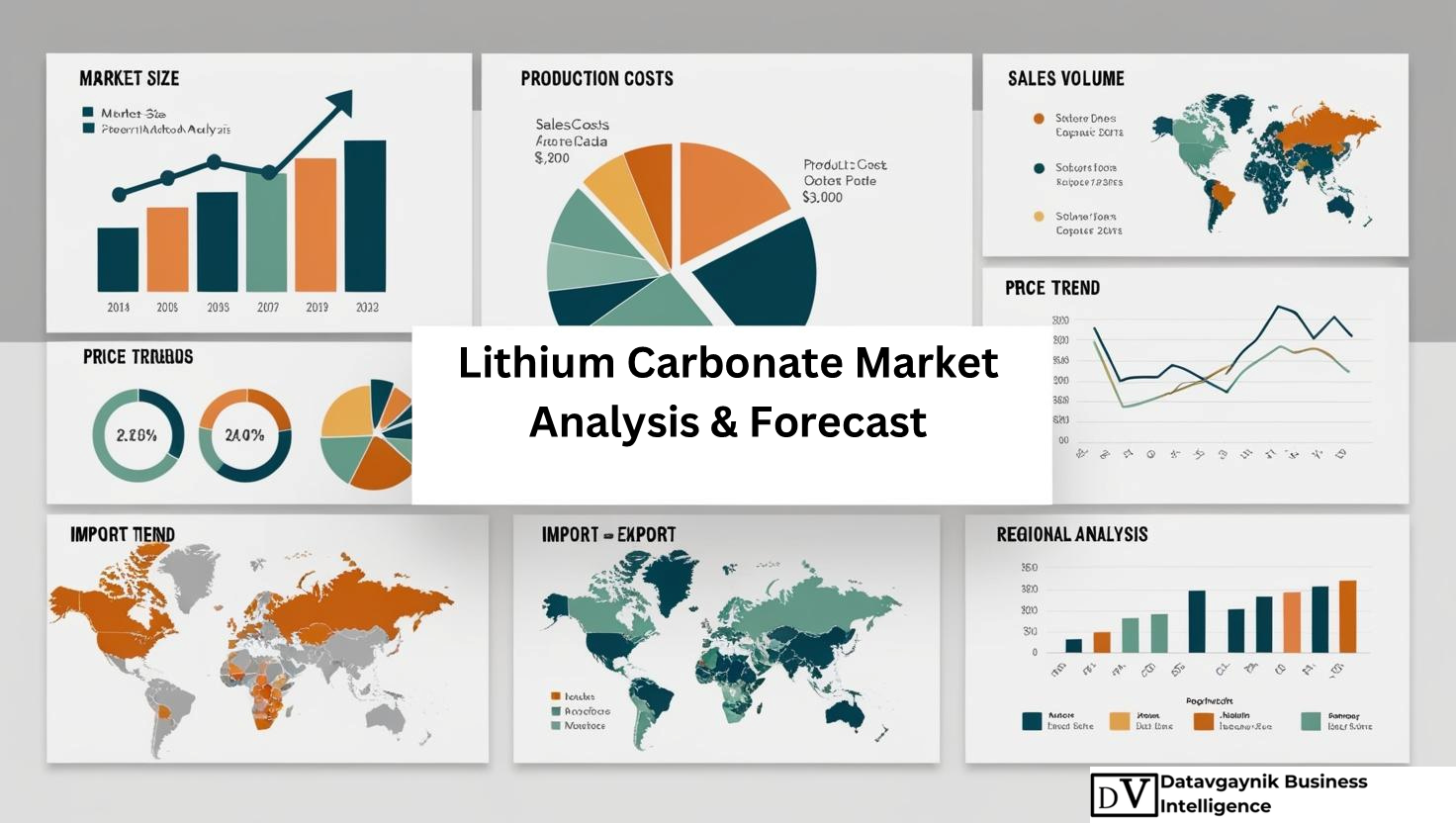

Lithium Carbonate Market Size, Production, Sales, Average Product Price, Market Share, Import vs Export

- Published 2025

- No of Pages: 120+

- 20% Customization available

Lithium Carbonate Market: Key Trends and Growth Drivers

Rising Demand for Electric Vehicles (EVs)

The Lithium Carbonate Market has witnessed significant growth over the past few years, primarily driven by the expanding electric vehicle (EV) industry. As governments worldwide push for cleaner energy solutions and stricter emissions regulations, the shift toward EVs is becoming more prominent. Lithium-ion batteries, which are central to the functioning of electric vehicles, rely heavily on Lithium Carbonate. The increasing adoption of electric vehicles, both in developed and emerging markets, is directly influencing the demand for Lithium Carbonate. For example, the global electric vehicle stock grew by over 50% in 2022, signaling a sharp increase in the need for lithium-based batteries. This surge is expected to continue, further bolstering the demand for Lithium Carbonate in the coming years.

Growing Energy Storage Requirements

The shift towards renewable energy sources, such as solar and wind, has led to a surge in energy storage solutions. Lithium-ion batteries are essential in this transition due to their efficiency, long lifespan, and high energy density. As countries ramp up their efforts to combat climate change, they are increasingly investing in energy storage systems to store renewable energy for later use. The Lithium Carbonate Market plays a pivotal role here, as it is a key component in the production of these batteries. The global energy storage market is expected to expand by over 20% annually, which will directly influence the demand for Lithium Carbonate, particularly in countries aiming to achieve net-zero emissions.

Datavagyanik also covers related markets such as the Lithium Oxide Market, the Lithium Sulfate Market, and the Lithium Phosphate Market. These compounds are commonly used in oxidation systems and industrial chemical processing, supporting shifts in formulation standards and regulatory compliance.

Growth in Consumer Electronics Sector

The consumer electronics sector remains one of the key drivers of the Lithium Carbonate Market. From smartphones and laptops to wearables and tablets, the demand for portable electronics continues to rise globally. Lithium-ion batteries are integral to these devices, and the increased need for smaller, more powerful batteries fuels the demand for high-quality Lithium Carbonate. For instance, the global smartphone market saw a 6% increase in shipments in 2022, which directly correlates with higher Lithium Carbonate consumption. As consumer demand for more powerful and longer-lasting batteries grows, so does the pressure on suppliers to meet these requirements with higher-purity Lithium Carbonate.

Technological Advancements in Battery Technologies

Advancements in battery technology are significantly influencing the Lithium Carbonate Market. Improvements in energy density, charging speed, and battery lifespan are all contributing to the rising demand for Lithium Carbonate. Innovations such as solid-state batteries, which offer higher energy densities, are expected to increase the demand for premium-grade Lithium Carbonate. Manufacturers of lithium-ion batteries are constantly optimizing their technologies to create more efficient, durable, and cost-effective products. These advancements are not only pushing the boundaries of what Lithium Carbonate can be used for but also accelerating its adoption across multiple industries.

Geopolitical Influence on Lithium Supply Chains

Geopolitical factors are playing an increasingly important role in the Lithium Carbonate Market. Countries rich in lithium reserves, such as Chile, Australia, and Argentina, are seeing growing geopolitical attention due to the demand for this critical resource. The competition for access to these resources is intensifying, with countries and corporations vying for long-term supply agreements to ensure a stable flow of Lithium Carbonate. For instance, the Chinese government has made strategic investments in lithium mining projects around the world, securing a significant portion of global lithium supply. This has implications for both production costs and the future availability of lithium, making the geopolitical landscape crucial for the stability of the Lithium Carbonate Market.

Sustainability and Recycling Initiatives

Sustainability is an increasingly important theme within the Lithium Carbonate Market. As concerns over resource depletion and environmental impact grow, the focus on recycling lithium from used batteries has intensified. Lithium-ion battery recycling allows for the recovery of Lithium Carbonate, which is then reused in the production of new batteries. This not only helps reduce the environmental footprint but also offers a sustainable solution to meet the growing demand for lithium. Several countries, including the U.S. and European nations, are making substantial investments in recycling infrastructure to support this trend. As battery recycling technologies evolve, the industry is expected to see a rise in the availability of recycled Lithium Carbonate, offering both economic and environmental benefits.

Lithium Carbonate Market Size and Economic Implications

The Lithium Carbonate Market Size has seen exponential growth in recent years and is expected to continue its upward trajectory. As industries such as electric vehicles, consumer electronics, and energy storage systems grow, so will the demand for Lithium Carbonate. The market size for Lithium Carbonate is projected to expand by nearly 10% annually over the next decade, driven by both technological advancements and increasing consumption across key sectors. This growth also has far-reaching economic implications, as countries with large lithium reserves are set to benefit from increased mining activities and related investments. Consequently, the economic importance of lithium-producing regions is growing, positioning them as key players in the global market.

Increasing Focus on Domestic Lithium Production

As global demand for lithium surges, many countries are prioritizing the development of domestic lithium production capabilities. For example, the United States, once heavily dependent on lithium imports, is focusing on increasing its domestic lithium extraction capacity. Key projects such as the Thacker Pass Lithium Mine in Nevada are expected to make significant contributions to U.S. lithium production. The European Union is also actively investing in lithium extraction projects within its borders to reduce reliance on foreign suppliers. These efforts are expected to enhance the stability of supply chains and reduce geopolitical risks associated with lithium imports, making the Lithium Carbonate Market more resilient to external shocks.

Expansion of Lithium Production Facilities

The expansion of lithium production facilities is a direct response to the increasing demand for Lithium Carbonate. In Australia, the world’s largest producer of lithium, new mines are being developed to meet global needs. The Greenbushes Lithium Mine, located in Western Australia, is one of the largest and most productive lithium mines globally, and ongoing investments in infrastructure are expected to further boost its production capacity. Similarly, in South America, known for its vast lithium brine reserves, several new extraction projects are underway to tap into the “Lithium Triangle” — Argentina, Bolivia, and Chile. These projects will play a pivotal role in securing global lithium supply, ensuring that the rising demand for Lithium Carbonate is met effectively.

Electric Mobility Transition and Global Impacts

The transition to electric mobility is not just a trend but a fundamental shift in how the global transportation system operates. Governments around the world are setting ambitious goals to reduce carbon emissions by pushing for the widespread adoption of electric vehicles. As the demand for electric vehicles continues to rise, so will the need for Lithium Carbonate, which is essential in powering lithium-ion batteries used in these vehicles. By 2030, global EV sales are projected to exceed 40 million units, nearly tripling current figures. This dramatic growth in the electric vehicle market underscores the pivotal role that Lithium Carbonate will play in shaping the future of transportation and energy storage.

Conclusion

The Lithium Carbonate Market is experiencing dynamic growth, driven by factors such as the electric vehicle revolution, advancements in battery technologies, and the rising demand for renewable energy storage. Governments, industries, and consumers are all contributing to the increasing demand for lithium-based solutions, which is creating substantial opportunities for businesses involved in lithium mining, battery production, and recycling. As the global economy shifts towards more sustainable practices, the role of Lithium Carbonate in powering clean energy technologies will become even more crucial. The market’s future is promising, and its expansion will continue to offer new avenues for investment and innovation across various industries.

“Track Country-wise Lithium Carbonate Production and Demand through our Lithium Carbonate Production Database”

- Lithium Carbonate production database for 27+ countries worldwide

- Lithium Carbonate sales volume for 31+ countries

- Country-wise Lithium Carbonate production capacity, production plant mapping, production capacity utilization for 27+ manufacturers

- Lithium Carbonate production plants and production plant capacity analysis by top manufacturers

“Track real-time Lithium Carbonate Prices, Lithium Carbonate price charts for 27+ countries, Lithium Carbonate weekly price tracker and Lithium Carbonate monthly price tracker”

- Track real-time Lithium Carbonate prices and Lithium Carbonate price trend in 27+ countries though our excel-based Lithium Carbonate price charts

- Real-time Lithium Carbonate price tracker dashboard with 27+ countries

- Complete transparency on Lithium Carbonate price trend through our Lithium Carbonate monthly price tracker, Lithium Carbonate weekly price tracker

Geographical Demand and Production in the Lithium Carbonate Market

The Lithium Carbonate Market is driven by varying demand patterns across regions, influenced by factors such as technological advancements, government policies, and industry shifts toward clean energy solutions. Geographically, the demand for lithium is primarily concentrated in regions where the transition to electric vehicles (EVs), renewable energy storage, and consumer electronics is most pronounced. The Lithium Carbonate Market is experiencing rapid growth in countries that are investing heavily in EV infrastructure, energy storage solutions, and battery manufacturing.

Asia Pacific: Dominating the Lithium Carbonate Demand

The Lithium Carbonate Market in the Asia Pacific region is one of the largest and most rapidly expanding. Countries like China, Japan, and South Korea are at the forefront of both production and consumption of lithium-based products. China, in particular, has positioned itself as the global leader in lithium consumption, primarily driven by its enormous electric vehicle market. By 2022, the country accounted for more than 50% of global lithium consumption. The demand for Lithium Carbonate is directly tied to the country’s aggressive push towards electric mobility and renewable energy storage solutions.

In China, the growing adoption of EVs, backed by government subsidies, has skyrocketed the demand for lithium-ion batteries, which require significant amounts of Lithium Carbonate. The country has also invested heavily in securing its lithium supply by acquiring mining assets globally, particularly in countries such as Argentina, Australia, and Zimbabwe. As China continues to scale up its production of electric vehicles and expand its renewable energy initiatives, the demand for Lithium Carbonate is expected to grow in tandem.

North America: Growing Demand in the U.S. and Mexico

The Lithium Carbonate Market in North America, particularly in the United States and Mexico, has been growing rapidly, driven by both the electric vehicle sector and energy storage needs. The U.S., which has been focusing on reducing its reliance on foreign energy sources, has increased its investments in domestic lithium production. The growing electric vehicle market, led by manufacturers like Tesla, General Motors, and Ford, has resulted in an upward trend in Lithium Carbonate consumption. The U.S. is expected to see a 20% annual growth in electric vehicle sales, fueling further demand for lithium-ion batteries and, consequently, Lithium Carbonate.

Additionally, the U.S. government’s emphasis on renewable energy solutions has contributed to the rise in Lithium Carbonate consumption, as energy storage systems powered by lithium-ion batteries are integral to the green transition. The expansion of domestic lithium production, exemplified by the Thacker Pass Lithium Mine project in Nevada, signals the growing importance of local supply chains in meeting the increasing demand for Lithium Carbonate.

Europe: Accelerating the Green Transition

In Europe, the Lithium Carbonate Market is set for significant growth as countries within the European Union (EU) make strides toward carbon neutrality and renewable energy adoption. Germany, France, and Spain are key players in this shift, with a strong focus on electric vehicle adoption and energy storage systems. Germany, home to major automakers like Volkswagen and BMW, is increasing its demand for Lithium Carbonate as it transitions toward electric mobility. The European Commission has also laid out plans to boost EV production and infrastructure, which will further spur demand for Lithium Carbonate.

Countries such as France and Spain are also investing heavily in energy storage projects, utilizing Lithium Carbonate-based lithium-ion batteries to store energy from renewable sources like solar and wind. These countries’ commitment to achieving carbon neutrality by 2050 is pushing the demand for Lithium Carbonate to unprecedented levels, making Europe a critical region for the global market.

South America: A Hub for Lithium Production

South America, particularly the “Lithium Triangle” of Argentina, Chile, and Bolivia, plays a pivotal role in the Lithium Carbonate Market. These countries hold the world’s largest lithium brine reserves, making them central to global lithium production. Chile, for example, is one of the top global producers of lithium, accounting for nearly 25% of the world’s lithium production. The extraction of lithium from brine in these countries is highly cost-effective compared to traditional mining methods, making South America a key supplier for the global market.

As demand for Lithium Carbonate continues to rise, these countries are ramping up production to meet the needs of international markets. In 2021, the combined lithium production of Argentina, Chile, and Bolivia accounted for nearly 60% of global lithium output. These nations are also focusing on increasing local processing capacities to produce higher-value lithium products, including Lithium Carbonate and lithium hydroxide, which are essential for battery production.

Lithium Carbonate Price Trend and Market Dynamics

The Lithium Carbonate Price has been volatile, largely influenced by supply and demand imbalances, geopolitical tensions, and shifts in production technologies. In the past five years, the Lithium Carbonate Price has surged significantly due to the increasing demand for lithium-ion batteries. In 2022, the price of Lithium Carbonate reached an all-time high of over $80,000 per ton, driven by strong demand from the electric vehicle sector and the rapid expansion of renewable energy storage projects.

The Lithium Carbonate Price Trend is also shaped by the pace of production and extraction technologies. Traditional mining methods, particularly in Australia and China, have faced challenges in scaling production efficiently, contributing to price fluctuations. However, the growing use of brine extraction in South America has led to more stable and cost-effective production, which could exert downward pressure on prices in the long term.

The Lithium Carbonate Price is also affected by geopolitical factors, especially the race for control over lithium-rich regions. For instance, trade tensions between China and the U.S. have had a significant impact on global supply chains, influencing the cost of Lithium Carbonate. Moreover, as more countries secure long-term supply agreements with lithium producers, this could help stabilize prices and ensure a consistent supply of Lithium Carbonate for the global market.

Market Segmentation: Application Areas Driving Demand

The Lithium Carbonate Market can be segmented based on applications, end-use industries, and geographical regions. The largest segment of the Lithium Carbonate Market is driven by its use in battery production. Lithium-ion batteries, essential for powering electric vehicles, energy storage systems, and consumer electronics, dominate the market and are expected to continue growing. The rise in electric vehicle adoption, which is projected to exceed 40 million units annually by 2030, will significantly impact the demand for Lithium Carbonate.

Other key application areas for Lithium Carbonate include the ceramics and glass industry, where it is used to improve the performance and durability of glass products. Lithium Carbonate is also used in the pharmaceutical sector for the production of lithium-based drugs to treat mental health disorders like bipolar disorder. These niche applications, although smaller in scale, contribute to the overall demand for Lithium Carbonate.

Lithium Carbonate Market Price and Supply Chain Considerations

The Lithium Carbonate Price is also a crucial factor in determining market dynamics, especially in the context of production costs and margins. As production of Lithium Carbonate ramps up to meet the growing demand, supply chains are being redefined. Companies with vertically integrated supply chains, covering everything from mining to processing and battery production, are better positioned to withstand price fluctuations and meet demand. In contrast, companies relying on non-integrated supply chains face greater risks due to market volatility and geopolitical uncertainties.

Supply chain disruptions, as witnessed in the early 2020s due to the COVID-19 pandemic and global trade tensions, have highlighted the vulnerability of the Lithium Carbonate Market. However, investments in sustainable and diversified supply chains are expected to improve market stability in the coming years. Recycling of lithium-ion batteries and new extraction technologies will also play a pivotal role in managing the growing demand for Lithium Carbonate while minimizing environmental impacts.

Conclusion: The Future of the Lithium Carbonate Market

The future of the Lithium Carbonate Market is shaped by a complex interplay of geographical demand, technological advancements, production scalability, and pricing dynamics. As global demand for electric vehicles, energy storage solutions, and consumer electronics continues to rise, the market for Lithium Carbonate will see robust growth. While the Lithium Carbonate Price may remain volatile in the short term, long-term stability will depend on advances in production technologies, recycling efforts, and the establishment of secure, diversified supply chains.

Geopolitically, the competition for lithium resources will intensify, especially as countries like China, the U.S., and those in the EU seek to secure a reliable supply of Lithium Carbonate. With substantial investments in production and recycling technologies, the Lithium Carbonate Market is expected to evolve, offering significant business opportunities in various sectors, from battery production to energy storage and beyond. As the world continues its transition to green energy, Lithium Carbonate will remain a critical component in driving global sustainability efforts.

“Lithium Carbonate Manufacturing Database, Lithium Carbonate Manufacturing Capacity”

-

-

- Lithium Carbonate top manufacturers market share for 27+ manufacturers

- Top 9 manufacturers and top 16 manufacturers of Lithium Carbonate in North America, Europe, Asia Pacific

- Lithium Carbonate production plant capacity by manufacturers and Lithium Carbonate production data for 27+ market players

- Lithium Carbonate production dashboard, Lithium Carbonate production data in excel format

-

“Lithium Carbonate price charts, Lithium Carbonate weekly price tracker and Lithium Carbonate monthly price tracker”

-

-

- Factors impacting real-time Lithium Carbonate prices in 21+ countries worldwide

- Lithium Carbonate monthly price tracker, Lithium Carbonate weekly price tracker

- Real-time Lithium Carbonate price trend, Lithium Carbonate price charts, news and updates

- Tracking Lithium Carbonate price fluctuations

-

Top Manufacturers in the Lithium Carbonate Market

The Lithium Carbonate Market is dominated by a few key players who contribute to the bulk of global production. These manufacturers are integral to the supply chain and are positioned to benefit from the growing demand driven by the electric vehicle (EV) and energy storage sectors. The leading manufacturers in the market include Albemarle Corporation, Sociedad Química y Minera de Chile (SQM), Ganfeng Lithium Co., Ltd., Tianqi Lithium Corporation, and Livent Corporation. These companies not only have significant production capacities but also maintain strategic partnerships with other industry leaders, allowing them to meet the rapidly expanding demand for Lithium Carbonate.

Albemarle Corporation

Albemarle Corporation is one of the largest producers of Lithium Carbonate globally. With a strong presence in the U.S., the company operates a wide array of chemical manufacturing plants, including in lithium production. Albemarle’s Lithium Carbonate production is primarily sourced from its operations in the Salar de Atacama in Chile, one of the world’s richest sources of lithium brine. The company produces lithium hydroxide and Lithium Carbonate for a wide range of applications, including batteries for electric vehicles. Albemarle’s focus on expanding its lithium production facilities to meet the rising global demand for EVs has placed it in a dominant position in the market.

SQM (Sociedad Química y Minera de Chile)

SQM, based in Chile, is another major player in the Lithium Carbonate Market, particularly in South America. The company operates some of the largest lithium extraction operations in the world, including those in the Salar de Atacama. SQM’s Lithium Carbonate production is heavily tied to its extensive lithium reserves, which are key to supplying the growing demand for battery-grade lithium. In 2022, SQM announced plans to expand its production capacity and increase output by up to 50% over the next five years, which will bolster its share of the Lithium Carbonate Market and meet the increasing demand from the automotive sector.

Ganfeng Lithium Co., Ltd.

Ganfeng Lithium, based in China, is one of the world’s largest producers of lithium products, including Lithium Carbonate. The company has vertically integrated operations that span from lithium extraction to the production of high-quality lithium compounds used in batteries. Ganfeng Lithium’s Lithium Carbonate is sold to major battery manufacturers around the world. As China leads the electric vehicle revolution, Ganfeng has secured long-term supply agreements with major companies in the automotive and electronics industries, further consolidating its position in the Lithium Carbonate Market.

Tianqi Lithium Corporation

Tianqi Lithium, another Chinese company, is a significant player in the Lithium Carbonate Market, with substantial production operations in both China and Australia. Tianqi operates the Greenbushes lithium mine in Western Australia, one of the largest and highest-grade lithium mines in the world. The company produces a range of lithium products, including Lithium Carbonate, which is critical for battery production. Tianqi Lithium’s strategic focus on securing a steady supply of raw materials and expanding its lithium refining capabilities allows it to maintain a competitive edge in the market.

Livent Corporation

Livent Corporation, a U.S.-based company, is another key player in the Lithium Carbonate Market. Livent focuses on the production of high-purity Lithium Carbonate and lithium hydroxide, essential for use in lithium-ion batteries. The company has seen substantial growth in recent years as demand for lithium compounds has surged, particularly in the electric vehicle market. Livent has production facilities in both North and South America and is working to expand its lithium production capabilities in response to the increasing demand from battery manufacturers.

Lithium Carbonate Market Share by Manufacturers

The Lithium Carbonate Market is highly concentrated, with the top five manufacturers holding a significant portion of the global market share. As of recent years, Albemarle and SQM account for the largest share of the market, followed closely by Ganfeng Lithium and Tianqi Lithium. The competition is primarily centered around production capacities and the ability to secure long-term contracts with key battery manufacturers and automakers.

Albemarle and SQM, both based in Chile, together dominate the Lithium Carbonate Market in South America, while Ganfeng and Tianqi have substantial market shares in China and Australia. Livent, with its operations in the U.S. and Argentina, is also a major player, but its market share is comparatively smaller when compared to these global giants.

The Lithium Carbonate Market share by manufacturers is also influenced by the geographical distribution of lithium reserves and the companies’ ability to access and extract lithium efficiently. The rise in demand for electric vehicles and renewable energy storage systems is creating new opportunities for these companies to expand their operations and increase their market share.

Recent News and Industry Developments

The Lithium Carbonate Market has been undergoing significant changes in recent years, with manufacturers focusing on scaling up production and exploring new extraction technologies. For example, in 2023, Albemarle Corporation announced its plans to invest $1.3 billion to expand its lithium production capacity in the U.S., aiming to meet the increasing demand for lithium in the electric vehicle sector. This expansion includes the construction of new facilities and the development of more efficient extraction technologies.

In late 2022, SQM secured a landmark agreement with Tesla to supply lithium hydroxide and Lithium Carbonate for battery production. This partnership is expected to strengthen SQM’s position in the Lithium Carbonate Market as demand from automakers like Tesla continues to rise. Additionally, SQM is working on expanding its lithium production capacity in Chile to meet growing global demand, particularly from the electric vehicle market.

Ganfeng Lithium has also been expanding its footprint in the global Lithium Carbonate Market. In 2022, Ganfeng acquired a significant stake in the Australian lithium mining company, Kidman Resources, which will provide it with access to additional lithium resources in Australia. This acquisition is expected to increase Ganfeng’s lithium production capabilities and enable it to meet the rising demand for Lithium Carbonate.

Tianqi Lithium, in collaboration with its joint venture partners, has made significant strides in increasing lithium production from its Greenbushes mine in Western Australia. The company has focused on expanding its lithium refining capacity, allowing it to produce higher-quality Lithium Carbonate suitable for battery production. Tianqi’s strong presence in Australia, combined with its strategic partnerships with major battery manufacturers, positions it well in the competitive Lithium Carbonate Market.

Livent Corporation, which has been focused on advancing its production technologies, recently announced plans to expand its lithium extraction facilities in South America. The company is investing heavily in its operations in Argentina, with the goal of increasing its Lithium Carbonate production by 25% in the next five years. Livent’s focus on high-purity lithium products for the EV market makes it a key player in the growing demand for Lithium Carbonate.

In conclusion, the Lithium Carbonate Market continues to experience rapid growth, driven by the increasing demand for electric vehicles, renewable energy storage solutions, and consumer electronics. The market is dominated by key players such as Albemarle, SQM, Ganfeng Lithium, Tianqi Lithium, and Livent Corporation, who continue to expand their production capacities to meet global demand. As the industry evolves, new partnerships, technological advancements, and expansions in lithium extraction and production will shape the future of the Lithium Carbonate Market.

“Lithium Carbonate Production Data and Lithium Carbonate Production Trend, Lithium Carbonate Production Database and forecast”

-

-

- Lithium Carbonate production database for historical years, 10 years historical data

- Lithium Carbonate production data and forecast for next 9 years

- Lithium Carbonate sales volume by manufacturers

-

“Track Real-time Lithium Carbonate Prices for purchase and sales contracts, Lithium Carbonate price charts, Lithium Carbonate weekly price tracker and Lithium Carbonate monthly price tracker”

-

-

- Gain control on your purchase and sales contracts through our real-time Lithium Carbonate price tracker and Lithium Carbonate price trend analysis

- Lithium Carbonate weekly price tracker and forecast for next four weeks

- Lithium Carbonate monthly price tracker and forecast for next two months

-

Market Scenario, Demand vs Supply, Average Product Price, Import vs Export, till 2035

- Global Lithium Carbonate Market revenue and demand by region

- Global Lithium Carbonate Market production and sales volume

- United States Lithium Carbonate Market revenue size and demand by country

- Europe Lithium Carbonate Market revenue size and demand by country

- Asia Pacific Lithium Carbonate Market revenue size and demand by country

- Middle East & Africa Lithium Carbonate Market revenue size and demand by country

- Latin America Lithium Carbonate Market revenue size and demand by

- Import-export scenario – United States, Europe, APAC, Latin America, Middle East & Africa

- Average product price – United States, Europe, APAC, Latin America, Middle East & Africa

- Market player analysis, competitive scenario, market share analysis

- Business opportunity analysis

Key questions answered in the Global Lithium Carbonate Market Analysis Report:

- What is the market size for Lithium Carbonate in United States, Europe, APAC, Middle East & Africa, Latin America?

- What is the yearly sales volume of Lithium Carbonate and how is the demand rising?

- Who are the top market players by market share, in each product segment?

- Which is the fastest growing business/ product segment?

- What should be the business strategies and Go to Market strategies?

The report covers Lithium Carbonate Market revenue, Production, Sales volume, by regions, (further split into countries):

- Asia Pacific (China, Japan, South Korea, India, Indonesia, Vietnam, Rest of APAC)

- Europe (UK, Germany, France, Italy, Spain, Benelux, Poland, Rest of Europe)

- North America (United States, Canada, Mexico)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa

Table of Contents:

Introduction to the Lithium Carbonate Market

- Overview of Lithium Carbonate and Its Importance in Modern Industries

- Historical Development and Evolution of the Lithium Carbonate Market

- Key Market Drivers and Trends in Lithium Carbonate Demand

Production of Lithium Carbonate: Methods and Technologies

- Extraction of Lithium Carbonate: Mining vs. Brine Processing

- The Role of Lithium Carbonate Production in Electric Vehicle Batteries

- Advanced Technologies in Lithium Carbonate Production: Efficiency and Cost-effectiveness

- Environmental Impacts of Lithium Carbonate Production and Sustainable Solutions

Applications of Lithium Carbonate Across Various Industries

- Lithium Carbonate in Battery Manufacturing: Focus on Electric Vehicles (EVs) and Energy Storage

- The Role of Lithium Carbonate in the Pharmaceutical Industry: Medical and Therapeutic Uses

- Lithium Carbonate as a Raw Material in Glass and Ceramics Manufacturing

- Lithium Carbonate in the Production of Lubricants and Greases

- Emerging Uses of Lithium Carbonate in Renewable Energy and Clean Technologies

Market Segmentation and Regional Analysis of the Lithium Carbonate Market

- Forms of Lithium Carbonate: Technical Grade vs. Battery Grade

- Analysis of Lithium Carbonate Demand by End-use Industries

- Regional Demand Analysis: Lithium Carbonate Market Trends in North America, Europe, Asia-Pacific, and Other Regions

- Growth Opportunities in Developing Economies: Key Markets and Emerging Applications

Supply Chain Dynamics in the Lithium Carbonate Market

- Key Suppliers and Manufacturers of Lithium Carbonate

- Raw Materials for Lithium Carbonate Production: Lithium Brines, Spodumene, and Clay

- Supply Chain Challenges and Opportunities in the Lithium Carbonate Market

- Global Trade of Lithium Carbonate: Export-Import Trends and Trade Agreements

Pricing Trends and Economic Influences on the Lithium Carbonate Market

- Key Factors Driving Lithium Carbonate Prices: Supply, Demand, and Raw Material Costs

- Price Volatility and Forecasting in the Lithium Carbonate Market

- The Impact of Market Fluctuations on Lithium Carbonate Producers and Consumers

- Economic Factors Shaping the Future of Lithium Carbonate Production and Pricing

Environmental and Sustainability Considerations in Lithium Carbonate Production

- Environmental Challenges in Lithium Carbonate Extraction and Processing

- Sustainability in Lithium Carbonate Manufacturing: Recycling and Waste Management

- Innovations for Reducing Environmental Footprint in Lithium Carbonate Production

- Regulatory Frameworks and Compliance for Sustainable Lithium Carbonate Production

Technological Advancements in Lithium Carbonate Production

- Innovations in Lithium Extraction Techniques: Direct Lithium Extraction (DLE)

- Technological Developments in Lithium Carbonate Purification and Quality Control

- Impact of Automation and Digitalization on Lithium Carbonate Manufacturing

- Future Trends in Lithium Carbonate Production Technologies

Regulatory Landscape and Policies Affecting the Lithium Carbonate Market

- Government Regulations and Policies Impacting Lithium Carbonate Extraction and Trade

- International Standards for Lithium Carbonate Production and Quality Assurance

- The Role of Sustainability Certifications and Environmental Guidelines

- Regulatory Challenges Faced by Lithium Carbonate Manufacturers

Competitive Landscape of the Lithium Carbonate Market

- Leading Players in the Lithium Carbonate Market: Key Companies and Their Market Shares

- Competitive Strategies: Mergers, Acquisitions, and Strategic Partnerships in the Lithium Sector

- Analysis of Competitive Advantage in Lithium Carbonate Production and Market Presence

- Research and Development Focus of Major Lithium Carbonate Manufacturers

Challenges and Risks in the Lithium Carbonate Market

- Supply Chain Bottlenecks and Raw Material Scarcity in Lithium Carbonate Production

- Geopolitical Risks and Trade Barriers Impacting the Lithium Market

- Environmental and Ethical Issues Surrounding Lithium Mining and Processing

- Technological Challenges in Scaling Up Lithium Carbonate Production

Future Outlook and Growth Opportunities in the Lithium Carbonate Market

- Projected Growth in Lithium Carbonate Demand and Production Over the Next Decade

- The Role of Lithium Carbonate in the Transition to a Green Economy

- Investment Opportunities in the Lithium Carbonate Industry

- Strategic Recommendations for Market Players to Capitalize on Emerging Opportunities

Conclusion: Key Takeaways for Stakeholders in the Lithium Carbonate Market

- Insights for Manufacturers, Producers, and Distributors in the Lithium Carbonate Market

- Strategic Recommendations for Navigating the Evolving Lithium Carbonate Market

- Final Thoughts on the Future of Lithium Carbonate in Global Markets

Other recently published reports:

“Every Organization is different and so are their requirements”- Datavagyanik

Companies We Work With

Do You Want To Boost Your Business?

drop us a line and keep in touch