thus boosting demand for cracking technologies.

Emerging Economies Unlock New Frontiers for Ammonia Cracking Catalystse Market Growth

Emerging markets in Southeast Asia, Africa, and Latin America are now actively exploring ammonia-based hydrogen systems as part of their energy diversification strategies. These countries benefit from abundant renewable resources and are becoming export hubs for green ammonia. Consequently, the Ammonia cracking catalystse Market is experiencing strong interest from local governments and private sector players looking to build hydrogen infrastructure from the ground up. For example, Indonesia and Brazil are initiating feasibility studies for ammonia terminals that will include localized cracking facilities.

High-Performance Catalysts Enhance Competitive Landscape in Ammonia Cracking Catalystse Market

The competitive landscape of the Ammonia cracking catalystse Market is evolving with the entry of new players and the continuous improvement of catalyst performance. Companies are competing not only on cost but also on parameters like activation temperature, catalyst lifetime, and resistance to poisoning. The push towards lower-temperature catalysts is particularly significant, as it enables the use of cracking systems in mobile and small-scale applications. With competition intensifying, innovation is emerging as the primary differentiator.

Strategic Investments and Partnerships Drive Innovation in Ammonia Cracking Catalystse Market

Strategic partnerships between technology developers, catalyst manufacturers, and energy companies are driving rapid commercialization of next-gen catalysts. Joint ventures in regions like North America and the Middle East are focusing on scaling production and reducing material costs. These collaborations are critical in accelerating the maturity of the Ammonia cracking catalystse Market, making it more accessible to emerging markets and diverse industries alike.

Sustainable Transport Revolution Spurs Ammonia Cracking Catalystse Market Expansion

The transportation sector is undergoing a paradigm shift, particularly in shipping and aviation, where ammonia is being tested as a carbon-free fuel. To utilize ammonia effectively, onboard or portside cracking units must be equipped with robust catalysts that can ensure consistent hydrogen output. As the global shipping industry moves towards IMO 2050 targets, the Ammonia cracking catalystse Market stands to benefit from investments in maritime hydrogen systems. Similarly, hydrogen-powered aircraft designs are incorporating cracking systems for in-flight fuel supply, adding a novel dimension to catalyst demand.

Future Outlook: Decentralized Hydrogen Production to Revolutionize Ammonia Cracking Catalystse Market

Looking ahead, the decentralization of hydrogen production will be a major force shaping the Ammonia cracking catalystse Market. Micro-grids, residential hydrogen systems, and mobile energy units will increasingly rely on compact, efficient ammonia cracking modules. As energy systems become more modular and localized, the need for scalable catalyst solutions becomes urgent. The market is poised for significant transformation as technological maturity meets decentralized deployment models.

“Track Country-wise Ammonia cracking catalysts Production and Demand through our Ammonia cracking catalysts Production Database”

-

-

- Ammonia cracking catalysts production database for 30+ countries worldwide

- Ammonia cracking catalysts Powder sales volume for 31+ countries

- Country-wise Ammonia cracking catalysts production capacity and production plant mapping, production capacity utilization for 30+ manufacturers

- Ammonia cracking catalysts production plants and production plant capacity analysis for top manufacturers

-

North America Takes Lead in Ammonia Cracking Catalystse Market with Hydrogen Infrastructure Growth

The Ammonia cracking catalystse Market in North America has surged forward due to aggressive investments in hydrogen infrastructure and the push for energy independence. For instance, the United States has committed over $8 billion to regional hydrogen hubs, many of which plan to use ammonia as a transport medium for hydrogen. This infrastructure development directly supports the demand for ammonia cracking catalysts in fueling stations, industrial sites, and maritime terminals.

Canada’s energy roadmap includes hydrogen as a key decarbonization pillar, with ammonia-based storage and transport systems forming a core part of the strategy. As such, demand for ammonia cracking catalyst systems is rising in refineries, mining operations, and remote grid systems. These developments are creating a strong pull for both high-performance and cost-efficient catalysts across the region.

Europe’s Decarbonization Agenda Accelerates Ammonia Cracking Catalystse Market Expansion

Europe represents one of the most dynamic regions for the Ammonia cracking catalystse Market, underpinned by strict decarbonization targets and strong regulatory support. Germany, for instance, is investing in ammonia terminals at ports like Wilhelmshaven to receive green ammonia imports and crack them into hydrogen. These terminals are expected to operate at high throughput, driving large-scale demand for ruthenium-based and nickel-based cracking catalysts.

France, the Netherlands, and the UK are also scaling up ammonia-based hydrogen systems to meet their renewable integration goals. In maritime logistics, ports in Belgium and Denmark are actively investing in cracking infrastructure to serve both domestic power needs and clean fuel for ships. The need for durable, low-temperature catalysts in these mobile and stationary settings is expected to elevate the Ammonia cracking catalystse Market across Western Europe.

Asia Pacific Dominates Global Ammonia Cracking Catalystse Market with Industrial Scale Production

Asia Pacific leads the global Ammonia cracking catalystse Market in both demand and production capacity. China has invested heavily in ammonia synthesis and cracking infrastructure as part of its long-term goal to reach carbon neutrality by 2060. The country is building dozens of ammonia-based hydrogen refueling stations, particularly in industrial parks and transport corridors. This high-volume, application-driven model demands robust catalysts with high yield and low energy requirements.

Japan is rapidly scaling its ammonia import terminals to support its hydrogen-based society ambitions. With ammonia being shipped from countries like Australia and Saudi Arabia, Japan requires localized cracking units equipped with high-performance catalysts capable of operating at lower temperatures to save energy. South Korea follows a similar trajectory, with ammonia forming a central component of its hydrogen distribution model, thus enlarging the Ammonia cracking catalystse Market.

Middle East Becomes Strategic Export Hub for Ammonia Cracking Catalystse Market

The Middle East is positioning itself as both a producer and exporter of green ammonia. Countries like Saudi Arabia and the UAE are developing massive solar-powered ammonia facilities aimed at serving international hydrogen markets. This transition is boosting the domestic Ammonia cracking catalystse Market as these nations need to establish local catalyst manufacturing and R&D capabilities to support export terminals and pilot plants.

For example, projects like NEOM in Saudi Arabia are setting the pace for integrated green ammonia ecosystems, including end-to-end cracking infrastructure. As ammonia exports begin to scale, the market for onboard cracking systems and industrial-scale cracking catalysts at receiving ports will rise, creating trans-regional opportunities for catalyst manufacturers.

Emerging Markets Drive Adoption of Decentralized Systems in Ammonia Cracking Catalystse Market

Countries like Brazil, South Africa, and Indonesia are increasingly adopting ammonia-based hydrogen solutions for decentralized energy systems. These regions often face limitations in pipeline infrastructure, making localized ammonia cracking systems an ideal alternative for off-grid hydrogen supply. This trend is driving the demand for compact, cost-effective, and energy-efficient catalysts.

India is emerging as a key player with its National Hydrogen Mission, aiming for large-scale ammonia production and distribution by 2030. Given the country’s industrial hydrogen needs in fertilizers and refineries, demand for cracking catalysts is growing at over 12% annually. This strong momentum is fostering local production facilities and partnerships with international catalyst developers.

Segmentation by Catalyst Type Strengthens Competitive Position in Ammonia Cracking Catalystse Market

The Ammonia cracking catalystse Market is segmented by catalyst type, each serving distinct industrial and commercial needs. Nickel-based catalysts dominate bulk industrial usage due to their affordability and durability. These are widely used in large-scale cracking systems, especially in chemical plants and refineries.

Ruthenium-based catalysts, though more expensive, are gaining ground for their superior performance at lower temperatures. These are ideal for applications in fuel cells and distributed energy systems, where energy efficiency is a priority. Iron-based catalysts are emerging as a cost-effective, environmentally sustainable option, particularly in pilot projects and developing markets. This product diversity is reshaping buyer preferences and driving innovation within the Ammonia cracking catalystse Market.

Application Segments Power Vertical Growth in Ammonia Cracking Catalystse Market

Hydrogen production remains the largest application segment in the Ammonia cracking catalystse Market, accounting for over 50% of total demand. Fuel cells and power generation follow closely, with rising adoption in vehicles, backup energy systems, and microgrids. The growing popularity of hydrogen-powered buses, ferries, and long-haul trucks is increasing the deployment of ammonia cracking systems, especially those utilizing high-efficiency catalysts.

The chemical industry also plays a significant role, particularly in hydrogen-intensive processes like methanol synthesis and ammonia reformation. Metallurgy, especially in green steel initiatives, is an emerging application segment using hydrogen derived from ammonia. These verticals collectively expand the use-case landscape for cracking catalysts.

Production Landscape Defines Regional Competitiveness in Ammonia Cracking Catalystse Market

Production of ammonia cracking catalysts is heavily concentrated in Asia Pacific, followed by Europe and North America. China leads global production due to its abundant raw material availability, skilled labor, and integrated chemical manufacturing hubs. Japan and South Korea focus on high-end catalyst formulations tailored for fuel cells and portable hydrogen generators.

In Europe, Germany and the Netherlands are investing in advanced catalyst R&D, focusing on reducing rare metal usage and improving recyclability. The US is catching up with significant private and public investments aimed at establishing domestic supply chains. These regional production centers are shaping the structure of the Ammonia cracking catalystse Market, driving technological advancements and improving global accessibility.

Ammonia Cracking Catalystse Price Trend Influenced by Raw Materials and Demand Surge

The Ammonia cracking catalystse Price Trend has been volatile in recent years, primarily due to fluctuations in the cost of key metals like ruthenium and nickel. For instance, ruthenium prices spiked by over 30% during 2023 due to increased demand in electronics and catalysts, impacting catalyst manufacturing costs directly.

At the same time, rising global demand has exerted upward pressure on the Ammonia cracking catalystse Price, especially for high-efficiency and low-temperature variants. However, scaling production and improvements in supply chain integration are beginning to stabilize pricing. Bulk procurement for industrial applications has helped reduce average prices by nearly 8% in some segments, indicating early signs of maturity in the supply side.

Regional Pricing Disparities Shape Strategy in Ammonia Cracking Catalystse Market

The Ammonia cracking catalystse Price varies significantly across regions based on factors such as import duties, manufacturing capabilities, and local demand. For example, catalysts in Europe tend to carry a premium due to stricter quality standards and reliance on advanced formulations. In contrast, Asia Pacific benefits from economies of scale and lower production costs, resulting in competitive pricing for mass-market products.

North America is seeing a bifurcation in Ammonia cracking catalystse Price points—lower for industrial-grade catalysts and higher for specialty variants used in mobility and aerospace. These regional price variations influence procurement strategies, with some companies opting for long-term supply contracts and others investing in localized production to control costs.

Innovation and Process Optimization Help Reduce Ammonia Cracking Catalystse Price Over Time

Process optimization and innovations in material science are playing a crucial role in reducing the Ammonia cracking catalystse Price over time. Manufacturers are exploring synthetic supports, reduced metal loadings, and nanostructuring techniques to improve performance while cutting raw material use. These advancements are expected to reduce prices by up to 20% over the next five years for selected product categories.

Furthermore, as the industry achieves greater standardization and automation, operational efficiencies will improve. This will enhance production throughput and allow suppliers to offer competitive pricing without sacrificing quality, helping scale the Ammonia cracking catalystse Market globally.

“Ammonia cracking catalysts Manufacturing Database, Ammonia cracking catalysts Manufacturing Capacity”

-

-

- Ammonia cracking catalysts top manufacturers market share for 30+ manufacturers

- Top 9 manufacturers and top 19 manufacturers of Ammonia cracking catalysts in North America, Europe, Asia Pacific

- Production plant capacity by manufacturers and Ammonia cracking catalysts production data for 30+ market players

- Ammonia cracking catalysts production dashboard, Ammonia cracking catalysts production data in excel format

-

Leading Players Dominating the Ammonia Cracking Catalystse Market

The Ammonia cracking catalystse Market is led by a group of global manufacturers known for innovation, production scale, and diverse product portfolios. These companies are shaping the direction of the market through extensive R&D, strategic partnerships, and commercial deployments across the hydrogen economy.

Top manufacturers include Johnson Matthey, Haldor Topsoe, BASF SE, Clariant, and Heraeus. Each of these players contributes significantly to the market’s overall value and technology evolution, particularly in applications requiring high durability, selectivity, and efficiency in hydrogen production from ammonia.

Johnson Matthey Maintains Stronghold in High-Performance Catalysts

Johnson Matthey holds a prominent position in the Ammonia cracking catalystse Market, particularly in the premium segment. Known for its platinum group metal (PGM) catalyst technologies, the company offers a range of high-efficiency catalyst solutions tailored for low-temperature ammonia cracking applications.

One of their notable product lines includes the “HyMet” series, designed for integration with fuel cell systems and distributed hydrogen applications. These catalysts are engineered to perform in compact systems and under intermittent operating conditions, making them ideal for mobility and grid support use cases. Johnson Matthey’s market share is estimated at over 20%, owing to its strong brand, global reach, and technical excellence.

Haldor Topsoe Commands Industrial-Scale Segment of Ammonia Cracking Catalystse Market

Haldor Topsoe is a major force in the industrial-scale segment of the Ammonia cracking catalystse Market. The company specializes in process catalysts for refineries and ammonia reforming plants, offering solutions designed for high-throughput, continuous operations.

Its product portfolio includes the “TK” catalyst series, optimized for steam methane reforming and ammonia cracking at elevated temperatures. These catalysts are widely used in petrochemical complexes, hydrogen hubs, and export terminals where operational stability and thermal efficiency are essential. Haldor Topsoe is estimated to hold around 18–22% of the global market share and is a key player in large-scale green ammonia projects across the Middle East and Europe.

BASF SE Expands Reach with Advanced Material Integration

BASF SE continues to expand its footprint in the Ammonia cracking catalystse Market by leveraging its expertise in material science and process engineering. Its cracking catalysts often incorporate proprietary support materials to enhance surface area and catalytic activity, which helps reduce operational temperatures and improve hydrogen yield.

BASF’s “O4K” catalyst series has been adopted in both mobile and fixed ammonia cracking systems, with applications ranging from backup energy supply to remote hydrogen production. The company’s share in the market is estimated at approximately 12–15%, with a growing presence in Asia Pacific and Latin America.

Clariant Strengthens Market Position Through Decentralized Energy Solutions

Clariant has carved a niche in the decentralized hydrogen production segment of the Ammonia cracking catalystse Market. The company focuses on developing modular and scalable catalysts suitable for microgrid systems, portable hydrogen units, and maritime applications.

Their “Catofin NH3Crack” line has gained attention for its ability to operate at lower pressures and fluctuating thermal loads, meeting the needs of portable and mobile applications. Clariant holds an estimated 8–10% share of the global market, with key customers in Europe and Southeast Asia.

Heraeus Targets Niche Segments with High-Temperature Catalyst Systems

Heraeus focuses on specialty catalyst systems that cater to high-temperature, high-load cracking environments. Its product range is particularly well-suited for heavy-duty industrial plants, including steelmaking and fertilizer production facilities.

With a market share close to 7%, Heraeus is recognized for its durable catalyst coatings and high resistance to poisoning. These features make their products suitable for applications involving variable feedstock quality or harsh operating conditions.

Market Share Dynamics Shaping Ammonia Cracking Catalystse Market Landscape

The Ammonia cracking catalystse Market is moderately consolidated, with the top five manufacturers controlling over 70% of global revenue. However, the rising demand for green hydrogen and decentralized energy systems is enabling the emergence of regional players and startups focused on innovative formulations.

Companies in South Korea, China, and India are entering the market with cost-effective alternatives, particularly in the iron-based and cobalt-based catalyst categories. These manufacturers are targeting price-sensitive markets and pilot-scale applications, gradually gaining share in segments underserved by global leaders.

Specialized Product Lines Define Competitive Differentiation

Differentiation within the Ammonia cracking catalystse Market is increasingly based on performance metrics such as operating temperature, hydrogen yield, durability, and cost per kg of hydrogen produced. For example, catalysts designed for low-temperature operation are becoming essential in mobile fuel cell applications and compact energy systems.

Product lines like Johnson Matthey’s HyMet, Clariant’s Catofin NH3Crack, and BASF’s O4K series are tailored for specific market needs and are helping these companies secure contracts in strategic energy projects. This product-level differentiation is critical in an evolving market where one-size-fits-all solutions no longer suffice.

Recent Developments Reshape Ammonia Cracking Catalystse Market Trajectory

In early 2024, Haldor Topsoe announced the expansion of its production capacity in Denmark to meet rising demand for ammonia cracking catalysts in European hydrogen projects. This facility is expected to increase catalyst output by 30% by mid-2025, directly supporting the EU’s hydrogen import strategy.

In March 2024, Johnson Matthey partnered with a U.S.-based hydrogen fueling startup to deploy HyMet catalyst modules across 50 stations in California and Texas, signaling an aggressive push into the mobility segment.

BASF, in January 2024, launched a pilot project in partnership with an Australian utility to demonstrate modular ammonia cracking systems for renewable energy storage. The trial results showed a 15% increase in catalyst life and a 20% reduction in operating costs.

Clariant, in Q4 2023, established a joint venture with a Japanese energy company to develop cracking catalysts tailored for marine applications. This move is aimed at capitalizing on the rising interest in ammonia as a shipping fuel and is expected to deliver commercial systems by 2026.

In June 2024, South Korean startups began pilot-scale exports of low-cost nickel-iron catalysts to Southeast Asia and Africa, targeting decentralized hydrogen systems in regions with limited infrastructure.

These strategic developments reflect how both global giants and emerging players are shaping the Ammonia cracking catalystse Market through innovation, capacity expansion, and new market entry strategies. As hydrogen adoption accelerates globally, competition is expected to intensify, making product performance, cost optimization, and regional adaptation the key battlegrounds of the future.

“Ammonia cracking catalysts Production Data and Ammonia cracking catalysts Production Trend, Ammonia cracking catalysts Production Database and forecast”

-

-

- Ammonia cracking catalysts production database for historical years, 10 years historical data

- Ammonia cracking catalysts production data and forecast for next 9 years

-

Market Scenario, Demand vs Supply, Average Product Price, Import vs Export, till 2035

- Global Ammonia cracking catalysts Market revenue and demand by region

- Global Ammonia cracking catalysts Market production and sales volume

- United States Ammonia cracking catalysts Market revenue size and demand by country

- Europe Ammonia cracking catalysts Market revenue size and demand by country

- Asia Pacific Ammonia cracking catalysts Market revenue size and demand by country

- Middle East & Africa Ammonia cracking catalysts Market revenue size and demand by country

- Latin America Ammonia cracking catalysts Market revenue size and demand by

- Import-export scenario – United States, Europe, APAC, Latin America, Middle East & Africa

- Average product price – United States, Europe, APAC, Latin America, Middle East & Africa

- Market player analysis, competitive scenario, market share analysis

- Business opportunity analysis

Key questions answered in the Global Ammonia cracking catalysts Market Analysis Report:

- What is the market size for Ammonia cracking catalysts in United States, Europe, APAC, Middle East & Africa, Latin America?

- What is the yearly sales volume of Ammonia cracking catalysts and how is the demand rising?

- Who are the top market players by market share, in each product segment?

- Which is the fastest growing business/ product segment?

- What should be the business strategies and Go to Market strategies?

The report covers Ammonia cracking catalysts Market revenue, Production, Sales volume, by regions, (further split into countries):

- Asia Pacific (China, Japan, South Korea, India, Indonesia, Vietnam, Rest of APAC)

- Europe (UK, Germany, France, Italy, Spain, Benelux, Poland, Rest of Europe)

- North America (United States, Canada, Mexico)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa

Table of Contents:

Ammonia Cracking Catalysts Market:

- Executive Summary

- Key Insights and Market Highlights

- Strategic Takeaways for Industry Stakeholders

- Summary of Growth Drivers and Future Opportunities

- Introduction to Ammonia Cracking Catalysts

- Definition and Functional Role in Hydrogen Production

- Importance in Industrial and Energy Applications

- Overview of the Ammonia Cracking Process

- Historical Development and Market Evolution

- Evolution of Ammonia Cracking Technologies

- Key Innovations in Catalyst Development

- Historical Market Trends and Industrial Adoption

- Classification of Ammonia Cracking Catalysts

- By Catalyst Type: Nickel-Based, Ruthenium-Based, Cobalt-Based, and Others

- By Formulation: Supported Catalysts, Non-Supported Catalysts

- Performance Metrics and Efficiency Comparison

- Global Ammonia Cracking Catalysts Market Overview (2020–2040)

- Market Size, Growth Trends, and Forecasts

- Key Market Dynamics: Drivers, Challenges, and Opportunities

- Emerging Trends in Catalyst Design and Application

- Key Market Drivers and Restraints

- Growing Demand for Hydrogen as a Clean Energy Source

- Technological Advancements in Catalyst Efficiency

- Impact of Environmental Regulations and Sustainability Goals

- Technological Innovations in Ammonia Cracking Catalysts

- Breakthroughs in Catalyst Materials and Nanotechnology

- Process Optimization for Higher Conversion Efficiency

- Role of Advanced Manufacturing Techniques

- Global Market Segmentation

- By Product Type: High-Temperature Catalysts, Low-Temperature Catalysts

- By Application: Hydrogen Generation, Fuel Cells, Industrial Processing

- By End-Use Industry: Energy, Chemicals, Automotive, Power Generation

- Regional Market Analysis

- North America: Hydrogen Economy Development and Market Growth

- Europe: Green Energy Transition and Industrial Demand

- Asia-Pacific: Rapid Industrialization and Renewable Energy Initiatives

- Latin America: Emerging Hydrogen Infrastructure and Opportunities

- Middle East & Africa: Role in Clean Energy Export and Industrial Adoption

- Competitive Landscape and Market Share Analysis

- Global Market Share of Leading Catalyst Manufacturers

- Strategic Initiatives: Mergers, Acquisitions, Partnerships

- Company Profiles and Technological Portfolios

- Production and Manufacturing Analysis

- Overview of Catalyst Production Processes

- Global Production Capacities and Facility Distribution

- Cost Structure Analysis and Process Efficiency

- Supply Chain Dynamics and Distribution Network

- Raw Material Sourcing and Supplier Landscape

- Logistics, Distribution Channels, and Global Supply Chains

- Supply Chain Risks and Mitigation Strategies

- Pricing Analysis and Market Profitability

- Historical and Current Pricing Trends

- Factors Influencing Price Fluctuations

- Profitability Analysis by Region and Product Type

- Global Trade Analysis and Export-Import Dynamics

- Major Exporters and Importers of Ammonia Cracking Catalysts

- Impact of Trade Policies and Tariffs

- Analysis of Global Trade Flows and Regional Dependencies

- Market Demand and Consumption Analysis

- Sector-Wise Demand for Ammonia Cracking Catalysts

- Trends in Industrial Consumption Patterns

- Emerging Applications and Growth Segments

- End-Use Industry Insights

- Hydrogen Production for Fuel Cells and Energy Applications

- Role in Ammonia-to-Hydrogen Conversion Systems

- Use in Chemical Processing and Industrial Applications

- Environmental Impact and Sustainability Considerations

- Eco-Friendly Catalyst Technologies

- Lifecycle Assessment and Carbon Footprint Analysis

- Regulatory Compliance and Sustainability Strategies

- Challenges and Risk Factors in the Market

- Technological Barriers and R&D Challenges

- Raw Material Supply Constraints

- Regulatory and Environmental Risks

- Investment Landscape and Strategic Opportunities

- Key Investment Regions and Growth Hotspots

- Venture Capital and Private Equity Trends in Clean Energy Catalysts

- Strategic Recommendations for Investors and Market Entrants

- Impact of Global Events on Market Dynamics

- Impact of COVID-19 on Catalyst Production and Supply Chains

- Geopolitical Tensions and Their Influence on Global Trade

- Economic Trends Affecting Market Growth and Development

- Future Outlook and Market Forecast (2025–2040)

- Long-Term Market Projections and Emerging Trends

- Technological Innovations Shaping the Future of Ammonia Cracking

- Growth Opportunities in Hydrogen and Clean Energy Markets

- Research and Development Landscape

- R&D Investments by Leading Market Players

- Recent Innovations and Patent Analysis

- Future Research Directions in Catalyst Development

- Case Studies and Industry Best Practices

- Successful Implementation of Ammonia Cracking Technologies

- Innovations Driving Market Leadership

- Lessons from Global Leaders in Hydrogen and Catalyst Technologies

- Appendices

- Glossary of Technical Terms

- Research Methodology and Data Sources

- List of Tables, Figures, and Charts

Other recently published reports:

“Every Organization is different and so are their requirements”- Datavagyanik

Companies We Work With

Do You Want To Boost Your Business?

drop us a line and keep in touch